Fall Detection System Market by Component (Accelerometer & Gyroscope, Unimodal/Bimodal, Multimodal Sensors), Algorithm (Simple Threshold, Machine Learning), System (In-Home Landline, In-Home Cellular, Wearable), End User, and Region - Global Forecast to 2022

[154 Pages Report] The overall fall detection system market was valued at USD 358.6 Million in 2016 and is expected to reach USD 497.3 Million by 2022, at a CAGR of 5.58% between 2017 and 2022. This report provides the market size and growth potential of the fall detection system market across different segments such as component, algorithm, system, end user, and geography. The study identifies and analyzes the market dynamics such as drivers, restraints, opportunities, and industry-specific challenges for the market. It also profiles the key players operating in the fall detection system market. Factors such as the increasing geriatric population and the adoption of machine learning approach for detecting fall are expected to propel the growth of the overall market. The base year considered for the study is 2016, and the market size forecast is provided for the period between 2017 and 2022.

According to the forecast provided by MarketsandMarkets, the overall fall detection system market was valued at USD 358.6 Million in 2016 and is expected to reach USD 497.3 Million by 2022, at a CAGR of 5.58% between 2017 and 2022. The growth of this market is driven by the availability of better accessibility to assistance in case of fall leading to reduced medical expenses, increasing demand for smartphone and wearable technology, and increasing demand for multimodal technology.

This report segments the fall detection system market on the basis of component, algorithm, system, end user, and geography. Accelerometers & gyroscopes led the market in 2016. Machine learning methods is the fastest-growing algorithm owing to the fact that machine learning method increases the robustness, sensitivity, and specificity of the fall detection system. Considering the market segmented on the basis of end user, senior citizens home end user held the largest size of the fall detection system market in 2016, while the market for hospitals, nursing, and senior assisted living facilities end users is likely to grow at the highest rate during the forecast period.

Wearable system is expected to hold the largest size of the fall detection system market during the forecast period. This is because wearable systems can be used in homes as well as outside. Furthermore, the availability of devices pre-installed with the machine learning algorithm is expected to be a major driver for the growth of the wearable systems segment. Also, wearable systems are preferred owing to their advantage of cost-efficiency and easy installation.

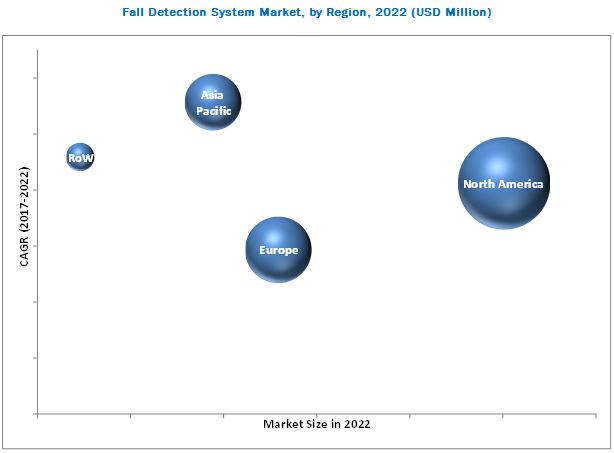

North America held the largest share of the fall detection system market in 2016. Asia Pacific is expected to be the fastest-growing market mainly because of technological innovations and the growing penetration of personal emergency response systems in the country. Along with this, the increasing geriatric population will also act as a key driver for the growth of the fall detection system market.

The major restraints for the companies in the market are the low practicality and acceptability of the technology among elders, and use of data from simulated conditions for designing the fall detection system algorithm. The major vendors in the fall detection system market include Koninklijke Philips N.V. (Netherlands), Connect America (US), The ADT Corporation (US), Tunstall Healthcare Group Ltd. (UK), Medical Guardian LLC (US), Bay Alarm Medical (US), Singapore Technologies Electronics Limited (Singapore), MobileHelp (US), MariGroup Oy (Finland), Mytrex, Inc. dba Rescue Alert (US), Semtech Corporation (Netherlands), AlertOne Services, LLC (US), and LifeFone (US). These players adopted various strategies such as new product developments; mergers and acquisitions; partnerships, agreements, and collaborations to cater to the needs of customers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Fall Detection System Market

4.2 Market, By Component (2017–2022)

4.3 Market, By Algorithm (2017–2022)

4.4 Market, By End User (2017–2022)

4.5 Market Based on Region and End User

4.6 US Held the Largest Share of the Fall Detection System Market in North America (2016)

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Better Accessibility to Assistance in Case of Fall, Leading to Reduced Medical Expenses

5.2.1.2 Increasing Demand for Smartphone and Wearable Technology Based Fall Detection System

5.2.1.3 Increasing Demand for Multimodal Technology

5.2.2 Restraints

5.2.2.1 Low Practicality and Acceptability of the Technology Among Elders

5.2.2.2 Use of Data From Simulated Conditions for Designing the Fall Detection System Algorithm

5.2.3 Opportunities

5.2.3.1 Increasing Geriatric Population

5.2.3.2 Machine Learning Approach for Detecting Fall

5.2.4 Challenges

5.2.4.1 Privacy Concerns Regarding the Use of Fall Detection Systems

5.2.4.2 Sensitivity and Specificity of Fall Detection System

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain Analysis

7 Market, By Component (Page No. - 45)

7.1 Introduction

7.2 Accelerometers & Gyroscopes

7.3 Other Unimodal/Bimodal Sensors

7.4 Multimodal Sensors

8 Market, By Algorithm (Page No. - 54)

8.1 Introduction

8.2 Simple Threshold

8.3 Machine Learning

9 Market, By System (Page No. - 61)

9.1 Introduction

9.2 Wearable Systems

9.3 In-Home Landline System

9.4 In-Home Cellular Systems

10 Market, By End User (Page No. - 71)

10.1 Introduction

10.2 Senior Citizens – Home

10.3 Senior Citizens – Outside

10.4 Hospitals, Nursing, and Senior Assisted Living Facilities

10.5 Lone Workers

10.6 Others

11 Geographical Analysis (Page No. - 86)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 UK

11.3.4 Italy

11.3.5 Spain

11.3.6 Rest of Europe

11.4 Asia Pacific

11.4.1 Japan

11.4.2 China

11.4.3 India

11.4.4 Rest of APAC

11.5 Rest of the World

11.5.1 Middle East and Africa

11.5.2 South America

12 Competitive Landscape (Page No. - 99)

12.1 Introduction

12.2 Key Players in the Fall Detection System Market

12.3 Strategic Benchmarking

12.3.1 Expansion in the US and Canada Market

12.4 Vendor Dive Overview

12.4.1 Vanguards (Leaders)

12.4.2 Dynamic

12.4.3 Innovators

12.4.4 Emerging

12.5 Business Strategies Adopted By Major Players in the Fall Detection System Market (25 Companies)

12.6 Analysis of the Product Portfolio of Major Players in the Fall Detection System Market (25 Companies)

*Top 25 Companies Analyzed for This Study are -Koninklijke Philips N.V.; the ADT Corporation; Medical Guardian LLC; Connect America; Tunstall Healthcare Group Ltd.; Greatcall; Mobilehelp; Bay Alarm Medical; Safe Guardian; Lifefone; Lifestation, Inc.; Singapore Technologies Electronics Limited; Alertone Services, LLC; Life Call Medical Alert System; Walgreen Company; Legrand Assisted Living & Healthcare; Semtech Corporation; Responsenow Medical Alert Systems; Mytrex, Inc. DBA Rescue Alert; Galaxy Medical Alert Systems; Valued Relationships; Care Innovations, LLC; Marigroup Oy; American Senior Safety Agency; and Lifewatch USA

13 Company Profiles (Page No. - 107)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

13.1 Introduction

13.2 Koninklijke Philips N.V.

13.3 Connect America

13.4 ADT Corporation

13.5 Tunstall Healthcare Group Ltd.

13.6 Medical Guardian LLC

13.7 Bay Alarm Medical

13.8 Singapore Technologies Electronics Limited

13.9 Mobilehelp

13.10 Mytrex, Inc. DBA Rescue Alert

13.11 Semtech Corporation

13.12 Alertone Services, LLC

13.13 Lifefone

13.14 Key Innovators

13.14.1 Intel Corporation

13.14.2 Marigroup Oy

13.14.3 Vital Connect Inc.

13.14.4 Blue Willow Systems

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 144)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (64 Tables)

Table 1 Currency Table

Table 2 Fall Detection System Market, 2014–2022 (USD Million)

Table 3 Fall Detection System Market, By Component, 2014–2022 (USD Million)

Table 4 Market for Accelerometers & Gyroscopes, By Algorithm, 2014–2022 (USD Million)

Table 5 Market for Accelerometers & Gyroscopes, By System, 2014–2022 (USD Million)

Table 6 Market for Accelerometers & Gyroscopes, By End User, 2014–2022 (USD Million)

Table 7 Market for Accelerometers & Gyroscopes, By Region, 2014–2022 (USD Million)

Table 8 Market for Other Unimodal/Bimodal Sensors, By Algorithm, 2014–2022 (USD Million)

Table 9 Market for Other Unimodal/Bimodal Sensors, By System, 2014–2022 (USD Million)

Table 10 Market for Other Unimodal/Bimodal Sensors, By End User, 2014–2022 (USD Million)

Table 11 Market for Other Unimodal/Bimodal Sensors, By Region, 2014–2022 (USD Million)

Table 12 Market for Multimodal Sensors, By Algorithm, 2014–2022 (USD Million)

Table 13 Market for Multimodal Sensors, By System, 2014–2022 (USD Million)

Table 14 Market for Multimodal Sensors, By End User, 2014–2022 (USD Million)

Table 15 Market for Multimodal Sensors, By Region, 2014–2022 (USD Million)

Table 16 Fall Detection System Market, By Algorithm, 2014–2022 (USD Million)

Table 17 Market for Simple Threshold, By Component, 2014–2022 (USD Million)

Table 18 Market for Simple Threshold, By System, 2014–2022 (USD Million)

Table 19 Market for Simple Threshold, By End User, 2014–2022 (USD Million)

Table 20 Market for Simple Threshold, By Region, 2014–2022 (USD Million)

Table 21 Market for Machine Learning, By Component, 2014–2022 (USD Million)

Table 22 Market for Machine Learning, By System, 2014–2022 (USD Million)

Table 23 Market for Machine Learning, By End User, 2014–2022 (USD Million)

Table 24 Market for Machine Learning, By Region, 2014–2022 (USD Million)

Table 25 Fall Detection System Market, By System, 2014–2022 (USD Million)

Table 26 Market for Wearable Systems, By Component, 2014–2022 (USD Million)

Table 27 Market for Wearable Systems, By Algorithm, 2014–2022 (USD Million)

Table 28 Market for Wearable Systems, By End User, 2014–2022 (USD Million)

Table 29 Market for Wearable Systems, By Region, 2014–2022 (USD Million)

Table 30 Market for In-Home Landline Systems, By Component, 2014–2022 (USD Million)

Table 31 Market for In-Home Landline Systems, By Algorithm, 2014–2022 (USD Million)

Table 32 Market for In-Home Landline Systems, By End User, 2014–2022 (USD Million)

Table 33 Market for In-Home Landline Systems, By Region, 2014–2022 (USD Million)

Table 34 Market for In-Home Cellular Systems, By Component, 2014–2022 (USD Million)

Table 35 Market for In-Home Cellular Systems, By Algorithm, 2014–2022 (USD Million)

Table 36 Market for In-Home Cellular Systems, By End User, 2014–2022 (USD Million)

Table 37 Market for In-Home Cellular Systems, By Region, 2014–2022 (USD Million)

Table 38 Fall Detection System Market, By End User, 2014–2022 (USD Million)

Table 39 Market for Senior Citizens – Home End User, By Component, 2014–2022 (USD Million)

Table 40 Market for Senior Citizens – Home End User, By Algorithm, 2014–2022 (USD Million)

Table 41 Market for Senior Citizens – Home End User, By System, 2014–2022 (USD Million)

Table 42 Market for Senior Citizens – Home End User, By Region, 2014–2022 (USD Million)

Table 43 Market for Senior Citizens – Outside End User, By Component, 2014–2022 (USD Million)

Table 44 Market for Senior Citizens – Outside End User, By Algorithm, 2014–2022 (USD Million)

Table 45 Market for Senior Citizens – Outside End User, By System, 2014–2022 (USD Million)

Table 46 Market for Senior Citizens – Outside End User, By Region, 2014–2022 (USD Million)

Table 47 Market for Hospitals, Nursing, and Senior Assisted Living Facilities End User, By Component, 2014–2022 (USD Million)

Table 48 Market for Hospitals, Nursing, and Senior Assisted Living Facilities End User, By Algorithm, 2014–2022 (USD Million)

Table 49 Market for Hospitals, Nursing, and Senior Assisted Living Facilities End User, By System, 2014–2022 (USD Million)

Table 50 Market for Hospitals, Nursing, and Senior Assisted Living Facilities End User, By Region, 2014–2022 (USD Million)

Table 51 Market for Lone Worker End User, By Component, 2014–2022 (USD Million)

Table 52 Market for Lone Worker End User, By Algorithm, 2014–2022 (USD Million)

Table 53 Market for Lone Worker End User, By System, 2014–2022 (USD Million)

Table 54 Market for Lone Worker End User, By Region, 2014–2022 (USD Million)

Table 55 Market for Other End Users, By Component, 2014–2022 (USD Million)

Table 56 Market for Other End Users, By Algorithm, 2014–2022 (USD Million)

Table 57 Market for Other End Users, By System, 2014–2022 (USD Million)

Table 58 Market for Other End Users, By Region, 2014–2022 (USD Million)

Table 59 Fall Detection System Market, By Region, 2014–2022 (USD Million)

Table 60 Market in North America, By Country, 2014–2022 (USD Million)

Table 61 Market in Europe, By Country, 2014–2022 (USD Million)

Table 62 Market in Asia Pacific, By Country, 2014–2022 (USD Million)

Table 63 Market in RoW, By Region, 2014–2022 (USD Million)

Table 64 Top 5 Players in the Fall Detection System Market, 2016

List of Figures (73 Figures)

Figure 1 Fall Detection System Market: Research Design

Figure 2 Data Triangulation

Figure 3 Research Flow

Figure 4 Fall Detection System Market (2014–2022)

Figure 5 Market for Multimodal Sensor Expected to Grow at the Highest Rate Between 2017 and 2022

Figure 6 Market for Machine Learning Methods Expected to Grow at A Higher Rate Between 2017 and 2022

Figure 7 Market for Wearable Systems Expected to Grow at the Highest Rate Between 2017 and 2022

Figure 8 North America Held the Largest Size of the Market in 2016

Figure 9 Market Expected to Grow at A Significant Rate During the Forecast Period Owing to Increasing Geriatric Population

Figure 10 Market for Multimodal Sensors Expected to Grow at the Highest Rate During the Forecast Period

Figure 11 Simple Threshold Expected to Lead the Market By 2022

Figure 12 Senior Citizens – Outside End User is Expected to Be the Top Market for Fall Detection System Between 2017 and 2022

Figure 13 Senior Citizen – Home to Hold A Major Share of the Market During the Forecast Period

Figure 14 Market in China Expected to Grow at the Highest Rate During the Forecast Period

Figure 15 Increasing Geriatric Population Acts as the Major Driver for the Fall Detection System Market

Figure 16 Fall Detection System Value Chain in 2016

Figure 17 Market for Multimodal Sensors Expected to Grow at the Highest Rate During the Forecast Period

Figure 18 Market for Accelerometers & Gyroscopes in Asia Pacific Expected to Grow at the Highest Rate During the Forecast Period

Figure 19 Market for Other Unimodal/Bimodal Sensors in Asia Pacific Expected to Grow at the Highest Rate During the Forecast Period

Figure 20 Asia Pacific Expected to Witness the Highest Growth Rate in the Fall Detection System Market for Multimodal Sensors During the Forecast Period

Figure 21 Machine Learning Methods Expected to Witness A Higher Growth Rate in the Fall Detection System Market During the Forecast Period

Figure 22 Market for Simple Threshold in Asia Pacific Expected to Grow at the Highest Rate During the Forecast Period

Figure 23 Market for Machine Learning Method in Asia Pacific Expected to Grow at the Highest Rate During the Forecast Period

Figure 24 Market for Wearable System Expected to Grow at the Highest Rate During the Forecast Period

Figure 25 Asia Pacific Expected to Witness the Highest Growth Rate for the Market for Wearable Systems During the Forecast Period

Figure 26 Market for In-Home Landline Systems in Asia Pacific Expected to Decline at the Lowest Rate During the Forecast Period

Figure 27 Asia Pacific Expected to Witness the Highest Growth Rate for the Market for In-Home Cellular Systems During the Forecast Period

Figure 28 Hospitals, Nursing, and Senior Assisted Living Facilities Expected to Witness the Highest Growth Rate in the Fall Detection Market During the Forecast Period

Figure 29 Asia Pacific Expected to Witness the Highest Growth Rate for Market for Senior Citizens – Home During the Forecast Period

Figure 30 Asia Pacific Expected to Witness the Highest Growth Rate in the Fall Detection Market for Senior Citizens – Outside During the Forecast Period

Figure 31 Asia Pacific Expected to Witness the Highest Growth Rate in the Fall Detection Market for Hospitals, Nursing, and Senior Assisted Living Facilities During the Forecast Period

Figure 32 Asia Pacific Expected to Grow at the Highest Rate in the Fall Detection Market for Lone Worker During the Forecast Period

Figure 33 Asia Pacific Expected to Witness the Highest Growth Rate in the Fall Detection Market for Other End Users During the Forecast Period

Figure 34 Geographic Snapshot of Fall Detector System Market (2017–2022)

Figure 35 Market in Asia Pacific Expected to Grow at the Highest Rate During the Forecast Period

Figure 36 North America: Fall Detection System Market Snapshot

Figure 37 US Expected to Witness the Highest Growth Rate in the Fall Detection Market in North America During the Forecast Period

Figure 38 Europe: Fall Detection System Market Snapshot

Figure 39 Rest of Europe Expected to Witness the Highest Growth Rate in the Fall Detection Market in Europe During the Forecast Period

Figure 40 Asia Pacific: Fall Detection System Market Snapshot

Figure 41 China Expected to Witness the Highest Growth Rate in the Fall Detection Market in Asia Pacific During the Forecast Period

Figure 42 The Middle East & Africa Expected to Witness A Higher Growth Rate in the Fall Detection Market in RoW During the Forecast Period

Figure 43 Market Players Adopted Acquisitions and Partnerships as A Key Strategy for Business Expansion

Figure 44 Strategic Benchmarking: Top Companies Largely Adopted Inorganic Strategies for Expansion in the US and Canada Market (2016)

Figure 45 Dive Chart

Figure 46 Geographic Revenue Mix of the Top Market Players

Figure 47 Koninklijke Philips N.V.: Company Snapshot

Figure 48 Koninklijke Philips N.V.: Product Offering Parameters

Figure 49 Koninklijke Philips N.V.: Business Strategy Parameters

Figure 50 Connect America: Product Offering Parameters

Figure 51 Connect America: Business Strategy Parameters

Figure 52 ADT Corporation: Product Offering Parameters

Figure 53 ADT Corporation: Business Strategy Parameters

Figure 54 Tunstall Healthcare Group Ltd.: Product Offering Parameters

Figure 55 Tunstall Healthcare Group Ltd.: Business Strategy Parameters

Figure 56 Medical Guardian LLC: Product Offering Parameters

Figure 57 Medical Guardian LLC: Business Strategy Parameters

Figure 58 Bay Alarm Medical: Product Offering Parameters

Figure 59 Bay Alarm Medical: Business Strategy Scorecard

Figure 60 Singapore Technologies Electronics Limited: Company Snapshot

Figure 61 Singapore Technologies Electronics Limited: Product Offering Parameters

Figure 62 Singapore Technologies Electronics Limited: Business Strategy Parameters

Figure 63 Mobilehelp: Product Offering Parameters

Figure 64 Mobilehelp: Business Strategy Parameters

Figure 65 Mytrex, Inc. DBA Rescue Alert: Product Offering Parameters

Figure 66 Mytrex, Inc. DBA Rescue Alert: Business Strategy Parameters

Figure 67 Semtech Corporation: Company Snapshot

Figure 68 Semtech Corporation: Product Offering Parameters

Figure 69 Semtech Corporation: Business Strategy Parameters

Figure 70 Alertone Services, LLC: Product Offering Parameters

Figure 71 Alertone Services, LLC: Business Strategy Scorecard

Figure 72 Lifefone: Product Offering Parameters

Figure 73 Lifefone: Business Strategy Parameters

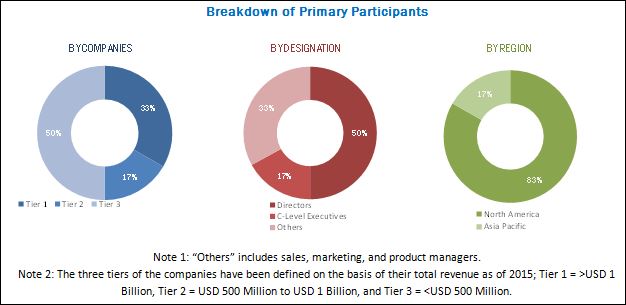

The research methodology used to estimate and forecast the fall detection system market begins with capturing data on key vendor revenues through secondary research. The secondary sources include US National Library of Medicine Association, International Journal of Telemedicine and Applications; annual reports, press releases, investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, websites, directories, and databases, among others. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the size of the overall market from the revenue of the key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting extensive interviews with key industry experts such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primary respondents is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The fall detection system ecosystem includes research and development (R&D) phase, followed by manufacturing and assembly, distribution, marketing and sales, and post-sales services. Koninklijke Philips N.V. (Netherlands), Tunstall Healthcare Group Ltd. (UK), The ADT Corporation (US), Singapore Technologies Electronics Limited (Singapore), and Semtech Corporation (Netherlands) are involved in the manufacturing and assembly of the fall detection system market. These companies further sell these systems either directly to the end users or to suppliers such as Connect America (US), Medical Guardian LLC (US), and Bay Alarm Medical (US).

Key Target Audience

- Original device manufacturers (ODMs)

- Component suppliers

- Research organizations and consulting companies

- Application providers

- Subcomponent manufacturers

- Maintenance and service providers

- Technology providers

- Associations, organizations, forums, and alliances related to fall detection system

Scope of the Report

The fall detection system market has been covered in detail in this report. To provide a holistic picture, the current market demand and forecasts have also been included in the report.

The fall detection system market has been segmented as follows:

By Component

- Accelerometers & Gyroscopes

- Other Unimodal/Bimodal Sensors

- Multimodal Sensors

By Algorithm

- Simple Threshold

- Machine Learning Methods

By System

- Wearable Systems

- In-Home Landline Systems

- In-Home Cellular Systems

By End User:

- Senior Citizens – Home

- Senior Citizens – Outside

- Hospitals, Nursing Homes, And Senior Assisted Living Facilities

- Lone Workers

- Others

By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Market size for 2019 and 2021 for segments such as component, algorithm, system, end user, and geography

- Company information: Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Fall Detection System Market

We are positional tracking tech startup company, recently we are going to make a radar device to apply in the healthcare field. Can you provide us with the scope of your research?

Hello I am doing a project in my management class on the fall-detection market and would greatly appreciate some information regarding data about this. Also would like to understand the market trends and digital technologies in fall detection systems.