Ethernet Connector and Transformer Market Size, Share & Industry Trends Analysis Report by Connector Type (RJ45, M12, M8, iX), Connector Application, Transmission Speed (10Base-T, 100Base-T, GigabitBase-T, 10GBase-T), Transformer Application and Region - Global Forecast to 2028

Updated on : Oct 22, 2024

Ethernet Connector and Transformer Market Size & Growth

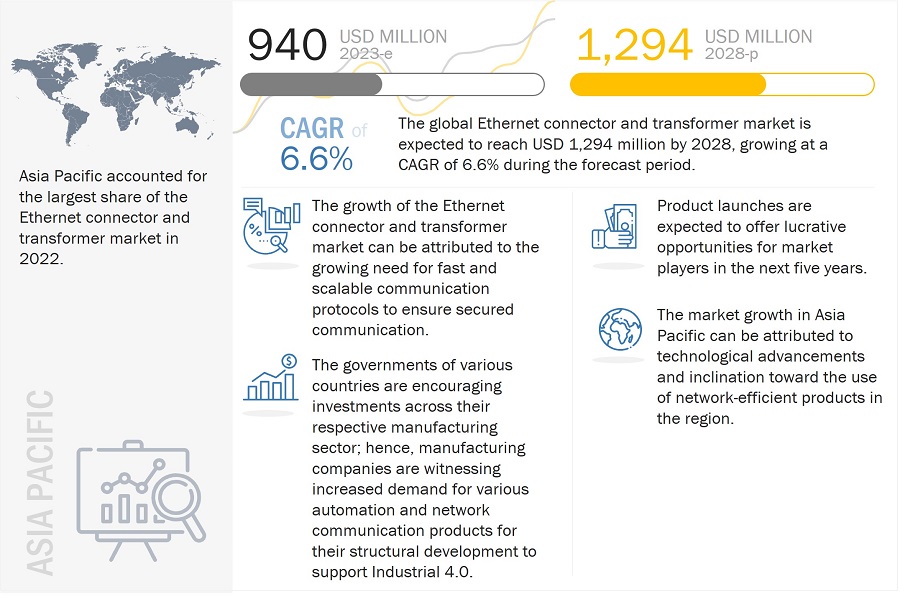

The global Ethernet connector and transformers market size was valued at USD 940 million in 2023 and is expected to reach USD 1,294 million by 2028, growing at a CAGR of 6.6% during the forecast period from 2023 to 2028.

The major factors driving the market growth include the high adoption of Ethernet technology by automotive manufacturers, significant initiatives by governments of developing countries to promote industrial automation, strong demand for cloud services, and the urgent need for scalable, faster, and reliable communication protocols.

Ethernet Connector and Transformer Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Ethernet Connector and Transformer Market

The Ethernet connector & transformer industry includes major Tier I and II players like TDK Corporation (Japan), TE Connectivity (Switzerland), Eaton Corporation (Ireland), Belden Inc. (US), Bourns, Inc. (US), and others.

Ethernet Connector and Transformer Market Trends

Driver: High demand for Ethernet technology by automobile manufacturers

According to industry experts, the number of automotive Ethernet ports will exceed the total number of all other Ethernet ports combined by 2025. Testing to meet signal integrity and electrical requirements for EMI and radiofrequency interference (RFI) emissions, latency, and synchronization are some key use cases of Ethernet in automobiles. LEMO’s 1000Base-T1 connector is a miniature connector designed to help vehicle manufacturers and test certification organizations carry out automotive testing procedures. These push-pull connectors are IP68-rated, making them resistant to water ingress, and they have gold-plated contacts for reliability and durability.

Restraint: Absence of standardized industrial communication protocols and interfaces

Devices used in industrial equipment exchange information via a variety of interfaces, technologies, and protocols. Data misrepresentation could occur in the absence of established communication interfaces and protocols. Additionally, it may be more difficult to integrate systems and leverage plug-and-play capabilities for unrelated systems. For instance, the majority of equipment manufacturers communicate with network devices using their own proprietary interface protocols, which makes it difficult to use equipment made by other manufacturers.

Opportunity: Rollout of 5G services

Data traffic has increased rapidly with the emergence of 5G technology. The number of 5G connections is increasing day by day. According to the Mobile Economy Report 2022, active 5G connections are expected to surpass 1 billion marks by 2022. Also, by 2025, 5G will dominate the mobile communication sector, with over 2 billion active 5G connections worldwide.

The rising volume of media content from social media and cloud-based platforms such as YouTube, Google, Facebook, and Twitter is driving the demand for Ethernet communication devices, such as routers, switches, hubs, and servers, to a great extent. Ethernet connectors and transformers are used in these network communication devices; hence, their market is also projected to increase.

Challenge: Cybersecurity threats

The increasing cybersecurity threats pose a major challenge for industrial communication solution providers due to the ever-increasing instances of virus attacks and hacking. The vital information in computer systems may be tampered with by viruses, which can cause a major loss to industries. Thus, the entire information flow could be disrupted if communication software systems are not protected with proper security measures. There is an increasing dependence on web-based communication and off-the-shelf IT solutions that are being used extensively in the industrial sector.

Therefore, industries implementing such communications are prone to malware targeted at industrial systems. With the rise in cyberattacks over the past decade, critical infrastructure cybersecurity is becoming a central concern among industrial automation users and vendors. For instance, ransomware is computer malware that has replaced the advanced persistent threat network attacks. This attack was first detected in the last decade and is considered one of the major cybersecurity threats today.

Ethernet connector market for RJ45 connectors to hold the highest market share during the forecast period

The Ethernet connector market RJ45 connectors are expected to gain the highest market share in the forecasted period. RJ45 connectors are most commonly used across residential and commercial environments to connect PCs, laptops, smart TVs, mobile phones, games consoles, media servers, printers, etc., to the internet.

These offer higher data transmission speeds, lower latency, lower security threats, and improved reliability, which drives the Ethernet connector market. Some major use cases of RJ45 connectors across IoT applications include smart lighting, IP cameras, gaming systems, voice-over IP, set-top boxes, etc.

Industrial automation equipment application for Ethernet connectors to hold the highest CAGR from 2023 to 2028

The Industrial Internet of Things (IIoT) is adding sensors, local processing power, and networking to many traditional industrial machines. Industrial robots have expanded beyond traditional settings, such as welding on an automotive assembly line. Autonomous delivery robots are becoming standard features in highly-automated factories and are even starting to appear on residential streets.

These new features are driving the need for reduced size, weight, power consumption, and increased throughput. Space limitations in many applications are calling for connectors that can handle both power and data simultaneously. New connectors like the iX connectors are gaining attraction due to the advent of these new use cases across industrial automation.

100Base-T transmission speed for Ethernet transformers to hold the highest market share from 2023 to 2028

The 100Base-T transmission speed holds the highest market share during the forecast period. Due to improvements in infotainment systems, advanced driver assistance systems (ADAS), powertrains, and body electronics, automobile electrical systems have grown more sophisticated over time.

Since connected car electronic control units (ECUs) share a significant amount of real-time data and firmware/software, these systems need quicker communication networks. Automotive companies partnered up with leading IC producers and system designers to create a brand-new Ethernet standard specifically for automotive communication networks in order to solve the bandwidth problem. Key companies offering 100Base-T Ethernet transformers include Bourns, Inc., Abracon, HALO Electronics, Pulse Electronics, and others.

Routers are expected to hold the highest share of the Ethernet transformer market during the forecast period.

Routers are expected to hold the highest market share during the forecast period. 5G networks are being rolled out at a faster pace around the world, and Internet of Things terminals and smart home products are entering thousands of households, enterprises, and institutions.

The increase in wireless terminals also makes WiFi technology have to improve in network bandwidth, access quantity, delay, and other aspects. With the launch of WiFi 6, companies are also investing in R&D to launch routers with the latest technology. Huawei, Cisco, Arista have already launched networking routers with WiFi 6 technology for higher data transmission speeds and lower latency. New-age LAN transformers are used in these routers to restrain the electromagnetic noise coming from the connected device and hence provide efficient data transmission speed without interruptions.

Ethernet connector & transformer market in Asia Pacific to hold the highest CAGR during the forecast period

The overall growth of the Ethernet connector and transformer industry is driven by the increasing adoption of machine-to-machine communication, industrial IoT, the development of new and connected technologies, and government initiatives to support smart factories.

The governments of various countries are encouraging investments across their respective manufacturing sector. Hence manufacturing companies are raising the demand for various automation and network communication products for their structural development to support Industrial 4.0. APAC is expected to hold the highest market share for the Ethernet connector and transformer market due to the rising number of government initiatives across the industrial automation sector.

The Chinese government is supporting R&D efforts for advanced manufacturing, bringing more automation and robots to the factory floor. This is expected to drive the demand for high-speed and reliable network communication protocols like Ethernet to run these machines. As the market for Ethernet grows, the demand for Ethernet connectors and transformers is also expected to increase.

Ethernet Connector and Transformer Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in Ehernet Connector and Transformer Industry

The Ethernet connector & transformer companies are

- TDK Corporation (Japan),

- TE Connectivity (Switzerland),

- Eaton Corporation (Ireland),

- Belden Inc. (US),

- Bourns, Inc. (US), and others.

Ehernet Connector and Transformer Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 940 million in 2023 |

| Projected Market Size | USD 1,294 million by 2028 |

| Ethernet Connector and Transformer Market Growth Rate | CAGR of 6.6% |

|

Ethernet Connector and Transformer Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Connector by Type, Connector by Application, Transformer by Transmission Speed, Transformer by Application |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

The major market players include TDK Corporation (Japan), TE Connectivity (Switzerland), Eaton Corporation (Ireland), Belden Inc (US), Rockwell Automation (US), Amphenol Corporation (US), Bel Fuse (US), Bourns Incorporation (US), Abracon (US), TT Electronics (UK), Schneider Electric (France), and Wurth Elektronik (Germany) (Total 26 players are profiled) |

Ethernet Connector and Transformer Market Highlights

The study categorizes the Ethernet connector & transformer market based on the following segments:

|

Aspect |

Details |

|

Ethernet connector market, by type |

|

|

Ethernet connector market, by application |

|

|

Ethernet transformer market, by transmission speed |

|

|

Ethernet transformer market, by application |

|

|

Ethernet connector & transformer market, by region |

|

Recent Developments in Ehernet Connector and Transformer Industry

- In November 2022, Belden, a leading global supplier of network infrastructure solutions, announced six new products in Q4 2022 that make possible simple and secure data transmission, connection, and management. One of the launched products was Lumberg Automation M8 D-Coded Data Connectors, designed to meet growing needs for miniaturized components that support cyber-physical integration in the Industrial Internet of Things.

- In October 2022, Pulse Electronics launched three new Dual Gigabit discrete transformer modules compatible with slower 10Base-T and 100Base-TX data rates and can be used to support Single Pair Ethernet (SPE) switches.

- In August 2022, Belden acquired macmon secure GmbH, one of the leaders in advanced network access control software. Macmon’s products are complementary to Belden’s leading industrial networking portfolio and will be integrated with the company’s Hirschmann offering to expand its ability to provide complete end-to-end solutions.

- In June 2022, Würth Elektronik and Vales semiconductor announced that they have introduced to the market a joint solution to enable medical image diagnosis and procedures with unprecedented video resolution. The offering encompasses secure, cost-effective, uncompressed, high-bandwidth video connectivity and advanced camera imaging.

- In June 2022, Bourns launched LAN gigabit Ethernet transformer (SM91602L) that includes common mode chokes for noise rejection for Ethernet applications and offers 4680 VDC isolation voltage/500 V working voltage/reinforced insulation with an operating temperature range of 0 to +85 °C.

Frequently Asked Questions (FAQ):

What is the market size for the Ethernet connector & transformer market?

The global Ethernet connector & transformers market is estimated to be valued at USD 940 million in 2023 and is expected to reach USD 1,294 million by 2028, at a CAGR of 6.6% from 2023 to 2028.

What are the major driving factors and opportunities in the Ethernet connector & transformer market?

Some of the major driving factors for the growth of this market include the adoption of Ethernet technology among automotive manufacturers, increasing initiatives by the government of developing countries to promote the adoption of industrial automation, rising demand for cloud services, and growing need for scalable, faster, reliable communication protocols. Moreover, the emergence of connected cars and the emergence of 5G technology create opportunities for market players.

Who are the leading players in the global Ethernet connector & transformer market?

Companies such as TDK Corporation (Japan), TE Connectivity (Switzerland), Eaton Corporation (Ireland), Belden Inc. (US), and Bourns, Inc. (US) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What is the recession impact on the Ethernet connector & transformer market?

The short-term outlook for semiconductor revenues has worsened in the third quarter of 2023. A rapid deterioration in the global economy and weakening consumer demand will negatively impact the global semiconductor market in 2023. Weaknesses in consumer-driven markets such as telecommunications and networking are driven largely by the decline in disposable income caused by rising inflation and interest rates. This will negatively impact the production and sales of smartphones, PCs, and other consumer electronic products. Rising inflation, increasing interest and unemployment rates, and an energy crisis will lead to slow economic activity. As a result, end-user industries experience deterioration of their businesses, cash flow, and ability to obtain investments, thereby delaying or canceling the plans to purchase products. Similarly, the vendors who provide electronic components to these OEMs experience similar problems, which impact their ability to fulfill orders or meet agreed service and quality levels. If regional or global economic conditions deteriorate, operations, financial position, and cash flows could be materially adversely affected.

What are some of the technological advancements in the market?

The iX connector was released in 2017 in collaboration with German-based development partner Harting Technology Group and has been used in a variety of industrial markets, such as factory automation, robotics, and machine vision. In August 2022, Hirose Electric added a new in-line jack variation to the ix Industrial Series Ethernet connector lineup. In order to meet the interconnectivity requirements of the various operating environments in which industrial equipment is used, Hirose is currently considering the development of new variations to the ix Industrial lineup, including a splash-proof type and a screw lock type. Moreover, in July 2021, Hirose Electric released the new right angle plug variation in response to market needs for space-saving routing, free of stress on the connector resulting from cable bending when space on the interface connection side of the device is limited. This will enhance the market applications of iX connectors across industrial applications to a great extent.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- High demand for Ethernet technology by automobile manufacturers- Strong initiatives by governments of developing countries to adopt industrial automation- Increased demand for cloud services- Growing need for scalable, faster, reliable communication protocolsRESTRAINTS- Absence of standardized industrial communication protocols and interfaces- Difficulty in migrating from traditional in-vehicle connectivity technologies to Ethernet technologyOPPORTUNITIES- Rollout of 5G services- Emergence of connected carsCHALLENGES- Cybersecurity threats- Handling enormous volume of network performance data

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 PORTER’S FIVE FORCES ANALYSIS

-

5.5 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.6 ECOSYSTEM ANALYSIS

-

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.8 AVERAGE SELLING PRICE OF ETHERNET CONNECTORS AND TRANSFORMERS OFFERED BY KEY PLAYERSAVERAGE SELLING PRICE TRENDS

- 5.9 CASE STUDY ANALYSIS

-

5.10 TECHNOLOGY ANALYSISCONTROLLER AREA NETWORKLOCAL INTERCONNECT NETWORKFLEXRAYOPEN PLATFORM COMMUNICATION UNIFIED ARCHITECTURE (OPC UA)

- 5.11 TRADE ANALYSIS

- 5.12 TARIFF ANALYSIS

- 5.13 LIST OF MAJOR PATENTS

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS AND REGULATIONS RELATED TO ETHERNET CONNECTORS AND TRANSFORMERS

- 5.15 KEY CONFERENCES AND EVENT, 2022–2023

- 6.1 INTRODUCTION

-

6.2 RJ45 CONNECTORMOST COMMON TYPE OF ETHERNET CONNECTOR

-

6.3 M12 CONNECTORDESIGNED FOR WASHDOWN AND CORROSIVE ENVIRONMENTS

-

6.4 M8 CONNECTORSUITABLE FOR HARSH ENVIRONMENTAL APPLICATIONS

-

6.5 IX CONNECTORHIGH-SPEED NEXT-GENERATION INDUSTRIAL AUTOMATION CONNECTOR DESIGNED FOR MATERIAL HANDLING AND ROBOTIC APPLICATIONS

- 7.1 INTRODUCTION

-

7.2 ROUTERS & SWITCHESUTILIZATION TO BUILD NETWORK CONNECTIONS BETWEEN COMPUTERS TO CONTRIBUTE TO MARKET GROWTH

-

7.3 CONTROL CABINETSINCREASED DEMAND FOR DATA CENTER SECURITY TO STIMULATE MARKET GROWTH

-

7.4 INDUSTRIAL AUTOMATION EQUIPMENTRISE OF CONNECTED MACHINES AND INDUSTRIAL IOT TO PUSH ETHERNET CONNECTOR MARKET GROWTH

-

7.5 SERVO DRIVESUSE OF ETHERNET FOR REMOTE MONITORING OF SERVO DRIVES TO BOOST MARKET GROWTH

-

7.6 WLAN ACCESS EQUIPMENTADOPTION OF ETHERNET CONNECTORS FOR WIRELESS INTERNET CONNECTIVITY TO PROPEL MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 10BASE-TBASIC ETHERNET STANDARD THAT USES UTP OR STP CABLING FOR CONNECTIVITY

-

8.3 100BASE-TFAST ETHERNET STANDARD FOR HOME AND LAN APPLICATIONS

-

8.4 GIGABITBASE-TETHERNET STANDARD SUITABLE FOR WIRED LOCAL NETWORKS

-

8.5 10GBASE-TETHERNET STANDARD BENEFICIAL FOR TELECOMMUNICATION AND NETWORK DEVICES

- 9.1 INTRODUCTION

-

9.2 ROUTERSALLOW MULTIPLE DEVICES TO USE SAME INTERNET CONNECTION AND MANAGE TRAFFIC BETWEEN NETWORKS

-

9.3 NETWORK SWITCHESHELP FORWARD DATA PACKETS BETWEEN CONNECTED DEVICES TO SHARE INFORMATION

-

9.4 NETWORK INTERFACE CARDSENABLE COMMUNICATION BETWEEN COMPUTER SYSTEMS THROUGH LAN

-

9.5 HUBSACT AS CONNECTION POINTS FOR ALL DEVICES ON LAN

-

9.6 SERVERSHELP PROTECT WEBSITES OR COMPUTERS FROM CYBER ATTACKS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAN MARKETUS- Ideal environment for innovation to facilitate advancements in Ethernet connector and transformer marketCANADA- Growing investments in process and discrete industries to contribute to market growthMEXICO- Expanding telecommunications industry to boost Mexican market

-

10.3 EUROPEIMPACT OF RECESSION ON EUROPEAN MARKETGERMANY- Technological innovations in automotive industry to fuel market growthUK- Growing adoption of automation to surge demand for Ethernet connectors and transformersFRANCE- Government’s France 2030 plan to boost adoption of Ethernet solutionsREST OF EUROPE

-

10.4 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFIC MARKETCHINA- Surging use of Ethernet technology in industrial environments to boost marketJAPAN- Huge investments in telecom sector to propel growthINDIA- Ongoing government initiatives to bring automation in different industries to stimulate market growthREST OF ASIA PACIFIC

-

10.5 ROWIMPACT OF RECESSION ON ROW MARKETMIDDLE EAST AND AFRICA- Adoption of cloud services to boost the growth of Ethernet transformer marketSOUTH AMERICA- Rising deployment of factory automation solutions in different industries to boost market

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS: ETHERNET CONNECTOR MARKET, 2022

- 11.4 MARKET SHARE ANALYSIS: ETHERNET TRANSFORMER MARKET, 2022

- 11.5 REVENUE ANALYSIS OF LEADING PLAYERS IN ETHERNET CONNECTOR AND TRANSFORMER MARKET

-

11.6 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 SMES EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE BENCHMARKINGSTARTUP MATRIX: DETAILED LIST OF KEY STARTUPS OFFERING ETHERNET CONNECTORS

- 11.9 COMPANY PRODUCT FOOTPRINT ANALYSIS

- 11.10 COMPETITIVE SCENARIO AND TRENDS

-

12.1 KEY PLAYERSTDK CORPORATION- Business overview- Products offered- MnM viewBOURNS, INC.- Business overview- Products offered- Product launches- MnM viewEATON CORPORATION PLC- Business overview- Products offered- Deals- MnM viewBELDEN- Business overview- Products offered- Recent developments- MnM viewABRACON- Business overview- Products offered- MnM viewWÜRTH ELEKTRONIK GMBH & CO. KG- Business overview- Products offered- Product launches- Deals- MnM viewBEL FUSE INC.- Business overview- Products offered- DealsTE CONNECTIVITY- Business overview- Products offered- DealsHALO ELECTRONICS- Business overview- Products offered- Product launches- DealsPULSE ELECTRONICS- Business overview- Products offered- Product launchesTAIMAG CORPORATION- Business overview- Products offered

-

12.2 OTHER KEY PLAYERSWEIDMÜLLER HOLDING AG & CO. KG.TT ELECTRONICSLINK-PPSHAREWAY TECHNOLOGY CO., LTD.IFM ELECTRONIC GMBHNEUTRIKSCHNEIDER ELECTRIC SEKEYSTONE ELECTRONICS CORP.MOLEXMENTECH TECHNOLOGYHARTING TECHNOLOGY GROUPAMPHENOL CORPORATIONKÜBLER GROUPROCKWELL AUTOMATIONLAPP GROUP

- 13.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.2 CUSTOMIZATION OPTIONS

- 13.3 RELATED REPORTS

- 13.4 AUTHOR DETAILS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 3 IMPACT OF PORTER’S FIVE FORCES ON ETHERNET CONNECTOR AND TRANSFORMER MARKET, 2022

- TABLE 4 IMPACT OF PORTER’S FIVE FORCES ON ETHERNET CONNECTOR AND TRANSFORMER MARKET, 2022-2028

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 7 ETHERNET CONNECTOR AND TRANSFORMER MARKET: ECOSYSTEM

- TABLE 8 AVERAGE SELLING PRICE OF TOP 3 TYPES OF ETHERNET CONNECTORS OFFERED BY KEY PLAYERS (USD)

- TABLE 9 AVERAGE SELLING PRICE OF HIGH-SPEED ETHERNET TRANSFORMERS OFFERED BY KEY PLAYERS (USD)

- TABLE 10 QUEST SELECTS CREE’S SMARTCAST POE TECHNOLOGY FOR EFFICIENT LIGHTING ACROSS ITS DATA CENTER

- TABLE 11 METRO NETWORKS BY AT&T DELIVER HIGH-SPEED ETHERNET CONNECTION ACROSS CISCO HEADQUARTERS

- TABLE 12 NEW BRUNSWICK SCHOOL CONTROLS ITS GROWING INFORMATION LOAD AND STRETCHES ITS BUDGET WITH ENVIRONMENTALLY FRIENDLY ROUTERS OFFERED BY D-LINK

- TABLE 13 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 14 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 15 MFN TARIFF FOR HS CODE: 853690 EXPORTED BY US, 2021

- TABLE 16 MFN TARIFF FOR HS CODE: 853690 EXPORTED BY CHINA, 2021

- TABLE 17 MFN TARIFF FOR HS CODE: 853690 EXPORTED BY GERMANY, 2021

- TABLE 18 LIST OF MAJOR PATENTS

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 DIFFERENT ETHERNET STANDARDS

- TABLE 24 NORTH AMERICA: SAFETY STANDARDS FOR ETHERNET CONNECTOR AND TRANSFORMER MARKET

- TABLE 25 EUROPE: SAFETY STANDARDS FOR ETHERNET CONNECTOR AND TRANSFORMER MARKET

- TABLE 26 ETHERNET CONNECTOR AND TRANSFORMER MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 27 ETHERNET CONNECTOR MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 ETHERNET CONNECTOR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 ETHERNET CONNECTOR MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 30 ETHERNET CONNECTOR MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 31 RJ45 CONNECTOR: ETHERNET CONNECTOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 32 RJ45 CONNECTOR: ETHERNET CONNECTOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 RJ45 CONNECTOR: ETHERNET CONNECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 RJ45 CONNECTOR: ETHERNET CONNECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 M12 CONNECTOR: ETHERNET CONNECTOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 36 M12 CONNECTOR: ETHERNET CONNECTOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 37 M12 CONNECTOR: ETHERNET CONNECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 M12 CONNECTOR: ETHERNET CONNECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 M8 CONNECTOR: ETHERNET CONNECTOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 40 M8 CONNECTOR: ETHERNET CONNECTOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 41 M8 CONNECTOR: ETHERNET CONNECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 M8 CONNECTOR: ETHERNET CONNECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 IX CONNECTOR: ETHERNET CONNECTOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 44 IX CONNECTOR: ETHERNET CONNECTOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 45 IX CONNECTOR: ETHERNET CONNECTOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 IX CONNECTOR: ETHERNET CONNECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 ETHERNET CONNECTOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 48 ETHERNET CONNECTOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 49 ROUTERS & SWITCHES: ETHERNET CONNECTOR MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 50 ROUTERS & SWITCHES: ETHERNET CONNECTOR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 51 CONTROL CABINETS: ETHERNET CONNECTOR MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 52 CONTROL CABINETS: ETHERNET CONNECTOR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 53 INDUSTRIAL AUTOMATION EQUIPMENT: ETHERNET CONNECTOR MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 54 INDUSTRIAL AUTOMATION EQUIPMENT: ETHERNET CONNECTOR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 SERVO DRIVES: ETHERNET CONNECTOR MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 56 SERVO DRIVES: ETHERNET CONNECTOR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 57 WLAN ACCESS EQUIPMENT: ETHERNET CONNECTOR MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 58 WLAN ACCESS EQUIPMENT: ETHERNET CONNECTOR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2019–2022 (USD MILLION)

- TABLE 60 ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2023–2028 (USD MILLION)

- TABLE 61 ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2019–2022 (MILLION UNITS)

- TABLE 62 ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2023–2028 (MILLION UNITS)

- TABLE 63 10BASE-T: ETHERNET TRANSFORMER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 64 10BASE-T: ETHERNET TRANSFORMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 65 10BASE-T: ETHERNET TRANSFORMER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 10BASE-T: ETHERNET TRANSFORMER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 100BASE-T: ETHERNET TRANSFORMER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 68 100BASE-T: ETHERNET TRANSFORMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 100BASE-T: ETHERNET TRANSFORMER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 100BASE-T: ETHERNET TRANSFORMER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 GIGABITBASE-T: ETHERNET TRANSFORMER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 72 GIGABITBASE-T: ETHERNET TRANSFORMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 73 GIGABITBASE-T: ETHERNET TRANSFORMER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 GIGABITBASE-T: ETHERNET TRANSFORMER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 10GBASE-T: ETHERNET TRANSFORMER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 76 10GBASE-T: ETHERNET TRANSFORMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 77 10GBASE-T: ETHERNET TRANSFORMER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 10GBASE-T: ETHERNET TRANSFORMER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 ETHERNET TRANSFORMER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 80 ETHERNET TRANSFORMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 81 ROUTERS: ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2019–2022 (USD MILLION)

- TABLE 82 ROUTERS: ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2023–2028 (USD MILLION)

- TABLE 83 NETWORK SWITCHES: TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2019–2022 (USD MILLION)

- TABLE 84 NETWORK SWITCHES: TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2023–2028 (USD MILLION)

- TABLE 85 NETWORK INTERFACE CARDS: ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2019–2022 (USD MILLION)

- TABLE 86 NETWORK INTERFACE CARDS: ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2023–2028 (USD MILLION)

- TABLE 87 HUBS: ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2019–2022 (USD MILLION)

- TABLE 88 HUBS: ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2023–2028 (USD MILLION)

- TABLE 89 SERVERS: ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2019–2022 (USD MILLION)

- TABLE 90 SERVERS: ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, 2023–2028 (USD MILLION)

- TABLE 91 ETHERNET CONNECTOR AND TRANSFORMER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 92 ETHERNET CONNECTOR AND TRANSFORMER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: ETHERNET CONNECTOR AND TRANSFORMER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: ETHERNET CONNECTOR AND TRANSFORMER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: ETHERNET CONNECTOR AND TRANSFORMER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 EUROPE: ETHERNET CONNECTOR AND TRANSFORMER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: ETHERNET CONNECTOR AND TRANSFORMER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: ETHERNET CONNECTOR AND TRANSFORMER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 ROW: ETHERNET CONNECTOR AND TRANSFORMER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 100 ROW: ETHERNET CONNECTOR AND TRANSFORMER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 OVERVIEW OF STRATEGIES ADOPTED BY MAJOR COMPANIES IN ETHERNET CONNECTOR AND TRANSFORMER MARKET

- TABLE 102 DEGREE OF COMPETITION FOR ETHERNET CONNECTOR MARKET

- TABLE 103 DEGREE OF COMPETITION FOR ETHERNET TRANSFORMER MARKET

- TABLE 104 ETHERNET CONNECTOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS, BY CONNECTOR TYPE

- TABLE 105 ETHERNET CONNECTOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS, BY REGION

- TABLE 106 COMPANY PRODUCT FOOTPRINT (ETHERNET TRANSFORMER)

- TABLE 107 COMPANY TRANSMISSION SPEED FOOTPRINT (ETHERNET TRANSFORMER)

- TABLE 108 COMPANY APPLICATION FOOTPRINT (ETHERNET TRANSFORMER)

- TABLE 109 COMPANY REGION FOOTPRINT (ETHERNET TRANSFORMER)

- TABLE 110 COMPANY PRODUCT FOOTPRINT (ETHERNET CONNECTOR)

- TABLE 111 COMPANY CONNECTOR TYPE FOOTPRINT (ETHERNET CONNECTOR)

- TABLE 112 COMPANY APPLICATION FOOTPRINT (ETHERNET CONNECTOR)

- TABLE 113 COMPANY REGION FOOTPRINT (ETHERNET CONNECTOR)

- TABLE 114 ETHERNET CONNECTOR AND TRANSFORMER MARKET: TOP PRODUCT LAUNCHES AND DEVELOPMENTS, MAY 2021 TO OCTOBER 2022

- TABLE 115 ETHERNET CONNECTOR AND TRANSFORMER MARKET: TOP DEALS AND OTHER DEVELOPMENTS, JANUARY 2020 TO JUNE 2022

- TABLE 116 TDK CORPORATION: BUSINESS OVERVIEW

- TABLE 117 BOURNS, INC.: BUSINESS OVERVIEW

- TABLE 118 EATON CORPORATION: BUSINESS OVERVIEW

- TABLE 119 BELDEN: BUSINESS OVERVIEW

- TABLE 120 ABRACON: BUSINESS OVERVIEW

- TABLE 121 WÜRTH ELEKTRONIK (WE): BUSINESS OVERVIEW

- TABLE 122 BEL FUSE INC.: BUSINESS OVERVIEW

- TABLE 123 TE CONNECTIVITY: BUSINESS OVERVIEW

- TABLE 124 HALO ELECTRONICS: BUSINESS OVERVIEW

- TABLE 125 PULSE ELECTRONICS: BUSINESS OVERVIEW

- TABLE 126 TAIMAG CORPORATION: BUSINESS OVERVIEW

- TABLE 127 WEIDMÜLLER HOLDING AG & CO. KG.: COMPANY SNAPSHOT

- TABLE 128 TT ELECTRONICS: COMPANY SNAPSHOT

- TABLE 129 LINK-PP: COMPANY SNAPSHOT

- TABLE 130 SHAREWAY TECHNOLOGY CO. LTD.: COMPANY SNAPSHOT

- TABLE 131 IFM ELECTRONIC GMBH: COMPANY SNAPSHOT

- TABLE 132 NEUTRIK: COMPANY SNAPSHOT

- TABLE 133 SCHNEIDER ELECTRIC SE: COMPANY SNAPSHOT

- TABLE 134 KEYSTONE ELECTRONICS CORP.: COMPANY SNAPSHOT

- TABLE 135 MOLEX: COMPANY SNAPSHOT

- TABLE 136 MENTECH TECHNOLOGY: COMPANY SNAPSHOT

- TABLE 137 HARTING TECHNOLOGY GROUP: COMPANY SNAPSHOT

- TABLE 138 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- TABLE 139 KÜBLER GROUP: COMPANY SNAPSHOT

- TABLE 140 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- TABLE 141 LAPP GROUP: COMPANY SNAPSHOT

- FIGURE 1 ETHERNET CONNECTOR AND TRANSFORMER MARKET SEGMENTATION

- FIGURE 2 ETHERNET CONNECTOR AND TRANSFORMER MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS FOR ETHERNET CONNECTOR MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS FOR ETHERNET TRANSFORMER MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—IDENTIFICATION OF REVENUE GENERATED BY COMPANIES FROM SELLING ETHERNET CONNECTORS AND TRANSFORMERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION: ETHERNET CONNECTOR AND TRANSFORMER MARKET

- FIGURE 9 GDP GROWTH PROJECTIONS TILL 2023 FOR MAJOR ECONOMIES (%)

- FIGURE 10 REVENUE PROJECTIONS IN ETHERNET CONNECTOR AND TRANSFORMER MARKET

- FIGURE 11 RJ45 CONNECTOR SEGMENT TO HOLD LARGEST SHARE OF ETHERNET CONNECTOR MARKET, BY TYPE, IN 2028

- FIGURE 12 INDUSTRIAL AUTOMATION EQUIPMENT SEGMENT TO HOLD LARGEST SHARE OF ETHERNET CONNECTOR MARKET, BY APPLICATION, IN 2028

- FIGURE 13 100BASE-T SEGMENT TO CAPTURE LARGEST SHARE OF ETHERNET TRANSFORMER MARKET, BY TRANSMISSION SPEED, IN 2028

- FIGURE 14 ROUTERS TO HOLD LARGEST SHARE OF ETHERNET TRANSFORMER MARKET, BY APPLICATION, IN 2028

- FIGURE 15 ETHERNET CONNECTOR AND TRANSFORMER MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 16 RISING USE OF ETHERNET TECHNOLOGY BY AUTOMOBILE COMPANIES TO DRIVE ETHERNET CONNECTOR AND TRANSFORMER MARKET

- FIGURE 17 US AND RJ45 CONNECTOR TO HOLD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2023

- FIGURE 18 WLAN ACCESS EQUIPMENT TO HOLD LARGEST SHARE OF ETHERNET CONNECTOR MARKET FOR RJ45 CONNECTORS THROUGHOUT FORECAST PERIOD

- FIGURE 19 ETHERNET CONNECTOR AND TRANSFORMER MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 20 ETHERNET TRANSFORMER AND CONNECTOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 IMPACT OF DRIVERS ON ETHERNET CONNECTOR AND TRANSFORMER MARKET

- FIGURE 22 IMPACT OF RESTRAINTS ON ETHERNET CONNECTOR AND TRANSFORMER MARKET

- FIGURE 23 IMPACT OF OPPORTUNITIES ON ETHERNET CONNECTOR AND TRANSFORMER MARKET

- FIGURE 24 IMPACT OF CHALLENGES ON ETHERNET CONNECTOR AND TRANSFORMER MARKET

- FIGURE 25 ETHERNET CONNECTOR AND TRANSFORMER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 28 ETHERNET CONNECTOR AND TRANSFORMER MARKET: ECOSYSTEM

- FIGURE 29 REVENUE SHIFT FOR PLAYERS IN ETHERNET CONNECTOR AND TRANSFORMER MARKET

- FIGURE 30 AVERAGE SELLING PRICE OF TOP 3 TYPES OF ETHERNET CONNECTORS OFFERED BY KEY PLAYERS

- FIGURE 31 AVERAGE SELLING PRICE OF HIGH-SPEED ETHERNET TRANSFORMERS OFFERED BY KEY PLAYERS

- FIGURE 32 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- FIGURE 33 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- FIGURE 34 LIST OF MAJOR COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST FEW YEARS (2012–2022)

- FIGURE 35 RJ45 CONNECTOR SEGMENT TO HOLD LARGEST SHARE OF ETHERNET CONNECTOR MARKET IN 2028

- FIGURE 36 INDUSTRIAL AUTOMATION EQUIPMENT SEGMENT TO DOMINATE ETHERNET CONNECTOR MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 37 100BASE-T ETHERNET TRANSFORMERS TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 38 ROUTERS TO ACCOUNT FOR LARGEST SHARE OF ETHERNET TRANSFORMER MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO DOMINATE ETHERNET CONNECTOR AND TRANSFORMER MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: SNAPSHOT OF ETHERNET CONNECTOR AND TRANSFORMER MARKET

- FIGURE 41 EUROPE: SNAPSHOT OF ETHERNET CONNECTOR AND TRANSFORMER MARKET

- FIGURE 42 ASIA PACIFIC: SNAPSHOT OF ETHERNET CONNECTOR AND TRANSFORMER MARKET

- FIGURE 43 CHINA TO RECORD HIGHEST CAGR IN ETHERNET CONNECTOR AND TRANSFORMER MARKET DURING FORECAST PERIOD

- FIGURE 44 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN ETHERNET CONNECTOR MARKET

- FIGURE 45 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN ETHERNET TRANSFORMER MARKET

- FIGURE 46 ETHERNET CONNECTOR AND TRANSFORMER MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

- FIGURE 47 ETHERNET CONNECTOR AND TRANSFORMER MARKET (GLOBAL): SMES EVALUATION QUADRANT, 2022

- FIGURE 48 TDK: COMPANY SNAPSHOT

- FIGURE 49 EATON CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 BELDEN: COMPANY SNAPSHOT

- FIGURE 51 BEL FUSE: COMPANY SNAPSHOT

- FIGURE 52 TE CONNECTIVITY: COMPANY SNAPSHOT

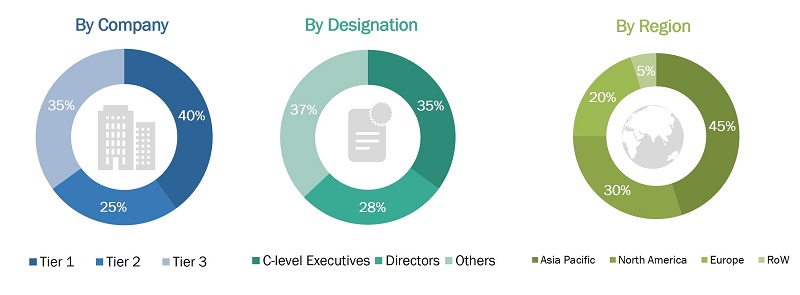

This research study involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the Ethernet connector & transformer market. Primary sources were several experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and organizations related to all the segments of the value chain of the Ethernet connector & transformer ecosystem.

In-depth interviews with various primary respondents, such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, were conducted to obtain and verify critical qualitative and quantitative information as well as to assess future market prospects.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

List Of Major Secondary Sources

|

SOURCE |

WEB LINK |

|

IEEE Communications Society |

https://www.comsoc.org/ |

|

Computer & Communications Industry Association |

https://www.ccianet.org/ |

|

International Society of Automation (ISA) |

https://www.isa.org/ |

|

Ethernet Alliance |

https://Ethernetalliance.org/ |

|

ODVA |

https://www.odva.org/ |

|

Industrial Data Communications Systems |

https://www.isa.org/ |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the Ethernet connector & transformer market through secondary research. Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Ethernet connector & transformer market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the Ethernet connector & transformer market from the revenues of key players and their shares in the market. The overall market size was calculated based on the revenues of key players identified in the market.

- Identifying various types of Ethernet connectors contributing to the growth of the Ethernet connector market

- Analyzing major Ethernet connector providers and studying their portfolios and solution offerings

- Analyzing trends pertaining to Ethernet communication, including type and applications,

- Tracking the ongoing and upcoming Ethernet connector developments by various companies or end users and forecasting the market based on these developments and other critical parameters.

- Identifying various types of Ethernet transformers based on transmission speed contributes to the growth of the Ethernet transformer market.

- Analyzing major Ethernet transformer providers and studying their portfolios and solution offerings

- Tracking the ongoing and upcoming Ethernet transformer developments by various companies or end users and forecasting the market based on these developments and other critical parameters.

- Conducting multiple discussions with key opinion leaders to understand the types of contracts signed and products and systems offered by market players to help analyze the break-up of the scope of work carried out by each major Ethernet connector & transformer company.

- Arriving at the market estimates by analyzing revenues of these companies generated from various countries through the revenues generated for Ethernet connector products and then combining the same to get the market estimates based on region.

- Verifying and crosschecking the estimates at every level through the discussion with key opinion leaders, including directors and operation managers, and then finally with the domain experts in MarketsandMarkets

- Referring to various paid and unpaid sources of information such as annual reports, press releases, white papers, blogs, news, and databases to validate the market estimations

Top-Down Approach

In the top-down approach, the overall size of the Ethernet connector & transformer market that was derived through percentage splits obtained from secondary and primary research was used to estimate the size of the individual markets (mentioned in the market segmentation).

For the calculation of the size of specific market segments, the overall size of the Ethernet connector & transformer market was considered to implement the top-down approach. The bottom-up approach was also implemented for the data extracted from secondary research to validate the obtained market size of different segments.

The market share of each company was estimated to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the sizes of the overall parent market and each market were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the next section.

- Focusing initially on top-line investments and expenditures made in the Ethernet connector & transformer ecosystem.

- Splitting the market considering the types of Ethernet connectors & transformers used in different applications, along with the key developments in the major market area.

- Collecting information related to revenue generated by players through the segments offering Ethernet connectors & transformers.

- Conducting multiple on-field discussions with key opinion leaders across each major company involved in the development of Ethernet connectors & transformers.

- Estimating the geographic split with the use of secondary sources based on numerous factors, such as the number of players in a specific country or region and Ethernet connectors & transformers used in various applications.

- Verifying and crosschecking the estimates at every level by discussions with key opinion leaders, including directors and operation managers, and then finally with the domain experts in MarketsandMarkets

Data Triangulation

After arriving at the overall size of the Ethernet connector & transformer market from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using top-down and bottom-up approaches

Study Objectives

- To define and forecast the Ethernet connector market size, by type and application, in terms of value.

- To define and forecast the Ethernet transformer market size, by transmission speed and application in terms of value.

- To describe and forecast the Ethernet connector and transformer market size for four key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the Ethernet connector and transformer market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the Ethernet connector and transformer ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2 and provide details of the competitive landscape.

- To analyze strategic approaches such as product launches, collaborations, contracts, acquisitions, agreements, expansions, and partnerships in the Ethernet connector and transformer market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ethernet Connector and Transformer Market