Flexitank Market by Type (Monolayer and Multilayer), Loading Type (Bottom Loading and Top Loading), Application (Food-Grade Liquids, Non-Hazardous Chemicals/Liquids, and Pharmaceutical Liquids), and Region - Global Forecast to 2023

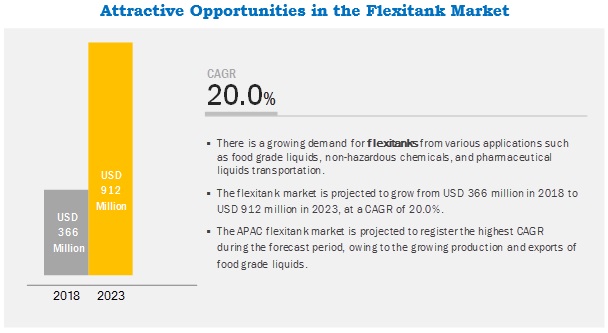

The flexitank market is projected to reach USD 912 million by 2023, at a CAGR of 20.0%. Growth in the global trade of food-grade liquids, non-hazardous chemicals, and pharmaceutical liquids is the major driver for the flexitanks market. Also, its competitive benefits over other traditional substitutes drive the flexitank market.

The multilayer segment dominates the flexitanks market and is projected to be the fastest-growing type segment.

The multilayer type segment accounted for the largest share and expected to register the highest CAGR during the forecast period. This segment has high-performance benefits over the monolayer segment. These benefits are its durability and strength which are highly required when flexitanks are transported throough old containers. Also, flexitanks have multiple layers which protect the cargo from getting contaminated. Its oxygen and moisture barrier properties are vital for the transportation of food-grade liquids. These benefits boost the flexitank market.

The food-grade liquids application segment is projected to register the highest CAGR during the forecast period.

Food grade liquids such as juice, juice concentrates, wine, animal oils, edible oils, glucose, glycerin, jam, malt extract, sauces, sorbitol, vinegar, water, and sugar syrup are traded in bulk quantities globally. These liquids are traded across all the regions. For example, edible oils and apple juice are exported majorly from the APAC region. Fruit juice, juice concentrate, and wine are exported from North America, South America, and Europe. Thus, flexitank finds global demand in the food-grade liquid application.

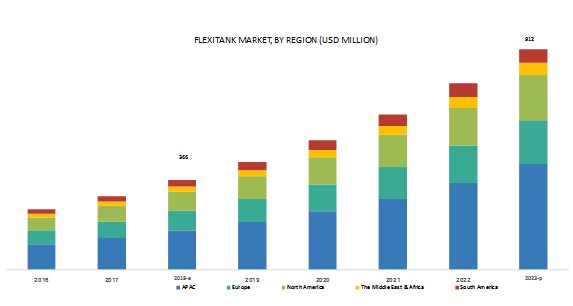

APAC is projected to be the largest market, during the forecast period.

APAC has the largest populous countries such as China and India. China, Japan, South Korea, Indonesia, Malaysia, and India are the major consumer markets for flexitanks. China, Hong Kong, Australia, Singapore, and New Zealand are among the top 15 exporters of wine. The presence of this huge wine exporting industry across the region is favorable for the demand for flexitanks. Also, in palm oil exports, Indonesia, Malaysia, and Thailand lead the market with largest exports. Indonesia and Malaysia are the 1st- and 2nd-largest palm oil exporting countries across the globe. Across APAC, the majority of the flexitank demand is driven by food-grade liquids exports.

Key Market Players in Flexitank Market

Braid Logistics (Scotland), Bulk Liquid Solutions (India), Environmental Packaging Technologies (US), SIA Flexitanks (Ireland), and Trans Ocean Bulk Logistics (US) are the key players operating in the flexitank market.

These companies have adopted various organic as well as inorganic growth strategies between 2015 and 2018 to strengthen their position in the market. New product launch and expansion were among the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for flexitanks from emerging economies.

Flexitank Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Units considered |

Value (USD) and Volume (Units) |

|

Segments |

Type, Loading Ttype, Application, and Region |

|

Regions |

North America, APAC, Europe, the Middle East & Africa, and South America |

|

Companies |

Braid Logistics (Scotland), Bulk Liquid Solutions (India), Environmental Packaging Technologies (US), SIA Flexitanks (Ireland), Trans Ocean Bulk Logistics (US) |

This research report categorizes the flexitanks market based on type, loading type, application, and region.

Flexitank Market, by Type:

- Monolayer

- Multilayer

Flexitanks Market, by Loading Type:

- Top Loading

- Bottom Loading

Flexitanks Market, by Application

- Food-Grade Liquids

- Non-Hazardous Chemicals/Liquids

- Pharmaceutical Liquids

Flexitanks Market, by Region:

- North America

- APAC

- Europe

- Middle East & Africa

- South America

The flexitanks market has been further analyzed based on key countries in each of these regions.

Recent Developments in Flexitank Market

- In October 2018, Braid Logistics expanded its global network in APAC with the establishment of Braid Japan Co., Ltd. (Japan). This expansion will allow the company to cater to the Japanese export market and expand its footprints across the APAC market.

- In November 2016, Braid Logistics innovated Braid Agi-tank, which is ideal for liquids with high solid contents such as pepper mesh, fruit pulp, grape mash, olives, and fish slurries. This newly launched flexitank has more than two injection points, which can be used to pneumatically mix high solid content liquids before discharge. These liquids can be pepper mesh, fruit pulp, grape mash, olives, fish slurries, and many other liquids.

- In June 2017, Environmental Packaging Technologies (EPT) launched a new flexitank under brand name LIQUIRIDE, especially for refrigerated shipping containers. The company will benefit from this new line of flexitanks, which focuses on applications requiring temperature-control transportation of fresh juices and concentrates.

- In June 2017, Environmental Packaging Technologies (EPT) doubled its production capacity of flexitanks at its Michigan, US plant. This development is in response to the increasing demand for flexitanks.

Critical Questions the Report Answers:

- What are the upcoming hot bets for the flexitank market?

- How is the market dynamics changing for different types of flexitanks?

- How is the market dynamics changing for a different application of flexitanks?

- Who are the major manufacturers of flexitanks?

- How is the market dynamics changing for different regions of flexitanks?

Frequently Asked Questions (FAQ):

How big is the Flexitank Market Industry?

The flexitank market is projected to reach USD 912 million by 2023, At a CAGR of 20.0%.

Who leading market players in Flexitank Market Industry?

Braid Logistics (Scotland), Bulk Liquid Solutions (India), Environmental Packaging Technologies (US), SIA Flexitanks (Ireland), Trans Ocean Bulk Logistics (US), Qingdao LAF Packaging (China), Hengxin Plastic (China), Qingdao Global Flexitank Logistics (China), Trust Flexitanks (Spain), and Rishi FIBC (India) are the leading players operating in the flexitank market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Data Triangulation

2.4 Limitations

2.5 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in the Flexitank Market

4.2 Flexitanks Market, By Type

4.3 Flexitank Market, By Loading Type

4.4 Flexitanks Market, By Application

4.5 APAC Flexitank Market, By Application and Country

4.6 Flexitanks Market, By Key Countries

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Trade of Wine Globally

5.2.1.2 Competitive Advantages Over Other Alternatives

5.2.2 Restraints

5.2.2.1 Volatility in Prices of Raw Materials to Hamper the Market Growth

5.2.3 Opportunities

5.2.3.1 Increase in Commodity Trade in Brics Nations

5.2.3.2 New Configuration in Flexitanks and Bigger Size of Containers

5.2.4 Challenges

5.2.4.1 Availability of Low-Quality Flexitanks and Containers

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Certification and Approvals

5.4.1 Loading Regulations

5.5 Macroeconomic Indicators

5.5.1 Introduction

5.5.2 Real GDP Growth Rate and Per Capita GDP of Major Economies

5.5.3 Global Wine Production

6 Flexitank Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Monolayer Flexitanks

6.2.1 Food-Grade Liquids Drive the Monolayer Flexitank Market

6.3 Mutilayer Flexitanks

6.3.1 Multilayer Type is the Fastest-Growing Segment

7 Flexitank Market, By Loading Type (Page No. - 42)

7.1 Introduction

7.2 Top Loading Flexitanks

7.2.1 Top Loading Flexitanks Have Higher Demand in Europe

7.3 Bottom Loading Flexitanks

7.3.1 Bottom Loading Flexitank Type is the Faster-Growing Segment

8 Flexitank Market, By Application (Page No. - 45)

8.1 Introduction

8.2 Food-Grade Liquids

8.2.1 Wine, Spirits, and Alcoholic Beverages

8.2.1.1 Wine is the Most Transported Food-Grade Liquid Through Flexitanks

8.2.2 Edible Oils

8.2.2.1 APAC is the Largest Exporter of Edible Oils

8.2.3 Juice, Juice Concentrates, and Syrups

8.2.3.1 Orange Juice and Apple Juice are Most Traded Juices Across the Globe

8.2.4 Others

8.3 Non-Hazardous Chemicals/Liquids

8.3.1 Non-Hazardous Chemicals/Liquids Segment is the Second-Largest Application of Flexitanks

8.4 Pharmaceutical Liquids

8.4.1 European Countries are the Largest Exporters of Pharmaceutical Liquids

9 Flexitank Market, By Region (Page No. - 50)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.1.1 China to Dominate the Global Flexitanks Market

9.2.2 Japan

9.2.2.1 The Presence of One of the Largest Chemical Industries is Favorable for the Flexitank Market

9.2.3 Malaysia

9.2.3.1 Malaysia is the Second-Largest Palm Oil Exporter Globally

9.2.4 Indonesia

9.2.4.1 Indonesia is the Largest Exporter of Palm Oil in the World Which is Positively Influencing the Flexitank Market Growth

9.2.5 South Korea

9.2.5.1 Demand for Flexitanks is Driven By Growing Exports of Chemical Products From the Country

9.2.6 India

9.2.6.1 India to Register the Largest CAGR in the Flexitank Market During the Forecast Period

9.2.7 Rest of APAC

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany Accounted for the Largest Market Share in Europe

9.3.2 France

9.3.2.1 France is the Largest Exporter of Wine in the World

9.3.3 Italy

9.3.3.1 Being the Second-Largest Wine Exporter in the World, Italy Drives the Demand for Flexitanks

9.3.4 UK

9.3.4.1 The UK’s Strong Position in Wine, Pharmaceutical Products, and Chemical Exports Drives the Flexitank Market

9.3.5 Spain

9.3.5.1 Spain is One of the Top 5 Wine Producers and Exporters, Which is Favorable for the Demand for Flexitanks

9.3.6 Rest of Europe

9.4 North America

9.4.1 US

9.4.1.1 The US is the Largest Exporter of Orange Juice, Wine, and Chemicals in North America

9.4.2 Mexico

9.4.2.1 Mexico’s Orange Juice Export is Expected to Drive the Flexitank Market

9.4.3 Canada

9.4.3.1 Orange Juice Exports to Boost the Demand for Flexitanks in Canada

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.1.1 Saudi Arabia is the Largest Exporter of Chemicals in the Region

9.5.2 Rest of the Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.1.1 Brazil is the Largest Producer and Exporter of Orange Juice

9.6.2 Rest of South America

10 Competitive Landscape (Page No. - 80)

10.1 Overview

10.2 Market Ranking of Key Players

10.3 Competitive Scenario

10.3.1 New Product Launch

10.3.2 Expansion

11 Company Profile (Page No. - 84)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Braid Logistics

11.2 Bulk Liquid Solutions

11.3 Environmental Packaging Technologies

11.4 SIA Flexitanks

11.5 Trans Ocean Bulk Logistics

11.6 Qingdao Laf Packaging

11.7 Hengxin Plastic

11.8 Qingdao Global Flexitank Logistics

11.9 Trust Flexitanks

11.10 Rishi FIBC

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11.11 Other Companies

11.11.1 Proagri Solutions

11.11.2 Anthente International

11.11.3 Myflexitank

11.11.4 Full-Pak

11.11.5 Andesocean

11.11.6 Hinrich Industries

11.11.7 Bornit Ltd.

11.11.8 Neoflex

11.11.9 Liqua

11.11.10 UWL Flexitanks

11.11.11 Flexpack

11.11.12 M&W Flexitank

11.11.13 Yunjet Plastic Packaging

11.11.14 Sun Flexitanks

11.11.15 One Flexitank

11.11.16 Büscherhoff Packaging Solutions

11.11.17 Qingdao BLT Packing Industrial

12 Appendix (Page No. - 102)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (72 Tables)

Table 1 Annual Percent Change of Real GDP Growth Rates From 2016 to 2023

Table 2 Trends and Forecast of GDP Per Capita, By Country, 2016–2020 (USD)

Table 3 Flexitank Market Size, By Type, 2016–2023 (Units)

Table 4 Flexitanks Market Size, By Type, 2016–2023 (USD Million)

Table 5 Flexitank Market Size, By Loading Type, 2016–2013 (Units)

Table 6 Flexitanks Market Size, By Loading Type, 2016–2013 (USD Million)

Table 7 Flexitank Market Size, By Application, 2016–2023 (Units)

Table 8 Flexitanks Market Size, By Application, 2016–2023 (USD Million)

Table 9 Flexitanks Market Size, By Region, 2016–2023 (Units)

Table 10 Flexitank Market Size, By Region, 2016–2023 (USD Million)

Table 11 APAC: Flexitank Market Size, By Country, 2016–2023 (Units)

Table 12 APAC: Market Size, By Country, 2016–2023 (USD Million)

Table 13 APAC: Market Size, By Application, 2016–2023 (Units)

Table 14 APAC: Market Size, By Application, 2016–2023 (USD Million)

Table 15 China: Flexitanks Market Size, By Application, 2016–2023 (Units)

Table 16 China: Market Size, By Application, 2016–2023 (USD Million)

Table 17 Japan: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 18 Japan: Market Size, By Application, 2016–2023 (USD Million)

Table 19 Malaysia: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 20 Malaysia: Market Size, By Application, 2016–2023 (USD Million)

Table 21 Indonesia: Flexitanks Market Size, By Application, 2016–2023 (Units)

Table 22 Indonesia: Market Size, By Application, 2016–2023 (USD Million)

Table 23 South Korea: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 24 South Korea: Market Size, By Application, 2016–2023 (USD Million)

Table 25 India: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 26 India: Market Size, By Application, 2016–2023 (USD Million)

Table 27 Rest of APAC: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 28 Rest of APAC: Market Size, By Application, 2016–2023 (USD Million)

Table 29 Europe: Flexitank Market Size, By Country, 2016–2023 (Units)

Table 30 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 31 Europe: Market Size, By Application, 2016–2023 (Units)

Table 32 Europe: Market Size, By Application, 2016–2023 (USD Million)

Table 33 Germany: Flexitanks Market Size, By Application, 2016–2023 (Units)

Table 34 Germany: Market Size, By Application, 2016–2023 (USD Million)

Table 35 France: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 36 France: Market Size, By Application, 2016–2023 (USD Million)

Table 37 Italy: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 38 Italy: Market Size, By Application, 2016–2023 (USD Million)

Table 39 UK: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 40 UK: Market Size, By Application, 2016–2023 (USD Million)

Table 41 Spain: Flexitanks Market Size, By Application, 2016–2023 (Units)

Table 42 Spain: Market Size, By Application, 2016–2023 (USD Million)

Table 43 Rest of Europe: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 44 Rest of Europe: Market Size, By Application, 2016–2023 (USD Million)

Table 45 North America: Flexitank Market Size, By Country, 2016–2023 (Units)

Table 46 North America: Market Size, By Country, 2016–2023 (USD Million)

Table 47 North America: Market Size, By Application, 2016–2023 (Units)

Table 48 North America: Market Size, By Application, 2016–2023 (USD Million)

Table 49 US: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 50 US: Market Size, By Application, 2016–2023 (USD Million)

Table 51 Mexico: Flexitanks Market Size, By Application, 2016–2023 (Units)

Table 52 Mexico: Market Size, By Application, 2016–2023 (USD Million)

Table 53 Canada: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 54 Canada: Market Size, By Application, 2016–2023 (USD Million)

Table 55 Middle East & Africa: Flexitank Market Size, By Country, 2016–2023 (Units)

Table 56 Middle East & Africa: Market Size, By Country, 2016–2023 (USD Million)

Table 57 Middle East & Africa: Market Size, By Application, 2016–2023 (Units)

Table 58 Middle East & Africa: Market Size, By Application, 2016–2023 (USD Million)

Table 59 Saudi Arabia: Flexitanks Market Size, By Application, 2016–2023 (Units)

Table 60 Saudi Arabia: Market Size, By Application, 2016–2023 (USD Million)

Table 61 Rest of the Middle East & Africa: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 62 Rest of the Middle East & Africa: Market Size, By Application, 2016–2023 (USD Million)

Table 63 South America: Flexitank Market Size, By Country, 2016–2023 (Units)

Table 64 South America: Market Size, By Country, 2016–2023 (USD Million)

Table 65 South America: Market Size, By Application, 2016–2023 (Units)

Table 66 South America: Market Size, By Application, 2016–2023 (USD Million)

Table 67 Brazil: Flexitanks Market Size, By Application, 2016–2023 (Units)

Table 68 Brazil: Market Size, By Application, 2016–2023 (USD Million)

Table 69 Rest of South America: Flexitank Market Size, By Application, 2016–2023 (Units)

Table 70 Rest of South America: Market Size, By Application, 2016–2023 (USD Million)

Table 71 New Product Launch, 2015–2018

Table 72 Expansion, 2015–2018

List of Figures (33 Figures)

Figure 1 Flexitank Market: Research Design

Figure 2 Flexitanks Market: Top-Down Approach

Figure 3 Flexitank Market: Bottom-Up Approach

Figure 4 Flexitanks Market: Data Triangulation

Figure 5 Multilayer Type to Dominate the Flexitank Market During the Forecast Period

Figure 6 Bottom Loading Type Accounted for the Larger Share in the Flexitanks Market in 2017

Figure 7 Food-Grade Liquids Application Was the Largest Segment of the Flexitank Market

Figure 8 APAC to Be the Largest and Fastest-Growing Flexitanks Market

Figure 9 Growth in Bulk Liquid Trade to Drive the Demand for Flexitanks

Figure 10 Multilayer Flexitank to Be the Larger Type Between 2018 and 2023

Figure 11 Bottom Loading to Capture the Higher Share During the Forecast Period

Figure 12 Food-Grade Liquids to Be the Largest Application of Flexitank By 2023

Figure 13 Food-Grade Liquids Segment and China Accounted for the Largest Market Share in APAC in 2017

Figure 14 India to Register the Highest CAGR in the Market

Figure 15 Driver, Restraints, Opportunities, and Challenges for the Flexitank Market

Figure 16 Trend of Wine Trade in Volume

Figure 17 Global Wine Trade, By Product Type (Volume)

Figure 18 Porter’s Five Forces Analysis: Flexitanks Market

Figure 19 Growth in Global Wine Production From 2010 to 2018

Figure 20 Multilayer Type Segment Dominates the Flexitank Market

Figure 21 Bottom Loading Segment to Dominate the Flexitanks Market

Figure 22 The Food-Grade Liquids Segment to Dominate the Flexitank Market

Figure 23 APAC to Emerge as A New Hotspot in the Global Flexitanks Market, 2018–2023

Figure 24 APAC: Flexitank Market Snapshot

Figure 25 Europe: Flexitanks Market Snapshot

Figure 26 North America: Flexitank Market Snapshot

Figure 27 Companies Adopted New Product Launch as the Key Growth Strategy Between 2015 and 2018

Figure 28 Ranking of Key Flexitanks Manufacturers in 2017

Figure 29 SWOT Analysis: Braid Logistics

Figure 30 SWOT Analysis: Bulk Liquid Solutions

Figure 31 SWOT Analysis: Environmental Packaging Technologies

Figure 32 SWOT Analysis: SIA Flexitanks

Figure 33 SWOT Analysis: Trans Ocean Bulk Logistics

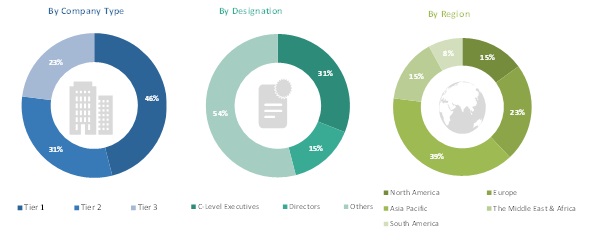

The study involved four major activities in estimating the current market size for flexitanks. The exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Flexitank Market Secondary Research

In the secondary research process, various secondary sources such as Hoovers and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Flexitank Market Primary Research

The flexitank market comprises several stakeholders such as raw material suppliers, distributors of flexitanks, , end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of manufacturers and suppliers of food-grade liquids, pharmaceutical liquids, and chemicals. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Flexitank Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the flexitank market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Flexitank Market Data Triangulation

After arriving at the overall market size using the market size estimation process explained above the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply of flexitanks and their applications.

Objectives of the Study in Flexitank Market

- To define, describe, and forecast the flexitank market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type, loading type, and application

- To forecast the size of the market with respect to five regions, namely, APAC, Europe, North America, South America, and the Middle East & Africa along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as new product launch and expansion undertaken in the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Notes: Micromarkets1 are the subsegments of the flexitank market included in the report.

Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Flexitank Market Regional Analysis:

- Country-level analysis of the flexitank market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Flexitank Market