Air Data Systems Market by End User (Civil and Military), Aircraft Type (NBA, WBA, RTA, VLA, UAV, RWA, Military Aircraft, General Aviation, and Fighter Jet), Component (Electronic Unit, Probes, and Sensors) and Region - Global Forecast to 2021

The air data systems market is projected to grow from USD 579.7 Million in 2016 to USD 762.9 Million by 2021, at a CAGR of 5.65% during the forecast period. The base year considered for the study is 2015, and the forecast period is from 2016 to 2021.

Objectives of the Study:

The report analyzes the air data systems (ADS) market on the basis of aircraft type (narrow body aircraft, wide body aircraft, very large aircraft, regional transport aircraft, business jet, fighter jet, military transport aircraft, rotary wing aircraft, and UAV), component (electronic unit, sensors, and probes), and end user (civil and military). These segments and subsegments are mapped across major regions, namely, North America, Europe, Asia-Pacific, and rest of the world (RoW).

The report provides an in-depth market intelligence regarding market dynamics and major factors influencing the growth of the ADS market (drivers, restraints, opportunities, and industry-specific challenges), along with an analysis of micromarkets with respect to individual growth trends, future prospects, and their contribution made to the overall market. The report also covers competitive developments, such as long-term contracts, new product launches & agreements, and research & development activities in the air data systems market, in addition to business and corporate strategies adopted by key market players.

The market is projected to grow from USD 579.7 Million in 2016 to USD 762.9 Million by 2021, at a CAGR of 5.65% during the forecast period. Rise in the number of aircraft orders & deliveries and growing demand for large military UAVs are key factors expected to drive the growth of the air data systems market. The market has been segmented on the basis of aircraft type, component, end user, and region.

Based on aircraft type, the air data systems market has been segmented into narrow body, wide body, very large body, general aviation, regional transport, rotary wing, military transport, fighter jet, and UAV. The narrow body aircraft segment dominated the market in 2016 and is expected to continue its dominance during the forecast period as well. According to Boeing’s Current Market Outlook 2016, the global fleet size of narrow body aircraft is 14,870, which is anticipated to reach 32,280 aircraft by 2035. Asia and North America have the largest fleet of narrow body aircraft, with 4,540 and 4,010 aircraft respectively. Increase in demand for narrow body aircraft globally is driving the market.

Based on component, the market has been segmented into electronic unit, sensors, and probes. Among them, the electronic unit segment is anticipated to grow at the highest CAGR from 2016 to 2021. As per the FAA-RVSM mandate, every aircraft flying between flight level (FL) 290 and 410 (inclusive) should have an RVSM (Reduced Vertical Separation Minimum) compliant electronic unit. The end users of the air data systems market include civil and military. Among the two, the civil segment has the largest market size and is also anticipated to grow at the highest CAGR during the forecast period. The civil aviation industry across the globe has been witnessing strong growth in recent years, driven by factors such as increase in air travel, rise in disposable income, and growth in international tourism, among others.

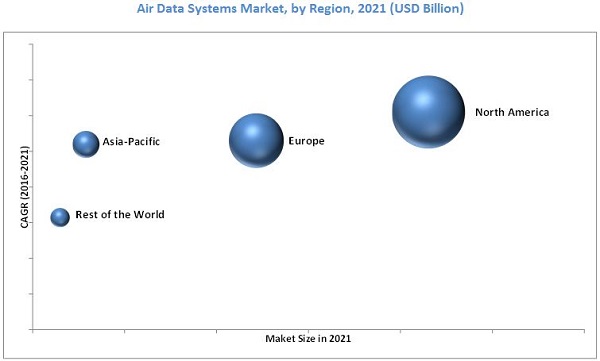

The geographical analysis of the air data systems market includes regions, such as North America, Europe, Asia-Pacific, and rest of the world. North America is estimated to lead the global market in 2016. The aviation industry is one of the most profitable industries in North America, with major aircraft manufacturers, such as Boeing (U.S.), Bombardier (Canada), Lockheed Martin (U.S.), Bell Helicopter (U.S.), and Sikorsky Aircraft (U.S.) present the region. These manufacturers help generate demand for air data systems. North America is expected to continue its dominance of the market during the forecast period.

The frequent need for calibration of sensors and high cost of ADS for medium scale UAVs are some of the factors restraining the growth of the air data systems market. Products offered by various companies operating in the ADS market have been listed in this report. The recent development and contract sections of the report include essential products developed and contracts undertaken by various companies between 2013 and 2016. Major players in the ADS market include Honeywell International, Inc. (U.S.), United Technologies Corporation (U.S.), Rockwell Collins, Inc. (U.S.), Curtiss-Wright Corp. (U.S.), AMETEK, Inc. (U.S.), Astronautics Corporation of America (U.S.), Shadin Avionics (U.S.), Meggit Avionics (U.K.), Thommen Aircraft Equipment (Switzerland), Aeroprobe Corp. (U.S.), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Study Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

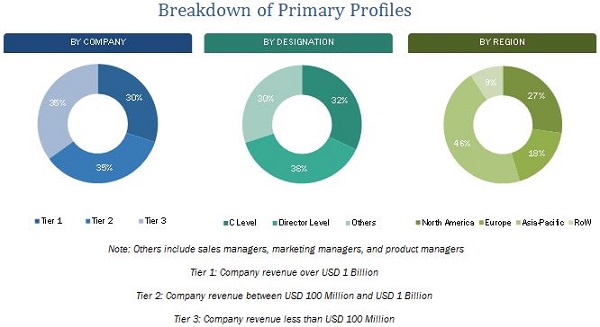

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Increase in Aviation Passenger Traffic

2.2.2.2 Rise in Demand of UAVs

2.2.2.3 Rising Need for Airspace

2.2.3 Supply-Side Indicators

2.2.3.1 Technological Advancement in ADCS

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities in the ADS Market

4.2 ADS Market, By Component, 2014-2021

4.3 North America ADS Market

4.4 ADS Market, By Aircraft Type

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Component

5.2.2 By Aircraft Type

5.2.3 By End User

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in the Number of Aircraft Orders and Deliveries

5.3.1.2 Rise in Demand for Large Military UAVs

5.3.1.3 Emerging Concepts of Integrated Systems to Reduce Weight and Enhance Performance

5.3.1.4 Increased Demand for Real-Time Data

5.3.2 Restraints

5.3.2.1 Frequent Need for Calibration of Sensors

5.3.2.2 High Cost of Adc Unit for Medium Scale UAVs

5.3.3 Opportunities

5.3.3.1 Introduction of Advanced ADS in Fighter Aircraft

5.3.3.2 Aviation Authority Mandates and Regulations

5.3.4 Challenges

5.3.4.1 Time-Consuming Mandatory Certifications

6 Industry Trends (Page No. - 49)

6.1 Introduction

6.2 Product Mapping in ADS

6.3 Technological Roadmap

6.4 Technology Trend

6.4.1 Error Free Digital Output

6.4.2 Air Data Sensing

6.4.3 New Design in ADS

6.5 Innovation & Patent Registrations

6.6 Key Trend Analysis

7 ADS Market, By End User (Page No. - 55)

7.1 Introduction

7.2 Civil

7.3 Military

8 ADS Market, By Aircraft Type (Page No. - 59)

8.1 Introduction

8.2 Narrow Body Aircraft

8.3 General Aviation

8.4 Rotary Wing Aircraft

8.5 WB Aircraft

8.6 Fighter Aircraft

8.7 RTA

8.8 Military Transport Aircraft

8.9 UAV

8.10 Very Large Aircraft

9 ADS Market, By Component (Page No. - 68)

9.1 Introduction

9.2 Electronic Unit

9.3 Probes

9.4 Sensors

10 Regional Analysis (Page No. - 72)

10.1 Introduction

10.2 North America

10.2.1 By End User

10.2.2 By Aircraft Type

10.2.3 By Component

10.2.4 By Country

10.2.4.1 U.S.

10.2.4.1.1 By End User

10.2.4.1.2 By Aircraft Type

10.2.4.1.3 By Component

10.2.4.2 Canada

10.2.4.2.1 By End User

10.2.4.2.2 By Aircraft Type

10.2.4.2.3 By Component

10.3 Europe

10.3.1 By End User

10.3.2 By Aircraft Type

10.3.3 By Component

10.3.4 By Country

10.3.4.1 France

10.3.4.1.1 By End User

10.3.4.1.2 By Aircraft Type

10.3.4.1.3 By Component

10.3.4.2 Italy

10.3.4.2.1 By End User

10.3.4.2.2 By Aircraft Type

10.3.4.2.3 By Component

10.3.4.3 U.K.

10.3.4.3.1 By End User

10.3.4.3.2 By Aircraft Type

10.3.4.3.3 By Component

10.3.4.4 Sweden

10.3.4.4.1 By End User

10.3.4.4.2 By Aircraft Type

10.3.4.4.3 By Component

10.4 Asia-Pacific

10.4.1 By End User

10.4.2 By Aircraft Type

10.4.3 By Component

10.4.4 By Country

10.4.4.1 Russia

10.4.4.1.1 By End User

10.4.4.1.2 By Aircraft Type

10.4.4.1.3 By Component

10.4.4.2 China

10.4.4.2.1 By End User

10.4.4.2.2 By Aircraft Type

10.4.4.2.3 By Component

10.4.4.3 Japan

10.4.4.3.1 By End User

10.4.4.3.2 By Aircraft Type

10.4.4.3.3 By Component

10.4.4.4 India

10.4.4.4.1 By End User

10.4.4.4.2 By Aircraft Type

10.4.4.4.3 By Component

10.5 RoW

10.5.1 By End User

10.5.2 By Aircraft Type

10.5.3 By Component

10.5.4 By Country

10.5.4.1 Brazil

10.5.4.1.1 By End User

10.5.4.1.2 By Aircraft Type

10.5.4.1.3 By Component

11 Competitive Landscape (Page No. - 103)

11.1 Introduction

11.2 Market Rank Analysis of ADS Market

11.3 Brand Analysis

11.4 Competitive Situation and Trends

11.4.1 Contracts

11.4.2 New Product Launches

11.4.3 Expansions

11.4.4 Agreements

12 Company Profiles (Page No. - 112)

(Business Overview, Products Offered, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.1 Introduction

12.2 Financial Highlights

12.3 Honeywell International Inc.

12.4 United Technologies Corporation

12.5 Rockwell Collins, Inc.

12.6 Ametek Inc.

12.7 Curtiss-Wright Corporation

12.8 Meggitt PLC

12.9 Astronautics Corporation of America

12.10 Shadin Avionics

12.11 Aeroprobe Corporation

12.12 Thommen Aircraft Equipment

*Details on Business Overview, Products Offered, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 134)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (72 Tables)

Table 1 New Aircraft Delivery Forecast Comparison, By Region, 2015-2034

Table 2 Variants of ADS Used in Aircraft

Table 3 Innovation & Patent Registrations, 2011-2016

Table 4 Key Trend Analysis, 2016

Table 5 Air Data Systems Market Size, By End User, 2014-2021 (USD Million)

Table 6 Air Data Systems Market Size for Civil End User Segment, By Region, 2014-2021 (USD Million)

Table 7 Air Data Systems Market Size for Military, By Region, 2014-2021 (USD Million)

Table 8 Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 9 Market Size for Narrow Body Aircraft, By Region, 2014-2021 (USD Million)

Table 10 Market Size for General Aviation Aircraft, By Region, 2014-2021 (USD Million)

Table 11 Market Size for Rotary Wing Aircraft, By Region, 2014-2021 (USD Million)

Table 12 Market Size for WB Aircraft, By Region, 2014-2021 (USD Million)

Table 13 Air Data Systems Market Size for Fighter Aircraft, By Region, 2014-2021 (USD Million)

Table 14 Air Data Systems Market Size for RTA, By Region, 2014-2021 (USD Million)

Table 15 Air Data Systems Market Size for Military Transport Aircraft, By Region, 2014-2021 (USD Million)

Table 16 Air Data Systems Market Size for UAV, By Region, 2014-2021 (USD Million)

Table 17 Air Data Systems Market Size for Very Large Aircraft, By Region, 2014-2021 (USD Million)

Table 18 Air Data Systems Market Size, By Component, 2014-2021 (USD Million)

Table 19 Air Data Systems Market Size in Electronic Unit, By Region, 2014-2021 (USD Million)

Table 20 Air Data Systems Market Size in Probes, By Region, 2014-2021 (USD Million)

Table 21 Air Data System Market Size in Sensors, By Region, 2014-2021 (USD Million)

Table 22 Air Data System Market Size, By Region, 2014–2021 (USD Million)

Table 23 North America: ADS Market Size , By Aircraft Type, 2014-2021 (USD Million)

Table 24 North America: ADS Market Size, By Component, 2014-2021 (USD Million)

Table 25 North America: ADS Market Size, By Country, 2014-2021 (USD Million)

Table 26 U.S.: Air Data System Market Size, By End User, 2014-2021 (USD Million)

Table 27 U.S.: Air Data System Market Size , By Aircraft Type, 2014-2021 (USD Million)

Table 28 U.S.: ADS Market Size , By Component, 2014-2021 (USD Million)

Table 29 Canada: Air Data System Market Size, By End User, 2014-2021 (USD Million)

Table 30 Canada: Air Data System Market Size , By Aircraft Type, 2014-2021 (USD Million)

Table 31 Canada: Air Data System Market Size , By Component, 2014-2021 (USD Million)

Table 32 Europe: Air Data System Market Size , By Aircraft Type, 2014-2021 (USD Million)

Table 33 Europe: Air Data System Market Size, By Component, 2014-2021 (USD Million)

Table 34 Europe: Air Data System Market Size, By Country, 2014-2021 (USD Million)

Table 35 France: Market Size, By End User, 2014-2021 (USD Million)

Table 36 France: Air Data System Market Size , By Aircraft Type, 2014-2021 (USD Million)

Table 37 France: Market Size , By Component, 2014-2021 (USD Million)

Table 38 Italy: Market Size, By End User, 2014-2021 (USD Million)

Table 39 Italy: Air Data System Market Size , By Aircraft Type, 2014-2021 (USD Thousand)

Table 40 Italy: Market Size, By Component, 2014-2021 (USD Million)

Table 41 U.K.: Air Data System Market Size, By End User, 2014-2021 (USD Million)

Table 42 U.K.: Air Data System Market Size, By Aircraft Type, 2014-2021 (USD Thousand)

Table 43 U.K.: Air Data System Market Size , By Component, 2014-2021 (USD Thousand)

Table 44 Sweden: Market Size, By End User, 2014-2021 (USD Million)

Table 45 Sweden: Air Data System Market Size , By Aircraft Type, 2014-2021 (USD Thousand)

Table 46 Sweden: ADS Market Size , By Component, 2014-2021 (USD Thousand)

Table 47 Asia-Pacific: ADS Market Size , By Aircraft Type, 2014-2021 (USD Million)

Table 48 Asia-Pacific: ADS Market Size, By Component, 2014-2021 (USD Million)

Table 49 Asia-Pacific: ADS Market Size, By Country, 2014-2021 (USD Million)

Table 50 Russia: ADS Market Size, By End User, 2014-2021 (USD Million)

Table 51 Russia: ADS Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 52 Russia: ADS Market Size, By Component, 2014-2021 (USD Million)

Table 53 China: ADS Market Size, By End User, 2014-2021 (USD Million)

Table 54 China: ADS Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 55 China: ADS Market Size, By Component, 2014-2021 (USD Million)

Table 56 Japan: ADS Market Size, By End User, 2014-2021 (USD Million)

Table 57 Japan: ADS Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 58 Japan: ADS Market Size, By Component, 2014-2021 (USD Thousand)

Table 59 India: ADS Market Size, By End User, 2014-2021 (USD Million)

Table 60 India: ADS Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 61 India: ADS Market Size, By Component, 2014-2021 (USD Million)

Table 62 RoW: ADS Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 63 RoW: ADS Market Size, By Component, 2014-2021 (USD Million)

Table 64 RoW: ADS Market Size, By Country, 2014-2021 (USD Million)

Table 65 Brazil: ADS Market Size, By End User, 2014-2021 (USD Million)

Table 66 Brazil: ADS Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 67 Brazil: ADS Market Size, By Component, 2014-2021 (USD Million)

Table 68 Brand Analysis of the Top Five Market Companies

Table 69 Contracts, October 2013- March 2016

Table 70 New Product Launches, February 2014- September 2015

Table 71 Expansions, 2015

Table 72 Agreements, 2016

List of Figures (52 Figures)

Figure 1 ADS Market: Markets Covered

Figure 2 Years Considered for the Study

Figure 3 Research Process Flow

Figure 4 ADS Market: Research Design

Figure 5 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 6 Total Aviation Passenger Traffic, 2005-2015 (Billion)

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Data Triangulation

Figure 10 North America Accounted for the Largest Share of the ADS Market in 2016

Figure 11 ADS Market, By Aircraft Type, 2016 & 2021 (USD Million)

Figure 12 ADS Market, By End User, 2016 & 2021 (USD Million)

Figure 13 ADS Market, By Component, 2016 & 2021 (USD Million)

Figure 14 Contracts Was the Most Adopted Strategy By Companies Between 2013 and 2016

Figure 15 Rise in Number of Aircraft Orders and Deliveries are Expected to Drive Growth of the ADS Market

Figure 16 Electronic Unit Segment is Projected to Lead the ADS Market During the Forecast Period

Figure 17 The U.S. Accounted for the Largest Share of the North America ADS Market in 2016

Figure 18 The Narrow Body Aircraft Segment is Projected to Lead the ADS Market During the Forecast Period

Figure 19 ADS Market Segmentation, By Component

Figure 20 Commercial ADS Market Segmentation, By Aircraft Type

Figure 21 ADS Market Segmentation, By End User

Figure 22 ADS Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Demand for Strategic UAVs is Projected to Grow During the Forecast Period

Figure 24 Number of Fighter Aircraft in Fleet With Old ADS in 2015

Figure 25 Evolution of Technology in ADS Market From 1960 to 2015

Figure 26 Advanced Technologies Used in the ADS Market

Figure 27 ADS Market, By End User, 2016 & 2021 (USD Million)

Figure 28 ADS Market Size, By Aircraft Type, 2016 & 2021 (USD Million)

Figure 29 ADS Market, By Component, 2016 & 2021 (USD Million)

Figure 30 Regional Snapshot: North America is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 31 North America ADS Market: Regional Snapshot (2016)

Figure 32 Europe ADS Market: Regional Snapshot (2016)

Figure 33 Asia-Pacific ADS Market: Regional Snapshot (2016)

Figure 34 Companies Adopted New Product Launches as the Key Growth Strategy Between October 2013 and March 2016

Figure 35 Ranking of Key Companies in the ADS Market in 2015

Figure 36 Regional Presence of Top Five Market Companies in the ADS Market, 2015

Figure 37 Leading Manufacturers in the ADS Market, Globally

Figure 38 ADS Market Witnessed Significant Growth Between February 2014 and March 2016

Figure 39 Contracts Was the Key Strategy Adopted By Companies Between October 2013 and March 2016

Figure 40 Regional Revenue Mix of the Top Five Market Companies, 2015

Figure 41 Financial Highlights of Major Companies in the ADS Market

Figure 42 Honeywell International Inc.: Company Snapshot

Figure 43 Honeywell International Inc.: SWOT Analysis

Figure 44 United Technologies Corporation: Company Snapshot

Figure 45 United Technologies Corporation: SWOT Analysis

Figure 46 Rockwell Collins, Inc.: Company Snapshot

Figure 47 Rockwell Collins, Inc.: SWOT Analysis

Figure 48 Ametek Inc.: Company Snapshot

Figure 49 Ametek Inc.: SWOT Analysis

Figure 50 Curtiss-Wright Corporation: Company Snapshot

Figure 51 Curtiss-Wright Corporation: SWOT Analysis

Figure 52 Meggitt PLC.: Company Snapshot

Research Methodology:

The market size estimation for various segments and subsegments of the air data systems market was arrived at by referring to varied secondary sources, such as OMICS International, European Defence Agency, market outlook and corroboration with primaries, and further market triangulation with the help of statistical techniques using econometric tools. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to acquire the final quantitative and qualitative data. This data is consolidated with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the market comprises raw material suppliers, manufacturers, distributors, and end users. Some of the key market players operating in the air data systems market include Honeywell International, Inc. (U.S.), United Technologies Corporation (U.S.), Rockwell Collins, Inc. (U.S.), Curtiss-Wright Corp. (U.S.), AMETEK, Inc. (U.S.), Astronautics Corporation of America (U.S.), Shadin Avionics (U.S.), Meggit Avionics (U.K.), Thommen Aircraft Equipment (Switzerland), and Aeroprobe Corp. (U.S.), among others. These players have adopted strategies such as contracts, new product developments, and agreements to strengthen their position in the ADS market.

Target Audience:

- Aircraft Manufacturers

- Air Data Systems Manufactures

- Air Data Systems Service Providers

- Sub-Component Suppliers

- Air Data Systems Distributors

- Technology Providers

Scope of the Report:

This research report categorizes the air data systems market into the following segments and subsegments:

Market, by Aircraft Type

- Narrow Body Aircraft

- Wide Body Aircraft

- Very Large Aircraft

- Regional Transport Aircraft

- Business Jet

- Fighter Jet

- Military Transport Aircraft

- Rotary Wing Aircraft

- UAV

Market, by Component

- Electronic Unit

- Sensors

- Probes

Market, by End User

- Civil

- Military

Market, by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Customizations Available for the Report:

With the given market data, MarketsandMarkets offers customizations as per the specific needs of the company. The following customization options are available for the report:

Company Information

- Detailed analysis and profiles of additional market players (Up to five)

- Geographic Analysis: Further breakdown of market at country-level

Growth opportunities and latent adjacency in Air Data Systems Market