Fire Protection System Pipes Market by Type (Seamless, Welded), Material (Steel, CPVC, Copper), Application (Fire Suppression System, Fire Sprinkler System), End-use Industry(Residential, Industrial, Commercial), and Region- Global Forecast to 2027

Fire Protection System Pipes Market

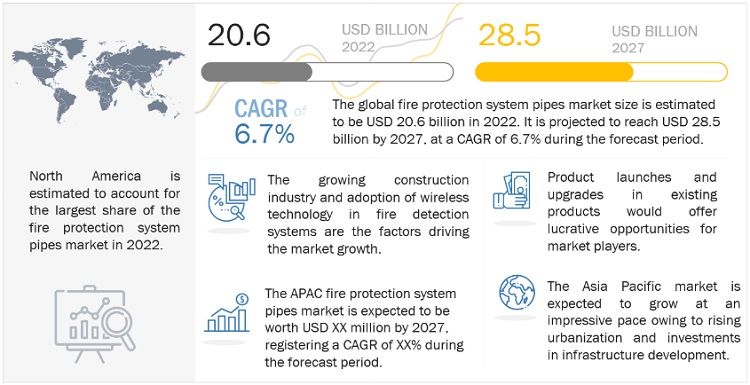

The global fire protection system pipes market was valued at USD 20.6 billion in 2022 and is projected to reach USD 28.5 billion by 2027, growing at a cagr 6.7% from 2022 to 2027. Growth of the market is fueled by the growth of the construction industry, increase in loss of human lives and property due to fire breakouts, stringent regulatory compliances, and rise in the adoption of wireless technology in fire detection systems.

Attractive Opportunities in the Fire Protection System Pipes Market

Note: e – estimated, p - projected

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Fire Protection System Pipes Market Dynamics

Drivers: Increasing urbanization and infrastructure development

The construction industry has been growing quickly in the past few years. According to the Global Construction Perspective, the global construction market is projected to grow to USD 8 trillion by 2030. Growth in the construction industry in the US is attributed to the high demand for housing and commercial places. The construction industry in Asia Pacific and Europe is expected to grow significantly over the next few years, driven by increasing infrastructure spending in both regions despite the challenges in the financial market.

Restraints: High installation and maintenance costs

High initial investments are required for the implementation of fire protection systems. This is due to the complexity of networks and the need to develop sophisticated tools to counter a fire situation. Due to this, vendors need to upgrade their solutions and develop new technologies regularly. Companies are spending a large amount of money on developing these advanced technologies, thereby increasing the cost of procurement for enterprises and government agencies to provide complete fire protection to infrastructure.

Opportunities: Periodic revision of regulatory compliance to increase fire safety

Authorities in most developed countries, such as the US, Canada, and Japan, have amended their standard building codes for mandates related to fire protection system installations. For example, the impact of the Sarbanes–Oxley Act on US-based companies has changed the fiduciary responsibilities of executive leadership, which now is not just about financial reporting but extends to all areas of risk management, including safety concerns. As a result, firms are spending millions of dollars to evaluate and correct shortcomings in the fire protection systems of their facilities, especially in locations where firefighting infrastructure is weak. Further, the Fire Safety Act in the UK received Royal Assent on 29 April 2021 and commenced on 16 May 2022. The Act amends the Regulatory Reform Order 2005, named the Fire Safety Order. This Act specifies that responsible persons (RPs) living in residential buildings must manage and reduce the risk of fire for the structure and external walls of the building, which includes cladding, windows, balconies, and entrance doors to individual flats that open into common parts.

Challenges: Lack of configuration and integration in fire protection solutions

The integration of user interface when numerous solutions are used in a control mechanism is a major challenge for fire protection system pipes market. If fire protection system pipes are directly connected to a centralised building control system, it can be effective and economical. This will enable information to be gathered from a central point and follow-up regulatory actions to be initiated immediately in case of emergency.

Welded pipes dominated fire protection system pipes market

The welded segment accounted for the larger share of the market in 2021. The higher demand for welded pipes is mainly attributed to their lower price when compared to seamless pipes.

Asia Pacific is the fastest-growing region for welded pipes in the fire protection system pipes market. The growth of this market is attributed to the rising demand from the domestic market and rapid growth in end-use industries, such as oil & gas, marine, and construction.

Countries such as China, India, Vietnam, and Indonesia are identified as high-growth markets as there are increasing opportunities and demand for fire protection system pipes. Markets in countries, such as Vietnam and Indonesia, are growing at high rates in product finishes, marine, and other heavy industries.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is the fastest-growing epoxy adhesives market.

Asia Pacific is a major market of fire protection system pipes, and is expected to grow faster during the forecast period. The growing manufacturing industries, cheap labor, high economic growth rate attributed to the growth of the fire protection system pipes market. Other factors such as global shift of production and consumption capacities from developed markets to emerging markets also contributes to the growth of the fire protection system pipes market in Asia Pacific.

Asia Pacific has more than half the world’s population and is increasingly becoming an important region for global trade and commerce. Japan, China, South Korea, and India are the major manufacturers of raw materials used in fire protection system pipes. Each of these countries strives to stimulate domestic consumption, which is expected to play an important role in driving the demand for fire protection system pipes during the forecast period.

Key Market Players

Johnson Controls (Ireland), Tata Steel (India), Simona AG (Germany), Astral Pipes (India), China Lesso (China) are the key players in the global fire protection system pipes market.

Johnson Controls is a provider of sustainable and smart buildings, industrial refrigeration, retail solutions, batteries, and oil and gas products. The company conducts its business in four business segments: Building Solution North America, Building Solutions EMEA/LA, Building Solutions Asia Pacific, Global Products. It offers fire protection system pipes through all the four segments.

Fire Protection System Pipes Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 20.6 billion |

|

Revenue Forecast in 2027 |

USD 28.5 billion |

|

CAGR |

6.7% |

|

Years Considered for the study |

2020-2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD) |

|

Segments |

By Type |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

Johnson Controls (Ireland), Tata Steel (India), Simona AG (Germany), Astral Pipes (India), and China Lesso (China). A total of 23 players have been covered. |

This research report categorizes the fire protection systems pipes market based on Type, End-use Industry, and Region.

By Type:

- Seamless Pipes

- Welded Pipes

By Material:

- Steel

- CPVC

- Copper

- Others

By Application:

- Fire Suppression System

- Fire Sprinkler System

By End-use Industry:

- Residential

- Industrial

- Commercial

By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In November 2022, Johnson Controls launched OpenBlue Enterprise Manager (OBEM) on Alibaba Cloud, a cloud computing and artificial intelligence service provider. This collaboration helps buildings to reduce carbon footprints, improve operational efficiency, optimize asset performance, and occupant health and experience. It is also expected to help Johnson Controls to expand its presence in the Chinese market.

- In November 2022, Zekelman Industries signed a definitive agreement to acquire the asset of EXLTUBE from SPS Companies, Inc., A manufacturer of mechanical tubing, hollow structural sections, standard pipes, and speciality products. This acquisition strengthened the manufacturing capabilities of steel tube and pipe of Zekelman Industries. It is expected to also add-on three co-located mills and 530,000+ square feet of warehouse and manufacturing space in the Kansas city region. This acquisition is expected to improve the service and enhance its product portfolio.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of fire protection system pipes?

The global fire protection system pipes market is driven by increasing urbanization and infrastructure development.

What are the major applications for fire protection system pipes?

The major applications of fire protection system pipes are fire sprinkler system and fire suppression system.

Who are the major manufacturers?

Johnson Controls (Ireland), Tata Steel (India), Simona AG (Germany), Astral Pipes (India), China Lesso (China) are some of the leading players operating in the global fire protection system pipes market.

Why fire protection system pipes are gaining market share?

The growth of this market is attributed to the increasing urbanization and infrastructure development. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing urbanization and infrastructure development- Rising number of fire incidents- Strict government regulations pertaining to fire protection- Growing adoption of wireless technology in fire detection systems- Technological advancements and innovations in construction industryRESTRAINTS- High installation and maintenance costs- Issues of false alarms and detection failures- High cost of smart detectorsOPPORTUNITIES- Periodic revision of regulatory compliance to increase fire safetyCHALLENGES- Lack of integration and configuration in fire protection solutions- Design and maintenance of fire sprinklers

-

5.3 VALUE CHAIN OVERVIEWRESEARCH & DEVELOPMENTRAW MATERIAL- Steel- CPVC- CopperMANUFACTURING PROCESS- Seamless pipe- Welded pipeEND-USE INDUSTRIES- Residential- Commercial- Industrial

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.5 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.6 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTTRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

- 5.7 SUPPLY CHAIN CRISIS SINCE COVID-19 PANDEMIC

-

5.8 GLOBAL SCENARIOSCHINA- China’s debt problem- Australia-China trade war- Environmental commitmentsEUROPE- Political instability in Germany- Energy crisis in Europe

-

5.9 ECOSYSTEM ANALYSIS

-

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.11 TECHNOLOGY ANALYSISINTERNET OF THINGS (IOT)

-

5.12 CASE STUDY ANALYSISSARACEN FIRE PROTECTION LIMITED PROVIDED FIRE SYSTEM FOR FOOD PROCESSING PLANTS IN ENGLAND

-

5.13 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON MARKETSTANDARDS

- 5.14 KEY CONFERENCES & EVENTS IN 2023–2024

- 6.1 INTRODUCTION

-

6.2 SEAMLESSHIGH STRENGTH AND PRESSURE HANDLING CAPACITY TO BOOST DEMAND

- 6.3 SEAMLESS PIPES

-

6.4 WELDED PIPESLONGITUDINAL SEAM AND SPIRAL WELD TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 STEELSUPERIOR RIGIDITY AND HIGH-PRESSURE HANDLING CAPACITY OF STEEL TO INCREASE DEMAND

-

7.3 CARBON STEELRESIDENTIAL AND COMMERCIAL SECTORS TO INCREASE DEMAND FOR PIPES MADE FROM CARBON STEEL

-

7.4 STAINLESS STEELEXCELLENT CHEMICAL AND CORROSION RESISTANCE OF STEEL PIPES TO DRIVE DEMAND

-

7.5 ALLOY STEELEXCELLENT PROPERTIES OF ALLOY STEEL TO DRIVE DEMAND

-

7.6 CPVCCPVC PIPES IN LIGHT HAZARDOUS OCCUPANCIES TO BOOST DEMAND

-

7.7 COPPERHIGH RIGIDITY AND LIGHTWEIGHT PROPERTIES TO INCREASE DEMAND FOR COOPER PIPESOTHERS

- 8.1 INTRODUCTION

-

8.2 FIRE SUPPRESSION SYSTEMDIFFERENT FIRE SUPPRESSOR MATERIALS USED BASED ON FIRE TYPEFIRE SUPPRESSION REAGENTS- Chemical fire suppression reagents- Gaseous system- Water system- Foam system

-

8.3 FIRE SPRINKLER SYSTEMRISE IN COMMERCIAL BUILDINGS, SMART BUILDINGS, AND INDUSTRIES TO BOOST DEMANDWET FIRE SPRINKLER SYSTEMDRY FIRE SPRINKLER SYSTEMPRE-ACTION FIRE SPRINKLER SYSTEMDELUGE FIRE SPRINKLER SYSTEMOTHER SPRINKLER SYSTEMS

- 9.1 INTRODUCTION

-

9.2 RESIDENTIALSTRINGENT REGULATIONS FOR RESIDENTIAL APPLICATIONS TO DRIVE MARKET

-

9.3 COMMERCIALGROWING CONCERNS OVER FIRE HAZARDS TO DRIVE MARKETEDUCATIONAL INSTITUTES- Water-based fire sprinkler systems used in educational institutes to drive marketOFFICE BUILDINGS- Growing urbanization to support market growthHEALTHCARE- Growing need for enhanced safety of patients to boost demandHOSPITALITY- Growing use of water-based fire protection systems in hotels to drive marketOTHERS

-

9.4 INDUSTRIALOIL& GAS AND MINING AND ENERGY & POWER TO SUPPORT MARKETENERGY & POWER- High demand for fire protection systems for safety of workforce and properties to drive marketGOVERNMENT- Extensive use of gaseous and water mist sprinklers in public facilities to drive marketMANUFACTURING- Evolving regulations to drive marketOIL & GAS AND MINING- High use of gas-based suppression systems and sprinkler systems to increase demandTRANSPORTATION & LOGISTICS- Increasing demand for swift and competent response to fire incidents to augment market growthOTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Rising awareness about benefits of fire protection systemsCANADA- Growing adoption of advanced fire protection systems in new constructionsMEXICO- Investments in infrastructure development

-

10.3 EUROPEGERMANY- End-use industries to drive demandUK- Government regulations to boost demandFRANCE- Stringent fire safety regulations to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICCHINA- Mandatory installation of fire protection systems to increase demandJAPAN- Rising public awareness about fire safety to increase demandSOUTH KOREA- Government regulations on fire safety to drive marketREST OF ASIA PACIFIC

-

10.5 SOUTH AMERICABRAZIL- Public safety regulations to support marketARGENTINA- Mining segment to continue driving marketREST OF SOUTH AMERICA

-

10.6 MIDDLE EAST & AFRICAMIDDLE EAST- High demand from oil & gas industry to drive marketAFRICA- Growing urbanization to support market growth

- 11.1 OVERVIEW

-

11.2 MARKET SHARE ANALYSISMARKET RANKING ANALYSISTATA STEELJOHNSON CONTROLSJINDAL INDUSTRIES PVT. LTD.SIMONA AGASTRAL LTD.

- 11.3 COMPANY REVENUE ANALYSIS

-

11.4 COMPANY EVALUATION QUADRANT MATRIX, 2021STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.5 SMALL & MEDIUM-SIZED ENTERPRISES (SMES) MATRIX, 2021PROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIES

- 11.6 STRENGTH OF PRODUCT PORTFOLIO

-

11.7 COMPETITIVE BENCHMARKINGMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIX

- 11.8 COMPETITIVE SITUATION & TRENDS

-

12.1 KEY PLAYERSJOHNSON CONTROLS- Business overview- Products offered- MnM viewTATA STEEL- Business overview- Products offered- MnM viewSIMONA AG- Business overview- Products offered- MnM viewASTRAL LTD.- Business overview- Products offered- MnM viewCHINA LESSO- Business overview- Products offered- MnM viewOCTAL STEEL- Business overview- Products offeredJINDAL INDUSTRIES PVT. LTD.- Business overview- Products offeredAQUATHERM- Business overview- Products offeredZEKELMAN INDUSTRIES- Business overview- Products offered- Recent developmentsTPMCSTEEL- Business overview- Products offeredFEDERAL STEEL SUPPLY- Business overview- Products offered

-

12.2 OTHER PLAYERSWEIFANG EAST STEEL PIPE- Products offeredTRIANGLE FIRE SYSTEMS- Products offeredBORUSAN MANNESMANN- Products offeredJAKOB ESCHBACH- Products offeredZINCHITALIA SPA- Products offeredRAWHIDE FIRE HOSE LLC- Products offeredBULL MOOSE TUBE COMPANY- Products offeredNEWAGE FIRE PROTECTION INDUSTRIES PVT. LTD.- Products offeredMERCEDES TEXTILES- Products offeredGUARDIAN FIRE EQUIPMENT INC.- Products offeredKAN-THERM GMBH- Products offeredMINIMAX- Products offeredENGINEERED FIRE PIPING- Products offered

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH LIMITATIONS

- TABLE 3 RISK ANALYSIS

- TABLE 4 FIRE PROTECTION SYSTEM PIPES MARKET SNAPSHOT, 2021 VS. 2027

- TABLE 5 FIRE PROTECTION SYSTEM PIPES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES (%)

- TABLE 7 KEY BUYING CRITERIA FOR FIRE PROTECTION SYSTEM PIPES

- TABLE 8 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE

- TABLE 9 FIRE PROTECTION SYSTEM PIPES MARKET: SUPPLY CHAIN ECOSYSTEM

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 CODES AND STANDARDS RELATED TO FIRE DETECTION

- TABLE 15 CODES AND STANDARDS RELATED TO FIRE SUPPRESSION

- TABLE 16 FIRE PROTECTION SYSTEM PIPES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 17 FIRE PROTECTION SYSTEM PIPE MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 18 CHARACTERISTICS OF SEAMLESS FIRE PROTECTION SYSTEM PIPES

- TABLE 19 SEAMLESS: FIRE PROTECTION SYSTEM PIPES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 20 PROPERTIES OF WELDED FIRE PROTECTION SYSTEM PIPES

- TABLE 21 WELDED: FIRE PROTECTION SYSTEM PIPES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 22 FIRE PROTECTION SYSTEM PIPE MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 23 CHARACTERISTICS OF STEEL FIRE PROTECTION SYSTEM PIPES

- TABLE 24 STEEL: FIRE PROTECTION SYSTEM PIPES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 25 CHARACTERISTICS OF CPVC FIRE PROTECTION SYSTEM PIPES

- TABLE 26 CPVC: FIRE PROTECTION SYSTEM PIPE MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 27 CHARACTERISTICS OF COPPER FIRE PROTECTION SYSTEM PIPES

- TABLE 28 COPPER: FIRE PROTECTION SYSTEM PIPES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 29 OTHERS: FIRE PROTECTION SYSTEM PIPE MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 30 FIRE PROTECTION SYSTEM PIPES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 31 FIRE PROTECTION SYSTEM PIPE MARKET IN FIRE SUPPRESSION SYSTEM, BY REGION 2020–2027 (USD MILLION)

- TABLE 32 CHARACTERISTICS OF FIRE SPRINKLER SYSTEM

- TABLE 33 ADVANTAGES AND DISADVANTAGES OF WET FIRE SPRINKLER SYSTEMS

- TABLE 34 ADVANTAGES AND DISADVANTAGES OF DRY FIRE SPRINKLER SYSTEMS

- TABLE 35 ADVANTAGES AND DISADVANTAGES OF PRE-ACTION FIRE SPRINKLER SYSTEMS

- TABLE 36 ADVANTAGES OF DELUGE FIRE SPRINKLER SYSTEM

- TABLE 37 FIRE PROTECTION SYSTEM PIPES MARKET IN FIRE SPRINKLER SYSTEM, BY REGION, 2020–2027 (USD MILLION)

- TABLE 38 FIRE PROTECTION SYSTEM PIPE MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 39 RESIDENTIAL: FIRE PROTECTION SYSTEM PIPES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 40 COMMERCIAL: FIRE PROTECTION SYSTEM PIPE MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 41 COMMERCIAL: FIRE PROTECTION SYSTEM PIPE MARKET FOR EDUCATIONAL INSTITUTES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 42 COMMERCIAL: FIRE PROTECTION SYSTEM PIPES MARKET FOR OFFICE BUILDINGS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 43 COMMERCIAL: FIRE PROTECTION SYSTEM PIPE MARKET FOR HEALTHCARE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 44 COMMERCIAL: FIRE PROTECTION SYSTEM PIPE MARKET FOR HOSPITALITY, BY REGION, 2020–2027 (USD MILLION)

- TABLE 45 COMMERCIAL: FIRE PROTECTION SYSTEM PIPE MARKET FOR OTHER INDUSTRIES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 46 INDUSTRIAL: FIRE PROTECTION SYSTEM PIPES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 47 INDUSTRIAL: FIRE PROTECTION SYSTEM PIPE MARKET FOR ENERGY & POWER, BY REGION, 2020–2027 (USD MILLION)

- TABLE 48 INDUSTRIAL: FIRE PROTECTION SYSTEM PIPE MARKET FOR GOVERNMENT, BY REGION, 2020–2027 (USD MILLION)

- TABLE 49 INDUSTRIAL: FIRE PROTECTION SYSTEM PIPE MARKET FOR MANUFACTURING, BY REGION, 2020–2027 (USD MILLION)

- TABLE 50 INDUSTRIAL: FIRE PROTECTION SYSTEM PIPE MARKET FOR OIL & GAS AND MINING, BY REGION, 2020–2027 (USD MILLION)

- TABLE 51 INDUSTRIAL: FIRE PROTECTION SYSTEM PIPE MARKET FOR TRANSPORTATION & LOGISTICS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 52 INDUSTRIAL: FIRE PROTECTION SYSTEM PIPES MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 53 FIRE PROTECTION SYSTEM PIPES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: FIRE PROTECTION SYSTEM PIPES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: FIRE PROTECTION SYSTEM PIPE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: FIRE PROTECTION SYSTEM PIPE MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: FIRE PROTECTION SYSTEM PIPE MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 58 NORTH AMERICA: FIRE PROTECTION SYSTEM PIPE MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: COMMERCIAL FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: INDUSTRIAL FIRE PROTECTION SYSTEM PIPE MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 61 EUROPE: FIRE PROTECTION SYSTEM PIPES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 62 EUROPE: FIRE PROTECTION SYSTEM PIPE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 63 EUROPE: FIRE PROTECTION SYSTEM PIPE MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 64 EUROPE: FIRE PROTECTION SYSTEM PIPE MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 65 EUROPE: FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 66 EUROPE: COMMERCIAL FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 67 EUROPE: INDUSTRIAL FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 68 ASIA PACIFIC: FIRE PROTECTION SYSTEM PIPES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 69 ASIA PACIFIC: FIRE PROTECTION SYSTEM PIPE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 70 ASIA PACIFIC: FIRE PROTECTION SYSTEM PIPE MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 71 ASIA PACIFIC: FIRE PROTECTION SYSTEM PIPE MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 72 ASIA PACIFIC: FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 73 ASIA PACIFIC: COMMERCIAL FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 74 ASIA PACIFIC: INDUSTRIAL FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 75 SOUTH AMERICA: FIRE PROTECTION SYSTEM PIPES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 76 SOUTH AMERICA: FIRE PROTECTION SYSTEM PIPE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 77 SOUTH AMERICA: FIRE PROTECTION SYSTEM PIPE MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 78 SOUTH AMERICA: FIRE PROTECTION SYSTEM PIPE MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 79 SOUTH AMERICA: FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 80 SOUTH AMERICA: COMMERCIAL FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 81 SOUTH AMERICA: INDUSTRIAL FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 82 MIDDLE EAST & AFRICA: FIRE PROTECTION SYSTEM PIPES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 83 MIDDLE EAST & AFRICA: FIRE PROTECTION SYSTEM PIPE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 84 MIDDLE EAST & AFRICA: FIRE PROTECTION SYSTEM PIPE MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

- TABLE 85 MIDDLE EAST & AFRICA: FIRE PROTECTION SYSTEM PIPE MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 86 MIDDLE EAST & AFRICA: FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 87 MIDDLE EAST & AFRICA: COMMERCIAL FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 88 MIDDLE EAST & AFRICA: INDUSTRIAL FIRE PROTECTION SYSTEM PIPES MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

- TABLE 89 OVERVIEW OF STRATEGIES ADOPTED BY KEY FIRE PROTECTION SYSTEM PIPES PLAYERS (2018–2022)

- TABLE 90 FIRE PROTECTION SYSTEM PIPES MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 91 FIRE PROTECTION SYSTEM PIPE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 92 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 93 HIGHEST ADOPTED STRATEGIES

- TABLE 94 NUMBER OF GROWTH STRATEGIES ADOPTED, BY KEY COMPANY

- TABLE 95 COMPANY INDUSTRY FOOTPRINT

- TABLE 96 COMPANY REGIONAL FOOTPRINT

- TABLE 97 COMPANY FOOTPRINT

- TABLE 98 FIRE PROTECTION SYSTEM PIPES MARKET: DEALS, 2018–2022

- TABLE 99 JOHNSON CONTROLS: BUSINESS OVERVIEW

- TABLE 100 TATA STEEL: BUSINESS OVERVIEW

- TABLE 101 SIMONA AG: BUSINESS OVERVIEW

- TABLE 102 ASTRAL LTD.: BUSINESS OVERVIEW

- TABLE 103 CHINA LESSO: BUSINESS OVERVIEW

- TABLE 104 OCTAL STEEL: BUSINESS OVERVIEW

- TABLE 105 JINDAL INDUSTRIES PVT. LTD.: BUSINESS OVERVIEW

- TABLE 106 AQUATHERM: BUSINESS OVERVIEW

- TABLE 107 ZEKELMAN INDUSTRIES: BUSINESS OVERVIEW

- TABLE 108 FEDERAL STEEL SUPPLY SE: BUSINESS OVERVIEW

- TABLE 109 WEIFANG EAST STEEL PIPE: BUSINESS OVERVIEW

- TABLE 110 TRIANGLE FIRE SYSTEMS: BUSINESS OVERVIEW

- TABLE 111 BORUSAN MANNESMANN: BUSINESS OVERVIEW

- TABLE 112 JAKOB ESCHBACH: BUSINESS OVERVIEW

- TABLE 113 ZINCHITALIA SPA: BUSINESS OVERVIEW

- TABLE 114 RAWHIDE FIRE HOSE LLC: BUSINESS OVERVIEW

- TABLE 115 BULL MOOSE TUBE COMPANY: BUSINESS OVERVIEW

- TABLE 116 NEWAGE FIRE PROTECTION INDUSTRIES PVT. LTD.: BUSINESS OVERVIEW

- TABLE 117 MERCEDES TEXTILES: BUSINESS OVERVIEW

- TABLE 118 GUARDIAN FIRE EQUIPMENT, INC.: BUSINESS OVERVIEW

- TABLE 119 KAN-THERM GMBH: BUSINESS OVERVIEW

- TABLE 120 MINIMAX: BUSINESS OVERVIEW

- TABLE 121 ENGINEERED FIRE PIPING: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION

- FIGURE 5 FIRE PROTECTION SYSTEM PIPES MARKET: DATA TRIANGULATION

- FIGURE 6 WELDED PIPES TO BE LARGER SEGMENT TYPE OF FIRE PROTECTION SYSTEM PIPES MARKET, 2022–2027

- FIGURE 7 STEEL PIPES SEGMENT TO DOMINATE GLOBAL FIRE PROTECTION SYSTEM PIPES MARKET DURING FORECAST PERIOD

- FIGURE 8 FIRE SPRINKLER SYSTEM PIPES TO DOMINATE GLOBAL FIRE PROTECTION SYSTEM PIPES MARKET DURING FORECAST PERIOD

- FIGURE 9 INDUSTRIAL END-USE INDUSTRY SEGMENT TO DOMINATE GLOBAL FIRE PROTECTION SYSTEM PIPES MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF FIRE PROTECTION SYSTEM PIPES MARKET IN 2021

- FIGURE 11 ASIA PACIFIC TO DRIVE FIRE PROTECTION SYSTEM PIPES MARKET

- FIGURE 12 WELDED PIPES TO BE LARGER TYPE SEGMENT OF FIRE PROTECTION SYSTEM PIPES MARKET DURING FORECAST PERIOD

- FIGURE 13 INDUSTRIAL SEGMENT TO DOMINATE MARKET IN 2027

- FIGURE 14 HEALTHCARE SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2027

- FIGURE 15 OIL & GAS AND MINING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2027

- FIGURE 16 INDUSTRIAL SEGMENT AND US ACCOUNTED FOR LARGEST MARKET SHARES IN NORTH AMERICA IN 2021

- FIGURE 17 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FIRE PROTECTION SYSTEM PIPES MARKET

- FIGURE 19 FIRE PROTECTION SYSTEM PIPES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 22 KEY BUYING CRITERIA FOR FIRE PROTECTION SYSTEM PIPES

- FIGURE 23 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

- FIGURE 24 FIRE PROTECTION SYSTEM PIPES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 TRENDS IN END-USE INDUSTRIES IMPACTING STRATEGIES OF MANUFACTURERS OF FIRE PROTECTION SYSTEMS

- FIGURE 26 WELDED PIPES TO DOMINATE FIRE PROTECTION SYSTEM PIPES MARKET

- FIGURE 27 STEEL SEGMENT TO DOMINATE FIRE PROTECTION SYSTEM PIPES MARKET IN 2027

- FIGURE 28 FIRE SPRINKLER SYSTEM APPLICATION TO DOMINATE MARKET

- FIGURE 29 INDUSTRIAL FIRE PROTECTION SYSTEM PIPES TO LEAD MARKET BETWEEN 2022 AND 2027

- FIGURE 30 ASIA PACIFIC TO BE FASTEST-GROWING FIRE PROTECTION SYSTEM PIPES MARKET

- FIGURE 31 NORTH AMERICA: FIRE PROTECTION SYSTEM PIPES MARKET SNAPSHOT

- FIGURE 32 EUROPE: FIRE PROTECTION SYSTEM PIPES MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: FIRE PROTECTION SYSTEM PIPES MARKET SNAPSHOT

- FIGURE 34 BRAZIL TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 35 MIDDLE EAST TO DOMINATE REGION

- FIGURE 36 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- FIGURE 37 RANKING OF KEY PLAYERS, 2021

- FIGURE 38 REVENUE ANALYSIS FOR KEY COMPANIES, 2018–2022

- FIGURE 39 FIRE PROTECTION SYSTEM PIPES MARKET: COMPANY EVALUATION QUADRANT MATRIX, 2021

- FIGURE 40 FIRE PROTECTION SYSTEM PIPES MARKET: SMES MATRIX, 2021

- FIGURE 41 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN FIRE PROTECTION SYSTEM PIPES MARKET

- FIGURE 42 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 43 TATA STEEL: COMPANY SNAPSHOT

- FIGURE 44 SIMONA AG: COMPANY SNAPSHOT

- FIGURE 45 ASTRAL LTD.: COMPANY SNAPSHOT

- FIGURE 46 CHINA LESSO: COMPANY SNAPSHOT

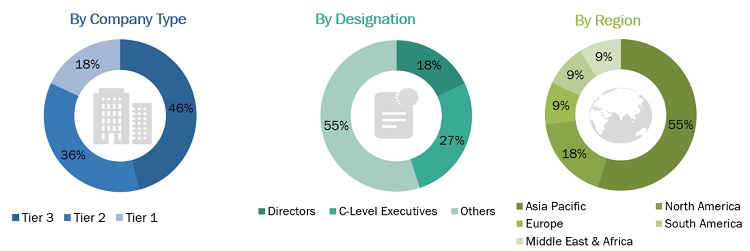

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global fire protection system pipes market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases & investor presentations of companies, white papers, regulatory bodies, trade directories, certified publications, articles from recognized authors, gold and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

In the primary research process, various sources from both, the supply and demand sides were interviewed to obtain and verify qualitative and quantitative information for this report as well as analyze prospects. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the fire protection system pipes market. Primary sources from the demand side include experts and key persons from the application segment. Extensive primary research has been conducted after understanding and analyzing the current scenario of the fire protection system pipes market through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

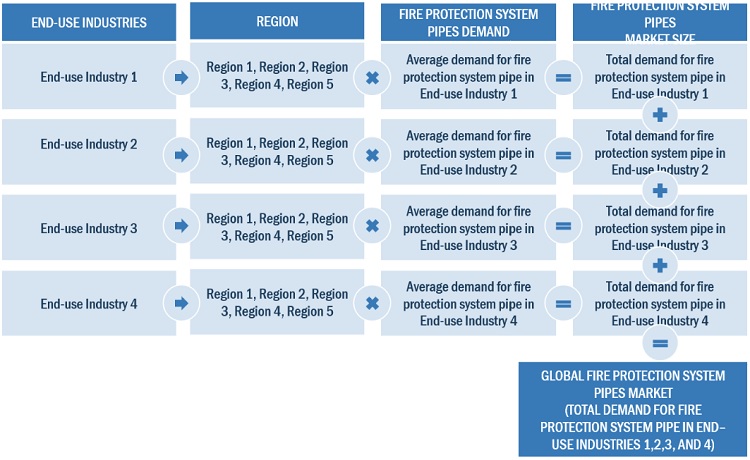

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the fire protection system pipes market size and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market shares in the key regions have been determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top players and extensive interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives, for key insights.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters affecting the markets covered in this study were accounted for, viewed in detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The three figures below represent the overall market size estimation process through the study.

Global Fire Protection System Pipes Market Size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both, the demand and supply sides. The market has been validated using both, the top-down and bottom-up approaches.

Report Objectives

- To define, describe, forecast, and analyze the fire protection system pipes market based on type, material, application, and end-use industry, in terms of value

- To describe and forecast the size of the market based on five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their respective countries in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing market growth

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, key stakeholders and buying criteria, key conferences and events, regulatory bodies, government agencies, and regulations pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

- To analyze competitive developments such as product launches, acquisitions, agreements, and partnerships in the market

Note: 1. Micromarkets are defined as the subsegments of the global fire protection system pipes market included in the report.

2. Core competencies of companies are determined in terms of the key developments and strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the epoxy adhesives market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fire Protection System Pipes Market