The study involved major activities in estimating the current market size for the industrial communication market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the industrial communication market.

Secondary Research

The secondary research for this study involved gathering information from various credible sources. These included company annual reports, investor presentations, press releases, whitepapers, certified publications, and articles from reputable associations and government publications. Additional data was obtained from corporate filings, professional and trade associations, journals, and industry-recognized authors. Research from consortiums, councils, and gold- and silver-standard websites, directories, and databases also contributed to the qualitative framework. Key global sources such as the International Trade Centre (ITC) and the International Monetary Fund (IMF) were consulted to support and validate the market analysis.

Primary Research

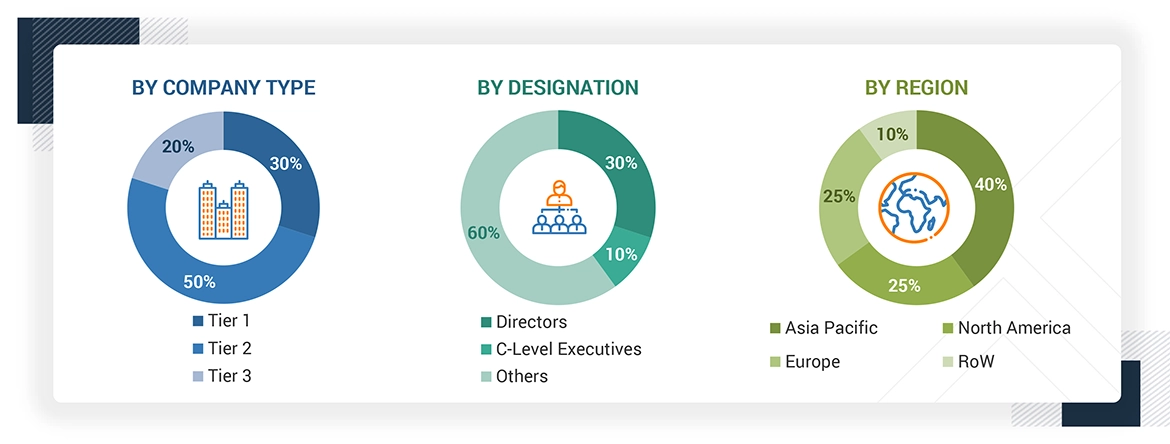

Extensive primary research was accomplished after understanding and analyzing the industrial communication market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 20% of the primary interviews were conducted with the demand side and 80% with the supply side. Primary data was collected through questionnaires, e-mails, and telephonic interviews. Various departments within organizations, such as sales, operations, and administration, were contacted to provide a holistic viewpoint in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the industrial communication market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Industrial Communication Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the industrial communication market through the process explained above, the overall market has been split into several segments. Data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using top-down and bottom-up approaches.

Market Definition

Industrial communication is the interaction of information and data between control systems, machines, and human beings within industries, making the operations automated, reliable, and efficient. Industrial communication is the backbone of the modern process industries and manufacturing through real-time monitoring, control, and coordination among equipment and systems. In contrast to general-purpose communications networks, industrial communication systems are intended to fulfill the particular needs of industrial environments, such as high reliability, low latency, and durability under harsh conditions, making them crucial for implementing Industry 4.0 and smart factory strategies.

Key Stakeholders

-

Brand Product Manufacturers/Original Equipment Manufacturers (OEMs)/Original Device Manufacturers (ODMs)

-

Industrial Communications Product Manufacturers

-

Semiconductor Component Suppliers/Foundries

-

Industrial Communication Material and Component Suppliers

-

Manufacturing Equipment Suppliers

-

System Integrators

-

Technology/IP Developers

-

Consulting and Market Research Service Providers

-

Industrial Communications and Material-related Associations, Organizations, Forums, and Alliances

-

Venture Capitalists and Startups

-

Research and Educational Institutes

-

Distributors and Resellers

-

End Users

Report Objectives

-

To define, describe, and forecast the industrial communication market size, by offering, communication protocol, and industry, in terms of value

-

To describe and forecast the market size for four key regions: North America, Europe, Asia Pacific, and the RoW, in terms of value

-

To define, describe, and forecast the industrial communication market size, by component (gateways and switches), in terms of volume

-

To provide detailed insights regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To analyze emerging applications and standards in the industrial communication market

-

To examine manufacturers of industrial communication solutions, their strategies, production plans, and the overall value chain, including material and component suppliers

-

To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

-

To analyze the market opportunities for stakeholders and provide a comprehensive competitive landscape analysis

-

To provide a detailed overview of the industrial communication ecosystem

-

To provide a detailed overview of the impact of AI/Gen AI, macroeconomic outlook for all regions, and the 2025 US tariff impact on the industrial communication market

-

To provide information about the key technology trends, trade analysis, and patents related to the industrial communication market

-

To strategically analyze average selling price trends, trends impacting customer business, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios, trade landscape, and case studies pertaining to the market under study

-

To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes them on various parameters within the broad categories of market ranking/share and product portfolio

-

To analyze competitive developments, such as partnerships, acquisitions, expansions, collaborations, and product launches, in the market

-

To strategically profile key players and analyze their market share, ranking, and core competencies

Available Customizations

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 7)

User

Sep, 2019

I am Interested in undertanding the total global industrial communications market in terms of volume and size. I am also interested in understanding the competitive landscape of market players for the industrial communication market and the key strategies adopted by them in this market..

User

Sep, 2019

I am interested in understanding the market for industrial communication in Europe. Also, I would like to know more about the industrial communication equipment market for specific countries in Europe and if these include communication protocol..

User

Sep, 2019

I am looking for in-depth analysis on the industrial communication market. Can you help me with the scope of the industrial communication market? I would like to know more about the segments covered in the report. I would also like to understand the research methodology used to arrive at the market size..

User

Sep, 2019

We would like to understand the ecosystem for the industrial communication market and the major product offerings of leading players in this market, along with the key strategies adopted by them. I am also looking for some use cases specific to industrial ethernet..

User

May, 2019

I would like to know the overall scope of the industrial communication market report in terms of the industries covered and the type of components, software, and services that are included in the report. Also, I would like to know if metal is included in the mining sector, and, if not, can you provide market sizing for the steel and metal industry?.