Flight Navigation System Market by Flight Instrument (Altimeter, Gyroscope, Autopilot, Sensors & Others), Product (Flight Control System, CN&S, & Flight Management System), Application (Fixed & Rotary Wing) & Region - Global Forecast to 2036

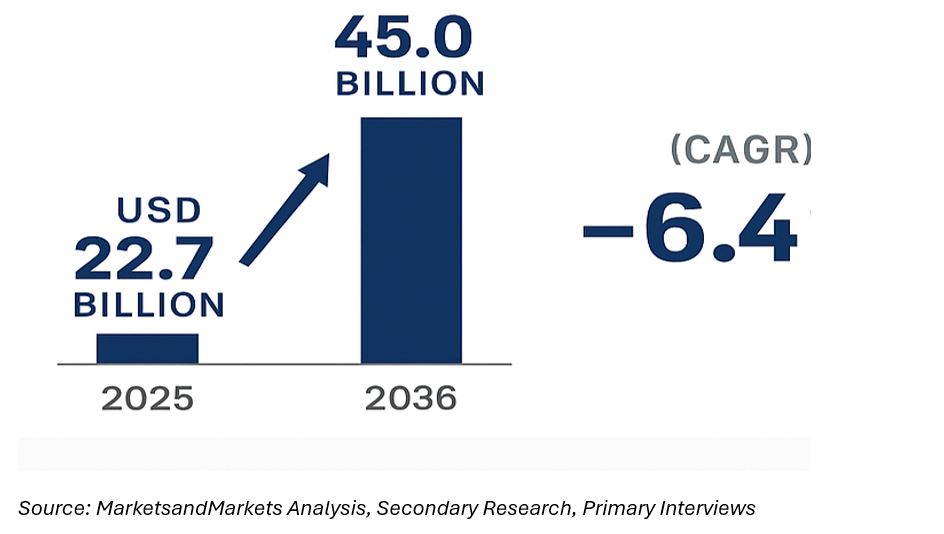

The flight navigation systems market continues to expand as airlines, OEMs, and defence operators modernize cockpits for performance-based navigation (PBN), integrate GNSS-inertial fusion for higher integrity, and retrofit legacy fleets for NextGen/SESAR procedures. Using 2025 as base, the flight navigation systems market is estimated at ~USD 22.7 billion and is projected to reach ~USD 45.0 billion by 2036, reflecting a ~6.4% CAGR (2025–2036). This trajectory sits squarely within the public range that clusters around ~6–7% to 2030, while extending to 2036.

In recent years, procurement has been driven by new aircraft deliveries and aftermarket retrofits that unlock RNAV/RNP routings, continuous-descent operations, and improved approach minima. FAA and ICAO/EASA guidance keeps the focus on onboard performance monitoring/alerting and standardized NavSpecs, which translate directly into avionics content per tail.

Market Definition and Scope

For this page, the flight navigation systems market covers on-aircraft navigation hardware and software: FMS, GNSS/GPS & multi-mode receivers, INS/AHRS, air data & sensors (ADC, radar altimeter integration), radio navigation (VOR/DME/ILS), terrain/obstacle and database functions embedded in nav suites, plus integration software and maintenance/updates tied to PBN operations. Ground CNS infrastructure and cabin connectivity are excluded, except where they are integral to airborne navigation performance or database updates (e.g., EFB/connected FMS).

Market Trends

The flight navigation systems market benefits from three durable vectors. First, fleet renewal: new-gen narrowbodies, regional jets, and business aircraft ship with highly integrated, software-updatable nav suites. Second, retrofit cycles: operators standardize fleets around common RNAV/RNP capabilities to shorten track miles, save fuel, and secure reliable minima. Third, defence & special mission demand leverages precision navigation for contested GNSS environments, pairing INS with multi-constellation receivers and RAIM-like integrity monitoring. Collectively, these vectors sustain mid-single-digit growth while software, data, and services become a rising share of lifetime value.

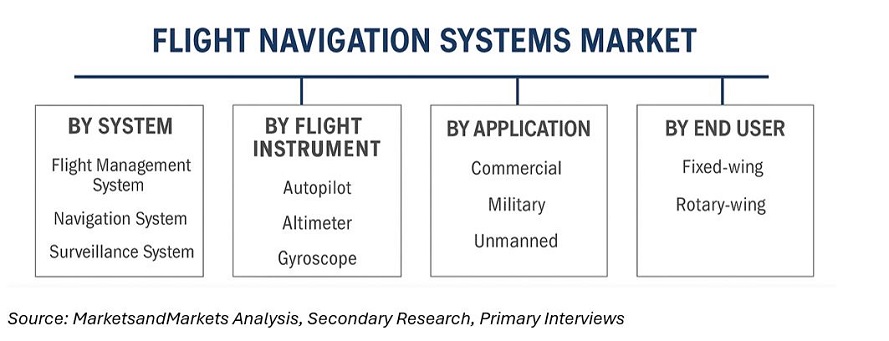

Segmentation Analysis

By System

The flight navigation systems market organizes into core avionics layers that tend to be upgraded together but budgeted separately across programs.

Flight Management Systems (FMS). The command layer for route computation, performance calculations, and PBN procedures; increasingly open-architecture and connected to enable continuous updates and data-driven advisories.

GNSS / Multi-Mode Receivers (MMR). Multi-constellation GNSS integrated with VOR/ILS/MLS as applicable; new deliveries favor multi-mode cards to simplify certification and fleet commonality.

Inertial (INS) & Attitude/Heading (AHRS). High-integrity attitude and position continuity for RNP AR and GNSS-degraded operations; growth reflects tighter integrity bounds for advanced RNP paths.

Air Data & Supporting Sensors. Air data computers, pitot-static processing, and radar altimeter coupling with the nav stack for approach/landing performance.

Radio Navigation (VOR/DME/ILS) Integration. Still relevant for redundancy and interoperability across mixed airspace; radio-nav interfaces remain part of FMS and receiver line items.

Software, Databases & Services. Navigation data, charting/flight-planning, and cyclic updates; restructuring of digital nav portfolios underscores how this layer monetizes beyond the LRU sale.

By Platform

Commercial transport (narrowbody and widebody), regional aircraft, business aviation, and rotorcraft dominate shipments; military fixed-wing and UAVs sustain steady demand for resilient navigation and higher-grade inertial systems.

By Application

En-route & terminal RNAV/RNP, approach/landing (including RNP AR and ILS-linked operations), and performance/trajectory optimization inside the FMS. FAA guidance on RNP with onboard monitoring/alerting is a central adoption driver across these use cases.

By End User

OEM linefit remains the larger revenue pool by absolute value in high-delivery years, while retrofit/aftermarket expands whenever fuel economics and procedure access justify payback. MRO & data services build annuity streams around databases, software unlocks, and periodic upgrades.

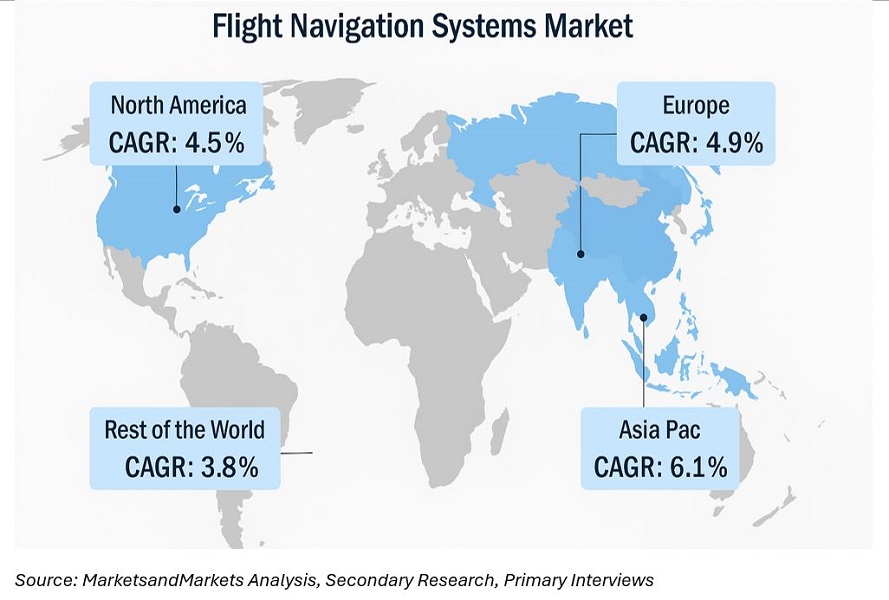

Regional Outlook

North America remains the largest revenue pool, driven by the rapid adoption of NextGen procedures, high fleet utilization, and a strong presence of OEMs and system integrators. Europe delivers stable growth under SESAR and widespread PBN enablement. Asia–Pacific is the fastest-growing region on the back of deliveries in China, India, and Southeast Asia, where new fleets ship with advanced nav from day one. Latin America and Middle East & Africa contribute via flagship-carrier upgrades and selective retrofit programs, with growth tracking traffic recovery and hub investments. Public trackers consistently show North America leading share and Asia–Pacific accelerating, which aligns with the above distribution.

Competitive Landscape

The flight navigation systems market is anchored by Honeywell, Collins Aerospace (RTX), Thales, Garmin, and L3Harris/Universal Avionics, with additional participation from CMC Electronics, uAvionix, Genesys Aerosystems, and Safran/GE-linked programs in specific niches. Vendor messaging in 2024–2025 emphasizes open architectures, AI-assisted decision support, and sustainability benefits (track-mile reductions and time-in-air savings). Meanwhile, portfolio moves around digital navigation and charting (e.g., Jeppesen/ForeFlight divestiture processes) highlight the value of software and data inside the navigation stack.

Sustainability Box

Navigation upgrades are a direct lever on fuel and CO2: PBN routes and RNP AR approaches reduce vectoring, enable continuous-descent operations, and limit holding. Over large fleets, minutes saved per sector translate into measurable emissions and noise gains, which is why airline ESG roadmaps often prioritize FMS upgrades and nav database currency as quick-payback items tied to operations.

Outlook & Key Statistics

- 2025: ~USD 22.7 billion

- 2036: ~USD 45.0 billion

- CAGR (2025–2036): ~6.4%

FAQs

What is driving upgrades now?

Airspace modernization to PBN and the payback from fuel/time savings are the immediate drivers. Operators also value common FMS/nav baselines across fleets for training and dispatch reliability.

How do software and data change the economics?

Beyond LRUs, navigation databases, charting, and connected-FMS features create recurring value, with portfolio reshuffles around digital navigation underscoring the long-term role of data and software.

Which region will grow fastest?

Asia–Pacific is set to grow the quickest on deliveries and new hubs, while North America retains the largest installed base and the highest proportion of PBN-enabled operations today.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Covered

1.2.2 Geographic Scope

1.2.3 Periodization

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increase in the Demand for Aircraft Deliveries

2.2.2.2 Increasing Demand for Accuracy in Navigation

2.2.2.3 Growth in Passenger Air Traffic

2.2.3 Supply-Side Analysis

2.2.3.1 Product Launches

2.2.3.2 Parent Market Analysis

2.3 Market Size Estimation

2.3.1.1 Bottom-Up Approach

2.3.1.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Flight Navigation Systems Market Overview

4.2 Flight Navigation Systems Market Growth, By Product

4.3 Flight Navigation Systems Market Share in Europe

4.4 Flight Navigation Systems Market Share Analysis

4.5 Flight Navigation Systems Market: Emerging vs Matured Economies

4.6 Flight Navigation Systems Market, By Application

4.7 Flight Navigation Systems Market, By Product Type

4.8 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Flight Navigation System Market, By Product

5.2.2 Flight Navigation System Market, By Flight Instrument

5.2.3 Flight Navigation System Market, By Application

5.2.4 Flight Navigation System Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Aircraft Orders & Deliveries

5.3.1.2 Increased Airspace Congestion of Aircraft

5.3.1.3 Economic Growth in Developing Economies

5.3.1.4 Demand for Next-Gen Aircraft

5.3.1.5 Developing Shifts in Navigation System Variants: Aiding Real-Time Position Monitoring

5.3.2 Restraint

5.3.2.1 Government Regulations

5.3.3 Opportunity

5.3.3.1 Automatic Dependent Surveillance -Broadcast

5.3.3.2 Increasing Operational Efficiency

5.3.4 Challenge

5.3.4.1 Adherence to Mandatory Certifications

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Prominent Companies

6.3.2 Small & Medium Enterprises

6.3.3 End Users (Aircraft Manufacturer & Airline Companies)

6.3.4 Key Influencers

6.4 Market Trends

6.5 Porter’s Five Forces Analysis

6.5.1 Threat of New Entrants

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

6.6 Strategic Benchmarking

6.6.1 Fns Market Retention Through Major Contracts

7 Commercial Flight Navigation Systems Market, By Flight Instrument (Page No. - 52)

7.1 Introduction

7.2 Autopilot

7.3 Altimeter

7.4 Gyroscope

7.4.1 Attitude Gyro

7.4.2 Turn Rate Gyro

7.4.3 Directional Gyro

7.5 Sensors

7.5.1 Airspeed Indicator

7.5.2 Vertical Speed Indicator

7.5.3 Pitot Tubes

7.6 Magnetic Compass

8 Commercial Flight Navigation Systems Market, By Product (Page No. - 56)

8.1 Introduction

8.2 Flight Control Systems Market

8.2.1 Primary Flight Controls

8.2.2 Secondary Flight Controls

8.3 Communication, Navigation & Surveillance (CNS) Systems Market

8.3.1 Radar

8.3.2 Instrument Landing Systems

8.3.3 Inertial Navigation Systems

8.3.4 Doppler Navigation System

8.3.5 Aircraft Transponder

8.3.6 Portable Avoidance Collision System

8.3.7 VOR/DME

8.3.8 Automatic Direction Finder

8.3.9 GNSS

8.4 Flight Management Systems Market

8.4.1 Visual Display Unit

8.4.2 Control Display Unit

8.4.3 Flight Management Computers

9 Commercial Flight Navigation Systems Market, By Application (Page No. - 69)

9.1 Introduction

9.2 Flight Navigation Systems Market, By Application

9.2.1 Flight Navigation Systems Market, By Aircraft Type

9.2.2 Fixed Wing Flight Navigation Systems Market, By Region

9.2.2.1 Fixed Wing Flight Navigation Systems Market, Very Large Aircraft

9.2.2.2 Fixed Wing Flight Navigation Systems Market, Wide Body Aircraft

9.2.2.3 Fixed Wing Flight Navigation Systems Market, Narrow Body Aircraft

9.2.2.4 Fixed Wing Flight Navigation Systems Market, Regional Transport Aircraft

9.2.3 Rotary-Wing Flight Navigation Systems Market, By Region

10 Commercial Flight Navigation Systems Market, By Region (Page No. - 76)

10.1 Introduction

10.2 North America

(Every Region and Country Would Have the Market Forecast By Application, Aircraft Type, and Product Type)

10.2.1 North America: Commercial Flight Navigation Systems Market, By Country

10.2.2 North America: Commercial Flight Navigation Systems Market, By Application

10.2.2.1 North America: Commercial Flight Navigation Systems Market, By Aircraft Type

10.2.3 North America: Commercial Flight Navigation Systems Market, By Product

10.2.4 U.S.

10.2.5 Canada

10.3 Asia-Pacific

10.3.4 China

10.3.5 India

10.3.6 Japan

10.3.7 Singapore

10.4 Europe

10.4.4 U.K.

10.4.5 France

10.4.6 Germany

10.4.7 Russia

10.5 Rest of the World (RoW)

11 Competitive Landscape (Page No. - 107)

11.1 Overview

11.2 Market Share Analysis, Flight Navigation Systems Market

11.3 Competitive Scenario

11.4 Contracts

11.5 New Product Launch

11.6 Partnerships, Agreements, Joint Ventures, & Collaborations

11.7 Acquisitions

11.8 Other Developments

12 Company Profiles (Page No. - 114)

*(Overview, Financials, Products & Services, Strategy, and Developments)

12.1 Honeywell International Inc.

12.2 Rockwell Collins, Inc.

12.3 Northrop Grumman Corporation

12.4 Raytheon Company

12.5 The Boeing Company

12.6 MOOG, Inc.

12.7 Sagem

12.8 Universal Avionics Systems Corporation

12.9 Garmin Ltd.

12.10 Esterline Technologies Corporation

*Details no Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 141)

13.1 Discussion Guide

List of Tables (78 Tables)

Table 1 Bifurcation of Years

Table 2 Aircraft Deliveries & Growth Rate (%) Across Various Regions, 2012-2013

Table 3 Market Drivers

Table 4 Regulatory Framework is A Major Restraint for Growth of This Market

Table 5 Opportunity

Table 6 Challenges

Table 7 Commercial Flight Navigation Systems Market, By Platform

Table 8 Fixed Wing Flight Navigation Systems Market , By Cockpit Architecture, 2012-2020 ($ Million )

Table 9 Flight Navigation Systems Market Size for Very Large Aircraft, By Region, 2012-2020 ($ Million )

Table 10 Flight Navigation Systems Market Size for Wide Body Aircraft, By Region, 2012-2020 ($ Billion )

Table 11 Flight Navigation Systems Market Size for Narrow Body Aircraft, By Region, 2012-2020($ Billion)

Table 12 Flight Navigation Systems Market for Regional Transport Aircraft, By Region, 2012-2020 ($ Million)

Table 13 Flight Navigation Systems Market, By Product Type, 2012-2020 ($Million)

Table 14 Flight Control Systems Market, By Sub-Systems, 2012-2020 ($Million)

Table 15 Flight Control Systems Market, By Region, 2012-2020 ($Million)

Table 16 Communication, Navigation, & Surveillance Systems Market , By Sub-Systems, 2012-2020 ($Million)

Table 17 Communication, Navigation, & Surveillance Systems Market , By Region, 2012-2020 ($Million)

Table 18 Radar , By Communication, Navigation, & Surveillance Systems Market, 2012-2020 ($Million)

Table 19 Instrument Landing System, By Communication, Navigation, & Surveillance Systems Market, 2012-2020 ($Million)

Table 20 Inertial Navigation System, By Communication, Navigation, & Surveillance Systems Market, 2012-2020 ($Million)

Table 21 Inertial Navigation System, By Communication, Navigation, & Surveillance Systems Market, 2012-2020 ($Million)

Table 22 Aircraft Transponder, By Communication, Navigation, & Surveillance Systems Market, 2012-2020 ($Million)

Table 23 Flight Management System Market, By Sub-Systems, 2012-2020 ($Million)

Table 24 Flight Management System Market, By Region, 2012-2020 ($Million)

Table 25 Flight Navigation Systems Market, By Geography, 2012-2020 ($Million)

Table 26 North America: Flight Navigation System Market Size , By Country, 2012-2020 ($Million)

Table 27 North America: Flight Navigation Systems Market Size, By Platform, 2012–2020 ($Million)

Table 28 North America: Fixed Wing Flight Navigation Systems Market Size , By Cockpit Architecture, 2012-2020 ($Million)

Table 29 North America: Flight Navigation Systems Market, By Systems , 2012-2020 ($Million)

Table 30 U.S.: Flight Navigation Systems Market Size, By Platform, 2012–2020 ($Million)

Table 31 U.S.: Fixed Wing Flight Navigation Systems Market Size, By Cockpit Architecture, 2012-2020 ($Million)

Table 32 U.S.: Flight Navigation Systems Market Size, By System, 2012–2020 ($Million)

Table 33 Canada: Flight Navigation System Market Size, By Platform, 2012–2020 ($Million)

Table 34 Canada: Fixed Wing Flight Navigation Systems Market Size, By Cockpit Architecture, 2012-2020 ($Million)

Table 35 Canada: Flight Navigation Systems Market Size, By System, 2012–2020 ($Million)

Table 36 Asia Pacific: Flight Navigation System Market Size, By Country, 2012-2020 ($Million)

Table 37 Asia Pacific: Flight Navigation Systems Market Size, By Platform, 2012–2020 ($Million)

Table 38 Asia Pacific: Fixed Wing Flight Navigation Systems Market Size , By Cockpit Architecture, 2012-2020 ($Million)

Table 39 Asia Pacific: Flight Navigation Systems Market, By Systems, 2012-2020 ($Million)

Table 40 China: Flight Navigation System Market Size, By Platform, 2012–2020 ($Million)

Table 41 China: Fixed Wing Flight Navigation Systems Market Size, By Cockpit Architecture, 2012-2020 ($Million)

Table 42 China: Flight Navigation Systems Market Size, By System, 2012–2020 ($Million)

Table 43 India: Flight Navigation System Market Size, By Platform, 2012–2020 ($Million)

Table 44 India: Fixed Wing Flight Navigation Systems Market Size, By Cockpit Architecture, 2012-2020 ($Million)

Table 45 India: Flight Navigation Systems Market Size, By System, 2012–2020 ($Million)

Table 46 Japan: Flight Navigation System Market Size, By Platform, 2012–2020 ($Million)

Table 47 Japan: Fixed Wing Flight Navigation Systems Market Size, By Cockpit Architecture,2 012-2020 ($Million)

Table 48 Japan: Flight Navigation Systems Market Size, By Sub System, 2012–2020 ($Million)

Table 49 Australia: Flight Navigation System Market Size, By Platform, 2012–2020 ($Million)

Table 50 Australia: Fixed Wing Flight Navigation Systems Market Size, By Cockpit Architecture, 2012-2020 ($Million)

Table 51 Australia:: Flight Navigation Systems Market Size, By System, 2012–2020 ($Million)

Table 52 Europe: Flight Navigation System Market Size , By Country, 2012-2020 ($ Million)

Table 53 Europe: Flight Navigation Systems Market Size, By Platform, 2012–2020 ($Million)

Table 54 Europe: Fixed Wing Flight Navigation Systems Market Size , By Cockpit Architecture , 2012-2020($ Million)

Table 55 Europe: Flight Navigation Systems Market, By Sub Systems, 2012-2020 ($ Million)

Table 56 U.K.: Flight Navigation System Market Size, By Platform, 2012–2020($Million)

Table 57 U.K.: Fixed Wing Flight Navigation Systems Market Size, By Cockpit Architecture , 2012-2020($ Million)

Table 58 U.K.: Flight Navigation Systems Market, By Sub Systems, 2012-2020 ($ Million)

Table 59 France: Flight Navigation System Market Size, By Platform, 2012–2020($Million)

Table 60 France: Fixed Wing Flight Navigation Systems Market Size, By Cockpit Architecture , 2012-2020($ Million)

Table 61 France: Flight Navigation Systems Market, By Sub Systems, 2012-2020 ($ Million)

Table 62 Germany: Flight Navigation System Market Size, By Platform, 2012–2020($Million)

Table 63 Germany: Fixed Wing Flight Navigation Systems Market Size, By Cockpit Architecture , 2012-2020($ Million)

Table 64 Germany: Flight Navigation System Market, By Sub Systems, 2012-2020 ($ Million)

Table 65 Russia: Flight Navigation Systems Market Size, By Platform, 2012–2020($Million)

Table 66 Russia: Fixed Wing Flight Navigation Systems Market Size, By Cockpit Architecture , 2012-2020($ Million)

Table 67 Russia: Flight Navigation Systems Market, By Sub Systems, 2012-2020 ($ Million)

Table 68 RoW: Flight Navigation System Market Size , By Region, 2012-2020 ($ Million)

Table 69 RoW: Flight Navigation Systems Market Size, By Platform, 2012–2020($Million)

Table 70 RoW: Fixed Wing Flight Navigation Systems Market Size, By Cockpit Architecture , 2012-2020($ Million)

Table 71 Middle East: Flight Navigation System Market, By Systems, 2012-2020 ($Million)

Table 72 Latin America: Flight Navigation Systems Market, By Systems, 2012-2020 ($Million)

Table 73 Africa: Flight Navigation Systems Market, By Systems, 2012-2020 ($Million)

Table 74 Contracts, 2010–2014

Table 75 New Product Launch, 2010–2014

Table 76 Partnerships, Agreements, Joint Ventures, & Collaborations, 2010–2014

Table 77 Acquisitions, 2010-2014

Table 78 Other Developments, 2010-2014

List of Figures (63 Figures)

Figure 1 Market Scope

Figure 2 Limitations

Figure 1 Research Design

Figure 2 Number of New Product Launches: Avionics vs. Flight Navigation Systems, 2012-2014

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown & Data Triangulation

Figure 6 Limitations of the Research Study

Figure 9 North American Region Held the Largest Share in Flight Navigation Systems Market in 2014

Figure 10 Attractive Market Opportunities in the Flight Navigation Systems Market, 2014-2020

Figure 11 Flight Management Systems Will Have the Highest Growth in the Flight Navigation Systems Market During the Forecast Period

Figure 12 The Europe Region Will Capture A Major Share in the Flight Navigation Systems Market in 2014

Figure 13 North America Will Attain the Highest Market Share in the Flight Navigation Systems Market in 2014

Figure 14 Emerging Economies Will Dominate the Flight Navigation Systems Market By 2020

Figure 15 Fixed Wing Aircraft Cost is Expected to Increase By 2020

Figure 16 Flight Control Systems Will Unravel New Revenue Pockets for Market Players By 2020

Figure 17 The APAC Market Will Lead the Exponential Growth Phase in the Coming Years

Figure 18 Flight Navigation System Market , By Product

Figure 19 Flight Navigation Systems Market, By Flight Instruments

Figure 20 Flight Navigation Systems Market, By Application

Figure 21 Flight Navigation System Market, By Region

Figure 22 Value Chain Analysis (2014): Major Value is Added During Production & Assembly Phase of the FNS

Figure 23 Supply Chain(2014): Direct Distribution is the Most Preferred Strategy Followed By Prominent Manufacturers of FNS

Figure 24 Demand for Performance-Based Navigation is Set to Increase

Figure 25 Porter’s Five Force Analysis (2013): Continuous Improvement in Technology in the FNS Aids Market Affects This Market Positively

Figure 26 Strategic Benchmarking: Rockwell Collins Majorly Adopted the Market Retention Strategy

Figure 27 Components of Flight Navigation Systems

Figure 28 Wide Body Aircraft Captures Major Share in the Flight Navigation Systems Market

Figure 29 The Asia Pacific Will Have Maximum Market Share in the Flight Navigation Systems Market for Very Large Aircraft

Figure 30 Europe Dominates the Flight Navigation Systems Market in Wide Body Aircraft

Figure 31 Flight Navigation System Market for Narrow Body Aircraft is Dominated By Asia Pacific Region

Figure 32 Flight Navigation System Market for Regional Transport Aircraft is Dominated By North America Region

Figure 33 North America Holds the Maximum Share for Rotary Copter Flight Navigation System Market

Figure 34 The Flight Management Systems is Expected to Register A High Growth Rate in the Flight Navigation Systems Market (2014-2020)

Figure 35 The Flight Control Systems Market (2014-2020)

Figure 36 The Communication, Navigation, & Surveillance Systems (2014-2020)

Figure 37 The Flight Management Systems Market is Expected to Register A High Growth Rate in the Flight Navigation Systems Market (2014-2020)

Figure 38 Geographic Snapshot , Market Share, 2014 – Flight Navigation Systems Market is Growing Very Rapidly in China

Figure 39 India- the Most Emerging Flight Navigation System Market as New Aircraft Deliveries is Gaining Traction

Figure 40 North America Market Snapshot: Demand is Expected to Be Driven By Increasing Aircraft Deliveries

Figure 41 Asia Pacific Market Snapshot: India is the Most Lucrative Market

Figure 42 U.K. Has the Major Share in European Commercial Avionic Systems Market (2014)

Figure 43 Flight Navigation Systems Market in RoW (2014)

Figure 44 Companies That Adopted Product Innovation as the Key Growth Strategy

Figure 45 Honeywell International Inc. Grew at the Fastest Rate Between 2011-2013

Figure 46 Flight Navigation Systems Market Share, By Key Player, 2013

Figure 47 Flight Navigation Systems Market Evolution Framework, 2011-2013

Figure 48 Flight Navigation Systems Market Share: Contracts Was the Key Strategy, 2010-2014

Figure 49 Honeywell International Inc.: Company Snapshot

Figure 50 Honeywell International, Inc.: SWOT Analysis

Figure 51 Rockwell Collins, Inc.: Company Snapshot

Figure 52 Rockwell Collins, Inc.: SWOT Analysis

Figure 53 Northrop Grumman Corporation: Company Snapshot

Figure 54 Northrop Grumman Corporation: SWOT Analysis

Figure 55 Raytheon Company: Company Snapshot

Figure 56 Raytheon Company: SWOT Analysis

Figure 57 The Boeing Company: Company Snapshot

Figure 58 The Boeing Company: SWOT Analysis

Figure 59 Moog, Inc.: Company Snapshot

Figure 60 Sagem: Company Snapshot

Figure 61 Universal Flight Navigation Systems Corporation: Business Overview

Figure 62 Garmin Ltd.: Business Overview

Figure 63 Esterline Technologies Corporation: Business Overview

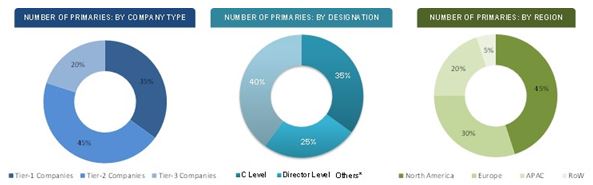

The research methodology used to estimate and forecast the flight navigation systems market begins with capturing data on key flight navigation systems revenues through secondary research. The bottom-up procedure was employed to arrive at the overall market size of the flight navigation systems market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments, which are then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, Directors and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments. The breakdown of profiles of primary discussion participants is depicted in the below figure:

The ecosystem of the flight navigation systems market comprises components suppliers, manufacturers, distributors, and end-users. The flight navigation systems market is characterized by direct distribution channels and the presence of OEMs as well as Tier 1 & Tier 2 companies. Some of the key players of the flight navigation systems market include Honeywell International Inc. (U.S.), Rockwell Collins (U.S.), Raytheon Company (U.S.), Northrop Grumman Corporation (U.S.), and The Boeing Company (U.S.), among others. These players are adopting strategies, such as new product developments, long-term contracts, and expansions to strengthen their positions in the flight navigation systems market. They are also focusing on developing new products by investing considerable amount of their revenues in research & development.

Scope of the Report:

This report categorizes the flight navigation systems market into the following segments:

Flight Navigation System Market, by Product

- Flight Management System (sub-segments)

- Flight Control System (sub-segments)

- Navigation, Communication and Surveillance system (sub-segments)

Flight Navigation System Market, by Application

- Fixed-wing

- Narrow body aircraft

- Wide body aircraft

- Very large aircraft

- Regional aircraft

- Rotary-wing

Flight Navigation Systems Market, by Flight Instrument

- Autopilot

- Altimeter

- Gyroscope (sub-segments)

- Sensors (sub-segments)

- Magnetic Compass

Flight Navigation Systems Market, by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

Customizations available for the report:

With the given market data, MarketsandMarkets offers customizations as per the needs of a company. The following customization options are available for the report:

-

Geographic Analysis

- Further breakdown of the Rest of Asia-Pacific flight navigation systems market into Australia, Malaysia and New Zealand, among others

-

Company Information

- Detailed analysis and profiling of additional market players (Upto 5)

Growth opportunities and latent adjacency in Flight Navigation System Market