Process Analyzer Market Size, Share & Industry Trends Growth Analysis Report by Liquid Analyzer (MLSS, Total Organic Carbon, pH, Liquid Density, Conductivity, Dissolved Oxygen), Gas Analyzer (Oxygen, Carbon Dioxide, Moisture, Toxic Gas, Hydrogen Sulfide), Industry and Region - Global Growth Driver and Industry Forecast to 2028

Updated on : Oct 22, 2024

Process Analyzer Market Size & Share

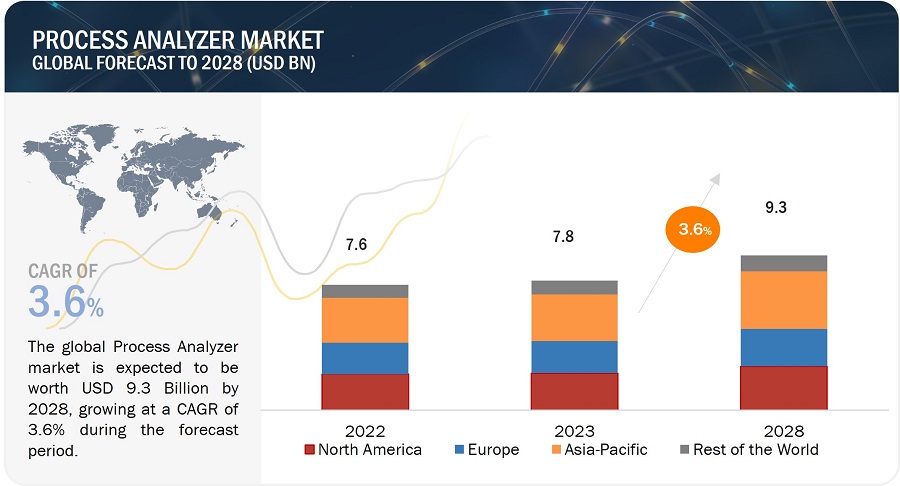

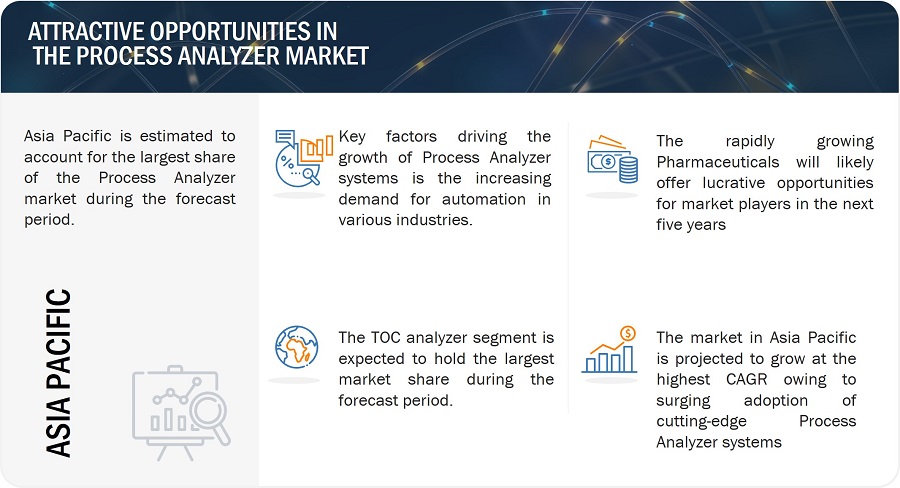

The global Process Analyzer market size is expected to grow from USD 7.8 billion in 2023 to USD 9.3 billion by 2028, growing at a CAGR of 3.6% during the forecast period from 2023 to 2028

The demand for exceptionally precise process analyzers is escalating within the expanding domains of drug development, bioprocessing, and personalized medicine. These analytical instruments are indispensable in research, development, and pharmaceutical manufacturing, guaranteeing the highest levels of quality.

Process Analyzer Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Process Analyzer Market Trends

Driver: Rising demand for water and wastewater treatment

The world is witnessing a reduction in freshwater availability due to various factors, including climatic changes, disturbing weather patterns, and increasing pollution. There is a rising awareness to conserve water and take initiatives such as increasing the efficiency of water supply systems, rainwater harvesting, and wastewater treatment.

Wastewater is water used in industrial plants or households. It must be treated before it is released into another body of water, such as a river or lake, so it does not cause further pollution of water sources. There is an urgent demand for safe drinking water globally, increasing the requirement for water and wastewater treatment plants. Such plants use various types of process analyzers to monitor the chemicals present in the water. Several companies have started investing in water and wastewater treatment plants to provide safe drinking to people worldwide. The demand for water in the pharmaceuticals and food industries has also propelled the demand for liquid and gas analyzers with advanced control capabilities.

Restraint: High infrastructure cost

The initial capital expenditure required to develop process analyzers may emerge as a major restraint for the growth of this market. The process analyzers introduced by a company must be innovative and different from those available in the market.

The reliability of the instrument and the accuracy of the results obtained from it form the major criteria for the acceptance of the product in the market. In the past, process measurements were often done off-line; this involved taking samples from the process and analyzing them in the laboratory. Apart from the delay in obtaining results, this also led to the possibility of samples getting contaminated. These factors prompted the need for process analyzers with capabilities for real-time online analysis.

Implementation of such online analyzers results in additional costs of installation in protected cabinets with cooling capabilities to dissipate the heat generated by the analyzers. Such installations include sample conditioning systems (SCS), which typically divert, deliver, and return small quantities of liquid or gas from the process streams to the analyzers. The SCS operation is a key determinant for the analyzer output; however, it adds to the costs as it is difficult to design, install, and operate. Thus, with increasing applications, it is imperative on the part of the market to not only meet the power efficiency in a cost-effective manner but also to manage the power consumption.

Opportunity: Growing demand for environmental monitoring

Process analyzers are essential instruments within industrial settings, providing continuous monitoring capabilities for emissions and critical process parameters in real time. These analyzers play a pivotal role in assisting industries in adhering to environmental regulations by furnishing precise and dependable data concerning pollutant levels, temperature, pressure, flow rates, and chemical composition.

This data ensures conformity with emission standards and enables proactive adjustments to processes, reducing both pollutant emissions and deviations from typical operating conditions. Beyond meeting regulatory obligations, process analyzers contribute to environmental safeguarding by curtailing air and water pollution, safeguarding ecosystems, and bolstering public health.

Furthermore, they support energy efficiency initiatives, pinpoint areas for process enhancement, enhance safety by identifying releases of hazardous substances, and facilitate comprehensive documentation and reporting to ensure transparency and accountability. Process analyzers are indispensable tools for industries striving to mitigate their environmental impact while optimizing operations for sustainability and compliance with regulations.

Challenge: Complexity of installation and operation

The challenges involved in the installation and operation of process analyzers can present notable challenges, particularly for users located in remote areas. These analyzers are meticulously designed instruments tasked with precisely monitoring a wide array of parameters within industrial processes. Setting them up correctly demands expertise in calibration, sensor placement, and seamless integration into existing process control systems.

Beyond installation, their ongoing operation necessitates regular maintenance, periodic calibration, and troubleshooting in case of malfunctions. These operational aspects typically require personnel with specialized knowledge and training. In remote regions where access to such expertise may be limited, the complexity associated with the installation and operation of process analyzers can result in prolonged downtime, reduced analytical accuracy, and increased operational costs.

Although advancements in analyzer technology have introduced features like remote monitoring and user-friendly interfaces, ensuring that users, particularly those in remote locations, receive adequate training and support remains essential. This approach is critical for optimizing the advantages of process analyzers and effectively addressing the intricacies tied to their use.

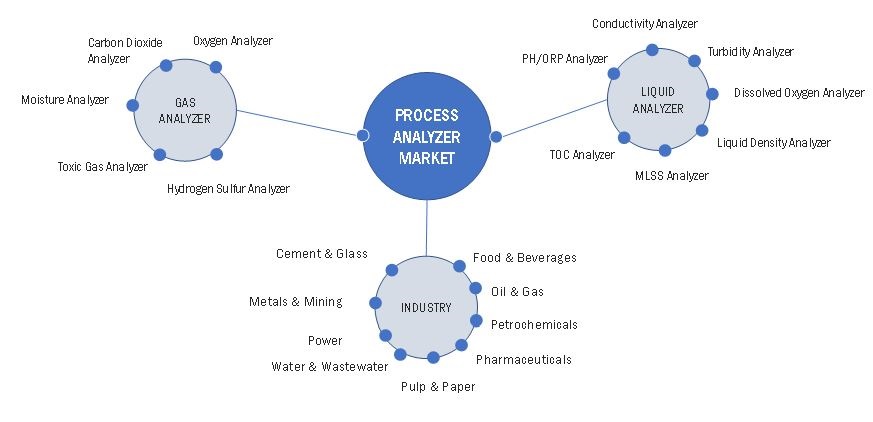

Process Analyzer Market Ecosystem

Component suppliers and system integrators have witnessed a decline in production activities. Consequently, OEMs have needed more essential components. The figure below shows the Process Analyzer ecosystem.

Process Analyzer Market Segment

By Liquid Analyzer, MLSS analyzer segment to grow at highest CAGR in the forecast period 2023-2028

The rise in utilization of MLSS analyzers is fueled by their crucial contribution to wastewater treatment processes. These analyzers are pivotal in monitoring and optimizing microorganism concentration within activated sludge, a key element in wastewater treatment.

The demand for effective wastewater treatment has surged due to the increasing focus on environmental sustainability and strict regulatory guidelines. MLSS analyzers are instrumental in maintaining the correct microorganism concentration, aiding in efficient waste breakdown. Additionally, advancements in sensor technology and automation have further bolstered the adoption of MLSS analyzers, ensuring accurate, real-time monitoring for efficient wastewater management and regulatory adherence.

By Gas Analyzer, Oxygen Analyzer segment to grow at highest CAGR in the forecast period 2023-2028.

An oxygen analyzer holds significance among gas analyzers widely applied across diverse industries. Oxygen plays a vital role in combustion processes, determining if the combustion is rich or lean based on its concentration.

These analyzers find utility in boiler combustion control, measuring oxygen levels in flammable gas mixtures, and environmental monitoring in reflow furnaces and globe boxes. Anticipated widespread utilization of oxygen analyzers across industries is projected to drive the oxygen analyzer segment, enabling it to achieve the highest Compound Annual Growth Rate (CAGR) during the forecast period..

By Industry, Pharmaceuticals is expected to register highest CAGR during the forecast period

The pharmaceutical industry is poised for remarkable growth, primarily due to stringent quality regulations governing pharmaceutical products. Essential for monitoring crucial process parameters within this sector, a range of gas and liquid analyzers have become indispensable tools.

Their significance lies in ensuring compliance with regulatory standards and maintaining the highest product quality. With a strong emphasis on quality control and adherence to guidelines, these analyzers play a vital role in enhancing processes and elevating the overall efficiency of pharmaceutical operations..

Process Analyzer Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Process Analyzer Market Regional Analysis

By Region, Asia Pacific to grow at highest CAGR during the forecast period

In 2022, the Asia Pacific region held the dominant global process analyzer industry share. The extensive adoption of process analyzer solutions in Asia can be attributed to its expansive manufacturing base.

Many prominent global corporations across various sectors have relocated their manufacturing facilities to this region due to cost-effective labor and ready access to a proficient workforce. The Asia Pacific is home to major industries like automotive, consumer electronics, pharmaceuticals, refining, and mining, further consolidating its position as a key hub for these sectors.

Process Analyzer Companies - Key Market Players

The Process Analyzer companies players have implemented various organic and inorganic growth strategies, such as product launches, collaborations, partnerships, and acquisitions, to strengthen their offerings in the market. The major players in the market are

- ABB (Switzerland),

- Emerson Electric Co. (US),

- Siemens (Germany),

- Endress+Hauser Group Services AG (Switzerland),

- Yokogawa Electric Corporation (Japan),

- Mettler Toledo (US), Suez (US),

- Thermo Fisher Scientific, Inc. (US),

- Ametek. Inc.(US),

- Anton Paar GmbH (Austria) and Others

The study includes an in-depth competitive analysis of these key players in the Process Analyzer market with their company profiles, recent developments, and key market strategies.

Process Analyzer Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 3.9 billion in 2023 |

| Projected Market Size | USD 6.2 billion by 2028 |

| Growth Rate | CAGR of 10.0% |

|

Years Considered |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

By Liquid Analyzer, By Gas Analyzer, By Industry, and Region |

|

Regions Covered |

North America, Asia Pacific, Europe, and the Rest of the World |

|

Companies Covered |

ABB (Switzerland), Emerson Electric Co. (US), Siemens (Germany), Endress+Hauser Group Services AG (Switzerland), Yokogawa Electric Corporation (Japan), Mettler Toledo (US), Suez (US), Thermo Fisher Scientific, Inc. (US), Ametek. Inc.(US), Anton Paar GmbH (Austria), and a total of 25 players covered |

Process Analyzer Market Highlights

This report has segmented the Process Analyzer market based on offerings, Liquid Analyzer, Gas Analyzer, and Industry and Region.

|

Segment |

Subsegment |

|

By Liquid Analyzer |

|

|

By Gas Analyzer |

|

|

By Industry |

|

|

By Region |

|

Recent Developments in Process Analyzer Industry

- In April 2023, Thermo Fisher Scientific Inc. introduced two novel wet chemistry analyzers, providing fully automated testing in compliance with the U.S. Environmental Protection Agency (EPA) standards. These systems cater to environmental, agricultural, and industrial testing laboratories with precise and streamlined analytical capabilities.

- In December 2022, ABB launched Sensi+ analyzer, revolutionizing natural gas quality monitoring. This single device detects H2S, H2O, and CO2 contaminants, enhancing pipeline safety, efficiency, and cost-effectiveness with real-time analysis, swift upset responses, and reduced emissions.

- In November 2022, Mettler Toledo introduced the latest iteration of Easy Vis, a compact solution for analyzing liquid samples. This device evaluates optical spectrum, color, and water characteristics, combining functionalities of a colorimeter, spectrophotometer, and water testing methods within a single, portable unit, replacing the need for three separate instruments.

FAQs:

What will be the Process Analyzer market size in 2023?

The Process Analyzer market will be valued at USD 7.8 billion in 2023.

What CAGR will be recorded for the Process Analyzer market from 2023 to 2028?

The global Process Analyzer market is expected to record a CAGR of 3.6% from 2023–2028.

Who are the top players in the Process Analyzer market?

The significant vendors operating in the Process Analyzer market include ABB (Switzerland), Emerson Electric Co. (US), Siemens (Germany), Endress+Hauser Group Services AG (Switzerland), Yokogawa Electric Corporation (Japan), Mettler Toledo (US), Suez (US), Thermo Fisher Scientific, Inc. (US), Ametek. Inc.(US), Anton Paar GmbH (Austria).

Which significant countries are considered in the Asia Pacific region?

The report includes an analysis of China, Japan, , India, and the Rest of Asia Pacific.

Which types have been considered in the Process Analyzer market?

Liquid Analyzer & Gas Analyzer are considered in the market study.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising need for efficient and effective water and wastewater treatment- Increasing adoption of process analyzers by pharma companies to ensure drug safety- Booming chemicals and petrochemical industries worldwideRESTRAINTS- Shortage of skilled professionals- High infrastructure setup costOPPORTUNITIES- Increasing demand for process analyzers from emerging markets such as China & India- Growing focus on environmental monitoringCHALLENGES- Need for continuous support and maintenance of installed analyzers- Complexities associated with installation and operation

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE OF PROCESS ANALYZERS PROVIDED BY KEY PLAYERS, BY TYPE

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCEINTERNET OF THINGS (IOT)CYBERSECURITYMICRO-ELECTRO-MECHANICAL SYSTEMS (MEMS)

-

5.8 PORTER’S FIVE FORCE ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISCASE STUDY 1: USE OF PROCESS ANALYZERS TO MEASURE H2S IN CRUDE OIL TO ENSURE SAFETY DURING TRANSPORTATIONCASE STUDY 2: DEPLOYMENT OF IN-SITU GAS ANALYZER FOR TROUBLE-FREE OXYGEN MEASUREMENT

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSISLIST OF MAJOR PATENTS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATIONS AND STANDARDSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.15 STANDARDSISO (INTERNATIONAL ORGANIZATION FOR STANDARDIZATION)- ISO 21501- ISO 14911IEC (INTERNATIONAL ELECTROTECHNICAL COMMISSION)- IEC 60079 seriesISA (INTERNATIONAL SOCIETY OF AUTOMATION)- ISA-88- ISA-84

- 6.1 INTRODUCTION

- 6.2 ON-LINE ANALYSIS

- 6.3 IN-LINE ANALYSIS

- 6.4 AT-LINE ANALYSIS

- 7.1 INTRODUCTION

-

7.2 PH/ORP ANALYZERUSE OF PH/ORP ANALYZERS IN REVERSE OSMOSIS AND COOLING PROCESSES TO FUEL SEGMENTAL GROWTH

-

7.3 CONDUCTIVITY ANALYZERRELIANCE ON CONDUCTIVITY ANALYZERS TO IMPROVE INDUSTRIAL PROCESS EFFICIENCY TO PROPEL MARKET

-

7.4 TURBIDITY ANALYZERNEED FOR ACCURATE TURBIDITY MEASUREMENT IN WASTEWATER TREATMENT FACILITIES TO ACCELERATE SEGMENTAL GROWTH

-

7.5 DISSOLVED OXYGEN ANALYZERINSTALLATION OF DISSOLVED OXYGEN ANALYZERS IN WATER MONITORING APPLICATIONS TO CONTRIBUTE TO MARKET GROWTH

-

7.6 LIQUID DENSITY ANALYZERDEPLOYMENT OF IOT TECHNOLOGY IN LIQUID DENSITY ANALYZERS TO PROPEL SEGMENTAL GROWTH

-

7.7 MLSS ANALYZERUTILIZATION OF MLSS ANALYZERS TO OPTIMIZE WASTEWATER TREATMENT TO DRIVE MARKET

-

7.8 TOC ANALYZERADOPTION OF TOC ANALYZERS TO ENSURE COMPLIANCE WITH PHARMACEUTICAL MANUFACTURING STANDARDS TO BOOST SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 OXYGEN ANALYZERADVANCEMENTS IN SENSOR TECHNOLOGY TO FUEL MARKET GROWTH

-

8.3 CARBON DIOXIDE ANALYZERNEED FOR ACCURATE MONITORING OF CO2 LEVELS TO DRIVE MARKET

-

8.4 MOISTURE ANALYZERGROWING IMPORTANCE OF MOISTURE CONTROL IN INDUSTRIES TO FOSTER SEGMENTAL GROWTH

-

8.5 TOXIC GAS ANALYZERADVANCED SENSOR TECHNOLOGY AND INTEGRATION OF IOT TO CREATE LUCRATIVE GROWTH OPPORTUNITIES

-

8.6 HYDROGEN SULFIDE ANALYZERINCREASING FOCUS ON REDUCING ENVIRONMENTAL IMPACT TO BOOST SEGMENTAL GROWTH

- 9.1 INTRODUCTION

-

9.2 OIL & GASINCREASING EMPHASIS ON MINIMIZING PRODUCTION COSTS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

-

9.3 PETROCHEMICALRISING LPG/LNG PRODUCTION TO BOOST DEMAND

-

9.4 PHARMACEUTICALSTRONG FOCUS ON DRUG SAFETY TO FUEL MARKET GROWTH

-

9.5 WATER & WASTEWATERINTEGRATION OF SENSORS AND ANALYZERS INTO CENTRALIZED CONTROL SYSTEMS TO DRIVE MARKET

-

9.6 POWERGROWING DEMAND FOR SUSTAINABLE ENERGY TO FUEL MARKET GROWTH

-

9.7 FOOD & BEVERAGERISING FOCUS ON ENHANCING FOOD PRODUCTION QUALITY, SAFETY, AND COST-EFFICIENCY TO BOOST DEMAND FOR PROCESS ANALYZERS

-

9.8 PAPER & PULPABILITY TO DETECT CONTAMINANTS AND VERIFY PULP PROPERTIES TO BOOST DEMAND

-

9.9 METALS & MININGGROWING DEMAND FOR METALS AND MINERALS TO INCREASE ADOPTION OF PROCESS ANALYZERS

-

9.10 CEMENT & GLASSINCREASED INVESTMENTS IN CONSTRUCTION OF RESIDENTIAL AND COMMERCIAL BUILDINGS TO FUEL MARKET GROWTH

-

9.11 OTHERSPROCESS ANALYZER MARKET, BY REGION

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACT ON MARKET IN NORTH AMERICAUS- Increasing use of predictive and preventive maintenance techniques to fuel market growthCANADA- Advent of Industry 4.0 and IIoT to drive marketMEXICO- Growing demand for minerals to create growth opportunities

-

10.3 EUROPERECESSION IMPACT ON MARKET IN EUROPEUK- Rising focus on workplace safety and energy conservation to boost demandGERMANY- Increasing adoption of automation to fuel market growthFRANCE- Stringent regulatory policies to drive demand from oil & gas and pharmaceutical companiesREST OF EUROPE (ROE)

-

10.4 ASIA PACIFICRECESSION IMPACT ON MARKET IN ASIA PACIFICCHINA- Rapid adoption of Industry 4.0 to accelerate market growthJAPAN- Thriving pharmaceutical industry to drive marketINDIA- Government-led initiatives to boost production in chemical and pharmaceutical industries to contribute to market growthREST OF ASIA PACIFIC

-

10.5 ROWRECESSION IMPACT ON MARKET IN ROWMIDDLE EAST & AFRICA- Increasing investments in infrastructure development to drive marketSOUTH AMERICA- Expanding industrial sector and stringent environmental regulations to drive market

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS, 2018–2022

- 11.3 MARKET SHARE ANALYSIS, 2022

-

11.4 EVALUATION MATRIX OF KEY COMPANIES, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.5 EVALUATION MATRIX OF STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES), 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

-

11.6 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSABB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEMERSON ELECTRIC CO.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSIEMENS- Business overview- Products/Solutions/Services offeredENDRESS+HAUSER GROUP SERVICES AG- Business overview- Products/Solutions/Services offered- Recent developmentsYOKOGAWA ELECTRIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMETTLER TOLEDO- Business overview- Products/Solutions/Services offered- Recent developmentsSUEZ- Business overview- Products/Solutions/Services offered- Recent developmentsTHERMO FISHER SCIENTIFIC INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMETEK, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewANTON PAAR GMBH- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER KEY PLAYERSHACHSHIMADZU CORPORATIONJUMO GMBH & CO. KGAPPLIED ANALYTICS, INC.OMEGA ENGINEERING, INC.VEGA GRIESHABER KGSARTORIUS AGSCHMIDT + HAENSCHMETROHM AGHORIBABERTHOLD TECHNOLOGIES GMBH & CO. KGKYOTO ELECTRONICS MANUFACTURING CO., LTD.MICHELL INSTRUMENTSSINAR TECHNOLOGYGOW-MAC INSTRUMENT COMPANY

-

12.3 STARTUP/SME PLAYERSSKALAR ANALYTICAL B.V.UIC, INC.COMET ANALYTICS, INC.TOC SYSTEMSSENSOTECHBOPP & REUTHER MESSTECHNIK GMBHROTOTHERM GROUPINTEGRATED SENSING SYSTEMSLIQUID ANALYTICAL RESOURCE, LLCELTRA GMBH

- 13.1 INTRODUCTION

- 13.2 STUDY LIMITATIONS

- 13.3 GAS SENSORS MARKET, BY PRODUCT

-

13.4 GAS ANALYZERS & MONITORSPRESSING NEED FOR WORKPLACE SAFETY TO BOOST DEMAND

-

13.5 GAS DETECTORSBOOMING AUTOMOTIVE SECTOR TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

-

13.6 AIR QUALITY MONITORSONGOING CAMPAIGNS AND PROGRAMS TO INCREASE AWARENESS ABOUT AIR POLLUTION CONTROL TO BOOST DEMAND

-

13.7 AIR PURIFIERS/AIR CLEANERSGROWING DEPLOYMENT IN COMMERCIAL AND RESIDENTIAL BUILDINGS TO DRIVE MARKET

-

13.8 HVAC SYSTEMSRISING NEED TO REGULATE ENVIRONMENTAL CONDITIONS TO DRIVE MARKET

-

13.9 MEDICAL EQUIPMENTINCREASING DEMAND FOR VENTILATORS AND INCUBATORS TO DRIVE MARKET

-

13.10 CONSUMER DEVICESSURGING ADOPTION OF WEARABLE DEVICES TO DRIVE MARKET

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 ROLE OF CRITICAL PARTICIPANTS IN ECOSYSTEM

- TABLE 2 AVERAGE SELLING PRICE OF PROCESS ANALYZERS OFFERED BY KEY PLAYERS, BY TYPE (USD)

- TABLE 3 AVERAGE SELLING PRICE OF PROCESS ANALYZER BY REGION (USD)

- TABLE 4 PORTER'S FIVE FORCES ANALYSIS WITH THEIR IMPACT (2022)

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES (%)

- TABLE 6 KEY BUYING CRITERIA OF TOP 3 INDUSTRIES

- TABLE 7 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 8 PROCESS ANALYZER MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019–2022 (USD MILLION)

- TABLE 14 PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023–2028 (USD MILLION)

- TABLE 15 LIQUID ANALYZER: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 16 LIQUID ANALYZER: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 PH/ORP ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 18 PH/ORP ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 19 CONDUCTIVITY ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 20 CONDUCTIVITY ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 21 TURBIDITY ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 22 TURBIDITY ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 23 DISSOLVED OXYGEN ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 24 DISSOLVED OXYGEN ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 25 LIQUID DENSITY ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 26 LIQUID DENSITY ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 27 MLSS ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 28 MLSS ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 29 TOC ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 30 TOC ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 31 PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019–2022 (USD MILLION)

- TABLE 32 PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023–2028 (USD MILLION)

- TABLE 33 GAS ANALYZER: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 GAS ANALYZER: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 OXYGEN ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 36 OXYGEN ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 37 CARBON DIOXIDE ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 38 CARBON DIOXIDE ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 39 MOISTURE ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 40 MOISTURE ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 41 TOXIC GAS ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 42 TOXIC GAS ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 43 HYDROGEN SULFIDE ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 44 HYDROGEN SULFIDE ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 45 PROCESS ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 46 PROCESS ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 47 OIL & GAS: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019–2022 (USD MILLION)

- TABLE 48 OIL & GAS: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023–2028 (USD MILLION)

- TABLE 49 OIL & GAS: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019–2022 (USD MILLION)

- TABLE 50 OIL & GAS: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023–2028 (USD MILLION)

- TABLE 51 OIL & GAS: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 OIL & GAS: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 PETROCHEMICAL: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019–2022 (USD MILLION)

- TABLE 54 PETROCHEMICAL: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023–2028 (USD MILLION)

- TABLE 55 PETROCHEMICAL: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019–2022 (USD MILLION)

- TABLE 56 PETROCHEMICAL: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023–2028 (USD MILLION)

- TABLE 57 PETROCHEMICAL: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 PETROCHEMICAL: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 PHARMACEUTICAL: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019–2022 (USD MILLION)

- TABLE 60 PHARMACEUTICAL: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023–2028 (USD MILLION)

- TABLE 61 PHARMACEUTICAL: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019–2022 (USD MILLION)

- TABLE 62 PHARMACEUTICAL: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023–2028 (USD MILLION)

- TABLE 63 PHARMACEUTICAL: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 PHARMACEUTICAL: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 WATER & WASTEWATER: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019–2022 (USD MILLION)

- TABLE 66 WATER & WASTEWATER: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023–2028 (USD MILLION)

- TABLE 67 WATER & WASTEWATER: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019–2022 (USD MILLION)

- TABLE 68 WATER & WASTEWATER: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023–2028 (USD MILLION)

- TABLE 69 WATER & WASTEWATER: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 WATER & WASTEWATER: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 POWER: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019–2022 (USD MILLION)

- TABLE 72 POWER: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023–2028 (USD MILLION)

- TABLE 73 POWER: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019–2022 (USD MILLION)

- TABLE 74 POWER: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023–2028 (USD MILLION)

- TABLE 75 POWER: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 POWER: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 FOOD & BEVERAGE: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019–2022 (USD MILLION)

- TABLE 78 FOOD & BEVERAGE: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023–2028 (USD MILLION)

- TABLE 79 FOOD & BEVERAGE: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019–2022 (USD MILLION)

- TABLE 80 FOOD & BEVERAGE: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023–2028 (USD MILLION)

- TABLE 81 FOOD & BEVERAGE: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 FOOD & BEVERAGE: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 PAPER & PULP: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019–2022 (USD MILLION)

- TABLE 84 PAPER & PULP: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023–2028 (USD MILLION)

- TABLE 85 PAPER & PULP: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019–2022 (USD MILLION)

- TABLE 86 PAPER & PULP: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023–2028 (USD MILLION)

- TABLE 87 PAPER & PULP: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 PAPER & PULP: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 METALS & MINING: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019–2022 (USD MILLION)

- TABLE 90 METAL & MINING: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023–2028 (USD MILLION)

- TABLE 91 METALS & MINING: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019–2022 (USD MILLION)

- TABLE 92 METALS & MINING: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023–2028 (USD MILLION)

- TABLE 93 METALS & MINING: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 METALS & MINING: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 CEMENT & GLASS: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019–2022 (USD MILLION)

- TABLE 96 CEMENT & GLASS: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023–2028 (USD MILLION)

- TABLE 97 CEMENT & GLASS: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019–2022 (USD MILLION)

- TABLE 98 CEMENT & GLASS: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023–2028 (USD MILLION)

- TABLE 99 CEMENT & GLASS: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 100 CEMENT & GLASS: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 OTHERS: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019–2022 (USD MILLION)

- TABLE 102 OTHERS: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023–2028 (USD MILLION)

- TABLE 103 OTHERS: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019–2022 (USD MILLION)

- TABLE 104 OTHERS: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023–2028 (USD MILLION)

- TABLE 105 OTHERS: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 106 OTHERS: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 108 PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: PROCESS ANALYZER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: PROCESS ANALYZER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: PROCESS ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: PROCESS ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: PROCESS ANALYZER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 114 EUROPE: PROCESS ANALYZER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 EUROPE: PROCESS ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 116 EUROPE: PROCESS ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: PROCESS ANALYZER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: PROCESS ANALYZER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: PROCESS ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: PROCESS ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 121 ROW: PROCESS ANALYZER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 122 ROW: PROCESS ANALYZER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 123 ROW: PROCESS ANALYZER MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 124 ROW: PROCESS ANALYZER MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 125 PROCESS ANALYZER MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 126 PROCESS ANALYZER MARKET SHARE ANALYSIS, 2022

- TABLE 127 LIQUID ANALYZER: COMPANY FOOTPRINT

- TABLE 128 GAS ANALYZER: COMPANY FOOTPRINT

- TABLE 129 INDUSTRY: COMPANY FOOTPRINT

- TABLE 130 REGION: COMPANY FOOTPRINT

- TABLE 131 OVERALL COMPANY FOOTPRINT

- TABLE 132 PROCESS ANALYZER MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 133 PROCESS ANALYZER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 134 PROCESS ANALYZER MARKET: PRODUCT LAUNCHES, 2021–2023

- TABLE 135 PROCESS ANALYZER MARKET: DEALS, 2021–2023

- TABLE 136 PROCESS ANALYZER MARKET: OTHER DEVELOPMENTS, 2021–2023

- TABLE 137 ABB: COMPANY OVERVIEW

- TABLE 138 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 ABB: PRODUCT LAUNCHES

- TABLE 140 ABB: DEALS

- TABLE 141 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 142 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 OTHERS: HONEYWELL INTERNATIONAL INC

- TABLE 144 SIEMENS: COMPANY OVERVIEW

- TABLE 145 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY OVERVIEW

- TABLE 147 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 148 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCT LAUNCHES

- TABLE 149 ENDRESS+HAUSER GROUP SERVICES AG: DEALS

- TABLE 150 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 151 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERINGS

- TABLE 152 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 153 METTLER TOLEDO: COMPANY OVERVIEW

- TABLE 154 METTLER TOLEDO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 METTLER TOLEDO: PRODUCT LAUNCHES

- TABLE 156 SUEZ: COMPANY OVERVIEW

- TABLE 157 SUEZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 SUEZ: PRODUCT LAUNCHES

- TABLE 159 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 160 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES

- TABLE 162 THERMO FISHER SCIENTIFIC INC.: DEALS

- TABLE 163 AMETEK, INC.: COMPANY OVERVIEW

- TABLE 164 AMETEK, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 AMETEK, INC.: PRODUCT LAUNCHES

- TABLE 166 AMETEK, INC.: OTHERS

- TABLE 167 ANTON PAAR GMBH: BUSINESS OVERVIEW

- TABLE 168 ANTON PAAR GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 170 GAS SENSORS MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

- TABLE 171 GAS SENSORS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- FIGURE 1 PROCESS ANALYZER MARKET: RESEARCH DESIGN

- FIGURE 2 PROCESS ANALYZER MARKET: SECONDARY AND PRIMARY RESEARCH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 4 PROCESS ANALYZER MARKET: BOTTOM-UP APPROACH

- FIGURE 5 PROCESS ANALYZER MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 ASSUMPTIONS OF RESEARCH STUDY

- FIGURE 8 TOC ANALYZER SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 9 OXYGEN ANALYZERS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 PHARMACEUTICAL INDUSTRY TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 11 PROCESS ANALYZER MARKET IN EUROPE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 BOOMING PHARMACEUTICALS INDUSTRY IN ASIA PACIFIC TO CREATE LUCRATIVE OPPORTUNITIES FOR PROCESS ANALYZER MARKET

- FIGURE 13 MLSS ANALYZER SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 OXYGEN ANALYZER SEGMENT TO SECURE LARGEST MARKET SHARE IN 2028

- FIGURE 15 PHARMACEUTICAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO DOMINATE GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 17 JAPAN ACCOUNTED FOR LARGEST SHARE OF GLOBAL MARKET IN 2022

- FIGURE 18 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 PROCESS ANALYZER MARKET DRIVERS: IMPACT ANALYSIS

- FIGURE 20 PROCESS ANALYZER MARKET RESTRAINTS: IMPACT ANALYSIS

- FIGURE 21 PROCESS ANALYZER MARKET OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 22 PROCESS ANALYZER MARKET CHALLENGES: IMPACT ANALYSIS

- FIGURE 23 SUPPLY CHAIN ANALYSIS MODEL

- FIGURE 24 GLOBAL PROCESS ANALYZER ECOSYSTEM

- FIGURE 25 AVERAGE SELLING PRICE OF DIFFERENT TYPES OF PROCESS ANALYZERS OFFERED BY KEY PLAYERS

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- FIGURE 28 KEY BUYING CRITERIA OF TOP 3 INDUSTRIES

- FIGURE 29 IMPORT DATA FOR HS CODE 902710, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR HS CODE 852580, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 31 TOP 10 COMPANIES WITH SIGNIFICANT SHARE OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 32 PATENT ANALYSIS RELATED TO PROCESS ANALYZER MARKET

- FIGURE 33 PROCESS ANALYZER MARKET, BY ANALYSIS TYPE

- FIGURE 34 PROCESS ANALYZER MARKET, BY LIQUID ANALYZER

- FIGURE 35 MLSS ANALYZERS TO DEPICT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 PROCESS ANALYZER MARKET, BY GAS ANALYZER

- FIGURE 37 OXYGEN ANALYZERS TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 38 PROCESS ANALYZER MARKET, BY INDUSTRY

- FIGURE 39 PHARMACEUTICAL INDUSTRY TO COMMAND PROCESS ANALYZER MARKET DURING FORECAST PERIOD

- FIGURE 40 PROCESS ANALYZER MARKET, BY REGION

- FIGURE 41 PROCESS ANALYZER MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: PROCESS ANALYZER MARKET SNAPSHOT

- FIGURE 43 EUROPE: PROCESS ANALYZER MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: PROCESS ANALYZER MARKET SNAPSHOT

- FIGURE 45 SOUTH AMERICA TO DOMINATE MARKET IN ROW THROUGHOUT FORECAST PERIOD

- FIGURE 46 REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2018–2022

- FIGURE 47 PROCESS ANALYZER MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 48 PROCESS ANALYZER MARKET: EVALUATION MATRIX OF KEY COMPANIES, 2022

- FIGURE 49 PROCESS ANALYZER MARKET: EVALUATION MATRIX OF STARTUPS/SMES, 2022

- FIGURE 50 ABB: COMPANY SNAPSHOT

- FIGURE 51 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 52 SIEMENS: COMPANY SNAPSHOT

- FIGURE 53 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY SNAPSHOT

- FIGURE 54 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 METTLER TOLEDO: COMPANY SNAPSHOT

- FIGURE 56 SUEZ: COMPANY SNAPSHOT

- FIGURE 57 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 58 AMETEK, INC.: COMPANY SNAPSHOT

- FIGURE 59 GAS SENSORS MARKET, BY PRODUCT

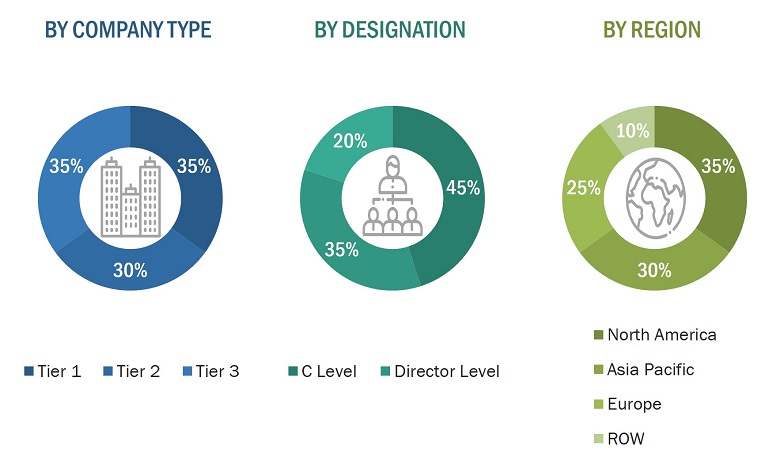

The study involves four significant activities for estimating the size of the Process Analyzer market. Exhaustive secondary research has been conducted to collect information related to the market. The next step is to validate these findings and assumptions related to the market size with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the Process Analyzer market. After that, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications, articles by recognized authors; directories; and databases. The secondary data has been collected and analyzed to determine the overall market size, further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the Process Analyzer market through secondary research. Several primary interviews have been conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been implemented to estimate and validate the size of the Process Analyzer market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Process Analyzer Market: Top-Down Approach

- In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

- For calculating the Process Analyzer market segments, the market size obtained by implementing the bottom-up approach has been used to implement the top-down approach, which was later confirmed with the primary respondents across different regions.

- The bottom-up approach has also been implemented for the data extracted from secondary research to validate the market size of various segments.

- Each company’s market share has been estimated to verify the revenue shares used earlier in the bottom-up approach. With the help of data triangulation and validation of data through primaries, the size of the overall Process Analyzer and each market have been determined and confirmed in this study.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments. The data was then triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Process analyzers are online instrumentation tools for industrial process analysis. They are used to identify the composition or physical properties of substances involved in the industrial process. Process analyzer equipment eliminates the need for routine sampling of an industrial process, which is time-consuming and may not provide representative samples. Process analyzer equipment caters to various industries such as oil & gas, petrochemicals, food & beverage, water & wastewater, pulp & paper, metal & mining, thermal power, and cement & glass. These analyzers also enable asset protection, process optimization, and compliance with environmental regulations. The Key players in the Process Analyzer Market are ABB (Switzerland), Emerson Electric Co. (US), Siemens (Germany), Endress+Hauser Group Services AG (Switzerland), Yokogawa Electric Corporation (Japan), Mettler Toledo (US), Suez (US), Thermo Fisher Scientific, Inc. (US), Ametek: Inc. (US), Anton Paar GmbH (Austria) and Other Players.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Providers of technology solutions

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations related to Process Analyzer

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- Existing end users and prospective ones

Report Objectives:

- To describe and forecast the Process Analyzer market in terms of value based on Liquid Analyzer, Gas Analyzer, and Industry

- To describe and forecast the Process Analyzer market size in terms of value for four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the Process Analyzer market

- To provide a detailed overview of the supply chain of the ecosystem

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To analyze the probable impact of the recession on the market in the future

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio.

- To analyze competitive developments such as acquisitions, product launches, partnerships, expansions, and collaborations undertaken in the Process Analyzer market

Available Customization:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional five market players

Growth opportunities and latent adjacency in Process Analyzer Market