eVTOL Aircraft Market by Lift Technology (Vectored Thrust, Multirotor, Lift Plus Cruise), Propulsion Type (Fully Electric, Hybrid Electric, Hydrogen Electric), System, Mode of Operation, Application, MTOW, Range and Region - Global Forecast to 2030

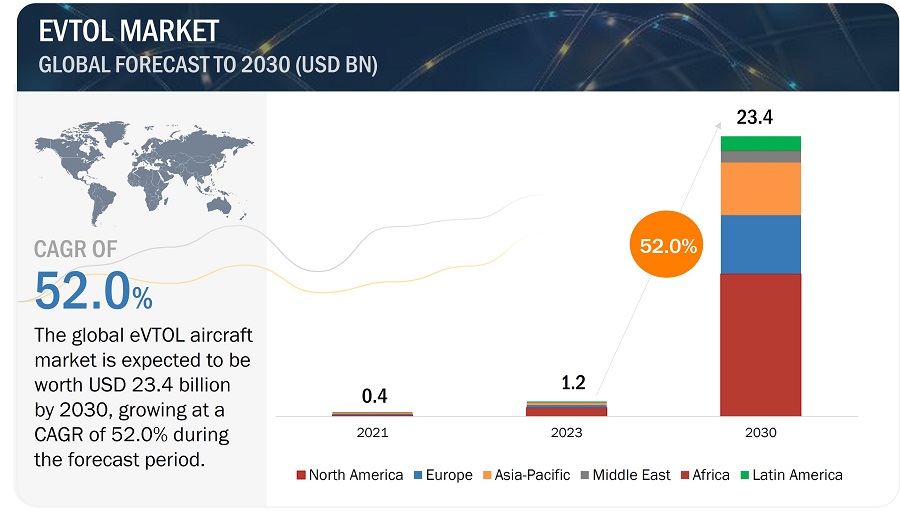

[226 Pages Report] The eVTOL Aircraft market size is projected to grow from USD 1.2 Billion in 2023 to USD 23.4 Billion by 2030, at a CAGR of 52.0% from 2023 to 2030. Electric Vertical Takeoff and Landing (eVTOL) aircraft serve the purpose of providing efficient, sustainable, and versatile transportation solutions for both passengers and cargo. eVTOLs are aircraft that can take off and land vertically, utilizing electric propulsion systems to achieve vertical flight and offering the potential for quiet, emission-free operations. These advanced aircraft are designed to operate in urban environments, overcoming traffic congestion by utilizing vertical space and providing faster point-to-point transportation. With their ability to hover, maneuver in tight spaces, and potentially operate autonomously, eVTOLs have the potential to revolutionize urban air mobility, offering convenient air taxi services and serving as efficient platforms for transportation, emergency response, and aerial logistics. Their electric propulsion systems contribute to reduced noise pollution and lower carbon emissions, aligning with the increasing focus on sustainable transportation solutions.

eVTOL Aircraft Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

eVTOL Aircraft Market Dynamics.

Driver: Improving technologies in batteries, motors, and power electronics

Improving technologies in batteries, motors, and power electronics serve as a catalyst for market growth. The continuous improvement in technologies related to batteries, motors, and power electronics serves as a significant driver for the EVTOL market. Breakthroughs in battery technology, such as advancements in energy density and faster charging capabilities, enable EVTOL aircraft to achieve longer flight ranges and reduced recharge times, enhancing their viability and commercial appeal. Similarly, advancements in electric motors, including higher power-to-weight ratios and increased efficiency, contribute to improved aircraft performance, enabling EVTOLs to take off, hover, and maneuver more effectively. Additionally, developments in power electronics, such as advanced motor controllers and energy management systems, enhance the overall efficiency and reliability of EVTOLs, optimizing energy consumption and extending flight durations. These technological advancements not only enable EVTOLs to meet performance and safety requirements but also contribute to reduced operational costs and environmental impact, fostering their widespread adoption. As battery, motor, and power electronics technologies continue to evolve, the EVTOL market is poised to benefit from increased efficiency, expanded capabilities, and improved overall performance, driving the growth and market potential of EVTOL aircraft.

Restraint: eVTOL aircraft crash due to failure in software

The occurrence of EVTOL aircraft crashes resulting from software failures serves as a significant restraint for the EVTOL market. The reliance on complex software systems for flight control and autonomous operations introduces a potential vulnerability, where software malfunctions or glitches can lead to catastrophic accidents. Such incidents can undermine public trust in the safety and reliability of EVTOLs, impeding market growth and regulatory approvals. The potential risks associated with software failures necessitate stringent testing, certification processes, and robust safety measures to mitigate these concerns. As EVTOL manufacturers address these challenges and implement robust software development practices, including thorough testing, redundancy, and fail-safe mechanisms, they can enhance the safety and reliability of their aircraft, alleviating concerns and driving market acceptance.

Opportunity: strategic developments serves as an opportunity

Strategic developments serve as opportunities for the EVTOL market. Strategic collaborations and partnerships between aerospace manufacturers, technology companies, and transportation service providers enable the pooling of expertise, resources, and networks, accelerating the development and commercialization of EVTOLs. These partnerships foster innovation, enhance research and development capabilities, and drive advancements in technology, regulatory frameworks, and infrastructure. Additionally, strategic investments in EVTOL start-ups and the establishment of dedicated test sites and vertiports create an ecosystem conducive to EVTOL deployment. The support from governments and regulatory bodies in the form of favorable policies, grants, and incentives further propels market opportunities. Strategic developments foster a collaborative and supportive environment, enabling the EVTOL market to flourish and unlock its full potential as a transformative mode of transportation.

Challenge: Safety Issues

Safety issues pertaining to the eVTOL market pose significant challenges to its growth and widespread adoption. The unique nature of eVTOL aircraft, with their vertical takeoff and landing capabilities, autonomous operations, and integration into urban airspace, introduces complex safety considerations. Ensuring the safety of passengers, crew, and people on the ground is of paramount importance. Challenges arise from multiple fronts. Firstly, the development and certification of autonomous flight systems necessitate robust testing procedures, risk assessment methodologies, and fail-safe mechanisms to ensure reliable and safe operations. This requires addressing potential software glitches, sensor failures, and communication disruptions that could lead to accidents. Secondly, the integration of eVTOLs into existing airspace systems presents challenges related to air traffic management, collision avoidance, and routing protocols. Coordination with air traffic control and other aircraft operators is crucial to ensure seamless and safe operations. Additionally, the eVTOL market must address concerns surrounding the resilience of battery systems, emergency procedures for in-flight contingencies, and the impact of adverse weather conditions on flight operations. Overcoming these safety challenges requires close collaboration between industry stakeholders, regulators, and standards organizations to establish comprehensive safety standards, robust certification processes, and a culture of continuous improvement. Adhering to stringent safety protocols, investing in rigorous testing and simulation, and maintaining transparent reporting of safety incidents is essential to instilling public confidence and addressing the challenges posed by safety in the eVTOL market.

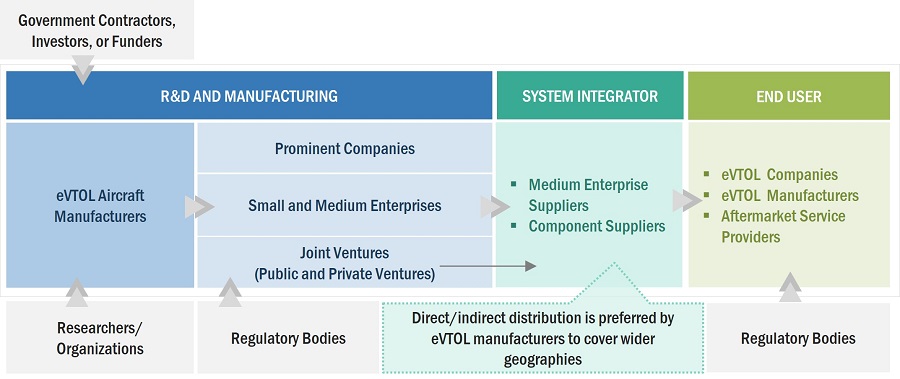

eVTOL Aircraft Market Ecosystem

The eVTOL market ecosystem comprises aerospace manufacturers, technology firms, and transportation service providers collaborating to drive innovation and commercialization. It involves strategic partnerships, investments, and research efforts to develop advanced propulsion systems, battery technologies, and autonomous flight capabilities. Regulatory bodies, government agencies, and infrastructure developers also play a crucial role in shaping the eVTOL market ecosystem by establishing safety standards, certification processes, and dedicated infrastructure such as vertiports and charging networks. The prominent companies are Jaunt Air Mobility (US), Lilium (Germany), Volocopter (Germany), and EHang (China), among others.

The Vectored Thrust segment accounts for the largest market size during the forecast period.

Based on Lift Technology, the market has been segmented into Vectored Thrust, Multirotor, and Lift Plus Cruise in the eVTOL Aircraft market.

Vectored thrust, as an EVTOL lift technology, commands the largest market share due to its exceptional characteristics. Its capability to manipulate propulsive force direction enhances maneuverability, making it ideal for diverse applications in the urban air mobility sector. With precise control during takeoff, landing, and hover, it offers heightened stability and versatility. Furthermore, its proven performance and established use in conventional aircraft inspire confidence among manufacturers and operators, consolidating its market dominance.

The Piloted segment is projected to have a higher growth rate during the forecast period.

Based on the mode of operation, the eVTOL Aircraft market has been segmented into piloted and autonomous. Among EVTOL modes of operations, piloted operation emerges as the fastest-growing segment. While autonomous holds future potential, piloted operation exhibits advantages that propel its growth. Passengers find reassurance and trust in the presence of human pilots, particularly during the initial stages of EVTOL deployment. Addressing safety concerns and regulatory compliance becomes more streamlined with human oversight. Moreover, seamless integration with existing airspace infrastructure and air traffic management systems simplifies the regulatory framework and accelerates market acceptance.

The > 200 Km segment is projected to have a higher growth rate during the forecast period.

Based on the range, the eVTOL Aircraft market has been segmented into <= 200 km and > 200 km. The >200 km range category demonstrates the highest growth rate within the EVTOL market. This extended range capability unlocks diverse opportunities, enabling EVTOLs to cater to regional air transportation requirements and efficiently connect distant locations. Suitable for intercity connections and longer-distance travel, this range meets the demands of a broader customer base. Leveraging advancements in battery efficiency and energy storage, this category strikes an optimal balance between payload capacity and energy efficiency. The expansion of this range fuels its faster compound growth, establishing it as a prominent segment within the EVTOL market.

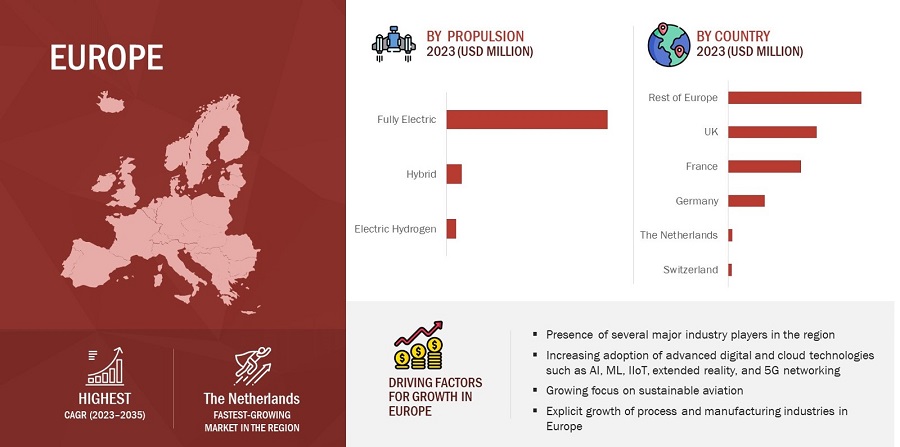

Europe is projected to grow at the highest CAGR during the forecast period.

Europe is projected to be the fastest-growing region in the eVTOL Aircraft market during the forecast period, owing to a number of variables that support the region's growth potential. The region has witnessed significant economic development, which has resulted in greater air travel demand and a rising commercial aviation sector. The rising emphasis on sustainable aviation practices and the emergence of urban air mobility and advanced air mobility solutions will drive the demand for eVTOL Aircraft. Numerous growing economies, like France, the UK, and Germany, have made significant investments in their aerospace sectors in Europe. The presence of important aircraft manufacturers and suppliers in the region has contributed to Europe's market leadership in eVTOL Aircraft.

Europe is projected to hold the highest market share during the forecast period.

eVTOL Aircraft Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the eVTOL Aircraft market are Jaunt Air Mobility (US), Lilium (Germany), Volocopter (Germany), and EHang (China), among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019-2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Lift Technology, Propulsion Type, System, Mode of Operation, Application, Mtow, Range and Region |

|

Geographies Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa |

|

Companies Covered |

Airbus SE (Netherlands), Elbit Systems Ltd.(Israel), Bell Textron, Inc. (US), Ehang Holdings Ltd. (China), Embraer SA (Brazil), Israel Aerospace Industries (Israel), |

eVTOL Aircraft Market Highlights

This research report categorizes the eVTOL Aircraft market based on Lift Technology, Propulsion Type(, System, Mode of Operation, Application, Mtow, Range, and Region.

|

Segment |

Subsegment |

|

By Lift Technology |

|

|

By Propulsion Type |

|

|

By System |

|

|

By Mode Of Operation |

|

|

By Application |

|

|

By Mtow |

|

|

By Range |

|

|

By Region |

|

Recent Developments

- AutoFlight, a Shanghai-based R&D specialist in autonomous flight and eVTOL technology, has secured a significant purchase commitment from EVFLY, an advanced air mobility services provider. Following AutoFlight's successful completion of the longest eVTOL flight to date with its Prosperity I all-electric aircraft, the deal entails over 200 eVTOL cargo and passenger aircraft that will form part of one of the world's first commercially available global fleets. Over the years, AutoFlight has been a focal point of our coverage, diligently working to develop and launch its flagship Prosperity I eVTOL, showcasing its commitment to advancing the field of autonomous flight and vertical take-off and landing technology.PowerCell, a leading fuel cell technology company, has achieved a groundbreaking milestone by signing a historic contract with ZeroAvia, a pioneering zero-emission aviation company. This contract marks the world's first-ever agreement for the serial delivery of hydrogen fuel stacks to the aviation industry. The agreement, valued at up to SEK 1.51 billion, is contingent on ZeroAvia obtaining the necessary certifications and entails the supply of 5,000 hydrogen fuel cell stacks. The deliveries are scheduled to commence in 2024. ZeroAvia, known for its focus on hydrogen-electric aviation solutions, aims to launch a 19-seat aircraft with a range of 300 miles by 2025.

- Lilium, a prominent player in the eVTOL market, has signed agreements with both Air-Dynamic SA and ASL Group. The agreement with Air-Dynamic involves pre-delivery payments for up to five Lilium eVTOL aircraft. Air-Dynamic, a Switzerland-based private jet and helicopter company, intends to operate these aircraft for customers in Switzerland and Italy. Additionally, Lilium has announced an agreement with ASL Group, a European business jet operator, for the purchase of six Pioneer Edition Jets. This agreement follows a previous Memorandum of Understanding (MoU) between ASL Group and Lilium, signed in July 2022. As part of the MoU, the companies have agreed to establish a network of landing sites spanning Belgium, Netherlands, Luxembourg, and Western Germany. These recent agreements highlight Lilium's expanding partnerships and growing presence in the eVTOL market, facilitating their vision of providing efficient and sustainable air transportation solutions across Europe.

- Volocopter and Safran Electrical & Power have signed an agreement at the Paris Air Show 2023 to collaborate on developing a next-generation powertrain for eVTOL aircraft. The collaboration aims to explore commercial and engineering partnerships, focusing on the entire electric powertrain, including the electrical propulsion system, battery units, and power distribution system. This strategic partnership signifies a significant step forward in advancing sustainable and efficient electric propulsion systems for the rapidly evolving urban air mobility sector.

Frequently Asked Questions (FAQ):

What is the current size of the eVTOL Aircraft market?

The eVTOL Aircraft market size is projected to grow from USD 1.2 billion in 2023 to USD 23.4 billion by 2030, at a CAGR of 52.0% from 2023 to 2030.

Who are the winners in the eVTOL Aircraft market?

Jaunt Air Mobility (US), Lilium (Germany), Volocopter (Germany), and EHang (China), among others, are some of the winners in the market.

What are some of the technological advancements in the market?

The eVTOL market is witnessing transformative changes driven by technological advancements across various key areas. Notable progress in battery technology, electric motor design, autonomous systems, aerodynamics, power electronics, and energy management systems has unlocked significant potential. These advancements have resulted in extended flight ranges, enhanced performance, and improved efficiency bolstered by autonomous capabilities that ensure heightened safety measures. Additionally, optimized aerodynamics enable improved maneuverability, while advancements in power electronics and energy management systems facilitate efficient power distribution. As a result, the eVTOL market is experiencing a shift towards efficient and sustainable urban air mobility.

What are the factors driving the growth of the market?

The increasing demand for efficient and sustainable transportation, advancements in technology, particularly in batteries, electric motors, and autonomous systems, the growing focus on environmental sustainability, and strategic collaborations and partnerships among aerospace manufacturers, technology firms, and transportation service providers are accelerating innovation, investment, and market development. The combined effect of these factors is fueling the growth of the eVTOL market.

What are the growth opportunities in the eVTOL Aircraft market?

The eVTOL Aircraft market offers several prospects for expansion to players. Market expansion is being driven by increasing areas of applications for eVTOLs, the advent of new aircraft programs, and systems to power the future of smaller aircraft and electric flight.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current market size for the eVTOL Aircraft market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, Dow Jones Factiva, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases. Secondary sources referred for this research study included General Aviation Manufacturers Association (GAMA); International Air Transport Association (IATA) publications, corporate filings (such as annual reports, investor presentations, and financial statements); Federal Aviation Administration (FAA) and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

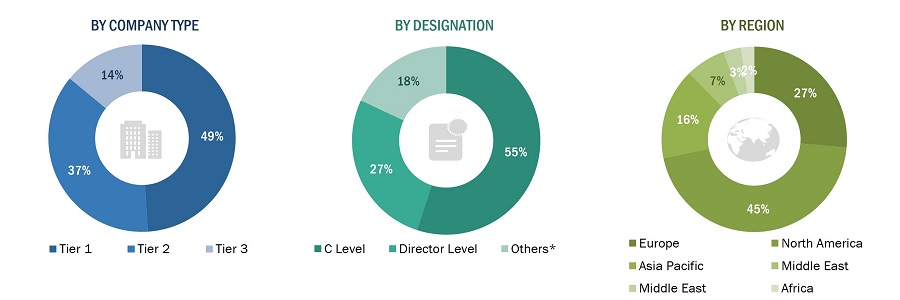

Primary Research

The eVTOL Aircraft Market comprises several stakeholders, such as raw material providers, eVTOL Aircraft manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in sensors and wireless connected systems. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the eVTOL Aircraft market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up Approach

The bottom-up approach was employed to arrive at the overall size of the eVTOL aircraft market from the revenues of key players and their shares in the market. Calculations based on the revenues of key players identified in the market led to the overall market size. The bottom-up approach was also implemented for data extracted from secondary research to validate the market segment revenues obtained. The market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the overall parent market size and each individual market size were determined and confirmed in this study.

Market size estimation methodology: Top-down Approach

In the top-down approach, eVTOL aircraft manufacturers were identified, and their revenue specific to the eVTOL aircraft market was identified. The base market number for each player was arrived at by assigning a weightage to the eVTOL aircraft contracts received by the eVTOL manufacturers with respect to the application, range, and scope undertaken (for example, integration, design, manufacturing, and platform deployment).

Data Triangulation

After arriving at the overall size of the eVTOL aircraft market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends. Along with this, the market size was validated using the top-down and bottom-up approaches.

In the bottom-up approach, the size of the eVTOL aircraft market was arrived at by calculating the regional-level data. In the top-down approach, the market size was derived by estimating the revenues of key companies operating in the market and validating the data acquired from primary research.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the eVTOL Aircraftmarket

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Latin America, Middle East, and Africa. Along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in eVTOL Aircraft Market

Surveying new developments in the aerospace market - the abstract would enable the management to judge if further study in the area is required.

We are currently researching and developing out own evtol craft, and I am seeking more information on the economics of the evtol market.