Erectile Dysfunction Devices Market by Type (Vacuum Constriction Devices, Penile Implants), Source (Vascular, Neurologic disorder), End-user (Hospital, Ambulatory Surgery Center), & Region (North America, Europe, Asia) - Global Forecast to 2028

Updated on : Aug 22, 2024

Erectile Dysfunction Devices Market Size, Share & Trends

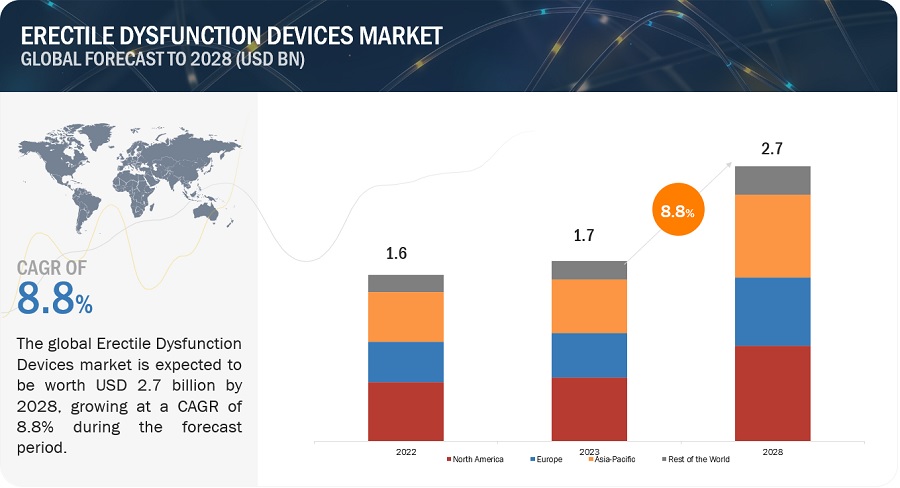

The global erectile dysfunction devices market, valued at US$1.6 billion in 2022, stood at US$1.7 billion in 2023 and is projected to advance at a resilient CAGR of 8.8% from 2023 to 2028, culminating in a forecasted valuation of US$2.7 billion by the end of the period. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

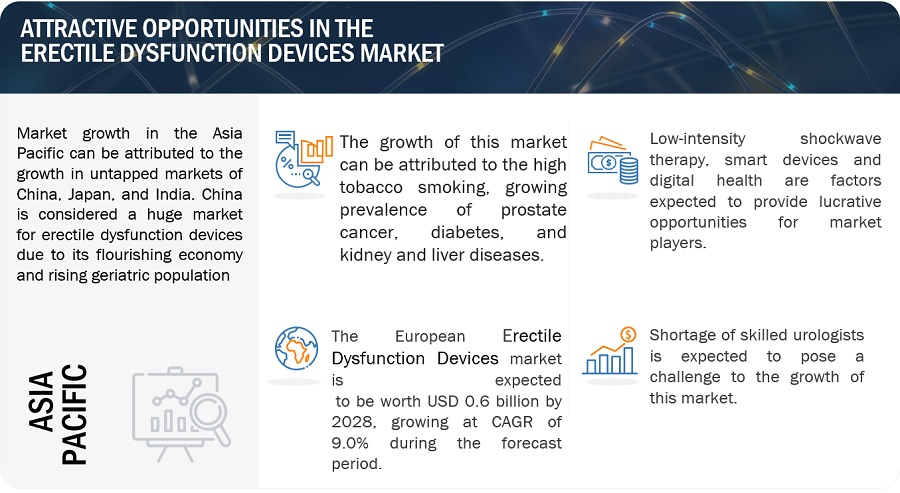

The growth in this market is attributed to the growing prevalence of erectile dysfunction with rise in the prevalence of prostate cancer, vascular and neurological disorders. However, the high costs associated with erectile dysfunction devices restrain the growth of this market.

Erectile Dysfunction Devices Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Erectile Dysfunction Devices Market Dynamics

DRIVER: Increase in prevalence of prostate cancer

Prostate cancer treatment possesses the most common side effect for erectile dysfunction as it reduces the body’s ability to generate testosterone. Thus, low testosterone will impact one’s libido, which makes them unable to maintain an erection. According to the WHO, 209,512 patients were living with prostate cancer in the US in 2020, and this figure is projected to increase to 257,264 by 2040. Whether the nerves were spared or not at the time of surgery or whether the most precise dose planning was used or not at the time of radiation therapy, the most common side effect after the treatment is erectile dysfunction. This is due to the delicate nerve and blood vessels which control the erection that is the physical aspect, and the changes could be seen due to any kind of trauma.

RESTRAINT: Risk associated with the use of erectile dysfunction devices

The side effects of shockwave treatment include penile skin bruising, hematoma, hematuria, infection of penile skin, painful erection, and difficulty having intercourse after infection or pain. The progression of lower urinary tract symptoms (LUTS) in lieu takes place as another side effect if not taking the PDE5 inhibitor. This is because a shock wave is a kind of acoustic wave that transfers energy that can be targeted and focused non-invasively to affect a distant selected anatomic region. ESWT for ED involves applying low-intensity shock waves to the penile shaft at a specified energy setting for a predetermined number of shocks per minute and for a set treatment duration and the number of treatments.

OPPORTUNITY: Technological advancement

Advancement in technology is important for the development of more effective and user-friendly ED devices. This includes improving vacuum erection devices (VEDs), penile implants, and other device options. As erectile function issues are most common, researchers are looking into new ways constantly to treat issues such as erectile dysfunction. A new treatment that is under development is Low-intensity Shock Treatment. Extracorporeal low-intensity shockwave therapy, or LIST, involves the use of acoustic waves to generate pressure impulses, which could vascularize the tissue inside the penis and promote blood flow.

CHALLENGE: Low awareness regarding prostate health among men

Among men aged 40 years and older, prostate cancer is a common cause of morbidity and mortality. It has been shown that prostate cancer awareness plays a key role in its early detection. However, among men aged over 50 years, the awareness of prostate health is alarmingly low, according to a new survey commissioned by the European Association of Urology (despite the fact that at the age of 60 and over, 40% of men suffer from an enlarged prostate).

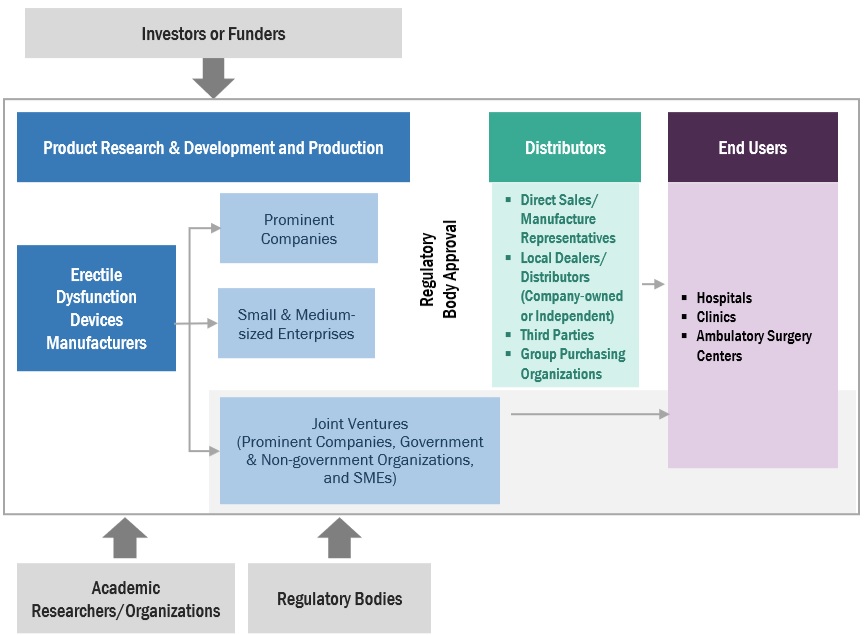

Erectile Dysfunction Devices Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of hyperspectral cameras and accessories. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Boston Scientific Corporation (US), Rigicon, Inc. (US), Coloplast Group (Denmark), Promedon GmbH (Argentina), and Zephyr Surgical Implants (Switzerland).

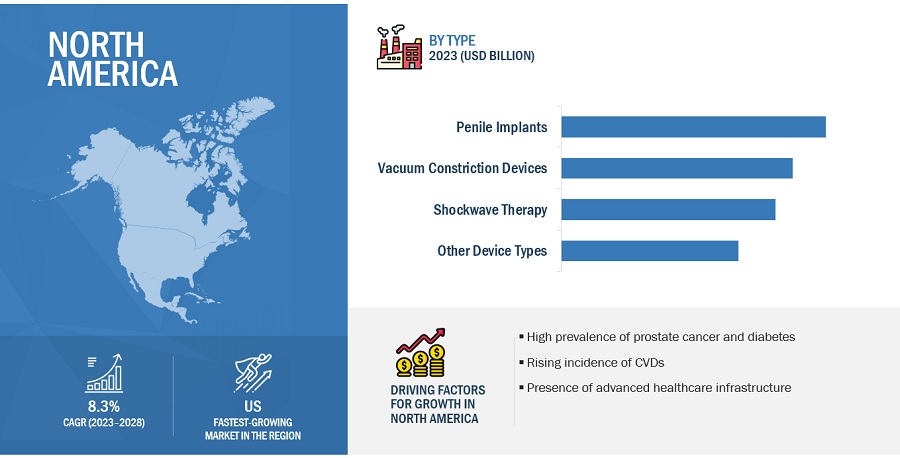

In 2022, penile implants segment to observe the highest share of the erectile dysfunction devices industry, by type.

Based on the products, the global erectile dysfunction devices market is broadly segmented into vacuum constriction devices, penile implants, shockwave therapy, and other device types. Shockwave therapy segment to observe the highest growth rate during the forecast period. The high growth rate can be attributed to this non-invasive treatment, with no pills or medications, growing manufacturers for the shockwave devices, and increasing research for ED treatment with shockwave therapy.

In 2022, more than 60 years segment to dominate the erectile dysfunction devices industry, by age group.

Based on age group, the erectile dysfunction devices market is segmented into less than 40 years, 40–60 years, and more than 60 years. More than 60 years to dominate the market due to the increased prevalence of age related prostate cancer and CVDs in this age group which could lead to erectile dysfunction as prevalence of ED increases with age and the targeted diseases.

In 2022, North America to dominate in erectile dysfunction devices industry.

The global erectile dysfunction devices market is segmented into North America, Europe, Asia Pacific, and Rest of the World. North America is expected to dominate during the forecast period, primarily due to sedentary lifestyle and a growing number of people living with diabetes and CVDs, technologically advanced devices are available, and the infrastructure of healthcare is well-established.

To know about the assumptions considered for the study, download the pdf brochure

The erectile dysfunction devices market is dominated by players such as Boston Scientific Corporation (US), Rigicon, Inc. (US), Coloplast Group (Denmark), Promedon GmbH (Argentina), and Zephyr Surgical Implants (Switzerland).

Scope of the Erectile Dysfunction Devices Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$1.7 billion |

|

Projected Revenue Size by 2028 |

$2.7 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 8.8% |

|

Market Driver |

Increase in prevalence of prostate cancera |

|

Market Opportunity |

Technological advancement |

This research report categorizes the Erectile dysfunction devices market to forecast revenue and analyze trends in each of the following submarkets:

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

By Type

- Vacuum Constriction Devices

- Penile Implants

- Shockwave Therapy

- Other Device Types

By Age Group

- Less than 40 years

- 40-60 years

- More than 60 years

By Cause

- Vascular Disorders and Diabetes

- Neurological Disorders

- Other Causes

By End User

- Hospitals and ASCs

- Clinics

Recent Developments of Erectile Dysfunction Devices Industry

- In 2023, Rigicon, Inc. (US) introduced the HL-LEVINE Combo Prosthesis Tool, which is a combination of the HL dilator tool and the traditional Furlow instrument, which are both used for penile implant surgery.

- In 2022, Advanced MedTech Holdings (Singapore) acquired Shenzhen Huikang Medical Apparatus Co., Ltd. (China). This acquisition expanded Advanced MedTech’s urological market access in China via a comprehensive nationwide sales and service network and an established local R&D, manufacturing, and supply chain ecosystem.

- In 2022, Wikkon’s extracorporeal shock wave lithotripter, model HK.ESWL-108A was successfully installed at Maria Clinic, Dili, East Timor.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global erectile dysfunction devices market?

The global erectile dysfunction devices market boasts a total revenue value of $2.7 billion by 2028.

What is the estimated growth rate (CAGR) of the global erectile dysfunction devices market?

The global erectile dysfunction devices market has an estimated compound annual growth rate (CAGR) of 8.8% and a revenue size in the region of $1.7 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing prevalence of prostate cancer- Growing incidence of diabetes, kidney and liver diseases, and atherosclerosis- High prevalence of tobacco smoking- Increasing research and development activitiesRESTRAINTS- Presence of alternative drug treatments- Risks associated with use of erectile dysfunction devices- High cost and lack of reimbursement policies for erectile dysfunction devicesOPPORTUNITIES- Technological advancements- Rising investments and grants- Expanding market opportunities in emerging countriesCHALLENGES- Survival of small players and new entrants- Low awareness regarding prostate health among men- Shortage of skilled urologists

- 5.3 PRICING ANALYSIS

-

5.4 PATENT ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSISERECTILE DYSFUNCTION DEVICES MARKET: ROLE IN ECOSYSTEM

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- Japan- China- India

- 5.10 TRADE ANALYSIS

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 PENILE IMPLANTSINFLATABLE IMPLANTS- Spontaneity of inflatable implants to drive growthMALLEABLE IMPLANTS- Low maintenance and affordability to drive growth

-

6.3 VACUUM CONSTRICTION DEVICESLOWER COST AND ACCESSIBILITY TO DRIVE GROWTH

-

6.4 SHOCKWAVE THERAPYNON-INVASIVE NATURE OF TREATMENT TO DRIVE GROWTH

- 6.5 OTHER DEVICE TYPES

- 7.1 INTRODUCTION

-

7.2 LESS THAN 40 YEARSINCREASE IN TOBACCO SMOKING TO DRIVE MARKET

-

7.3 40–60 YEARSINCREASING PREVALENCE OF CVD TO DRIVE GROWTH

-

7.4 MORE THAN 60 YEARSHIGH PREVALENCE OF VASCULAR DISORDERS TO DRIVE GROWTH

- 8.1 INTRODUCTION

-

8.2 VASCULAR DISORDERS AND DIABETESVASCULAR DISORDERS AND DIABETES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

-

8.3 NEUROLOGICAL DISORDERSGROWING PREVALENCE OF NEUROLOGICAL DISORDERS TO DRIVE GROWTH

- 8.4 OTHER CAUSES

- 9.1 INTRODUCTION

-

9.2 HOSPITALS AND ASCSAVAILABILITY OF REIMBURSEMENT AND MULTIDISCIPLINARY CARE IN HOSPITALS TO DRIVE GROWTH

-

9.3 CLINICSCLINICS SEGMENT TO HOLD LARGER MARKET SHARE

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- US held largest share of North American market in 2022CANADA- Growing government investments and continuous technological developments to drive growth

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Germany to dominate European market during forecast periodFRANCE- Favorable government initiatives to support growthUK- Rising incidence of kidney disorders to drive growthITALY- Aging population to drive growthSPAIN- Growing awareness of ED to drive growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTJAPAN- Japan to hold largest share of Asia Pacific marketCHINA- China to register highest growth in Asia Pacific market during forecast periodINDIA- Favorable government initiatives to drive growthREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACTLATIN AMERICA- High prevalence of chronic diseases to drive growthMIDDLE EAST & AFRICA- Increasing healthcare spending to drive growth

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

-

11.3 COMPANY EVALUATION MATRIX (2022)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.4 COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.5 COMPETITIVE BENCHMARKING

-

11.6 COMPETITIVE SCENARIOKEY PRODUCT LAUNCHESKEY DEALSOTHER KEY DEVELOPMENTS

-

12.1 KEY PLAYERSBOSTON SCIENTIFIC CORPORATION- Business overview- Products offered- MnM viewCOLOPLAST GROUP- Business overview- Products offered- MnM viewRIGICON, INC.- Business overview- Products offered- Recent developments- MnM viewPROMEDON GMBH- Business overview- Products offered- MnM viewZEPHYR SURGICAL IMPLANTS- Business overview- Products offered- MnM viewOWEN MUMFORD LTD.- Business overview- Products offered- Recent developmentsAUGUSTA MEDICAL SYSTEMS LLC- Business overview- Products offeredSHENZHEN HUIKANG MEDICAL APPARATUS CO., LTD.- Business overview- Products offered- Recent developmentsZIMMER MEDIZINSYSTEME GMBH- Business overview- Products offeredMEDISPEC LTD.- Business overview- Products offeredMTS MEDICAL UG- Business overview- Products offered- Recent developments

-

12.2 OTHER PLAYERSNOVAMEDTEKSTORZ MEDICAL AGTHE ELATORTIMM MEDICALOHH-MED MEDICAL LTD.COMPHYA SADIREXGROUPADVIN HEALTH CAREGIDDYGLOBAL LIFE TECHNOLOGIES LTD.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 KEY DATA FROM PRIMARY SOURCES

- TABLE 2 AVERAGE SELLING PRICE OF DEVICES OFFERED BY KEY PLAYERS

- TABLE 3 LIST OF KEY PATENTS

- TABLE 4 PORTER’S FIVE FORCES ANALYSIS: ERECTILE DYSFUNCTION DEVICES MARKET

- TABLE 5 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 6 CANADA: LEVEL OF RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 7 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 8 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 9 IMPORT DATA FOR MECHANO-THERAPY APPLIANCES, MASSAGE APPARATUS, AND PSYCHOLOGICAL APTITUDE-TESTING APPARATUS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 10 EXPORT DATA FOR MECHANO-THERAPY APPLIANCES, MASSAGE APPARATUS, AND PSYCHOLOGICAL APTITUDE-TESTING APPARATUS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 11 ERECTILE DYSFUNCTION DEVICES MARKET: LIST OF KEY CONFERENCES AND EVENTS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ERECTILE DYSFUNCTION DEVICES

- TABLE 13 KEY BUYING CRITERIA FOR ERECTILE DYSFUNCTION DEVICES

- TABLE 14 ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 15 PENILE IMPLANTS: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 16 PENILE IMPLANTS: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 INFLATABLE PENILE IMPLANTS OFFERED BY MARKET PLAYERS

- TABLE 18 INFLATABLE PENILE IMPLANTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 MALLEABLE PENILE IMPLANTS OFFERED BY MARKET PLAYERS

- TABLE 20 MALLEABLE PENILE IMPLANTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 VACUUM CONSTRICTION DEVICES OFFERED BY MARKET PLAYERS

- TABLE 22 VACUUM CONSTRICTION DEVICES: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 SHOCKWAVE THERAPY PRODUCTS OFFERED BY MARKET PLAYERS

- TABLE 24 SHOCKWAVE THERAPY: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 OTHER DEVICE TYPES OFFERED BY MARKET PLAYERS

- TABLE 26 OTHER DEVICE TYPES: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 28 LESS THAN 40 YEARS: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 40–60 YEARS: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 MORE THAN 60 YEARS: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 32 VASCULAR DISORDERS AND DIABETES: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 NEUROLOGICAL DISORDERS: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 OTHER CAUSES: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 36 HOSPITALS AND ASCS: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 CLINICS: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 45 US: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 46 US: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 47 US: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 48 US: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 49 US: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 50 CANADA: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 51 CANADA: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 52 CANADA: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 53 CANADA: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 54 CANADA: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 55 EUROPE: ERECTILE DYSFUNCTION DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 EUROPE: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 EUROPE: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 59 EUROPE: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 60 EUROPE: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 61 GERMANY: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 GERMANY: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 63 GERMANY: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 64 GERMANY: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 65 GERMANY: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 66 FRANCE: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 FRANCE: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 68 FRANCE: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 69 FRANCE: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 70 FRANCE: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 UK: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 72 UK: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 73 UK: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 74 UK: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 75 UK: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 76 ITALY: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 ITALY: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 78 ITALY: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 79 ITALY: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 80 ITALY: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 81 SPAIN: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 SPAIN: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 SPAIN: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 84 SPAIN: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 85 SPAIN: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 86 REST OF EUROPE: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 REST OF EUROPE: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 88 REST OF EUROPE: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 90 REST OF EUROPE: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: ERECTILE DYSFUNCTION DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 97 JAPAN: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 JAPAN: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 JAPAN: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 100 JAPAN: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 101 JAPAN: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 102 CHINA: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 CHINA: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 CHINA: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 105 CHINA: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 106 CHINA: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 107 INDIA: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 INDIA: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 INDIA: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 110 INDIA: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 111 INDIA: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 ROAPAC: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 ROAPAC: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 ROAPAC: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 115 ROAPAC: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 116 ROAPAC: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 117 REST OF THE WORLD: ERECTILE DYSFUNCTION DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 118 REST OF THE WORLD: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 REST OF THE WORLD: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 120 REST OF THE WORLD: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 121 REST OF THE WORLD: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 122 REST OF THE WORLD: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 123 LATIN AMERICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 LATIN AMERICA: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 LATIN AMERICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 126 LATIN AMERICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: ERECTILE DYSFUNCTION DEVICES MARKET FOR PENILE IMPLANTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2021–2028 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 133 ERECTILE DYSFUNCTION DEVICES MARKET SHARE ANALYSIS, BY KEY PLAYER (2022)

- TABLE 134 ERECTILE DYSFUNCTION DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 135 PRODUCT FOOTPRINT OF KEY PLAYERS

- TABLE 136 REGIONAL FOOTPRINT OF KEY PLAYERS

- TABLE 137 ERECTILE DYSFUNCTION DEVICES MARKET: LIST OF KEY START-UPS/SMES

- TABLE 138 KEY PRODUCT LAUNCHES, JANUARY 2020–JUNE 2023

- TABLE 139 KEY DEALS, JANUARY 2020–JUNE 2023

- TABLE 140 OTHER KEY DEVELOPMENTS, JANUARY 2020–JUNE 2023

- TABLE 141 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- TABLE 142 COLOPLAST GROUP: COMPANY OVERVIEW

- TABLE 143 RIGICON, INC.: COMPANY OVERVIEW

- TABLE 144 RIGICON, INC.: PRODUCT LAUNCHES

- TABLE 145 PROMEDON GMBH: COMPANY OVERVIEW

- TABLE 146 ZEPHYR SURGICAL IMPLANTS: COMPANY OVERVIEW

- TABLE 147 OWEN MUMFORD LTD.: COMPANY OVERVIEW

- TABLE 148 OWEN MUMFORD LTD.: OTHER DEVELOPMENTS

- TABLE 149 AUGUSTA MEDICAL SYSTEMS LLC: COMPANY OVERVIEW

- TABLE 150 SHENZHEN HUIKANG MEDICAL APPARATUS CO., LTD.: COMPANY OVERVIEW

- TABLE 151 SHENZHEN HUIKANG MEDICAL APPARATUS CO., LTD.: DEALS

- TABLE 152 SHENZHEN HUIKANG MEDICAL APPARATUS CO., LTD.: OTHER DEVELOPMENTS

- TABLE 153 ZIMMER MEDIZINSYSTEME GMBH: COMPANY OVERVIEW

- TABLE 154 MEDISPEC LTD.: COMPANY OVERVIEW

- TABLE 155 MTS MEDICAL UG: COMPANY OVERVIEW

- TABLE 156 MTS MEDICAL UG: DEALS

- FIGURE 1 ERECTILE DYSFUNCTION DEVICES MARKET: MARKET SEGMENTATION

- FIGURE 2 ERECTILE DYSFUNCTION DEVICES MARKET: REGIONAL SEGMENTATION

- FIGURE 3 ERECTILE DYSFUNCTION DEVICES MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

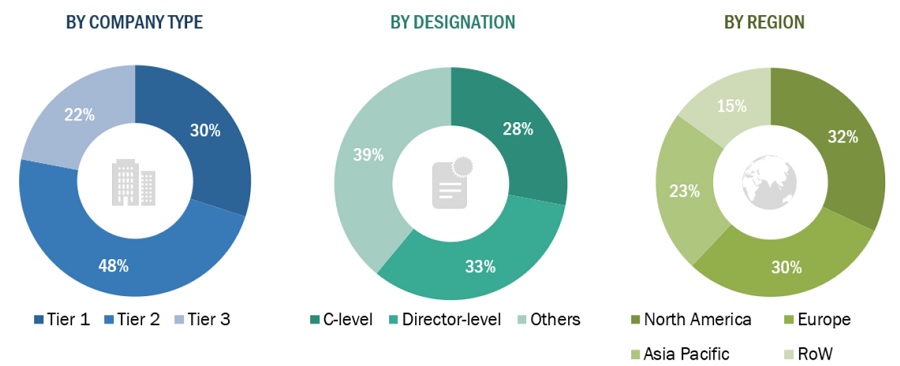

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 BOTTOM-UP APPROACH: PATIENT-BASED APPROACH

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 9 ERECTILE DYSFUNCTION DEVICES MARKET: TOP-DOWN APPROACH

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 ERECTILE DYSFUNCTION DEVICES MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 12 ERECTILE DYSFUNCTION DEVICES MARKET, BY AGE GROUP, 2023 VS. 2028 (USD BILLION)

- FIGURE 13 ERECTILE DYSFUNCTION DEVICES MARKET, BY CAUSE, 2023 VS. 2028 (USD BILLION)

- FIGURE 14 ERECTILE DYSFUNCTION DEVICES MARKET, BY END USER, 2023 VS. 2028 (USD BILLION)

- FIGURE 15 REGIONAL SNAPSHOT OF ERECTILE DYSFUNCTION DEVICES MARKET

- FIGURE 16 INCREASING PREVALENCE OF PROSTATE CANCER TO DRIVE MARKET GROWTH

- FIGURE 17 PENILE IMPLANTS SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2022

- FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC MARKET TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 DEVELOPING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 21 ERECTILE DYSFUNCTION DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 PATENT ANALYSIS FOR PENILE IMPLANTS (JANUARY 2013–DECEMBER 2022)

- FIGURE 23 VALUE CHAIN ANALYSIS OF ERECTILE DYSFUNCTION DEVICES MARKET

- FIGURE 24 ERECTILE DYSFUNCTION DEVICES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 ERECTILE DYSFUNCTION DEVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 KEY PLAYERS IN ERECTILE DYSFUNCTION DEVICES MARKET

- FIGURE 27 REVENUE SHIFT IN ERECTILE DYSFUNCTION DEVICES MARKET

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ERECTILE DYSFUNCTION DEVICES

- FIGURE 29 KEY BUYING CRITERIA FOR ERECTILE DYSFUNCTION DEVICES

- FIGURE 30 NORTH AMERICA: ERECTILE DYSFUNCTION DEVICES MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: ERECTILE DYSFUNCTION DEVICES MARKET SNAPSHOT

- FIGURE 32 ERECTILE DYSFUNCTION DEVICES MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 33 ERECTILE DYSFUNCTION DEVICES MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- FIGURE 34 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 35 COLOPLAST GROUP: COMPANY SNAPSHOT (2022)

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships of the leading players, the competitive landscape of the erectile dysfunction devices market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the market. A database of the key industry leaders was also prepared using secondary research.

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as hospitals and research institutes) and supply side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing, and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

All major product manufacturers offering various erectile dysfunction devices were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value erectile dysfunction devices market was also split into various segments and subsegments at the region and country level based on the:

- Product mapping of various manufacturers for each type of market at the regional and country-level

- Relative adoption pattern of each market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Top-Down Approach: Patient-Based Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Erectile dysfunction devices industry.

Market Definition

Erectile dysfunction is defined as the persistent inability to achieve or maintain a penile erection sufficient for satisfactory sexual performance. Most men suffer from erectile dysfunction, which is caused by physical problems usually related to the blood supply of the penis. An erectile dysfunction pump is a device used to help achieve and maintain an erection by drawing blood into the penis via air suction. It is not a cure for erectile dysfunction, but it can help increase the ability to have sexual intercourse.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- Doctors/Technician

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To define, describe, segment, and forecast the erectile dysfunction devices market by type, age group, cause, end user, and region.

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Rest of the world.

- To profile key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions; product launches; expansions; collaborations, agreements, & partnerships; and R&D activities of the leading players in the market.

- To benchmark players within the market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Erectile dysfunction devices market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Erectile dysfunction devices Market

Growth opportunities and latent adjacency in Erectile Dysfunction Devices Market