Juice Concentrates Market by Application (Beverages, Soups & Sauces, Dairy, and Bakery & Confectionery), Type (Fruit, and Vegetable), Ingredient (Single, and Multi-Fruit and Vegetable), Form, and Region - Global Forecast to 2027

Juice Concentrates Market Growth Opportunities and Forecast(2022-2027)

By 2027, the global juice concentrates market is expected to increase at a compound annual growth rate (CAGR) of 4.9% to reach $93.7 billion globally. The market's size worldwide was estimated at $73.7 billion in 2022. Juice concentrates are made by removing most of the water from the original fruit juice, leaving behind a concentrated liquid with a more intense flavor and higher sugar content than the original juice. The resulting concentrate can be stored more easily and takes up less space than the original juice, making it a popular choice for manufacturers and consumers alike.

Some of the advantages of using juice concentrates include a longer shelf life, easy transportation and storage, consistent flavor, and reduced shipping costs due to the removal of water from the product.The global market is expanding at a rapid pace, with a promising outlook that highlights the increasing demand for these versatile ingredients in a variety of food and beverage products. These highly concentrated juices are becoming increasingly popular due to their convenience, extended shelf life, and versatility in a wide range of food and beverage applications. As consumers become more health-conscious and demand easy-to-use products, juice concentrates are seen as a natural and healthy alternative to traditional juice products. This growth is being fueled by a variety of factors, including the trend towards health and wellness, the convenience and versatility of juice concentrates as an ingredient, and the increasing demand for these products in emerging economies.

To know about the assumptions considered for the study, Request for Free Sample Report

As a result, the global market is set for a bright future as manufacturers continue to invest in research and development to create innovative and sustainable products that meet changing consumer demands. With their widespread use as an ingredient in soft drinks, jams, jellies, and baby foods, among other food and beverage products, the demand for juice concentrates is expected to continue its swift expansion in the coming years. This underscores the growing importance of these highly concentrated juices in the food and beverage industry, and highlights the increasing trend of consumers seeking out healthy and natural options in their diets.

Juice Concentrates Market Dynamics

Drivers: Sustainability is the key to the bolstering demand for Juice Concentrates

Global thirst for commercial beverages is rising, especially for plant-based beverages, carbonated water, functional beverages as energy drinks, and ready-to-drink beverages. Beverage production necessitates safe raw material procurement and the maintenance of desired end-product characteristics through safe, cost-effective, and sustainable multi-stage processing. The industry has witnessed an increasing sustainability trend over a couple of years. Sustainable food sourcing is a prime aspect and includes shifting to use more organic and/or locally grown and raised produce in beverage plants and ties in with several goals for shrinking the environmental impact. Moreover, recently manufacturers have started to take consumer product demands seriously by working on expanding their range of products to include healthier and diet-specific items with fewer chemicals and preservatives.

Rising global food insecurity demands greater efficiency at transporting food from surplus points to famine places. Millennials and Gen Z aspire to achieve sustainability along the entire supply chain. For example, The Sustainable Trade Initiative (IDH) convenes companies, CSOs, and governments in sustainable public-private partnerships. IDH works in the processed fruit and vegetable sector to develop more sustainable production and processing practices, contribute to better environmental management, and ultimately improve workers' and farmers' livelihoods. The Sustainable Juice Covenant is a global initiative to make the sourcing, production, and trade of fruit- and vegetable-derived juices, purees, and concentrates 100% sustainable by 2030.

Restraints: Burgeoning demand for NFC juices

Not from concentrate (NFC) juices are made up of fruits that have been processed into fruit juices, and if stored in the appropriate temperature, have the advantage of lasting for up to two years. The rise in the demand for NFC juices can be attributed to the changing consumer preference from volume to nutrition. Another factor that drives the demand is the ‘pureness’, and ‘realness’ of the juice, which has positively affected consumers’ buying preference. NFC juice is a more convenient product, which includes a three-step consumption process of open, pour, and consume, which proves to be a convenient product for consumers. On the other hand, NFC juices are considered to be premium juices and are priced higher when compared to regular juices; they also contain less sugar compared to other beverages and has therefore become an alternative product to carbonated beverages. The projection of NFC juices as a healthy fruit drink is causing a restraint in the growth of the juice concentrates market, since it is sold as a premium product in the market.

Challenges: Demand for clean labelled products from consumer

The Natural and organic concepts are two tools used predominantly in the food industry by marketers in order to increase the demand for natural ingredients in the market. Clean-label ingredients are essentially natural ingredients with no chemicals. With the rise in health awareness, consumers are opting for clean-label foods that use natural ingredients such as natural colors & flavors, which are safer to consume. They are ready to pay high prices for products that are minimally processed. Consumers have been observed to thoroughly check labels before buying products as they prefer clean-label ones. This challenge can be overcome through investments in natural ingredients by fruit & vegetable ingredient producers. Thus, companies are focusing on developing new products from natural sources with minimal processing, thereby making them clean-label products.

In addition to the consumers’ selection of special-quality fruits & vegetables, taste and experience are also playing an increasingly important role. Consumers are willing to pay premium prices for products that have consistently good taste.

Fruit Juice Concentrates are in High Demand

Fruit juice concentrates are used in a variety of industries, such as beverage, bakery & confectionery, food, and alcohol. Fruit juice concentrates, such as apple concentrates and pear concentrates, are used as sugar substitutes in the bakery & confectionery industry, in the production of cakes, cookies, and pasteries.

Fruit juice concentrates witness high demand around the world, as there is an increasing awareness regarding living a healthy life and consuming healthy products among consumers in both developed and developing countries. Fruits such as orange, apple, and pineapple have significant demand due to their health benefits. These concentrates, especially red grape, are also used in the wine industry. Countries, such as Australia, that produce wine on a large scale have a good market opportunity for growth of the red grape concentrates market.

Beverages Segment is Gaining Traction in the Global Juice Concentrates Market

Fruits and vegetable concentrates are widely applicable in the beverage industry. Fruits concentrates are especially used in the production of both alcoholics as well as non-alcoholic beverages. Fruit and vegetable juice concentrates are used in various beverages such as energy drinks, juices, tea, and smoothies and are available in different forms such as frozen, crystallized, or liquid. Fruits such as grapes and apples are the common fruits used to produce alcoholic beverages. Moreover, exotic superfruits, such as juniper berries and passion fruits, are also utilized to make alcoholic beverages. The beverage industry, which is growing globally in all the major regions, such as North America, Europe, Asia-Pacific, and Latin America, demand fruits and vegetables to produce new and innovative beverages. The huge soft drinks market in developing nations, such as India and China, needs fruits and vegetable concentrates on producing soft drinks based on consumer demand.

Opportunities: Value-added products are gaining momentum

Consumers have shifted preference towards food & beverages that support a healthy and sustainable lifestyle; implying, beverages should not only contain physical health benefits but beyond. While diet should provide solutions to improve digestion and boost the immune system, the products should be natural and come with a high degree of functionality. An increased level of environmental and health consciousness has got instilled amongst consumers, resulting in increasing demand for beverages with optimal nutritional and functional profiles. Japanese beverage market witnesses demand for energy drinks, sports drinks and RTD coffee drinks. A section of beverages holding popularity is beauty drinks, beverages that support the physical appearance and skin, and is a prominent trend amongst Japanese consumers.

Implementation of state-of-the-art technologies paves way towards high-quality products from nature in various formats, be it, minimally processed full spectrum powders, which retain the entire healthy content or the raw material to high-end standardized botanical extracts with guaranteed amounts of certain naturally occurring healthy compounds, like antioxidants. Alongside plant extracts, strong infusions, distillates and essences, natural colours and flavours provide for the choice of an individual flavour and vibrant colour.

Energy drinks are gaining traction owing to its innovative concepts, exciting flavours and diverse positioning options. There is a very fast-paced development in the energy drink sector, along with combining it with other categories, such as tea, coffee or juice. Natural sourcing, sugar reduction and functional added value are the attributes that are gaining significance in purchase pattern and presents a lucrative opportunity for growth. Besides, tailor-made ingredients are claiming fame in the revolutionizing juice concentrates market.

To know about the assumptions considered for the study, download the pdf brochure

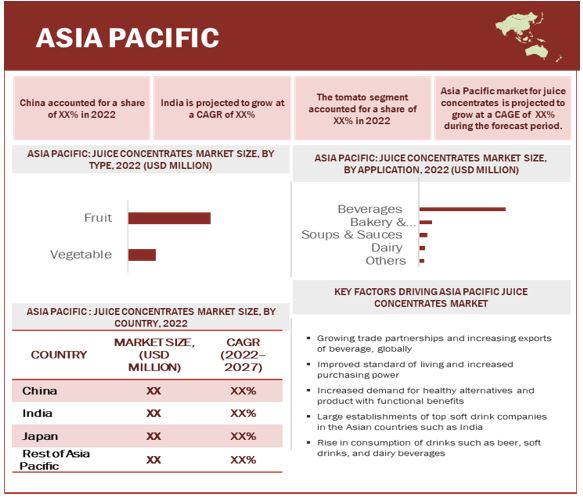

Asia Pacific is projected to be the fastest-growing region in the global juice concentrates market

Asia-Pacific is projected to be the fastest-growing region in the global juice concentrates market with the highest CAGR. The main countries contributing significantly toward the region's growth include China, India, Japan, Australia, and New Zealand. The rapidly growing fast-food industry and young demography in the Asia-Pacific region have led to an increase in the consumption of convenience food, which is expected to enhance the growth of the market for juice concentrates. The growth of the juice concentrates market is proportionally dependent upon the growth of the convenience and health food industry. The demand for juice concentrates is anticipated to increase in the Asia-Pacific region due to Western dietary habits, rising disposable income, and changing lifestyles of people in countries such as China, India, and Japan.

Key Companies

The key players in this market include Archer Daniels Midland Company (US), Südzucker AG (Germany), Ingredion Incorporated (US), SunOpta, Inc (Canada), Kerry Group PLC (Ireland), IPRONA SPA (Italy), Symrise AG (Germany), Döhler Group SE (Germany), SVZ International B.V (Netherlands), and Kanegrade Limited (UK). These companies are known for their strong presence in the global Juice concentrates market and have a wide range of products and services. They are involved in the production, processing, and distribution of Juice concentrates and hold a significant share in the global market. They also invest heavily in research and development to create new products and improve existing ones to cater to the evolving market trends and customer needs.

Juice Concentrates Market Report Scope

|

Report Metric |

Details |

|

Juice Concentrates Market Size in 2022 |

USD 73.7 billion |

|

2027 Value Projection |

USD 93.7 billion |

|

Forecast Period 2022 to 2027 CAGR |

CAGR of 4.9% |

|

No. of Pages |

241 |

|

Tables, & Figures |

257 market data Tables and 44 Figures |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Segments covered |

Ingredients, Region, Type, Application |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Primary companies highlighted |

Archer Daniels Midland Company (US), Südzucker AG (Germany), Ingredion Incorporated (US), SunOpta, Inc (Canada), Kerry Group PLC (Ireland), IPRONA SPA (Italy), Symrise AG (Germany), Döhler Group SE (Germany), SVZ International B.V (Netherlands), and Kanegrade Limited (UK). |

|

Growth Drivers |

|

Target Audience:

-

Raw material suppliers

- Farmers

- Agriculture institutes

- R&D institutes

- Fruit & vegetable concentrates manufacturers/suppliers

-

Regulatory bodies

- Food additive associations and organizations such as the FDA, EFSA, USDA, and FSANZ

- Associations and industry bodies such as the World Health Organization (WHO), Institute of Food and Agricultural Sciences (IFAS).

- Government agencies and NGOs

- Food safety agencies

-

Intermediary suppliers

- Wholesalers

- Dealers

-

Consumers

- Food & beverage manufacturers/suppliers

- Retailers

- End users

This research report categorizes the juice concentrates market based on type, application, ingredient, form, and region

Based on Type (Revenue, USD billion, 2022 - 2027)

-

Fruit Juice Concentrates

- Orange

- Apple

- Pineapple

- Red Grapes

- Berries

- Others*

-

Vegetables Juice Concentrates

- Carrot

- Cucumber

- Tomato

- Onion & Garlic

- Others**

Based on Application

-

Beverage

- Nectar

- Fruit Juice

- Powdered Juice

- Others***

- Soups & Sauces

- Dairy

- Bakery & Confectionery

- Others****

Based on Ingredient

- Single Fruit/Vegetable Concentrates

- Multi-Fruit/Vegetable Concentrates

Based on Form

- Clear Concentrate

- Powdered Concentrate

- Frozen Concentrate

*Others include banana, mango, and pear

**Others include spinach, beetroot, and ginger

***Others include still drinks and RTD beverages

****Others include baby food, desserts, and sweet & savory snacks

Based on Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Juice Concentrates Market Recent Developments

- In September 2021, Ingredion Incorporated established manufacturing facility units in Canada. The new state-of-the-art facility's operating standards are aligned with Ingredion's stringent manufacturing and quality standards.

- In September 2021, Kerry Group PLC completed the acquisition of Hare Topco, Inc trading as Niacet Corp. Niacet is a global market leader in technologies for preservation.

- In March 2021, AGRANA Fruit Japan Ltd. acquired Taiyo Kagaku Co. Ltd. as part of its strategy to expand its presence in Asia. After China, India, and South Korea, Japan is now the fourth Asian country in which the company is located.

- In October 2019, Archer Daniels Midland introduced its Isotonic Malt-Cola, which has a fresh flavor and provides functional benefits to Middle Eastern consumers. The company launched flavor combinations such as maca with nutty undertones or moringa extract in the energy drink area. ADM also debuted with a new line of pure smoothies.

- In April 2019, Döhler has acquired a significant stake in Spanish juice producer Zumos Catalano Aragoneses to strengthen its position in the European fruit concentrate market (Zucasa).

Frequently Asked Questions (FAQ):

How big is the juice concentrates market?

The global juice concentrates market is expected to reach $93.7 billion by 2027, growing at a CAGR of 4.9%. In 2022, its valuation was $73.7 billion.

Which players are involved in the manufacturing of juice concentrates market?

Key players in this market include Archer Daniels Midland Company (US), Südzucker AG (Germany), Ingredion Incorporated (US), SunOpta, Inc (Canada), Kerry Group PLC (Ireland), IPRONA SPA (Italy), Symrise AG (Germany), Döhler Group SE (Germany), SVZ International B.V (Netherlands), and Kanegrade Limited (UK).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for the juice concentrates market?

On request, We will provide details on the market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of the juice concentrates market?

The future growth potential of the juice concentrates market is promising, driven by several factors that reflect evolving consumer preferences, dietary trends, and market dynamics. The increasing demand for natural and healthy food and beverage options is expected to boost the consumption of juice concentrates, as they offer a convenient and cost-effective way to enjoy the nutritional benefits of fruit juices. Additionally, the growing awareness of the health benefits associated with consuming fruit-based products, such as antioxidants and vitamins, is likely to drive demand for juice concentrates as ingredients in various food and beverage applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SEGMENTATION

FIGURE 1 JUICE CONCENTRATES MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2017–2021

1.6 VOLUME UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 2 JUICE CONCENTRATES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 JUICE CONCENTRATES MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 JUICE CONCENTRATES MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 6 BEVERAGES SEGMENT DOMINATE THE GLOBAL JUICE CONCENTRATES MARKET DURING THE FORECAST PERIOD IN TERMS OF VALUE

FIGURE 7 FRUIT JUICE CONCENTRATES SEGMENT IS PROJECTED TO LEAD THE JUICE CONCENTRATES MARKET IN TERMS OF VALUE BETWEEN 2022 AND 2027

FIGURE 8 CLEAR JUICE CONCENTRATES SEGMENT LED THE MARKET IN TERMS OF VALUE IN 2021, AMONG OTHER FORMS

FIGURE 9 EUROPE ACCOUNTED FOR THE LARGEST SHARE IN THE REGION-LEVEL MARKET, IN TERMS OF VALUE, 2021

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES IN THE JUICE CONCENTRATES MARKET

FIGURE 10 ADVANCEMENTS IN THE FOOD PROCESSING INDUSTRY IN THE DEVELOPING REGION ARE ALSO SUPPORTING THE GROWTH OF THE JUICE CONCENTRATES MARKET.

4.2 JUICE CONCENTRATES MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 11 EUROPE ACCOUNTED FOR THE LARGEST SHARE IN 2021

4.3 ASIA PACIFIC: JUICE CONCENTRATES MARKET BY KEY APPLICATION & COUNTRY

FIGURE 12 CHINA ACCOUNTED FOR THE LARGEST SHARE IN THE ASIA PACIFIC MARKET IN 2021

4.4 JUICE CONCENTRATES MARKET, BY FORM

FIGURE 13 CLEAR JUICE CONCENTRATES IS PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 JUICE CONCENTRATES MARKET, BY INGREDIENTS

FIGURE 14 THE SINGLE-FRUIT/VEGETABLE SEGMENT IS PROJECTED TO DOMINATE THE JUICE CONCENTRATES MARKET DURING THE FORECAST PERIOD

4.6 JUICE CONCENTRATES MARKET BY TYPE

FIGURE 15 FRUITS SEGMENT TO DOMINATE BY TYPE SEGMENT OF JUICE CONCENTRATES MARKET DURING THE FORECAST YEAR

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 SUSTAINABILITY AND FUNCTIONAL ATTRIBUTES DEFINING THE DYNAMICS OF THE JUICE CONCENTRATES MARKET

5.2.1 DRIVERS

5.2.1.1 Sustainability is the key to the bolstering demand for Juice Concentrates

5.2.1.2 Increasing popularity of convenience food & beverage products

5.2.1.3 Rising anti-sugar movement curbing the sales of carbonated soft drinks

5.2.1.4 Substitute for sugar in the bakery & confectionery industry

5.2.2 RESTRAINTS

5.2.2.1 Burgeoning demand for NFC Juices

5.2.2.2 Slow product innovation cycles compared to fast-paced transformation in consumer behavior

5.2.3 OPPORTUNITIES

5.2.3.1 Value-added products are gaining momentum

5.2.3.2 Growth in investment opportunities for the development of new food & beverage processing technologies

5.2.3.3 Rise in demand from developing countries such as China and India

5.2.4 CHALLENGES

5.2.4.1 Demand for clean-label products from consumers

5.2.4.2 Infrastructural challenges in developing countries

6 INDUSTRY TRENDS (Page No. - 66)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 17 JUICE CONCENTRATES MARKET: VALUE CHAIN ANALYSIS

6.3 MARKET ECOSYSTEM & SUPPLY CHAIN

FIGURE 18 JUICE CONCENTRATES: SUPPLY CHAIN ANALYSIS

6.3.1 RESEARCH & DEVELOPMENT

6.3.2 INPUTS

6.3.3 PRODUCTION

6.3.4 LOGISTICS & DISTRIBUTION

6.3.5 MARKETING & SALES

6.3.6 END-USER INDUSTRY

TABLE 2 JUICE CONCENTRATES MARKET: SUPPLY CHAIN (ECOSYSTEM)

FIGURE 19 JUICE CONCENTRATES MARKET: MARKET MAP

6.4 TECHNOLOGY ANALYSIS

6.5 TRENDS/DISRUPTIONS IMPACTING THE BUSINESS OF CUSTOMERS

FIGURE 20 TRENDS/DISRUPTIONS IMPACTING THE BUSINESS OF CUSTOMERS

6.6 TRADE ANALYSIS

TABLE 3 FRUIT & VEGETABLE JUICES: IMPORT EXPORT DATA

TABLE 4 TRADE ANALYSIS: IMPORT DATA OF FROZEN ORANGE JUICE, UNFERMENTED, 2020

TABLE 5 TRADE ANALYSIS: EXPORT DATA OF FROZEN ORANGE JUICE, UNFERMENTED, 2020

6.7 PATENT ANALYSIS

TABLE 6 KEY PATENTS PERTAINING TO JUICE CONCENTRATES, 2013–2015

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 JUICE CONCENTRATES MARKET: PORTER’S FIVE FORCES ANALYSIS

6.8.1 THREAT OF NEW ENTRANTS

6.8.2 THREAT OF SUBSTITUTES

6.8.3 BARGAINING POWER OF SUPPLIERS

6.8.4 BARGAINING POWER OF BUYERS

6.8.5 INTENSITY OF COMPETITIVE RIVALRY

6.9 AVERAGE SELLING PRICING TREND

6.9.1 AVERAGE SELLING PRICING TREND/ INDICATIVE PRICE ANALYSIS

FIGURE 21 PRICING TREND OF JUICE CONCENTRATES, 2019-2021 (USD/KG)

6.9.2 AVERAGE SELLING PRICES OF KEY PLAYERS BY APPLICATION

TABLE 8 FOB PRICES OF JUICE CONCENTRATES BY APPLICATION (USD/TON)

FIGURE 22 PRICING TREND OF FROZEN JUICE CONCENTRATES IN US

6.10 TARIFF REGULATORY LANDSCAPE

6.10.1 IMPORT EXPORT NORMS

6.10.2 QUALITY NORMS

6.10.3 NORTH AMERICA

TABLE 9 LIST OF FRUITS &VEGETABLES CONTAINING MINIMUM BRIX LEVEL

6.10.4 EUROPE

6.10.5 SOUTH AMERICA

6.10.6 ASIA-PACIFIC

6.10.7 REST OF THE WORLD (ROW)

6.10.8 REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA-PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 23 INFLUENCE OF STAKEHOLDERS IN BUYING JUICE CONCENTRATES FOR FOOD & BEVERAGE APPLICATIONS

TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING FOR TOP THREE APPLICATIONS

6.11.2 BUYING CRITERIA

FIGURE 24 KEY BUYING CRITERIA FOR APPLICATIONS

TABLE 15 KEY BUYING CRITERIA FOR JUICE CONCENTRATES APPLICATIONS

6.12 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 16 JUICE CONCENTRATES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

7 JUICE CONCENTRATES MARKET BY TYPE (Page No. - 88)

7.1 INTRODUCTION

FIGURE 25 FRUIT JUICE CONCENTRATES TO DOMINATE THE MARKET (USD MILLION)

TABLE 17 GLOBAL JUICE CONCENTRATES MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 18 GLOBAL JUICE CONCENTRATES MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 19 GLOBAL FRUIT JUICE CONCENTRATES MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 20 GLOBAL FRUIT JUICE CONCENTRATES MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 21 GLOBAL VEGETABLE JUICE CONCENTRATES MARKET SIZE BY TYPE, 2018–2021 (USD MILLION)

TABLE 22 GLOBAL VEGETABLE JUICE CONCENTRATES MARKET SIZE BY TYPE, 2022–2027 (USD MILLION)

7.2 FRUIT JUICE CONCENTRATES

FIGURE 26 GLOBAL FRUIT JUICE CONCENTRATES MARKET IN 2022 VS 2027 (USD MILLION)

TABLE 23 GLOBAL FRUIT JUICE CONCENTRATES MARKET SIZE BY REGION, 2018–2021 (USD MILLION)

TABLE 24 GLOBAL FRUIT JUICE CONCENTRATES MARKET SIZE BY REGION, 2022–2027 (USD MILLION)

7.2.1 ORANGE

7.2.1.1 Orange will have the highest CAGR during the forecast period in terms of value

7.2.2 APPLE

7.2.2.1 It is widely used as a sweetener, often in place of sugar or corn syrup

7.2.3 PINEAPPLE

7.2.3.1 Pineapple juice concentrates are gaining popularity due to their health benefits

7.2.4 RED GRAPE

7.2.4.1 Red Grape finds demand predominantly in the production of wine

7.2.5 BERRIES

7.2.5.1 Berries are expected to grow at a CAGR of 4.8 percent.

7.2.6 OTHER CITRUS FRUIT JUICE CONCENTRATE

7.2.7 OTHER FRUIT JUICE CONCENTRATE

7.3 VEGETABLE JUICE CONCENTRATES

FIGURE 27 EUROPE TO LEAD THE VEGETABLE JUICE CONCENTRATES MARKET SEGMENT BETWEEN 2022 AND 2027 (USD MILLION)

TABLE 25 GLOBAL VEGETABLE JUICE CONCENTRATES MARKET SIZE BY REGION, 2018–2021 (USD MILLION)

TABLE 26 GLOBAL VEGETABLE JUICE CONCENTRATES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3.1 CARROT

7.3.1.1 Carrot is a popular vegetable among American consumers

7.3.2 CUCUMBER

7.3.2.1 Cucumbers' freshness and use in green juices are driving up demand

7.3.3 TOMATO

7.3.3.1 Tomato concentrates deliver end-use versatility and is expected to keep the demand stable

7.3.4 ONION & GARLIC

7.3.4.1 Powdered concentrates will see greater demand in onion and garlic segment

7.3.5 OTHER VEGETABLE JUICE CONCENTRATES

8 JUICE CONCENTRATES MARKET, BY INGREDIENT (Page No. - 99)

8.1 INTRODUCTION

FIGURE 28 SINGLE FRUIT/VEGETABLE SEGMENT IS PROJECTED TO ACCOUNT FOR THE HIGHER SHARE IN TERMS OF VALUE

TABLE 27 GLOBAL JUICE CONCENTRATES MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

TABLE 28 GLOBAL JUICE CONCENTRATES MARKET SIZE, BY INGREDIENT, 2022–2027 (USD MILLION)

8.2 SINGLE FRUIT/VEGETABLE CONCENTRATES

8.2.1 SINGLE FRUIT/VEGETABLE JUICE CONCENTRATES TO WITNESS INCREASED DEMAND FROM FOOD AND BEVERAGE MANUFACTURERS

TABLE 29 GLOBAL SINGLE FRUIT/VEGETABLE CONCENTRATE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 GLOBAL SINGLE FRUIT/VEGETABLE CONCENTRATE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 MULTI-FRUIT/VEGETABLE CONCENTRATES

8.3.1 INCREASED CUSTOMER INTEREST IN NEW FLAVORS AND ADDITIONAL NUTRITIONAL BENEFITS WILL DRIVE THE INDUSTRY

TABLE 31 GLOBAL MULTI-FRUIT/VEGETABLE CONCENTRATES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 GLOBAL MULTI-FRUIT/VEGETABLE CONCENTRATES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 JUICE CONCENTRATES MARKET, BY FORM (Page No. - 104)

9.1 INTRODUCTION

FIGURE 29 CLEAR CONCENTRATES IS PROJECTED TO LEAD THE JUICE CONCENTRATES MARKET IN TERMS OF VALUE

TABLE 33 GLOBAL JUICE CONCENTRATES, MARKET SIZE, BY FORM, 2018–2021 (USD MILLION))

TABLE 34 GLOBAL JUICE CONCENTRATES, MARKET SIZE, BY FORM, 2022–2027 (USD MILLION))

9.2 CLEAR CONCENTRATE

9.2.1 DURING THE FORECAST PERIOD, CLEAR CONCENTRATES HAVE THE LARGEST SHARE

TABLE 35 GLOBAL CLEAR JUICE CONCENTRATES, MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 GLOBAL CLEAR JUICE CONCENTRATES, MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 POWDERED CONCENTRATE

9.3.1 POWDERED CONCENTRATES WILL SEE RISING DEMAND AS THE FOOD AND BEVERAGE INDUSTRY EXPANDS

TABLE 37 GLOBAL POWDERED JUICE CONCENTRATES, MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 GLOBAL POWDERED JUICE CONCENTRATES, MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 FROZEN CONCENTRATE

9.4.1 DURING THE FORECAST PERIOD, FROZEN CONCENTRATES WILL HAVE THE HIGHEST CAGR

TABLE 39 GLOBAL FROZEN JUICE CONCENTRATES, MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 GLOBAL FROZEN JUICE CONCENTRATES, MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 JUICE CONCENTRATES MARKET BY APPLICATION (Page No. - 110)

10.1 INTRODUCTION

FIGURE 30 BEVERAGES SEGMENT TO DOMINATE THE GLOBAL JUICE CONCENTRATES MARKET IN 2022 IN TERMS OF VALUE

TABLE 41 GLOBAL JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 42 GLOBAL JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 43 GLOBAL JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (MT)

TABLE 44 GLOBAL JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (MT)

10.2 BEVERAGES

TABLE 45 GLOBAL JUICE CONCENTRATES, BY BEVERAGES APPLICATION, MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 GLOBAL JUICE CONCENTRATES, BY BEVERAGES APPLICATION, MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 47 GLOBAL JUICE CONCENTRATES, BY BEVERAGES APPLICATION, MARKET SIZE, BY REGION, 2018–2021 (MT)

TABLE 48 GLOBAL JUICE CONCENTRATES, BY BEVERAGES APPLICATION, MARKET SIZE, BY REGION, 2022–2027 (MT)

TABLE 49 GLOBAL JUICE CONCENTRATES, MARKET SIZE, BY BEVERAGE SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 50 GLOBAL JUICE CONCENTRATES, MARKET SIZE, BY BEVERAGE SUB-APPLICATION, 2022–2027 (USD MILLION)

10.2.1 NECTAR

10.2.1.1 Low or no sugar and no artificial agents to stimulate growth

10.2.2 FRUIT JUICE

10.2.2.1 Manufacturers will capitalize on health trends to boost sales.

10.2.3 POWDERED JUICE

10.2.3.1 Fortification will improve consumer interest in powdered juice

10.2.4 OTHERS

10.3 SOUPS & SAUCES

10.3.1 READY-TO-EAT CULTURE WILL DRIVE GROWTH.

TABLE 51 GLOBAL JUICE CONCENTRATES, BY SOUPS & SAUCES APPLICATION, MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 GLOBAL JUICE CONCENTRATES, BY SOUPS & SAUCES APPLICATION, MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 GLOBAL JUICE CONCENTRATES, BY SOUPS & SAUCES APPLICATION, MARKET SIZE, BY REGION, 2018–2021 (MT)

TABLE 54 GLOBAL JUICE CONCENTRATES, BY SOUPS & SAUCES APPLICATION, MARKET SIZE, BY REGION, 2022–2027 (MT)

10.4 DAIRY

10.4.1 GROWING DAIRY INDUSTRY TO PROMOTE JUICE CONCENTRATES GROWTH

TABLE 55 GLOBAL JUICE CONCENTRATES, BY DAIRY APPLICATION, MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 GLOBAL JUICE CONCENTRATES, BY DAIRY APPLICATION, MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 57 GLOBAL JUICE CONCENTRATES, BY DAIRY APPLICATION, MARKET SIZE, BY REGION, 2018–2021 (MT)

TABLE 58 GLOBAL JUICE CONCENTRATES, BY DAIRY APPLICATION, MARKET SIZE, BY REGION, 2022–2027 (MT)

10.5 BAKERY & CONFECTIONERY

10.5.1 POWDERED CONCENTRATES WILL SEE GREATER DEMAND IN THE BAKERY MARKET FOR APPLICATIONS SUCH AS FLAVORING AGENTS

TABLE 59 GLOBAL JUICE CONCENTRATES, BY BAKERY & CONFECTIONERY APPLICATION, MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 GLOBAL JUICE CONCENTRATES, BY BAKERY & CONFECTIONERY APPLICATION, MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 61 GLOBAL JUICE CONCENTRATES, BY BAKERY & CONFECTIONERY APPLICATION, MARKET SIZE, BY REGION, 2018–2021 (MT)

TABLE 62 GLOBAL JUICE CONCENTRATES, BY BAKERY & CONFECTIONERY APPLICATION, MARKET SIZE, BY REGION, 2022–2027 (MT)

10.6 OTHER APPLICATIONS

TABLE 63 GLOBAL JUICE CONCENTRATES, BY OTHER APPLICATION, MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 GLOBAL JUICE CONCENTRATES, BY OTHER APPLICATION, MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 65 GLOBAL JUICE CONCENTRATES, BY OTHER APPLICATION, MARKET SIZE, BY REGION, 2018–2021 (MT)

TABLE 66 GLOBAL JUICE CONCENTRATES, BY OTHER APPLICATION, MARKET SIZE, BY REGION, 2022–2027 (MT)

11 JUICE CONCENTRATES MARKET BY REGION (Page No. - 125)

11.1 INTRODUCTION

FIGURE 31 EUROPE IS EXPECTED TO DOMINATE THE GLOBAL JUICE CONCENTRATES MARKET BETWEEN 2022 AND 2027

TABLE 67 GLOBAL JUICE CONCENTRATES, MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 GLOBAL JUICE CONCENTRATES, MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 69 GLOBAL JUICE CONCENTRATES, MARKET SIZE, BY REGION, 2018–2021(MT)

TABLE 70 GLOBAL JUICE CONCENTRATES, MARKET SIZE, BY REGION, 2022–2027 (MT)

FIGURE 32 REGIONAL SNAPSHOT: ASIA PACIFIC TO BE THE MOST ATTRACTIVE MARKET FOR JUICE CONCENTRATE MANUFACTURERS (2022–2027)

11.2 NORTH AMERICA

11.2.1 INTRODUCTION

TABLE 71 NORTH AMERICA: JUICE CONCENTRATES MARKET SIZE BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: JUICE CONCENTRATES MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: JUICE CONCENTRATES MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: JUICE CONCENTRATES MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY FRUIT TYPE, 2018–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY FRUIT TYPE, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: JUICE CONCENTRATES MARKET SIZE, BY VEGETABLE TYPE, 2018–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY VEGETABLE TYPE, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: JUICE CONCENTRATES MARKET SIZE, BY INGREDIENTS, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY BEVERAGE SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY BEVERAGE SUB-APPLICATION, 2022–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (MT)

TABLE 88 NORTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (MT)

11.2.2 US

11.2.2.1 US is the largest & fastest-growing market for juice concentrates in North America

TABLE 89 US: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 90 US: JUICE CONCENTRATES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Canada’s innovative technology in the agriculture sector helps in the growth of the juice concentrates market

TABLE 91 CANADA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 92 CANADA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.4 MEXICO

11.2.4.1 Mexico sources around 90% of its food processing ingredients locally

TABLE 93 MEXICO: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 94 MEXICO: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 INTRODUCTION

FIGURE 33 EUROPE: MARKET SNAPSHOT

TABLE 95 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 97 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 98 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 99 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY FRUIT TYPE, 2018–2021 (USD MILLION)

TABLE 100 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY FRUIT TYPE, 2022–2027 (USD MILLION)

TABLE 101 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY VEGETABLE TYPE, 2018–2021 (USD MILLION)

TABLE 102 EUROPE: JUICE CONCENTRATES MARKET SIZE BY VEGETABLE TYPE, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

TABLE 104 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY INGREDIENT, 2022–2027 (USD MILLION)

TABLE 105 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 106 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 107 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 108 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 109 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (MT)

TABLE 110 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (MT)

TABLE 111 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY BEVERAGE SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 112 EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY BEVERAGE SUB-APPLICATION, 2022–2027 (USD MILLION)

11.3.2 GERMANY

11.3.2.1 AGRANA supplies fruit concentrates to dairy, ice cream, bakery, and sweet industry

TABLE 113 GERMANY: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 114 GERMANY: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 France has a higher demand for freshly extracted fruit juices than juice produced from concentrates.

TABLE 115 FRANCE: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 116 FRANCE: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.4 SPAIN

11.3.4.1 Vegetable juice concentrates are used in soups & sauces in Spain

TABLE 117 SPAIN: JUICE CONCENTRATES MARKET, SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 118 SPAIN: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.5 UK

11.3.5.1 Consumers in UK are demanding healthier, nutritious, and convenient food products.

TABLE 119 UK: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 120 UK: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.6 ITALY

11.3.6.1 Italy is the mature market for juice concentrates.

TABLE 121 ITALY: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 122 ITALY: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.7 THE NETHERLANDS

11.3.7.1 The Netherlands is the world’s second-largest exporter of fruit & vegetable juices

TABLE 123 THE NETHERLANDS: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 124 THE NETHERLANDS: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.8 REST OF EUROPE

11.3.8.1 Agriculture has a bigger influence on the economy of Denmark and Ireland

TABLE 125 REST OF EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 126 REST OF EUROPE: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 INTRODUCTION

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 127 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 130 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 131 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY FRUIT TYPE, 2018–2021 (USD MILLION)

TABLE 132 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY FRUIT TYPE, 2022–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY VEGETABLE TYPE, 2018–2021 (USD MILLION)

TABLE 134 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY VEGETABLE TYPE, 2022–2027 (USD MILLION)

TABLE 135 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

TABLE 136 ASIA PACIFIC: JUICE CONCENTRATES MARKET SIZE, BY INGREDIENTS, 2022–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 138 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 140 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 141 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (MT)

TABLE 142 ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (MT)

TABLE 143 ASIA PACIFIC: JUICE CONCENTRATES MARKET SIZE, BY BEVERAGE SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: JUICE CONCENTRATES MARKET SIZE BY BEVERAGE SUB-APPLICATION, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 The increase in consumption of healthy food products has provided opportunities.

TABLE 145 CHINA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 146 CHINA: JUICE CONCENTRATES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 The country has around 60% of its land involved in agricultural purposes.

TABLE 147 INDIA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 148 INDIA: JUICE CONCENTRATES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Japan has increased its consumption of products that are rich in nutrients.

TABLE 149 JAPAN: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 150 JAPAN: JUICE CONCENTRATES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

11.4.5.1 Consumers in the UK demand healthier, nutritious, and convenient food products.

TABLE 151 REST OF ASIA PACIFIC: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: JUICE CONCENTRATES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.5 SOUTH AMERICA

11.5.1 INTRODUCTION

TABLE 153 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 154 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 155 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 156 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 157 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY FRUIT TYPE, 2018–2021 (USD MILLION)

TABLE 158 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY FRUIT TYPE, 2022–2027 (USD MILLION)

TABLE 159 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY VEGETABLE TYPE, 2018–2021 (USD MILLION)

TABLE 160 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY VEGETABLE TYPE, 2022–2027 (USD MILLION)

TABLE 161 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

TABLE 162 SOUTH AMERICA: JUICE CONCENTRATES MARKET SIZE, BY INGREDIENTS, 2022–2027 (USD MILLION)

TABLE 163 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 164 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 165 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 166 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 167 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (MT)

TABLE 168 SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (MT)

TABLE 169 SOUTH AMERICA: JUICE CONCENTRATES MARKET SIZE, BY BEVERAGE SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 170 SOUTH AMERICA: JUICE CONCENTRATES MARKET SIZE, BY BEVERAGE SUB-APPLICATION, 2022–2027 (USD MILLION)

11.5.2 BRAZIL

11.5.2.1 Companies in Brazil keep looking to launch products with immunity-boosting benefits.

TABLE 171 BRAZIL: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 172 BRAZIL: JUICE CONCENTRATES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.3 ARGENTINA

11.5.3.1 Many multinational companies operate locally to meet the demand of Argentina.

TABLE 173 ARGENTINA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 174 ARGENTINA: JUICE CONCENTRATES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.4 CHILE

11.5.4.1 During COVID-19, Chilean consumers became more conscious about their nutrition

TABLE 175 CHILE: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 176 CHILE: JUICE CONCENTRATES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.5 REST OF SOUTH AMERICA

11.5.5.1 Urbanization has resulted in the growth of the market in these countries.

TABLE 177 REST OF SOUTH AMERICA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 178 REST OF SOUTH AMERICA: JUICE CONCENTRATES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.6 ROW

11.6.1 INTRODUCTION

TABLE 179 ROW: JUICE CONCENTRATES, MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 180 ROW: JUICE CONCENTRATES, MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 181 ROW: JUICE CONCENTRATES, MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 182 ROW: JUICE CONCENTRATES, MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 183 ROW: JUICE CONCENTRATES, MARKET SIZE, BY FRUIT TYPE, 2018–2021 (USD MILLION)

TABLE 184 ROW: JUICE CONCENTRATES, MARKET SIZE, BY FRUIT TYPE, 2022–2027 (USD MILLION)

TABLE 185 ROW: JUICE CONCENTRATES, MARKET SIZE, BY VEGETABLE TYPE, 2018–2021 (USD MILLION)

TABLE 186 ROW: JUICE CONCENTRATES, MARKET SIZE, BY VEGETABLE TYPE, 2022–2027 (USD MILLION)

TABLE 187 ROW: JUICE CONCENTRATES, MARKET SIZE, BY INGREDIENT, 2018–2021 (USD MILLION)

TABLE 188 ROW: JUICE CONCENTRATES MARKET SIZE, BY INGREDIENTS, 2022–2027 (USD MILLION)

TABLE 189 ROW: JUICE CONCENTRATES, MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 190 ROW: JUICE CONCENTRATES, MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 191 ROW: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 192 ROW: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 193 ROW: JUICE CONCENTRATES MARKET SIZE, BY BEVERAGE SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 194 ROW: JUICE CONCENTRATES MARKET SIZE, BY BEVERAGE SUB-APPLICATION, 2022–2027 (USD MILLION)

11.6.2 MIDDLE EAST

11.6.2.1 The fruit concentrates of Middle East is lucrative as raw material production is high

TABLE 195 MIDDLE EAST: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 196 MIDDLE EAST: JUICE CONCENTRATES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.6.3 AFRICA

11.6.3.1 Africa is rich in natural resources and can provide raw materials to many markets.

TABLE 197 AFRICA: JUICE CONCENTRATES, MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 198 AFRICA: JUICE CONCENTRATES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 179)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2021

TABLE 199 JUICE CONCENTRATES MARKET: DEGREE OF COMPETITION (FRAGMENTED)

12.3 KEY PLAYER STRATEGIES

12.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 35 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD BILLION)

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 36 JUICE CONCENTRATES INDUSTRY MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

12.5.5 PRODUCT FOOTPRINT

TABLE 200 COMPANY BY APPLICATION FOOTPRINT

TABLE 201 COMPANY BY TYPE FOOTPRINT

TABLE 202 COMPANY REGIONAL FOOTPRINT

TABLE 203 OVERALL, COMPANY FOOTPRINT

12.6 JUICE CONCENTRATES INDUSTRY MARKET, START-UP/SME EVALUATION QUADRANT, 2021

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

TABLE 204 JUICE CONCENTRATES MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 205 JUICE CONCENTRATES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

FIGURE 37 JUICE CONCENTRATES INDUSTRY MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UP/SME)

12.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

12.7.1 PRODUCT LAUNCHES

TABLE 206 PRODUCT LAUNCHES, 2019

12.7.2 DEALS

TABLE 207 DEALS, 2018–2021

12.7.3 OTHERS

TABLE 208 OTHERS, 2018–2021

13 COMPANY PROFILES (Page No. - 192)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)*

13.2.1 ARCHER DANIELS MIDLAND COMPANY

TABLE 209 ARCHER DANIELS MIDLAND COMPANY: BUSINESS OVERVIEW

FIGURE 38 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

TABLE 210 ARCHER DANIELS MIDLAND COMPANY: PRODUCTS OFFERED

TABLE 211 ARCHER DANIELS MIDLAND COMPANY: PRODUCT LAUNCHES, 2019

TABLE 212 ARCHER DANIELS MIDLAND COMPANY: OTHERS, 2018

13.2.2 SÜDZUCKER AG

TABLE 213 SÜDZUCKER AG: BUSINESS OVERVIEW

FIGURE 39 SÜDZUCKER AG: COMPANY SNAPSHOT

TABLE 214 SÜDZUCKER AG: PRODUCTS OFFERED

TABLE 215 SÜDZUCKER AG: DEALS, 2018–2021

TABLE 216 SÜDZUCKER AG: OTHERS, 2020

13.2.3 INGREDION INCORPORATED

TABLE 217 INGREDION INCORPORATED: BUSINESS OVERVIEW

FIGURE 40 INGREDION INCORPORATED: COMPANY SNAPSHOT

TABLE 218 INGREDION INCORPORATED: PRODUCTS OFFERED

TABLE 219 INGREDION INCORPORATED: OTHERS, 2021

13.2.4 SUNOPTA INC

TABLE 220 SUNOPTA INC: BUSINESS OVERVIEW

FIGURE 41 SUNOPTA INC: COMPANY SNAPSHOT

TABLE 221 SUNOPTA INC: PRODUCTS OFFERED

TABLE 222 SUNOPTA INC: OTHERS, 2022

13.2.5 KERRY GROUP PLC

TABLE 223 KERRY GROUP PLC: BUSINESS OVERVIEW

FIGURE 42 KERRY GROUP PLC: COMPANY SNAPSHOT

TABLE 224 KERRY GROUP PLC: PRODUCTS OFFERED

TABLE 225 KERRY GROUP PLC: DEALS, 2018–2021

TABLE 226 KERRY GROUP PLC: OTHERS, 2019-2021

13.2.6 IPRONA SPA

TABLE 227 IPRONA SPA: BUSINESS OVERVIEW

TABLE 228 IPRONA SPA: PRODUCTS OFFERED

TABLE 229 IPRONA SPA: PRODUCT LAUNCHES, 2020

13.2.7 SYMRISE AG

TABLE 230 SYMRISE AG: BUSINESS OVERVIEW

FIGURE 43 SYMRISE AG: COMPANY SNAPSHOT

TABLE 231 SYMRISE AG: PRODUCTS OFFERED

13.2.8 DÖHLER GROUP SE

TABLE 232 DÖHLER GROUP SE: BUSINESS OVERVIEW

TABLE 233 DÖHLER GROUP SE: PRODUCTS OFFERED

TABLE 234 DÖHLER GROUP SE: DEALS, 2019-2021

13.2.9 SVZ INTERNATIONAL BV

TABLE 235 SVZ INTERNATIONAL BV: BUSINESS OVERVIEW

TABLE 236 SVZ INTERNATIONAL BV: PRODUCTS OFFERED

TABLE 237 SVZ INTERNATIONAL BV: PRODUCT LAUNCHES,2020

13.2.10 KANEGRADE LIMITED

TABLE 238 KANEGRADE LIMITED: BUSINESS OVERVIEW

TABLE 239 KANEGRADE LIMITED: PRODUCTS OFFERED

13.2.11 SENSIENT TECHNOLOGIES CORPORATION

TABLE 240 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 44 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 241 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

13.3 OTHER PLAYERS (SMES/START-UPS)

13.3.1 PRODALIM RESOURCES LTD (PRODALIM B.V)

TABLE 242 PRODALIM RESOURCES LTD (PRODALIM B.V): BUSINESS OVERVIEW

TABLE 243 PRODALIM RESOURCES LTD (PRODALIM B.V): PRODUCTS OFFERED

TABLE 244 PRODALIM RESOURCES LTD (PRODALIM B.V): DEALS,2018

TABLE 245 PRODALIM RESOURCES LTD (PRODALIM BV): PRODUCT LAUNCHES, 2020

13.3.2 BAOR PRODUCTS GROUP

TABLE 246 BAOR PRODUCTS GROUP: BUSINESS OVERVIEW

TABLE 247 BAOR PRODUCTS GROUP: PRODUCTS OFFERED

13.3.3 KELLER JUICES SRL.

TABLE 248 KELLER JUICES SRL: BUSINESS OVERVIEW

TABLE 249 KELLER JUICES SRL.: PRODUCTS OFFERED

13.3.4 JUICE CONCENTRATE TM

TABLE 250 JUICE CONCENTRATE TM: BUSINESS OVERVIEW

TABLE 251 JUICE CONCENTRATE TM.: PRODUCTS OFFERED

13.3.5 RAJE AGRO FOOD

TABLE 252 RAJE AGRO FOOD: BUSINESS OVERVIEW

TABLE 253 RAJE AGRO FOOD.: PRODUCTS OFFERED

13.3.6 AUSTRALIAN PURE FRUITS

13.3.7 SUN IMPEX

13.3.8 SHIMLA HILLS OFFERINGS PVT. LTD.

13.3.9 GHOUSIA FRUIT COMPANY

13.3.10 WESTERN HILL FOODS LTD.

13.3.11 NEL TRADING COMPANY

TABLE 254 NEL TRADING COMPANY: BUSINESS OVERVIEW

TABLE 255 NEL TRADING COMPANY: PRODUCTS OFFERED

13.3.12 MUHTAROGLU GROUP

TABLE 256 MUHTAROGLU GROUP: BUSINESS OVERVIEW

TABLE 257 MUHTAROGLU GROUP: PRODUCTS OFFERED

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 235)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

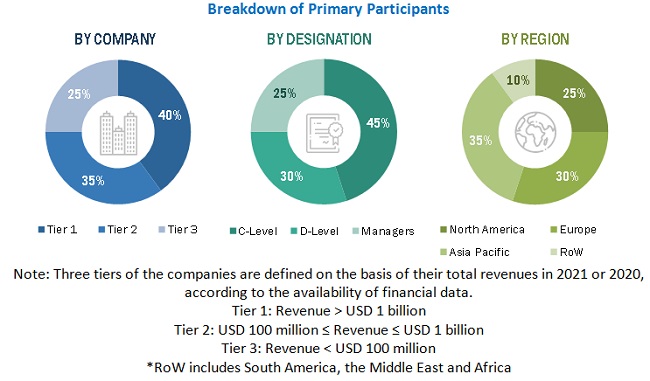

To gather comprehensive and reliable insights into the juice concentrates market, this research study relied on a range of diverse and credible sources. In addition to extensive secondary sources like directories and databases, including Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, the study involved in-depth interviews with key industry players, subject matter experts, and C-level executives. By engaging with experts and participants from various segments of the market's supply chain, this study was able to obtain critical qualitative and quantitative information that could be verified for accuracy and used to assess prospects for growth and expansion. Overall, this rigorous and multifaceted research approach helped to provide a robust and accurate understanding of the juice concentrates market and its evolving trends and opportunities.

Juice Concentrates Market Secondary Research

In the secondary research process, various secondary sources were referred to, to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain, the total pool of key customers, market classification, and segmentation according to industry trends to the bottom-most level and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Juice Concentrates Market Primary Research

The market includes several stakeholders in the supply chain—suppliers, R&D institutes, and end-product manufacturers. The demand side of the market is characterized by the presence of food & beverage manufacturers. The supply side is characterized by the presence of key providers of raw materials. Various primary sources from both markets' supply and demand sides were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Juice Concentrates Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the market's total size. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following details:

- The key customers in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market customers and extensive interviews for opinions from leaders such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying numerous factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Juice Concentrates Market Report Objectives

- To define, segment, and project the global market for juice concentrates market on the basis of type, application, ingredient,form and region.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in juice concentrates market

Reconstituted juice & its impact on juice concentrates Market

Reconstituted juice's effect on the market for juice concentrates will mostly rely on customer demand and juice producers' preferences. While the industry has undoubtedly been impacted by reconstituted juice, this hasn't necessarily led to a decrease in the demand for juice concentrate goods as a whole. Instead, by giving customers and businesses alike more alternatives, it has increased the size of the market.

Consumer desire for handy, inexpensive, and long-lasting juice products, as well as changes in the quantity and price of raw materials like fruit, have all influenced the reconstituted juice industry. Consumer tastes that have changed, such as a stronger emphasis on health and wellness and a move away from artificial chemicals and preservatives, have also had an impact on market growth.

It's crucial to keep in mind, though, that market predictions and trends can be affected by a wide range of variables, including shifting consumer behaviour, industry regulations, and unanticipated occurrences like global pandemics. Any precise projection would thus need to consider a number of the existing and future market variables.

Companies developing new business opportunities by expanding the reach of reconstituted juice market.

Reconstituted juice has been a well-liked beverage for many years. It is created by adding water to concentrated juice. As technology and consumer tastes keep changing, there are a number of potential future use-cases for reconstituted juice market, including:

Enhancement of nutrients: To meet the needs of health-conscious consumers, reconstituted juice may be reinforced with additional nutrients, such as vitamins, minerals, and antioxidants.

Reconstituted juice may be intended to provide certain health advantages, such as improving digestion, increased energy, or immune system support, as functional foods and beverages become more and more popular.

Reconstituted juice might be carried out using the following sustainably sourced ingredients and packaging, such as biodegradable materials, as consumers become more environmentally conscious.

Top players in the reconstituted juice market are Coca-Cola, PepsiCo, Nestlé, Dr. Pepper Snapple Group, Welch's, Tropicana, Ocean Spray, Tree Top, Minute Maid, Florida's Natural, and other top companies are active in the reconstituted juice industry.

The development of reconstituted juice will have an impact on a number of significant companies, such as:

Agriculture: Agricultural practices, such as the kinds of fruits grown, the methods used for harvesting them, and the quality of production, can be affected by the demand for concentrated juice as a raw material for reconstituted juice production.

Packaging: As the demand for reconstituted juice grows, packaging businesses may need to adjust to fulfil market demands by developing environmentally friendly packaging that can sustain the rehydration process.

Food and beverage production: The need for specially designed machinery for the manufacturing process of reconstituted juice might drive research and development in this area.

Retail: When the market for reconstituted juice expands the retail environment may change. For example, new product categories may be developed, product positioning and marketing strategies may be modified, and cutting-edge technology for inventory management and delivery may be used.

Health and wellness: Consumers seeking for better beverage alternatives may start selecting reconstituted juice, which might have an impact on the health and wellness sector, including fitness and nutrition programes, as well as marketing and labelling rules for food and beverages.

Speak to our Analyst today to know more about "Reconstituted Juice Market"

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for juice concentrates into the Greece

- Further breakdown of other countries in the RoW market for juice concentrates into Egypt, Israel, and Turkey

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Juice Concentrates Market