TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2023

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH APPROACH

FIGURE 1 EGRC MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

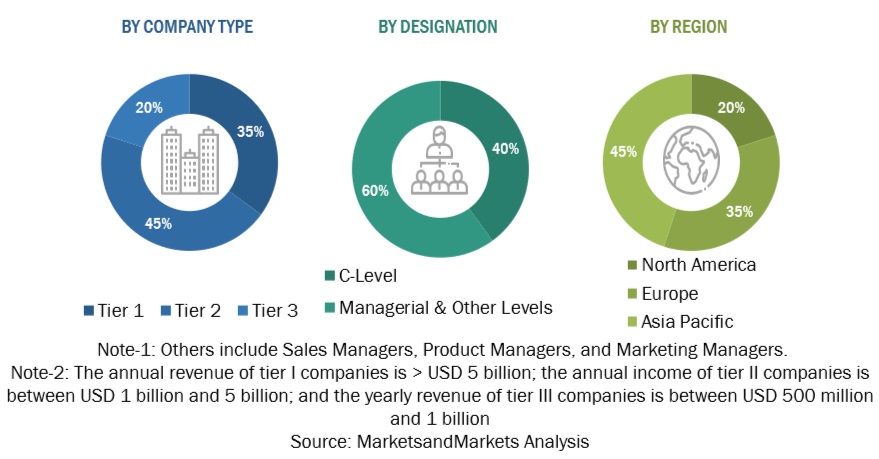

2.1.2.1 Breakdown of primary profiles

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 2 EGRC MARKET: DATA TRIANGULATION

FIGURE 3 EGRC MARKET ESTIMATION: RESEARCH FLOW

2.3 MARKET SIZE ESTIMATION

2.3.1 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1, TOP-DOWN (SUPPLY-SIDE) – COLLECTIVE REVENUE GENERATED BY EGRC VENDORS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2, SUPPLY-SIDE ANALYSIS

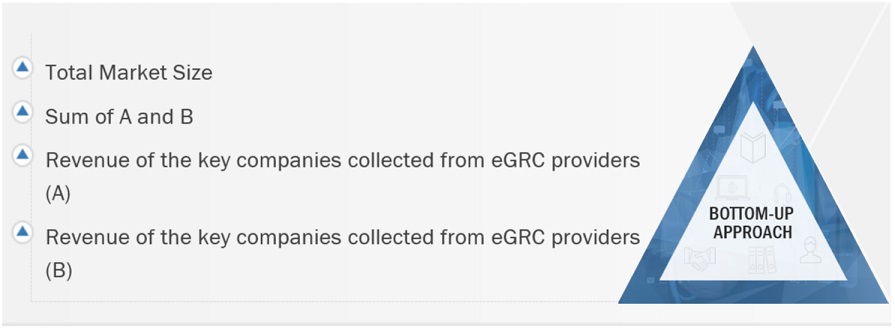

2.3.2 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2, BOTTOM-UP (DEMAND-SIDE)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION METHODOLOGY

2.5.1 FOR KEY PLAYERS

FIGURE 7 COMPANY EVALUATION (MAJOR PLAYERS): WEIGHTAGE CRITERIA

2.5.2 FOR STARTUPS

FIGURE 8 COMPANY EVALUATION (STARTUPS): WEIGHTAGE CRITERIA

2.6 RESEARCH ASSUMPTIONS

TABLE 3 EGRC MARKET: RESEARCH ASSUMPTIONS

2.7 STUDY LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 57)

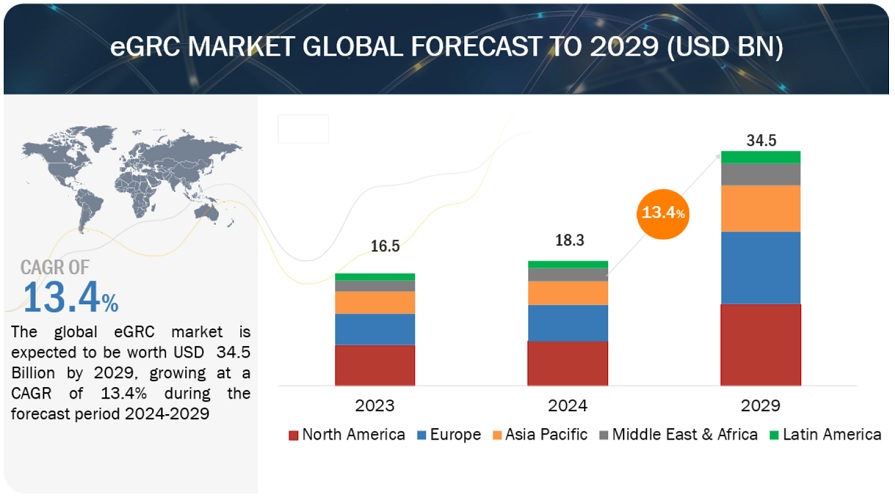

FIGURE 9 GLOBAL EGRC MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

FIGURE 10 EGRC MARKET: SEGMENTS SNAPSHOT

FIGURE 11 EGRC MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 63)

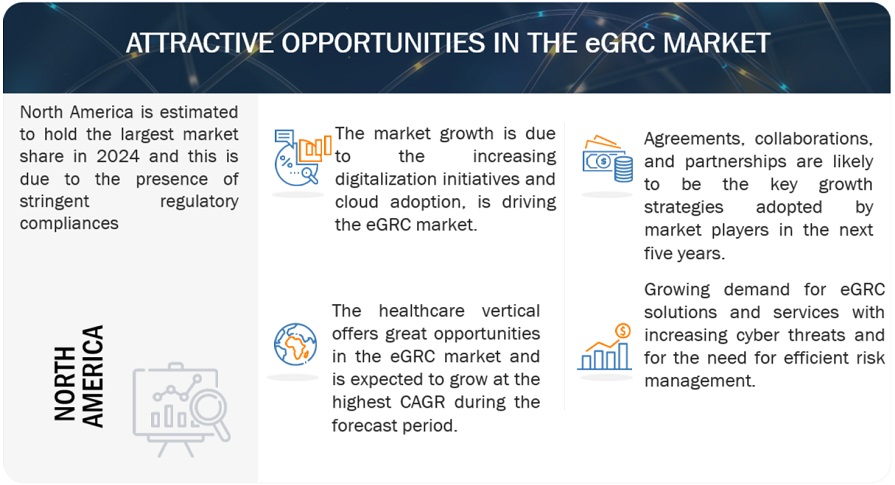

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN EGRC MARKET

FIGURE 12 INCREASING CYBER THREATS FACED BY ORGANIZATIONS ACROSS VARIOUS SECTORS TO BOOST EGRC MARKET GROWTH

4.2 EGRC MARKET, BY OFFERING

FIGURE 13 EGRC SOLUTIONS TO BE LARGER SEGMENT OF MARKET DURING FORECAST PERIOD

4.3 EGRC MARKET, BY SOLUTION

FIGURE 14 RISK MANAGEMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.4 EGRC MARKET, BY SERVICE

FIGURE 15 MANAGED SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.5 EGRC MARKET, BY SOLUTION USAGE

FIGURE 16 INTERNAL SEGMENT TO RECORD LARGER MARKET SIZE DURING FORECAST PERIOD

4.6 EGRC MARKET, BY DEPLOYMENT MODE

FIGURE 17 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.7 EGRC MARKET, BY BUSINESS FUNCTION

FIGURE 18 FINANCE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.8 EGRC MARKET, BY ORGANIZATION SIZE

FIGURE 19 LARGE ENTERPRISES TO BE LARGER SEGMENT DURING FORECAST PERIOD

4.9 EGRC MARKET, BY VERTICAL

FIGURE 20 BFSI TO BE LARGEST VERTICAL DURING FORECAST PERIOD

4.1 EGRC MARKET: INVESTMENT SCENARIO

FIGURE 21 EUROPE TO EMERGE AS MOST LUCRATIVE MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 68)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 EGRC MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing need to comply with stringent regulatory mandates

5.2.1.2 Rising cybersecurity threats

5.2.1.3 Flexibility and scalability offered by cloud-based eGRC systems

5.2.2 RESTRAINTS

5.2.2.1 Adapting to changing laws and regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of AI/ML and blockchain technologies into GRC solutions

5.2.3.2 Integration of eGRC with core business operations

5.2.4 CHALLENGES

5.2.4.1 Gap between company’s culture and its eGRC framework

5.2.4.2 Development of comprehensive eGRC solutions

5.3 CASE STUDY ANALYSIS

5.3.1 FORTUNE 500 FINANCIAL SERVICES COMPANY IMPLEMENTED SERVICENOW GRC

5.3.2 MEDIUM ENTERPRISE BANK CHOSE WOLTERS KLUWER E-SIGN TO SECURE DOCUMENT EXCHANGE

5.3.3 GLOBAL FOOD AND BEVERAGE GIANT STRENGTHENED AND STREAMLINED CORPORATE GOVERNANCE USING METRICSTREAM GRC SOLUTION

5.3.4 ROBECO IMPLEMENTED SOLUTION BY SAI360 TO MEET COMPLIANCE REQUIREMENTS

5.3.5 SHEMEN INDUSTRIES ADOPTED PROCESSGENE SOFTWARE SUITE TO AUTOMATE GRC

5.3.6 LME IMPLEMENTED RISKONNECT GRC TO MANAGE RISK AND COMPLIANCE

5.4 EGRC EVOLUTION

FIGURE 23 EGRC MARKET: EVOLUTION

5.4.1 2002-2007 (SOX CAPTIVITY)

5.4.2 2007-2012 (ENTERPRISE GRC)

5.4.3 2012-2017 (GRC ARCHITECTURE)

5.4.4 2017-2021 (AGILE GRC)

5.4.5 2021-PRESENT (COGNITIVE GRC)

5.5 VALUE CHAIN ANALYSIS

FIGURE 24 EGRC MARKET: VALUE CHAIN ANALYSIS

5.5.1 PLANNING AND DESIGNING

5.5.2 EGRC SOLUTION PROVIDERS

5.5.3 SYSTEM INTEGRATION

5.5.4 DISTRIBUTION

5.5.5 END USERS

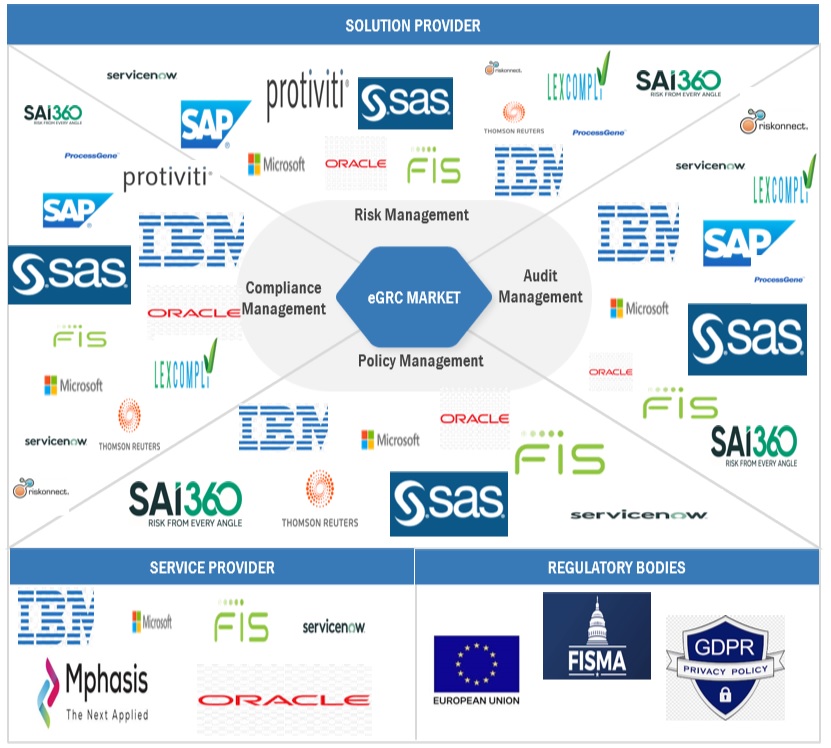

5.6 ECOSYSTEM ANALYSIS

FIGURE 25 EGRC MARKET: ECOSYSTEM

TABLE 4 EGRC MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.7 EGRC FRAMEWORK

FIGURE 26 EGRC FRAMEWORK

5.8 PORTER'S FIVE FORCES ANALYSIS

TABLE 5 EGRC MARKET: IMPACT OF PORTER'S FIVE FORCES

FIGURE 27 EGRC MARKET: PORTER'S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 BARGAINING POWER OF SUPPLIERS

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 THREAT OF SUBSTITUTES

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 PRICING ANALYSIS

5.9.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS

FIGURE 28 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOFTWARE

TABLE 6 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOFTWARE

5.9.2 INDICATIVE PRICING ANALYSIS

TABLE 7 INDICATIVE PRICING ANALYSIS OF IBM SOLUTIONS

TABLE 8 INDICATIVE PRICING ANALYSIS OF SAP GRC-SOD CONTROL

TABLE 9 INDICATIVE PRICING ANALYSIS OF SAS ENTERPRISE GRC

TABLE 10 INDICATIVE PRICING ANALYSIS OF STANDARDFUSION EGRC

TABLE 11 INDICATIVE PRICING ANALYSIS OF METRICSTREAM CONNECTEDGRC -INTEGRATED WITH AWS AUDIT MANAGER

5.10 TECHNOLOGY ANALYSIS

5.10.1 KEY TECHNOLOGIES

5.10.1.1 Master data management

5.10.1.2 Robotic process automation

5.10.1.3 Business intelligence

5.10.1.4 Identity and access management

5.10.2 COMPLEMENTARY TECHNOLOGIES

5.10.2.1 Cloud computing

5.10.2.2 AI and ML

5.10.2.3 Blockchain technology

5.10.2.4 Big data

5.10.3 ADJACENT TECHNOLOGIES

5.10.3.1 Enterprise resource planning systems

5.10.3.2 Customer relationship management systems

5.10.3.3 Operational technology

5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 29 EGRC MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.12 PATENT ANALYSIS

5.12.1 EGRC MARKET: PATENT ANALYSIS

FIGURE 30 GLOBAL TOP 20 PATENTS OWNERS, 2023

FIGURE 31 REGIONAL ANALYSIS OF PATENTS GRANTED IN EGRC MARKET

TABLE 12 LIST OF MAJOR PATENTS GRANTED

5.13 TECHNOLOGY ROADMAP

5.13.1 EGRC MARKET: TECHNOLOGY ROADMAP TILL 2030

5.13.1.1 Short-term roadmap (2023–2025)

5.13.1.2 Mid-term roadmap (2026–2028)

5.13.1.3 Long-term roadmap (2029–2030)

5.14 BEST PRACTICES IN EGRC MARKET

5.15 REGULATORY LANDSCAPE

5.15.1 INTRODUCTION

5.15.2 GENERAL DATA PROTECTION REGULATION

5.15.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.15.4 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

5.15.5 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.15.6 HEALTH INFORMATION TECHNOLOGY FOR ECONOMIC AND CLINICAL HEALTH

5.15.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

5.16.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

TABLE 18 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

5.17 KEY CONFERENCES & EVENTS

TABLE 19 EGRC MARKET: DETAILED LIST OF KEY CONFERENCES & EVENTS, 2024-2025

5.18 INVESTMENT LANDSCAPE

FIGURE 34 LEADING GLOBAL EGRC INVESTMENT ROUNDS AND FUNDING RAISED BY COMPANIES

6 EGRC MARKET, BY OFFERING (Page No. - 105)

6.1 INTRODUCTION

FIGURE 35 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 20 EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 21 EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

6.1.1 OFFERING: EGRC MARKET DRIVERS

6.2 SOLUTIONS

6.2.1 GROWING NEED TO ANALYZE REGULATORY REQUIREMENTS AND POLICIES TO DRIVE SEGMENT

FIGURE 36 RISK MANAGEMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 22 EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 23 EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 24 SOLUTION: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 25 SOLUTION: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

6.2.2 RISK MANAGEMENT

TABLE 26 RISK MANAGEMENT: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 27 RISK MANAGEMENT: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

6.2.2.1 Operational risk management

6.2.2.2 Financial risk management

6.2.2.3 Third-party/Vendor risk management

6.2.2.4 Incident and crisis management

6.2.3 AUDIT MANAGEMENT

TABLE 28 AUDIT MANAGEMENT: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 29 AUDIT MANAGEMENT: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

6.2.3.1 Internal audit

6.2.3.2 External audit

6.2.4 COMPLIANCE MANAGEMENT

TABLE 30 COMPLIANCE MANAGEMENT: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 31 COMPLIANCE MANAGEMENT: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

6.2.5 POLICY MANAGEMENT

TABLE 32 POLICY MANAGEMENT: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 33 POLICY MANAGEMENT: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

6.2.6 PRIVACY MANAGEMENT

TABLE 34 PRIVACY MANAGEMENT: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 35 PRIVACY MANAGEMENT: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

6.3 SERVICES

6.3.1 NEED TO ENSURE FAST AND SMOOTH IMPLEMENTATION OF SOLUTIONS TO PROPEL SEGMENT GROWTH

FIGURE 37 PROFESSIONAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 36 EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 37 SERVICES: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 38 SERVICES: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 39 SERVICES: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

6.3.2 PROFESSIONAL

6.3.2.1 Consulting and training

6.3.2.2 Integration

6.3.2.3 Support and maintenance

6.3.3 MANAGED

7 EGRC MARKET, BY SOLUTION USAGE (Page No. - 119)

7.1 INTRODUCTION

FIGURE 38 INTERNAL TO BE LARGER SEGMENT DURING FORECAST PERIOD

TABLE 40 EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 41 EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

7.1.1 SOLUTION USAGE: EGRC MARKET DRIVERS

7.2 INTERNAL

7.2.1 EMPHASIS ON CENTRALIZING RISK DATA AND AUTOMATING COMPLIANCE PROCESSES TO BOOST SEGMENT GROWTH

TABLE 42 INTERNAL: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 43 INTERNAL: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

7.3 EXTERNAL

7.3.1 RISING NEED FOR AUTOMATED MONITORING OF CONTROLS AND MANAGEMENT OF RISKS TO DRIVE SEGMENT

TABLE 44 EXTERNAL: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 45 EXTERNAL: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

8 EGRC MARKET, BY DEPLOYMENT MODE (Page No. - 124)

8.1 INTRODUCTION

FIGURE 39 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 46 EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 47 EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

8.1.1 DEPLOYMENT MODE: EGRC MARKET DRIVERS

8.2 CLOUD

8.2.1 RISING ADOPTION BY SMES TO DRIVE SEGMENT

TABLE 48 CLOUD: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 49 CLOUD: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

8.3 ON-PREMISES

8.3.1 EMPHASIS ON GREATER CONTROL OVER DATA TO BOOST SEGMENT GROWTH

TABLE 50 ON-PREMISES: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 51 ON-PREMISES: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

9 EGRC MARKET, BY ORGANIZATION SIZE (Page No. - 129)

9.1 INTRODUCTION

FIGURE 40 LARGE ENTERPRISES TO BE LARGER SEGMENT DURING FORECAST PERIOD

TABLE 52 EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 53 EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

9.1.1 ORGANIZATION SIZE: EGRC MARKET DRIVERS

9.2 LARGE ENTERPRISES

9.2.1 ADVANTAGES OF IMPLEMENTING INTEGRATED SOLUTIONS TO PROPEL SEGMENT GROWTH

TABLE 54 LARGE ENTERPRISES: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 55 LARGE ENTERPRISES: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

9.3 SMES

9.3.1 FOCUS ON DIGITALIZATION TO BOOST DEMAND

TABLE 56 SMES: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 57 SMES: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

10 EGRC MARKET, BY BUSINESS FUNCTION (Page No. - 134)

10.1 INTRODUCTION

FIGURE 41 FINANCE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 58 EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 59 EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

10.1.1 BUSINESS FUNCTION: EGRC MARKET DRIVERS

10.2 FINANCE

10.2.1 INCREASING NEED TO MITIGATE RISK OF FINANCIAL FRAUD TO BOOST SEGMENT GROWTH

TABLE 60 FINANCE: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 61 FINANCE: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

10.3 IT

10.3.1 FOCUS ON POLICY STANDARDIZATION AND MANAGEMENT TO DRIVE SEGMENT

TABLE 62 IT: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 63 IT: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

10.4 LEGAL

10.4.1 EMPHASIS ON ADHERENCE TO EXTERNAL LAWS AND REGULATIONS TO FUEL SEGMENT GROWTH

TABLE 64 LEGAL: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 65 LEGAL: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

10.5 OPERATIONS

10.5.1 GROWING DEMAND FOR AUTOMATED AND STREAMLINED PROCESSES TO PROPEL SEGMENT GROWTH

TABLE 66 OPERATIONS: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 67 OPERATIONS: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

11 EGRC MARKET, BY VERTICAL (Page No. - 141)

11.1 INTRODUCTION

FIGURE 42 BFSI SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 68 EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 69 EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

11.1.1 VERTICAL: EGRC MARKET DRIVERS

11.2 BFSI

11.2.1 RISING NEED TO ADAPT TO CHANGING REGULATORY ENVIRONMENT TO DRIVE SEGMENT

TABLE 70 BFSI: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 71 BFSI: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

11.3 TELECOMMUNICATION

11.3.1 FOCUS ON RISK MANAGEMENT AND REGULATORY COMPLIANCE TO PROPEL SEGMENT

TABLE 72 TELECOMMUNICATION: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 73 TELECOMMUNICATION: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

11.4 ENERGY & UTILITIES

11.4.1 INCREASED EFFICIENCY OF OPERATIONS TO PROPEL SEGMENT GROWTH

TABLE 74 ENERGY & UTILITIES: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 75 ENERGY & UTILITIES: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

11.5 GOVERNMENT

11.5.1 RISING ADOPTION TO MANAGE INTERNAL CONTROLS DRIVES SEGMENT GROWTH

TABLE 76 GOVERNMENT: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 77 GOVERNMENT: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

11.6 HEALTHCARE

11.6.1 INCREASED STRINGENT COMPLIANCE MANDATES TO FUEL SEGMENT GROWTH

TABLE 78 HEALTHCARE: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 79 HEALTHCARE: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

11.7 MANUFACTURING

11.7.1 ENHANCED DECISION-MAKING CAPABILITIES TO DRIVE ADOPTION

TABLE 80 MANUFACTURING: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 81 MANUFACTURING: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

11.8 RETAIL & ECOMMERCE

11.8.1 REDUCED OPERATIONAL COST AND ENHANCED PROFIT MARGINS TO DRIVE ADOPTION

TABLE 82 RETAIL & ECOMMERCE: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 83 RETAIL & ECOMMERCE: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

11.9 IT & ITES

11.9.1 PRIVACY AND SECURITY ISSUES TO DRIVE SEGMENT

TABLE 84 IT & ITES: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 85 IT & ITES: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

11.10 TRANSPORTATION & LOGISTICS

11.10.1 REQUIREMENT OF ADHERENCE TO STRINGENT LOCAL AND GLOBAL REGULATIONS TO DRIVE DEMAND

TABLE 86 TRANSPORTATION & LOGISTICS: EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 87 TRANSPORTATION & LOGISTICS: EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

11.11 OTHER VERTICALS

12 EGRC MARKET, BY REGION (Page No. - 154)

12.1 INTRODUCTION

FIGURE 43 EUROPE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 88 EGRC MARKET, BY REGION, 2018–2023 (USD MILLION)

TABLE 89 EGRC MARKET, BY REGION, 2024–2029 (USD MILLION)

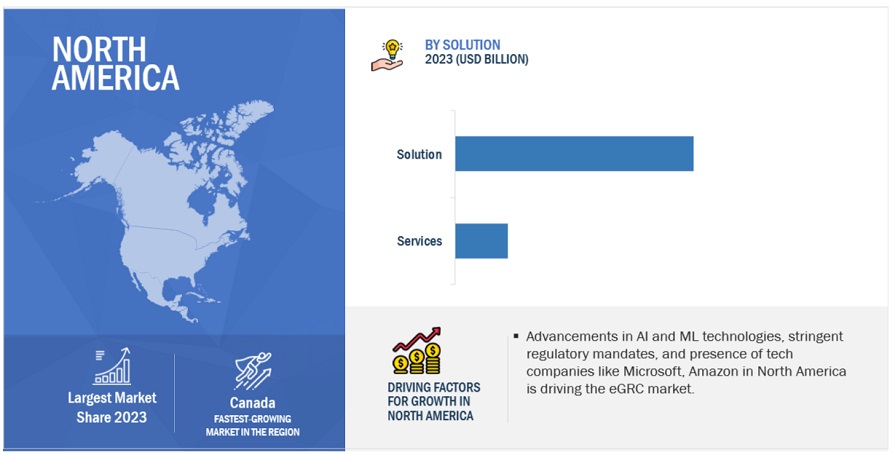

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: RECESSION IMPACT

12.2.2 NORTH AMERICA: EGRC MARKET DRIVERS

12.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

TABLE 90 NORTH AMERICA: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 91 NORTH AMERICA: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 92 NORTH AMERICA: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 93 NORTH AMERICA: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 94 NORTH AMERICA: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 95 NORTH AMERICA: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 96 NORTH AMERICA: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 97 NORTH AMERICA: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 98 NORTH AMERICA: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 99 NORTH AMERICA: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 100 NORTH AMERICA: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 101 NORTH AMERICA: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 102 NORTH AMERICA: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 103 NORTH AMERICA: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 104 NORTH AMERICA: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 105 NORTH AMERICA: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

TABLE 106 NORTH AMERICA: EGRC MARKET, BY COUNTRY, 2018–2023 (USD MILLION)

TABLE 107 NORTH AMERICA: EGRC MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

12.2.4 US

12.2.4.1 Stringent regulatory mandates to drive market

TABLE 108 US: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 109 US: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 110 US: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 111 US: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 112 US: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 113 US: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 114 US: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 115 US: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 116 US: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 117 US: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 118 US: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 119 US: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 120 US: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 121 US: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 122 US: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 123 US: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.2.5 CANADA

12.2.5.1 Development of effective risk management solutions to propel market

TABLE 124 CANADA: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 125 CANADA: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 126 CANADA: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 127 CANADA: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 128 CANADA: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 129 CANADA: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 130 CANADA: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 131 CANADA: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 132 CANADA: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 133 CANADA: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 134 CANADA: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 135 CANADA: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 136 CANADA: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 137 CANADA: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 138 CANADA: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 139 CANADA: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: RECESSION IMPACT

12.3.2 EUROPE: EGRC MARKET DRIVERS

12.3.3 EUROPE: REGULATORY LANDSCAPE

FIGURE 45 EUROPE: MARKET SNAPSHOT

TABLE 140 EUROPE: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 141 EUROPE: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 142 EUROPE: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 143 EUROPE: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 144 EUROPE: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 145 EUROPE: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 146 EUROPE: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 147 EUROPE: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 148 EUROPE: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 149 EUROPE: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 150 EUROPE: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 151 EUROPE: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 152 EUROPE: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 153 EUROPE: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 154 EUROPE: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 155 EUROPE: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

TABLE 156 EUROPE: EGRC MARKET, BY COUNTRY, 2018–2023 (USD MILLION)

TABLE 157 EUROPE: EGRC MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

12.3.4 UK

12.3.4.1 Technical proficiency and substantial IT budgets of companies across sectors to propel market

TABLE 158 UK: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 159 UK: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 160 UK: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 161 UK: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 162 UK: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 163 UK: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 164 UK: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 165 UK: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 166 UK: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 167 UK: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 168 UK: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 169 UK: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 170 UK: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 171 UK: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 172 UK: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 173 UK: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.3.5 GERMANY

12.3.5.1 Rising incidences of cyber threats to boost market growth

TABLE 174 GERMANY: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 175 GERMANY: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 176 GERMANY: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 177 GERMANY: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 178 GERMANY: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 179 GERMANY: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 180 GERMANY: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 181 GERMANY: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 182 GERMANY: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 183 GERMANY: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 184 GERMANY: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 185 GERMANY: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 186 GERMANY: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 187 GERMANY: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 188 GERMANY: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 189 GERMANY: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.3.6 FRANCE

12.3.6.1 Active digitalization initiatives to drive market

TABLE 190 FRANCE: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 191 FRANCE: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 192 FRANCE: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 193 FRANCE: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 194 FRANCE: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 195 FRANCE: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 196 FRANCE: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 197 FRANCE: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 198 FRANCE: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 199 FRANCE: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 200 FRANCE: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 201 FRANCE: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 202 FRANCE: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 203 FRANCE: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 204 FRANCE: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 205 FRANCE: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.3.7 ITALY

12.3.7.1 Increased demand in finance sector

TABLE 206 ITALY: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 207 ITALY: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 208 ITALY: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 209 ITALY: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 210 ITALY: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 211 ITALY: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 212 ITALY: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 213 ITALY: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 214 ITALY: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 215 ITALY: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 216 ITALY: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 217 ITALY: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 218 ITALY: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 219 ITALY: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 220 ITALY: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 221 ITALY: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.3.8 IRELAND

12.3.8.1 Accelerated digital transformation efforts to drive market

TABLE 222 IRELAND: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 223 IRELAND: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 224 IRELAND: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 225 IRELAND: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 226 IRELAND: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 227 IRELAND: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 228 IRELAND: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 229 IRELAND: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 230 IRELAND: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 231 IRELAND: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 232 IRELAND: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 233 IRELAND: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 234 IRELAND: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 235 IRELAND: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 236 IRELAND: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 237 IRELAND: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.3.9 REST OF EUROPE

TABLE 238 REST OF EUROPE: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 239 REST OF EUROPE: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 240 REST OF EUROPE: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 241 REST OF EUROPE: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 242 REST OF EUROPE: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 243 REST OF EUROPE: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 244 REST OF EUROPE: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 245 REST OF EUROPE: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 246 REST OF EUROPE: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 247 REST OF EUROPE: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 248 REST OF EUROPE: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 249 REST OF EUROPE: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 250 REST OF EUROPE: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 251 REST OF EUROPE: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 252 REST OF EUROPE: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 253 REST OF EUROPE: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: RECESSION IMPACT

12.4.2 ASIA PACIFIC: EGRC MARKET DRIVERS

12.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

TABLE 254 ASIA PACIFIC: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 255 ASIA PACIFIC: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 256 ASIA PACIFIC: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 257 ASIA PACIFIC: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 258 ASIA PACIFIC: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 259 ASIA PACIFIC: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 260 ASIA PACIFIC: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 261 ASIA PACIFIC: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 262 ASIA PACIFIC: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 263 ASIA PACIFIC: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 264 ASIA PACIFIC: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 265 ASIA PACIFIC: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 266 ASIA PACIFIC: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 267 ASIA PACIFIC: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 268 ASIA PACIFIC: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 269 ASIA PACIFIC: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

TABLE 270 ASIA PACIFIC: EGRC MARKET, BY COUNTRY, 2018–2023 (USD MILLION)

TABLE 271 ASIA PACIFIC: EGRC MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

12.4.4 CHINA

12.4.4.1 Implementation of new corporate governance framework to support market growth

TABLE 272 CHINA: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 273 CHINA: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 274 CHINA: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 275 CHINA: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 276 CHINA: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 277 CHINA: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 278 CHINA: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 279 CHINA: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 280 CHINA: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 281 CHINA: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 282 CHINA: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 283 CHINA: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 284 CHINA: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 285 CHINA: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 286 CHINA: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 287 CHINA: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.4.5 JAPAN

12.4.5.1 Rising adoption of advanced technologies to drive market

TABLE 288 JAPAN: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 289 JAPAN: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 290 JAPAN: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 291 JAPAN: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 292 JAPAN: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 293 JAPAN: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 294 JAPAN: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 295 JAPAN: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 296 JAPAN: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 297 JAPAN: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 298 JAPAN: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 299 JAPAN: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 300 JAPAN: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 301 JAPAN: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 302 JAPAN: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 303 JAPAN: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.4.6 INDIA

12.4.6.1 Rapid developments in technology to drive demand

TABLE 304 INDIA: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 305 INDIA: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 306 INDIA: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 307 INDIA: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 308 INDIA: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 309 INDIA: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 310 INDIA: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 311 INDIA: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 312 INDIA: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 313 INDIA: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 314 INDIA: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 315 INDIA: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 316 INDIA: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 317 INDIA: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 318 INDIA: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 319 INDIA: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.4.7 AUSTRALIA AND NEW ZEALAND

12.4.7.1 Stringent regulations to boost market

TABLE 320 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 321 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 322 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 323 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 324 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 325 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 326 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 327 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 328 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 329 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 330 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 331 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 332 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 333 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 334 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 335 AUSTRALIA AND NEW ZEALAND: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.4.8 SINGAPORE

12.4.8.1 Increased adoption in banking sector to drive demand

TABLE 336 SINGAPORE: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 337 SINGAPORE: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 338 SINGAPORE: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 339 SINGAPORE: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 340 SINGAPORE: EGRC MARKET, BY SERVICE, USAGE, 2018–2023 (USD MILLION)

TABLE 341 SINGAPORE: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 342 SINGAPORE: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 343 SINGAPORE: EGRC MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

TABLE 344 SINGAPORE: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 345 SINGAPORE: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 346 SINGAPORE: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 347 SINGAPORE: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 348 SINGAPORE: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 349 SINGAPORE: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 350 SINGAPORE: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 351 SINGAPORE: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.4.9 REST OF ASIA PACIFIC

TABLE 352 REST OF ASIA PACIFIC: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 353 REST OF ASIA PACIFIC: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 354 REST OF ASIA PACIFIC: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 355 REST OF ASIA PACIFIC: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 356 REST OF ASIA PACIFIC: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 357 REST OF ASIA PACIFIC: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 358 REST OF ASIA PACIFIC: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 359 REST OF ASIA PACIFIC: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 360 REST OF ASIA PACIFIC: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 361 REST OF ASIA PACIFIC: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 362 REST OF ASIA PACIFIC: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 363 REST OF ASIA PACIFIC: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 364 REST OF ASIA PACIFIC: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 365 REST OF ASIA PACIFIC: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 366 REST OF ASIA PACIFIC: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 367 REST OF ASIA PACIFIC: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

12.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

12.5.2 MIDDLE EAST & AFRICA: EGRC MARKET DRIVERS

12.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

TABLE 368 MIDDLE EAST & AFRICA: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 369 MIDDLE EAST & AFRICA: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 370 MIDDLE EAST & AFRICA: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 371 MIDDLE EAST & AFRICA: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 372 MIDDLE EAST & AFRICA: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 373 MIDDLE EAST & AFRICA: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 374 MIDDLE EAST & AFRICA: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 375 MIDDLE EAST & AFRICA: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 376 MIDDLE EAST & AFRICA: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 377 MIDDLE EAST & AFRICA: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 378 MIDDLE EAST & AFRICA: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 379 MIDDLE EAST & AFRICA: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 380 MIDDLE EAST & AFRICA: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 381 MIDDLE EAST & AFRICA: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 382 MIDDLE EAST & AFRICA: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 383 MIDDLE EAST & AFRICA: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

TABLE 384 MIDDLE EAST & AFRICA: EGRC MARKET, BY COUNTRY, 2018–2023 (USD MILLION)

TABLE 385 MIDDLE EAST & AFRICA: EGRC MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

12.5.4 UAE

12.5.4.1 Adoption of advanced technologies to drive market

TABLE 386 UAE: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 387 UAE: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 388 UAE: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 389 UAE: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 390 UAE: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 391 UAE: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 392 UAE: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 393 UAE: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 394 UAE: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 395 UAE: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 396 UAE: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 397 UAE: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 398 UAE: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 399 UAE: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 400 UAE: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 401 UAE: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.5.5 KSA

12.5.5.1 Government initiatives to boost market

TABLE 402 KSA: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 403 KSA: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 404 KSA: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 405 KSA: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 406 KSA: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 407 KSA: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 408 KSA: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 409 KSA: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 410 KSA: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 411 KSA: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 412 KSA: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 413 KSA: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 414 KSA: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 415 KSA: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 416 KSA: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 417 KSA: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.5.6 SOUTH AFRICA

12.5.6.1 Need to manage compliance to propel market

TABLE 418 SOUTH AFRICA: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 419 SOUTH AFRICA: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 420 SOUTH AFRICA: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 421 SOUTH AFRICA: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 422 SOUTH AFRICA: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 423 SOUTH AFRICA: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 424 SOUTH AFRICA: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 425 SOUTH AFRICA: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 426 SOUTH AFRICA: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 427 SOUTH AFRICA: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 428 SOUTH AFRICA: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 429 SOUTH AFRICA: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 430 SOUTH AFRICA: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 431 SOUTH AFRICA: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 432 SOUTH AFRICA: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 433 SOUTH AFRICA: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.5.7 REST OF MIDDLE EAST & AFRICA

TABLE 434 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 435 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 436 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 437 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 438 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 439 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 440 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 441 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 442 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 443 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 444 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 445 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 446 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 447 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 448 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 449 REST OF MIDDLE EAST & AFRICA: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: RECESSION IMPACT

12.6.2 LATIN AMERICA: EGRC MARKET DRIVERS

12.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 450 LATIN AMERICA: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 451 LATIN AMERICA: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 452 LATIN AMERICA: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 453 LATIN AMERICA: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 454 LATIN AMERICA: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 455 LATIN AMERICA: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 456 LATIN AMERICA: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 457 LATIN AMERICA: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 458 LATIN AMERICA: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 459 LATIN AMERICA: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 460 LATIN AMERICA: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 461 LATIN AMERICA: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 462 LATIN AMERICA: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 463 LATIN AMERICA: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 464 LATIN AMERICA: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 465 LATIN AMERICA: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

TABLE 466 LATIN AMERICA: EGRC MARKET, BY COUNTRY, 2018–2023 (USD MILLION)

TABLE 467 LATIN AMERICA: EGRC MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

12.6.4 BRAZIL

12.6.4.1 Stringent compliance regulations to fuel market growth

TABLE 468 BRAZIL: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 469 BRAZIL: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 470 BRAZIL: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 471 BRAZIL: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 472 BRAZIL: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 473 BRAZIL: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 474 BRAZIL: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 475 BRAZIL: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 476 BRAZIL: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 477 BRAZIL: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 478 BRAZIL: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 479 BRAZIL: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 480 BRAZIL: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 481 BRAZIL: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 482 BRAZIL: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 483 BRAZIL: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.6.5 MEXICO

12.6.5.1 Rising need to protect sensitive data to boost market

TABLE 484 MEXICO: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 485 MEXICO: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 486 MEXICO: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 487 MEXICO: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 488 MEXICO: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 489 MEXICO: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 490 MEXICO: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 491 MEXICO: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 492 MEXICO: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 493 MEXICO: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 494 MEXICO: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 495 MEXICO: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 496 MEXICO: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 497 MEXICO: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 498 MEXICO: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 499 MEXICO: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

12.6.6 REST OF LATIN AMERICA

TABLE 500 REST OF LATIN AMERICA: EGRC MARKET, BY OFFERING, 2018–2023 (USD MILLION)

TABLE 501 REST OF LATIN AMERICA: EGRC MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 502 REST OF LATIN AMERICA: EGRC MARKET, BY SOLUTION, 2018–2023 (USD MILLION)

TABLE 503 REST OF LATIN AMERICA: EGRC MARKET, BY SOLUTION, 2024–2029 (USD MILLION)

TABLE 504 REST OF LATIN AMERICA: EGRC MARKET, BY SERVICE, 2018–2023 (USD MILLION)

TABLE 505 REST OF LATIN AMERICA: EGRC MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 506 REST OF LATIN AMERICA: EGRC MARKET, BY SOLUTION USAGE, 2018–2023 (USD MILLION)

TABLE 507 REST OF LATIN AMERICA: EGRC MARKET, BY SOLUTION USAGE, 2024–2029 (USD MILLION)

TABLE 508 REST OF LATIN AMERICA: EGRC MARKET, BY DEPLOYMENT MODE, 2018–2023 (USD MILLION)

TABLE 509 REST OF LATIN AMERICA: EGRC MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 510 REST OF LATIN AMERICA: EGRC MARKET, BY ORGANIZATION SIZE, 2018–2023 (USD MILLION)

TABLE 511 REST OF LATIN AMERICA: EGRC MARKET, BY ORGANIZATION SIZE, 2024–2029 (USD MILLION)

TABLE 512 REST OF LATIN AMERICA: EGRC MARKET, BY BUSINESS FUNCTION, 2018–2023 (USD MILLION)

TABLE 513 REST OF LATIN AMERICA: EGRC MARKET, BY BUSINESS FUNCTION, 2024–2029 (USD MILLION)

TABLE 514 REST OF LATIN AMERICA: EGRC MARKET, BY VERTICAL, 2018–2023 (USD MILLION)

TABLE 515 REST OF LATIN AMERICA: EGRC MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 288)

13.1 INTRODUCTION

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 516 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

13.3 HISTORICAL REVENUE ANALYSIS

FIGURE 46 HISTORICAL REVENUE ANALYSIS OF KEY EGRC VENDORS

13.4 VALUATION AND FINANCIAL METRICS OF KEY EGRC VENDORS

FIGURE 47 VALUATION AND FINANCIAL METRICS OF KEY EGRC VENDORS

13.5 MARKET SHARE ANALYSIS

FIGURE 48 MARKET SHARE OF KEY EGRC VENDORS, 2023

TABLE 517 EGRC MARKET: DEGREE OF COMPETITION

13.6 PRODUCT/BRAND COMPARISON

FIGURE 49 COMPARISON OF VENDORS’ BRANDS

13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

13.7.1 STARS

13.7.2 EMERGING LEADERS

13.7.3 PERVASIVE PLAYERS

13.7.4 PARTICIPANTS

FIGURE 50 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

13.7.5 COMPANY FOOTPRINT: KEY PLAYERS

13.7.5.1 Company footprint

FIGURE 51 EGRC MARKET: COMPANY FOOTPRINT

13.7.5.2 Product footprint

TABLE 518 EGRC MARKET: PRODUCT FOOTPRINT

13.7.5.3 Solution footprint

TABLE 519 EGRC MARKET: SOLUTION FOOTPRINT

13.7.5.4 Vertical footprint

TABLE 520 EGRC MARKET: VERTICAL FOOTPRINT

13.7.5.5 Regional footprint

TABLE 521 EGRC MARKET: REGIONAL FOOTPRINT

13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

13.8.1 PROGRESSIVE COMPANIES

13.8.2 RESPONSIVE COMPANIES

13.8.3 DYNAMIC COMPANIES

13.8.4 STARTING BLOCKS

FIGURE 52 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

13.8.5.1 Detailed list of key startups/SMEs

TABLE 522 EGRC MARKET: KEY STARTUPS/SMES

13.8.5.2 Competitive benchmarking of key startups/SMEs

TABLE 523 EGRC MARKET: VERTICAL FOOTPRINT OF STARTUPS/SMES

TABLE 524 EGRC MARKET: REGIONAL FOOTPRINT OF STARTUPS/SMES

13.9 COMPETITIVE SCENARIO AND TRENDS

13.9.1 PRODUCT LAUNCHES

TABLE 525 EGRC MARKET: PRODUCT LAUNCHES, JANUARY 2021–APRIL 2024

13.9.2 DEALS

TABLE 526 EGRC MARKET: DEALS, JANUARY 2021–MARCH 2024

14 COMPANY PROFILES (Page No. - 314)

14.1 MAJOR PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)*

14.1.1 WOLTERS KLUWER

TABLE 527 WOLTERS KLUWER: COMPANY OVERVIEW

FIGURE 53 WOLTERS KLUWER: COMPANY SNAPSHOT

TABLE 528 WOLTERS KLUWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 529 WOLTERS KLUWER: PRODUCT LAUNCHES

TABLE 530 WOLTERS KLUWER: DEALS

14.1.2 FIS

TABLE 531 FIS: COMPANY OVERVIEW

FIGURE 54 FIS: COMPANY SNAPSHOT

TABLE 532 FIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 533 FIS: DEALS

14.1.3 MICROSOFT

TABLE 534 MICROSOFT: COMPANY OVERVIEW

FIGURE 55 MICROSOFT: COMPANY SNAPSHOT

TABLE 535 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 536 MICROSOFT: PRODUCT LAUNCHES

TABLE 537 MICROSOFT: DEALS

14.1.4 LEXISNEXIS

TABLE 538 LEXISNEXIS: COMPANY OVERVIEW

TABLE 539 LEXISNEXIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 540 LEXISNEXIS: PRODUCT LAUNCHES

TABLE 541 LEXISNEXIS: DEALS

14.1.5 SAS INSTITUTE

TABLE 542 SAS INSTITUTE: COMPANY OVERVIEW

TABLE 543 SAS INSTITUTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 544 SAS INSTITUTE: PRODUCT LAUNCHES

TABLE 545 SAS INSTITUTE: DEALS

14.1.6 IBM

TABLE 546 IBM: COMPANY OVERVIEW

FIGURE 56 IBM: COMPANY SNAPSHOT

TABLE 547 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 548 IBM: PRODUCT LAUNCHES

TABLE 549 IBM: DEALS

14.1.7 ORACLE

TABLE 550 ORACLE: BUSINESS OVERVIEW

FIGURE 57 ORACLE: COMPANY SNAPSHOT

TABLE 551 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 552 ORACLE: PRODUCT LAUNCHES

TABLE 553 ORACLE: DEALS

14.1.8 SAP

TABLE 554 SAP: COMPANY OVERVIEW

FIGURE 58 SAP: COMPANY SNAPSHOT

TABLE 555 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 556 SAP: PRODUCT LAUNCHES

TABLE 557 SAP: DEALS

14.1.9 SERVICENOW

TABLE 558 SERVICENOW: COMPANY OVERVIEW

FIGURE 59 SERVICENOW: COMPANY SNAPSHOT

TABLE 559 SERVICENOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 560 SERVICENOW: DEALS

14.1.10 THOMSON REUTERS

TABLE 561 THOMSON REUTERS: COMPANY OVERVIEW

FIGURE 60 THOMSON REUTERS: COMPANY SNAPSHOT

TABLE 562 THOMSON REUTERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 563 THOMSON REUTERS: PRODUCT LAUNCHES

TABLE 564 THOMSON REUTERS: DEALS

14.1.11 MEGA INTERNATIONAL

TABLE 565 MEGA INTERNATIONAL: COMPANY OVERVIEW

TABLE 566 MEGA INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.12 MPHASIS

TABLE 567 MPHASIS: COMPANY OVERVIEW

FIGURE 61 MPHASIS: COMPANY SNAPSHOT

TABLE 568 MPHASIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 569 MPHASIS: DEALS

14.1.13 METRICSTREAM

TABLE 570 METRICSTREAM: COMPANY OVERVIEW

TABLE 571 METRICSTREAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 572 METRICSTREAM: PRODUCT LAUNCHES

TABLE 573 METRICSTREAM: DEALS

14.1.14 RISKONNECT

TABLE 574 RISKONNECT: COMPANY OVERVIEW

TABLE 575 RISKONNECT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 576 RISKONNECT: PRODUCT LAUNCHES

TABLE 577 RISKONNECT: DEALS

14.1.15 NAVEX GLOBAL

TABLE 578 NAVEX GLOBAL: COMPANY OVERVIEW

TABLE 579 NAVEX GLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 580 NAVEX GLOBAL: PRODUCT LAUNCHES

14.1.16 ONETRUST

TABLE 581 ONETRUST: COMPANY OVERVIEW

TABLE 582 ONETRUST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 583 ONETRUST: PRODUCT LAUNCHES

TABLE 584 ONETRUST: DEALS

14.1.17 LOGICMANAGER

TABLE 585 LOGICMANAGER: COMPANY OVERVIEW

TABLE 586 LOGICMANAGER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.18 ALLGRESS

TABLE 587 ALLGRESS: COMPANY OVERVIEW

TABLE 588 ALLGRESS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.19 SURECLOUD

TABLE 589 SURECLOUD: COMPANY OVERVIEW

TABLE 590 SURECLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 591 SURECLOUD: PRODUCT LAUNCHES

14.1.20 ACUITY RISK MANAGEMENT

TABLE 592 ACUITY RISK MANAGEMENT: COMPANY OVERVIEW

TABLE 593 ACUITY RISK MANAGEMENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.21 C&F S.A.

TABLE 594 C&F S.A.: COMPANY OVERVIEW

TABLE 595 C&F S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 596 C&F S.A.: DEALS

14.1.22 ONSPRING

TABLE 597 ONSPRING: COMPANY OVERVIEW

TABLE 598 ONSPRING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 599 ONSPRING: PRODUCT LAUNCHES

14.1.23 OXIAL

TABLE 600 OXIAL: COMPANY OVERVIEW

TABLE 601 OXIAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.24 READINOW

TABLE 602 READINOW: COMPANY OVERVIEW

TABLE 603 READINOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 604 READINOW: PRODUCT LAUNCHES

14.1.25 GLOBALSUITE SOLUTIONS

TABLE 605 GLOBALSUITE SOLUTIONS: COMPANY OVERVIEW

TABLE 606 GLOBALSUITE SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 607 GLOBALSUITE SOLUTIONS: DEALS

14.1.26 OPTIMISO

TABLE 608 OPTIMISO: COMPANY OVERVIEW

TABLE 609 OPTIMISO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14.2 OTHER PLAYERS

14.2.1 STANDARDFUSION

14.2.2 COMENSURE

14.2.3 DYNAMIC-GRC

14.2.4 VCOMPLY

14.2.5 LOGIC GATE

14.2.6 SMARTSUITE

15 ADJACENT MARKETS (Page No. - 392)

15.1 INTRODUCTION

TABLE 610 ADJACENT MARKETS AND FORECASTS

15.1.1 LIMITATIONS

15.2 ANTI-MONEY LAUNDERING MARKET

TABLE 611 ANTI-MONEY LAUNDERING MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

TABLE 612 ANTI-MONEY LAUNDERING MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

TABLE 613 ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

TABLE 614 ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

TABLE 615 ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

TABLE 616 ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

TABLE 617 ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

TABLE 618 ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

TABLE 619 ANTI-MONEY LAUNDERING MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 620 ANTI-MONEY LAUNDERING MARKET, BY REGION, 2023–2028 (USD MILLION)

15.3 REGTECH MARKET

TABLE 621 REGTECH MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 622 REGTECH MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 623 SERVICES: REGTECH MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 624 SERVICES: REGTECH MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 625 REGTECH MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 626 REGTECH MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 627 REGTECH MARKET, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 628 REGTECH MARKET, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 629 REGTECH MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 630 REGTECH MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 631 REGTECH MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 632 REGTECH MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 633 REGTECH MARKET, BY REGION, 2016–2020 (USD MILLION)

15.4 RISK ANALYTICS MARKET

TABLE 634 RISK ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 635 RISK ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 636 RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 637 RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 638 RISK ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 639 RISK ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 640 RISK ANALYTICS MARKET, BY RISK TYPE, 2016–2021 (USD MILLION)

TABLE 641 RISK ANALYTICS MARKET, BY RISK TYPE, 2022–2027 (USD MILLION)

TABLE 642 RISK ANALYTICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 643 RISK ANALYTICS MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 644 RISK ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 645 RISK ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

16 APPENDIX (Page No. - 404)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in eGRC Market