Epoxy Primer Market by Substrate (Metal, Concrete & Masonry, and Fiberglass), Application (Building & Construction, Automotive, Marine, and Machinery & Equipment), Technology (Solvent-borne, and Waterborne), and Region-Global Forecast to 2023

The global epoxy primer market was valued at USD 8.01 billion in 2017 and is projected to reach USD 10.91 billion by 2023, at a CAGR of 5.1% between 2018 and 2023. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023. Epoxy primer is a sealer that produces excellent non-porous finish on the applied topcoats. It has superior bonding capacity and offers excellent adhesion to a wide variety of substrates such as metal, concrete & masonry, wood, fiberglass, and others. It also has water resistant and corrosion inhibiting capabilities. Therefore, it is preferred in different applications such as building & construction, automotive, marine, and machinery & equipment.

Market Dynamics

Drivers

- High demand from various applications

- Increasing need to reduce the loss caused by corossion

Restraints

- Fluctuating raw material prices

- Stringent environmental regulations

Opportunities

- Growing demand for high-performance epoxy primer

- High Industrial growth in APAC and the Middle East & Africa

The high demand of epoxy primer in various applications and increasing need to reduce the loss caused by corrosion drives the global epoxy primer market.

Epoxy primers offer excellent adhesion and corrosion resistance properties, which make them preferable for various applications such as building & construction, automotive, marine, oil & gas, energy, and machinery & equipment. The focus on infrastructural development and construction activities in emerging economies such as APAC and the Middle East & Africa is driving the demand for epoxy primers in the building & construction application. Automotive and marine are also the important application areas of epoxy primer. The automotive application is expected to register the high growth during the forecast period. Automotive sales in APAC have witnessed a steady growth in the past few years. According to Asia Motor, business vehicle sales have grown by 2.4% in 2015 in this region. The key countries contributing to the growth in this region include China, India, Japan, South Korea, and Indonesia. China and India are projected to be the fastest-growing markets during the forecast period, owing to the growth in the automotive industry. These factors have played an important role in fueling the demand for epoxy primers in the automotive application.

Objectives of the Study

- To define, describe, and forecast the global epoxy primer market, in terms of value and volume, on the basis of substrate, application, technology, and geography

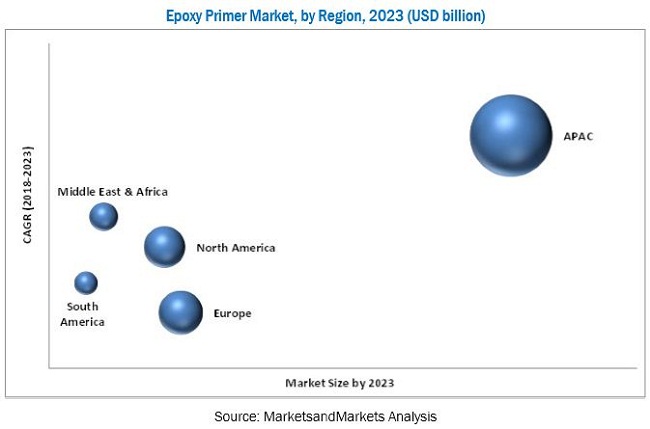

- To forecast the market size with respect to 5 main regions—APAC, Europe, North America, South America, and the Middle East & Africa

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the epoxy primer market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the opportunities in the epoxy primer market for stakeholders and draw a competitive landscape for market leaders

- To analyze competitive developments such as investments & expansions; joint ventures; mergers & acquisitions; product developments; and research & development (R&D) activities in the epoxy primer market

- To strategically profile key players and comprehensively analyze their core competencies

During this research study, major players operating in the epoxy primer market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Both, the top-down and bottom-up approaches were used to estimate and validate the size of the epoxy primer market, and to estimate the size of various other dependent submarkets. This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, Chemical Weekly, Factiva, ICIS, and the Securities and Exchange Commission (SEC), among other government and private websites, to identify and collect information useful for a technical, market-oriented, and commercial study of the epoxy primer market.

To know about the assumptions considered for the study, download the pdf brochure

The epoxy primer market has a diversified and established ecosystem of upstream players—such as raw material suppliers—and downstream stakeholders—such as manufacturers, vendors, end users, and government organizations. Key global players of the epoxy primer market are The Sherwin-Williams Company (US), PPG Industries Inc. (US), AkzoNobel N.V. (Netherlands), BASF SE (Germany), Axalta Coating Systems LLC (US), Kansai Paint Co. Ltd. (Japan), Nippon Paint Co. Ltd. (Japan), Tikkurila Oyj (Finland), and RPM International Inc. (US).

Major Market Developments

- In June 2017, Sherwin-Williams acquired The Valspar Corporation (US). The acquisition helps the company in enhancing its position as a premier global paints and coatings provider. Both the companies have benefited from this acquisition, as it has increased their product range and innovation capabilities, and helped them in enhancing their technologies.

- In October 2017, PPG Industries acquired the Crown Group (US), a coating application company. The company operates in 11 sites and offers coating products including epoxy primers for the automotive, agriculture, construction, heavy truck, and other industries. The acquisition helps in enhancing the company’s ability to serve its customers efficiently.

- In July 2017, AkzoNobel acquired Flexcrete Technologies Ltd. (UK) that produces products for the protection and repair of concrete substrates. Flexcrete Technologies produces epoxy primers under the brands Metal-Prime WB and Bond-Prime. These products are used over a variety of substrates in commercial and industrial applications.

- In December 2017, BASF’s coatings division inaugurated a new automotive coatings plant at its Bangpoo manufacturing site, Samutprakarn province, Thailand. The new plant is the first BASF automotive coatings manufacturing facility in ASEAN. It produces solvent-borne and waterborne automotive coatings to meet the growing market demands in the region.

- In June 2017, Th invested about USD 49 million to start a new paints & coatings manufacturing facility and commercial operation in the Lipetsk region of Russia. This site employs about 200 people and produces about 25 million liters of coatings at full capacity. It manufactures and distributes coating products, including epoxy primers, for automotive, industrial, packaging, and protective, and marine applications. The expansion helps in better serving the existing customers in Europe, and also increases the presence in Europe, Middle East and Africa (EMEA).

Key Target Audience

- Manufacturers, dealers, and suppliers of epoxy primer

- Raw material manufacturers of epoxy primer

- Regional manufacturers of coatings

- Government and regional agencies

- Research and development institutions

Scope of the Report

The global epoxy primer market has been covered in detail in this report. Current market demand and forecasts have also been included to provide a comprehensive market scenario.

Epoxy primer Market, By Substrate:

- Metal

- Concrete & Masonry

- Fiberglass

Epoxy primer Market, By Application

- Building & Construction

- Automotive

- Marine

- Machinery & Equipment

Epoxy primer Market, By Technology

- Solvent-borne

- Waterborne

Epoxy primer Market, By Region

- APAC

- Europe

- North America

- Middle East & Africa

- South America

The market has been further studied for key countries in each of these regions.

Available Customization

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of the company. The following customization options are available for the report:

Regional Analysis

- A country-level analysis of the epoxy primer market based on substrate, application, and technology.

Company Information

- Detailed analysis and profiles of additional market players

The global epoxy primer market is estimated to be USD 8.52 billion in 2018 and is projected to reach USD 10.91 billion by 2023, at a CAGR of 5.1% between 2018 and 2023. The increasing demand for epoxy primer in various applications and the growing awareness to reduce the loss caused by corrosion are expected to drive the growth of epoxy market.

Epoxy primers are used as sealers to produce excellent non-porous finish on the applied topcoats. They have superior bonding capacity and offer excellent adhesion to a wide variety of substrates such as metal, concrete & masonry, wood, fiberglass, and others. They also have water resistant and corrosion inhibiting properties. Therefore, they are used in different applications such as building & construction, automotive, marine, and machinery & equipment.

The epoxy primer market has been segmented on the basis of substrate, namely, metal, concrete & masonry, fiberglass, and others. The metal substrate is estimated to account for the largest share of the epoxy primer market in 2018. The epoxy primer experience high demand from building & construction, automotive, and marine sector. These primers are used to wet the surface and provide excellent adhesion to the applied coats. They also offer excellent corrosion and chemical resistance, thereby preventing rust formation. Based on application, the building & construction segment is estimated to account for the largest share of the epoxy primer market in 2018. It is widely used on concrete & masonry surfaces for flooring application. In this application, it is also preferred for metal substrates that are used for priming structures.

Based on technology, the solvent-borne segment is estimated to account for the largest share of the epoxy primer market in 2018. The epoxy primers produced using solvent-borne technology have superior characteristics and are used in a wide variety of applications such as building & construction, automotive, marine, and other industrial machinery & equipment.

APAC is estimated to account for a major share of the overall epoxy primer market in 2018. The market is driven by the increasing demand from various applications, such as building & construction, automotive, power generation, oil & gas, and marine. Moreover, the high growth of the emerging economies and increasing disposable income in APAC make it an attractive market for coatings, thereby the epoxy primer market.

The fluctuating raw material prices and environmental regulations to reduce the use of epoxy primers produced using solvent-borne technology are restraining the growth of the market.

Key global players of the epoxy primer market are The Sherwin-Williams Company (US), PPG Industries Inc. (US), AkzoNobel N.V. (Netherlands), BASF SE (Germany), Axalta Coating Systems LLC (US), Kansai Paint Co. Ltd. (Japan), Nippon Paint Co. Ltd. (Japan), Tikkurila Oyj (Finland), and RPM International Inc. (US). Top players focus on expansions and new product launches as major strategies to consolidate their position in the market. There is a high competition among these market players, and they focus on organic and inorganic growth strategies to increase their market share and global foothold. For instance, in June 2017, Sherwin-Williams acquired Valspar Corporation (US). The acquisition has helped the company enhance its position as a premier global paints and coatings provider, globally. In October 2017, PPG Industries acquired the Crown Group (US), a coating application company. The acquisition helps it serve its customers better in North America. PPG Industries has also invested about USD 49.0 million to start a new paints & coatings manufacturing facility and commercial operation in the Lipetsk region of Russia. The expansion helps it better serve the existing customers in Russia and Eastern Europe and increases its presence in Europe and the Middle East & Africa (EMEA).

Various application such as building & construction, automotive, and marine drive the growth of epoxy primer market

Building & Construction

Building & construction is one of the largest application of epoxy primer. In building & construction, epoxy primers are used in floors, walls, and ceilings. These primers are used in residential, commercial, and industrial buildings such as warehouses, manufacturing plants, pharmaceutical buildings, food & beverage plants, and laboratories. The use of these primers helps in penetrating into the concrete and sealing the surface to improve adhesion of the coating. Epoxy primers are also used in the metal parts and pipes to offer resistance to corrosion, chemicals, and solvents. They are mainly used in the building & construction applications to ensure excellent adhesion to subsequent paint layers.

Automotive

In automotive application, the epoxy primers are used by both automotive OEM and automotive refinish systems. The epoxy primers are applied to different substrates such as metal, and fiberglass. It improves surface smoothness, increases basecoat and topcoat adhesion, and also protects vehicles from UV rays. The epoxy primers have several advantages over metal and fiber substrate to enhance adhesion, enhances the gloss of topcoat, reduces discoloration, prevents rust and corrosion, and protects the vehicle body from stone chipping, deformation, abrasion, and scratches. It also offers excellent resistance to moisture, solvent, and chemicals.

Marine

In marine application, epoxy primers are used in a wide variety of substrates such as aluminum, steel, composites, carbon fiber, and wood. The use of these primers aids in sealing the surface of the substrates to offer excellent adhesion to the subsequent polyurethane topcoat. They are mostly used on exterior and interior cabin/trim, bilge, lockers, and hull above the waterline. They are preferred in marine applications as they offer excellent characteristics and advantages such as good penetration and adhesion, moisture tolerance, protection, and corrosion resistance to seawaters.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming trends of epoxy primer in various application?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

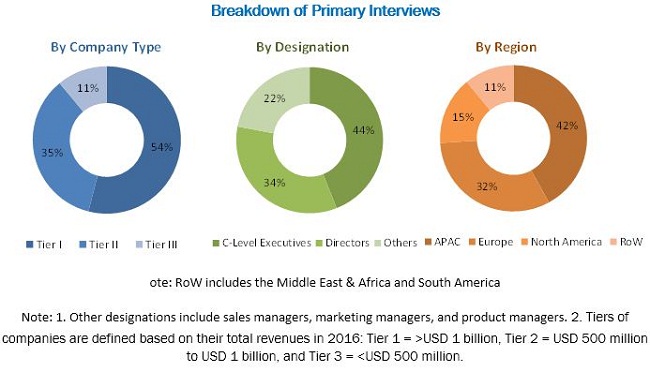

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Top-Down and Bottom-Up Approach

2.3 Data Triangulation

2.3.1 Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Epoxy Primer Market

4.2 Epoxy Primer Market, By Substrate

4.3 Epoxy Primer Market, By Application

4.4 Epoxy Primer Market in APAC, By Country and Application

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Demand From Various Applications

5.2.1.2 Increasing Need to Reduce the Loss Caused By Corrosion

5.2.2 Restraints

5.2.2.1 Fluctuating Raw Material Prices

5.2.2.2 Stringent Environment Regulations

5.2.3 Opportunities

5.2.3.1 Growing Demand for High-Performance Epoxy Primers

5.2.3.2 High Industrial Growth in APAC and Middle East & Africa

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Epoxy Primer Market, By Substrate (Page No. - 36)

6.1 Introduction

6.2 Metal

6.3 Concrete & Masonry

6.4 Fiberglass

6.5 Others

7 Epoxy Primer Market, By Application (Page No. - 42)

7.1 Introduction

7.2 Building & Construction

7.3 Automotive

7.4 Marine

7.5 Machinery & Equipment

7.6 Others

8 Epoxy Primer Market, By Technology (Page No. - 49)

8.1 Introduction

8.2 Solvent-Borne Technology

8.3 Waterborne Technology

9 Epoxy Primer Market, By Region (Page No. - 53)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 South Korea

9.2.5 Indonesia

9.2.6 Thailand

9.2.7 Malaysia

9.2.8 Rest of APAC

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Italy

9.3.5 Spain

9.3.6 Russia

9.3.7 Turkey

9.3.8 Poland

9.3.9 Rest of Europe

9.4 North America

9.4.1 US

9.4.2 Canada

9.4.3 Mexico

9.5 Middle East & Africa

9.5.1 Africa

9.5.2 Saudi Arabia

9.5.3 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 86)

10.1 Overview

10.2 Market Ranking of Key Players

10.3 Competitive Scenario

10.3.1 Mergers & Acquisitions

10.3.2 New Product Launches

10.3.3 Investments & Expansions

11 Company Profiles (Page No. - 94)

11.1 PPG Industries

11.2 Akzonobel

11.3 Sherwin-Williams

11.4 Axalta Coating Systems

11.5 BASF SE

11.6 Nippon Paint

11.7 Jotun

11.8 Asian Paints

11.9 Kansai Paint

11.10 3M

11.11 Hempel

11.12 RPM International

11.13 Tikkurila Oyj

11.14 Berger Paints

11.15 Other Market Players

11.15.1 KCC

11.15.2 Carpoly

11.15.3 Sika

11.15.4 Diamond Vogel Paints

11.15.5 Hunan Xiangjiang Paint

11.15.6 DAW

11.15.7 BESA

11.15.8 Noroo Paint & Coatings

11.15.9 HMG Paints

11.15.10 Chugoku Marine Paints

11.15.11 Toa Performance Coating (Toapc) Corporation

12 Appendix (Page No. - 135)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (73 Tables)

Table 1 Epoxy Primer Market Size, By Substrate, 2016–2023 (USD Million)

Table 2 Epoxy Primer Market Size, By Substrate, 2016–2023 (Kiloton)

Table 3 Epoxy Primer Market Size for Metal Substrate, By Region, 2016–2023 (USD Million)

Table 4 Epoxy Primer Market Size for Metal Substrate, By Region, 2016–2023 (Kiloton)

Table 5 Epoxy Primer Market Size for Concrete & Masonry Substrate, By Region, 2016–2023 (USD Million)

Table 6 Epoxy Primer Market Size for Concrete & Masonry Substrate, By Region, 2016–2023 (Kiloton)

Table 7 Epoxy Primer Market Size for Fiberglass Substrate, By Region, 2016–2023 (USD Million)

Table 8 Epoxy Primer Market Size for Fiberglass Substrate, By Region, 2016–2023 (Kiloton)

Table 9 Epoxy Primer Market Size for Other Substrates, By Region, 2016–2023 (USD Million)

Table 10 Epoxy Primer Market Size for Other Substrates, By Region, 2016–2023 (Kiloton)

Table 11 By Market Size, By Application, 2016–2023 (USD Million)

Table 12 By Market Size, By Application, 2016–2023 (Kiloton)

Table 13 By Market Size in Building & Construction, By Region, 2016–2023 (USD Million)

Table 14 By Market Size in Building & Construction, By Region, 2016–2023 (Kiloton)

Table 15 By Market Size in Automotive, By Region, 2016–2023 (USD Million)

Table 16 By Market Size in Automotive, By Region, 2016–2023 (Kiloton)

Table 17 By Market Size in Marine, By Region, 2016–2023 (USD Million)

Table 18 By Market Size in Marine, By Region, 2016–2023 (Kiloton)

Table 19 By Market Size in Machinery & Equipment, By Region, 2016–2023 (USD Million)

Table 20 By Market Size in Machinery & Equipment, By Region, 2016–2023 (Kiloton)

Table 21 By Market Size in Other Applications, By Region, 2016–2023 (USD Million)

Table 22 By Market Size in Other Applications, By Region, 2016–2023 (Kiloton)

Table 23 By Market Size, By Technology, 2016–2023 (USD Million)

Table 24 By Market Size, By Technology, 2016–2023 (Kiloton)

Table 25 By Market Size for Solvent-Borne Technology, By Region, 2016–2023 (USD Million)

Table 26 By Market Size for Solvent-Borne Technology, By Region, 2016–2023 (Kiloton)

Table 27 By Market Size for Waterborne Technology, By Region, 2016–2023 (USD Million)

Table 28 By Market Size for Waterborne Technology, By Region, 2016–2023 (Kiloton)

Table 29 By Market Size, By Region, 2016–2023 (USD Million)

Table 30 By Market Size, By Region, 2016–2023 (Kiloton)

Table 31 APAC: By Market Size, By Country, 2016–2023 (USD Million)

Table 32 APAC By Market Size, By Country, 2016–2023 (Kiloton)

Table 33 APAC: By Market Size, By Substrate, 2016–2023 (USD Million)

Table 34 APAC: By Market Size, By Substrate, 2016–2023 (Kiloton)

Table 35 APAC: By Market Size, By Application, 2016–2023 (USD Million)

Table 36 APAC: By Market Size, By Application, 2016–2023 (Kiloton)

Table 37 APAC: By Market Size, By Technology, 2016–2023 (USD Million)

Table 38 APAC: By Market Size, By Technology, 2016–2023 (Kiloton)

Table 39 Europe: By Market Size, By Country, 2016–2023 (USD Million)

Table 40 Europe: By Market Size, By Country, 2016–2023 (Kiloton)

Table 41 Europe: By Market Size, By Substrate, 2016–2023 (USD Million)

Table 42 Europe: By Market Size, By Substrate, 2016–2023 (Kiloton)

Table 43 Europe: By Market Size, By Application, 2016–2023 (USD Million)

Table 44 Europe: By Market Size, By Application, 2016–2023 (Kiloton)

Table 45 Europe: By Market Size, By Technology, 2016–2023 (USD Million)

Table 46 Europe: By Market Size, By Technology, 2016–2023 (Kiloton)

Table 47 North America: By Market Size, By Country, 2016–2023 (USD Million)

Table 48 North America: By Market Size, By Country, 2016–2023 (Kiloton)

Table 49 North America: By Market Size, By Substrate, 2016–2023 (USD Million)

Table 50 North America: By Market Size, By Substrate, 2016–2023 (Kiloton)

Table 51 North America: By Market Size, By Application, 2016–2023 (USD Million)

Table 52 North America: By Market Size, By Application, 2016–2023 (Kiloton)

Table 53 North America: By Market Size, By Technology, 2016–2023 (USD Million)

Table 54 North America: By Market Size, By Technology, 2016–2023 (Kiloton)

Table 55 Middle East & Africa: By Market Size, By Country, 2016–2023 (USD Million)

Table 56 Middle East & Africa: By Market Size, By Country, 2016–2023 (Kiloton)

Table 57 Middle East & Africa: By Market Size, By Substrate, 2016–2023 (USD Million)

Table 58 Middle East & Africa: By Market Size, By Substrate, 2016–2023 (Kiloton)

Table 59 Middle East & Africa: By Market Size, By Application, 2016–2023 (USD Million)

Table 60 Middle East & Africa: By Market Size, By Application, 2016–2023 (Kiloton)

Table 61 Middle East & Africa: By Market Size, By Technology, 2016–2023 (USD Million)

Table 62 Middle East & Africa: By Market Size, By Technology, 2016–2023 (Kiloton)

Table 63 South America: By Market Size, By Country, 2016–2023 (USD Million)

Table 64 South America: By Market Size, By Country, 2016–2023 (Kiloton)

Table 65 South America: By Market Size, By Substrate, 2016–2023 (USD Million)

Table 66 South America: By Market Size, By Substrate, 2016–2023 (Kiloton)

Table 67 South America: By Market Size, By Application, 2016–2023 (USD Million)

Table 68 South America: By Market Size, By Application, 2016–2023 (Kiloton)

Table 69 South America: By Market Size, By Technology, 2016–2023 (USD Million)

Table 70 South America: By Market Size, By Technology, 2016–2023 (Kiloton)

Table 71 Mergers & Acquisitions, 2015–2018

Table 72 New Product Launches, 2015–2018

Table 73 Investments & Expansions, 2015–2018

List of Figures (43 Figures)

Figure 1 Epoxy Primer Market Segmentation

Figure 2 Epoxy Primer Market: Research Design

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Epoxy Primer Market: Data Triangulation

Figure 6 Metal Substrate Dominates the Epoxy Primer Market

Figure 7 Building & Construction to Be the Largest Application

Figure 8 APAC to Dominate the Epoxy Primer Market

Figure 9 Emerging Economies Offer High Growth Opportunities to the Epoxy Primer Market

Figure 10 Metal Substrate to Register the Highest Cagr

Figure 11 Automotive Application to Register the Highest Cagr

Figure 12 China Was the Largest Market for Epoxy Primer

Figure 13 Overview of Factors Governing the Epoxy Primer Market

Figure 14 Metal Substrate to Dominate the Epoxy Primer Market

Figure 15 Building & Construction to Lead the Epoxy Primer Market

Figure 16 Solvent-Borne Technology Dominates the Epoxy Primer Market

Figure 17 China to Register the Highest Cagr Between 2018 and 2023

Figure 18 APAC: Epoxy Primer Market Snapshot

Figure 19 Europe: Epoxy Primer Market Snapshot

Figure 20 North America: Epoxy Primer Market Snapshot

Figure 21 Building & Construction Application to Drive the Middle East & African Epoxy Primer Market

Figure 22 Building & Construction Application to Dominate the SouthAmerican Epoxy Primer Market

Figure 23 Companies Adopted Merger & Acquisition as the Key Growth Strategy Between 2015 and 2018

Figure 24 Market Ranking of Key Players (2017)

Figure 25 PPG Industries: Company Snapshot

Figure 26 PPG Industries: SWOT Analysis

Figure 27 Akzonobel: Company Snapshot

Figure 28 Akzonobel: SWOT Analysis

Figure 29 Sherwin-Williams: Company Snapshot

Figure 30 Sherwin-Williams: SWOT Analysis

Figure 31 Axalta Coating Systems: Company Snapshot

Figure 32 Axalta Coating Systems: SWOT Analysis

Figure 33 BASF: Company Snapshot

Figure 34 BASF: SWOT Analysis

Figure 35 Nippon Paint: Company Snapshot

Figure 36 Jotun: Company Snapshot

Figure 37 Asian Paints: Company Snapshot

Figure 38 Kansai Paint: Company Snapshot

Figure 39 3M: Company Snapshot

Figure 40 Hempel: Company Snapshot

Figure 41 RPM International: Company Snapshot

Figure 42 Tikkurila: Company Snapshot

Figure 43 Berger Paints: Company Snapshot

Growth opportunities and latent adjacency in Epoxy Primer Market