Emission Control Catalysts Market by Type (Palladium, Platinum, Rhodium), Application (Mobile sources (off road, and on road), and Stationary Sources), and Region (North America, Europe, APAC, South America & RoW) - Global Forecast to 2026

Updated on : September 03, 2025

Emission Control Catalysts Market

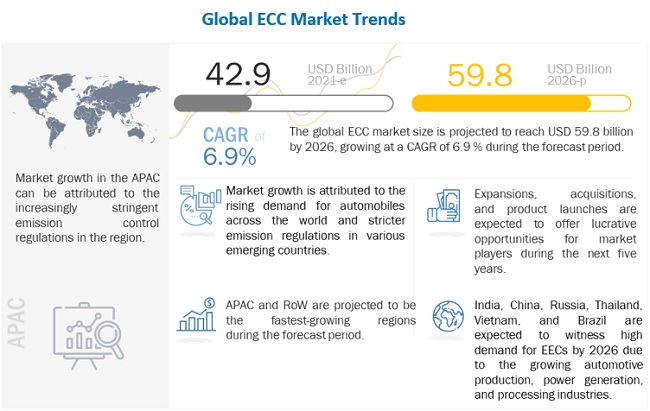

The global emission control catalysts market was valued at USD 42.9 billion in 2021 and is projected to reach USD 59.8 billion by 2026, growing at a cagr 6.9% from 2021 to 2026. This high growth is primarily driven by the growth of the global automobile sector. ECC are very important among various applications such as mobile, and stationary sources. The major factors driving the market are the stringent emission standards implemented by governments across the globe and increasing aftermarket for catalytic converters. Moreover, increasing power generation plants in various countries, and rising awareness among automobile manufacturers about the benefits of using catalytic converters is also influencing market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Global Emission Control Catalysts Market

ECCs have applications in mobile and stationary emission sources such as automobiles and the industrial sector.

It enables the elimination or reduction of harmful chemicals generated by automobiles, power plants, gas turbines, and other sources of environmental pollution. The ECC helps reduce nitrogen oxides (NOx), hydrocarbons, carbon monoxide (CO), and other non-permissible emissions to decrease their negative impact on the environment.

COVID-19 pandemic has significantly disrupted the automotive sector in 2020, with halted manufacturing due to lockdown restrictions owing to the non-availability of workforces, supply chain disruptions, country-wide lockdowns, and limited availability of raw materials. ECC manufacturers also experienced the impact of COVID-19 in terms of production and sales volumes during the first and second quarters of 2020 due to the decline in the global automotive industry. Amid the COVID-19 pandemic, there has been a rise in the prices of PGMs due to restricted operations in the mining industry, shortage of labor, and supply chain disruptions. The supply and demand for PGMs was negatively affected due to the impact of COVID-19 on various industries including automotive, and industrial processing units. However, stimulus package by various government globally has helped the countries to support the declining economy, which is also expected to support various end-use industries and lead to economic recovery post the COVID-19 crisis.

Emission Control Catalysts Market Dynamics

Driver: Stringent emission control regulations to drive the emission control catalysts market

Rapid industrialization and urbanization contribute to the higher emissions in the environment which is a major challenge across the globe. Automobile and industrial emissions are increasing rapidly due to on-road and off-road emission sources such as passenger cars, light-duty and heavy-duty commercial vehicles, and others are major sources of emissions leading to air pollution and environmental issues. Growing concerns over environmental pollution are leading to the implementation of stringent emission regulations resulting in increased demand for advanced catalyst converters utilizing precious metals. The stringent emission regulations are increasing the demand for lighter, faster, and low fuel consumption vehicles which is expected to boost the growth of the ECC market.

Restrain: Rising demand for battery-operated electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid vehicles supported by government incentives to impact the market for ECCs

Electric vehicles have zero tailpipe emissions are does not require ECC which is a major restraint for the ECC market. Due to the rising concerns over global warming and increasing air pollution, various governments globally are supporting EV manufacturers and providing subsidies to EV owners in the form of financial incentives, purchase bonuses, and tax savings. The global battery electric vehicle market has grown rapidly in recent years owing to the rising oil prices and environmental pollution. The usage of EV vehicles is rising and is expected to account for a high proportion of the overall vehicle production in future which could hamper the growth of ECC market. However, emerging countries such as India account for lower sales of EVs, HEVs, and PHEVs which was less than 1% of the overall sales of vehicles in 2019 according to the Bureau of Energy Efficiency. Due to low impact of EV the ECC market in the country is expected to grow during the forecast period.

Opportunity: Rising awareness among manufacturers in the reduction of vehicle emissions by installing catalytic converters

ECC are used in large number of automobiles and industrial processing units to reduce emissions from internal combustion engines and industrial activities. Development in automotive engines technologies and catalytic converters such as two-way catalytic converters, three-way catalytic converters, and SCR systems are addressing the complexities of emissions. Catalytic converter is capable of destroying approximately 98% hydrocarbons, carbon monoxide, and nitrogen oxides produced by the vehicle engine. Manufacturers are developing new and advanced systems that require significantly less PGMs and simultaneously improve the overall performance of the catalytic converters to meet the required emission standards.

Palladium is estimated to account for the largest share of the global ECC market during the forecast period.

Palladium is one of the metals from the PGM group that dominates the catalytic converter technology. Palladium is used as an oxidation catalyst which is widely used in gasoline auto catalyst (petrol-based engines) that in diesel engines. Catalysts containing equivalent ratios of platinum and palladium are expected to be launched to improve the quality of catalytic converters to curb the rising emissions. Palladium is the ability to maintain acceptable performance at sustained high temperatures during the lifespan of the vehicle.

Mobile sources is expected to be the largest ECC application during the forecast period.

Mobile sources is the largest application of ECC which accounted for a share of 81% in terms of value in 2020.

Due to high volatile organic compound (VOC) emissions such as alkenes, alkanes, and various others from HDVs and LDVs, mobile sources have a higher demand for ECC. Growth of the automotive industry is resulting in a rise in harmful emissions and rising demand for ECC in automotive industry to reduce harmful emissions

Increase usage of gasoline engines leads to growing demand of palladium in catalytic converter.

Palladium is one of the metals from the PGM group that dominates the catalytic converter technology. Palladium is used as an oxidation catalyst which is widely used in gasoline auto catalyst (petrol-based engines) that in diesel engines. Catalysts containing equivalent ratios of platinum and palladium are expected to be launched to improve the quality of catalytic converters to curb the rising emissions.

Stringent emission regulations in mobile sources to grow the demand for ECC

The mobile industry is the largest market for PGM based on ECC. The ECC market is derived further dividing the market into on road, and off road. The catalytic converters are installed in the vehicles that turn the toxic exhaust emissions into non-toxic substances by using precious metals such as platinum, palladium, and rhodium as catalysts. These precious metals react with the toxic gases, break them down to lesser harmful pollutants and are released into the environment. Though these metals are expensive, there is a huge demand for the most efficient catalytic technologies.

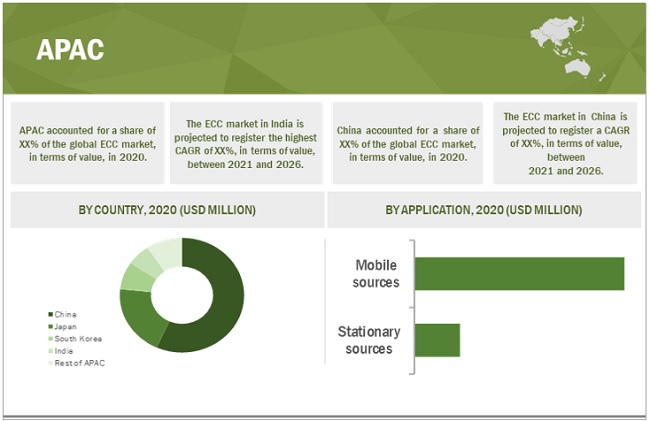

By region, APAC is expected to account for the largest share of the global market during the forecast period.

Based on region, the ECC market has been segmented into APAC, Europe, North America, the Middle East & Africa, and South America. APAC is the largest growing ECC market owing to the increasing investments in the automobile & industrial sector, along with the rapidly growing population of the region. Increasing consumer purchasing power has propelled the growth of various industries in this region. These factors are expected to lead to increasing demand for ECC in the region during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Emission Control Catalysts Market Players

The ECC market comprises major players such as BASF catalyst (Germany), Johnson Matthey (UK), Umicore (Belgium), Tenneco (US), Cataler (Japan), Heraeus (Germany), Bosal (Netherlands), Clean Diesel Technologies (US), Cormetech (US), DCL International Inc. (Canada), Hitachi Zosen Corporation (Japan), IBDIEN (Austria), Interkat (Germany), Kunming Sino-Platinum Metals Catalyst (China), Nett Technologies (Japan), NGK Insulators (Japan), Shell Global (Netherlands), Sinocat (China), and Zelolyst International (US).

Emission Control Catalysts Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 42.9 billion |

|

Revenue Forecast in 2026 |

USD 59.8 billion |

|

CAGR |

6.9% |

|

Years considered for the study |

2019-2026 |

|

Base year |

2020 |

|

Forecast period |

2021-2026 |

|

Units considered |

Volume (Ton), Value (USD Billion, and Million) |

|

Segments |

Metal type, Application, and Region |

|

Regions |

North America, APAC, Europe, South America, and the Rest of the World |

|

Companies |

Johnson Matthey (UK), BASF Catalyst (Germany), Umicore (Belgium), Tenneco (US), Clariant (Switzerland), Cataler (Japan), Total 25 major players covered |

This research report categorizes the ECC market based on metal type, application, and region.

On the basis of metal type, the ECC market has been segmented as follows:

- Palladium based

- Platinum based

- Rhodium based

- Others (vanadium, ruthenium, and irirdium)

On the basis of application, the ECC market has been segmented as follows:

- Mobile sources (off road, and on road)

- Stationary sources

On the basis of catalytic converter, the ECC market has been segmented as follows:

- Diesel oxidation catalyst

- Selective catalytic reduction

- Lean NOx trap

- Three-way catalytic converter

- Four-way catalytic converter

On the basis of region, the ECC market has been segmented as follows:

- APAC

- Europe

- North America

- South America

- Rest of the World

Recent Developments

- In 2021, BASF expanded its production capacity of mobile emission catalysts in Chennai, India. The strategic expansion is aimed towards increasing the capacity for heavy-duty on and off-road segment automotive

- In 2019, Johnson Matthey launched an innovative automatically regenerating ActivDPFTM diesel particulate filter (DPF) system for stationary diesel engines. This will help in delivering clean energy, without depending on a filter monitoring system. This new development will help the company to meet the need of customers in the automobile industry.

- In 2017, Umicore acquired the heavy-duty diesel businesses of Haldor Topsoe, a Denmark-based ECC manufacturer. The acquisition is expected to help the company gain customer bases in Europe and China as well as the emission control technology for heavy-duty diesel applications.

Upcoming Changes

The previous version of the report was published in 2019, with 2017 as the historical year and 2018 as the base year.

|

CHANGE |

DESCRIPTION |

|

Scope of the Market |

Subsegments have been modified based on the latest secondary research. The impact of COVID-19 on various countries and end-use sectors has been considered while designing the market engineering process and forecasting the new edition of the ECC market report. |

|

COVID-19 Impact |

The new version of the report includes an analysis of the impact of COVID-19 on the overall ECC market. |

|

Segments |

The end-use industry segment is subdivided into subtypes and is added in this study. |

|

YC-YCC Shift |

The YC-YCC shift for the ECC market has been added in this new version. |

|

Market Overview |

In the new version of the report, patent analysis, technology analysis, trade analysis, market mapping/ecosystem map, tariff & regulatory analysis, pricing analysis, and case study analysis have been added. |

|

Competitive Leadership Mapping |

A competitive evaluation matrix has been added wherein players are categorized as star, emerging leaders, pervasive, and emerging companies. The top 25 manufacturers operating in the market have been evaluated in this section. The competitive landscape section studies the strength of product portfolios and business strategy excellence for the top 25 companies. |

|

Company Profiles |

Strategic developments have changed the status quo of industry leaders, and it was prudent to analyze the changing business landscape. Therefore, companies have been studied for their current focus and strategies adopted, the right to win in the market, and strategic strength. |

|

New Financial Data |

The new edition of the report provides updated financial information in the context of the market till 2020 (depending upon availability) for each listed company in a graphical format in a single diagram. This is expected to help analyze the present status of profiled companies in terms of financial strength, profitability, key revenue-generating regions/countries, segment revenue, and business segment focus in terms of the highest revenue-generating segment. |

|

Recent Market Developments |

Recent developments are helpful in knowing market trends and growth strategies adopted by players in the market. In the new version of the report, the latest developments are listed from 2017 to 2021. |

|

Latest Product Portfolio |

Tracking the product portfolio helps analyze the product offerings of a player in the market. The new edition of the report provides updated product portfolios of the profiled companies. |

Frequently Asked Questions (FAQ):

How big is the Emission Control Catalyst Market?

Emission Control Catalyst Market worth $59.8 billion by 2026.

What is the growth rate of Emission Control Catalyst Market?

Emission Control Catalyst Market grows at a CAGR of 6.9% during the forecast period.

What are the upcoming hot bets for the ECC market?

Technological advancement such as nanotechnology,rising industrialization, urbanization, and development in material technology are hot belts for the ECC market.

How are the market dynamics changing for different metal types of ECC?

Rising demand for palladium in the automotive industry due to the rise in the use of petrol (gasoline) vehicles, supported by stringent emission regulations. Other metal such as vanadium for industrial processing to maintain emission standards

How are the market dynamics changing for different end-use applications of ECC?

Mobile and stationary applications of ECC are projected to grow supported by increasing production in automotive industry, industrialization,and rising emission regulations.

Who are the major manufacturers of ECC?

Johnson Matthey (UK), BASF catalyst (Germany), Umicore (Belgium), Tenneco (US), Cataler (Japan), and Heraeus (Germany) are major manufacturers of ECC.

How are the market dynamics changing for different regions of ECC?

ECC market penetration is high in Europe and North America. APAC is projected to grow in the ECC market owing to adoption of stringent emission norms equivalent to Europe. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 EMISSION CONTROL CATALYSTS MARKET: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 EMISSION CONTROL CATALYSTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Primary interviews – demand- and supply-sides

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 EMISSION CONTROL CATALYSTS MARKET: BOTTOM-UP APPROACH

2.2.2 MARKET: STUDY APPROACH

FIGURE 3 DEMAND-SIDE APPROACH

2.2.3 TOP-DOWN APPROACH

FIGURE 4 EMISSION CONTROL CATALYSTS MARKET: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: MARKET TOP-DOWN APPROACH

2.3 FORECAST NUMBER CALCULATION

2.3.1 DEMAND-SIDE FORECAST PROJECTIONS

2.4 DATA TRIANGULATION

FIGURE 6 EMISSION CONTROL CATALYSTS MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS AND RISKS ASSOCIATED WITH THE EMISSION CONTROL CATALYSTS MARKET

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 7 PALLADIUM SEGMENT TO GROW AT THE HIGHEST CAGR IN THE EMISSION CONTROL CATALYSTS MARKET DURING THE FORECAST PERIOD

FIGURE 8 MOBILE SOURCES APPLICATION IS PROJECTED TO ACCOUNT FOR THE LARGER SHARE OF THE MARKET DURING THE FORECAST PERIOD

FIGURE 9 APAC TO BE THE FASTEST-GROWING REGION DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL EMISSION CONTROL CATALYSTS MARKET

FIGURE 10 INCREASING DEMAND FOR EMISSION CONTROL CATALYSTS IN EMERGING COUNTRIES

4.2 MARKET IN THE APAC, 2020

FIGURE 11 MOBILE SOURCES TO BE THE LARGER APPLICATION SEGMENT AND CHINA TO BE THE LARGEST MARKET IN THE APAC

4.3 MARKET, BY METAL TYPE

FIGURE 12 PALLADIUM TO BE THE LARGEST METAL TYPE SEGMENT BETWEEN 2021 AND 2026

4.4 MARKET, BY APPLICATION

FIGURE 13 MOBILE SOURCES TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 MARKET SHARE, BY REGION

FIGURE 14 MARKET IN INDIA TO GROW AT THE HIGHEST CAGR BETWEEN 2021 AND 2026

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE EMISSION CONTROL CATALYSTS MARKET 55

5.2.1 DRIVERS

5.2.1.1 Stringent emission control regulations to drive the emission control catalysts market

FIGURE 16 ON-ROAD LIGHT AND HEAVY-DUTY VEHICLE EMISSION REGULATIONS OUTLOOK, 2014–2025

5.2.1.2 Rising demand for diesel oxidation catalysts due to the increasing adoption of diesel engine vehicles

5.2.1.3 Rising demand for advanced selective catalytic reduction (SCR)systems in heavy diesel engines

5.2.1.4 Growing aftermarket for catalytic converters expected to boost the demand for ECC

TABLE 1 CATALYTIC CONVERTER AVERAGE LIFE, BY TYPE

5.2.2 RESTRAINTS

5.2.2.1 Rising demand for battery-operated electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid vehicles supported by government incentives to impact the market for ECCs

FIGURE 17 RISING SALES OF BEVS, 2020-2025 (‘000 UNITS)

TABLE 2 GOVERNMENT INCENTIVES FOR ELECTRIC VEHICLES IN 2020, BY COUNTRY,

5.2.2.2 Possibility of undesired secondary emissions by precious metals

5.2.3 OPPORTUNITIES

5.2.3.1 Rising awareness among manufacturers in the reduction of vehicle emissions by installing catalytic converters

5.2.3.2 Increasing innovation and focus on the washcoat technology

5.2.4 CHALLENGES

5.2.4.1 Decline in global automotive industry impacted by COVID-19

5.2.4.2 Fluctuating prices of platinum group metals

5.2.4.3 Loss of the efficiency of precious metals through poisoning and thermal deactivation

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS OF THE EMISSION CONTROL CATALYSTS MARKET

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 EMISSION CONTROL CATALYST MANUFACTURERS

5.4.3 CANNERS

5.4.4 INTEGRATORS

5.4.5 ORIGINAL EQUIPMENT MANUFACTURERS (OEM)/ INDUSTRIAL PROCESSING UNITS

5.5 MACROECONOMIC INDICATORS

5.5.1 GDP TRENDS AND FORECASTS

TABLE 3 PROJECTED GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2018–2021

5.5.2 OPERATIONAL DATA

5.5.3 TRENDS IN THE AUTOMOTIVE INDUSTRY

5.5.4 AUTOMOTIVE INDUSTRY

TABLE 4 GLOBAL MOTOR VEHICLE PRODUCTION BY MAJOR COUNTRIES, 2017-2020

5.5.5 THE CHEMICAL INDUSTRY

FIGURE 20 CHEMICAL SALES BY COUNTRY (2019)

5.6 TARIFFS & REGULATIONS

5.6.1 NORTH AMERICA

5.6.1.1 US

5.6.1.2 Canada

5.6.2 APAC

5.6.3 EUROPE

TABLE 5 OVERVIEW OF AUTOMOBILE EMISSION REGULATION SPECIFICATIONS FOR PASSENGER CARS BY REGION

5.7 CASE STUDY ANALYSIS

5.7.1 COST-EFFECTIVE EMISSION CONTROL SOLUTION FOR BEIJING TRANSIT BUSES

5.7.2 DIESEL PARTICULATE FILTER(DPF) FOR POWERING CONSTRUCTION EQUIPMENT IN A SUBWAY EXPANSION PROJECT

5.8 TECHNOLOGY ANALYSIS

5.8.1 DEVELOPMENTS IN SENSOR TECHNOLOGIES TO MONITOR VEHICLE EMISSIONS

5.8.2 NANOTECHNOLOGY IN EMISSION CONTROL

5.8.3 THE DEVELOPMENT OF ADVANCED SELECTIVE CATALYTIC REDUCTION (SCR) SYSTEMS

5.9 ECOSYSTEM

FIGURE 21 THE EMISSION CONTROL CATALYST ECOSYSTEM

5.9.1 EMISSION CONTROL CATALYSTS MARKET: ECOSYSTEM

5.10 IMPACT OF COVID-19 ON THE MARKET

5.10.1 COVID-19

5.10.2 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

FIGURE 22 PACE OF GLOBAL PROPAGATION OF COVID-19 IS UNPRECEDENTED

5.11 IMPACT ON APPLICATIONS

5.12 PATENT ANALYSIS

5.12.1 INTRODUCTION

5.12.1.1 Methodology

5.12.1.2 Document type

FIGURE 23 GRANTED PATENTS VS. APPLIED PATENTS

FIGURE 24 PUBLICATION TRENDS - LAST TEN YEARS

5.12.2 INSIGHT

5.12.3 JURISDICTION ANALYSIS

FIGURE 25 PATENT ANALYSIS, BY JURISDICTION

5.12.4 TOP COMPANIES/APPLICANTS

FIGURE 26 TOP COMPANIES/ APPLICATIONS WITH THE HIGHEST NUMBER OF PATENTS

5.12.5 LIST OF PATENTS BY BASF CORPORATION

5.12.6 LIST OF PATENTS BY JOHNSON MATTHEY PUBLIC LIMITED COMPANY

5.12.7 LIST OF PATENTS BY UMICORE AG & CO KG.

5.12.8 TOP TEN PATENT OWNERS (US) IN THE LAST TEN YEARS

5.13 RAW MATERIALS ANALYSIS

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

FIGURE 27 INDUSTRIALIZATION AND TECHNOLOGIES TO DRIVE FUTURE GROWTH

5.15 TRADE ANALYSIS

5.15.1 PLATINUM

5.15.1.1 Import trade data for platinum for top ten countries, 2016-2020 (USD)

5.15.1.2 Export trade data for platinum for top ten countries, 2016-2020 (USD)

5.15.2 PALLADIUM

5.15.2.1 Import trade data for palladium for top ten countries, 2016-2020 (USD)

5.15.2.2 Export trade data for palladium for top ten countries, 2016-2020 (USD)

5.15.3 RHODIUM

5.15.3.1 Import trade data for rhodium for top ten countries, 2016-2020 (USD)

5.15.3.2 Export trade data for rhodium for top ten countries, 2016-2020 (USD)

5.16 PRICE ANALYSIS

FIGURE 28 EMISSION CONTROL CATALYST AVERAGE PGM PRICES (USD/KG)

6 EMISSION CONTROL CATALYSTS MARKET, BY METAL TYPE (Page No. - 87)

6.1 INTRODUCTION

FIGURE 29 PALLADIUM IS THE HIGHLY CONSUMED METAL TYPE IN THE ECC MARKET

TABLE 6 EMISSION CONTROL CATALYSTS MARKET, BY TYPE, 2017–2020 (TONS)

TABLE 7 MARKET SIZE, BY TYPE, 2021–2026 (TONS)

TABLE 8 MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 9 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

6.2 PALLADIUM-BASED EMISSION CONTROL CATALYSTS

6.2.1 RISING DEMAND FOR PALLADIUM FOR THE MANUFACTURE OF CATALYTIC CONVERTERS FOR GASOLINE ENGINES

6.3 PLATINUM-BASED EMISSION CONTROL CATALYSTS

6.3.1 PLATINUM TO BE THE SECOND-LARGEST SEGMENT FOR EMISSION CONTROL CATALYSTS DUE TO OXIDATION AND REDUCTION PROPERTIES

6.4 RHODIUM-BASED EMISSION CONTROL CATALYSTS

6.4.1 INCREASING DEMAND FOR RHODIUM OWING TO ITS CAPABILITY OF REMOVING NOX EMISSIONS

6.5 OTHER METAL-BASED EMISSION CONTROL CATALYSTS

7 EMISSION CONTROL CATALYSTS MARKET, BY CATALYTIC CONVERTER TYPE (Page No. - 92)

7.1 INTRODUCTION

7.2 DIESEL OXIDATION CATALYST

FIGURE 30 WORKING OF A DIESEL OXIDATION CATALYST

FIGURE 31 TYPICAL EMISSION REDUCTION PERFORMANCE, BY DIESEL OXIDATION CATALYST

7.3 SELECTIVE CATALYTIC REDUCTION

7.4 LEAN NOX TRAP

FIGURE 32 WORKING OF A LEAN DE-NOX TRAP

7.5 THREE-WAY CATALYTIC CONVERTER

FIGURE 33 WORKING OF A THREE-WAY CATALYTIC CONVERTER

7.6 FOUR-WAY CATALYTIC CONVERTER

FIGURE 34 WORKING OF A FOUR-WAY CATALYTIC CONVERTER

8 EMISSION CONTROL CATALYSTS MARKET, BY APPLICATION (Page No. - 96)

8.1 INTRODUCTION

FIGURE 35 MOBILE SOURCES TO BE THE LARGER APPLICATION SEGMENT OF THE EMISSION CONTROL CATALYSTS MARKET DURING THE FORECAST PERIOD

TABLE 10 MARKET SIZE, BY APPLICATION, 2017–2020 (TONS)

TABLE 11 MARKET SIZE, BY APPLICATION, 2021–2026 (TONS)

TABLE 12 MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 13 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 MOBILE SOURCES

FIGURE 36 APPLICABILITY OF EMISSION CONTROL TECHNOLOGIES IN MOBILE SOURCES APPLICATION

8.2.1 ON-ROAD MOBILE SOURCES

8.2.1.1 Light-duty vehicles and SCR technology to drive emission control catalysts market

8.2.2 OFF-ROAD MOBILE SOURCES

8.2.2.1 Agriculture and transportation sector to boost emission control catalysts market

8.3 STATIONARY SOURCES

8.3.1 POWER PLANT INDUSTRIES TO DRIVE EMISSION CONTROL CATALYSTS MARKET IN THE STATIONARY APPLICATION

9 EMISSION CONTROL CATALYSTS MARKET, BY REGION (Page No. - 101)

9.1 INTRODUCTION

FIGURE 37 EMISSION CONTROL CATALYSTS MARKET IN INDIA AND RUSSIA TO GROW AT THE HIGHEST CAGRS DURING THE FORECAST PERIOD

TABLE 14 MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 15 MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 16 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.2 APAC

FIGURE 38 APAC: EMISSION CONTROL CATALYSTS MARKET SNAPSHOT

TABLE 18 APAC: EMISSION CONTROL CATALYSTS MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 19 APAC: MARKET SIZE, BY COUNTRY, 2021–2026 (TON)

TABLE 20 APAC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 21 APAC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 22 APAC: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 23 APAC: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 24 APAC: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 25 APAC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Rapid urbanization, industrialization, and increasing automotive production to boost the emission control catalysts market

TABLE 26 CHINA: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 27 CHINA: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 28 CHINA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 29 CHINA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.2 JAPAN

9.2.2.1 Technological advancements and increasing emission norms are expected to drive the emission control catalysts market

TABLE 30 JAPAN: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 31 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 32 JAPAN: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 33 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.3 SOUTH KOREA

9.2.3.1 Growing automotive industry is driving the emission control catalysts market

TABLE 34 SOUTH KOREA: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 35 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 36 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 37 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.4 INDIA

9.2.4.1 Government initiatives, such as Make in India and Automotive Mission Plan for boosting automotive production to drive the emission control catalysts market

TABLE 38 INDIA: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 39 INDIAN: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 40 INDIA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 41 INDIA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.5 REST OF APAC

TABLE 42 REST OF APAC: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 43 REST OF APAC: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 44 REST OF APAC: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 45 REST OF APAC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3 EUROPE

FIGURE 39 EUROPE: EMISSION CONTROL CATALYSTS MARKET SNAPSHOT

TABLE 46 EUROPE: EMISSION CONTROL CATALYSTS MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 47 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (TON)

TABLE 48 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 50 EUROPE:MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 51 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 52 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 53 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Rising emission standards to increase the demand for emission control catalysts

TABLE 54 GERMANY: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 55 GERMANY: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 56 GERMANY: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 57 GERMANY; MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.2 UK

9.3.2.1 Investment policies in the automotive industry to boost the emission control catalysts market

TABLE 58 UK: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 59 UK: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 60 UK: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 61 UK: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 The presence of major automobile manufacturers drives the emission control catalysts market

TABLE 62 FRANCE: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 63 FRANCE:MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 64 FRANCE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 65 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.4 SPAIN

9.3.4.1 Carbon neutrality 2050 mission to propel the emission control catalysts market growth

TABLE 66 SPAIN: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 67 SPAIN: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 68 SPAIN: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 69 SPAIN: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.5 ITALY

9.3.5.1 Rising industrial emissions to boost the emission control catalysts market

TABLE 70 ITALY: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 71 ITALY: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 72 ITALY: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 73 ITALY: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 74 REST OF EUROPE: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 75 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026(TON)

TABLE 76 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 77 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.4 NORTH AMERICA

FIGURE 40 NORTH AMERICA: EMISSION CONTROL CATALYSTS MARKET SNAPSHOT

TABLE 78 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (TON)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.1 US

9.4.1.1 Increasing demand for passenger cars to boost emission control catalysts market in the country

TABLE 86 US: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 87 US: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 88 US: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 89 US: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.2 CANADA

9.4.2.1 Government initiatives for carbon neutrality and trade agreements with different countries are favorable for the emission control catalysts market growth

TABLE 90 CANADA: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 91 CANADA: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 92 CANADA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 93 CANADA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.3 MEXICO

9.4.3.1 Geographical advantages and industrialization to drive the emission control catalysts market in the country

TABLE 94 MEXICO: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 95 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 96 MEXICO: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 97 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.5 SOUTH AMERICA

TABLE 98 SOUTH AMERICA: EMISSION CONTROL CATALYSTS MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 99 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (TON)

TABLE 100 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 101 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 102 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 103 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 104 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 105 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Growing industrial sector to boost emission control catalysts market in the country

TABLE 106 BRAZIL: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 107 BRAZIL: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 108 BRAZIL: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 109 BRAZIL: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.5.2 ARGENTINA

9.5.2.1 Stringent emission standards similar to those of the EU will increase the demand for emission control catalysts in the country

TABLE 110 ARGENTINA: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 111 ARGENTINA: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 112 ARGENTINA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 113 ARGENTINA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.5.3 REST OF SOUTH AMERICA

TABLE 114 REST OF SOUTH AMERICA: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 115 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 116 REST OF SOUTH AMERICA:MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 117 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.6 REST OF THE WORLD (ROW)

TABLE 118 ROW: EMISSION CONTROL CATALYSTS MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 119 ROW: MARKET SIZE, BY COUNTRY, 2021–2026 (TON)

TABLE 120 ROW: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 121 ROW: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 122 ROW: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 123 ROW: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 124 ROW: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 125 ROW: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.6.1 RUSSIA

9.6.1.1 Growing automotive industry to boost the demand for emission control catalysts

TABLE 126 RUSSIA: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 127 RUSSIA: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 128 RUSSIA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 129 RUSSIA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.6.2 SOUTH AFRICA

9.6.2.1 Automotive industry to lead the emission control catalysts market

TABLE 130 SOUTH AFRICA: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 131 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 132 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 133 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.6.3 MIDDLE EAST & NORTH AFRICA

9.6.3.1 Growth in various end-use industries in the region

TABLE 134 MIDDLE EAST & NORTH AFRICA: EMISSION CONTROL CATALYSTS MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 135 MIDDLE EAST & NORTH AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (TON)

TABLE 136 MIDDLE EAST & NORTH AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 137 MIDDLE EAST & NORTH AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 149)

10.1 OVERVIEW

FIGURE 41 COMPANIES ADOPTED EXPANSIONS AS KEY GROWTH STRATEGY DURING 2017–2021

10.2 MARKET EVALUATION FRAMEWORK

TABLE 138 NUMBER OF RECENT DEVELOPMENTS OVER THE PAST FIVE YEARS

10.3 MARKET SHARE ANALYSIS

FIGURE 42 EMISSION CONTROL CATALYSTS MARKET SHARE, BY COMPANY (2020)

TABLE 139 MARKET: DEGREE OF COMPETITION

10.4 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2020

FIGURE 43 RANKING OF TOP FIVE PLAYERS IN THE EMISSION CONTROL CATALYSTS MARKET, 2020

10.5 COMPANY EVALUATION MATRIX, 2021 (TIER 1)

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 44 EMISSION CONTROL CATALYSTS MARKET: (GLOBAL) COMPANY EVALUATION MATRIX, 2021

FIGURE 45 COMPANY PRODUCT FOOTPRINT (TIER 1)

FIGURE 46 BUSINESS STRATEGY EXCELLENCE (TIER 1)

10.6 STARTUP AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 STARTING BLOCK

10.6.4 DYNAMIC COMPANY

FIGURE 47 EMISSION CONTROL CATALYSTS MARKET: STARTUP AND SME MATRIX, 2020

FIGURE 48 STRENGTH OF PRODUCT PORTFOLIO (SMES)

FIGURE 49 BUSINESS STRATEGY EXCELLENCE (SMES)

10.7 COMPANY FOOTPRINT

TABLE 140 OVERALL COMPANY FOOTPRINTS

TABLE 141 COMPANY TYPE FOOTPRINT

TABLE 142 COMPANY APPLICATION FOOTPRINT

TABLE 143 COMPANY REGION FOOTPRINT

10.8 COMPETITIVE SCENARIO

10.8.1 EMISSION CONTROL CATALYSTS MARKET: NEW PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 144 MARKET: NEW PRODUCT LAUNCHES AND DEVELOPMENTS

10.8.2 MARKET: DEALS

TABLE 145 EMISSION CONTROL CATALYSTS MARKET: DEALS

10.8.3 OTHER DEVELOPMENTS

TABLE 146 MARKET: OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 167)

(Business Overview, Products Offered, Product Launches, Deals, Other Developments, Strategic Choices Made, Weaknesses and Competitive Threats, Key Strengths/Right to Win, and MnM View)*

11.1 JOHNSON MATTHEY

FIGURE 50 JOHNSON MATTHEY: COMPANY SNAPSHOT

TABLE 147 JOHNSON MATTHEY: BUSINESS OVERVIEW

11.2 BASF CATALYST

FIGURE 51 BASF CATALYST: COMPANY SNAPSHOT

TABLE 148 BASF CATALYSTS: BUSINESS OVERVIEW

11.3 UMICORE

FIGURE 52 UMICORE: COMPANY SNAPSHOT

TABLE 149 UMICORE: BUSINESS OVERVIEW

11.4 TENNECO, INC

FIGURE 53 TENNECO, INC: COMPANY SNAPSHOT

TABLE 150 TENNECO, INC: BUSINESS OVERVIEW

11.5 HERAEUS HOLDING

FIGURE 54 HERAEUS HOLDING: COMPANY SNAPSHOT

TABLE 151 HERAEUS HOLDING: BUSINESS OVERVIEW

11.6 CLARIANT

FIGURE 55 CLARIANT: COMPANY SNAPSHOT

TABLE 152 CLARIANT: BUSINESS OVERVIEW

11.7 CDTI ADVANCED MATERIALS, INC

FIGURE 56 CDTI ADVANCED MATERIALS, INC: COMPANY SNAPSHOT

TABLE 153 CDTI ADVANCED MATERIAL, INC: BUSINESS OVERVIEW

11.8 CATALER CORPORATION

FIGURE 57 CATALER CORPORATION: COMPANY SNAPSHOT

TABLE 154 CATALER CORPORATION: BUSINESS OVERVIEW

11.9 CUMMINS, INC

TABLE 155 CUMMINS, INC: BUSINESS OVERVIEW

FIGURE 58 CUMMINS INC: COMPANY SNAPSHOT

11.10 BOSAL

TABLE 156 BOSAL: BUSINESS OVERVIEW

* Business Overview, Products Offered, Product Launches, Deals, Other Developments, Strategic Choices Made, Weaknesses and Competitive Threats, Key Strengths/Right to Win, and MnM View might not be captured in case of unlisted companies.

11.11 OTHER MARKET PLAYERS

11.11.1 CORMETECH

11.11.2 DCL INTERNATIONAL INC.

11.11.3 ECOCAT INDIA PVT. LTD

11.11.4 HITACHI ZOSEN CORPORATION

11.11.5 HJS EMISSION TECHNOLOGY GMBH & CO. KG

11.11.6 IBIDEN

11.11.7 INTERKAT CATALYST GMBH

11.11.8 KLARIUS PRODUCTS LTD

11.11.9 KUNMING SINO-PLATINUM METALS CATALYST CO. LTD.

11.11.10 NETT TECHNOLOGIES, INC

11.11.11 NGK INSULATORS, LTD.

11.11.12 SHELL GLOBAL

11.11.13 SINOCAT ENVIRONMENTAL TECHNOLOGY CO., LTD

11.11.14 SOLVAY

11.11.15 ZELOLYST INTERNATIONAL

12 APPENDIX (Page No. - 200)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

Emission Control Systems Market Overview

The Emission Control Systems Market refers to the market for technologies and products that control and reduce emissions from internal combustion engines. The market is driven by increasing environmental regulations and growing demand for cleaner and more fuel-efficient vehicles.

Emission control systems and emission control catalysts are interdependent markets. Emission control catalysts are one of the key components of emission control systems. They are used to reduce the emissions of harmful gases such as nitrogen oxides, carbon monoxide, and hydrocarbons from the exhaust of vehicles. The demand for emission control systems and emission control catalysts is influenced by similar factors such as environmental regulations, vehicle production, and demand for cleaner transportation.

The growth of the emission control systems market is expected to have a positive impact on the emission control catalysts market. As more vehicles adopt emission control systems, the demand for emission control catalysts will also increase. The market for emission control catalysts is expected to grow as governments across the world implement stricter environmental regulations and vehicle manufacturers adopt new technologies to comply with these regulations.

Futuristic growth use-cases of Emission Control Systems Market

The Emission Control Systems Market is expected to witness significant growth in the future. One of the key growth drivers is the increasing demand for electric vehicles. As more electric vehicles are produced and sold, the demand for emission control systems will decline. However, the market for emission control systems will continue to grow as hybrid vehicles become more popular.

Another growth use-case for the market is the development of new emission control technologies. These include technologies such as selective catalytic reduction (SCR), diesel oxidation catalysts (DOC), and diesel particulate filters (DPF), which are becoming increasingly popular in the automotive industry.

Top players in Emission Control Systems Market

The top players in the Emission Control Systems Market include companies such as Johnson Matthey, Tenneco Inc., Faurecia, BASF SE, and Umicore SA. These companies are investing heavily in research and development to develop new technologies and products that are more efficient and cost-effective.

Other industries impacted by Emission Control Systems Market

The Emission Control Systems Market is expected to impact other industries such as the automotive industry, chemical industry, and the manufacturing industry. As more stringent environmental regulations are implemented, automotive manufacturers will be required to invest in emission control technologies, which will drive demand for these products. In addition, chemical and manufacturing companies will be required to develop and produce the materials and components necessary for these technologies, which will create new opportunities for these industries.

Speak to our Analyst today to know more about Emission Control Systems Market!

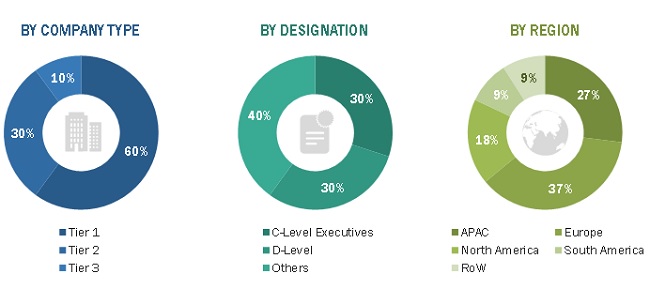

The study involved four major activities to estimate the current market size of Emission Control Catalyst (ECC). Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Emission Control Catalysts Market Secondary Research

In the secondary research process, various secondary sources such as Factiva, Zauba, Hoovers, and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulations form agencies such as the US Environmental Protection Agency (EPA), Association for Emissions Control by Catalyst (AECC), and other regulatory bodies, and databases.

Emission Control Catalysts Market Primary Research

The ECC market comprises several stakeholders, such as raw material suppliers, canners, integrators, end-use manufacturers, and regulatory organizations in the supply chain. The demand side of this market is included lab technicians, technologists, and sales/purchase managers from the ECC industry. The supply side is characterized by advancements in technology and diverse application segments. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Emission Control Catalysts Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the ECCs market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Emission Control Catalysts Market Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the mobile and stationary sources.

Emission Control Catalysts Market Report Objectives

- To analyze and forecast the ECC market size, terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the market by metal type, application, and catalytic converter.

- To forecast the size of the market with respect to five regions, namely, Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa (MEA), along with their countries

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments such as new product launch, merger & acquisition, and investment & expansion in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

Emission Control Catalysts Market Report Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of APAC for ECC market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Emission Control Catalysts Market