Electronic Drug Delivery Systems Market by Type (Electronic Wearable Infusion Pump, Autoinjectors, Injection Pens, Electronic Inhalers), Indication (Diabetes, Multiple Sclerosis, Cardiovascular Disease, Asthma & COPD) - Global Forecast to 2024

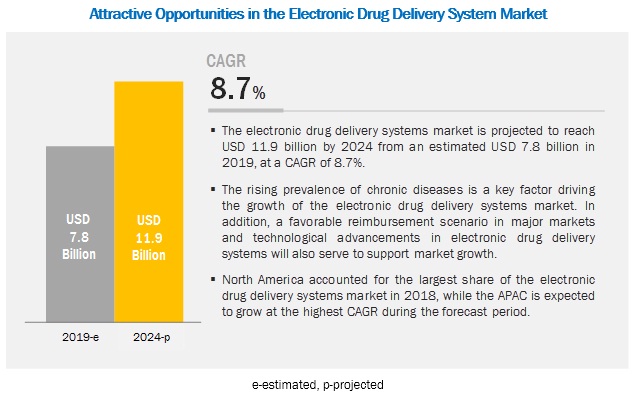

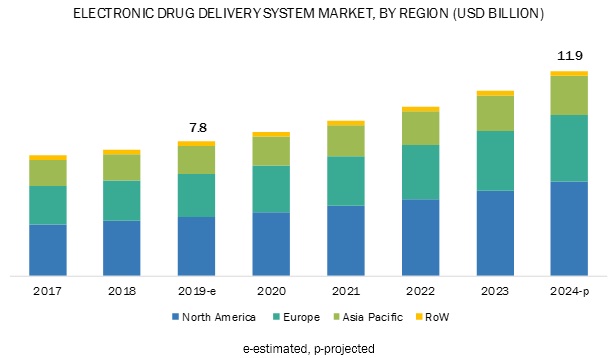

[125 Pages Report] The electronic drug delivery systems market is projected to reach USD 11.9 billion by 2024 from USD 7.8 billion in 2019, at a CAGR of 8.7%. The high prevalence of target diseases, the favorable reimbursement scenario in major markets, and advancements in technologies and designs of electronic drug delivery systems. However, disadvantages associated with electronic device operation and functionality could restrict the market to a certain extent.

The electronic wearable infusion pumps segment dominated the electronic drug delivery systems market in 2018

By type, the market is segmented into electronic wearable infusion pumps, electronic autoinjectors, electronic injection pens, and electronic inhalers. The electronic wearable infusion pumps segment is expected to account for the largest market share of the market in 2019. The wider availability of commercial infusion pumps for diabetes treatment as compared to other types of electronic drug delivery systems is driving the growth of this market.

Diabetes segment to account for the largest share of the electronic drug delivery systems market, by indication, in 2018

The diabetes segment accounted for the largest share of the market in 2018. This is mainly due to the high prevalence of diabetes across the globe and the high availability of electronic drug delivery devices such as insulin pumps and injection pens by major market players in comparison to other therapeutic areas. For instance, there were about 30.2 million people suffering from diabetes in the US in 2017, and this figure is estimated to reach 35.6 million by 2045 (Source: IDF).

The North American market is expected to grow at the highest CAGR during the forecast period

North America dominated the market in 2018. The North America region is expected to witness the highest CAGR during the forecast period. The rising prevalence of target diseases, the favorable reimbursement scenario, and approvals, and launches of innovative electronic drug delivery systems in the region are some of the key factors driving the growth of this regional segment. For instance, in June 2017, Medtronic PLC (Ireland) launched Minimed 670G system (an electronic infusion pump) in the US.

Key Market Players

Prominent players in the electronic drug delivery system market are Merck Group (Germany), Insulet Corporation (US), Bayer AG (Germany), Medtronic plc (Ireland), Novo Nordisk (Denmark), United Therapeutics Corporation (US), AstraZeneca (UK), Tandem Diabetes Care (US), and Amgen (US).

Merck Group led the electronic drug delivery systems market with a share of 23.0% in 2018. The company develops, manufactures, and commercializes prescription medicines, biologic therapies, vaccines, and health products. To maintain its leading position in the market, the company focuses on organic growth strategies such as expansions. For instance, in February 2018, Merck group opened a new OLED (an organic light-emitting diode) technology center in China. This was aimed to develop and enhance innovative technologies for strategic markets in the Asia Pacific.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Indication, and Region |

|

Geographies covered |

North America, Europe, the Asia Pacific, and the Rest of the World |

|

Companies covered |

Medtronic plc (Ireland), Novo Nordisk (Denmark), Insulet Corporation (US), Bayer AG (Germany), United Therapeutics Corporation (US), AstraZeneca (UK), Tandem Diabetes Care (US), Merck Group (Germany), Amgen (US), F. Hoffmann-La Roche (Switzerland), Companion Medical (US), FindAir SP. Z O. O. (Poland), ViCentra B.V. (Netherland), Canθ SPA (Italy), and Debiotech S.A. (Switzerland). |

The research report categorizes the market into the following segments and subsegments:

Market, by Type

- Electronic Wearable Infusion Pumps

- Electronic Autoinjectors

- Electronic Injection Pens

- Electronic Inhalers

Market, by Indication

- Diabetes

- Multiple Sclerosis

- Cardiovascular Disease

- Asthma & COPD

- Other Indications (growth hormone therapy, primary immunodeficiency disease, thalassemia, and Parkinsons disease)

Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Rest of the World

- Latin America

- The Middle East & Africa

Recent Developments

- In April 2019, Vicentra B.V (Netherland) launched an electronic insulin pump named Kaleido in the UK.

- In November 2018, United Therapeutics (US) signed a licensing agreement with Arena Pharmaceuticals (US) to commercialize Arenas hypertensive drug - Ralinepag.

- In February 2018, Merck Group (Germany) opened a new OLED (an organic light-emitting diode) technology center in China. This was aimed to develop and enhance innovative technologies for strategic markets in the Asia Pacific.

Critical questions answered in the report:

- How will the current technological trends affect the market in the long term period?

- What are the reasons contributing to the growth of the electronic wearable infusion pumps market?

- Which regions are likely to grow at the highest CAGR?

- What are the challenges hindering the adoption of electronic drug delivery system devices?

- What are the growth strategies being implemented by major market players?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation Approach

2.4 Market Share Analysis

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Electronic Drug Delivery Systems: Market Overview

4.2 North America: Market, By Type, 2018

4.3 Geographical Snapshot of the Market

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Prevalence of Target Diseases

5.2.1.2 Favorable Reimbursement Scenario in Major Markets

5.2.1.3 Advancements in Technologies and Designs

5.2.2 Restraints

5.2.2.1 Preference for Alternative Drug Delivery Modes and the Possibility of Errors

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Biologics and Mabs

5.2.3.2 Growth Opportunities in Emerging Markets

5.2.4 Challenges

5.2.4.1 Unfavorable Reimbursement Structure in Developing Countries

6 Market, By Type (Page No. - 36)

6.1 Introduction

6.1.1 Electronic Wearable Infusion Pumps

6.1.1.1 Electronic Wearable Infusion Pumps Dominate the Market

6.1.2 Electronic Autoinjectors

6.1.2.1 Electronic Autoinjectors are Likely to Register Negative Growth During the Forecast Period Due to the Continuous Influx of Generic Versions of Conventional Autoinjectors in the Market

6.1.3 Electronic Injection Pens

6.1.3.1 Growing Focus of Pharmaceutical Companies on Developing Electronic/Connected Injection Pens Will Drive Market Growth

6.1.4 Electronic Inhalers

6.1.4.1 Electronic Inhalers are Developed to Improve Medication Adherence in Asthma & COPD Management

7 Market, By Indication (Page No. - 48)

7.1 Introduction

7.2 Diabetes

7.2.1 Diabetes Accounted for the Largest Segment of the Market

7.3 Multiple Sclerosis

7.3.1 Launch of Generic Versions of Conventional Injectables Will Stifle Market Growth

7.4 Cardiovascular Disease

7.4.1 Development of Innovative Electronic Drug Delivery Systems for Cvd Treatment Will Drive Market Growth

7.5 Asthma & COPD

7.5.1 Development of Smart Inhalers and Digital Sensors is Likely to Improve Medication Adherence in Asthma & COPD Patients

7.6 Other Indications

8 Market, By Region (Page No. - 61)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 The US has A Favorable Reimbursement Scenario for Electronic Drug Delivery Devices, Which is A Key Factor Driving the Market for Electronic Drug Delivery Systems

8.2.2 Canada

8.2.2.1 Growing Presence of Device Manufacturers in the Country is Expected to Propel Market Growth

8.3 Europe

8.3.1 Germany

8.3.1.1 Germany is the Largest Market for Electronic Drug Delivery Systems in Europe

8.3.2 UK

8.3.2.1 High Burden of Target Diseases to Support Market Growth

8.3.3 France

8.3.3.1 High Prevalence of Diabetes in the Country to Propel Market Growth

8.3.4 Rest of Europe

8.4 Asia Pacific

8.4.1 Japan

8.4.1.1 Large Geriatric Population and the High Prevalence of Cvd to Support Market Growth

8.4.2 China

8.4.2.1 Growing Focus of Major Players on Biologics Development to Drive Market Growth

8.4.3 India

8.4.3.1 Lack of Reimbursement and Guidelines on Electronic Drug Delivery Systems Could Limit Market Growth

8.4.4 RoAPAC

8.5 Rest of the World

8.5.1 Latin America

8.5.1.1 High Incidence of Chronic Diseases to Drive the Demand for Electronic Drug Delivery Systems

8.5.2 Middle East & Africa

8.5.2.1 Favorable Reforms in South Africa to Support Market Growth

9 Competitive Landscape (Page No. - 88)

9.1 Overview

9.2 Market Share Analysis

9.3 Key Player Analysis

9.3.1 Merck Group

9.3.2 Medtronic PLC

9.4 Competitive Scenario

9.4.1 Product Launches

9.4.2 Expansions

9.4.3 Agreements & Collaborations

9.5 Competitive Leadership Mapping (2018)

9.5.1 Visionary Leaders

9.5.2 Innovators

9.5.3 Dynamic Differentiators

9.5.4 Emerging Companies

10 Company Profiles (Page No. - 94)

10.1 Merck Group

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 Recent Developments

10.2 Medtronic PLC

10.2.1 Business Overview

10.2.2 Products Offered

10.2.3 Recent Developments

10.3 United Therapeutics Corporation

10.3.1 Business Overview

10.3.2 Products Offered

10.3.3 Recent Developments

10.4 Insulet Corporation

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 Recent Developments

10.5 Bayer AG

10.5.1 Business Overview

10.5.2 Products Offered

10.5.3 Recent Developments

10.6 Novo Nordisk

10.6.1 Business Overview

10.6.2 Products Offered

10.6.3 Recent Developments

10.7 Companion Medical

10.7.1 Business Overview

10.7.2 Products Offered

10.7.3 Recent Developments

10.8 Tandem Diabetes Care, Inc.

10.8.1 Business Overview

10.8.2 Products Offered

10.8.3 Recent Developments

10.9 F.Hoffmann-La Roche, Ltd.

10.9.1 Business Overview

10.9.2 Products Offered

10.9.3 Recent Developments

10.10 Amgen, Inc.

10.10.1 Business Overview

10.10.2 Products Offered

10.10.3 Recent Developments

10.11 Astrazeneca PLC

10.11.1 Business Overview

10.11.2 Products Offered

10.11.3 Recent Developments

10.12 Findair SP. Z O. O.

10.12.1 Business Overview

10.12.2 Products Offered

10.12.3 Recent Developments

10.13 Vicentra B.V.

10.13.1 Business Overview

10.13.2 Products Offered

10.13.3 Recent Developments

10.14 Canθ SPA

10.14.1 Business Overview

10.14.2 Products Offered

10.15 Debiotech S.A.

10.15.1 Business Overview

10.15.2 Products Offered

11 Appendix (Page No. - 119)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Related Reports

11.4 Author Details

List of Tables (86 Tables)

Table 1 Commercially Available Biologics as Potential Applications for Electronic Drug Delivery Systems in the Coming Years

Table 2 Market, By Type, 20172024 (usD Million)

Table 3 Electronic Drug Delivery Systems Market, By Product, 20172024 (usD Million)

Table 4 Comparative Table of Commercially Available Insulin Pumps

Table 5 Electronic Wearable Infusion Pumps Market, By Region, 20172024 (USD Million)

Table 6 North America: Electronic Wearable Infusion Pumps Market, By Country, 20172024 (USD Million)

Table 7 Europe: Electronic Wearable Infusion Pumps Market, By Country, 20172024 (USD Million)

Table 8 Asia Pacific: Electronic Wearable Infusion Pumps Market, By Country, 20172024 (USD Million)

Table 9 RoW: Electronic Wearable Infusion Pumps Market, By Region, 20172024 (USD Million)

Table 10 Electronic Autoinjectors Market, By Region, 20172024 (USD Million)

Table 11 North America: Electronic Autoinjectors Market, By Country, 20172024 (USD Million)

Table 12 Europe: Electronic Autoinjectors Market, By Country, 20172024 (USD Million)

Table 13 Asia Pacific: Electronic Autoinjectors Market, By Country, 20172024 (USD Million)

Table 14 RoW: Electronic Autoinjectors Market, By Region, 20172024 (USD Million)

Table 15 Electronic Injection Pens Market, By Region, 20172024 (USD Million)

Table 16 North America: Electronic Injection Pens Market, By Country, 20172024 (USD Million)

Table 17 Europe: Electronic Injection Pens Market, By Country, 20172024 (USD Million)

Table 18 Asia Pacific: Electronic Injection Pens Market, By Country, 20172024 (USD Million)

Table 19 RoW: Electronic Injection Pens Market, By Region, 20172024 (USD Million)

Table 20 Electronic Inhalers Market, By Country, 20172024 (USD Million)

Table 21 Market, By Indication, 20172024 (USD Million)

Table 22 Top Five Countries With the Highest Number of Diabetics (2079 Years), 2017 vs. 2045

Table 23 Electronic Drug Delivery Systems Market for Diabetes, By Region, 20172024 (USD Million)

Table 24 North America: Market for Diabetes, By Country, 20172024 (USD Million)

Table 25 Europe: Market for Diabetes, By Country, 20172024 (USD Million)

Table 26 Asia Pacific: Market for Diabetes, By Country, 20172024 (USD Million)

Table 27 RoW: Market for Diabetes, By Region, 20172024 (USD Million)

Table 28 Market for Multiple Sclerosis, By Region, 20172024 (USD Million)

Table 29 North America: Market for Multiple Sclerosis, By Country, 20172024 (USD Million)

Table 30 Europe: Market for Multiple Sclerosis, By Country, 20172024 (USD Million)

Table 31 Asia Pacific: Market for Multiple Sclerosis, By Country, 20172024 (USD Million)

Table 32 RoW: Market for Multiple Sclerosis, By Region, 20172024 (USD Million)

Table 33 Market for Cardiovascular Disease, By Region, 20172024 (USD Million)

Table 34 North America: Market for Cardiovascular Disease, By Country, 20172024 (USD Million)

Table 35 Europe: Market for Cardiovascular Disease, By Country, 20172024 (USD Million)

Table 36 Asia Pacific: Market for Cardiovascular Disease, By Country, 20172024 (USD Million)

Table 37 RoW: Market for Cardiovascular Disease, By Region, 20172024 (USD Million)

Table 38 Prevalence of COPD & Asthma in 2010 and 2016 (Million)

Table 39 Market for Asthma & COPD, By Country, 20172024 (USD Million)

Table 40 Market for Other Indications, By Region, 20172024 (USD Million)

Table 41 North America: Market for Other Indications, By Country, 20172024 (USD Million)

Table 42 Europe: Market for Other Indications, By Country, 20172024 (USD Million)

Table 43 Asia Pacific: Market for Other Indications, By Country, 20172024 (USD Million)

Table 44 RoW: Market for Other Indications, By Region, 20172024 (USD Million)

Table 45 Market, By Region, 20172024 (USD Million)

Table 46 Market, By Country, 20172024 (USD Million)

Table 47 North America: Market, By Country, 20172024 (USD Million)

Table 48 North America: Market, By Type, 20172024 (USD Million)

Table 49 North America: Market, By Indication, 20172024 (USD Million)

Table 50 US: Market, By Type, 20172024 (USD Million)

Table 51 US: Market, By Indication, 20172024 (USD Million)

Table 52 Canada: Market, By Type, 20172024 (USD Million)

Table 53 Canada: Market, By Indication, 20172024 (USD Million)

Table 54 Europe: Recent Developments in the Market, 20172018

Table 55 Europe: Market, By Country, 20172024 (USD Million)

Table 56 Europe: Market, By Type, 20172024 (USD Million)

Table 57 Europe: Market, By Indication, 20172024 (USD Million)

Table 58 Germany: Market, By Type, 20172024 (USD Million)

Table 59 Germany: Market, By Indication, 20172024 (USD Million)

Table 60 UK: Market, By Type, 20172024 (USD Million)

Table 61 UK: Market, By Indication, 20172024 (USD Million)

Table 62 France: Electronic Drug Delivery Systems Market, By Type, 20172024 (USD Million)

Table 63 France: Market, By Indication, 20172024 (USD Million)

Table 64 RoE: Market, By Type, 20172024 (USD Million)

Table 65 RoE: Market, By Indication, 20172024 (USD Million)

Table 66 Asia Pacific: Market, By Country, 20172024 (USD Million)

Table 67 Asia Pacific: Market, By Type, 20172024 (USD Million)

Table 68 Asia Pacific: Market, By Indication, 20172024 (USD Million)

Table 69 Japan: Market, By Type, 20172024 (USD Million)

Table 70 Japan: Market, By Indication, 20172024 (USD Million)

Table 71 China: Market, By Type, 20172024 (USD Million)

Table 72 China: Market, By Indication, 20172024 (USD Million)

Table 73 India: Market, By Type, 20172024 (USD Million)

Table 74 India: Market, By Indication, 20172024 (USD Million)

Table 75 RoAPAC: Market, By Type, 20172024 (USD Million)

Table 76 RoAPAC: Market, By Indication, 20172024 (USD Million)

Table 77 RoW: Market, By Region, 20172024 (USD Million)

Table 78 RoW: Market, By Type, 20172024 (USD Million)

Table 79 RoW: Market, By Indication, 20172024 (USD Million)

Table 80 Latin America: Market, By Type, 20172024 (USD Million)

Table 81 Latin America: Market, By Indication, 20172024 (USD Million)

Table 82 Middle East & Africa: Market, By Type, 20172024 (USD Million)

Table 83 Middle East & Africa: Market, By Indication, 20172024 (USD Million)

Table 84 Product Launches

Table 85 Expansions

Table 86 Agreements & Collaborations

List of Figures (32 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Electronic Drug Delivery Systems Market Share, By Type, 2018

Figure 7 Market Share, By Indication, 2018

Figure 8 Geographic Snapshot: stems Market, 2018

Figure 9 Growing Prevalence of Chronic Diseases is Likely to Drive the Market for Electronic Drug Delivery Systems

Figure 10 Electronic Wearable Infusion Pumps Accounted for the Largest Share of the North American Market in 2018

Figure 11 North America to Witness the Highest Growth During the Forecast Period

Figure 12 Market: Drivers, Restraints, Opportunities, & Challenges

Figure 13 Market, By Type, 2019 vs. 2024 (USD Million)

Figure 14 Market, By Indication, 2019 vs. 2024 (USD Million)

Figure 15 Market, By Region, 2019 vs. 2024

Figure 16 North America: Market Snapshot 65

Figure 17 Europe: Market Snapshot

Figure 18 Asia Pacific: Market Snapshot

Figure 19 RoW: Market Snapshot

Figure 20 Market Share Analysis By Key Players (2018)

Figure 21 Competitive Leadership Mapping: Market

Figure 22 Merck Group: Company Snapshot

Figure 23 Medtronic PLC: Company Snapshot

Figure 24 United Therapeutics Corporation: Company Snapshot

Figure 25 Insulet Corporation: Company Snapshot

Figure 26 Bayer AG: Company Snapshot

Figure 27 Exchange Rate (Utilized for the Conversion of Eur to USD)

Figure 28 Novo Nordisk: Company Snapshot

Figure 29 Tandem Diabetes Care, Inc.: Company Snapshot

Figure 30 F.Hoffmann-La Roche Ltd.: Company Snapshot

Figure 31 Amgen: Company Snapshot

Figure 32 Astrazeneca PLC: Company Snapshot

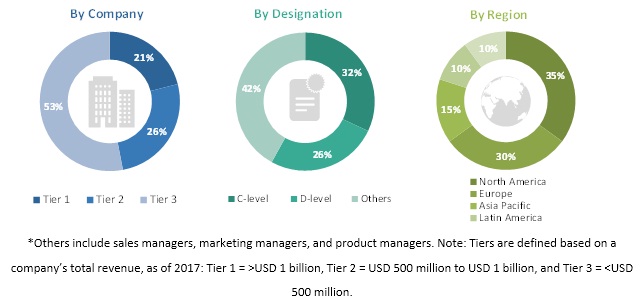

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the electronic drug delivery systems market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the electronic drug delivery system market. The primary sources from the demand side included industry experts, such as researchers and scientists, and industry experts from medical devices companies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, indication, and region).

Data Triangulation

After arriving at the market size, the electronic drug delivery system market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments.

Objectives of the Study

- To define, describe, segment, and forecast the global electronic drug delivery systems market by type, indication, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in four main regions along with their respective key countries (North America, Europe, the Asia Pacific, and the Rest of the World)

- To profile key players in the global market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as product launches and expansions; and R&D activities of the leading players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- A further breakdown of the Rest of Asia Pacific market into South Korea, New Zealand, and other Southeast Asian countries

- A further breakdown of the European market into Spain, Belgium, Netherlands, Sweden, and the Rest of Europe.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electronic Drug Delivery Systems Market