Enterprise Mobility Management Market by Component, Solution (Mobile Device Management, Mobile Application Management), Deployment Mode, Organization Size, Vertical (BFSI, Manufacturing), and Region (2022 - 2026)

Updated on : Aug 23, 2023

Enterprise Mobility Management Market Size, Key Insights & Analysis

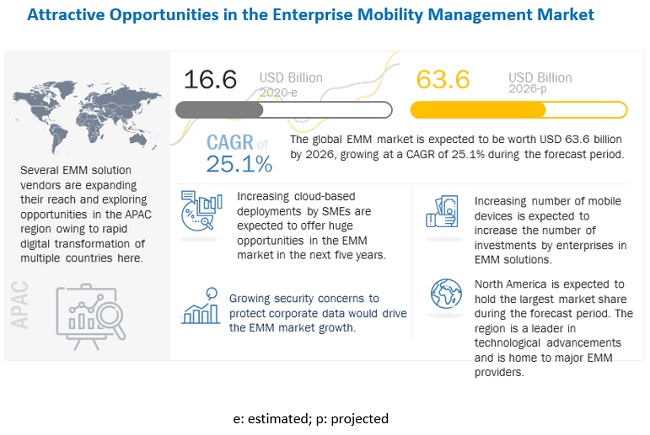

The Enterprise Mobility Management Market size is projected to grow at a CAGR of 10.3% during the forecast period to reach USD 63.6 billion by 2026 from an estimated USD 16.6 billion in 2020. The increasing mobile workforce and adoption of BYOD programs within enterprises to improve their workforce productivity, thus allowing employees to work from anywhere, at any time, and using any device to access corporate data on the go has boost the demand for enterprise mobility management solutions. In addition to this, proliferation of new mobile devices in the market drives the implementation of mobile device management solutions in regions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact Analysis

In response to the widespread transmission of the COVID-19, employers are compelled to provide their employees with remote access options, enabling them to work outside of the corporate infrastructure. Providing a work-from-home option for employees is a prudent measure to prevent the spread of viruses throughout the workplace. In this pandemic crisis, many organizations have also implemented a BYOD program that allows employees to use their personal devices for work to ensure business continuity. With a remote workforce, organizations are ensuring that employees can access corporate resources while working from home and have the right tools to stay productive.

These factors lead to large enterprises deploying enterprise mobility management solutions. These solutions also provide remote security and management capabilities to enable BYOD, as well as manage corporate devices. Countries have come up with unique mobile solutions with secured systems to reduce the spread of COVID-19 virus. For instance, Oman has launched Tarassud Plus, a powerful secured system that combines a mobile application using AI with enhanced features that help find COVID-19 statistics, guidelines, and the best practices to prevent the spread of the infection.

Enterprise Mobility Management Market Dynamics

Driver: Increasing trend of work from home due to the COVID-19 pandemic drives the adoption of enterprise mobility management solutions

With the COVID-19 pandemic, more companies are adopting remote work practices. The demand for mobility in the current workforce is on the rise, particularly due to the impact of the COVID-19 pandemic that is driving the shift to remote working. Adoption of enterprise mobility management solutions is on the rise as these solutions give companies the option to control, update, and even wipe data off of devices from a distance. Remote workforces and MDM are more important than ever in 2020’s pandemic reality. Unmanaged remote endpoints are one of the biggest risks to an organization’s cybersecurity posture today.

Enterprises have spent large amounts of money over the past several months rolling out more robust VPN solutions and mobile devices (laptops and tablets) for users to be able to perform their jobs remotely, while security has seemingly taken a backseat to these larger efforts to keep workforces employed and productive. For instance, the demand for mobile device management solutions in the Apple space is surging, as the pandemic drives forward the transition even as an increasing number of enterprises move to adopt Macs, iPhones, and iPads in their business. Enterprise mobility management solutions also offer remote wiping that can irretrievably erase any content in the device with the help of a trigger if loss or theft of the device is identified, further preventing loss of critical data. The need for enterprise mobility management market and the ability to detect and remediate vulnerabilities on remote endpoints is now a necessity rather than a convenience.

Restraint: enterprise mobility management solutions to cater to every business need for a consistent end-user experience

Vendors that offer enterprise mobility management solutions are unable to customize the solution as per specific business requirements. Enterprises often complain about the inability of the enterprise mobility management solution to address flexibility and agility with multi-user connections. Every business has different security needs for mobile devices that gain access to the corporate network. Vendors also face several challenges while integrating enterprise mobility management into an organization’s existing security and management controls and workflows. However, the right enterprise mobility management solution can enhance both security and efficiency, allowing an IT admin to control and monitor systems from a single access point. Every company is different with varying business needs and gaining an accurate awareness of what a company requires is extremely challenging. Since the needs of every company would differ, the implementation of enterprise mobility management solutions should also be different for a consistent end-user experience.

Opportunity: Rising number of cyberattacks on personal devices and business-critical data drives the adoption of enterprise mobility management solutions

According to Lookout’s report, enterprise mobile phishing attacks have increased over time. Since Q4 2019, enterprise mobile phishing attack rates have grown about 37% globally. The US has seen some of the worst of it, with a 66% increase since the end of 2019. As more mobile devices are deployed in the workplace, phishing attacks that target those devices are becoming more common, creating a need to train employees on proper mobile security protocols.

Skilled cybersecurity professionals who could collaborate with developers are necessary to ensure the effectiveness of security. For new companies, encrypting all data with a cryptographic hash should be done. The digital signature of each file would be verified by the system to ensure data integrity. If an intruder gains unauthorized file access, the file’s digital signature would be altered, and the system notifies the concerned parties of any malicious activity. There should also be an authentication mechanism to restrict data access. Businesses could implement a multi-factor authentication of all network users. Block-chain-based cybersecurity solutions, such as a digital identification system, could simplify the authentication process. Another thing to take into consideration is to adopt an authentication mechanism that’s AI-powered. It will change access privileges based on the network and location of an employee.

Enterprise Mobility Management Market Challenge: Poor enterprise system integrators

Every organization should have multiple systems for workflow automation to run in synchronization. To share critical data, various systems should be interconnected. In the same way, mobile devices, such as smartphones and laptops, should integrate with complex business systems in a seamless way. Failure to integrate mobile devices with complex systems could lead to information silos, which are made when critical information is only available on one device and not shared with the network of the company. An employee who works from home from time to time, for example, and fails to share important files after moving to another company would generate an information silo. Thus, advanced apps are needed, which could interact with several complex business systems to simplify the processing of data and workflows across.

By component type, the solution segment is expected to hold the largest share during the forecast period

Organizations are relying on enterprise mobility management solutions to enhance customer acquisitions, retain existing customers, and enhance the customer experience and profitability. Organizations need to manage their data efficiently and effectively to enhance their productivity and maintain business continuity. The proliferation of data amounting to big data has forced vendors to adopt enterprise mobility management solutions and help IT teams simplify and manage their decision-making process. Enterprise mobility management solutions enable the analysis of vast amounts of social media and sensor-based data to uncover new insights about relationships between customers, products, and operations, and represent them in an easy-to-understand manner. Enterprise mobility management solutions and services are already being accepted and implemented by large enterprises and SMEs.

The cloud segment is estimated to account for a faster CAGR rate during the forecast period

Under the deployment segment, the cloud is expected to grow at a higher growth rate during the forecast period. Cloud-based solutions involve the Software-as-a-Service (SaaS) model, wherein users can access enterprise mobility management solutions virtually through the internet. In this deployment type, enterprise mobility management solutions are delivered via the cloud. The advantages of deploying cloud-based enterprise mobility management solutions include flexibility, scalability, affordability, operational efficiency, and low costs. However, cloud-deployed enterprise mobility management solutions have certain shortcomings, such as lack of control over applications, strict government regulations, and private content. The overall adoption of cloud-based enterprise mobility management solutions is projected to be on the rise and would be high during the forecast period, due to the associated functionalities and core features.

The BFSI vertical area is expected to grow at the larger market size during the forecast period

Under the vertical segment, the BFSI vertical is expected to hold a larger market size during the forecast period. The rising trend of the BYOD trend in the BFSI sector has led to the adoption of enterprise mobility management solutions. Several companies in the BFSI sector are increasingly focusing on enhancing workplace mobility, thereby improving employee productivity and satisfaction. For instance, ABANCA, one of the largest banks based in Galicia (Spain), required a flexible, extensible platform that enables its IT department to manage COPE devices

North America is expected to account for the largest market size during the forecast period

North America is expected to hold the largest market size and dominate the enterprise mobility management market from 2020 to 2026. North America is home to multiple enterprise mobility management vendors, such as IBM, Microsoft, ManageEngine, and Citrix, who offer enterprise mobility management solutions and services. These companies target higher revenues and business expansions due to the strong competition across the North American region. Organizations in North America focus on innovations to keep up with the latest technologies in the market. In this region, verticals such as BFSI, retail, and healthcare and life sciences adopt enterprise mobility management solutions due to various benefits, such as efficient management of day-to-day transactions in the BFSI vertical, improved supply chain management process, and enhanced ability of healthcare machines to track patient health.

To know about the assumptions considered for the study, download the pdf brochure

Enterprise Mobility Management Companies

The major vendors in enterprise mobility management market are IBM (US), Microsoft(US), Cisco (US), BlackBerry (Canada), VMware(US), SAP (Germany), Citrix (US), Matrix42(Germany), MobileIron (US), Nationsky (China), Snow Software(Sweden), Sophos (UK), SOTI (Canada), Codeproof (US), Netplus Mobility (US), Hexnode (US), ManageEngine(US), Miradore (Finland), Quest Software (US), Ivanti(US), Scalefusion (India), 42Gears Mobility Systems(India), Social Mobile (US), AppTech (Switzerland), and Jamf (US).

The enterprise mobility management platform vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market.

Scope of the Report

|

Report Metric |

Details |

|

Market Size value in 2020 |

$16.6 Billion |

|

Market Size value in 2026 |

$63.6 Billion |

|

Growth Rate |

25.1% CAGR |

|

Largest Market |

North America |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Market Segments covered |

Component, Organization Size, Deployment Mode, Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe, MEA and Latin America |

|

List of Companies in Enterprise Mobility Management |

IBM (US), Microsoft(US), Cisco (US), BlackBerry (Canada), VMware(US), SAP (Germany), Citrix (US), Matrix42(Germany), MobileIron (US), Nationsky (China), Snow Software(Sweden), Sophos (UK), SOTI (Canada), Codeproof (US), Netplus Mobility (US), Hexnode (US), ManageEngine(US), Miradore (Finland), Quest Software (US), Ivanti(US), Scalefusion (India), 42Gears Mobility Systems(India), Social Mobile (US), AppTech (Switzerland), and Jamf (US) (Total 25 companies) |

The study categorizes the enterprise mobility management market based on component, organization size, deployment mode, vertical, at the regional and global level.

Market by Component

-

Solutions

- MDM

- MAM

- MCM

- Identity and Access Management

- Mobile Expense Management

-

Services

-

Professional Services

- Consulting

- Support and Maintenance

- Deployment and Integration

- Managed Services

-

Professional Services

Market by Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

Market by Deployment Modes

- Cloud

- On-premises

Market by Verticals

- BFSI

- Retail and eCommerce

- Healthcare and Life Sciences

- IT and Telecom

- Manufacturing

- Government

- Transportation and Logistics

- Travel and Hospitality

- Others Verticals

Market by Regions

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

APAC

- Japan

- China

- India

- Rest of APAC

-

MEA

- Israel

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2020, IBM launched Watson Works to address the challenges of returning to the workplace. Watson Works is a curated set of products that embed Watson AI models and applications to help companies navigate many aspects of the return-to-workplace challenge following lockdowns put in place to slow the spread of COVID-19.

- In July 2020, Citrix and Microsoft joined hands to reimagine new flexible workplaces during the COVID-19 pandemic situation. Under the partnership, Microsoft will select Citrix Workspace as a preferred digital workspace solution, and Citrix will select Microsoft Azure as a preferred cloud platform, moving Citrix’s existing on-premises customers to Microsoft Azure to enable them to work anywhere across devices.

- In May 2020, BlackBerry launched BlackBerry Spark Suites, which include the BlackBerry Spark UEM Express Suite, BlackBerry Spark UEM Suite, BlackBerry Spark UES Suite, and BlackBerry Spark Suite.

- In December 2020, Cisco announced an agreement to acquire IMImobile. Both companies have reached an agreement on the terms of a recommended cash offer pursuant to which Cisco will pay 595 pence per share in exchange for each share of IMImobile, or an aggregate purchase price of approximately USD 730 million assuming fully diluted shares, net of cash, and including debt.

- In August 2019, VMware unveiled innovations across its industry-leading Workspace ONE Platform. The new modern management, security, and multi-cloud VDI innovations enable the IT staff to leverage the power of automation to intelligently manage and secure access to any app, on any cloud, and delivered to any device.

Frequently Asked Questions (FAQ):

How big is the Enterprise mobility management market?

What is growth rate of the Enterprise mobility management market?

Who are the key players in Enterprise mobility management market?

Who will be the leading hub for Enterprise mobility management market?

What is the Enterprise mobility management market segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 6 ENTERPRISE MOBILITY MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 ENTERPRISE MOBILITY MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF ENTERPRISE MOBILITY MANAGEMENT THROUGH OVERALL ENTERPRISE MOBILITY MANAGEMENT SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 14 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON THE ENTERPRISE MOBILITY MANAGEMENT MARKET

FIGURE 15 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 50)

TABLE 4 GLOBAL ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE AND GROWTH RATE, 2016–2019 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE AND GROWTH RATE, 2020–2026 (USD MILLION, Y-O-Y%)

FIGURE 16 SOLUTIONS SEGMENT TO HOLD A LARGER MARKET SIZE IN 2020

FIGURE 17 MOBILE DEVICE MANAGEMENT SEGMENT TO HOLD A LARGER MARKET SHARE IN 2020

FIGURE 18 MANAGED SERVICES SEGMENT TO HOLD A LARGER MARKET SIZE IN 2020

FIGURE 19 CONSULTING SEGMENT TO HOLD THE LARGEST MARKET SHARE IN 2020

FIGURE 20 ON-PREMISES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2020

FIGURE 21 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2020

FIGURE 22 BANKING, INSURANCE, AND FINANCIAL SERVICES VERTICAL TO HOLD THE LARGEST MARKET SHARE IN 2020

FIGURE 23 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ENTERPRISE MOBILITY MANAGEMENT MARKET

FIGURE 24 EMERGING TREND OF DEVICE FLEXIBILITY FOR USERS WHILE RETAINING CONTROL FOR IT TO DRIVE MARKET GROWTH

4.2 ENTERPRISE MOBILITY MANAGEMENT MARKET: TOP THREE VERTICALS

FIGURE 25 MANUFACTURING SEGMENT TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2026

4.3 MARKET, BY REGION

FIGURE 26 NORTH AMERICA ACCOUNTED FOR THE LARGEST SHARE IN THE MARKET IN 2020

4.4 NORTH AMERICAN MARKET, BY COMPONENT AND VERTICAL

FIGURE 27 SOLUTIONS AND BFSI SEGMENTS ACCOUNTED FOR LARGE MARKET SHARES IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ENTERPRISE MOBILITY MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing trend of work from home due to the COVID-19 pandemic drives the adoption of ENTERPRISE MOBILITY MANAGEMENT solutions

5.2.1.2 Rise in real-time data access and penetration of cloud-based ENTERPRISE MOBILITY MANAGEMENT services among SMEs

5.2.2 RESTRAINTS

5.2.2.1 ENTERPRISE MOBILITY MANAGEMENT solutions to cater to every business need for a consistent end-user experience

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing BYOD presents larger growth opportunities for key players

5.2.3.2 Rising number of cyberattacks on personal devices and business-critical data drives the adoption of ENTERPRISE MOBILITY MANAGEMENT solutions

5.2.4 CHALLENGES

5.2.4.1 Poor enterprise system integrators

5.2.4.2 Data security and privacy concerns

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 ENTERPRISE MOBILITY MANAGEMENT MARKET: ECOSYSTEM

FIGURE 29 ENTERPRISE MOBILITY MANAGEMENT MARKET: ECOSYSTEM

5.4 CASE STUDY ANALYSIS

5.4.1 ASSIST CARE GROUP CUTS TIME SPENT IN TECH SUPPORT BY OVER 90% WITH SOTI MOBICONTROL

5.4.2 ESCOS AUTOMATION ACHIEVES 50% IMPROVEMENTS IN EFFICIENCY WITH 42GEARS’ SUREMDM

5.4.3 CADENCE ACCELERATED BUSINESS PRODUCTIVITY WITH THE HELP OF MICROSOFT365

5.4.4 CITI ORIENT SECURITIES IMPROVED EFFICIENCY AND SECURITY WITH BLACKBERRY UEM AND AWINGU

5.4.5 WORKING WITH IBM AND ATEA, ISS DEPLOYED AN ENTERPRISE MOBILITY MANAGEMENT PLATFORM TO SAFEGUARD ITSELF

5.5 ENTERPRISE MOBILITY MANAGEMENT MARKET: COVID-19 IMPACT

FIGURE 30 ENTERPRISE MOBILITY MANAGEMENT MARKET TO WITNESS A SLOWDOWN IN 2020

5.6 PATENT ANALYSIS

5.6.1 METHODOLOGY

5.6.2 DOCUMENT TYPE

TABLE 6 PATENTS FILED

5.6.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 31 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2010-2020

5.6.3.1 Top Applicants

FIGURE 32 TOP 10 COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2010-2020

5.7 VALUE CHAIN ANALYSIS

FIGURE 33 ENTERPRISE MOBILITY MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

5.8 TECHNOLOGY ANALYSIS

5.8.1 BYOD AND ENTERPRISE MOBILITY MANAGEMENT

5.8.2 ARTIFICIAL INTELLIGENCE AND ENTERPRISE MOBILITY MANAGEMENT

5.8.3 BEACON TECHNOLOGY AND ENTERPRISE MOBILITY MANAGEMENT

5.8.4 INTERNET OF THINGS AND ENTERPRISE MOBILITY MANAGEMENT

5.8.5 5G AND ENTERPRISE MOBILITY MANAGEMENT

5.9 AVERAGE SELLING PRICE TREND

5.10 PORTER’S FIVE FORCE ANALYSIS

FIGURE 34 PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

6 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY COMPONENT (Page No. - 75)

6.1 INTRODUCTION

6.1.1 COMPONENTS: ENTERPRISE MOBILITY MANAGEMENT MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 35 SERVICES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 7 MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 8 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

6.2 SOLUTIONS

FIGURE 36 IDENTITY AND ACCESS MANAGEMENT SEGMENT TO RECORD THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 9 ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 10 ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

6.3 MOBILE DEVICE MANAGEMENT

6.4 MOBILE APPLICATION MANAGEMENT

6.5 MOBILE CONTENT MANAGEMENT

6.6 MOBILE EXPENSE MANAGEMENT

6.7 IDENTITY AND ACCESS MANAGEMENT

6.8 SERVICES

FIGURE 37 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 11 SERVICES: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 12 SERVICES: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

6.8.1 PROFESSIONAL SERVICES

FIGURE 38 SUPPORT AND MAINTENANCE SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 13 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 14 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

6.8.1.1 Consulting

6.8.1.2 Support and maintenance

6.8.1.3 Deployment and integration

6.8.2 MANAGED SERVICES

7 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 87)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: ENTERPRISE MOBILITY MANAGEMENT MARKET DRIVERS

7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 39 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 15 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 16 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

7.2 LARGE ENTERPRISES

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY DEPLOYMENT MODE (Page No. - 92)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

8.1.2 DEPLOYMENT MODE: COVID-19 IMPACT

FIGURE 40 CLOUD SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 17 MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 18 ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

8.2 ON-PREMISES

8.3 CLOUD

9 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY VERTICAL (Page No. - 97)

9.1 INTRODUCTION

9.1.1 VERTICALS: ENTERPRISE MOBILITY MANAGEMENT MARKET DRIVERS

9.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 41 MANUFACTURING VERTICAL TO RECORD THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 19 MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 20 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.3 GOVERNMENT

9.4 HEALTHCARE AND LIFE SCIENCES

9.5 RETAIL AND E-COMMERCE

9.6 MANUFACTURING

9.7 INFORMATION TECHNOLOGY AND TELECOM

9.8 TRANSPORTATION AND LOGISTICS

9.9 TRAVEL AND HOSPITALITY

9.10 OTHER VERTICALS

10 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY REGION (Page No. - 107)

10.1 INTRODUCTION

FIGURE 42 INDIA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 43 ASIA PACIFIC TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 21 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: ENTERPRISE MOBILITY MANAGEMENT MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATIONS

10.2.3.1 Health Insurance Portability and Accountability Act of 1996

10.2.3.2 California Consumer Privacy Act

10.2.3.3 Gramm–Leach–Bliley Act

10.2.3.4 Health Information Technology for Economic and Clinical Health Act

10.2.3.5 Sarbanes-Oxley Act

10.2.3.6 Federal Information Security Management Act

10.2.3.7 Payment Card Industry Data Security Standard

10.2.3.8 Federal Information Processing Standards

FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

TABLE 23 NORTH AMERICA: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 24 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 25 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 26 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 27 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 32 NORTH AMERICA: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.4 US

10.2.5 CANADA

10.3 EUROPE

10.3.1 EUROPE: ENTERPRISE MOBILITY MANAGEMENT MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATIONS

10.3.3.1 General Data Protection Regulation

10.3.3.2 European Committee for Standardization

10.3.3.3 European Technical Standards Institute

TABLE 39 EUROPE: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 40 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 41 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 42 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 43 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 44 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 46 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 47 EUROPE: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 48 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 53 EUROPE: ENTERPRISE MOBILITY MANAGEMENT SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 54 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.4 UK

10.3.5 GERMANY

10.3.6 FRANCE

10.3.7 REST OF EUROPE

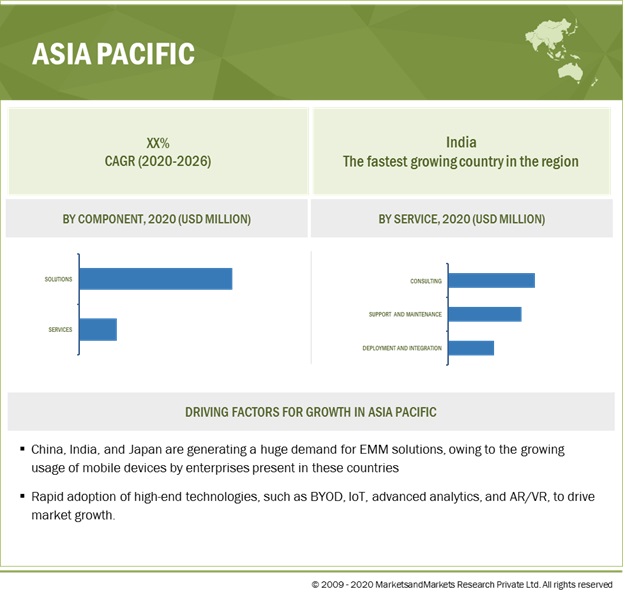

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: ENTERPRISE MOBILITY MANAGEMENT MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATIONS

10.4.3.1 Privacy Commissioner for Personal Data

10.4.3.2 Act on the Protection of Personal Information

10.4.3.3 Critical Information Infrastructure

10.4.3.4 International Organization for Standardization 27001

10.4.3.5 Personal Data Protection Act

FIGURE 45 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 55 ASIA PACIFIC: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 63 ASIA PACIFIC: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.4 CHINA

10.4.5 JAPAN

10.4.6 INDIA

10.4.7 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: ENTERPRISE MOBILITY MANAGEMENT MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

10.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

10.5.3.2 Cloud Computing Framework

10.5.3.3 GDPR Applicability in the Kingdom of Saudi Arabia (KSA)

10.5.3.4 Protection of Personal Information Act

TABLE 71 MIDDLE EAST AND AFRICA: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.5.4 KINGDOM OF SAUDI ARABIA

10.5.5 UNITED ARAB EMIRATES

10.5.6 SOUTH AFRICA

10.5.7 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: ENTERPRISE MOBILITY MANAGEMENT MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATIONS

10.6.3.1 Brazil Data Protection Law

10.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 87 LATIN AMERICA: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 88 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 89 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 90 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 91 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016-2019 (USD MILLION)

TABLE 92 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 93 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 94 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 95 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 96 LATIN AMERICA: ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 97 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 98 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 99 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 100 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 101 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 102 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.6.4 BRAZIL

10.6.5 MEXICO

10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 164)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 46 MARKET EVALUATION FRAMEWORK

11.3 MARKET SHARE, 2020

FIGURE 47 MICROSOFT TO LEAD THE ENTERPRISE MOBILITY MANAGEMENT MARKET IN 2020

11.4 HISTORICAL REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 48 REVENUE ANALYSIS OF KEY MARKET PLAYERS

11.5 RANKING OF KEY MARKET PLAYERS IN ENTERPRISE MOBILITY MANAGEMENT MARKET, 2020

FIGURE 49 RANKING OF KEY PLAYERS, 2020

11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 103 COMPANY PRODUCT FOOTPRINT

11.7 COMPETITIVE SCENARIO

11.7.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 104 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2018–2021

11.7.2 BUSINESS EXPANSIONS

TABLE 105 BUSINESS EXPANSIONS, 2019-2020

11.7.3 MERGERS AND ACQUISITIONS

TABLE 106 MERGERS AND ACQUISITIONS, 2018–2020

11.7.4 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS

TABLE 107 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS, 2018–2021

11.8 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

11.8.1 STAR

11.8.2 EMERGING LEADERS

11.8.3 PERVASIVE

11.8.4 PARTICIPANTS

FIGURE 50 ENTERPRISE MOBILITY MANAGEMENT MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

11.8.5 STRENGTH OF PRODUCT PORTFOLIO (GLOBAL)

FIGURE 51 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE ENTERPRISE MOBILITY MANAGEMENT MARKET

11.8.6 BUSINESS STRATEGY EXCELLENCE (GLOBAL)

FIGURE 52 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

11.9 STARTUP/SME EVALUATION MATRIX, 2020

11.9.1 PROGRESSIVE COMPANIES

11.9.2 RESPONSIVE COMPANIES

11.9.3 DYNAMIC COMPANIES

11.9.4 STARTING BLOCKS

FIGURE 53 MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2020

11.9.5 STRENGTH OF PRODUCT PORTFOLIO (STARTUP/SME)

FIGURE 54 PRODUCT PORTFOLIO ANALYSIS OF TOP STARTUPS IN THE MARKET

11.9.6 BUSINESS STRATEGY EXCELLENCE (STARTUP/SME)

FIGURE 55 BUSINESS STRATEGY EXCELLENCE OF TOP STARTUPS IN THE ENTERPRISE MOBILITY MANAGEMENT MARKET

12 COMPANY PROFILES (Page No. - 183)

12.1 INTRODUCTION

(Business Overview, Platform, Solutions & Services, Key Insights, Recent Developments, MnM View)*

12.2 IBM

TABLE 108 IBM: BUSINESS OVERVIEW

FIGURE 56 IBM: COMPANY SNAPSHOT

TABLE 109 IBM: SOLUTION OFFERED

12.3 CISCO

TABLE 110 CISCO: BUSINESS OVERVIEW

FIGURE 57 CISCO: COMPANY SNAPSHOT

TABLE 111 CISCO: SOLUTION OFFERED

12.4 BLACKBERRY

TABLE 112 BLACKBERRY: BUSINESS OVERVIEW

FIGURE 58 BLACKBERRY: COMPANY SNAPSHOT

TABLE 113 BLACKBERRY: SOLUTION OFFERED

12.5 MICROSOFT

TABLE 114 MICROSOFT: BUSINESS OVERVIEW

FIGURE 59 MICROSOFT: COMPANY SNAPSHOT

TABLE 115 MICROSOFT: SOLUTION OFFERED

12.6 VMWARE

TABLE 116 VMWARE: BUSINESS OVERVIEW

FIGURE 60 VMWARE: COMPANY SNAPSHOT

TABLE 117 VMWARE: SOLUTION OFFERED

12.7 SAP

TABLE 118 SAP: BUSINESS OVERVIEW

FIGURE 61 SAP: COMPANY SNAPSHOT

TABLE 119 SAP: SOLUTION OFFERED

12.8 CITRIX

TABLE 120 CITRIX: BUSINESS OVERVIEW

FIGURE 62 CITRIX: COMPANY SNAPSHOT

TABLE 121 CITRIX: SOLUTION OFFERED

12.9 MATRIX42

TABLE 122 MATRIX42: SOLUTIONS OFFERED

12.10 MOBILEIRON

TABLE 123 MOBILEIRON: BUSINESS OVERVIEW

FIGURE 63 MOBILEIRON: COMPANY SNAPSHOT

TABLE 124 MOBILEIRON: SOLUTION OFFERED

12.11 NATIONSKY

12.11.1 PLATFORMS AND SERVICES OFFERED

TABLE 125 NATIONSKY: SOLUTION OFFERED

12.12 SNOW SOFTWARE

TABLE 126 SNOW SOFTWARE: SOLUTION OFFERED

12.13 SOPHOS

TABLE 127 SOPHOS: BUSINESS OVERVIEW

FIGURE 64 SOPHOS: COMPANY SNAPSHOT

TABLE 128 SOPHOS: SOLUTION OFFERED

12.14 SOTI

TABLE 129 SOTI: SOLUTION OFFERED

12.15 CODEPROOF

TABLE 130 CODEPROOF: SOLUTION OFFERED

12.16 NETPLUS MOBILITY

TABLE 131 NETPLUS MOBILITY: SOLUTION OFFERED

12.17 HEXNODE

TABLE 132 HEXNODE: SOLUTION OFFERED

12.18 MANAGEENGINE

TABLE 133 MANAGEENGINE: SOLUTION OFFERED

12.19 MIRADORE

TABLE 134 MIRADORE: SOLUTION OFFERED

12.20 QUEST SOFTWARE

12.21 IVANTI

12.22 SOCIAL MOBILE

12.23 JAMF

12.24 42GEARS MOBILITY SYSTEMS

12.25 SCALEFUSION

12.26 APPTEC

(Business Overview, Platform, Solutions & Services, Key Insights, Recent Developments, MnM View)*

13 ADJACENT AND RELATED MARKETS (Page No. - 253)

13.1 INTRODUCTION

13.2 BYOD AND ENTERPRISE MOBILITY MARKET - GLOBAL FORECAST TO 2021

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.3 BYOD AND ENTERPRISE MOBILITY MARKET, BY DEVICE

TABLE 135 BYOD AND ENTERPRISE MOBILITY DEVICES MARKET SHIPMENT, 2014–2021 (MILLION UNITS)

13.2.3.1 Smartphones

TABLE 136 SMARTPHONES: MARKET SHIPMENT, BY REGION, 2014–2021 (MILLION UNITS)

13.2.3.2 Laptops

TABLE 137 LAPTOPS: MARKET SHIPMENT, BY REGION, 2014–2021 (MILLION UNITS)

13.2.3.3 Tablets/Phablets

TABLE 138 TABLETS/PHABLETS: MARKET SHIPMENT, BY REGION, 2014–2021 (MILLION UNITS)

13.2.4 BYOD AND ENTERPRISE MOBILITY MARKET, BY COMPONENT

13.2.4.1 Software

TABLE 139 BYOD AND ENTERPRISE MOBILITY MARKET SIZE, BY SOFTWARE, 2014–2021 (USD BILLION)

13.2.4.2 Security

TABLE 140 BYOD AND ENTERPRISE MOBILITY MARKET SIZE, BY SECURITY, 2014–2021 (USD BILLION)

13.2.4.3 Services

TABLE 141 BYOD AND ENTERPRISE MOBILITY MARKET SIZE, BY SERVICE, 2014–2021 (USD BILLION)

13.2.5 BYOD AND ENTERPRISE MOBILITY MARKET, BY DEPLOYMENT MODE

TABLE 142 BYOD AND ENTERPRISE MOBILITY MARKET SIZE, BY DEPLOYMENT, 2014–2021 (USD BILLION)

13.2.6 BYOD AND ENTERPRISE MOBILITY MARKET ANALYSIS, BY VERTICAL

TABLE 143 BYOD AND ENTERPRISE MOBILITY MARKET SIZE, BY VERTICAL, 2014–2021 (USD BILLION)

13.2.7 BYOD AND ENTERPRISE MOBILITY MARKET ANALYSIS, BY REGION

TABLE 144 BYOD AND ENTERPRISE MOBILITY MARKET SIZE, BY REGION, 2014–2021 (USD BILLION)

13.3 MOBILE UC&C MARKET - GLOBAL FORECAST TO 2025

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.3 MOBILE UC&C MARKET, BY SOLUTION

TABLE 145 GLOBAL MOBILE UC&C MARKET SIZE, BY SOLUTION, 2012-2019 (USD MILLION)

13.3.4 MOBILE UC&C MARKET, BY SERVICE

TABLE 146 GLOBAL MOBILE UC&C MARKET SIZE, BY SERVICE, 2012-2019 (USD MILLION)

13.3.5 MOBILE UC&C MARKET, BY DEPLOYMENT MODE

TABLE 147 GLOBAL MOBILE UC&C SOLUTION MARKET SIZE, BY DEPLOYMENT TYPE, 2012-2019 (USD MILLION)

13.3.6 MOBILE UC&C MARKET, BY USER

TABLE 148 GLOBAL MOBILE UC&C MARKET SIZE, BY USER TYPE, 2012-2019 (USD MILLION)

13.3.7 MOBILE UC&C MARKET, BY INDUSTRY VERTICAL

TABLE 149 GLOBAL MOBILE UC&C MARKET SIZE, BY INDUSTRY VERTICAL, 2012-2019 (USD MILLION)

13.3.8 MOBILE UC&C MARKET, BY REGION

TABLE 150 GLOBAL MOBILE UC&C MARKET SIZE, BY REGION, 2012-2019 (USD MILLION)

14 APPENDIX (Page No. - 264)

14.1 INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

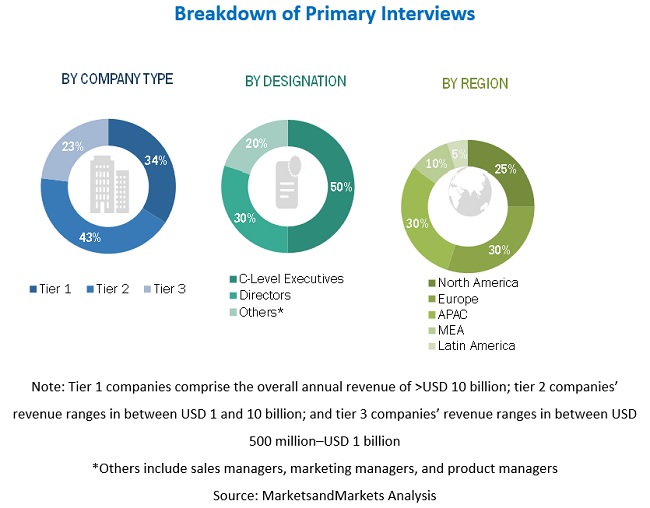

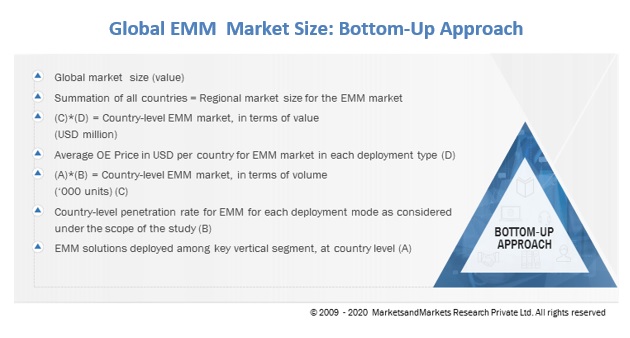

The study involved four major activities in estimating the current market size of the enterprise mobility management market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the enterprise mobility management market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek, Dun Bradstreet, and Factiva, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from enterprise mobility management solution vendors, system integrators, service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Enterprise Mobility Management Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the enterprise mobility management market.

- In this approach, the overall enterprise mobility management market size for each organization size have been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various enterprise mobility management platform type used in the key verticals.

- Several primary interviews have been conducted with key opinion leaders related to enterprise mobility management providers, including key OEMs and Tier I suppliers

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, segment, and project the global market size of the enterprise mobility management market

- To understand the structure of the enterprise mobility management market by identifying its various subsegments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze the market by component, organization size, deployment mode, vertical, and region

- To project the size of the market and its submarkets, in terms of value, for North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify significant growth strategies adopted by players across key regions

- To analyze competitive developments, such as expansions and funding, new product launches, mergers and acquisitions, strategic partnerships, and agreements, in the enterprise mobility management market

- To analyze the impact of COVID-19 pandemic on enterprise mobility management market

Available customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of enterprise mobility management market

- Profiling of additional market players (total up to 10)

- Country-level analysis of main 2 segments such as component, solutions

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Enterprise Mobility Management Market