Engineered fluids (Fluorinated fluids) Market by Type (Lubricants, Solvents, Heat Transfer Fluids), End-Use Industry (Electronics & Semiconductor, Automotive, Chemical Processing, Oil & Gas, Power Generation, Aerospace), Region - Global Forecast to 2023

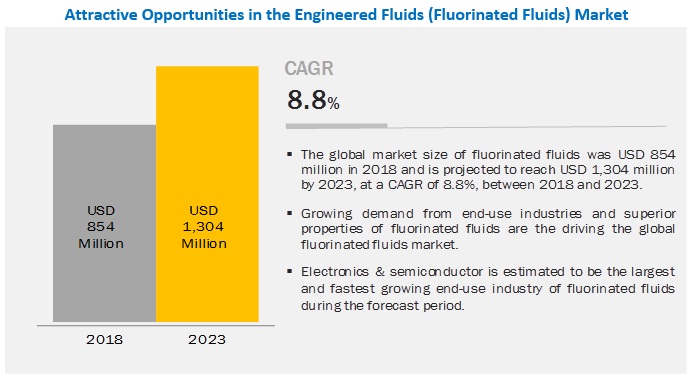

[145 Pages Report] The market for engineered fluids (fluorinated fluids) is projected to grow from USD 854 million in 2018 to USD 1,304 million by 2023, at a CAGR of 8.8% during the forecast period. Engineered fluids (fluorinated fluids) are versatile materials that are used for thermal management application. Some of the exceptional properties of these fluids include chemical stability, non-toxicity, non-flammability, high and low-temperature use, and excellent compatibility with a wide range of plastics, metals, and elastomers. Engineered fluids (fluorinated fluids) are used in various end-use Industries such as electronics & semiconductor, automotive, chemical processing, oil & gas, power generation, and aerospace, to reduce friction between machine parts.

Electronics & semiconductor is projected to be the fastest-growing end-use industry during the forecast period.

The semiconductor industry is expected to increase its revenue mainly by diversification into new technologies such as the Internet of things (IoT) and artificial intelligence (AI). A lot of companies are also investing in R&D to develop cutting edge technologies. Engineered fluids (fluorinated fluids) are used in applications such as electronics cooling, heating, testing, chamber cleaning, connectors, process chamber, and wafer handling.These applications of engineered fluids (fluorinated fluids) are expected to drive the market.

Lubricants is projected to be the largest segment of the engineered fluids (fluorinated fluids) market during the forecast period.

Fluorinated lubricants are fluorocarbon ether polymers of polyhexafluoropropylene oxide. Fluorinated lubricants are also known as perfluoropolyether. Fluorinated oils, greases, and wax are covered under this segment. They are non-flammable, chemically inert, non-reactive, and evaporate very slowly. Fluorinated lubricants possess superior properties as compared to petroleum-based lubricants. These fluids are designed to perform effectively between 130°F and 572°F whereas petroleum-based lubricants fail to perform 0.4°F and above 212°F. Such properties are driving the fluorinated lubricants market.

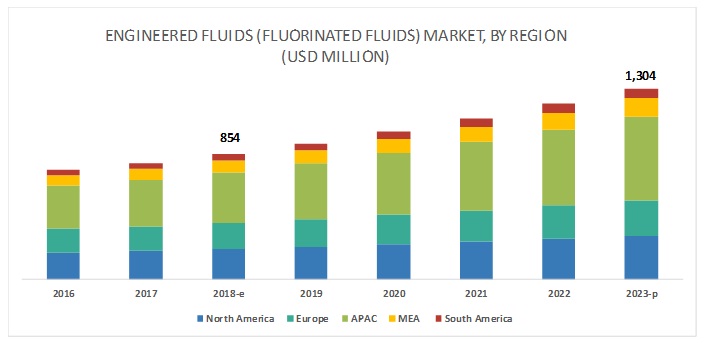

APAC is estimated to be the largest market during the forecast period.

APAC is estimated to lead the overall engineered fluids (fluorinated fluids) market during the forecast period. The region has emerged as the largest consumer of engineered fluids (fluorinated fluids), owing to the growth in demand for engineered fluids (fluorinated fluids) in countries such as China, Japan, India, South Korea, and Indonesia. The growing industrialization in these countries and low manufacturing cost have encouraged global companies to establish their presence in the countries of APAC. These factors are expected to drive the market for engineered fluids (fluorinated fluids) in the region during the forecast period.

Key Market Players

The leading players in the engineered fluids (fluorinated fluids) market are Daikin Industries (Japan), Solvay SA (Belgium), The Chemours Company (US), 3M (US), Asahi Glass Company (Japan), Halocarbon Products Corporation (US), Halopolymer (Russia), F2 Chemicals (UK), IKV Tribology (UK), Lubrilog Lubrication Engineering (France), Nye lubricants (US), and Interflon (Netherlands).

Chemours ranks among the top global leaders in the engineered fluids (fluorinated fluids) market. The company has a strong presence in APAC, North America, and Europe, with production facilities located in each of these regions. The well-established distribution network and high brand value help the company in penetrating markets across the globe.

Daikin covers major markets with production and sales network in the US, France, the Netherlands, Germany, China, Japan, South Korea, Hong Kong, and Taiwan. The strategic presence in these countries allows the company to cater to the demand from the growing electronics, automotive, and aerospace industries in the respective regions.

Solvay is one of the leading manufacturers of engineered fluids (fluorinated fluids), with a presence in 61 countries. The company is focused on maintaining strong R&D capacities in order to develop products that are environment-friendly. The company has also increased its product portfolio and provides engineered fluids (fluorinated fluids) to various end-use industries such as textile, aerospace, military, industrial, electrical, electronics, boiler, and food.

Scope of Report

|

Report Metric |

Details |

|

Years considered for the study |

20162023 |

|

Base year |

2017 |

|

Forecast period |

20182023 |

|

Units considered |

Value (USD Million) and Volume (Tons) |

|

Segments |

Type, End-use industry and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies profiled |

Daikin Industries (Japan), Solvay SA (Belgium), The Chemours Company (US), 3M (US), Asahi Glass Company (Japan), Halocarbon Products Corporation (US), Halopolymer (Russia), F2 Chemicals (UK), IKV Tribology (UK), Lubrilog Lubrication Engineering (France), Nye Lubricants (US), and Interflon (Netherlands) among the total 20 major players covered |

This research report categorizes the global engineered fluids (fluorinated fluids) market on the basis of type, end-use industry, and region.

On the basis of type:

- Lubricants

- Solvents

- Heat Transfer Fluids

On the basis of end-use industry:

- Aerospace

- Automotive

- Electronics & Semiconductor

- Oil & Gas

- Power Generation

- Chemical Processing

On the basis of region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

The market is further analyzed for the key countries in each of these regions.

Recent Developments

- In February 2017, Chemours opened a new production facility at its Christi plant in Ingleside, Texas (US). This will triple the companys capacity for the HFO-1234yf-based-products and make it a world leader in low global warming potential products.

- In February 2017, Solvay acquired Energain Technology from DuPont, thereby, expanding its product portfolio catering to the battery production industry. This acquisition will boost Solvays technological road map in the battery production industry.

Key Questions Addressed by the Report

- What are the global trends in demand for engineered fluids (fluorinated fluids)? Will the market witness an increase or decline in demand in the coming years?

- What is the estimated demand for engineered fluids (fluorinated fluids)? Which type is used the most in the end-use industries?

- What were the revenue pockets for the engineered fluids (fluorinated fluids) market in 2017?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- Which are the major engineered fluids (fluorinated fluids) manufacturers, globally?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

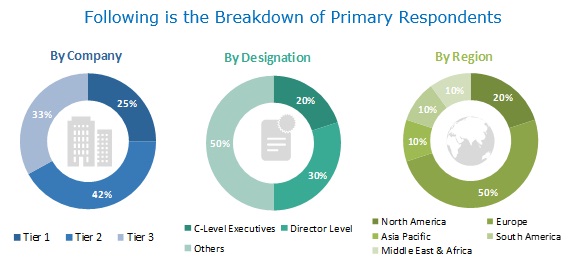

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Engineered Fluids (Fluorinated Fluids) Market

4.2 APAC Engineered Fluids (Fluorinated Fluids) Market, By Type and Country

4.3 Engineered Fluids (Fluorinated Fluids) Market, By Type

4.4 Engineered Fluids (Fluorinated Fluids) Market, By End-Use Industry

4.5 Engineered Fluids (Fluorinated Fluids) Market, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Superior Properties of Fluorinated Fluids

5.2.1.2 Environment-Friendly Properties of Fluorinated Fluids

5.2.1.3 High Demand in APAC

5.2.1.4 Growth of End-Use Industries

5.2.2 Restraints

5.2.2.1 High Cost of Technology Development and Manufacturing of Fluorinated Fluids

5.2.3 Opportunities

5.2.3.1 Growing Demand for Heat Exchangers

5.2.3.2 Replacement of Petroleum-Based Lubricants With Fluorinated Lubricants

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Engineered Fluids (Fluorinated Fluids) Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Lubricants

6.2.1 Superior Properties of Fluorinated Lubricants in Comparison to Petroleum-Based Lubricants are Driving This Segment of the Market

6.3 Solvents

6.3.1 Environmental-Friendly Properties of Fluorinated Solvents are Boosting the Market

6.4 Heat Transfer Fluids

6.4.1 Low Toxicity and Energy-Saving Properties of Heat Transfer Fluids are the Key Governing Factors for the Market

7 Engineered Fluids (Fluorinated Fluids) Market, By End-Use Industry (Page No. - 46)

7.1 Introduction

7.2 Aerospace

7.2.1 Increasing Demand in Oxygen Systems, Actuators, and Mechanical Components is Projected to Drive the Engineered Fluids (Fluorinated Fluids) Market in the Aerospace Industry

7.3 Automotive

7.3.1 Properties Such as Strong Weatherability and High Resistance to Fuel Make Fluorinated Fluids Suitable for Use in the Automotive Industry

7.4 Electronics & Semiconductor

7.4.1 Increasing thermal Management Issues in the Electronics Industry are Boosting the Demand for Fluorinated Fluids

7.5 Oil & Gas

7.5.1 Special Properties Such as Non-Flammability, Non-Toxicity, and Extended Equipment Life are the Factors Governing the Market Growth in This End-Use Segment

7.6 Chemical Processing

7.6.1 Increase in Chemical Production in APAC is Driving the Demand for Fluorinated Fluids in the Chemical Processing Industry

7.7 Power Generation

7.7.1 Long Lasting Lubrication in the Power Generation Industry is Expected to Drive the Market.

7.8 Others

8 Engineered Fluids (Fluorinated Fluids) Market, By Region (Page No. - 59)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Increasing Demand for High-Performance Machines and Growing Investments in the Electronics & Semiconductor Industry is Projected to Drive the Market

8.2.2 Canada

8.2.2.1 Increasing Focus on Manufacturing Technology-Driven Products is Spurring the Demand for Fluorinated Fluids

8.2.3 Mexico

8.2.3.1 Low Operational Cost for Manufacturing in the Country is Expected to Boost the Demand for Fluorinated Fluids

8.3 Europe

8.3.1 Germany

8.3.1.1 Improved Price Competitiveness, Innovation in the Manufacturing Sector, and Focus on Developing Advanced Automotive and Industrial Electronics are Expected to Drive the Demand for Fluorinated Fluids

8.3.2 UK

8.3.2.1 Strong Hold on the Production of High-End Consumer Electronics is Significantly Increasing the Demand for Fluorinated Fluids

8.3.3 France

8.3.3.1 Opportunities in the Electronics Industry and Increasing Manufacturing Activities are Contributing to the Market Growth

8.3.4 Russia

8.3.4.1 Increasing Investments in Chemical and Petrochemical Industries are Boosting the Demand for Fluorinated Fluids

8.3.5 Italy

8.3.5.1 Increasing Focus on Aerospace and Industrial Sectors is Spurring the Demand for Fluorinated Fluids

8.3.6 Rest of Europe

8.4 APAC

8.4.1 China

8.4.1.1 Low Manufacturing Cost and Presence of Component Manufacturers are Fueling the Market

8.4.2 India

8.4.2.1 Increase in Fdi, Supportive Government Policies, and Low Manufacturing Cost are Expected to Impact the Market Growth Positively

8.4.3 Japan

8.4.3.1 Presence of A Strong Electronics Industry is Increasing the Demand for Fluorinated Fluids

8.4.4 South Korea

8.4.4.1 The Countrys Focus on Increasing Electronics Chip Manufacturing is Driving the Market

8.4.5 Indonesia

8.4.5.1 Competitive Labor Cost and Revision of Tax Allowance and Tax Holidays to Investors are Driving the Demand for Fluorinated Fluids

8.4.6 Vietnam

8.4.6.1 Growing Economy and Government Initiatives are Fueling the Market Growth

8.4.7 Rest of APAC

8.5 South America

8.5.1 Brazil

8.5.1.1 New Government Policies on Fdi and High Tax on Imported Products are Likely to Have A Significant Impact on the Market

8.5.2 Argentina

8.5.2.1 Increasing Investment in the Electronics & Semiconductor Industry and Growing Production Activities in the Chemical Processing and Oil & Gas Industries to Drive the Demand for Fluorinated Fluids

8.5.3 Rest of South America

8.6 Middle East & Africa

8.6.1 South Africa

8.6.1.1 Increasing Focus on Electronics and Automotive Components Manufacturing are the Factors Governing the Market Growth

8.6.2 Saudi Arabia

8.6.2.1 Increasing Focus on the Non-Oil Sector is Driving the Demand for Fluorinated Fluids

8.6.3 Rest of Middle East & Africa

9 Competitive Landscape (Page No. - 114)

9.1 Introduction

9.2 Competitive Leadership Mapping, 2017

9.2.1 Terminology/Nomenclature

9.2.1.1 Visionary Leaders

9.2.1.2 Dynamic Differentiators

9.2.1.3 Emerging Companies

9.2.1.4 Innovators

9.2.2 Strength of Product Portfolio

9.2.3 Business Strategy Excellence

9.3 Competitive Scenario

9.3.1 Expansion

9.3.2 Agreement

9.3.3 Acquisition

10 Company Profiles (Page No. - 120)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 The Chemours Company

10.2 Daikin Industries

10.3 Solvay Sa

10.4 The 3M Company

10.5 Asahi Glass Company

10.6 Halocarbon Products Corporation

10.7 Engineered Custom Lubricants

10.8 Halopolymer Kirovo-Chepetsk

10.9 F2 Chemicals Ltd.

10.10 IKV Tribology

10.11 Other Players

10.11.1 Lubrilog Lubrication Engineering

10.11.2 Nye Lubricants

10.11.3 Interflon

10.11.4 Finish Line

10.11.5 Harves Co. Ltd.

10.11.6 Honeywell International Inc.

10.11.7 Frontier Performance Lubricants, Inc.

10.11.8 Condat Lubricants

10.11.9 Kluber Lubricants

10.11.10 Performance Fluids Limited

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 139)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Related Reports

11.4 Author Details

List of Tables (151)

Table 1 Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 2 Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 3 Fluorinated Lubricants Market Size, By Region, 20162023 (Ton)

Table 4 Fluorinated Lubricants Market Size, By Region, 20162023 (USD Million)

Table 5 Fluorinated Solvents Market Size, By Region, 20162023 (Ton)

Table 6 Fluorinated Solvents Market Size, By Region, 20162023 (USD Million)

Table 7 Fluorinated Heat Transfer Fluids Market Size, By Region, 20162023 (Ton)

Table 8 Fluorinated Heat Transfer Fluids Market Size, By Region, 20162023 (USD Million)

Table 9 Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 10 Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 11 Applications of Fluorinated Fluids in Aerospace Industry

Table 12 Aerospace Applications and Their Functions

Table 13 Aircraft Fleet Forecast, By Region

Table 14 Engineered Fluids (Fluorinated Fluids) Market Size in Aerospace End-Use Industry, By Region, 20162023 (Ton)

Table 15 Engineered Fluids (Fluorinated Fluids) Market Size in Aerospace End-Use Industry, By Region, 20162023 (USD Million)

Table 16 Applications of Fluorinated Fluids in Automotive Industry

Table 17 Engineered Fluids (Fluorinated Fluids) Market Size in Automotive End-Use Industry, By Region, 20162023 (Ton)

Table 18 Engineered Fluids (Fluorinated Fluids) Market Size in Automotive End-Use Industry, By Region, 20162023 (USD Million)

Table 19 Engineered Fluids (Fluorinated Fluids) Market Size in Electronics & Semiconductor End-Use Industry, By Region, 20162023 (Ton)

Table 20 Engineered Fluids (Fluorinated Fluids) Market Size in Electronics & Semiconductor End-Use Industry, By Region, 20162023 (USD Million)

Table 21 Engineered Fluids (Fluorinated Fluids) Market Size in Oil & Gas End-Use Industry, By Region, 20162023 (Ton)

Table 22 Engineered Fluids (Fluorinated Fluids) Market Size in Oil& Gas End-Use Industry, By Region, 20162023 (USD Million)

Table 23 Engineered Fluids (Fluorinated Fluids) Market Size in Chemical Processing End-Use Industry, By Region, 20162023 (Ton)

Table 24 Engineered Fluids (Fluorinated Fluids) Market Size in Chemical Processing End-Use Industry, By Region, 20162023 (USD Million)

Table 25 Engineered Fluids (Fluorinated Fluids) Market Size in Power Generation End-Use Industry, By Region, 20162023 (Ton)

Table 26 Engineered Fluids (Fluorinated Fluids) Market Size in Power Generation End-Use Industry, By Region, 20162023 (USD Million)

Table 27 Engineered Fluids (Fluorinated Fluids) Market Size in Others End-Use Industries, By Region, 20162023 (Ton)

Table 28 Engineered Fluids (Fluorinated Fluids) Market Size in Others Industries, By Region, 20162023 (USD Million)

Table 29 Engineered Fluids (Fluorinated Fluids) Market Size, By Region, 20162023 (Ton)

Table 30 Engineered Fluids (Fluorinated Fluids) Market Size, By Region, 20162023 (USD Million)

Table 31 North America: Engineered Fluids (Fluorinated Fluids) Market Size, By Country, 20162023 (Ton)

Table 32 North America: Engineered Fluids (Fluorinated Fluids) Market Size, By Country, 20162023 (USD Million)

Table 33 North America: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 34 North America: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 35 North America: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 36 North America: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 37 US: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 38 US: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 39 US: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 40 US: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 41 Canada: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 42 Canada: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 43 Canada: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 44 Canada: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 45 Mexico: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 46 Mexico: Engineered Fluids (Fluorinated Fluids) Market Size, By Type,20162023 (USD Million)

Table 47 Mexico: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 48 Mexico: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 49 Europe: Engineered Fluids (Fluorinated Fluids) Market Size, By Country, 20162023 (Ton)

Table 50 Europe: Engineered Fluids (Fluorinated Fluids) Market Size, By Country, 20162023 (USD Million)

Table 51 Europe: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 52 Europe: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 53 Europe: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 54 Europe: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 55 Germany: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 56 Germany: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 57 Germany: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 58 Germany: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 59 UK: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 60 UK: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 61 UK: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 62 UK: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 63 France: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 64 France: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 65 France: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 66 France: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 67 Russia: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 68 Russia: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 69 Russia: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 70 Russia: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry,20162023 (USD Million)

Table 71 Italy: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 72 Italy: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 73 Italy: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 74 Italy: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 75 Rest of Europe: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 76 Rest of Europe: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 77 Rest of Europe: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 78 Rest of Europe: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 79 APAC: Engineered Fluids (Fluorinated Fluids) Market Size, By Country, 20162023 (Ton)

Table 80 APAC: Engineered Fluids (Fluorinated Fluids) Market Size, By Country, 20162023 (USD Million)

Table 81 APAC: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 82 APAC: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 83 APAC: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 84 APAC: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 85 China: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 86 China: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 87 China: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 88 China: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 89 India: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 90 India: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 91 India: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 92 India: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 93 Japan: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 94 Japan: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 95 Japan: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 96 Japan: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 97 South Korea: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 98 South Korea: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 99 South Korea: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 100 South Korea: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 101 Indonesia: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 102 Indonesia: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 103 Indonesia: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 104 Indonesia: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry,20162023 (USD Million)

Table 105 Vietnam: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 106 Vietnam: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 107 Vietnam: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 108 Vietnam: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 109 Rest of APAC: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 110 Rest of APAC: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 111 Rest of APAC: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 112 Rest of APAC: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 113 South America: Engineered Fluids (Fluorinated Fluids) Market Size, By Country, 20162023 (Ton)

Table 114 South America: Engineered Fluids (Fluorinated Fluids) Market Size, By Country, 20162023 (USD Million)

Table 115 South America: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 116 South America: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 117 South America: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 118 South America: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 119 Brazil: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 120 Brazil: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 121 Brazil: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 122 Brazil: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 123 Argentina: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 124 Argentina: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 125 Argentina: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 126 Argentina: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 127 Rest of South America: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 128 Rest of South America: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 129 Rest of South America: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 130 Rest of South America: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 131 Middle East & Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By Country, 20162023 (Ton)

Table 132 Middle East & Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By Country, 20162023 (USD Million)

Table 133 Middle East & Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 134 Middle East & Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 135 Middle East & Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 136 Middle East & Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 137 South Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 138 South Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 139 South Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 140 South Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 141 Saudi Arabia: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 142 Saudi Arabia: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 143 Saudi Arabia: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 144 Saudi Arabia: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 145 Rest of Middle East & Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (Ton)

Table 146 Rest of Middle East & Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By Type, 20162023 (USD Million)

Table 147 Rest of Middle East & Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (Ton)

Table 148 Rest of Middle East & Africa: Engineered Fluids (Fluorinated Fluids) Market Size, By End-Use Industry, 20162023 (USD Million)

Table 149 Expansion, 2017

Table 150 Agreement, 2017

Table 151 Acquisition, 2017

List of Figures (34 Figures)

Figure 1 Engineered Fluids (Fluorinated Fluids) Market Segmentation

Figure 2 Engineered Fluids (Fluorinated Fluids) Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Engineered Fluids (Fluorinated Fluids) Market: Data Triangulation

Figure 6 Lubricants Was the Largest Type of Fluorinated Fluids in 2018

Figure 7 Electronics & Semiconductor to Be the Fastest-Growing End-Use Industry of Fluorinated Fluids

Figure 8 APAC to Be the Fastest-Growing Engineered Fluids (Fluorinated Fluids) Market

Figure 9 Versatility and Superior Properties to Drive the Engineered Fluids (Fluorinated Fluids) Market Between 2018 and 2023

Figure 10 Lubricants Segment Accounted for the Largest Market Share in APAC

Figure 11 Lubricants Segment to Register the Highest Cagr

Figure 12 Electronics & Semiconductor to Be the Largest End-Use Industry

Figure 13 India to Be the Fastest-Growing Market for Fluorinated Fluids

Figure 14 Drivers, Restraints, and Opportunities Governing the Engineered Fluids (Fluorinated Fluids) Market

Figure 15 Porters Five Forces Analysis of the Engineered Fluids (Fluorinated Fluids) Market

Figure 16 Electronics & Semiconductor End-Use Industry Accounted for the Largest Market Share in 2018

Figure 17 Fleet Size, By Type, 2017 vs. 2037

Figure 18 APAC to Dominate the Market During the Forecast Period

Figure 19 India to Be the Fastest-Growing Engineered Fluids (Fluorinated Fluids) Market

Figure 20 North America: Engineered Fluids (Fluorinated Fluids) Market Snapshot

Figure 21 APAC: Engineered Fluids (Fluorinated Fluids) Market Snapshot

Figure 22 Companies Majorly Adopted Organic Growth Strategies in 2017

Figure 23 Market Evaluation Framework

Figure 24 Engineered Fluids (Fluorinated Fluids) Market: Competitive Leadership Mapping, 2017

Figure 25 The Chemours Company: Company Snapshot

Figure 26 The Chemours Company: SWOT Analysis

Figure 27 Daikin Industries: Company Snapshot

Figure 28 Daikin Industries: SWOT Analysis

Figure 29 Solvay Sa: Company Snapshot

Figure 30 Solvay Sa: SWOT Analysis

Figure 31 The 3M Company: Company Snapshot

Figure 32 The 3M Company: SWOT Analysis

Figure 33 Asahi Glass Company: Company Snapshot

Figure 34 Asahi Glass Company: SWOT Analysis

The study involved four major activities in estimating the current market size for engineered fluids (fluorinated fluids). Exhaustive secondary research was done to collect information on the peer and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; publications from recognized websites; and databases were referred to for identifying and collecting information. Secondary research was used to obtain key information about the supply chain of the industry, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The engineered fluids (fluorinated fluids) market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the aerospace, automotive, electronics & semiconductor, oil & gas, power generation, chemical processing, and other industries such as pharmaceutical and food & beverage. The supply side is characterized by advancements in technology and diverse end-use industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global engineered fluids (fluorinated fluids) market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, was determined through primary and secondary research.

- All percentage shares were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials such as directors and marketing executives.

Data Triangulation

After arriving at the total market size through the estimation process, the overall market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated by using both top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there were three sources-top-down approach, bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the engineered fluids (fluorinated fluids) market, in terms of value and volume

- To provide detailed information regarding the significant factors (drivers, restraints, and opportunities) influencing the growth of the market

- To analyze and forecast the market size on the basis of type and end-use industry

- To forecast the market size of different segments with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze the competitive developments, such as expansion, acquisition, and agreement

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Geographical Analysis:

- Country-level analysis of the global engineered fluids (fluorinated fluids) market

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Growth opportunities and latent adjacency in Engineered fluids (Fluorinated fluids) Market