Enteral Feeding Devices Market Size by Type (Tubes, Pump, Syringes, Administration Sets), Age Group (Adult, Pediatric), Application (Oncology, Gastrointestinal, & Neurological Disorders, Diabetes), End User (Hospital, Home Care, ACS) & Region - Global Forecast to 2029

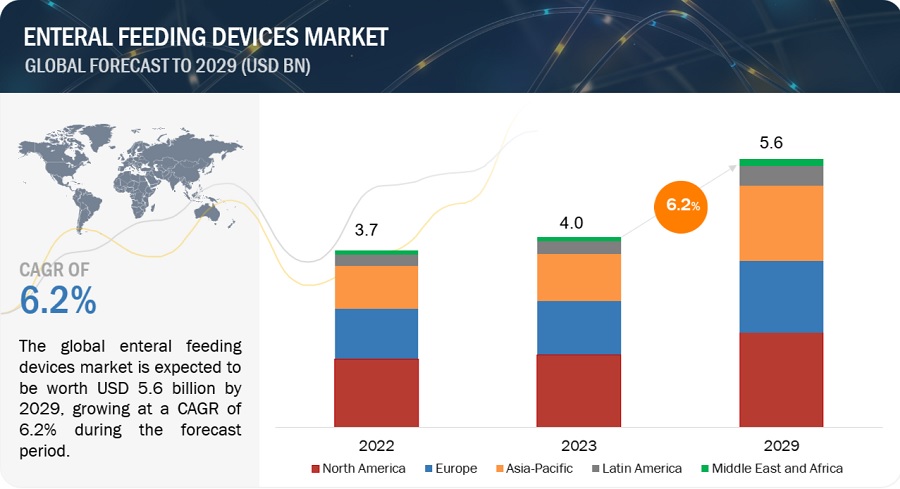

The size of global enteral feeding devices market in terms of revenue was estimated to be worth $4.0 billion in 2023 and is poised to reach $5.6 billion by 2029, growing at a CAGR of 6.2% from 2023 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

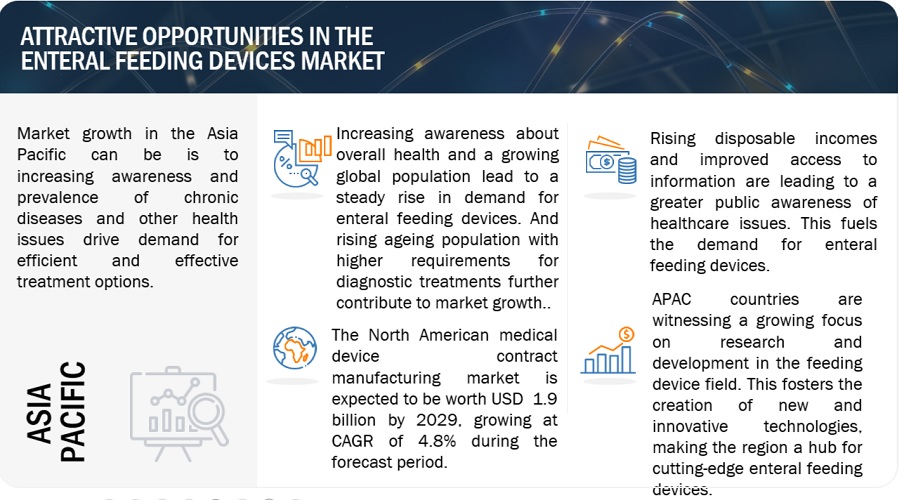

Enteral feeding devices is rapidly transforming the industry, offering significant advantages for manufacturers. The global rise in chronic disease prevalence, particularly among the aging population, is a major driver for the demand for enteral feeding devices. Increased awareness among healthcare professionals and the public about the benefits of enteral feeding is leading to its wider adoption. Educational initiatives and advancements in enteral feeding technology are contributing to this growing awareness.

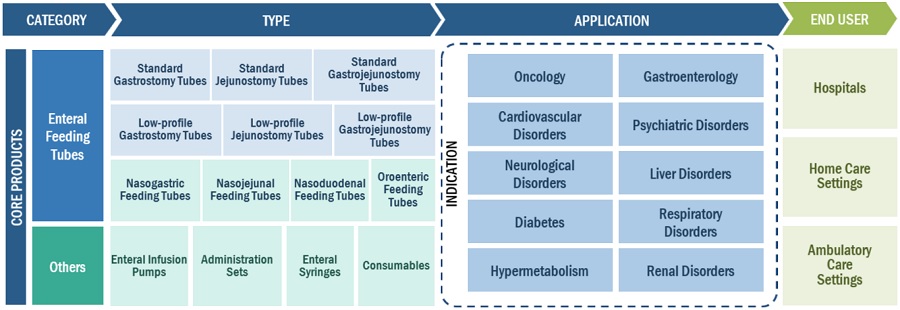

In this report, the enteral feeding devices market is segmented into – type, age group, application, end user and region.

Attractive Opportunities in the Enteral Feeding Devices Market

To know about the assumptions considered for the study, Request for Free Sample Report

Enteral feeding devices Market Dynamics

Driver: Rapid growth in geriatric population and age-related chronic diseases

Global life expectancy is increasing, leading to a larger proportion of older adults (aged 65 and above) in the population. This demographic shift is particularly pronounced in developed countries, advancements in healthcare, improved living standards, and declining birth rates contribute to the rise of the geriatric population. As people age, they become more susceptible to chronic illnesses and experience a decline in appetite or swallowing difficulties. Enteral feeding devices provide a reliable way to deliver essential nutrients, preventing malnutrition and promoting overall health in elderly patients

Restraint: Lack of Patient Awareness

Enteral feeding often isn't openly discussed in public forums, leading to a general lack of knowledge about its existence and benefits. Healthcare campaigns often prioritize raising awareness about specific diseases rather than treatment options like enteral feeding also patients unfamiliar with enteral feeding might be hesitant or apprehensive about starting therapy due to fear of the unknown which is expected to restrain the market growth.

Opportunity: Growing demand for enteral feeding in the home care sector

Improvements in enteral feeding devices are making them more user-friendly, portable, and reliable for home use. This includes quieter pumps, disposable feeding sets, and remote monitoring capabilities also the healthcare landscape is moving towards home-based care, offering greater convenience and cost-effectiveness for patients and healthcare systems. Enteral feeding devices enable patients to receive essential nutrition in the comfort of their own homes which is expected to create opportunities for the growth of the market.

Challenge: Dearth of skilled professionals and endoscopy specialists

The growing demand for enteral feeding might outpace the availability of nurses, dietitians, and other healthcare professionals trained in their proper placement, management, and monitoring Placing some enteral feeding tubes, particularly gastrostomy (G-tubes) and jejunostomy (J-tubes), often requires endoscopic procedures. A shortage of endoscopy specialists can create bottlenecks in timely device placement which is expected to challenge the market growth.

ENTERAL FEEDING DEVICES MARKET ECOSYSTEM

The enteral feeding devices market is becoming increasingly competitive, with new players entering the market and established players vying for market share. This competition drives down prices as companies try to undercut each other. The cost of materials, equipment, and labor is increasing, putting pressure on dental businesses to maintain profitability while keeping prices competitive. Consolidation within the enteral nuitrition industry, particularly the rise of homecare settings creates larger entities with greater purchasing power. This can lead to lower prices for supplies and equipment, further pressuring smaller players also government regulations and changes in insurance coverage can impact reimbursement rates for endoscopic procedures, forcing providers to adjust their pricing strategies

By type, the enterostomy feeding tubes in enteral in tube segment of the enteral feeding devices industry is expected to show the highest CAGR from 2024 to 2029.

The class of device segment is segmented into class I, class II and class III devices.

Enterostomy feeding tubes, unlike the nasogastric (NG) tubes that most people might think of for enteral feeding, are placed directly into the stomach (gastrostomy) or small intestine (jejunostomy) through a surgical opening in the abdominal wall also enterostomy feeding tubes are designed for long-term enteral feeding (weeks to years). NG tubes are typically used for shorter periods (less than 4-6 weeks) due to discomfort and increased risk of irritation in the nose and esophagus which is expected to drive the segment growth.

By application, head and neck cancer in oncology segment of the enteral feeding devices industry is expected to show the highest CAGR from 2024 to 2029.

Head and neck cancer treatments, including surgery, radiation therapy, and chemotherapy, can cause significant swallowing difficulties and mouth sores. This makes it painful or even impossible for patients to consume enough food orally. Enteral feeding tubes provide a reliable way to deliver essential nutrients directly into the stomach or small intestine, bypassing the mouth and esophagus which is expected to drive the segment growth.

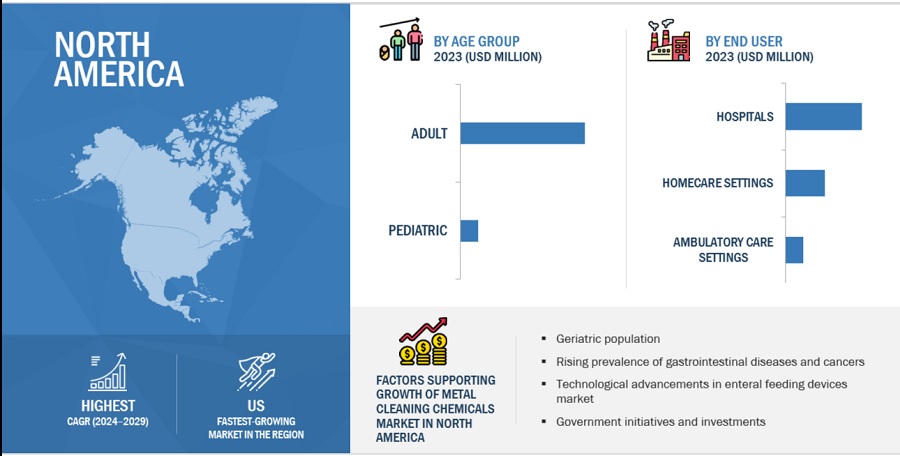

By age group, adult segment of the enteral feeding devices industry is expected to show the highest CAGR from 2024 to 2029.

Chronic illnesses like diabetes, cancer, and neurological disorders are becoming increasingly common, particularly among the aging population. These conditions can significantly impact a patient's ability to eat enough food orally. Enteral feeding tubes provide a reliable and safe method for delivering essential nutrients, promoting recovery and improving quality of life which is expected to drive the segment growth

North America accounted for the largest CAGR of the global enteral feeding devices industry., by region in the forecast period.

The enteral feeding devices market in North America is expected to grow at the highest CAGR due to a combination of factors that highlight the region's changing healthcare landscape. Some North American governments are promoting diagnostic health awareness and offering subsidies for several treatments, further stimulating market growth. The enteral feeding device market in North America is experiencing a significant boom, driven by a confluence of factors impacting both patient needs and the healthcare landscape.

To know about the assumptions considered for the study, download the pdf brochure

The key players in the Enteral feeding devices market The prominent players in the medical device contract manufacturing market include include Fresenius SE & Co. KGAA. (Germany), Cardinal Health, Inc. (US), Nestlé S.A. (Switzerland), Avanos Medical, Inc. (US), Danone S.A. (France), Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), CONMED Corporation (US), Cook Medical (US), Moog Inc. (US), Boston Scientific Corporation (US), Baxter International Inc. (US), Vygon (France), and Other players in the enteral feeding devices market are Applied Medical Technology (US), Amsino International Inc. (US), Omex Medical Technology (India), Danumed Medizintechnik (Germany), Medline Industries, Inc. (US), Fuji Systems (Japan), Kentec Medical (US), Dynarex Corporation (US), Vesco Medical LLC (US), Medela AG (Switzerland), Alcor Scientific (US), and Romsons (India)

Scope of the Enteral Feeding Devices Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2024 |

$4.0 billion |

|

Projected Revenue Size by 2029 |

$5.6 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 6.2% |

|

Market Driver |

Rapid growth in geriatric population and age-related chronic diseases |

|

Market Opportunity |

Growing demand for enteral feeding in the home care sector |

The research report categorizes the market into the following segments:

The study categorizes the enteral feeding devices market to forecast revenue and analyze trends in each of the following submarkets:

By product Type

-

Enteral Feeding Tubes

-

Enterostomy Feeding Tubes

-

Standard Tubes

-

- Standard Gastrostomy Tubes

- Standard Jejunostomy Tubes

- Standard Gastrojejunostomy Tubes

-

Low-profile Tubes

- Low-profile Gastrostomy Tubes

- Low-profile Jejunostomy Tubes

- Low-profile Gastrojejunostomy Tubes

-

-

Nasoenteric Feeding Tubes

- Nasogastric Feeding Tubes

- Nasojejunal Feeding Tubes

- Nasoduodenal Feeding Tubes

-

Standard Tubes

- Oroenteric Feeding Tubes

-

Enterostomy Feeding Tubes

- Enteral Feeding Pumps

- Administration Sets

- Enteral Syringes

- Consumables

By Age Group

- Adults

- Pediatric

By Application

-

Oncology

- Head & Neck Cancer

- Stomach & Gastrointestinal Cancer

- Liver Cancer

- Pancreatic Cancer

- Esophageal Cancer

- Other Cancer

- Gastrointestinal Diseases

- Neurological Disorders

- Diabetes

- Hypermetabolism

- Other Applications

By End User

- Hospitals

- Home Care Settings

- Ambulatory Care Settings

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Benelux

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- Southeast Asia

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East Africa

- GCC Countries

Recent Developments of Enteral Feeding Devices Industry:

- In September 2022, Cardinal Health, Inc. (US) announced the partnership with Kinaxis (Canada) to enhance the Kinaxis RapidResponse Platform used for supply chain agility and medical product visibility.

- In November 2022, Boston Scientific signed an agreement for the acquisition of Apollo Endosurgery, Inc.,. This agreement includes devices, which are used during endoluminal surgery (ELS) procedures, to close gastrointestinal defects, manage gastrointestinal complications, and aid in weight loss for patients suffering from obesity.

- In March 2021, Applied Medical Technology, Inc. (US) launched its gastric-jejunal enteral feeding tube family (G-JETs) to include the low-profile micro-G-JET to link up the enteral nutrition needs of pediatric patients.

- In March 2022, Vygon Group (France) announced the acquisition of distributor Macatt Medica (Peru). The acquisition is expected to grow the presence of Vygon Group (France), in the South American region, specifically for its broad range of enteral feeding products.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global enteral feeding devices market?

The global enteral feeding devices market boasts a total revenue value of $5.6 billion by 2029.

What is the estimated growth rate (CAGR) of the global enteral feeding devices market?

The global enteral feeding devices market has an estimated compound annual growth rate (CAGR) of 6.2% and a revenue size in the region of $4.0 billion in 2023. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the enteral feeding devices market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the enteral feeding devices market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the enteral feeding devices market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

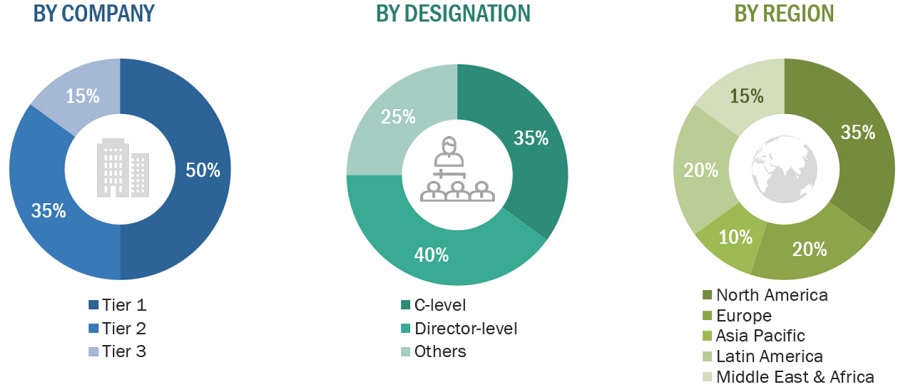

A breakdown of the primary respondents for the enteral feeding devices market is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include Others include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=<USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

The research methodology used to estimate the size of the enteral feeding devices market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the enteral feeding devices market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall enteral feeding devices market was obtained from secondary data and validated by primary participants to arrive at the total enteral feeding devices market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall enteral feeding devices market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Enteral feeding devices Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Enteral feeding devices Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

An enteral feeding device is defined as a medical device that helps patients with nutritional need or who are unable to chew solid food with their mouths to get the nutrition they need. The process of ingesting food through gastrointestinal tract is known as enteral feeding (GI). The stomach, mouth, and other digestive organs are part of the GI system.

Key Stakeholders

- Manufacturers and distributors of medical devices

- Manufacturers and distributors of medical device components

- Enteral feeding devices companies

- Healthcare institutes

- Diagnostic laboratories

- Hospitals and clinics

- Academic institutes

- Research institutes

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Objectives of the Study

- To define, describe, segment, analyze, and forecast the global enteral feeding devices market by type, age group, application, end user and region

- To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micro markets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the enteral feeding devices market in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa and GCC countries.

- To profile the key players in the enteral feeding devices market and comprehensively analyze their core competencies.

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; expansions; acquisitions; and product launches and approvals in the enteral feeding devices market.

- To analyze the impact of the recession on the enteral feeding devices market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific enteral feeding devices market into Indonesia, Philippines, Vietnam, Hong Kong, and other countries

- Further breakdown of the Rest of Europe enteral feeding devices market into Belgium, Russia, the Netherlands, Switzerland, and other countries.

- Further breakdown of the Rest of Latin America enteral feeding devices market into Argentina, Peru, and other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Enteral Feeding Devices Market