Flare Monitoring Market by Mounting Method (In Process-Mass Spectrometers, Gas Chromatographs, Gas Analyzers; Remote-IR Imagers, MSIR Imagers), Industry (Refineries, Petrochemical, Onshore Oil & Gas Production Sites), & Geography - Global Forecast to 2035

Flare Monitoring Market Overview (2025-2035)

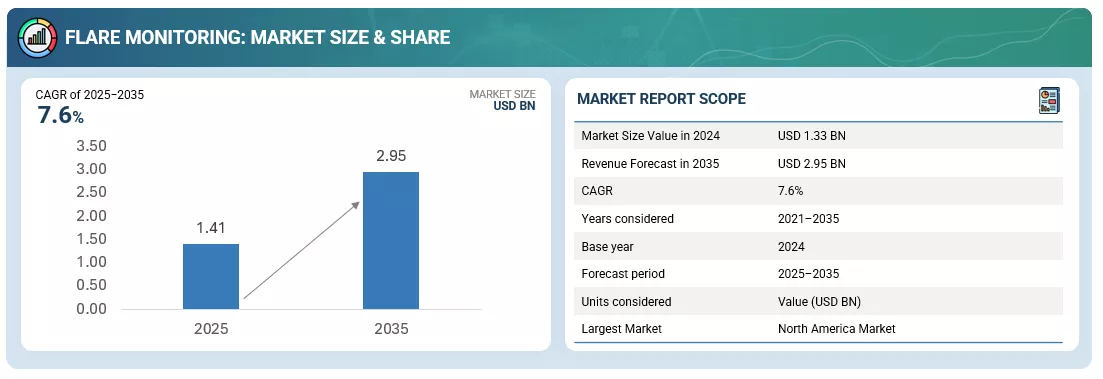

The global flare monitoring market was valued at USD 1.33 billion in 2024 and is estimated to reach USD 2.95 billion by 2035, at a CAGR of 7.6% between 2025 and 2035.

The global flare monitoring market is witnessing steady growth as industries increasingly prioritize environmental sustainability, operational efficiency, and regulatory compliance. Flaring, the controlled burning of waste gases during oil and gas extraction or petrochemical processes, is a significant source of greenhouse gas emissions. The demand for flare monitoring systems has grown as governments worldwide tighten environmental regulations to control emissions and ensure safer industrial operations. These systems play a vital role in providing real time data on flare combustion efficiency and gas composition, enabling industries to minimize wastage and enhance safety. From refineries and petrochemical plants to onshore oil and gas production sites, flare monitoring solutions are becoming indispensable for efficient and responsible operations. The market is expected to expand significantly from 2025 to 2035, driven by advancements in sensor technology, increasing adoption of automation, and the rising importance of sustainability across industries.

Market Dynamics

The primary drivers of the flare monitoring market include strict environmental regulations, growing awareness of industrial safety, and the need to reduce operational emissions. Regulatory bodies such as the Environmental Protection Agency and the European Union’s Industrial Emissions Directive have enforced guidelines mandating accurate flare monitoring systems. These regulations compel operators to adopt advanced monitoring equipment that can provide real time and continuous data on flare performance. In addition, companies are focusing on achieving zero routine flaring targets set by international organizations to reduce greenhouse gas emissions.

Moreover, industrial players are recognizing the financial and reputational benefits of sustainable operations. By monitoring flare performance, industries can detect incomplete combustion, gas leaks, or inefficiencies that lead to energy losses. The implementation of flare monitoring systems helps reduce costs, ensures compliance, and minimizes environmental impact. The integration of digital technologies such as the Internet of Things, artificial intelligence, and data analytics has further accelerated the market, offering predictive insights and automated control capabilities.

Despite its strong growth trajectory, the market faces challenges such as the high initial cost of advanced monitoring systems, complex calibration requirements, and technical limitations in extreme operating environments. However, ongoing innovation in sensor technology and the emergence of compact, cost effective systems are likely to overcome these barriers over the forecast period.

Flare Monitoring Market by Mounting Method

The flare monitoring market can be categorized into in process and remote monitoring systems based on the mounting method. Each approach offers unique advantages depending on the operational requirements and environmental conditions.

In process flare monitoring involves the use of sensors and analytical instruments installed directly in the process stream to measure the composition and characteristics of flare gases. This method provides highly accurate and continuous data, which is crucial for maintaining compliance with emission regulations and optimizing combustion efficiency. In process systems typically employ equipment such as mass spectrometers, gas chromatographs, and gas analyzers. Mass spectrometers are capable of detecting and quantifying multiple gas components with high precision, making them ideal for detailed process analysis. Gas chromatographs are widely used for separating and identifying hydrocarbons and other gas components, ensuring that the combustion process operates within safe and efficient limits. Gas analyzers, on the other hand, provide real time measurement of specific gases like carbon dioxide, methane, and sulfur compounds, which are critical indicators of flare efficiency.

Remote flare monitoring, in contrast, utilizes noncontact optical systems to measure flare parameters from a distance. This method is particularly suitable for hazardous or inaccessible sites, where direct measurement is challenging. Remote monitoring systems use technologies such as infrared imagers and multispectral infrared imagers, which can detect heat signatures and measure flare temperature and combustion characteristics. These devices can operate under harsh weather conditions and provide accurate data even at long ranges. The increasing use of drones and advanced imaging software has further enhanced the capability of remote flare monitoring systems, allowing continuous observation and real time reporting of flare performance across large industrial facilities.

Market by Industry

The flare monitoring market finds major applications across several industries, including refineries, petrochemical plants, and onshore oil and gas production sites. Each of these sectors has distinct operational needs that influence the type of monitoring systems deployed.

Refineries represent one of the largest end users of flare monitoring systems. Refining operations involve complex processes such as distillation, cracking, and reforming, which often produce excess gases that need to be safely flared. Accurate flare monitoring is essential to ensure complete combustion, reduce emissions, and maintain compliance with environmental regulations. Refineries increasingly deploy both in process and remote monitoring systems to achieve comprehensive control over flare activities. These systems help operators track flare performance, identify inefficiencies, and maintain optimal combustion conditions, thus improving both safety and profitability.

The petrochemical industry is another significant segment driving market growth. Petrochemical plants produce large volumes of volatile organic compounds and other gases that require safe flaring. Monitoring systems in this sector play a critical role in managing emissions and preventing environmental contamination. The adoption of advanced in process monitoring systems with integrated data analytics allows petrochemical operators to maintain transparency and accountability in their environmental performance.

Onshore oil and gas production sites also account for a considerable share of the flare monitoring market. These sites often operate in remote locations, making remote flare monitoring the preferred approach. The use of infrared and multispectral imagers enables continuous observation of flaring activities without direct human intervention. This helps operators ensure compliance with emission standards and maintain operational safety in challenging field conditions.

In addition to these primary industries, flare monitoring systems are gradually finding applications in emerging sectors such as liquefied natural gas terminals and power generation plants. As global demand for cleaner energy sources increases, flare monitoring technologies will play an essential role in minimizing emissions and optimizing efficiency.

Regional Analysis

The flare monitoring market demonstrates strong regional diversity, with varying growth patterns across the Middle East and Africa, the Americas, Europe, and the Asia Pacific region.

The Middle East and Africa region holds a substantial share of the global flare monitoring market, primarily due to the dominance of the oil and gas sector. Countries such as Saudi Arabia, the United Arab Emirates, and Nigeria have implemented stringent environmental policies to control flaring emissions and meet sustainability targets. The increasing adoption of advanced monitoring technologies in refineries and petrochemical plants across this region is driving market growth. Investments in smart infrastructure and digital oilfield solutions are further promoting the integration of flare monitoring systems.

In the Americas, particularly in North America, strong environmental regulations and technological advancements are key drivers of market expansion. The United States has witnessed significant investments in flare monitoring due to strict Environmental Protection Agency mandates requiring continuous emission monitoring. The presence of leading oil and gas producers and advanced technology providers also contributes to the region’s dominance. Latin America, led by Brazil and Mexico, is also emerging as a potential market as energy companies focus on modernizing production facilities and improving environmental performance.

Europe represents another crucial market driven by rigorous environmental standards and the European Union’s commitment to reducing greenhouse gas emissions. European refineries and chemical industries are early adopters of digital flare monitoring systems, supported by government incentives for sustainable industrial practices. The increasing adoption of smart monitoring networks integrated with IoT and cloud based platforms is transforming flare monitoring operations across the region.

The Asia Pacific region is expected to exhibit the highest growth rate over the forecast period. Rapid industrialization, expanding oil and gas exploration activities, and growing awareness of environmental sustainability are key factors propelling demand. Countries such as China, India, and Indonesia are investing heavily in modernizing their industrial infrastructure, creating significant opportunities for flare monitoring solution providers. Government initiatives promoting clean energy and emission control are likely to accelerate the adoption of advanced flare monitoring technologies across the region.

Technological Advancements and Innovation

Technological innovation is a defining factor shaping the future of the flare monitoring market. Manufacturers are focusing on developing more compact, efficient, and cost effective systems that can operate under extreme environmental conditions. Advances in infrared and multispectral imaging technologies have enhanced the accuracy and reliability of remote monitoring systems. Additionally, the integration of artificial intelligence and machine learning algorithms enables predictive analytics, allowing operators to detect performance deviations and potential safety risks in real time.

The rise of digital twins and cloud based monitoring platforms is transforming traditional flare monitoring into a data driven operation. Digital twins enable the simulation of flare performance, helping operators predict the impact of process changes and optimize efficiency. Cloud connectivity facilitates centralized monitoring across multiple sites, improving visibility and decision making. Moreover, the incorporation of automated calibration and self diagnostics features reduces maintenance requirements and enhances system reliability.

Future Outlook

The future of the flare monitoring market appears promising, with a strong emphasis on sustainability, digitalization, and regulatory compliance. As industries transition toward cleaner energy and zero emission targets, the role of flare monitoring systems will become increasingly critical. The market is expected to benefit from the growing demand for integrated monitoring and control solutions, combining in process and remote systems for holistic management.

Strategic partnerships, mergers, and acquisitions are likely to play a vital role in expanding the technological capabilities and geographic reach of market players. Companies are investing in research and development to introduce next generation monitoring systems equipped with advanced analytics and remote accessibility features. Furthermore, the increasing focus on environmental transparency and corporate social responsibility is encouraging industries to adopt comprehensive monitoring frameworks.

The research report categorizes the Flare Monitoring Market to forecast the revenues and analyze the trends in each of the following sub-segments:

By Mounting Method

-

In Process

- Mass Spectrometers

- Gas Chromatographs

- Flowmeters

- Calorimeters

- Others*

-

Remote

- Thermal (IR) Imagers

- Multi-Spectrum Infrared (MSIR) Imagers

- Others**

By Industry

- Refineries

- Petrochemicals

- Onshore Oil and Gas Production Sites

- Landfills

- Others (Offshore, Metals, and Steel Production)

By Geography

-

North America

- US, Canada, Mexico

-

Europe

- Russia

- UK

- Norway

- Rest of Europe

-

Asia Pacific

- China

- India

- Australia

- Rest Of Asia Pacific

- Rest of the World

Key Market Players

Siemens AG (Germany), ABB Ltd. (Switzerland), FLIR Systems (US), Thermo Fisher Scientific (US), Honeywell International Inc. (US).

Critical questions the report answers:

- Which are the most significant revenue-generating regions for the flare monitoring market?

- What are the significant growth trends at the forefront of new market innovations?

- How is the current regulatory framework expected to impact the flare monitoring market?

- What are the prime strategies followed by the leaders/ key players in the flare monitoring market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

FAQ

1. What is Flare Monitoring?

Answer:

Flare monitoring is the process of measuring and analyzing flare stacks to ensure safe combustion of excess gases and compliance with environmental regulations.

2. What drives the growth of the Flare Monitoring Market?

Answer:

Stringent environmental regulations, increasing focus on emission control, and rising industrialization in oil & gas and petrochemical sectors drive market growth.

3. What are the major types of Flare Monitoring systems?

Answer:

The two main types are in-process flare monitoring and remote flare monitoring, depending on installation and monitoring methods.

4. Which industries use Flare Monitoring systems?

Answer:

Flare monitoring is widely used in oil & gas, refineries, chemical plants, and onshore/offshore production facilities.

5. What are the key benefits of Flare Monitoring?

Answer:

It helps reduce harmful emissions, ensures regulatory compliance, improves safety, and optimizes combustion efficiency.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for Study

1.4 Currency

1.5 Limitations

1.6 Package Size

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.1.2 Major Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share Using Bottom-Up Approach (Demand-Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share Using Top-Down Approach (Supply-Side)

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Flare Monitoring Market Overview, 2017-2023

4.2 Market, By Industry and Region (2017)

4.3 Market, By Mounting Method, 2017-2023

4.4 Market, By Region, 2017-2023

4.5 Market, By Region (2016, 2017, and 2023)

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Need for Controlling Waste Gas Combustion Parameters Due to Stringent Local and Global Environmental Regulations

5.3.1.2 Benefits of Direct Flare Monitoring Systems

5.3.1.3 Expansion of Oil & Gas and Petrochemical Industries

5.3.2 Restraints

5.3.2.1 Shift in Focus Towards Eliminating Flaring By Major Countries

5.3.3 Opportunities

5.3.3.1 Growing Demand From Emerging Economies

5.3.4 Challenges

5.3.4.1 Technological Challenges in Adhering to Regulatory Norms and Reducing Overall System Cost

5.4 Regulatory Standards

5.5 Value Chain Analysis

6 Market, By Mounting Method (Page No. - 49)

6.1 Introduction

6.2 In-Process

6.2.1 Mass Spectrometers

6.2.2 Gas Chromatographs

6.2.3 Gas Analyzers

6.2.4 Flowmeters

6.2.5 Calorimeters

6.2.6 Others

6.3 Remote

6.3.1 Thermal (IR) Imagers

6.3.2 Multi Spectrum Infrared (MSIR) Imagers

6.3.3 Others

7 Market, By Industry (Page No. - 66)

7.1 Introduction

7.2 Onshore Oil & Gas Production Sites

7.3 Refineries

7.4 Petrochemical

7.5 Landfills

7.6 Others

7.6.1 Offshore

7.6.2 Metal and Steel Production

8 Geographic Analysis (Page No. - 79)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Russia

8.3.2 UK

8.3.3 Norway

8.3.4 Rest of Europe (RoE)

8.4 Asia Pacific (APAC)

8.4.1 China

8.4.2 India

8.4.3 Australia

8.4.4 Rest of APAC (RoAPAC)

8.5 RoW

8.5.1 Middle East and Africa

8.5.2 South America

9 Competitive Landscape (Page No. - 105)

9.1 Introduction

9.2 Ranking Analysis of Players in Market

9.3 Competitive Situation and Trends

9.3.1 Agreements, Partnerships and Collaborations

9.3.2 New Product Launches

9.3.3 Mergers & Acquisitions

9.3.4 Expansions

10 Company Profiles (Page No. - 113)

10.1 Introduction

10.2 Key Players

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.2.1 Siemens Group

10.2.2 ABB.

10.2.3 Flir Systems

10.2.4 Thermo Fisher Scientific

10.2.5 Honeywell

10.2.6 Emerson Electric Co.

10.2.7 Ametek Inc.

10.2.8 Zeeco Inc.

10.2.9 MKS Instruments

10.2.10 Lumasense Technologies Inc.

10.2.11 Fluenta

10.2.12 Endress+Hauser Ag

10.2.13 Williamson Corporation

10.2.14 John Zink Company, LLC

10.2.15 Eaton Hernis Scan Systems

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.3 Key Innovators

10.3.1 Providence Photonics LLC

10.3.2 Galvanic Applied Sciences

10.3.3 Oleumtech Corporation

10.3.4 Powertrol, Inc.

10.3.5 TKH Security Solutions

11 Appendix (Page No. - 152)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (74 Tables)

Table 1 Flare Monitoring Market, By Mounting Method, 2015–2023 (USD Million)

Table 2 Remote Market, 2015–2023 (Units)

Table 3 In-Process Market, By Technology, 2015–2023 (USD Million)

Table 4 Mass Spectrometers: In-Process Market, By Industry, 2018–2023 (USD Million)

Table 5 Mass Spectrometers: In-Process Market, By Region, 2018–2023 (USD Million)

Table 6 Gas Chromatographs: In-Process Market, By Industry, 2018–2023 (USD Million)

Table 7 Gas Chromatographs: In-Process Market, By Region, 2018–2023 (USD Million)

Table 8 Gas Analyzers: In-Process Market, By Industry, 2015–2023 (USD Million)

Table 9 Gas Analyzers: In-Process Market, By Region, 2015–2023 (USD Million)

Table 10 Flowmeters: In-Process Market, By Industry, 2015–2023 (USD Million)

Table 11 Flowmeters: In-Process Market, By Region, 2015–2023 (USD Million)

Table 12 Calorimeters: In-Process Market, By Industry, 2015–2023 (USD Thousand)

Table 13 Calorimeters: In-Process Market, By Region, 2015–2023 (USD Thousand)

Table 14 Other Technologies: In-Process Market, By Industry, 2015–2023 (USD Thousand)

Table 15 Other Technologies: In-Process Market, By Region, 2015–2023 (USD Thousand)

Table 16 Remote Market, By Technology, 2015–2023 (USD Million)

Table 17 Thermal (IR) Imagers: Remote Market, By Industry, 2015–2023 (USD Million)

Table 18 Thermal (IR) Imagers: Remote Market, By Region, 2015–2023 (USD Million)

Table 19 MSIR Imagers: Remote Market, By Industry, 2015–2023 (USD Thousand)

Table 20 MSIR Imagers: Remote Market, By Region, 2015–2023 (USD Thousand)

Table 21 Other Technologies: Remote Market, By Industry, 2015–2023 (USD Thousand)

Table 22 Other Technologies: Remote Market, By Region, 2015–2023 (USD Thousand)

Table 23 Market, By Industry, 2015–2023 (USD Million)

Table 24 Onshore Oil & Gas Production Sites: In-Process Market, By Technology, 2015–2023 (USD Thousand)

Table 25 Onshore Oil & Gas Production Sites: Remote Market, By Technology, 2015–2023 (USD Thousand)

Table 26 Onshore Oil & Gas Production Sites: Market, By Region, 2015–2023 (USD Million)

Table 27 Refineries Industry: In-Process Market, By Technology, 2015–2023 (USD Million)

Table 28 Refineries Industry: Remote Market, By Technology, 2015–2023 (USD Million)

Table 29 Refineries Industry: Market, By Region, 2015–2023 (USD Million)

Table 30 Petrochemicals Industry: In-Process Market, By Technology, 2015–2023 (USD Million)

Table 31 Petrochemicals Industry: Remote Market, By Technology, 2015–2023 (USD Million)

Table 32 Petrochemicals Industry: Market, By Region, 2015–2023 (USD Million)

Table 33 Landfills Industry: In-Process Market, By Technology, 2015–2023 (USD Thousand)

Table 34 Landfills Industry: Remote Market, By Technology, 2015–2023 (USD Thousand)

Table 35 Landfills Industry: Market, By Region, 2015–2023 (USD Thousand)

Table 36 Other Industries: In-Process Market, By Technology, 2015–2023 (USD Thousand)

Table 37 Other Industries: Remote Market, By Technology, 2015–2023 (USD Thousand)

Table 38 Other Industries: Market, By Region, 2015–2023 (USD Million)

Table 39 Market, By Region, 2015–2023 (USD Million)

Table 40 North America: Market, By Country, 2015–2023 (USD Million)

Table 41 North America: Market, By Mounting Method, 2015–2023 (USD Million)

Table 42 US Oil Production, Gas Production, Oil Refinery Capacity, and Upstream Gas Flaring, 2014, 2015, and 2016

Table 43 US: Market, By Mounting Method, 2015–2023 (USD Million)

Table 44 Canada Oil Production, Gas Production, Oil Refinery Capacity, and Upstream Gas Flaring, 2014, 2015, and 2016

Table 45 Canada: Market, By Mounting Method, 2015–2023 (USD Million)

Table 46 Mexico: Oil Production, Gas Production, Oil Refinery Capacity, and Upstream Gas Flaring, 2014, 2015, and 2016

Table 47 Mexico: Market, By Mounting Method, 2015–2023 (USD Million)

Table 48 Europe: Market, By Country, 2015–2023 (USD Million)

Table 49 Europe: Market, By Mounting Method, 2015–2023 (USD Million)

Table 50 Russia Oil Production, Gas Production, Oil Refinery Capacity, and Upstream Gas Flaring, 2014, 2015, and 2016

Table 51 Russia: Market, By Mounting Method, 2015–2023 (USD Million)

Table 52 UK Oil Production, Gas Production, Oil Refinery Capacity, and Upstream Gas Flaring, 2014, 2015, and 2016

Table 53 UK: Market, By Mounting Method, 2015–2023 (USD Million)

Table 54 Norway: Oil Production, Gas Production, Oil Refinery Capacity, and Upstream Gas Flaring, 2014, 2015, and 2016

Table 55 Norway: Market, By Mounting Method, 2015–2023 (USD Million)

Table 56 RoE: Market, By Mounting Method, 2015–2023 (USD Million)

Table 57 APAC: Market, By Country, 2015–2023 (USD Million)

Table 58 APAC: Market, By Mounting Method, 2015–2023 (USD Million)

Table 59 China Oil Production, Gas Production, Oil Refinery Capacity, and Upstream Gas Flaring, 2014, 2015, and 2016

Table 60 China: Market, By Mounting Method, 2015–2023 (USD Million)

Table 61 India Oil Production, Gas Production, Oil Refinery Capacity, and Upstream Gas Flaring, 2014, 2015, and 2016

Table 62 India: Market, By Mounting Method, 2015–2023 (USD Million)

Table 63 Australia Oil Production, Gas Production, Oil Refinery Capacity, and Upstream Gas Flaring, 2014, 2015, and 2016

Table 64 Australia: Market, By Mounting Method, 2015–2023 (USD Million)

Table 65 RoAPAC: Market, By Mounting Method, 2015–2023 (USD Million)

Table 66 RoW: Market, By Region, 2015–2023 (USD Million)

Table 67 RoW: Market, By Mounting Method, 2015–2023 (USD Million)

Table 68 Middle East & Africa: Market, By Mounting Method, 2015–2023 (USD Million)

Table 69 South America: Market, By Mounting Method, 2015–2023 (USD Million)

Table 70 Market Ranking Analysis, By Key Player, 2017

Table 71 Agreements, Partnerships and Collaborations, 2015–2017

Table 72 New Product Launches, 2015–2017

Table 73 Acquisitions, 2015–2017

Table 74 Expansions, 2015–2017

List of Figures (42 Figures)

Figure 1 Flare Monitoring Market Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation and Region

Figure 4 Market: Research Approach

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Data Triangulation Methodology

Figure 8 Market, By Mounting Method (2017 vs 2023): Remote Technology to Record Higher Growth During Forecast Period

Figure 9 Market, By Industry (2017 vs 2023): Refineries to Hold Largest Market Share During Forecast Period (USD Million)

Figure 10 Market, By Region, 2017

Figure 11 Market to Witness Attractive Growth Opportunities

Figure 12 Refineries Industry and North America Region to Hold Largest Market Shares

Figure 13 Remote Technology Expected to Record Highest Growth (USD Million)

Figure 14 Middle East & Africa Projected to Record Highest Growth

Figure 15 North America Holds Largest Market Share in 2016 and 2017

Figure 16 Market: Market Segmentation

Figure 17 Drivers, Restraints, Opportunities, and Challenges for Market

Figure 18 Oil Production, 2012-2016

Figure 19 Oil Refinery Capacity, 2012-2016

Figure 20 Top 20 Flaring Countries, 2014, 2015, and 2016

Figure 21 Flare Monitoring Value Market Chain Analysis: Manufacturing and Assembling Contribute Highest Value Addition

Figure 22 Market, By Mounting Method

Figure 23 Remote Market to Record Double-Digit Growth During Forecast Period (USD Million)

Figure 24 Market, By Industry

Figure 25 Refineries Industry to Dominate Market During Forecast Period (USD Million)

Figure 26 Market, By Geography

Figure 27 Market: Middle East & Africa to Record Highest Growth During Forecast Period

Figure 28 North America: Market Snapshot

Figure 29 Europe: Market Snapshot

Figure 30 APAC: Market Snapshot

Figure 31 Partnerships, Agreements, and Collaborations the Key Growth Strategy Adopted By Market Players Between 2015 and 2017

Figure 32 Key Strategies Adopted By Major Players in Market Between 2015 and 2017

Figure 33 Agreements, Partnerships, & Collaborations the Key Growth Strategy Adopted By Market Players Between 2015 and 2017

Figure 34 Siemens Group: Company Snapshot

Figure 35 ABB : Company Snapshot

Figure 36 Flir Systems: Company Snapshot

Figure 37 Thermo Fisher Scientific: Company Snapshot

Figure 38 Honeywell: Company Snapshot

Figure 39 Emerson Electric Co.: Company Snapshot

Figure 40 Ametek Inc.: Company Snapshot

Figure 41 MKS Instruments: Company Snapshot

Figure 42 Endress+Hauser AG: Company Snapshot

Growth opportunities and latent adjacency in Flare Monitoring Market

I am interested in getting a market research report on the size of the portable flaring industry, these are temporary and mobile units that are brought on sites for plant shutdowns or pipeline maintenance work. Does Markets and Markets have a report in this category that could size and introduce that market?