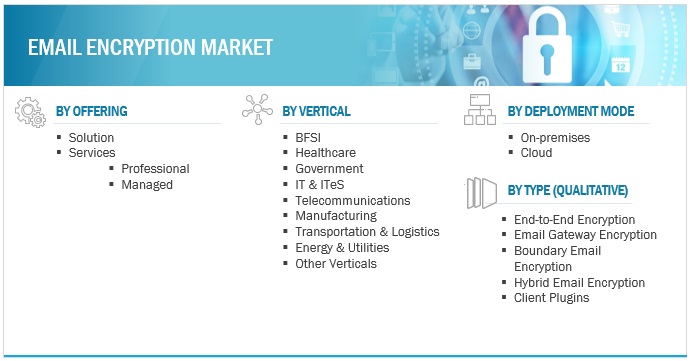

Email Encryption Market by Offering (Solution and Services), Deployment (On-premises and cloud), Vertical (BFSI, healthcare, government, IT & ITeS, telecommunications, manufacturing, retail & eCommerce) and Region - Global Forecast to 2028

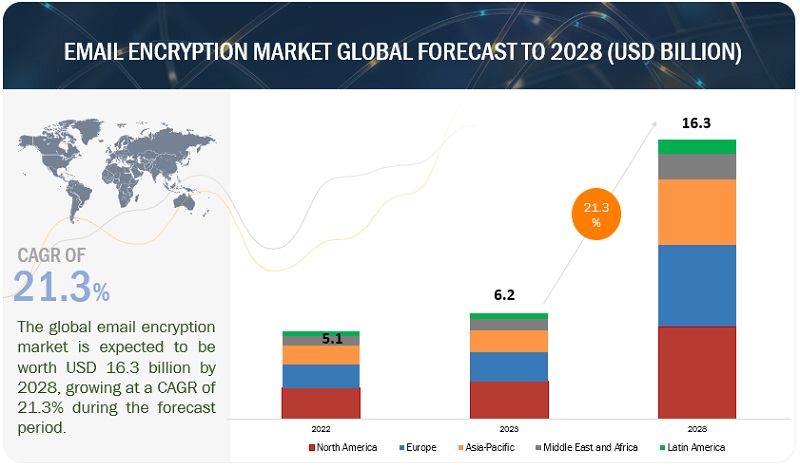

[287 Pages Report] The global Email Encryption market size is projected to grow from USD 6.2 billion in 2023 to USD 16.3 billion by 2028 at a CAGR of 21.3% during the forecast period.

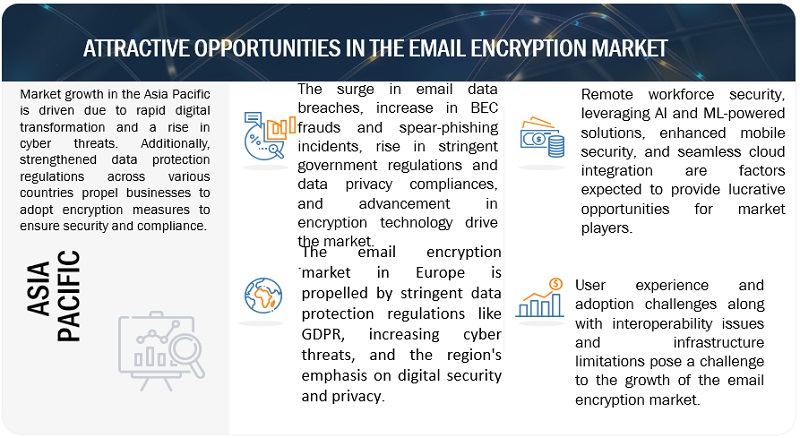

Various pivotal elements influence the Email Encryption market’s expansion. One of the primary drivers is the noticeable surge in email data breaches, which has raised alarm bells for businesses and individuals alike. The security landscape is further complicated by a rising tide of BEC frauds and spear-phishing attacks, tactics employed by cybercriminals to deceive recipients into revealing sensitive information or transferring funds. On the regulatory front, governments across the globe are tightening their data protection frameworks and imposing stringent mandates to ensure that personal and business data remains confidential and secure. This has pressured firms to adopt robust security measures, further boosting the demand for advanced encryption solutions. Furthermore, there is a constant stream of innovations and advancements in encryption techniques, ensuring that communications remain ahead of potential threats. This continuous evolution and refinement in methodologies are integral to the sustained growth of the email encryption market.

The Email Encryption market benefits from opportunities driven by remote workforce security, leveraging AI and ML-powered solutions, enhanced mobile security, and seamless cloud integration. These factors create favorable conditions for the market’s growth, with organizations seeking advanced solutions to safeguard their systems and valuable data, further contributing to the rising demand for Email Encryption solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

The impact of a recession on the email encryption market is multifaceted. Generally, recessions tend to reduce overall IT spending as businesses cut costs and delay investments. However, the email encryption market shows resilience or even growth during economic downturns for a few reasons. Firstly, as companies move to trim costs, there’s an increased emphasis on digital operations and remote work, heightening the need for secure communication channels and emphasizing the importance of email encryption. Secondly, cybercriminals often exploit economic vulnerabilities and uncertainties to increase their malicious activities, pushing companies to prioritize cybersecurity measures, including email encryption, to safeguard their sensitive data. Furthermore, regulatory compliance requirements related to data protection don’t wane during recessions, meaning businesses must maintain or bolster their encryption standards irrespective of economic conditions. Thus, while a downturn generally poses challenges for most sectors, the email encryption market witnesses sustained demand due to the essential nature of cybersecurity in an increasingly digital business landscape.

COVID-19 Impact

The COVID-19 pandemic pronounced affected the email encryption market, vastly amplifying its significance. As the pandemic forced businesses and institutions to transition swiftly to remote working and digital operations, the volume of email communication surged exponentially. This rapid shift highlighted the critical need for secure communication channels and presented opportunities for cybercriminals to exploit the vulnerabilities of hastily implemented digital setups. There was a noticeable uptick in phishing attempts and cyber-attacks, leveraging the pandemic’s theme to deceive users. As organizations grappled with these challenges, the demand for robust email encryption solutions soared, seen as a frontline defense against these threats. Furthermore, with heightened data protection and privacy awareness in a remote work environment, businesses were more inclined to invest in cybersecurity tools, positioning email encryption as an essential component. Thus, the pandemic underscored the indispensability of email encryption in an era of unpredictability and accelerated digital transformation.

Email Encryption Market Dynamics

Driver: Advancements in Encryption Technology

The email encryption market is witnessing robust growth fueled by recent advances in encryption technology. Key developments in recent years have fortified email security, with quantum physics introducing accelerated encryption for various devices. Concurrently, research in cryptography is paving the way for more secure telecom networks, addressing quantum bit decay in fiber-optic cables.

Furthermore, some noteworthy strides in the sector include the rise of biometric encryption, eliminating the heavy dependence on passwords, and the consistent role of VPNs in augmenting email security.

Restraint: Cost Constraints Associated with Email Encryption Solutions

A primary restraint in adopting email encryption solutions among businesses is the significant financial commitment involved. Although these tools are vital for preventing data breaches, they considerably inflate operational expenses. The root of this increase is the expanded IT infrastructure needed for secure email communication.

Typically, the cost structure for such solutions is based on a monthly fee per user, ranging from USD 4 to USD 10. This price could surge based on the size of the encrypted files. While free encryption tools exist, they often lack the sophistication required for adequate data protection.

Furthermore, for budget-conscious SMEs, the financial implications are particularly pronounced. Beyond the upfront costs, recurrent expenditures such as licensing fees, software maintenance, and technical support amplify the overall financial load. Thus, integrating these solutions with pre-existing IT systems introduces another dimension of complexity and potential costs.

Opportunity:Seamless Cloud Integration

The increasing adoption of cloud platforms like Microsoft 365 and Google Workspace has emphasized the need for secure email communication. As organizations blend remote and on-site work, there’s a growing demand for email encryption solutions that integrate effortlessly with cloud services and traditional on-premises systems. This transition to hybrid models and cloud integration is driving the demand in the email encryption market.

Challenge:Interoperability Issues and Infrastructure Limitations

In the email encryption market, one of the predominant challenges is interoperability and infrastructure limitations. Different organizations using a variety of encryption solutions lead to compatibility roadblocks, especially given the absence of a universal encryption standard. Additionally, smaller entities, in particular, face the dual challenge of managing the costs and complexities associated with setting up dedicated on-premises encryption infrastructures. Therefore, when some turn to smaller cloud providers as an alternative, they often encounter disruptions in their workflow. This amalgamation of challenges underscores the complexities organizations, especially the smaller ones, must navigate to implement effective email encryption.

Email Encryption Market Ecosystem

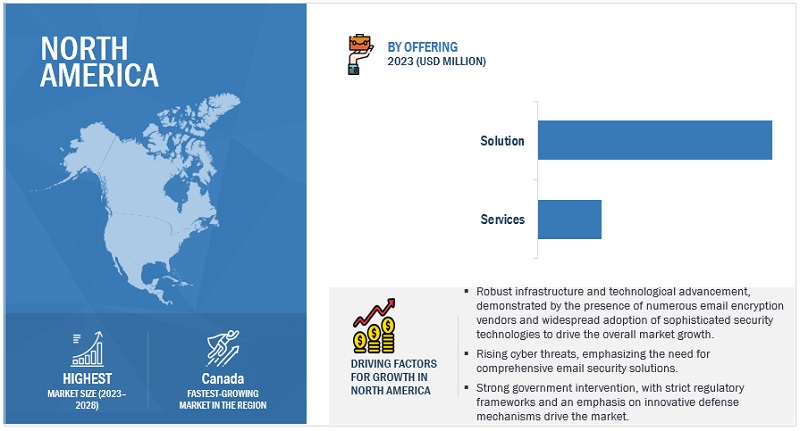

By region, North America accounts for the highest market size during the forecast period.

North America dominates the email encryption market primarily because of its advanced technological infrastructure, stringent regulatory compliance requirements, and heightened awareness of cybersecurity threats. The region is home to many global corporations, which necessitates adopting secure communication methods to protect sensitive data. Furthermore, regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR) compel businesses to implement robust data protection measures, further driving the demand for email encryption solutions. Moreover, with a significant presence of leading email encryption vendors, North America enjoys a proactive approach to cybersecurity, fostering a larger market size for email encryption.

Key Market Players

Some of the well-established and key market players in the Email Encryption market include Fortinet (US), BAE Systems (UK), Mimecast (UK), Cisco (US), Proofpoint (US), Zoho (India), Broadcom (US), OpenText (Canada), Barracuda Networks (US), Thales (France), HPE (US), Entrust (US), Fortra (US), Sophos (UK), Trend Micro (Japan), Seclore (US), Egress Software (UK), Echoworx (Canada), LuxSci (US), Neocertified (US), SSH Communication (Finland), Retarus (Germany), Paubox (US), PreVeil (US), Sealit Technologies (UK), SendSafely (US), and Zivver (Netherlands).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

|

|

Base year considered |

|

|

Forecast period |

|

|

Forecast units |

|

|

Segments Covered |

|

|

Geographies covered |

|

|

Companies covered |

|

The study categorizes the Email Encryption market by offering, deployment, verticals, and regions.

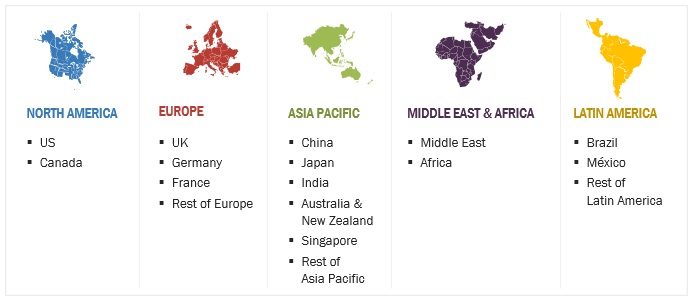

By Region:

Recent Developments

- In July 2023, Telefónica Tech (Spain) partnered with Proofpoint to introduce ‘Clean Email Business’ in Spain, enhancing email security for medium-sized companies. The service incorporates advanced features such as spam filtering, malicious attachment and URL analysis, and protection against BEC attacks. The initiative is geared towards ensuring security, regulatory compliance, and uninterrupted business continuity for its users.

- In April 2023, Barracuda Networks, Inc. forged a strategic distribution agreement with Ingram Micro to bolster its presence in the Gulf region. Under this agreement, Ingram Micro will distribute Barracuda’s comprehensive cybersecurity solutions, covering email, applications, cloud, network, and data protection. This partnership aims to provide resellers across the UAE, Kuwait, Qatar, Oman, Bahrain, Yemen, and Pakistan with access to Barracuda’s cutting-edge cybersecurity offerings.

- In March 2023, proteanTecs (Israel) and BAE Systems partnered to enable a zero-trust supply chain for defense and critical infrastructure applications. With this partnership, proteanTecs’ advanced deep data analytics technology will be leveraged by BAE Systems to ensure product authentication and supply chain integrity, thereby potentially strengthening email encryption by ensuring the hardware components are authentic and secure.

- In January 2023, Zoho Corporation’s Bigin CRM introduced an ‘Email-In’ topping feature that automates the process of mapping emails sent to different aliases within an organization to the relevant customer records, streamlining email organization and implicitly enhancing security. In addition, the ‘File Cabinet’ topping allows customers to manage documents through unique, secure links, bolstering data protection and suggesting a move towards improved email content security.

- In August 2022, Mimecast introduced the Mimecast X1 Platform, an advanced email and collaboration security solution designed to safeguard business communications in hybrid work environments. It uses AI and ML to detect threats, offers scalable cloud-delivered security, and integrates seamlessly with other security systems through its extensive API ecosystem.

Frequently Asked Questions (FAQ):

What are the opportunities in the global Email Encryption market?

Remoter workforce security, leveraging AI and ML-powered solutions, enhanced mobile security, and seamless cloud integration create market opportunities for the global Email Encryption market.

What is the definition of the Email Encryption market?

According to MarketsandMarkets, email encryption is a security technique that uses cryptographic principles to protect email content from unauthorized access. This helps in maintaining the confidentiality and integrity of the conveyed information. When emails undergo encryption, their content, attachments, and sometimes even metadata are transformed into a coded or ciphertext format. This makes the data unreadable to anyone without the appropriate decryption key.

Which region is expected to show the highest market share in the Email Encryption market?

North America is expected to account for the largest market share during the forecast period.

What are the challenges in the global Email Encryption market?

User experience and adoption challenges along with interoperability issues and infrastructure limitations are the challenges in the email encryption market.

What are the major market players covered in the report?

Major vendors, namely, include Fortinet (US), BAE Systems (UK), Mimecast (UK), Cisco (US), Proofpoint (US), Zoho (India), Broadcom (US), OpenText (Canada), Barracuda Networks (US), Thales (France), HPE (US), Entrust (US), Fortra (US), Sophos (UK), Trend Micro (Japan), Seclore (US), Egress Software (UK), Echoworx (Canada), LuxSci (US), Neocertified (US), SSH Communication (Finland), Retarus (Germany), Paubox (US), PreVeil (US), Sealit Technologies (UK), SendSafely (US), and Zivver (Netherlands).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

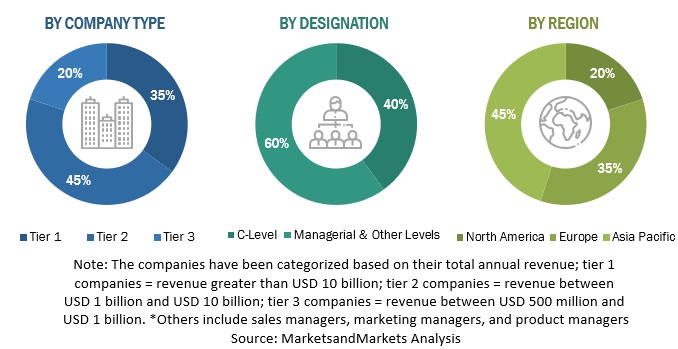

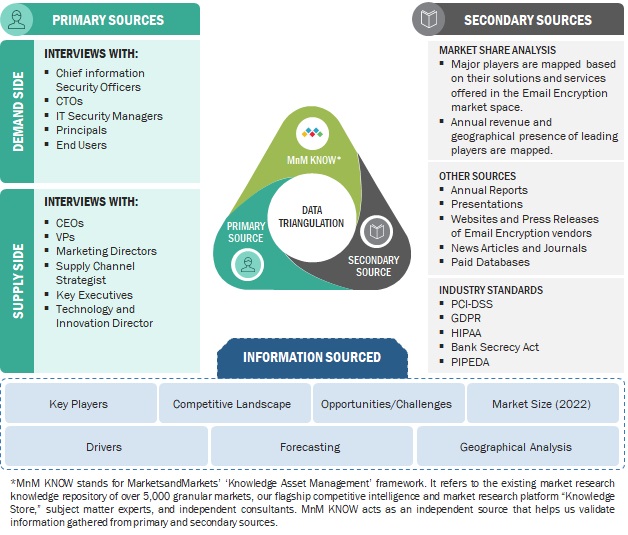

The study involved significant activities in estimating the current market size for Email Encryption. Intensive secondary research was conducted to collect information about Email Encryption and related ecosystems. The industry executives validated these findings, assumptions, and sizing across the value chain using a primary research process as a next step. Top-down and bottom-up market estimation approaches were used to estimate the market size globally, followed by the market breakup and data triangulation procedures to assess the market segment and sub-segments in Email Encryption.

Secondary Research Process:

In the secondary research process, various sources were referred to for identifying and collecting information regarding Email Encryption. These sources include annual reports, press releases, Email Encryption software and service vendor investor presentations, forums, vendor-certified publications, and industry/association white papers. These secondary sources were utilized to obtain key information about Email Encryption’s solutions and services supply & value chain, a list of 100+ key players and SMEs, market classification, and segmentation per the industry trends and regional markets. The secondary research also gives us insights into the key developments from market and technology perspectives, which primary respondents further validated.

The factors considered for estimating the regional market size include technological initiatives undertaken by governments of different countries, gross domestic product (GDP) growth, ICT spending, recent market developments, and market ranking analysis of primary Email Encryption solutions and service vendors.

Primary Research Process:

We have conducted primary research with industry executives from both the supply and demand sides. The primary sources from the supply side include chief executive officers (CEOs), vice presidents (VPs), marketing directors, and technology and innovation executives of key companies operating in the Email Encryption market. We have conducted primary interviews with the executives to obtain qualitative and quantitative information for Email Encryption.

The market engineering process implemented the top-down and bottom-up approaches and various data triangulation methods to estimate and forecast the market segments and subsegments. During the post-market engineering process, we conducted primary research to verify and validate the critical numbers we arrived at. The primary analysis was also undertaken to identify the segmentation types, industry trends, the competitive landscape of the Email Encryption market players, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation Process:

Both top-down and bottom-up approaches were implemented for market size estimation to estimate, project, and forecast the size of the global and other dependent sub-segments in the overall Email Encryption market.

The research methodology that has been used to estimate the market size includes these steps:

- The key players, SMEs, and startups were identified through secondary sources. Their revenue contributions in the market were determined through primary and secondary sources.

- Annual and financial reports of the publicly listed market players were considered for the company’s revenue details, and,

- Primary interviews were also conducted with industry leaders to collect information about their companies, competitors, and key players in the market.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Top-down and Bottom-up Approach-

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

Data triangulation is a crucial step in the market engineering process for Email Encryption. It involves utilizing multiple data sources and methodologies to validate and cross-reference findings, thereby enhancing the reliability and accuracy of the market segment and subsegment statistics. To conduct data triangulation, various factors and trends related to the Email Encryption market are studied from both the demand and supply sides. It includes analyzing data from diverse sources such as market research reports, industry publications, regulatory bodies, financial institutions, and technology providers. By examining data from different perspectives and sources, data triangulation helps mitigate potential biases and discrepancies. It provides a more comprehensive understanding of the market dynamics, including the size, growth rate, market trends, and customer preferences.

Furthermore, data triangulation aids in identifying any inconsistencies or outliers in the data, enabling researchers to refine their analysis and make informed decisions. It strengthens the credibility of the market engineering process by ensuring that the conclusions drawn are based on robust and corroborated data. Data triangulation is a rigorous and systematic approach that enhances the reliability and validity of market segment and subsegment statistics in Email Encryption. It provides a solid foundation for informed decision-making and strategic planning within the industry.

Market Definition

As defined by MarketsandMarkets, Email encryption is a security measure that employs cryptographic methods to shield email contents from unsolicited access. This ensures the preservation of the relayed information’s secrecy and reliability. Additionally, when emails are encrypted, the content, attachments, and occasionally the metadata gets converted into an encoded or ciphertext form, making it inaccessible to anyone lacking the necessary decryption key.

Key Stakeholders

- Government agencies

- Email encryption solution vendors

- Open-source providers

- Internet service providers

- Independent software vendors

- Cloud service providers

- Third-party providers

- System integrators

- Value-Added Resellers (VARs)

- Information Technology (IT) security agencies

- Research organizations

Report Objectives

- To define, describe, and forecast the Email Encryption market based on offering, deployment, verticals, and regions:

- To predict and estimate the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile the key players of the market and comprehensively analyze their market size and core competencies.

- Track and analyze competitive developments, such as new product launches, mergers and acquisitions, partnerships, agreements, and collaborations in the global Email Encryption market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional Email Encryption market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Email Encryption Market

Knowing the Latest Innovations and Understanding the Geographical share hold of Email Encryption Market