Latin America Infusion Pump Market Size, Growth, Share & Trends Analysis

Latin America Infusion Pump Market by Product (Accessories & Consumables, Devices (Volumetric, Insulin, Syringe, Ambulatory, PCA)), Application (Chemotherapy, Diabetes, Analgesia, Pediatrics, Hematology), End User (Hospitals) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Latin America infusion pump market is projected to reach USD 1,004.9 million by 2030 from USD 743.7 million in 2025, at a CAGR of 6.2% from 2025 to 2030. The growth of the Latin America infusion pump market is driven by the increasing healthcare investments, rising prevalence of chronic diseases, and advancements in medical technology.

KEY TAKEAWAYS

-

BY PRODUCTOn the basis of product, the Latin America infusion pump market is segmented into accessories & consumables and devices. The largest share of the consumables and accessories segment is driven by the rising prevalence of chronic diseases, including major health conditions such as diabetes, cancer, and cardiovascular disorders. These conditions require continuous and accurate medication administration, increasing the demand for compatible accessories. Essential components like intravenous (IV) sets, catheters, and specialized tubing are crucial in ensuring effective and safe treatment delivery for patients.

-

BY APPLICATIONOn the basis of application, the Latin America infusion pump market has been segmented into chemotherapy/oncology, diabetes management, gastroenterology, analgesia/pain management, pediatrics/ neonatology, hematology, and other applications. In 2024, the chemotherapy/oncology application segment became the dominant category within the Latin America infusion pump market, securing the largest share. This strong market position is primarily driven by the rising incidence of cancer across the region, which has significantly increased the demand for efficient treatment solutions. Furthermore, the growing availability and adoption of ambulatory infusion pumps tailored for chemotherapy are improving accessibility, enabling patients to receive treatments in more convenient settings, including at home.

-

BY END USEROn the basis of end users, the Latin America infusion pump market has been segmented into hospitals, homecare settings, ambulatory care settings, academic & research institutes, oncology centers and other end users. In 2024, the hospitals segment accounted for the largest share of the Latin America infusion pump market, driven by their strong financial capabilities, which enable investment in high-cost infusion devices necessary for delivering advanced medical care. Additionally, hospitals serve a large patient population, creating significant demand for reliable infusion systems to ensure effective medication delivery across various treatments.

-

BY REGIONOn the basis of country, the Latin America infusion pump market is segmented into Brazil, Mexico, Argentina, Colombia, Chile, Ecuador, Peru and Rest of Latin America. Colombia is projected to experience the highest CAGR in the Latin America infusion pump market from 2025 to 2030, reflecting a significant surge in demand for these critical medical devices. This robust growth is attributed to the expanding healthcare infrastructure, increasing government investment in the healthcare sector, and rising awareness of chronic diseases. The country's growing population, particularly the aging demographic, is driving the demand for advanced medical devices like infusion pumps.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, BD (US), Baxter (US), B. Braun Melsungen AG (Germany) have entered into a number of agreements and partnerships to cater to the growing demand for adoption of advanced infusion pumps in clinical settings.

The Latin America infusion pump market is experiencing robust growth driven by several interrelated factors, including the rising prevalence of chronic diseases, significant technological advancements, and an evolving healthcare landscape. The increasing incidence of conditions such as hypertension, cardiovascular diseases, and respiratory disorders necessitates the use of infusion pumps for precise and consistent treatment management. Additionally, advancements in medical technology, the growing elderly population, and increasing awareness of preventive healthcare are further fueling the demand for infusion pumps across the region.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on businesses in the Latin America infusion pump market is driven by evolving healthcare needs, technological innovations, and the increasing demand for precise and efficient medication delivery. Healthcare providers, including hospitals, clinics, and homecare settings, are the primary users of infusion pump solutions, focusing on accurate, continuous infusion for various treatments such as chemotherapy, pain management, and critical care. The growing emphasis on improving patient outcomes, along with the rise in demand for homecare and remote patient monitoring, is accelerating the adoption of advanced infusion pump technologies. These factors are shaping the market's growth trajectory, enhancing both patient safety and healthcare efficiency across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising incidence of diabetes

-

Growing geriatric population and subsequent rise in chronic diseases

Level

-

Stringent regulatory requirements for product commercialization

-

Increasing adoption of refurbished & rented infusion pumps

Level

-

High growth potential in emerging economies

-

Increasing adoption of specialty infusion systems

Level

-

Increasing incidence of medication errors and lack of wireless connectivity in majority of hospitals

-

Rural and Remote Area Access

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising incidence of diabetes

The rising incidence of diabetes in Latin America is a key driver of the infusion pump market. As the prevalence of diabetes increases, the demand for effective management solutions, including insulin pumps, is growing. Infusion pumps are essential for providing accurate and controlled delivery of insulin, which is critical for patients managing diabetes. With more individuals diagnosed with diabetes, healthcare providers in the region are increasingly adopting infusion pumps to improve treatment outcomes and enhance patient quality of life. This trend is further fueled by the growing awareness of diabetes management and the shift towards more personalized and effective care models.

Stringent regulatory requirements for product commercialization

Stringent regulatory requirements for product commercialization pose a significant restraint to the Latin America infusion pump market. Each country in the region has its own set of regulations, approval processes, and standards for medical devices, which can be time-consuming and complex. These regulatory barriers create delays in the market entry of new infusion pump technologies, increase costs for manufacturers, and may restrict the availability of advanced devices, especially in countries with more rigid healthcare regulations. The variation in regulatory frameworks across different Latin American countries further complicates the process for international companies seeking to expand their market presence.

Opportunity: High growth potential in emerging economies

The Latin America infusion pump market holds significant growth potential in emerging economies across the region. As healthcare infrastructure improves and economic conditions stabilize, countries such as Brazil, Mexico, and Colombia are investing more in modern medical technologies, creating an opportunity for infusion pump manufacturers. The rising demand for advanced healthcare solutions, coupled with an expanding middle class and increased healthcare spending, is driving the adoption of infusion pumps in both public and private healthcare settings. Additionally, the growing awareness of chronic diseases, such as diabetes and cardiovascular conditions, presents further opportunities for growth as more patients require continuous and precise medication delivery.

Challenge:Increasing incidence of medication errors and lack of wireless connectivity in majority of hospitals

The increasing incidence of medication errors and inadequate wireless connectivity in hospitals pose significant challenges to the Latin America infusion pump market. Medication errors, often caused by incorrect dosing or infusion rates, highlight the need for more accurate and reliable infusion systems. However, many healthcare facilities in the region still face challenges with insufficient wireless infrastructure, which hinders the full integration of advanced infusion pumps with hospital networks. This lack of connectivity limits the potential of smart infusion pumps, which rely on real-time data transmission for enhanced accuracy and remote monitoring, thereby impacting patient safety and the overall efficiency of treatment delivery.

latin america infusion pump market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of Perfusor Space pumps in critical care and oncology departments across Brazil, Mexico, and Argentina. | Compact design for ease of use, precise infusion control, and integration with hospital IT systems to enhance patient safety. |

|

Adoption of Agilia infusion systems for intensive care and neonatal units in Latin America. | Customizable drug libraries and easy-to-use interface, reducing the risk of dosing errors. |

|

Use of Alaris smart infusion pumps in leading hospitals across Brazil, Mexico, and Peru for medication error reduction and integrated patient monitoring. | Wireless drug library updates and Dose Error Reduction Software (DERS) ensure high accuracy in drug delivery, enhancing patient safety. |

|

Deployment of CADD-Solis VIP pumps for home healthcare settings and post-surgical care. | Portable, lightweight design with long battery life, enabling patients to receive infusions in home or ambulatory care settings. |

|

Supply of TE-series infusion pumps for general ward and ambulatory use in Mexico and Peru. | The infusion pumps are lightweight, portable, and user-friendly, making them ideal for general wards and outpatient settings. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis of the Latin America infusion pump market encompasses the various elements and key players involved in the market's development and operation. Manufacturers, including device producers and technology developers, play a crucial role throughout the entire process, from research and product development to optimization and commercialization. End users, such as hospitals, clinics, homecare settings, and specialized treatment centers, represent the primary consumers of infusion pump systems and are integral stakeholders in the market's supply chain. Regulatory bodies, such as national health authorities and international standards organizations, heavily influence the market by enforcing safety standards, approvals, and certifications. These regulatory frameworks ensure that infusion pumps meet required safety and efficacy benchmarks, shaping market dynamics and guiding the introduction of new technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Latin America Infusion Pump Market, By Product

Based on products, the Latin America infusion pump market has been segmented into accessories & consumables and devices. In the Latin America infusion pump market, accessories and consumables hold the largest share due to their essential role in ensuring the proper functioning and safety of infusion systems. Consumables like intravenous (IV) sets, catheters, and tubing are critical for delivering accurate and continuous medication, especially in high-demand healthcare settings such as hospitals and homecare. The recurring need for these disposable components, along with their direct impact on patient safety and treatment efficacy, drives their significant market share. Additionally, as infusion pump technology advances, the demand for specialized, high-quality consumables that integrate with smart infusion systems continues to rise, further contributing to their dominant share in the market.

Latin America Infusion Pump Market, By Application

By application, the chemotherapy/oncology segment held the largest share of the Latin America Infusion Pump Market in 2024. This is due to the growing incidence of cancer across the region and the need for precise medication delivery in oncology treatments. Infusion pumps are essential for administering chemotherapy drugs accurately and consistently, ensuring that patients receive the correct dosage and infusion rate. As cancer rates rise and the demand for more advanced and personalized treatment regimens increases, the need for reliable infusion systems in oncology departments continues to grow. This, combined with the increasing adoption of ambulatory infusion pumps for at-home chemotherapy, further strengthens the dominance of the chemotherapy/oncology segment in the market.

Latin America Infusion Pump Market, By End USer

Hospitals hold the largest share in the Latin America infusion pump market due to their critical role in providing advanced medical care and managing a high volume of patients with complex treatment needs. Infusion pumps are essential in various hospital departments, including intensive care units, oncology, and emergency care, for accurate and controlled medication delivery. The substantial patient population and the increasing demand for sophisticated healthcare solutions drive hospitals to invest in advanced infusion systems. Additionally, hospitals are often the first adopters of new technologies, and their significant healthcare budgets allow for the procurement of high-quality infusion pumps, further solidifying their dominant share in the market.

REGION

Colombia to be fastest-growing region in Latin America infusion pump market during forecast period

Colombia is expected to witness the highest CAGR in the Latin America infusion pump market during the forecast period, mainly due to its improving healthcare infrastructure, increased government healthcare spending, and growing demand for advanced medical technologies. As the country's healthcare system modernizes, there is a greater focus on enhancing patient care through accurate medication delivery, especially in critical care, oncology, and home healthcare. The rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, further drives the need for infusion pumps. Additionally, Colombia's expanding middle class and increasing access to healthcare services contribute to the growing adoption of advanced infusion systems, propelling the market's rapid growth in the country.

latin america infusion pump market: COMPANY EVALUATION MATRIX

In the Latin America infusion pump market matrix, B. Braun Melsungen AG (Star) leads with a strong regional presence and a comprehensive product portfolio, driving widespread adoption of advanced infusion systems in hospitals and critical care settings. The company’s robust manufacturing capabilities, along with its focus on innovation and patient safety, solidify its dominant position. Roche Diagnostics (Emerging Leader) is gaining significant traction with innovative solutions tailored for specialized applications, such as oncology and homecare settings, positioning itself for rapid growth. While B. Braun dominates with its established market leadership and extensive product offerings, Roche Diagnostics shows strong growth potential and is on track to progress toward the leaders' quadrant as it expands its presence and develops region-specific solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 707.6 MN |

| Market Forecast in 2030 (Value) | USD 1,004.9 MN |

| CAGR | 6.2% |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Ecuador, Peru, Rest of Latin America |

WHAT IS IN IT FOR YOU: latin america infusion pump market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | In-depth assessment of infusion pumps by type, including volumetric, syringe, ambulatory infusion pumps | Analysis of emerging trends such as connected infusion systems, smart pump technology, AI-driven safety features, remote monitoring capabilities, and patient-centric designs that enhance adherence and treatment outcomes. |

| Company Information | Comprehensive profiles of major players such as B. Braun, BD, Fresenius Kabi, Baxter, and ICU Medical | Identification of strategic partnerships, collaborations, licensing deals, and mergers & acquisitions shaping the Latin America infusion pump market landscape. |

| Geographic Analysis |

|

Regional market outlook with detailed growth opportunities, regulatory updates, adoption trends, and competitive positioning across major Latin American countries. |

RECENT DEVELOPMENTS

- Jamuary 2025 : B. Braun introduced the Clik-FIX Epidural/Peripheral Nerve Block (PNB) Catheter Securement Device, the newest member of its Clik-FIX family of securement solutions. This device is designed to be soft, compact, and secure, effectively minimizing the risk of catheter displacement or dislodgement during regional anesthesia procedures.

- October 2024 : Terumo Corporation expanded its footprint in Latin America to support the automation of manufacturing for businesses in Brazil, Colombia, and Mexico. Its goal is to enhance operational efficiency and reduce costs in the manufacturing processes for local companies in the region.

- September 2024 : BD acquired the critical care business of Edwards Lifesciences and rebranded it as BD Advanced Patient Monitoring. This acquisition strengthens BD's infusion systems, particularly the BD Alaris Infusion System, by incorporating advanced monitoring capabilities, AI-driven decision support tools, and closed-loop hemodynamic monitoring.

Table of Contents

Methodology

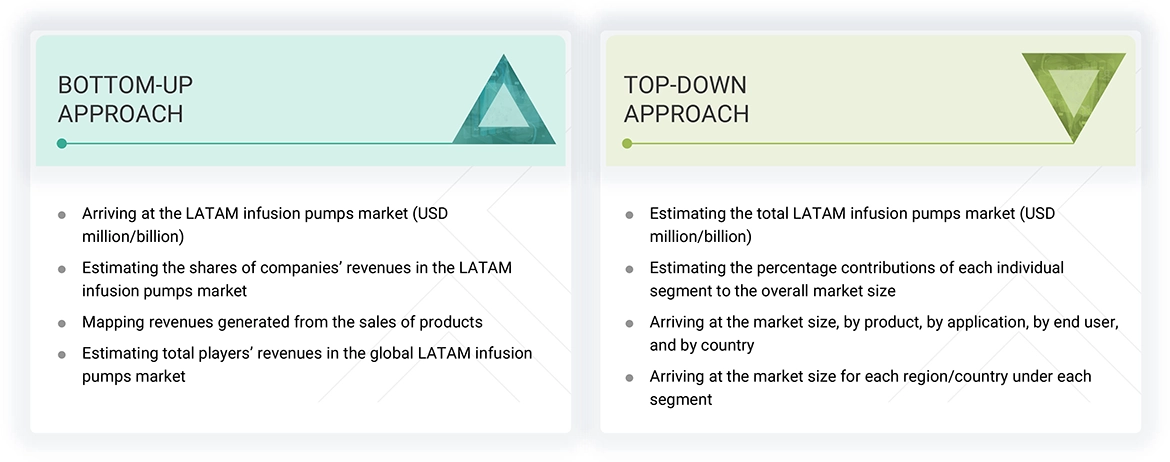

The study involved four major activities to estimate the current size of the LATAM infusion pumps market—exhaustive secondary research collected information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources were utilized to identify and gather information to study the LATAM infusion pumps market. These sources included company annual reports, press releases, investor presentations, white papers, certified publications, and articles by recognized authors. We also consulted reputable websites, regulatory bodies, and databases such as D&B Hoovers, Bloomberg Business, and Factiva.

This research aimed to gather crucial information about the leading companies in the industry, market classification, and segmentation based on industry trends, down to the most detailed levels, including geographic markets. Additionally, we focused on key developments related to the market. Through this secondary research, a database of key industry leaders was created.

Primary Research

Extensive primary research was conducted after gathering information about the LATAM infusion pump market through secondary research. Several primary interviews were held with market experts from both the demand and supply sides across major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Data was collected through questionnaires, emails, and telephone interviews. The primary sources from the supply side included various industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), Directors of business development, marketing, product development/innovation teams, and other key executives from manufacturers and distributors operating in the LATAM infusion pump market, as well as key opinion leaders.

Primary interviews were conducted to gather valuable insights, including market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. This primary research also provided an understanding of various trends related to technologies, applications, industry verticals, and regions. Stakeholders, including customers and end users, were interviewed to gain the buyers' perspective on suppliers, the products themselves, their current usage, and the future outlook of their businesses. This information is crucial as it impacts the overall market dynamics.

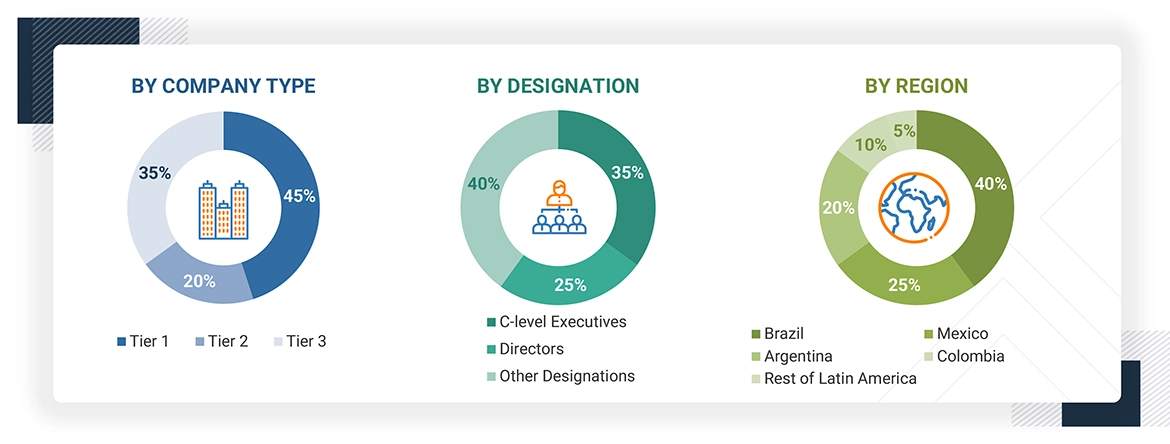

The following is a breakdown of the primary respondents:

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the LATAM infusion pump market includes the following details.

The market sizing was undertaken from the global side.

Country-level Analysis: The size of the LATAM infusion pumps market was obtained from the annual presentations of leading players and secondary data available in the public domain. Shares of products in the overall LATAM infusion pump market were obtained from secondary data and validated by primary participants to arrive at the total LATAM infusion pump market. Primary participants further validated the numbers.

Geographic Market Assessment (By Region & Country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

Industry experts contacted during primary research validated the assumptions and approaches at each point. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall LATAM infusion pump market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

LATAM Infusion Pumps Market Size: Bottom-up Approach & Top-down Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size, using the market size estimation processes. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying various factors and trends from both the demand and supply sides in the LATAM infusion pumps market.

Market Definition

An infusion pump is a medical device that administers controlled amounts of fluid into a patient’s body. Various pumps deliver nutrients or medication, such as insulin or other hormones, antibiotics, chemotherapy drugs, and pain relievers to patients. These devices offer significant advantages over manual fluid administration, including delivering fluids in minimal volumes and at precisely programmed rates or automated intervals.

Stakeholders

- Infusion Pump & Accessories Manufacturers

- Infusion Pump Device & Accessories Distributors

- Healthcare Service Providers

- Various Research Associations related to Infusion Pumps

- Research Institutes

- Health Insurance Payers

- Market Research & Consulting Companies

- Venture Capitalists & Investors

- Healthcare Professionals

- Procurement Managers

- Various Research & Consulting Companies

- World Health Organization (WHO)

- Organisation for Economic Co-operation and Development (OECD)

- National Institutes of Health (NIH)

- Centers for Disease Control and Prevention (CDC)

Report Objectives

- To define, describe, and forecast the LATAM infusion pumps market based on product, application, end user, and country

- To provide detailed information regarding the primary factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To estimate the size and growth potential of the infusion pumps market in the LATAM region

- To profile the key players operating in the market and comprehensively analyze their revenue shares, core competencies2, and market shares

- To track and analyze competitive developments such as expansions, acquisitions, collaborations, product launches, agreements, and partnerships in the market

- To benchmark players in the market using the proprietary “Competitive Leadership Matrix” framework, which analyzes market players on various parameters within the broad categories of business strategy and product offering

- To evaluate and analyze the impact of generative AI on the infusion pumps market across the LATAM region

Key Questions Addressed by the Report

What is the expected addressable market value of the Latin America infusion pumps market during the forecast period?

The market is projected to reach USD 1.00 billion by 2030 from USD 0.74 billion in 2025, growing at a CAGR of 6.2%.

What are the key drivers for the Latin America infusion pumps market?

Key drivers include the rising incidence of diabetes, a growing geriatric population, an increase in chronic diseases, rising surgical procedures, and growing adoption of enteral feeding pumps due to a surge in pre-term births.

Which segments have been included in this report?

The market is segmented by product, application, end user, and region.

Which are the top industry players in the Latin America infusion pumps market?

Leading players include Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), Baxter International Inc. (US), Fresenius Kabi (Germany), Medtronic (Ireland), ICU Medical, Inc. (US), Terumo Corporation (Japan), and NIPRO CORPORATION (Japan).

What are the opportunities for market growth?

Growth opportunities include increased demand for neonatal pumps due to a rise in pre-term births and the expanding target patient population.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Latin America Infusion Pump Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Latin America Infusion Pump Market