Automotive Fuel Tank Market by Capacity (<45L, 45L-70L, >70L), Material (Aluminum, Plastic, Steel), CNG Tank Type (1, 2, 3 & 4), Propulsion (Hybrid, Hydrogen, ICE, NGV), 2-Wheeler (Motorcycle, Moped), SCR Technology and Region - Global Forecast to 2026

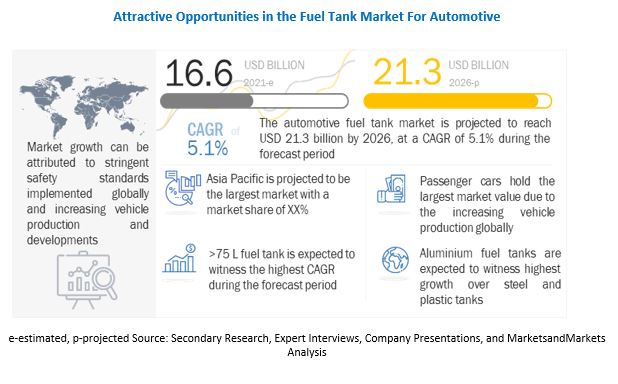

[281 Pages Report] The Automotive Fuel Tank Market was valued at USD 16.6 billion in 2021 and is expected to reach USD 21.3 billion units by 2026, at a CAGR of 5.1%. Factors such as the growing demand, increase in vehicle production, rapid urbanization and growing investments for the development of lightweight vehicles with higher fuel efficiency and longer driving range are expected to drive the demand for the fuel tank market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on Automotive Fuel Tank Market

The automotive industry plays a crucial role in building the global economy. However, the COVID-19 outbreak disrupted the entire automotive supply chain on a global scale during the second and third quarters of 2020, impacting new vehicle sales in FY 2020. According to OICA and MarketsandMarkets analysis, vehicle production (including LDV and HDV) witnessed a decline of 19.6% in 2020. The pandemic presented an uncertain recovery timeline for the automotive industry due to lockdowns and shutdown of manufacturing facilities in various parts of the world. The automotive industry faced four major challenges amid COVID-19—limited supply of vehicle parts, reduced sales of new vehicles, the shutdown of production facilities, and a decline in working capital. As the automotive fuel tank market is dependent on the production of vehicles, this market is expected to be impacted due to the outbreak. However, according to various industry experts, the recovery may regain momentum by the second half of 2021 as the demand for passenger cars, LCV’s and HCV,s is likely to grow, whereas as subsequent growth is observed in two wheeler sales across regions in 2021, which will likely drive the two wheeler fuel tank market.

Market Dynamics

Driver: Growing vehicle production volume

The automotive industry has witnessed steady growth in vehicle production and sales in the past few years. According to the Organization Internationale des Constructeurs d'Automobiles (OICA), the global vehicle production was estimated to be 92.2 million units in 2019. The growth in vehicle production can be attributed to increasing population, improved socio-economic conditions, economic growth, and development of infrastructure. An increase in disposable income of the middle class, particularly in developing nations such as India and Mexico, has also contributed to the increase in vehicle production and demand. Alongwith, the demand for two wheelers is subsequently increasing, due to preference for individual mobility and two wheelers being a cost effective mode of transport.

Restraint: Impact of Increase in electric vehicle production.

One of the major restraints in the fuel tank market is the increasing market penetration of electric vehicles. The increasing demand for zero emission vehicles is also likely to enhance electric vehicle sales in the future. Electric vehicle technologies have become affordable over time with several governments promoting the adoption of electric vehicles by providing tax subsidies and other incentives. A significant increase in financial support from governments in the form of tax rebates and subsidies and regulations to promote eco-friendly vehicles have led to an increase in the adoption rate of electric vehicles. Additionally, improvements in battery and charging technology and reduction in battery price have fueled the demand for electric vehicles. Therefore, increased production and sales of electric vehicles may lead to a decline in the automotive fuel tank market. Currently, the impact of these vehicles on the fuel tank market may be negligible. However, these vehicles are expected to have a huge impact on the fuel tank market in the future.

Opportunities: To build economical fuel tanks using lightweight materials

Alternate fuel vehicles use gaseous materials such as CNG, LNG and hydrogen require strong, safe, and lightweight tanks to maintain normal vehicle size, weight, and driving range. Traditional alternative fuel tanks are made of common grade steel and, over time, the gas can migrate into the metal making the metal brittle causing leakage from the tank. The HDPE plastic fuel tanks are light in weight and are safe to use in vehicles which majorly contribute in reducing the overall weight of the vehicle. Emergence of fuel cell technology has is an efficient solution to achieve a high driving range of about 500 km and a lesser refueling time compared to battery electric vehicles. It is estimated that by 2035, about 5 million vehicles equipped with fuel cell technology could be in production. Carbon fiber composite, which is lighter than other materials, is ideal for hydrogen tanks that need to withstand a high pressure of 700 bars. The benefit of using materials such as carbon fiber composites for alternative fuel tanks is that they keep weight to a minimum, while offering high shock resistance and long life. Fuel tanks manufactured with carbon fiber composites present a good opportunity for manufacturers.

Challenges: High cost of composite tanks and regulatory approvals.

Composite materials are the most advantageous for reduction of weight as they are stronger than most of the metals and have a higher strength to weight ratio. Composites are also flexible to design and can be shaped into any desired form. A single complex shaped composite can eliminate many complex metal assemblies, which helps to reduce maintenance and costs. Carbon, aramid, and glass fibers are very expensive and have complicated processes involved in manufacturing which increases the initial cost of fuel tanks. Also tanks made with composite materials have to undergo lot of regulatory approvals which makes it more challenging. Regulations on recycling of fuel tanks is also a key challenge faced by the fuel tank market.

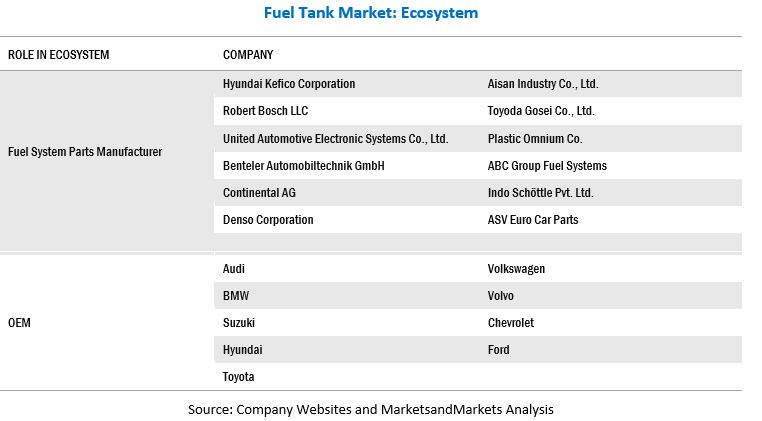

Ecosystem for Automotive Fuel Tank Market

The market ecosystem comprises raw materials suppliers, fuel system component/part manufacturers and OEMs. Fuel tank, fuel injectors, fuel fill hose, gas cap, fuel pump, fuel filter, fuel lines, fuel gauge, fuel gauge sending unit, fuel return lines, emission vapor controls, fuel pressure regulator, pulsation damper are the various components in the automotive fuel tank systems made of various materials. Plastic, Steel, Aluminum, Copper and Iron based alloys and rubber are used for manufacturing various components in the automotive fuel tank systems. The raw material suppliers supply desired raw materials to the components manufacturing companies, by which the component manufacturing companies design and produce components according to OEM requirements. OEMs then directly deploy these systems and install them in their vehicle models.

High Density Polyethylene to be the most widely used material for automotive fuel tanks market

Plastic fuel tanks are principally produced using High Density Polyethylene (HDPE). These tanks are lightweight and can be easily molded according to the requirements of OEMs. The demand for plastic fuel tanks is higher than metal fuel tanks, resulting in an increased demand for HDPE. Plastic fuel tanks find application in almost every vehicle segment, including passenger cars, LCVs, and HCVs. As of 2020, plastic fuel tanks are estimated to account for the largest share, in terms of both volume and value, of the global automotive fuel tank market. The demand for plastic fuel tanks is primarily driven by increasing vehicle production and the growing trend of vehicle weight reduction, which has been triggered by stringent emission norms. Also, there is an increase in the number of passenger and commercial vehicles in developing countries like India as well as developed countries like Japan.

Lightweight Type 4 CNG tanks are expected to be the fastest-growing segment during the forecast period

According to the NGV Journal, almost 85 countries across the globe use CNG-powered vehicles, with more than 22.4 million vehicles and 25,000 fueling stations spread across 2,900 cities worldwide. CNG cylinders are designed based on the type of material (metal, glass fiber, and carbon fiber) used. These tanks can be classified into four types—Type 1, Type 2, Type 3, and Type 4—and come in different sizes, depending on specific requirements of the vehicle. Type 4 tanks are lightweight and predominantly used in HDVs. Thus, vehicles equipped with Type 4 tanks offer better fuel efficiency.

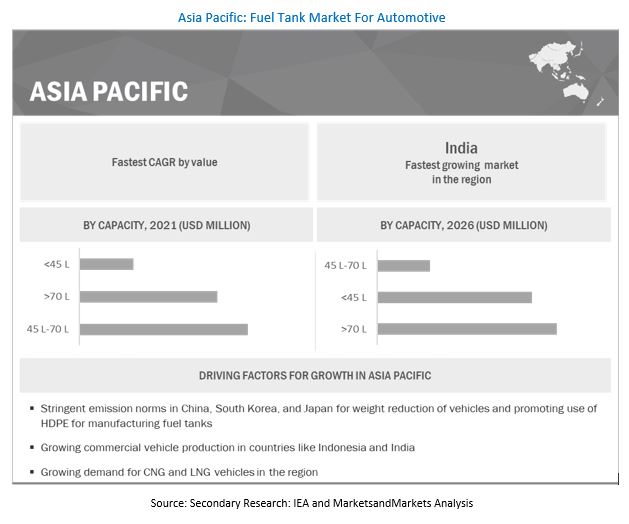

Asia Pacific is expected to lead the market during the forecast period

The Asia Oceania region is the largest automobile producer, given the increasing demand for passenger vehicles in countries such as China, India, Japan, and South Korea. China is the biggest manufacturer of vehicles in the world. India’s commercial vehicle market has been growing eminently and contributes a significant share to the national GDP. Moreover, growing industrialization and improving developments in infrastructure in the Asia Oceania region is driving the growth of commercial vehicles. Also, the manufacturing and production of vehicles are growing at a fast pace due to FDIs coming in countries like Thailand, Malaysia, and Vietnam. With this growth in vehicle production, the demand for automotive fuel tanks has increased in Asia Oceania.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The automotive fuel tank market is dominated by a few global players and several regional players. Some of the key players in the fuel tank market for automotive are The Plastic Omnium Group (France), Textron – KautexV (US), Yapp (China), TI Fluid Systems (UK), Yachiyo (Japan), Unipres Corporation (Japan), Magna International (Canada) and FTS - Fuel Total Systems (Japan).

These companies have strong distribution networks at a global level and offer an extensive product range. They have adopted strategies of new product development, acquisition, and contracts & partnerships to sustain their market position.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) and Volume (‘000 Units) |

|

Segments covered |

Capacity, Material, SCR Technology, Propulsion, CNG Tank and Region, Two wheeler by type and region |

|

Geographies covered |

Asia Pacific, North America, Europe, and Rest of the World |

|

Companies covered |

The Plastic Omnium Group (France), Textron – Kautex (US), Yapp (China), TI Fluid Systems (UK), Yachiyo (Japan), Unipres Corporation (Japan), Magna International (Canada) and FTS - Fuel Total Systems (Japan), SMA Serbatoi S.p.A. (Italy), SRD Holdings Limited (Japan). |

This research report categorizes the for automotive fuel tank market based on capacity, material, SCR technology, propulsion type, CNG tank type and region

Based on Capacity, the market has been segmented as follows:

- <45L

- 45L – 70L

- >70L

Based on Material, the market has been segmented as follows:

- Aluminum

- Plastic

- Steel

Based on SCR technology, the market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Rest of the world

Based on CNG tank type, the market has been segmented as follows:

- Type 1

- Type 2

- Type 3

- Type 4

Based on Propulsion, the market has been segmented as follows:

- Hybrid

- Hydrogen

- ICE

- NGV

Based on Region, the market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Rest of the world

Based on region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Indonesia

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

North America

- Canada

- US

- Mexico

-

Europe

- France

- Germany

- Italy

- Russia

- Spain

- Turkey

- UK

- Rest of Europe

-

Rest of the World

- Argentina

- Iran

- Brazil

- South Africa

Based on two-wheeler , the market has been segmented as follows:

- Motorcycle

- Moped

Recent Developments

- In October 2020, Plastic Omnium (40% stake) and ElringKlinger (60% stake) agreed to use hydrogen-based fuel cell technology to create EKPO Fuel Cell Technologies, a joint venture dedicated to fuel cell stack development, production, and commercialization. It showcased a broad product portfolio to hydrogen systems integrators.

- In April 2021, With a new generation of fuel tank systems, to identify areas where Kautex and the customers need to focus on when bringing a software-controlled system to the market, the company has undertaken Rhapsody software vehicle testing. Refueling tests were done with this software-controlled system both, in the lab and at fuel stations in the Bonn area.

- In May 2021, TI Fluid Systems launched the Integrated Thermal Manifold assembly (ITMa). It provides a one-piece, lightweight, blow-molded plastic manifold to optimize complex line design and replace multiple line bundle assemblies of thermal loops. This is needed for heating and cooling of next generation electric vehicles.

- In April 2019, Yachiyo enhanced its position with local automakers at its subsidiary in Zhongshan, Guangdong Province, China. The company expanded its development and sales strength in the Chinese market by increasing the number of employees in the fiscal year ending in March 2020.

- In July 2019, Unipres Corporation established a subsidiary company in Wuhan, China. As China’s automotive market is expected to grow further, the company decided to establish the subsidiary to expand its business with carmakers located in Wuhan, including the Renault-Nissan-Mitsubishi Alliance. The new company will be Unipres Wuhan Corporation, capitalized at USD 22 million.

Frequently Asked Questions (FAQ):

What is the current size of the automotive fuel tank market?

The automotive fuel tank market is estimated to be USD 16.6 billion in 2021 and is projected to reach USD 21.3 billion by 2030 at a CAGR of 5.1%.

Who are the top key players in the automotive fuel tank market?

The automotive fuel tank market is dominated by globally established players such as The Plastic Omnium Group (France), Textron – Kautex (US), Yapp (China), TI Fluid Systems (UK), Yachiyo (Japan), Unipres Corporation (Japan), Magna International (Canada) and FTS - Fuel Total Systems (Japan). These companies focus on developing new products, adopt expansion strategies and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in this growing automotive fuel tank market.

What is the COVID-19 impact on the automotive fuel tank market?

The COVID-19 outbreak disrupted the entire automotive supply chain on a global scale during the second and third quarters of 2020, impacting new vehicle sales in FY 2020. Due to COVID-19, most of the countries implemented complete lockdowns for more than two months, which, in turn, impacted vehicle production. Manufacturing units around the world were shut down, thus impacting production on a global scale. Although a few OEMs resumed partial production during the later quarters of 2020, the automotive fuel tank market declined significantly in 2020.

What are the trends in the automotive fuel tank market?

The increasing demand for reduced weight of vehicles has encouraged the manufacturers to adopt plastic fuel tanks which are light in weight and safe and durable. Need for environment friendly vehicles is improving the demand for CNG and Hydrogen fuel tanks. Growing demand of two wheelers across countries are likely to boost the two wheeler fuel tank market.

What is the future of the automotive fuel tank market?

Growing need of mobility with fuel efficient and cost effective solutions, increased demand for passanger cars, commercial vehicles and two wheelers is expected to drive automotive fuel tank market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 AUTOMOTIVE FUEL TANK MARKET SEGMENTATION

FIGURE 2 MARKET: BY REGION

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 3 AUTOMOTIVE FUEL TANK MARKET: RESEARCH DESIGN

FIGURE 4 RESEARCH DESIGN MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY SECONDARY SOURCES FOR ESTIMATING MARKETIZE

2.2.3 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 6 AUTOMOTIVE FUEL TANK: MARKET ESTIMATION

FIGURE 7 AUTOMOTIVE FUEL TANK MARKET: BOTTOM-UP APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.6 ASSUMPTIONS

TABLE 1 PARAMETERS AND ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT & RANGES

TABLE 2 RISK ASSESSMENT & RANGES

3 EXECUTIVE SUMMARY (Page No. - 42)

3.1 PRE & POST COVID-19 SCENARIO

FIGURE 9 PRE- & POST-COVID-19 SCENARIO: FUEL TANK MARKET, 2018-2026 (USD MILLION)

TABLE 3 AUTOMOTIVE FUEL TANK MARKET: PRE- VS. POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

FIGURE 10 MARKET OVERVIEW

FIGURE 11 >75L IS EXPECETD TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN FUEL TANK MARKET

FIGURE 12 INCREASING VEHICLE PRODUCTION AND REDUCTION IN VEHICLE WEIGHT DRIVE MARKET

4.2 AUTOMOTIVE FUEL TANK MARKET, BY REGION

FIGURE 13 ASIA PACIFIC ESTIMATED TO BE FASTEST GROWING MARKET DURING FORECAST PERIOD

4.3 ASIA PACIFIC MARKET, BY CAPACITY & COUNTRY

FIGURE 14 45–70 L SEGMENT TO HOLD LARGEST SHARE OF ASIA PACIFIC MARKET IN 2021

4.4 MARKET, BY VEHICLE TYPE

FIGURE 15 PASSENGER CAR TO BE LARGEST SEGMENT IN THE FORECAST PERIOD

4.5 SCR TANK MARKET, BY REGION

FIGURE 16 ASIA PACIFIC TO COMMAND LARGEST SHARE OF SCR TANK MARKET IN 2021 DUE TO STRINGENT EMISSION STANDARDS AND GOVERNMENT REGULATIONS

4.6 CNG FUEL TANK MARKET, BY TYPE

FIGURE 17 TYPE 4 PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD DUE TO EMISSION NORMS AND NEED TO REDUCE OVERALL VEHICLE WEIGHT

4.7 AUTOMOTIVE FUEL TANK MARKET, BY PROPULSION

FIGURE 18 ICE VEHICLES TO BE LARGEST SEGMENT IN 2021 AS IT HOLD THE LARGEST SHARE IN VEHICLE PRODUCTION

4.8 TWO-WHEELER FUEL TANK MARKET, BY REGION

FIGURE 19 ASIA PACIFIC ESTIMATED TO BE FASTEST GROWING TWO-WHEELER FUEL TANK MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 AUTOMOTIVE FUEL TANK: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing vehicle production volume

5.2.1.2 Reduction in vehicle weight leading to advancements of materials

FIGURE 21 EMISSION NORMS FOR ON-ROAD VEHICLES, 2014–2025

5.2.2 RESTRAINTS

5.2.2.1 Impact of electric vehicle production

FIGURE 22 BEV SALES BY REGION, 2021 VS. 2026 (‘000 UNITS)

5.2.2.2 Stringent evaporative emission standards

5.2.3 OPPORTUNITIES

5.2.3.1 Efforts to build economical fuel tanks using lightweight materials

5.2.4 CHALLENGES

5.2.4.1 High cost of composite tanks and regulatory approvals

5.2.4.2 Regulations pertaining to recycling of shredded fuel tank plastics

5.2.5 IMPACT OF COVID-19 ON FUEL TANK MARKET

5.3 PATENT ANALYSIS

5.4 ECOSYSTEM/MARKET MAP

TABLE 4 FUEL TANK MARKET: ECOSYSTEM

5.5 AVERAGE SELLING PRICE ANALYSIS

TABLE 5 FUEL TANK MARKET: AVERAGE OE PRICE RANGE (USD) ANALYSIS, BY VEHICLE TYPE, 2021

5.6 PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 RIVALRY AMONG ESISTING COMPETITORS

5.7 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS OF MARKET

5.8 MARKET, SCENARIOS (2018–2026)

FIGURE 24 GLOBAL MARKET: COVID-19 SCENARIOS ANALYSIS

5.8.1 MARKET, MOST LIKELY SCENARIO

TABLE 6 MOST LIKELY SCENARIO: GLOBAL MARKET, BY REGION, 2018–2026 (USD MILLION)

5.8.2 MARKET, LOW-IMPACT SCENARIO

TABLE 7 LOW-IMPACT SCENARIO: GLOBAL MARKET, BY REGION, 2018–2026 (USD MILLION)

5.8.3 MARKET, HIGH-IMPACT SCENARIO

TABLE 8 HIGH-IMPACT SCENARIO: GLOBAL MARKET, BY REGION, 2018–2026 (USD MILLION)

FIGURE 25 REVENUE SHIFT FOR AUTOMOTIVE FUEL TANK MANUFACTURERS

6 AUTOMOTIVE FUEL TANK MARKET, BY MATERIAL (Page No. - 67)

6.1 INTRODUCTION

6.2 RESEARCH METHODOLOGY

6.3 KEY INDUSTRY INSIGHTS

FIGURE 26 AUTOMOTIVE FUEL TANK MARKET, BY MATERIAL, 2021 VS. 2026 (METRIC TON)

TABLE 9 MARKET, BY MATERIAL, 2018–2020 (‘000 UNITS)

TABLE 10 MARKET, BY MATERIAL, 2018–2020 (METRIC TONS)

TABLE 11 MARKET, BY MATERIAL, 2021–2026 (‘000 UNITS)

TABLE 12 MARKET, BY MATERIAL, 2021–2026 (METRIC TONS)

6.4 PLASTIC

6.4.1 PLASTIC TANKS TO LEAD MARKET DUE TO LIGHT WEIGHT ADVANTAGES OVER METAL TANKS

TABLE 13 PLASTIC: FUEL TANK MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 14 PLASTIC: MARKET, BY REGION, 2018–2020 (METRIC TONS)

TABLE 15 PLASTIC: MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 16 PLASTIC: MARKET, BY REGION, 2021–2026 (METRIC TONS)

6.5 STEEL

6.5.1 MARKET FOR STEEL EXPECTED TO DECLINE DUE TO USE OF LIGHTWEIGHT MATERIAL

TABLE 17 STEEL: MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 18 STEEL: MARKET, BY REGION, 2018–2020 (METRIC TONS)

TABLE 19 STEEL: MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 20 STEEL: MARKET, BY REGION, 2021–2026 (METRIC TONS)

6.6 ALUMINUM

6.6.1 ALUMINUM TO BE MOST WIDELY USED MATERIAL IN COMMERCIAL VEHICLES

TABLE 21 ALUMINUM: MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 22 ALUMINUM: MARKET, BY REGION, 2018–2020 (METRIC TONS)

TABLE 23 ALUMINUM: MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 24 ALUMINUM: MARKET, BY REGION, 2021–2026 (METRIC TONS)

7 AUTOMOTIVE MARKET, BY VEHICLE TYPE (Page No. - 76)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS/LIMITATIONS

7.1.3 INDUSTRY INSIGHTS

FIGURE 27 GLOBAL MARKET, BY VEHICLE TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 25 GLOBAL MARKET, BY VEHICLE TYPE,2018–2020 (‘000 UNITS)

TABLE 26 GLOBAL MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 27 GLOBAL MARKET, BY VEHICLE TYPE, 2021–2026 (‘000 UNITS)

TABLE 28 GLOBAL MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

7.2 PASSENGER CARS

7.2.1 INCREASING POPULARITY OF SEDANS AND SUVS WILL BOOST PASSENGER CARS SEGMENT

TABLE 29 PASSENGER CARS: MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 30 PASSENGER CARS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 31 PASSENGER CARS: MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 32 PASSENGER CARS: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 LIGHT COMMERCIAL VEHICLES (LCV)

7.3.1 GROWING POPULARITY OF PICK-UP TRUCKS AND LIGHT VEHICLES TO DRIVE LCV SEGMENT

TABLE 33 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 34 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 35 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 36 LIGHT COMMERCIAL VEHICLE: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.4 TRUCKS

7.4.1 STRINGENT EMISSION STANDARDS TO BOOST GASOLINE FUEL TANKS IN TRUCKS

TABLE 37 TRUCKS: MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 38 TRUCKS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 39 TRUCKS: MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 40 TRUCKS: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.5 BUSES

7.5.1 INCREASING PRODUCTION VOLUME TO BOOST BUSES SEGMENT

TABLE 41 BUSES: MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 42 BUSES: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 43 BUSES: MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 44 BUSES: MARKET, BY REGION, 2021–2026 (USD MILLION)

8 AUTOMOTIVE FUEL TANK MARKET, BY CAPACITY (Page No. - 87)

8.1 INTRODUCTION

8.2 RESEARCH METHODOLOGY

8.3 KEY INDUSTRY INSIGHTS

FIGURE 28 GLOBAL MARKET, BY CAPACITY, 2021 VS. 2026 (USD MILLION)

TABLE 45 GLOBAL MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 46 GLOBAL MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 47 GLOBAL MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 48 GLOBAL MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

8.4 <45 LITERS

8.4.1 INCREASING PRODUCTION OF MINI PASSENGER CARS IN INDIA AND JAPAN TO DRIVE <45L SEGMENT IN ASIA PACIFIC

TABLE 49 <45L: MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 50 <45L: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 51 <45L: MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 52 <45L: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.5 45–70 LITERS

8.5.1 INCREASING SUV ADOPTION IN US AND CANADA TO DRIVE 45–70L SEGMENT IN NORTH AMERICA

TABLE 53 45–70L: MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 54 45-70 L: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 55 45–70L: MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 56 45-70 L: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.6 >70 LITERS

8.6.1 HIGH TRUCK, BUS, AND LCV PRODUCTION IN ASIA PACIFIC TO FUEL >70L SEGMENT

TABLE 57 >70L: MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 58 >70L: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 59 >70L: MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 60 >70L: MARKET, BY REGION, 2021–2026 (USD MILLION)

9 AUTOMOTIVE SELECTIVE CATALYTIC REDUCTION (SCR) TANK MARKET, BY REGION AND VEHICLE TYPE (Page No. - 96)

9.1 INTRODUCTION

FIGURE 29 AUTOMOTIVE SELECTIVE CATALYTIC REDUCTION (SCR) SYSTEM

9.2 RESEARCH METHODOLOGY

9.3 KEY INDUSTRY INSIGHTS

FIGURE 30 AUTOMOTIVE SCR TANK MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 61 AUTOMOTIVE SCR TANK MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 62 AUTOMOTIVE SCR TANK MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 63 AUTOMOTIVE SCR TANK MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 64 AUTOMOTIVE SCR TANK MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 65 AUTOMOTIVE SCR TANK MARKET, BY VEHICLE TYPE, 2018–2020 (‘000 UNITS)

TABLE 66 AUTOMOTIVE SCR TANK MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 67 AUTOMOTIVE SCR TANK MARKET, BY VEHICLE TYPE, 2021–2026 (‘000 UNITS)

TABLE 68 AUTOMOTIVE SCR TANK MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 HIGH PRODUCTION OF DIESEL-POWERED VEHICLES IN REGION EXPECTED TO DRIVE MARKET

TABLE 69 ASIA PACIFIC: SCR TANK MARKET, BY VEHICLE TYPE, 2018–2020 (‘000 UNITS)

TABLE 70 ASIA PACIFIC: SCR TANK MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 71 ASIA PACIFIC: SCR TANK MARKET, BY VEHICLE TYPE, 2021–2026 (‘000 UNITS)

TABLE 72 ASIA PACIFIC: SCR TANK MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

9.5 EUROPE

9.5.1 DECREASING ADOPTION OF DIESEL PASSENGER CARS WILL HAVE SIGNIFICANT IMPACT ON MARKET

TABLE 73 EUROPE: SCR TANK MARKET, BY VEHICLE TYPE, 2018–2020 (‘000 UNITS)

TABLE 74 EUROPE: SCR TANK MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 75 EUROPE: SCR TANK MARKET, BY VEHICLE TYPE, 2021–2026 (‘000 UNITS)

TABLE 76 EUROPE: SCR TANK MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

9.6 NORTH AMERICA

9.6.1 INCREASING ADOPTION OF DIESEL-POWERED SUVS AND PICKUPS TO BOOST MARKET

TABLE 77 NORTH AMERICA: SCR TANK MARKET, BY VEHICLE TYPE, 2018–2020 (‘000 UNITS)

TABLE 78 NORTH AMERICA: SCR TANK MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 79 NORTH AMERICA: SCR TANK MARKET, BY VEHICLE TYPE, 2021–2026 (‘000 UNITS)

TABLE 80 NORTH AMERICA: SCR TANK MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

9.7 REST OF THE WORLD (ROW)

9.7.1 INCREASING PASSENGER CAR PRODUCTION IS EXPECTED TO DRIVE THE MARKET

TABLE 81 ROW: SCR TANK MARKET, BY VEHICLE TYPE, 2018–2020 (‘000 UNITS)

TABLE 82 ROW: SCR TANK MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 83 ROW: SCR TANK MARKET, BY VEHICLE TYPE, 2021–2026 (‘000 UNITS)

TABLE 84 ROW: SCR TANK MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

10 AUTOMOTIVE CNG TANK MARKET, BY TYPE (Page No. - 108)

10.1 INTRODUCTION

10.2 RESEARCH METHODOLOGY

10.3 KEY INDUSTRY INSIGHTS

TABLE 85 TYPES OF COMPRESSED NATURAL GAS (CNG) CYLINDERS

TABLE 86 WEIGHT REDUCTION OF DIFFERENT TYPES OF CNG CYLINDERS

TABLE 87 COMPARISON OF WEIGHT AND COST OF CNG CYLINDERS

TABLE 88 COMPARISON OF DIFFERENT PARAMETERS FOR CNG CYLINDER TYPES

FIGURE 31 AUTOMOTIVE CNG TANK MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 89 AUTOMOTIVE CNG TANK MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 90 AUTOMOTIVE CNG TANK MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 91 AUTOMOTIVE CNG TANK MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 92 AUTOMOTIVE CNG TANK MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.4 TYPE 1

10.4.1 HIGH DEMAND FOR CNG VEHICLES IN COUNTRIES LIKE INDIA TO DRIVE TYPE 1 SEGMENT

TABLE 93 TYPE 1: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 94 TYPE 1: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 95 TYPE 1: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 96 TYPE 1: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2021–2026 (USD MILLION)

10.5 TYPE 2

10.5.1 BALANCE BETWEEN COST AND WEIGHT DRIVES TYPE 2 MARKET

TABLE 97 TYPE 2: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 98 TYPE 2: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 99 TYPE 2: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 100 TYPE 2: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2021–2026 (USD MILLION)

10.6 TYPE 3

10.6.1 GROWTH IN PRODUCTION OF COMMERCIAL VEHICLES TO DRIVE TYPE 3 SEGMENT

TABLE 101 TYPE 3: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 102 TYPE 3: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 103 TYPE 3: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 104 TYPE 3: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2021–2026 (USD MILLION)

10.7 TYPE 4

10.7.1 INCREASED DEMAND FOR LIGHTWEIGHT AND FUEL-EFFICIENT VEHICLES TO DRIVE TYPE 4 SEGMENT

TABLE 105 TYPE 4: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 106 TYPE 4: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 107 TYPE 4: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 108 TYPE 4: AUTOMOTIVE CNG TANK MARKET, BY REGION, 2021–2026 (USD MILLION)

11 AUTOMOTIVE FUEL TANK MARKET, BY PROPULSION (Page No. - 120)

11.1 INTRODUCTION

11.2 RESEARCH METHODOLOGY

11.3 KEY INDUSTRY INSIGHTS

FIGURE 32 GLOBAL MARKET, BY PROPULSION, 2021 VS. 2026 (USD MILLION)

TABLE 109 GLOBAL MARKET, BY PROPULSION, 2018–2020 (‘000 UNITS)

TABLE 110 GLOBAL MARKET, BY PROPULSION, 2018–2020 (USD MILLION)

TABLE 111 GLOBAL MARKET, BY PROPULSION, 2021–2026 (‘000 UNITS)

TABLE 112 GLOBAL MARKET, BY PROPULSION, 2021–2026 (USD MILLION)

11.4 ICE

11.4.1 LARGE PRODUCTION CAPACITIES IN CHINA AND INDIA EXPECTED TO DRIVE ICE MARKET

TABLE 113 ICE VEHICLE MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 114 ICE VEHICLE MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 115 ICE VEHICLE MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 116 ICE VEHICLE MARKET, BY REGION, 2021–2026 (USD MILLION)

11.5 NATURAL GAS VEHICLE (NGV)

TABLE 117 REFUELING INFRASTRUCTURE FOR METHANE POWERED TRANSPORT IN EU

TABLE 118 GHG PERFORMANCE OF CNG CARS COMPARED TO PETROL AND DIESEL

TABLE 119 COMPARISON OF EMISSIONS FOR MOST SOLD CNG VEHICLES IN EU IN 2017 (VOLKSWAGEN GOLF VII) TO EQUIVALENT MODELS (G CO2EQ./KM)

TABLE 120 REAL-WORLD TAILPIPE EMISSIONS OF EURO 6 VEHICLES

11.5.1 GROWING DEMAND FOR CNG/LNG VEHICLES IN INDIA TO BOOST NGV MARKET

TABLE 121 NGV MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 122 NGV MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 123 NGV MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 124 NGV MARKET, BY REGION, 2021–2026 (USD MILLION)

11.6 HYDROGEN

11.6.1 INCREASING EMISSION NORMS ACROSS COUNTRIES TO DRIVE MARKET

TABLE 125 HYDROGEN MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 126 HYDROGEN MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 127 HYDROGEN MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 128 HYDROGEN MARKET, BY REGION, 2021–2026 (USD MILLION)

11.7 HYBRID

11.7.1 TAX REBATES AND INCENTIVES ON PURCHASE OF HYBRID CARS TO BOOST MARKET

TABLE 129 HYBRID: AUTOMOTIVE MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 130 HYBRID: MARKET, BY REGION,2018–2020 (USD MILLION)

TABLE 131 HYBRID: MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 132 HYBRID: MARKET, BY REGION, 2021–2026 (USD MILLION)

12 AUTOMOTIVE FUEL TANK MARKET, BY REGION (Page No. - 133)

12.1 INTRODUCTION

FIGURE 33 GLOBAL MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 133 GLOBAL MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 134 GLOBAL MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 135 GLOBAL MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 136 GLOBAL MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: AUTOMOTIVE FUEL TANK MARKET SNAPSHOT

TABLE 137 ASIA PACIFIC: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 138 ASIA PACIFIC: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 140 ASIA PACIFIC: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (‘000 UNITS)

TABLE 142 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (‘000 UNITS)

TABLE 144 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.1 CHINA

12.2.1.1 Large production capability expected to drive Chinese market

TABLE 145 CHINA: DETAILS OF AUTOMOTIVE FUEL TANK AND COMPONENT SUPPLIERS BY VEHICLE MODEL

TABLE 146 CHINA: MARKET, BY CAPACITY2018–2020 (‘000 UNITS)

TABLE 147 CHINA: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 148 CHINA: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 149 CHINA: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.2.2 JAPAN

12.2.2.1 Consumer preference for mini and mid segment cars to fuel Japanese market

TABLE 150 JAPAN: DETAILS OF AUTOMOTIVE FUEL TANK AND COMPONENT SUPPLIERS BY VEHICLE MODELS

TABLE 151 JAPAN: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 152 JAPAN: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 153 JAPAN: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 154 JAPAN: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.2.3 SOUTH KOREA

12.2.3.1 Government policies on lightweight and eco-friendly vehicles to drive South Korean market

TABLE 155 SOUTH KOREA: DETAILS OF AUTOMOTIVE FUEL TANK AND COMPONENT SUPPLIERS BY VEHICLE MODELS

TABLE 156 SOUTH KOREA: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 157 SOUTH KOREA: MARKET, BY CAPACITY,2018–2020 (USD MILLION)

TABLE 158 SOUTH KOREA: MARKET, BY CAPACITY,2021–2026 (‘000 UNITS)

TABLE 159 SOUTH KOREA: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.2.4 INDIA

12.2.4.1 High production of commercial vehicles to boost Indian market

TABLE 160 INDIA: DETAILS OF AUTOMOTIVE FUEL TANK AND COMPONENT SUPPLIERS BY VEHICLE MODELS

TABLE 161 INDIA: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 162 INDIA: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 163 INDIA: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 164 INDIA: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.2.5 INDONESIA

12.2.5.1 Government subsidies for automobile manufacturers boost Indonesian market

TABLE 165 INDONESIA: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 166 INDONESIA: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 167 INDONESIA: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 168 INDONESIA: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.2.6 THAILAND

12.2.6.1 Government schemes to drive market in Thailand

TABLE 169 THAILAND: DETAILS OF AUTOMOTIVE FUEL TANK AND COMPONENT SUPPLIERS BY VEHICLE MODELS

TABLE 170 THAILAND: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 171 THAILAND: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 172 THAILAND: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 173 THAILAND: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.2.7 REST OF ASIA PACIFIC

12.2.7.1 Presence of large manufacturing companies in Australia to drive the fuel tank market

TABLE 174 REST OF ASIA PACIFIC: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 175 REST OF ASIA PACIFIC: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 177 REST OF ASIA PACIFIC: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 35 NORTH AMERICA: AUTOMOTIVE FUEL TANK MARKET SNAPSHOT

TABLE 178 NORTH AMERICA: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 179 NORTH AMERICA: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 180 NORTH AMERICA: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 181 NORTH AMERICA: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

TABLE 182 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (‘000 UNITS)

TABLE 183 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 184 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (‘000 UNITS)

TABLE 185 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.1 US

12.3.1.1 Increasing LCV & HCV production due to growth of trucking to drive US market

TABLE 186 US: DETAILS OF AUTOMOTIVE FUEL TANK AND COMPONENT SUPPLIERS BY VEHICLE MODEL

TABLE 187 US: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 188 US: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 189 US: MARKET, BY CAPACITY,2021–2026 (‘000 UNITS)

TABLE 190 US: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.3.2 MEXICO

12.3.2.1 Collaboration with US and Canada for free trade to boost Mexican market

TABLE 191 MEXICO: DETAILS OF AUTOMOTIVE FUEL TANK AND COMPONENT SUPPLIERS BY VEHICLE MODEL

TABLE 192 MEXICO: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 193 MEXICO: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 194 MEXICO: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 195 MEXICO: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.3.3 CANADA

12.3.3.1 Presence of prominent OEMs to drive Canadian market

TABLE 196 CANADA: DETAILS OF AUTOMOTIVE FUEL TANK AND COMPONENT SUPPLIERS BY VEHICLE MODEL

TABLE 197 CANADA: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 198 CANADA: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 199 CANADA: MARKET, BY CAPACITY,2021–2026 (‘000 UNITS)

TABLE 200 CANADA: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.4 EUROPE

TABLE 201 EUROPE: DETAILS OF FUEL TANK AND COMPONENT SUPPLIERS BY VEHICLE MODEL

FIGURE 36 EUROPE: AUTOMOTIVE FUEL TANK MARKET SNAPSHOT

TABLE 202 EUROPE: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 203 EUROPE: MARKET, BY CAPACITY,2018–2020 (USD MILLION)

TABLE 204 EUROPE: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 205 EUROPE: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

TABLE 206 EUROPE: MARKET, BY COUNTRY, 2018–2020 (‘000 UNITS)

TABLE 207 EUROPE: MARKET, BY COUNTRY,2018–2020 (USD MILLION)

TABLE 208 EUROPE: MARKET, BY COUNTRY, 2021–2026 (‘000 UNITS)

TABLE 209 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.1 GERMANY

12.4.1.1 R&D on composite fiber fuel tanks to drive German market

TABLE 210 GERMANY: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 211 GERMANY: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 212 GERMANY: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 213 GERMANY: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.4.2 FRANCE

12.4.2.1 Government policies for use of alternate fuel vehicles to drive French market

TABLE 214 FRANCE: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 215 FRANCE: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 216 FRANCE: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 217 FRANCE: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.4.3 UK

12.4.3.1 Stringent emission norms to boost UK market

TABLE 218 UK: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 219 UK: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 220 UK: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 221 UK: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.4.4 SPAIN

12.4.4.1 Technological investments in alternate fuels to drive Spanish market

TABLE 222 SPAIN: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 223 SPAIN: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 224 SPAIN: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 225 SPAIN: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.4.5 RUSSIA

12.4.5.1 Presence of major fuel tank manufacturers to drive Russian market

TABLE 226 RUSSIA: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 227 RUSSIA: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 228 RUSSIA: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 229 RUSSIA: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.4.6 ITALY

12.4.6.1 Government projects and initiatives drive Italian market

TABLE 230 ITALY: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 231 ITALY: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 232 ITALY: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 233 ITALY: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.4.7 TURKEY

12.4.7.1 High production volume of passenger cars to drive Turkish market

TABLE 234 TURKEY: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 235 TURKEY: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 236 TURKEY: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 237 TURKEY: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.4.8 REST OF EUROPE

12.4.8.1 Increasing presence of vehicle manufacturers to drive market in Rest of Europe

TABLE 238 REST OF EUROPE: MARKET, BY CAPACITY,2018–2020 (‘000 UNITS)

TABLE 239 REST OF EUROPE: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 240 REST OF EUROPE: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 241 REST OF EUROPE: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.5 REST OF THE WORLD (ROW)

FIGURE 37 ROW: AUTOMOTIVE FUEL TANK MARKET, 2021 VS. 2026 (USD MILLION)

TABLE 242 ROW: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 243 ROW: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 244 ROW: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 245 ROW: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

TABLE 246 ROW: MARKET, BY COUNTRY, 2018–2020 (‘000 UNITS)

TABLE 247 ROW: MARKET, BY COUNTRY,2018–2020 (USD MILLION)

TABLE 248 ROW: MARKET, BY COUNTRY, 2021–2026 (‘000 UNITS)

TABLE 249 ROW: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.5.1 BRAZIL

12.5.1.1 Growing vehicle production to drive Brazilian market

TABLE 250 BRAZIL: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 251 BRAZIL: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 252 BRAZIL: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 253 BRAZIL: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.5.2 SOUTH AFRICA

12.5.2.1 Declining vehicle sales may have negative impact on South African market

TABLE 254 SOUTH AFRICA: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 255 SOUTH AFRICA: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 256 SOUTH AFRICA: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 257 SOUTH AFRICA: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.5.3 ARGENTINA

12.5.3.1 Sharp decline in vehicle demand would negatively impact Argentinian market

TABLE 258 ARGENTINA: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 259 ARGENTINA: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 260 ARGENTINA: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 261 ARGENTINA: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

12.5.4 IRAN

12.5.4.1 Upcoming government plans for domestic parts production to drive Iranian market

TABLE 262 IRAN: MARKET, BY CAPACITY, 2018–2020 (‘000 UNITS)

TABLE 263 IRAN: MARKET, BY CAPACITY, 2018–2020 (USD MILLION)

TABLE 264 IRAN: MARKET, BY CAPACITY, 2021–2026 (‘000 UNITS)

TABLE 265 IRAN: MARKET, BY CAPACITY, 2021–2026 (USD MILLION)

13 TWO-WHEELER FUEL TANK MARKET, BY REGION (Page No. - 197)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS/LIMITATIONS

FIGURE 38 TWO-WHEELER FUEL TANK MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 266 MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 267 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 268 MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 269 MARKET, BY REGION, 2021–2026 (USD MILLION)

13.2 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 270 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (‘000 UNITS)

TABLE 271 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 272 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (‘000 UNITS)

TABLE 273 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

13.2.1 CHINA

TABLE 274 CHINA: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 275 CHINA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 276 CHINA: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 277 CHINA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.2.2 INDIA

TABLE 278 INDIA: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 279 INDIA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 280 INDIA: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 281 INDIA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.2.3 JAPAN

TABLE 282 JAPAN: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 283 JAPAN: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 284 JAPAN: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 285 JAPAN: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.2.4 INDONESIA

TABLE 286 INDONESIA: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 287 INDONESIA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 288 INDONESIA: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 289 INDONESIA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.2.5 THAILAND

TABLE 290 THAILAND: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 291 THAILAND: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 292 THAILAND: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 293 THAILAND: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.3 EUROPE

FIGURE 40 EUROPE: MARKET, BY COUNTRY, 2021 VS. 2026

TABLE 294 EUROPE: MARKET, BY COUNTRY, 2018–2020 (‘000 UNITS)

TABLE 295 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 296 EUROPE: MARKET, BY COUNTRY, 2021–2026 (‘000 UNITS)

TABLE 297 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

13.3.1 GERMANY

TABLE 298 GERMANY: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 299 GERMANY: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 300 GERMANY: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 301 GERMANY: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.3.2 FRANCE

TABLE 302 FRANCE: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 303 FRANCE: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 304 FRANCE: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 305 FRANCE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.3.3 UK

TABLE 306 UK: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 307 UK: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 308 UK: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 309 UK: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.3.4 ITALY

TABLE 310 ITALY: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 311 ITALY: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 312 ITALY: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 313 ITALY: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.3.5 SPAIN

TABLE 314 SPAIN: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 315 SPAIN: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 316 SPAIN: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 317 SPAIN: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.3.6 POLAND

TABLE 318 POLAND: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 319 POLAND: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 320 POLAND: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 321 POLAND: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.3.7 RUSSIA

TABLE 322 RUSSIA: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 323 RUSSIA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 324 RUSSIA: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 325 RUSSIA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.4 NORTH AMERICA

FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

TABLE 326 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (‘000 UNITS)

TABLE 327 NORTH AMERICA: MARKET, BY COUNTRY,2018–2020 (USD MILLION)

TABLE 328 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (‘000 UNITS)

TABLE 329 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

13.4.1 US

TABLE 330 US: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 331 US: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 332 US: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 333 US: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.4.2 CANADA

TABLE 334 CANADA: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 335 CANADA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 336 CANADA: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 337 CANADA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.5 REST OF THE WORLD (ROW)

FIGURE 42 ROW: MARKET, 2021 VS. 2026 (USD MILLION)

TABLE 338 ROW: MARKET, BY COUNTRY, 2018–2020 (‘000 UNITS)

TABLE 339 ROW: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 340 ROW: MARKET, BY COUNTRY, 2021–2026 (‘000 UNITS)

TABLE 341 ROW: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

13.5.1 BRAZIL

TABLE 342 BRAZIL: MARKET, BY TYPE,2018–2020 (‘000 UNITS)

TABLE 343 BRAZIL: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 344 BRAZIL: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 345 BRAZIL: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.5.2 COLOMBIA

TABLE 346 COLOMBIA: MARKET, BY TYPE,2018–2020 (‘000 UNITS)

TABLE 347 COLOMBIA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 348 COLOMBIA: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 349 COLOMBIA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.5.3 SOUTH AFRICA

TABLE 350 SOUTH AFRICA: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 351 SOUTH AFRICA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 352 SOUTH AFRICA: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 353 SOUTH AFRICA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.5.4 ISRAEL

TABLE 354 ISRAEL: MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 355 ISRAEL: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 356 ISRAEL: MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 357 ISRAEL: MARKET, BY TYPE, 2021–2026 (USD MILLION)

14 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 233)

14.1 ASIA PACIFIC: A POTENTIAL MARKET FOR AUTOMOTIVE FUEL TANK

14.2 ALUMINUM TO CREATE NEW REVENUE POCKETS IN FUEL TANK MANUFACTURING

14.3 INCREASING INVESTMENT AND DEVELOPMENTS OF FCEVS IS EXPECTED TO CREATE OPPORTUNITIES

14.4 CONCLUSION

15 COMPETITIVE LANDSCAPE (Page No. - 235)

15.1 OVERVIEW

15.2 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2020

15.3 MARKET SHARE ANALYSIS

TABLE 358 MARKET STRUCTURE, 2020

FIGURE 43 MARKET SHARE ANALYSIS, 2020

15.4 COMPETITIVE LEADERSHIP MAPPING

15.4.1 TERMINOLOGY

15.4.2 VISIONARY LEADERS

15.4.3 INNOVATORS

15.4.4 DYNAMIC DIFFERENTIATORS

15.4.5 EMERGING COMPANIES

FIGURE 44 AUTOMOTIVE FUEL TANK MANUFACTURERS: COMPETITIVE LEADERSHIP MAPPING (2020)

15.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 45 AUTOMOTIVE FUEL TANK MANUFACTURERS: COMPANY-WISE PRODUCT OFFERING ANALYSIS

15.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 46 AUTOMOTIVE FUEL TANK MANUFACTURERS: COMPANY-WISE BUSINESS STRATEGY ANALYSIS

FIGURE 47 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENT & PARTNERSHIPS/ AGREEMENTS/SUPPLY CONTRACTS/COLLABORATIONS/JOINT VENTURES AS THE KEY GROWTH STRATEGY, 2018–2021

15.7 COMPETITIVE SCENARIO

15.7.1 NEW PRODUCT DEVELOPMENTS/LAUNCH

TABLE 359 NEW PRODUCT DEVELOPMENTS/LAUNCH, 2021

15.7.2 EXPANSIONS

TABLE 360 EXPANSIONS, 2018–2020

15.7.3 ACQUISITIONS

TABLE 361 ACQUISITIONS, 2017–2018

15.7.4 PARTNERSHIPS/CONTRACTS

TABLE 362 PARTNERSHIPS/CONTRACTS, 2019-20

15.8 RIGHT TO WIN

16 COMPANY PROFILES (Page No. - 247)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

16.1 THE PLASTIC OMNIUM GROUP

FIGURE 48 THE PLASTIC OMNIUM GROUP: COMPANY SNAPSHOT

16.1.2 THE PLASTIC OMNIUM GROUP: PRODUCTS OFFERED

16.1.3 THE PLASTIC OMNIUM GROUP: MAJOR CUSTOMERS

TABLE 363 THE PLASTIC OMNIUM GROUP: ORGANIC DEVELOPMENTS

16.2 TEXTRON (KAUTEX)

FIGURE 49 TEXTRON: COMPANY SNAPSHOT

16.2.2 KAUTEX: PRODUCTS OFFERED

16.2.3 KAUTEX: MAJOR CUSTOMERS

TABLE 364 KAUTEX: PRODUCT LAUNCHES

TABLE 365 KAUTEX: DEALS

16.3 YAPP

FIGURE 50 YAPP: COMPANY SNAPSHOT

16.3.2 YAPP: PRODUCTS OFFERED

16.3.3 YAPP: MAJOR CUSTOMERS

16.4 TI FLUID SYSTEMS

FIGURE 51 TI FLUID SYSTEMS: COMPANY SNAPSHOT

16.4.2 TI FLUID SYSTEMS: PRODUCTS OFFERED

16.4.3 TI FLUID SYSTEMS: MAJOR CUSTOMERS

TABLE 366 TI FLUID SYSTEMS: PRODUCT LAUNCHES

TABLE 367 TI FLUID SYSTEMS: DEALS

16.5 YACHIYO

FIGURE 52 YACHIYO: COMPANY SNAPSHOT

16.5.2 YACHIYO: PRODUCTS OFFERED

16.5.3 YACHIYO: MAJOR CUSTOMERS

TABLE 368 YACHIYO: DEALS

16.6 UNIPRES CORPORATION

FIGURE 53 UNIPRES CORPORATION: COMPANY SNAPSHOT

16.6.2 UNIPRES CORPORATION: PRODUCTS OFFERED

16.6.3 UNIPRES CORPORATION: MAJOR CUSTOMERS

TABLE 369 UNIPRES CORPORATION: DEALS

16.7 MAGNA INTERNATIONAL

FIGURE 54 MAGNA INTERNATIONAL: COMPANY SNAPSHOT

16.7.2 MAGNA INTERNATIONAL: PRODUCTS OFFERED

16.7.3 MAGNA INTERNATIONAL: MAJOR CUSTOMERS

TABLE 370 MAGNA INTERNATIONAL: DEALS

16.8 FTS

TABLE 371 FTS: DEALS

16.9 SMA SERBATOI S.P.A.

16.10 SRD HOLDINGS LTD.

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

16.11 ASIA PACIFIC

16.11.1 METAL TECH CO., LTD.

16.11.2 HWASHIN CO., LTD.

16.11.3 DALI & SAMIR ENGINEERING PVT. LTD

16.11.4 BELLSONIC CORPORATION

16.11.5 CREFACT CORPORATION

16.12 EUROPE

16.12.1 DONGHEE

16.12.2 KONGSBERG AUTOMOTIVE

16.13 NORTH AMERICA

16.13.1 WESTPORT FUEL SYSTEMS

16.13.2 BOYD WELDING

17 APPENDIX (Page No. - 274)

17.1 CURRENCY & PRICING

TABLE 372 CURRENCY EXCHANGE RATES (WRT PER USD)

17.2 INSIGHTS OF INDUSTRY EXPERTS

17.3 DISCUSSION GUIDE

17.4 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.5 AVAILABLE CUSTOMIZATIONS

17.6 RELATED REPORTS

17.7 AUTHOR DETAILS

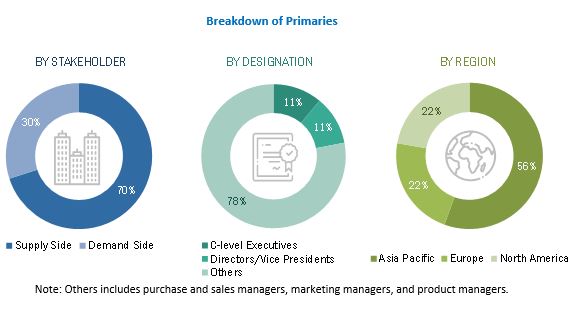

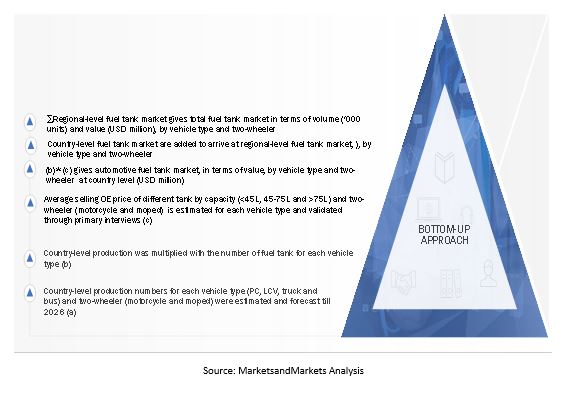

The study involved four major activities to estimate the current size of the fuel tank market for automotive. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of various segments and subsegments.

Secondary Research

The secondary sources referred to in this research study include the Organisation Internationale des Constructeurs d'Automobiles (OICA), the International Energy Agency (IEA), corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. Additionally, secondary research has been carried out to understand the average selling prices of various fuel tanks by size, historic sales of new vehicles, and vehicle production. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as vehicle production and sales forecast, future technology trends, and upcoming technologies in the automotive fuel tank industry. Data triangulation was then done with the information gathered from secondary research. Stakeholders from demand as well as supply side have been interviewed to understand their views on the aforementioned points.

Primary interviews have been conducted with market experts from demand and supply side across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the automotive fuel tank market and other dependent submarkets, as mentioned below:

- Key players in the global market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included study of annual and quarterly financial reports and regulatory filings of major market players (public) as well as interviews with industry experts for detailed market insights.

- All industry-level penetration rates, percentage shares, splits, and breakdowns for the fuel tank market for automotive were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Automotive Fuel Tank Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends.

Report Objectives

-

To define, describe, and project the size of the fuel tank market for automotive based on material, capacity, SCR technology, CNG, propulsion, two wheeler fuel tank by type and region, by volume

(‘000 units) and value (USD million/billion)- To analyze and forecast the fuel tank market based on capacity [<45L, 45L-70L, >70L]

- To analyze and forecast the fuel tank market based on material [Plastic, Aluminium, Steel]

- To analyze and forecast the fuel tank market based on SCR tank market by region [Asia Pacific, Europe, North America, and RoW]

- To analyze and forecast the fuel tank market for automotive based on SCR tank market by vehicle type [Passanger car, LCV, HCV]

- To analyze and forecast the fuel tank market for automotive based on CNG tank by type [Type 1, Type 2, Type 3, Type 4]

- To analyze and forecast the fuel tank market for automotive based on Propulsion Type [Hybrid, Hydrogen, ICE & NGV]

- To analyze and forecast the fuel tank market for automotive based on region [Asia Pacific, Europe, North America, and RoW]

- To analyze and forecast the two wheeler fuel tank market by region [Asia Pacific, Europe, North America, and RoW]

- To forecast the fuel tank market, by volume and value, with respect to four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

-

To analyze the following with respect to the market

- Value Chain Analysis

- Ecosystem

- Market Scenario Analysis

- Porter’s Five Force Analysis

- Patent Analysis

- To analyze the share of key players in the fuel tank market and conduct a revenue analysis of the top 5 players on a competitive evaluation quadrant for fuel tank suppliers

- To track recent developments and analyze the recent financials of key fuel tank suppliers

Fuel tank materials & Its impact on Automotive Fuel Tank Market

The fuel tank material used in automobiles is an important factor influencing the automotive fuel tank market. To meet fuel efficiency regulations and reduce emissions, the automotive industry has seen a shift towards lightweight materials for fuel tanks. As a result, advanced fuel tank materials such as high-density polyethylene (HDPE), steel, aluminium, and composites have been developed. Various factors influence fuel tank material selection, including cost, weight, durability, safety, and environmental impact. Because of its lightweight, low cost, and excellent durability, HDPE is a popular choice for fuel tank material. Because of their strength and durability, aluminium and steel are also commonly used, particularly in heavy-duty commercial vehicles. Composites, on the other hand, have an excellent strength-to-weight ratio and corrosion resistance, making them ideal for high-performance vehicles.

The material of the fuel tank influences the overall cost, safety, and environmental impact of the vehicle, making it an important factor in the automotive fuel tank market. In recent years, there has been an increase in demand for lightweight and environmentally friendly fuel tanks, and manufacturers are investing in research and development to develop new materials that meet these requirements. As a result, automotive fuel tank material will continue to play a significant role in the market.

By extending the reach of Fuel tank materials companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Cost: The cost of fuel tank materials is a key factor that impacts the overall cost of the vehicle. Materials such as aluminium and composites are generally more expensive than traditional materials like steel or plastic.

- Fuel efficiency: Fuel tank materials also impact the fuel efficiency of the vehicle. Lightweight materials like composites and aluminium can help reduce the weight of the vehicle, which in turn reduces fuel consumption and emissions.

- Safety: Fuel tank materials also impact the safety of the vehicle. Materials like HDPE are known for their excellent durability and resistance to impact.

- Environmental impact: The impact of fuel tank materials on the environment is another important factor that will impact the market. Materials like composites and aluminium are recyclable and have a lower carbon footprint compared to traditional materials.

The top players in the Fuel tank materials Market are Lear Corporation, Faurecia, Magna International, Brose Fahrzeugteile GmbH & Co. KG.

Some of the key industries that are going to get impacted because in the future because of Fuel tank materials are,

- Material suppliers: The suppliers of raw materials such as aluminium, composites, and plastics will be impacted by the demand for new fuel tank materials.

- Aerospace: Materials such as composites and aluminium are already widely used in the aerospace industry, and advancements in these materials could lead to more fuel-efficient and lightweight aircraft.

- Renewable energy: Lightweight and durable fuel tanks could enable the development of more efficient and cost-effective hydrogen fuel cells, which could play a crucial role in the transition to clean energy.

- Shipping and transportation: Lightweight fuel tanks could enable the development of more fuel-efficient ships and trucks, which would help reduce emissions and operating costs.

- Defence: The defence industry could also be impacted by advancements in fuel tank materials.

Speak to our analyst today to know more about "Fuel tank materials Market"

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Fuel Tank Market, By Capacity

- <45 L

- 45-70 L

- >70 L

Fuel Tank Market By Region, By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Truck

- Bus

Fuel Tank Market By Region, By Material

- Aluminum

- Steel

- Plastic

Note: Countries Considered In Asia Pacific Are: China, Japan, India, South Korea, Indonesia, Thailand, and Rest of Asia Pacific; North America: US, Canada, and Mexico; Europe: Italy, UK, Germany, France, Spain, Russia, Turkey and rest of Europe; RoW: Argentina, Iran, Brazil, South Africa

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Fuel Tank Market

I need asap a breakdown of the mexico passenger vehicle tank market by single layer plastic tank vs multi layer plastic tank vs metal tanks

Please quote the price and please advise if there is any discount. Furthermore, could we have few pages for reference before purchase? Thank you.

What is the capacity of a 3.75-liter tank?