Financial Analytics Market by Solution (Financial Functions Analytics and Financial Market Analytics), Application (Wealth Management, Transaction Monitoring, and Customer Management), and Industry Vertical - Global Forecast to 2023

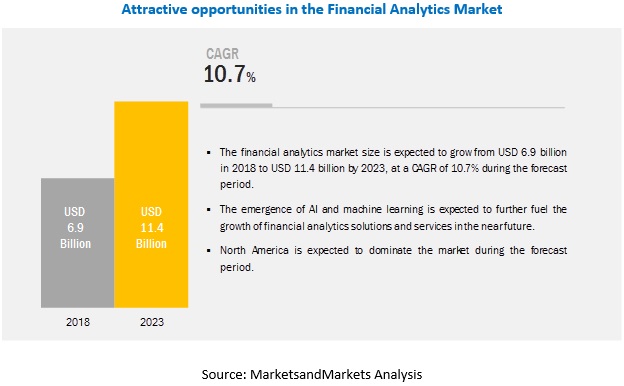

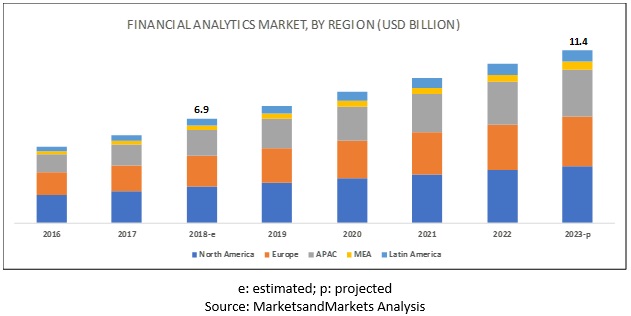

The global Financial Analytics Market is projected to grow significantly, with a valuation of USD 6.9 billion in 2018 and an expected reach of USD 11.4 billion by 2023, leading to a Compound Annual Growth Rate (CAGR) of 10.7% during the forecast period.

Focus on minimizing planning and budgeting cycles, rise of digital transformation initiatives and more awareness about applications of financial analytics solutions are some major drivers leading to the growth of financial analytics market. In the era of severe competition, organizations pay more attention to enhance customer satisfaction and therefore, adopting advanced analytics solutions to gauge 360 degree customer view. More awareness about changing customer behavior is instrumental in assessing customer value and designing consistent omni-channel customer experience model. To ensure improved financial performance, organizations are utilizing financial analytics solutions for improved visibility into revenue, expenses and resource utilization. Adoption of financial analytics solutions provides insights around financial efficiency, operational Key Performance Indicators (KPIs), and product and customer profitability. These improved insights enable organizations to channelize their investments for stronger profits and business performance.

North America to account for the largest market size during the forecast period

This report covers 5 major geographies - North America, Asia Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America. This market is estimated to have North America as the strongest contributor. Growing awareness about applications of analytics solutions, strong innovation focus and organizational focus on enhancing customer experience are some of the key drivers for growth of market in North America. Apart from Banking and Financial Services, retail and healthcare are the other key verticals supporting growth of financial analytics market in North America. Organizations are opting for financial analytics solutions for improved financial forecasting and wealth management processes.

On other hand, growth in Europe will be driven by adoption of financial analytics solutions by Small and Mid-sized Enterprises (SMEs). SMEs in Europe are opting for financial analytics solutions to reduce unnecessary costs and improve RoI. However, Eurozone crisis, low interest rates and skeptical outlook for making major investments are hampering adoption of Financial Analytics solution in European market.

The cloud deployment mode to grow at a higher CAGR during the forecast period

The demand for cloud-based financial analytics solutions is expected to witness strong growth over next 5 years. Speed of deployment, ease of scalability, and 24x7 availability are some of the key drivers for adoption of cloud-based financial analytics solutions. As majority of the organizations aim for improving financial performance, cloud-based solutions are vital due to less operational, maintenance and installation costs. Developing economies in APAC, MEA and Latin America are likely to experience higher growth in financial analytics market due to customizable solutions and ease of adoption. Financial analytics solution providers are collaborating with major cloud service providers like IBM, AWS and Google for strengthening their customer base and improve their capabilities.

Machine learning and artificial intelligence capabilities to fuel the growth of the overall market

Various capabilities of AI based solutions would help to leverage huge volumes of data to unearth business value. The adoption of artificial intelligence in the financial sector can result in improved trust, accuracy, and resilience of the financial ecosystem. Different verticals are utilizing artificial intelligence and machine learning capabilities to improve their investment decision-making processes, strengthen their compliance frameworks and sharpen fraud detection & risk mitigation capabilities. Advanced analysis contributed by artificial intelligence and machine learning solutions would enhance portfolio management processes resulting in higher returns.

Financial analytics solutions to support complex regulatory environments and better financial management

Finance professionals are opting for advanced financial analytics solutions to manage complex regulatory requirements in the era of dynamic regulatory and compliance scenario. Multi-national organizations are required to manage diverse requirements of Basel III, General Data Protection Regulation, Dodd–Frank Wall Street Reform, and Consumer Protection Act. Financial analytics solutions empower organizations to sharpen their fraud detection and risk mitigation capabilities. A minor error in achieving compliance and meeting regulatory requirements can cost organizations loss of major clients and result into significant monetary impact on financial analytics market. Ease of deployment and simplicity of integration are other drivers impacting adoption of financial analytics solutions. Business leaders are leveraging financial analytics solutions for improving their financial positioning. Cash forecasting and risk management capabilities of financial analytics solutions are instrumental in predicting revenue, improving supply chain efficiencies, analyzing key drivers for financial losses, and improving profitability of various business segments.

Key Market Players

The financial analytics market comprises major vendors, such as Oracle (US), IBM (US), Teradata (US), TIBCO Software (US), SAP (Germany), SAS Institute (US), Alteryx (US), Qlik (US), FICO (US), GoodData (US), Birst (US), Google (US), Information Builders (US), Zoho Corporation (US), and Domo (US). The study includes an in-depth competitive analysis of these key players in the global market, along with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Application, Deployment Modes, Organization Size, Industry Vertical, and Region |

|

Regions covered |

North America, APAC, Europe, Latin America, and MEA |

|

Companies covered |

Oracle (US), IBM (US), Teradata (US), TIBCO Software (US), SAP (Germany), SAS Institute (US), Alteryx (US), Qlik (US), FICO (US), GoodData (US), Birst (US), Google (US), Information Builders (US), Zoho Corporation (US), and Domo (US) |

This research report categorizes the financial analytics market based on components, applications, deployment modes, organization size, industry verticals, and regions.

Based on Components, the market is divided into the following segments:

-

Solutions

- Financial Function Analytics

- Financial Market Analytics

-

Services

- Managed Services

- Professional Services

Based on Applications, the financial analytics market is divided into the following segments:

- Wealth Management

- Governance, Risk, and Compliance Management

- Financial Forecasting and Budgeting

- Customer Management

- Transaction Monitoring

- Claim Management

- Fraud Detection and Prevention

- Stock Management

Based on Deployment modes, the market is divided into the following segments:

- On-premises

- Cloud

Based on Organization size, the financial analytics market is divided into the following segments

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on Industry Verticals, the market is divided into the following segments

- Banking, Financial Services, and Insurance (BFSI)

- Telecom and IT

- Government

- Energy and Utilities

- Manufacturing and Automotive

- Healthcare and Pharmaceutical

- Retail and eCommerce

- Media and Entertainment

- Transportation and Logistics

- Others (real estate and education)

Based on Regions, the financial analytics market is divided into the following regions:

- North America

- Europe

- APAC

- Latin America

- MEA

Recent Developments:

- In February 2019, Oracle’s Financial Services Global Business Unit collaborated with Blue Prism, a Robotic Process Automation (RPA) software provider, to integrate Oracle's Financial Services Financial Crime and Compliance Management suite with Blue Prism's Digital Workforce solution. The partnership would combine RPA capabilities with the automation of critical compliance tasks. It would further help financial institutions in the investigation, resolution, and reporting of financial crimes and suspicious activities.

- In February 2019, IBM Watson announced major collaborations and partnerships with several industry partners, including Garmin Health, Guardhat, Mitsufuji, and SmartCone, to improve employee safety in hazardous environments. The partnerships and collaborations would lead to new offerings that would leverage the benefits of the IoT technology in association with IBM’s existing enterprise asset management platform - Maximo.

-

In January 2019, SAP announced a new solution, S/4 Hana, for financial products. The solution provides a central hub to manage data between operational and finance systems, thereby streamlining accounting flows and supporting increased transparency and control. It also helps organizations in performing data analysis for financial steering.

Key Questions Addressed by the Report:

- What are the opportunities in the market?

- What is the competitive landscape of the market?

- What are the key regulations that will impact the market?

- How are mergers and acquisitions evolving in the market?

- What are the dynamics of the financial analytics market?

Frequently Asked Questions (FAQ):

What is the estimated industry size of Financial Analytics?

Financial Analytics Market size in terms of revenue was valued USD 6.9 billion and is anticipated to increase up to USD 11.4 billion by 2023.What is the growth rate of Financial Analytics Market?

The global Financial Analytics Market is registering a CAGR of 10.7% to 2023.Which region has highest growth rate in Financial Analytics Market?

North America to account for largest market share during forecast periodWhich are the top companies to hold the market share in Financial Analytics?

The major vendors in Financial Analytics Market include Oracle (US), IBM (US), Teradata (US), TIBCO Software (US), SAP (Germany), SAS Institute (US), Alteryx (US), Qlik (US), FICO (US), GoodData (US), Birst (US), Google (US), Information Builders (US), Zoho Corporation (US), and Domo (US).What are the factors driving the Financial Analytics Market?

The key drivers supporting the growth of the Financial Analytics Market include Machine learning and artificial intelligence capabilities to fuel the growth of the overall marketWhat are the services offering by the Financial Analytics Market?

The services offered in the Financial Analytics Market are Managed Services and Professional Services.To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Financial Analytics Market Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.4 Assumptions for the Study

2.5 Limitations of the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Market

4.2 Market: Market Share Across Regions

5 Market Overview and Industry Trends (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Need for Reducing Planning and Budgeting Cycles

5.2.1.2 Emergence of New IT Applications and Infrastructure Such as Big Data and Advanced Analytics

5.2.2 Restraints

5.2.2.1 Surge of New Regulations and Financial Standards

5.2.3 Opportunities

5.2.3.1 Increasing Adoption of Predictive Analytics Across Industries

5.2.3.2 Evolution of AI and Machine Learning

5.2.4 Challenges

5.2.4.1 Integration of Data From Data Silos

5.3 Financial Analytics Market Trends

5.3.1 Financial Management Ecosystem

5.3.2 Regulations

5.3.2.1 Basel Committee on Banking Supervision (BCBS)

5.3.2.2 Basel III

5.3.2.3 Dodd Frank Act

5.3.2.4 General Data Protection Regulation (GDPR)

5.3.2.5 International Financial Reporting Standards (IFRS)

5.3.2.6 Markets in Financial Instruments Directive (MFID)

5.3.2.7 Payment Card Industry Data Security Standard (PCI DSS)

5.3.2.8 Sarbanes-Oxley Act of 2002

5.3.3 Market: Use Cases

5.3.3.1 Use Case #1: Deliver Personalized Interactions

5.3.3.2 Use Case #2: Improving Performance Measures

5.3.3.3 Use Case #3: Increase Revenue and Decrease Customers’ Business Inefficiencies

5.3.4 Market: Future Outlook

5.3.4.1 Ai-Enabled Finance

6 Financial Analytics Market, By Component (Page No. - 41)

6.1 Introduction

6.2 Solutions

6.2.1 Financial Function Analytics

6.2.2 Financial Market Analytics

6.3 Services

6.3.1 Managed Services

6.3.2 Professional Services

6.3.2.1 Support and Maintenance

6.3.2.2 Deployment and Integration

6.3.2.3 Consulting

7 Market By Application (Page No. - 49)

7.1 Introduction

7.2 Wealth Management

7.2.1 Capital Management

7.2.2 Asset Liability Management

7.2.3 Investment Management

7.2.4 Others

7.3 Governance, Risk, and Compliance Management

7.3.1 Credit and Market Risk Management

7.3.2 Governance and Compliance Management

7.4 Financial Forecasting and Budgeting

7.4.1 Cash Flow Analytics

7.4.2 Revenue Prediction

7.5 Customer Management

7.5.1 Customer Experience Analytics

7.5.2 Customer Profitability Analytics

7.6 Transaction Monitoring

7.7 Claim Management

7.7.1 Insurance Management

7.8 Fraud Detection and Prevention

7.9 Stock Management

7.9.1 Debt Management

7.9.2 Equity Management

7.10 Others

8 Financial Analytics Market, By Deployment Model (Page No. - 60)

8.1 Introduction

8.2 On-Premises

8.3 Cloud

9 Financial Analytics Industry, By Organization Size (Page No. - 64)

9.1 Introduction

9.2 Large Enterprises

9.3 Small and Medium-Sized Enterprises

10 Financial Analytics Market, By Industry Vertical (Page No. - 68)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Manufacturing and Automotive

10.4 Retail and Ecommerce

10.5 Telecommunications and IT

10.6 Transportation and Logistics

10.7 Healthcare and Pharmaceuticals

10.8 Energy and Utilities

10.9 Government

10.10 Others

11 Financial Analytics Market, By Region (Page No. - 79)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.3 Europe

11.3.1 Germany

11.3.2 UK

11.3.3 France

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 Japan

11.4.2 Singapore

11.4.3 China

11.4.4 India

11.4.5 Rest of APAC

11.5 Latin America

11.5.1 Brazil

11.5.2 Mexico

11.5.3 Rest of Latin America

11.6 Middle East and Africa

11.6.1 Middle East

11.6.2 Africa

12 Competitive Landscape (Page No. - 105)

12.1 Competitive Leadership Mapping

12.1.1 Visionary Leaders

12.1.2 Innovators

12.1.3 Dynamic Differentiators

12.1.4 Emerging Companies

12.2 Strength of Product Portfolio

12.3 Business Strategy Excellence

13 Company Profiles (Page No. - 109)

(Business Overview, Solutions, Platform & Software, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.1 Oracle

13.2 IBM

13.3 SAP

13.4 SAS Institute

13.5 Alteryx

13.6 Tibco Software

13.7 Fair Isaac Corporation (FICO)

13.8 Teradata

13.9 Qlik

13.10 Gooddata

13.11 Birst

13.12 Google

13.13 Information Builders

13.14 Zoho Corporation

13.15 Domo

*Details on Business Overview, Solutions, Platform & Software, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 141)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customization

14.5 Related Reports

14.6 Author Details

List of Tables (76 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2018

Table 2 Financial Analytics Market Size and Y-O-Y, 2016–2023 (USD Million, Y-O-Y %)

Table 3 Market Size, By Component, 2016–2023 (USD Million)

Table 4 Solutions: Market Size, By Type, 2016–2023 (USD Million)

Table 5 Financial Function Analytics Market Size, By Region, 2016–2023 (USD Million)

Table 6 Financial Market Analytics Market Size, By Region, 2016–2023 (USD Million)

Table 7 Services: Market Size, By Region, 2016–2023 (USD Million)

Table 8 Services: Market Size, By Type, 2016–2023 (USD Million)

Table 9 Professional Services: Market Size, By Type, 2016–2023 (USD Million)

Table 10 Market Size, By Application, 2016–2023 (USD Million)

Table 11 Wealth Management: Market Size, By Region, 2016–2023 (USD Million)

Table 12 Governance, Risk, and Compliance Management: Market Size, By Region, 2016–2023 (USD Million)

Table 13 Financial Forecasting and Budgeting: Financial Analytics Market Size, By Region, 2016–2023 (USD Million)

Table 14 Customer Management: Market Size, By Region, 2016–2023 (USD Million)

Table 15 Transaction Monitoring: Market Size, By Region, 2016–2023 (USD Million)

Table 16 Claim Management: Market Size, By Region, 2016–2023 (USD Million)

Table 17 Fraud Detection and Prevention: Market Size, By Region, 2016–2023 (USD Million)

Table 18 Stock Management: Market Size, By Region, 2016–2023 (USD Million)

Table 19 Others: Market Size, By Region, 2016–2023 (USD Million)

Table 20 Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 21 On-Premises: Market Size, By Region, 2016–2023 (USD Million)

Table 22 Cloud: Market Size, By Region, 2016–2023 (USD Million)

Table 23 Market Size, By Organization Size, 2016–2023 (USD Million)

Table 24 Large Enterprises: Financial Analytics Market Size, By Region, 2016–2023 (USD Million)

Table 25 Small and Medium-Sized Enterprises: Market Size, By Region, 2016–2023 (USD Million)

Table 26 Market Size, By Vertical, 2016–2023 (USD Million)

Table 27 Banking, Financial Services, and Insurance: Market Size, By Region, 2016–2023 (USD Million)

Table 28 Manufacturing and Automotive: Market Size, By Region, 2016–2023 (USD Million)

Table 29 Retail and Ecommerce: Market Size, By Region, 2016–2023 (USD Million)

Table 30 Telecommunications and IT: Market Size, By Region, 2016–2023 (USD Million)

Table 31 Transportation and Logistics: Market Size, By Region, 2016–2023 (USD Million)

Table 32 Healthcare and Pharmaceuticals: Market Size, By Region, 2016–2023 (USD Million)

Table 33 Energy and Utilities: Market Size, By Region, 2016–2023 (USD Million)

Table 34 Government: Market Size, By Region, 2016–2023 (USD Million)

Table 35 Others: Market Size, By Region, 2016–2023 (USD Million)

Table 36 Market Size, By Region, 2016–2023 (USD Million)

Table 37 North America: Financial Analytics Market Size, By Component, 2016–2023 (USD Million)

Table 38 North America: Market Size, By Solutions, 2016–2023 (USD Million)

Table 39 North America: Market Size, By Service, 2016–2023 (USD Million)

Table 40 North America: Market Size, By Application, 2016–2023 (USD Million)

Table 41 North America: Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 42 North America: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 43 North America: Market Size, By Industry Vertical, 2016–2023 (USD Million)

Table 44 North America: Market Size, By Country, 2016–2023 (USD Million)

Table 45 Europe: Financial Analytics Market Size, By Component, 2016–2023 (USD Million)

Table 46 Europe: Market Size, By Solutions, 2016–2023 (USD Million)

Table 47 Europe: Market Size, By Services, 2016–2023 (USD Million)

Table 48 Europe: Market Size, By Application, 2016–2023 (USD Million)

Table 49 Europe: Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 50 Europe: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 51 Europe: Market Size, By Industry Vertical, 2016–2023 (USD Million)

Table 52 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 53 Asia Pacific: Financial Analytics Market Size, By Component, 2016–2023 (USD Million)

Table 54 Asia Pacific: Market Size, By Solutions, 2016–2023 (USD Million)

Table 55 Asia Pacific: Market Size, By Services, 2016–2023 (USD Million)

Table 56 Asia Pacific: Market Size, By Application, 2016–2023 (USD Million)

Table 57 Asia Pacific: Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 58 Asia Pacific: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 59 Asia Pacific: Market Size, By Industry Vertical, 2016–2023 (USD Million)

Table 60 Asia Pacific: Market Size, By Industry Vertical, 2016–2023 (USD Million)

Table 61 Latin America: Financial Analytics Market Size, By Component, 2016–2023 (USD Million)

Table 62 Latin America: Market Size, By Solutions, 2016–2023 (USD Million)

Table 63 Latin America: Market Size, By Services, 2016–2023 (USD Million)

Table 64 Latin America: Market Size, By Application, 2016–2023 (USD Million)

Table 65 Latin America: Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 66 Latin America: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 67 Latin America: Market Size, By Industry Vertical, 2016–2023 (USD Million)

Table 68 Latin America: Market Size, By Countries, 2016–2023 (USD Million)

Table 69 Middle East and Africa: Financial Analytics Market Size, By Component, 2016–2023 (USD Million)

Table 70 Middle East and Africa: Market Size, By Solutions, 2016–2023 (USD Million)

Table 71 Middle East and Africa: Market Size, By Services, 2016–2023 (USD Million)

Table 72 Middle East and Africa: Market Size, By Application, 2016–2023 (USD Million)

Table 73 Middle East and Africa: Market Size, By Deployment Model, 2016–2023 (USD Million)

Table 74 Middle East and Africa: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 75 Middle East and Africa: Market Size, By Industry Vertical, 2016–2023 (USD Million)

Table 76 Middle East and Africa: Market Size, By Region, 2016–2023 (USD Million)

List of Figures (34 Figures)

Figure 1 Financial Analytics Market: Research Design

Figure 2 Market: Bottom-Up and Top-Down Approaches

Figure 3 Market to Witness High Growth During the Forecast Period

Figure 4 Market, By Component (2018 –2023)

Figure 5 Market, By Solution (2018–2023)

Figure 6 Market, By Service (2018–2023)

Figure 7 Market, By Application (2018–2023)

Figure 8 Market, By Deployment Model (2018–2023)

Figure 9 Market, By Industry Vertical (2018–2023)

Figure 10 Increasing Adoption of Predictive Analytics Across Industries, Coupled With Evolution of AI Capabilities are Expected to Be the Major Factors Contributing to the Growth of the Financial Analytics Market

Figure 11 North America to Hold the Highest Market Share in 2018

Figure 12 Drivers, Restraints, Opportunities, and Challenges: Market

Figure 13 Solutions Segment to Account for A Larger Market Size During the Forecast Period

Figure 14 Financial Market Analytics Segment to Grow at A Higher CAGR During the Forecast Period

Figure 15 Customer Management Segment to Grow at the Highest CAGR During the Forecast Period

Figure 16 Cloud Deployment Model to Grow at A Higher CAGR During the Forecast Period

Figure 17 Small and Medium-Sized Enterprises to Grow at A Higher CAGR During the Forecast Period

Figure 18 Retail and Ecommerce Industry Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 19 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Financial Analytics Market (Global) Competitive Leadership Mapping, 2018

Figure 23 Oracle: Company Snapshot

Figure 24 SWOT Analysis: Oracle

Figure 25 IBM: Company Snapshot

Figure 26 SWOT Analysis: IBM

Figure 27 SAP: Company Snapshot

Figure 28 SAP: SWOT Analysis

Figure 29 SAS Institute: Company Snapshot

Figure 30 SWOT Analysis: SAS Institute

Figure 31 Alteryx: Company Snapshot

Figure 32 SWOT Analysis: Tibco Software

Figure 33 Fair Isaac Corporation: Company Snapshot

Figure 34 Teradata: Company Snapshot

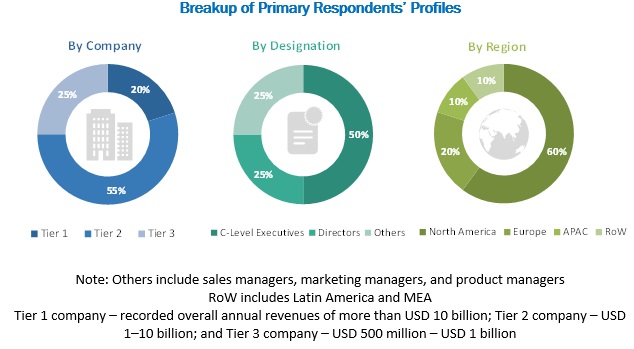

The study involved 4 major activities to estimate the current market size of the financial analytics market. Exhaustive secondary research was conducted to collect in-depth market insights, identify adjacent markets, and the parent market. The next step was to validate the findings, assumptions, and market size estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research process leveraged the information available through online sources, along with databases such as D&B Hoovers, Bloomberg Businessweek, and Factiva. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers; certified publications and articles by recognized authors; gold standard and silver standard websites; financial analytics technology Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Industry experts from both supply and demand sides of the financial analytics market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, related key executives from various vendors who provide financial analytics software, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For estimating and forecasting the financial analytics market and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined with the help of primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the precise value of the overall parent market size was estimated. This market size was used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the financial analytics market based on components, applications, deployment modes, organization size, industry verticals, and regions

- To provide detailed information about the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape of the market

- To forecast the revenue of the market’s segments with respect to 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their recent developments and positions in the global market

- To analyze the competitive developments, such as partnerships, collaborations, acquisitions, new product launches and product enhancements, and new business strategies, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Financial Analytics Market