Electric Aircraft Market by Type (Fixed Wing, Rotary Wing, Hybrid Wing), Platform (Regional Transport Aircraft, Business Jets, Light & Ultralight Aircraft), System, Technology, Application and Region - Global Forecast to 2030

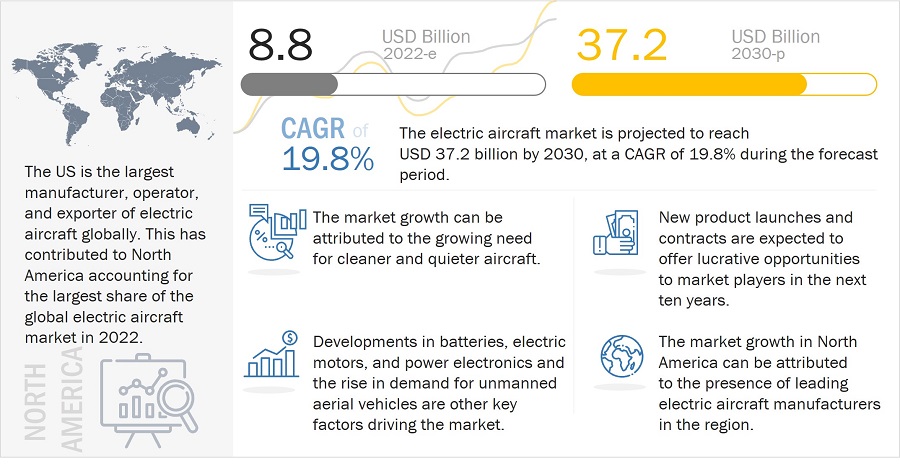

[255 Pages Report] The Electric Aircraft Market was valued at $8,800 Million in 2022 and is estimated to grow from $10,100 Million USD in 2023 to $37,200 Million USD by 2030 at a CAGR (Compound Annual Growth Rate) of 19.8%. Rising demand for environment-friendly aircraft and the growing development of UAVs and electric VTOLs are the key factors driving the electric aircraft market.

Electric Aircraft Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

An electric aircraft uses batteries for power and propulsion, which is traditionally achieved by fossil fuels. There has been a growing need for sustainable alternatives to fossil fuel to reduce the carbon emissions resulting from aircraft, as the global aircraft fleet size and air travel is expected to increase in the future. Electric aircraft are more energy-efficient and are considered a cleaner and quieter mode of air travel. Recent technological advancements in power electronics, battery technologies, and electrical motors played a major role in driving the market for electric aircraft. The adoption of electric aircraft is expected to drive value and unlock significant improvements in terms of aircraft weight, energy efficiency, total life cycle cost, maintenance, and aircraft reliability.

Attractive Growth Opportunities in Electric Aircraft Market

Electric Aircraft market Dynamics:

Driver: Growing Need for cleaner and quieter aircraft

According to the International Energy Agency (IEA), global flights produced around 720 million tons of carbon dioxide in 2021. The global aviation industry produces over 2% of all the CO2 emissions induced by humans.

With an increase in the number of global aircraft fleet size and air travel, these numbers are expected to rise even higher. Hence, there has been a pressing need for electric aircraft, which will help reduce the carbon footprint of the aviation industry. Organizations and governing bodies such as the International Civil Aviation Organization, the Federal Aviation Administration, and the European Union Aviation Safety Agency have called for sustainable alternatives to aircraft fuel as they estimate that aircraft-generated emissions are expected to be three-fold in volume by 2050. Since electric engines do not have noises associated with jet or combustion engines, they result in no aircraft noise levels. In an electric aircraft, manufacturers aim to improve efficiency by replacing hydraulically controlled systems with electric systems.

Electric aircraft manufacturers such as Airbus (France), Eviation (Israel), Embraer (Brazil), and Joby Aviation (US) identify the need for cleaner aircraft as a major opportunity in the near future. Thus, the need for sustainable air travel is a major factor driving the electric aircraft industry.

Opportunity: Emergence of Advanced Air Mobility

The purpose of advanced air mobility is to provide a convenient, safe, and affordable air travel system that will use highly automated aircraft transporting passengers or cargo at lower altitudes. Advanced air mobility includes services such as air taxis, commercial inter-city, cargo delivery, public services, or private/recreational vehicles. This presents a great market opportunity for electric aircraft manufacturers as the demand for this type of air mobility will only increase in the future, considering the ever-growing population and congestion of cities.

According to Roland Berger, advanced air mobility is expected to grow at the highest rate in the coming few years, and urban air taxis will dominate the full-electric advanced air mobility market. NASA hosted an Advanced Air Mobility National Campaign promoting confidence in the public and expediting the urban, suburban, rural, and regional advanced air mobility by 2022. The campaign had announced agreements with four new organizations, Electra Aero (US), Overair (US), Supernal (US), and Ellis & Associates (US), to exchange information related to the development and testing of vehicles, systems, and technology to integrate air taxis, cargo delivery, and other advanced aircraft concepts into the National Airspace System (NAS). With the existing propulsion technologies, long-range commercial flights might not seem possible. However, advanced air mobility aircraft certainly seems possible, and many of the manufacturers such as Pipistrel (Slovenia), Joby Aviation (US), and Eviation (Israel) are focusing on developing small all-electric aircraft. Innovative startups such as Joby Aviation have developed a flying eVTOL taxi prototype that can carry five people up to 150 miles on a single charge. They have also acquired Uber’s urban air mobility (UAM) initiative. Hence, advanced air mobility is a great opportunity for all electric aircraft manufacturers in the coming few years.

Challenge: Development of high energy density batteries

One of the biggest challenges that electric aircraft manufacturers face in terms of long-distance flights is the low energy density of batteries. The energy density for aircraft propulsion is usually measured in watt-hours per kilogram (Wh/kg). The existing lithium-ion batteries have an energy density of around 250 Wh/kg, which is way lesser than the energy density provided by conventional jet fuel or kerosene of around 12,000 Wh/kg. Thus, all-electric long-haul commercial flights are still a distant reality as conventional fossil fuels are about 14 times more energy-rich than battery-powered alternatives.

Hence, aircraft would require electric batteries that weigh 30 times more than their current fuel intake to achieve the range of distances covered by fossil fuels. This is a major challenge that aircraft manufacturers must address if they want to achieve the goal of all-electric commercial flights. Advancements such as lithium-sulfur batteries significantly increase the energy density to 500 Wh/kg or 600 Wh/kg. However, some industry experts claim that batteries that will enable all-electric commercial flights will not be available until the late 2030s to early 2040s. It will take a considerable amount of time to build batteries sufficient to electrify the medium and long-range flights that make up the bulk of commercial aviation, which is a big challenge faced by electric aircraft manufacturers.

The Aerostructures segment is estimated to dominate the electric aircraft market during the forecast period

By system, the aerostructures segment is estimated to dominate the electric aircraft market during the forecast period. Aerostructures account for the largest share of the total development cost of an aircraft. Newly developed electric aircraft, especially eVTOL aircraft, require some of the most advanced materials to make them lightweight while maintaining their structural strength. These factors contribute to the large share of the system segment in the electric aircraft market.

The Rotary Wing segment to witness largest market share in 2022

Based on type, the electric aircraft market has been segmented into fixed wing, rotary wing, and hybrid wing. The rotary wing segment is estimated to account for the largest share of the electric aircraft market in 2022. This is due to the increased deployment of rotary wing air taxis to reduce the price and convenience of urban flights.

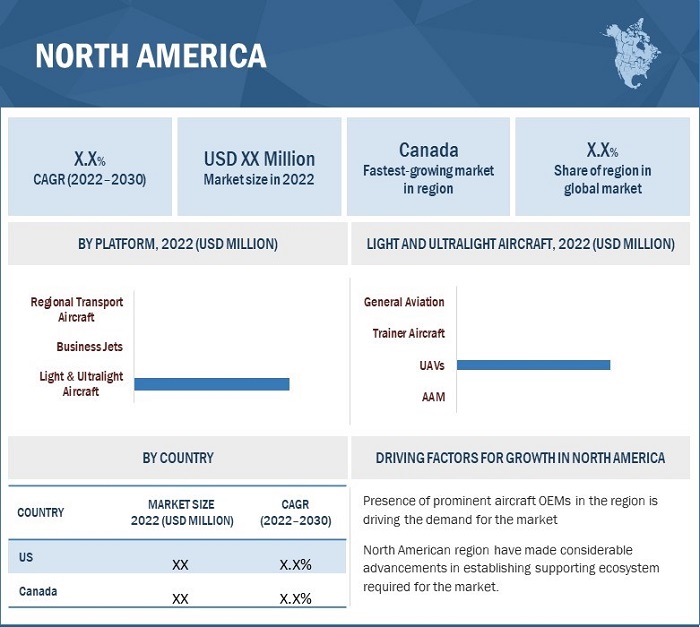

North American region is expected to have the highest market share during the forecast period

Based on region, the electric aircraft market has been segmented into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. While North America is estimated to lead the electric aircraft market in 2022, the market in Latin American region is projected to register the highest CAGR during the forecast period. North American region constitutes that largest electric aircraft manufacturers and are also in the lead of adoption of the advanced air mobility solutions. Latin America having companies like Embraer (Brazil) that are receiving high numbers of contracts with their electric aircraft. Latin America is also leading with larger adoption of advanced air mobility solutions.

Electric Aircraft Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Electric Aircraft Companies - Key Market Players

The electric aircraft companies are dominated by globally established players such as Airbus SE (France), Eve Air Mobility (Brazil), Joby Aviation (US), Vertical Aerospace (UK), and Lilium N.V. (Germany) among others. These key players offer electric aircraft and services to different key stakeholders.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018-2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2030 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Platform, Type, System, Application, Technology and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Latin America and Africa |

|

Companies covered |

Airbus SE (France), Eve Air Mobility (Brazil), Joby Aviation (US), Vertical Aerospace (UK), and Lilium N.V. (Germany)) |

Electric Aircraft Market Highlights

This research report categorizes the Electric Aircraft market into End Use, Technology, Type, Detection, Component and Region.

|

Segment |

Subsegment |

|

By Type |

|

|

By System |

|

|

By Technology |

|

|

By Platform |

|

|

By Application |

|

Recent Developments

- In January 2023, Eviation Aircraft secured a contract from Aerus, an emerging regional airline in Mexico, for the supply of 30 of its commuter Alice aircraft. Aerus intends to utilize Alice for middle-mile travel across regions including Nuevo León, Tamaulipas, Coahuila, and Veracruz, providing historically underserved communities in northern areas of the country with access to carbon-free, cost-effective, and convenient air travel.

- In December 2022, Eve Air Mobility (Eve), the subsidiary of Embraer SA, signed a Letter of Intent (LOI) with FlyBIS Aviation Limited (FlyBIS), an advanced air mobility start-up based in Caxias do Sul, in the south of Brazil, to collaborate on the development of eVTOL operations in Brazil and South America. Based on the agreement, FlyBIS will also purchase up to 40 of Eve’s eVTOL vehicles.

Frequently Asked Questions (FAQ):

What is the current size of the electric aircraft market?

The Electric Aircraft market is expected to grow from USD 8.8 billion in 2022 to USD 37.2 billion in 2030, at a CAGR of 19.8%.

Who are the winners and small enterprises in the Electric Aircraft market?

Major players operating in the electric aircraft market include Airbus SE (France), Eve Air Mobility (Brazil), Joby Aviation (US), Vertical Aerospace (UK), and Lilium N.V. (Germany) among others. These key players offer electric aircraft and services to different key stakeholders.

What are some of the technological advancements in the market?

Energy harvesting, also called energy scavenging or power harvesting, is the process of obtaining energy from the outside environment and converting it to electrical energy, which can be used to power an aircraft. Several proposed energy harvesting (EH) methods exist for aerospace applications. Some of them include the usage of thermal gradients, solar radiation, vibration, and airflow. Sensors with a power range of 10-50 MW are used to harvest energy from the environment. For example, transducers such as photovoltaic generators, thermoelectric generators, electromagnetic, piezoelectric, and triboelectric converters are used to convert external energies into electrical energies and power the aircraft. The energy harvesting method can be useful for UAVs as it can prolong flight time with the use of solar power. Energy harvesting is an emerging subject of research in the aerospace industry as it can possibly solve the power source issues of electric aircraft.

What are the factors driving the growth of the market?

The latest developments in electric and electronic aircraft technologies offer significant opportunities to electric aircraft as well as component manufacturers. Aircraft manufacturers are examining ways to generate and distribute large power sufficient to carry an aircraft over long distances. High energy density batteries, high-performance electric motors, distributed architectures, and power electronics (in the starter/generation system of the main engine) are some of the upcoming technologies for aircraft. Lithium-sulfur batteries are expected to offer a potential solution for aircraft propulsion, as key industry players are investing in developing new lithium-based batteries with high power density. Presently, battery technologies are in the development stage and can supply power to small passenger aircraft traveling short distances.

Which sectors are witnessing larger adoptions?

The main developments are focusing on commercial and passenger taxing applications. But the military are also keen in adopting electric aircrafts for last mile and mid-mile delivery that will complement the other military operations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing need for cleaner and quieter aircraft- Advances in batteries, electric motors, and power electronics- Rise in demand for unmanned aerial vehiclesRESTRAINTS- Increased aircraft weight due to heavy batteries- High voltage and thermal issuesOPPORTUNITIES- Emergence of advanced air mobility- Use of all-electric aircraft for logisticsCHALLENGES- Development of high energy density batteries- Battery recharging infrastructure at airports- Designing all-electric manned aircraft- Ensuring airworthiness of electric aircraft

- 5.3 RECESSION IMPACT ANALYSIS

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.5 VALUE CHAIN ANALYSISRAW MATERIALSR&DCOMPONENT MANUFACTURINGOEMSEND USERSAFTER-SALES SERVICES

-

5.6 MARKET ECOSYSTEM MAPPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TRADE DATA ANALYSIS

-

5.9 TECHNOLOGY ANALYSISLITHIUM-SULFUR BATTERIESHYDROGEN FUEL CELLSHIGH ENERGY DENSITY ELECTROCHEMICAL STORAGE FOR LARGE AIRCRAFTREDUCED CHARGING TIME OF AIRCRAFT BATTERIES

- 5.10 TARIFF AND REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

- 5.11 AVERAGE SELLING PRICE ANALYSIS

- 5.12 VOLUME DATA

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS IN 2022–2023

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY ADVANCEMENTS IN ELECTRIC AIRCRAFT MARKETURBAN AIR MOBILITYENERGY HARVESTINGHIGH-POWER BATTERIES AND MOTORS

-

6.3 EMERGING TRENDS IN ELECTRIC AIRCRAFT MANUFACTURING3D PRINTINGARTIFICIAL INTELLIGENCEPREDICTIVE MAINTENANCE

- 6.4 SUPPLY CHAIN ANALYSIS

-

6.5 USE CASESJOBY AEROSPACE COMPLETES ALL-ELECTRIC FLIGHT WITH ELECTRIC VERTICAL TAKE-OFF AIR TAXIEVIATION OFFERS ALICE, A 9-PASSENGER ELECTRIC PROPELLER-POWERED AIRPLANEEXTRA AIRCRAFT'S EXTRA 330LE ELECTRIC PLANE POWERED BY SIEMENS ELECTRIC DRIVE SYSTEMROLLS ROYCE’S FIRST ALL-ELECTRIC AIRCRAFT COMPLETES MAIDEN FLIGHT

-

6.6 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 REGIONAL TRANSPORT AIRCRAFTINCREASING NEED FOR COST-EFFECTIVE SHORT-HAUL AIRLINERS EXPECTED TO DRIVE SEGMENT

-

7.3 BUSINESS JETSINCREASED CORPORATE ACTIVITIES AND NEED FOR AIRCRAFT WITH LOW CARBON FOOTPRINT TO DRIVE DEMAND

-

7.4 LIGHT & ULTRALIGHT AIRCRAFTGENERAL AIRCRAFT- Developments in electric propulsion of general aircraft expected to drive segmentTRAINER AIRCRAFT- Short take-off and landing capability to drive segmentUAVS- Low noise footprint of electric UAVs to fuel their adoption in civil and military applicationsADVANCED AIR MOBILITY- Most eVTOL aircraft used in AAM applications

- 8.1 INTRODUCTION

-

8.2 FIXED WINGFIXED WING ELECTRIC AIRCRAFT WITNESSING ADOPTION FOR COMMERCIAL PASSENGER TRANSPORTATION

-

8.3 ROTARY WINGROTARY WING ELECTRIC AIRCRAFT ADOPTED FOR URBAN AIR MOBILITY

-

8.4 HYBRID WINGMISSION COMPLEXITY AND CONGESTED AIR TRAFFIC TO FUEL DEMAND FOR HYBRID WING AIRCRAFT

- 9.1 INTRODUCTION

-

9.2 BATTERIESADVANCEMENTS IN BATTERY POWER DENSITY TO DRIVE SEGMENT

-

9.3 ELECTRIC MOTORSELECTRIC MOTORS PROVIDE BETTER POWER-TO-WEIGHT RATIO IN AIRCRAFT

-

9.4 AEROSTRUCTURESADVANCED AEROSTRUCTURES HELP ENHANCE AIRCRAFT PERFORMANCE, CONSERVE ENERGY, AND LOWER COSTS

-

9.5 AVIONICSDEVELOPMENT OF URBAN AIR MOBILITY AIRCRAFT TO ENCOURAGE ADVANCEMENTS IN AVIONICS SYSTEMS

-

9.6 SOFTWAREADVANCED SOFTWARE SYSTEMS REQUIRED TO RUN COMPLICATED SYSTEMS OF URBAN AIR MOBILITY AIRCRAFT

- 9.7 OTHERS

- 10.1 INTRODUCTION

-

10.2 CTOLINCREASING NEED FOR LONG-RANGE AIRCRAFT TO DRIVE DEMAND FOR BUSINESS JETS AND REGIONAL TRANSPORT AIRCRAFT

-

10.3 STOLINCREASING DEVELOPMENTS IN HYBRID WING AIRCRAFT TO DRIVE SEGMENT

-

10.4 VTOLLARGE DEPLOYMENT OF VTOL AIRCRAFT FOR AIR TAXI AND EMS SERVICES TO DRIVE SEGMENT

- 11.1 INTRODUCTION

-

11.2 CIVILINCREASING DEVELOPMENTS IN URBAN MOBILITY APPLICATIONS TO DRIVE SEGMENT

-

11.3 MILITARYNEED FOR LOW-NOISE AIRCRAFT IN ISR MISSIONS TO BOOST SEGMENT

- 12.1 INTRODUCTION

- 12.2 REGIONAL RECESSION IMPACT ANALYSIS

-

12.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Presence of leading OEMs to drive marketCANADA- Aircraft modernization programs to drive market

-

12.4 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Increasing demand for eco-friendly commercial aircraft to drive marketINDIA- Increased spending on armed forces modernization to drive marketJAPAN- Increasing in-house development of aircraft to drive marketAUSTRALIA- Increase in usage of military and commercial drones to drive marketSOUTH KOREA- Modernization programs in aviation industry to drive marketREST OF ASIA PACIFIC

-

12.5 EUROPEPESTLE ANALYSIS: EUROPEUK- Technological advancements in air travel to drive marketFRANCE- Significant investments in aerospace to drive marketGERMANY- Rising investments in air travel and connectivity to drive marketITALY- Projects related to energy-efficient air freight and passenger transportation to boost marketREST OF EUROPE

-

12.6 MIDDLE EASTPESTLE ANALYSIS: MIDDLE EASTISRAEL- Increased R&D spending on UAVs for military and commercial applications to drive marketUAE- Increasing commercial electric air taxi initiatives to drive marketSAUDI ARABIA- High military expenditure to drive marketTURKEY- Increasing investments in UAM ecosystem to drive marketREST OF MIDDLE EAST

-

12.7 LATIN AMERICAPESTLE ANALYSIS: LATIN AMERICABRAZIL- Introduction of air taxi services by Airbus for intercity and intracity travel to drive marketMEXICO- Presence of renowned OEMs to result in more efficient and sustainable city travelREST OF LATIN AMERICA

- 12.8 AFRICA

- 13.1 INTRODUCTION

- 13.2 COMPETITIVE OVERVIEW

- 13.3 MARKET SHARE ANALYSIS, 2021

- 13.4 REVENUE ANALYSIS

-

13.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.6 START-UPS/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

13.7 COMPETITIVE SCENARIODEALSOTHERS

-

14.1 KEY PLAYERSAIRBUS SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewELBIT SYSTEMS LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAEROVIRONMENT, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEVE AIR MOBILITY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEHANG HOLDINGS LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewISRAEL AEROSPACE INDUSTRIES- Business overview- Products/Solutions/Services offeredPIPISTREL- Business overview- Products/Solutions/Services offered- Recent developmentsEVIATION AIRCRAFT INC.- Business overview- Products/Solutions/Services offered- Recent developmentsLILIUM N.V.- Business overview- Products/Solutions/Services offered- Recent developmentsJOBY AVIATION, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsARCHER AVIATION INC.- Business overview- Products/Solutions/Services offered- Recent developmentsVOLOCOPTER GMBH- Business overview- Products/Solutions/Services offered- Recent developmentsSZ DJI TECHNOLOGY CO., LTD.- Business overview- Products/Solutions/Services offeredYUNEEC INTERNATIONAL- Business overview- Products/Solutions/Services offered- Recent developmentsAURORA FLIGHT SCIENCES- Business overview- Products/Solutions/Services offered- Recent developmentsVERTICAL AEROSPACE GROUP LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsHEART AEROSPACE- Business overview- Products/Solutions/Services offered- Recent developments

-

14.2 OTHER PLAYERSWRIGHT ELECTRIC, INCBYE AEROSPACEBETA TECHNOLOGIESDELOREAN AEROSPACEELECTRIC AIRCRAFT CORPORATIONEXTRA AIRCRAFTWISK AERO LLC.JAUNT AIR MOBILITY

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN ELECTRIC AIRCRAFT MARKET

- TABLE 2 PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 ELECTRIC AIRCRAFT MARKET ECOSYSTEM

- TABLE 4 TRADE DATA TABLE FOR ELECTRIC AIRCRAFT MARKET

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 AVERAGE SELLING PRICE: ELECTRIC AIRCRAFT MARKET, BY TYPE (USD MILLION)

- TABLE 10 ELECTRIC AIRCRAFT DELIVERIES, BY TYPE, 2018-2021 (UNITS)

- TABLE 11 ELECTRIC AIRCRAFT DELIVERIES, BY TYPE, 2022-2030 (UNITS)

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ELECTRIC AIRCRAFT PRODUCTS AND SYSTEMS (%)

- TABLE 13 KEY BUYING CRITERIA FOR ELECTRIC AIRCRAFT

- TABLE 14 ELECTRIC AIRCRAFT MARKET: CONFERENCES AND EVENTS, 2022–2023

- TABLE 15 ELECTRIC AIRCRAFT MARKET: KEY PATENTS

- TABLE 16 ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 17 ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

- TABLE 18 LIGHT & ULTRALIGHT AIRCRAFT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 19 LIGHT & ULTRALIGHT ELECTRIC AIRCRAFT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 20 ELECTRIC AIRCRAFT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 21 ELECTRIC AIRCRAFT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 22 ELECTRIC AIRCRAFT MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

- TABLE 23 ELECTRIC AIRCRAFT MARKET, BY SYSTEM, 2022–2030 (USD MILLION)

- TABLE 24 ELECTRIC AIRCRAFT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 25 ELECTRIC AIRCRAFT MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

- TABLE 26 ELECTRIC AIRCRAFT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 27 ELECTRIC AIRCRAFT MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 28 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 29 ELECTRIC AIRCRAFT MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 30 ELECTRIC AIRCRAFT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 31 NORTH AMERICA: ELECTRIC UAV MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 32 NORTH AMERICA: ELECTRIC UAV MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 33 NORTH AMERICA: ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 34 NORTH AMERICA: ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: LIGHT & ULTRALIGHT AIRCRAFT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 36 NORTH AMERICA: LIGHT & ULTRALIGHT AIRCRAFT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 37 US: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 38 US: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 39 CANADA: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 40 CANADA: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: ELECTRIC UAV MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 42 ASIA PACIFIC: ELECTRIC UAV MARKET, BY COUNTRY, 2021–2030 (USD MILLION)

- TABLE 43 ASIA PACIFIC: ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 44 ASIA PACIFIC: ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2021–2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: LIGHT & ULTRALIGHT AIRCRAFT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 46 ASIA PACIFIC: LIGHT & ULTRALIGHT AIRCRAFT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 47 CHINA: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 48 CHINA: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 49 INDIA: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 50 INDIA: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 51 JAPAN: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 52 JAPAN: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 53 AUSTRALIA: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 54 AUSTRALIA: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 55 SOUTH KOREA: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 56 SOUTH KOREA: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 57 REST OF APAC: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 58 REST OF APAC: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 59 EUROPE: ELECTRIC UAV MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 60 EUROPE: ELECTRIC UAV MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 61 EUROPE: ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 62 EUROPE: ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

- TABLE 63 EUROPE: ELECTRIC AIRCRAFT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 64 EUROPE: LIGHT & ULTRALIGHT AIRCRAFT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 65 UK: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 66 UK: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 67 FRANCE: ELECTRIC UAVS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 68 FRANCE: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 69 GERMANY: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 70 GERMANY: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 71 ITALY: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 72 ITALY: ELECTRIC UAVS MARKET, SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 73 REST OF EUROPE: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 74 REST OF EUROPE: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 75 MIDDLE EAST: ELECTRIC UAV MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 76 MIDDLE EAST: ELECTRIC UAV MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 77 MIDDLE EAST: ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 78 MIDDLE EAST: ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

- TABLE 79 MIDDLE EAST: ELECTRIC AIRCRAFT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 80 MIDDLE EAST: LIGHT & ULTRALIGHT AIRCRAFT MARKET, TYPE, 2022–2030 (USD MILLION)

- TABLE 81 ISRAEL: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 82 ISRAEL: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 83 UAE: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 84 UAE: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 85 SAUDI ARABIA: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 86 SAUDI ARABIA: ELECTRIC AIRCRAFT MARKET, LIGHT & ULTRALIGHT AIRCRAFT, BY UAVS, 2022–2030 (USD MILLION)

- TABLE 87 TURKEY: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 88 TURKEY: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 89 REST OF MIDDLE EAST: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 90 REST OF MIDDLE EAST: ELECTRIC UAVS MARKET, SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 91 LATIN AMERICA: ELECTRIC UAVS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 92 LATIN AMERICA: ELECTRIC UAVS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 93 LATIN AMERICA: ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 94 LATIN AMERICA: ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

- TABLE 95 LATIN AMERICA: ELECTRIC AIRCRAFT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 96 LATIN AMERICA: LIGHT & ULTRALIGHT AIRCRAFT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 97 BRAZIL: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 98 BRAZIL: ELECTRIC UAVS MARKET, BY SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 99 MEXICO: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 100 MEXICO: ELECTRIC UAVS MARKET, SUBTYPE, 2022–2030 (USD MILLION)

- TABLE 101 REST OF LATIN AMERICA: ELECTRIC UAVS MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

- TABLE 102 REST OF LATIN AMERICA: ELECTRIC UAVS MARKET, 2022–2030 (USD MILLION)

- TABLE 103 AFRICA: ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 104 AFRICA: ELECTRIC AIRCRAFT MARKET, BY PLATFORM, 2022–2030 (USD MILLION)

- TABLE 105 AFRICA: LIGHT & ULTRALIGHT AIRCRAFT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 106 AFRICA: LIGHT & ULTRALIGHT AIRCRAFT MARKET, BY TYPE, 2022–2030 (USD MILLION)

- TABLE 107 KEY DEVELOPMENTS BY LEADING MARKET PLAYERS BETWEEN 2018 AND 2023

- TABLE 108 COMPANY PRODUCT FOOTPRINT

- TABLE 109 COMPANY APPLICATION FOOTPRINT

- TABLE 110 COMPANY RANGE FOOTPRINT

- TABLE 111 COMPANY SYSTEM FOOTPRINT

- TABLE 112 COMPANY REGION FOOTPRINT

- TABLE 113 ELECTRIC AIRCRAFT MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 114 ELECTRIC AIRCRAFT MARKET: DEALS, 2019–2023

- TABLE 115 ELECTRIC AIRCRAFT MARKET: OTHERS, 2019–2023

- TABLE 116 AIRBUS SE: BUSINESS OVERVIEW

- TABLE 117 AIRBUS SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 118 AIRBUS SE.: DEALS

- TABLE 119 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 120 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 121 ELBIT SYSTEMS LTD.: DEALS

- TABLE 122 AEROVIRONMENT, INC.: BUSINESS OVERVIEW

- TABLE 123 AEROVIRONMENT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 AEROVIRONMENT, INC.: DEALS

- TABLE 125 EVE AIR MOBILITY: BUSINESS OVERVIEW

- TABLE 126 EVE AIR MOBILITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 EVE AIR MOBILITY: DEALS

- TABLE 128 EHANG HOLDINGS LTD.: BUSINESS OVERVIEW

- TABLE 129 EHANG HOLDINGS LTD. PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 EHANG HOLDINGS LTD: DEALS

- TABLE 131 ISRAEL AEROSPACE INDUSTRIES: BUSINESS OVERVIEW

- TABLE 132 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 PIPISTREL: BUSINESS OVERVIEW

- TABLE 134 PIPISTREL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 PIPISTREL: DEALS

- TABLE 136 EVIATION AIRCRAFT INC.: BUSINESS OVERVIEW

- TABLE 137 EVIATION AIRCRAFT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 EVIATION AIRCRAFT INC.: DEALS

- TABLE 139 LILIUM N.V.: BUSINESS OVERVIEW

- TABLE 140 LILIUM N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 LILIUM N.V.: DEALS

- TABLE 142 JOBY AVIATION, INC.: BUSINESS OVERVIEW

- TABLE 143 JOBY AVIATION, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 JOBY AVIATION, INC.: DEALS

- TABLE 145 ARCHER AVIATION INC.: BUSINESS OVERVIEW

- TABLE 146 ARCHER AVIATION INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 ARCHER AVIATION INC.: DEALS

- TABLE 148 VOLOCOPTER GMBH: BUSINESS OVERVIEW

- TABLE 149 VOLOCOPTER GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 VOLOCOPTER GMBH.: DEALS

- TABLE 151 SZ DJI TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 152 SZ DJI TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 YUNEEC INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 154 YUNEEC INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 YUNEEC INTERNATIONAL: DEALS

- TABLE 156 AURORA FLIGHT SCIENCES: BUSINESS OVERVIEW

- TABLE 157 AURORA FLIGHT SCIENCES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 AURORA FLIGHT SCIENCES: DEALS

- TABLE 159 VERTICAL AEROSPACE GROUP LTD.: BUSINESS OVERVIEW

- TABLE 160 VERTICAL AEROSPACE GROUP LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 VERTICAL AEROSPACE GROUP LTD.: DEALS

- TABLE 162 HEART AEROSPACE: BUSINESS OVERVIEW

- TABLE 163 HEART AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 HEART AEROSPACE: DEALS

- FIGURE 1 ELECTRIC AIRCRAFT MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 QUARTERLY REVENUE OF MAJOR ELECTRIC AIRCRAFT MANUFACTURERS, 2022–2023

- FIGURE 5 MARKET SIZE CALCULATION

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (DEMAND-SIDE)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY-SIDE)

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 AEROSTRUCTURES SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 11 ROTARY WING SEGMENT ESTIMATED TO DOMINATE MARKET IN 2022

- FIGURE 12 MILITARY SEGMENT ESTIMATED TO ACCOUNT FOR LARGER MARKET SHARE THAN CIVIL SEGMENT IN 2022

- FIGURE 13 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 14 GROWING NEED FOR CLEANER AND QUIETER AIRCRAFT TO DRIVE MARKET FROM 2022 TO 2030

- FIGURE 15 LIGHT & ULTRALIGHT AIRCRAFT SEGMENT TO LEAD MARKET FROM 2022 TO 2030

- FIGURE 16 VTOL SEGMENT TO LEAD MARKET FROM 2022 TO 2030

- FIGURE 17 ELECTRIC AIRCRAFT MARKET IN UK TO REGISTER HIGHEST CAGR FROM 2022 TO 2030

- FIGURE 18 ELECTRIC AIRCRAFT MARKET: MARKET DYNAMICS

- FIGURE 19 RECESSION IMPACT ANALYSIS

- FIGURE 20 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS: ELECTRIC AIRCRAFT MARKET

- FIGURE 22 ELECTRIC AIRCRAFT MARKET: MARKET ECOSYSTEM

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING ELECTRIC AIRCRAFT MARKET

- FIGURE 24 AVERAGE SELLING PRICE OF ELECTRIC AIRCRAFT ACROSS DIFFERENT PLATFORMS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ELECTRIC AIRCRAFT

- FIGURE 26 KEY BUYING CRITERIA FOR ELECTRIC AIRCRAFT PRODUCTS AND SYSTEMS

- FIGURE 27 TECHNOLOGY ADVANCEMENTS IMPACTING ELECTRIC AIRCRAFT MARKET

- FIGURE 28 SUPPLY CHAIN ANALYSIS

- FIGURE 29 LIGHT & ULTRALIGHT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 30 HYBRID WING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 31 BATTERIES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 32 VTOL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 33 CIVIL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 ELECTRIC AIRCRAFT MARKET: REGIONAL SNAPSHOT

- FIGURE 35 NORTH AMERICA ELECTRIC AIRCRAFT MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC ELECTRIC AIRCRAFT MARKET SNAPSHOT

- FIGURE 37 EUROPE ELECTRIC AIRCRAFT MARKET SNAPSHOT

- FIGURE 38 MIDDLE EAST ELECTRIC AIRCRAFT MARKET SNAPSHOT

- FIGURE 39 LATIN AMERICA ELECTRIC AIRCRAFT MARKET SNAPSHOT

- FIGURE 40 AFRICA ELECTRIC AIRCRAFT MARKET SNAPSHOT

- FIGURE 41 MARKET SHARE OF TOP PLAYERS IN ELECTRIC AIRCRAFT MARKET, 2021 (%)

- FIGURE 42 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- FIGURE 43 ELECTRIC AIRCRAFT MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 44 AIRCRAFT ELECTRIC MARKET START-UPS/SMES COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 45 AIRBUS SE.: COMPANY SNAPSHOT

- FIGURE 46 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 47 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

- FIGURE 48 EVE AIR MOBILITY: COMPANY SNAPSHOT

- FIGURE 49 EHANG HOLDINGS LTD.: COMPANY SNAPSHOT

- FIGURE 50 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

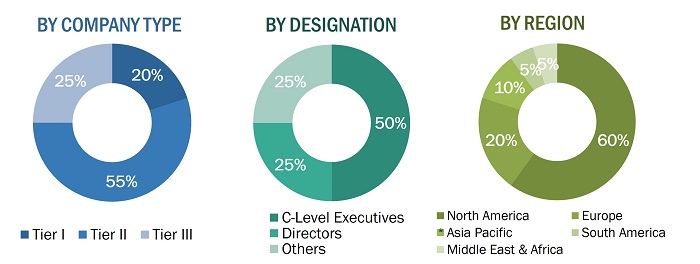

The research study conducted on the electric aircraft market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the Electric Aircraft market. The primary sources considered included industry experts from the Electric Aircraft market as well as raw material providers, Electric Aircraft manufacturers, solution providers, technology developers, alliances, government agencies, and aftermarket service providers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the Electric Aircraft market as well as to assess the growth prospects of the market.

Secondary Research

The ranking of companies operating in the Electric Aircraft market was arrived at based on secondary data made available through paid and unpaid sources, the analysis of product portfolios of the major companies in the market and rating them on the basis of their performance and quality. These data points were further validated by primary sources.

Secondary sources referred for this research study on the Electric Aircraft market included government sources, such as corporate filings that included annual reports, investor presentations, and financial statements, and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by various primary respondents.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from aircraft landing gear vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using electric aircraft were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of aircraft landing gear and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

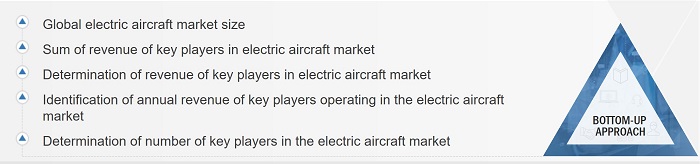

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Electric Aircraft market. The following figure offers a representation of the overall market size estimation process employed for the purpose of this study on the Electric Aircraft market.

The research methodology used to estimate the market size includes the following details:

- Key players in this market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the Electric Aircraft market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market Size Estimation Methodology: Bottom-Up Approach

Market Size Estimation Methodology: Top-Down Approach

DataTriangulation

After arriving at the overall market size through the market size estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the Electric Aircraft market based on platform, type, system, application, technology and Region.

- To analyze demand- and supply-side indicators influencing the growth of the market

- To understand the market structure by identifying high-growth segments and subsegments of the market

- To provide in-depth market intelligence regarding key market dynamics, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To forecast the revenues of market segments with respect to 6 main regions: North America, Europe, Asia Pacific, Middle East, Latin America and Africa.

- To analyze technological advancements and new product launches in the market from 2019 to 2023

- To provide a detailed competitive landscape of the market, in addition to market share analysis of leading players

- To identify the financial position, product portfolio, and key developments of leading players operating in the market

- To analyze micromarkets with respect to their individual growth trends, prospects, and contribution to the overall market

- To provide a comprehensive analysis of business and corporate strategies adopted by key market players.

- To profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Aircraft Market

I want to understand the number of aircraft operations (and petroleum-based jet-fuel consumption) that could go electric by 2030.

Dear Sir or Madam, I am looking for a market research report, which is considering different companies developing e-aircrafts and aircraft strategies but also battery manufacturers. It should emphasize the battery (technologies, challenges, market, prospects, etc. in detail) in dependence on the different approaches by the aircraft manufacturer and load profiles for the system (battery). So, I want to know, if your report is covering the battery as a component in such detail that this is also interesting for battery developers. Can it be extended otherwise? When was it updated lastly and when will it be updated next? Please let me know and send me a sample adjusted to our interests. Many thanks! Best regards, Jan Majchel.

I would like to know more about the concept of MEA and as a novice in this field, I figured this brochure might help me understand better about the different types of MEA out there.