Flue Gas Desulfurization System Market by Type (Wet, Dry & Semi-Dry), End-Use Industry (Power Generation, Chemical, Iron & Steel, Cement Manufacturing), Installation (Greenfield and Brownfield) and Region - Global Forecast to 2026

Updated on : September 02, 2025

Flue Gas Desulfurization Systems Market

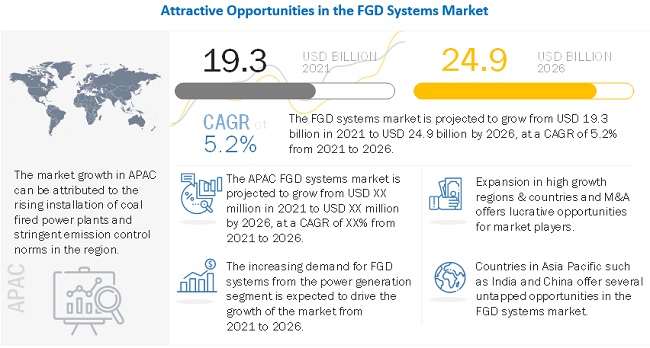

The global flue gas desulfurization systems market was valued at USD 19.3 billion in 2021 and is projected to reach USD 24.9 billion by 2026, growing at 5.2% cagr from 2021 to 2026. The flue gas desulfurization (FGD) systems market has been witnessing consistent growth owing to the increasing concerns regarding environmental pollution, growing prevalence of airborne diseases, and enforcement of environmental laws & regulations. The rise in demand for FGD systems from the power generation, chemical, iron & steel, and cement & manufacturing industries is expected to drive the market globally. Stringent environmental regulations focused on the control of excessive industrial sulfur dioxide emissions are further expected to drive the growth of the market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on FGD systems market

As a result of the COVID-19 pandemic, the levels of pollution seen across different countries have decreased. According to the International Energy Agency, global energy use in 2020 declined by about 5%, the biggest drop in 70 years. Supply chain and economic disruption caused delay, postponement and cancellation of the announced projects affected the FGD systems market. FGD systems also find major applications in the chemical and cement industries. The COVID-19 pandemic has had a major impact on key industries, such as chemical, iron & steel, and cement manufacturing. The demand for chemicals has experienced severe shocks across end markets, with global supply chains being disrupted. Due to this, the stock prices & revenue of major chemical companies have taken significant hits, thus delayed investment on new FGD systems installation.

Flue Gas Desulfurization Systems Market Dynamics

Driver: Stringent standards for sulfur oxide emission

Historically, the power and manufacturing sectors have been major sources of air pollution, with marine transportation joining the list in the last few decades. Combustion of fossil fuels in coal-fired power plants, manufacturing facilities, and marine transport releases sulfur dioxide and various nitrogen oxides, which, upon reaction with atmospheric moisture and oxygen, form sulfuric and nitric acid fumes, ultimately leading to acid rain. This acidic water robs the soil of its essential nutrients, many a time inhibiting the reproduction capabilities of trees while also doing considerable damage to associated ecosystems. There are also adverse effects on human health in terms of direct or indirect exposure to sulfur oxides, with problems ranging from cardiovascular diseases to premature death. Hence, the need for the removal of toxic contaminants like SOx, NOx, mercury, and particulate matter at their source becomes paramount.

Restraint: Emergence and faster adoption of clean energy sources

Cleaner, cooler, and healthier environment redefined the necessity to adopt renewable sources of energy for sustainability, and hence, the reliance on carbon fuels is decreasing. Countries are making efforts to develop renewable sources of energy such as hydropower, offshore & onshore wind, solar photovoltaic, and bioenergy. This is the key challenge affecting the growth of coal fire power plants and as a result affecting the FGD systems market.

Opportunity: Increasing number of coal-fired power plants in China and India

According to the International Energy Agency, coal remained a major fuel in global energy systems and accounted for almost 36.7% share of electricity generation in 2019. China, India, and other emerging economies of the Asia Pacific region accounted for the highest increase in the usage of coal for power generation, while consumption patterns decreased in North America and Europe.

Challenge: High energy consumption of FGD system operations in power plants

A standard FGD system consists of an electrostatic precipitator followed by the main desulfurization unit, a scrubber, and an in-line steam reheater. This energy-intensive technology accounts for roughly 2.5% to 6% of the total energy generation capacity of a coal-fired power plant. Thus, the operational costs rise substantially, leading to economic infeasibility for plants with a capacity of less than 500 MW. Major energy consumption is attributed to the reheater, water & slurry pumps, and tank agitation. Other factors that influence energy consumption patterns are scrubber design, coal characteristics, plant design, and regulatory constraints. These high energy requirements pose a major challenge to the growth of the FGD systems market.

Wet FGD systems segment accounted for the largest share in 2020

Based on type, the market has been segmented into wet and dry & semi-dry FGD systems. Key factors responsible for the adoption of wet FGD technology are its high removal efficiency, high emission standards set by federal governments, an increase in electricity demand, and an increase in the number of coal-fired power plants in emerging economies. The growth of the wet FGD systems segment can also be attributed to its early commercial deployment in 1970 and its high efficiency in terms of SO2 removal. Moreover, the by-product of typical wet FGD systems, which use limestone as a reagent, is gypsum. This can be marketed to cement and wallboard manufacturers and the fertilizer industry.

The power generation segment is expected to be fastest growing and accounted for the largest market share in 2020

Based on end-use industry, the power generation end-use industry segment accounted for the largest share of the global FGD market in 2020. Coal-fired power plants are the major source of sulfur pollutants, due to the usage of high sulfur content coals in power plants. Therefore, increased power generation is the reason for the dominance of the power generation segment over other end-use industries.

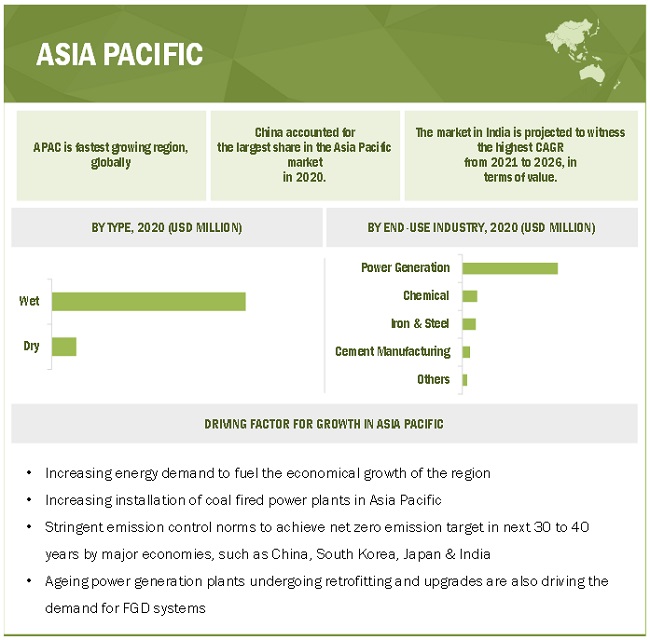

Asia Pacific accounted for the largest share of the FGD systems market in 2020

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific FGD systems market will see increased demand from the power generation industry as a result of the increased regulations and power production in the region. The power generation industry consumed the highest amount of FGD in the region and accounted for the largest share in the Asia Pacific FGD systems market in 2020. As the chemical sector, as well as the cement and metal smelting industries, are growing in Asia Pacific, more opportunities are expected for this market in this region in the coming years.

Flue Gas Desulfurization Systems Market Players

Key players in this market are Mitsubishi Heavy Industries Ltd. (Japan), General Electric Company (US), Andritz AG (Austria), Doosan Lentjes GmbH (Germany), Babcock & Wilcox Enterprises Inc. (US), Rafako S.A. (Poland), FLSmidth & Co. (Denmark), Hamon Group (Belgium), Marsulex Environmental Technologies (US), Thermax Ltd. (India), Ducon Technologies Inc. (US), Chiyoda Corporation (Japan), China Boqi Environmental (Holding) Co. Ltd. (China), LAB S.A. (France), Valmet Corporation (Finland), Kawasaki Heavy Industries Ltd. (Japan), Macrotek Inc. (Canada), China Everbright International Ltd. (China), AECOM (US), Burns & McDonnell (US), Rudis Trbovlje (Slovenia), Steinmuller Engineering GmbH (Germany), Shandong Baolan Environmental Protection Engineering Co. Ltd. (China), IDE Technologies (Israel), and KC Cottrell (South Korea).

Flue Gas Desulfurization Systems Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million) Volume (Megawatt) |

|

Segments Covered |

Type, End-use Industry, and Installation |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Mitsubishi Heavy Industries Ltd. (Japan), General Electric Company (US), Doosan Lentjes GmbH (Germany), Babcock & Wilcox Enterprises Inc. (US), Rafako S.A. (Poland), FLSmidth & Co. (Denmark), Hamon Group (Belgium), Marsulex Environmental Technologies (US), Thermax Ltd.(India), and Andritz AG (Austria), Ducon Technologies Inc. (US), Chiyoda Corporation (Japan), China Boqi Environmental (Holding) Co. Ltd. (China), LAB S.A. (France), Valmet Corporation (Finland), Kawasaki Heavy Industries Ltd. (Japan), Macrotek Inc. (Canada), China Everbright International Ltd. (China), AECOM (US), Burns & McDonnell (US), Rudis Trbovlje (Slovenia), Steinmuller Engineering GmbH (Germany), Shandong Baolan Environmental Protection Engineering Co. Ltd. (China), IDE Technologies (Israel) and KC Cottrell (South Korea) |

This research report categorizes the FGD systems market based on type, end-use industry, installation, and region, and forecasts revenues as well as analyzes trends in each of these submarkets.

Based on type, the FGD systems market has been segmented into:

-

Wet FGD Systems

- Limestone

- Seawater

- Others (ammonia and sodium)

- Dry & Semi-dry FGD Systems

Based on end-use industry, the FGD systems market has been segmented into:

- Power Generation

- Chemical

- Iron & Steel

- Cement Manufacturing

- Others (paper & pulp, waste incineration, and glass)

Based on installation, the FGD systems market has been segmented into:

- Greenfield

- Brownfield

Based on the region, the FGD systems market has been segmented into:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In July 2020, General Electric (GE) Steam Power signed an agreement with NTPC Limited, India, for the supply of wet FGD systems for 3 coal-fired power plants. With these wet FGD systems, the company will help NTPC treat approximately 35 million cubic meters per hour of flue gas, meeting India’s thermal power plant emission norms for SO2. This agreement also allows GE to strengthen its foothold in the country in which it already has 15.28 GW of SO2 reduction systems.

- In February 2020, Mitsubishi Hitachi Power Systems (MHPS) received a 12 year maintenance service extension for the BLCP power station in Thailand. This agreement covers the maintenance of major equipment, including boilers, steam turbines, and flue gas cleaning systems. It will strengthen the service business of the company and boost revenue generation.

- In July 2019, Doosan Lentjes announced the delivery and commissioning of two FGD systems in Vietnam. This system deployed seawater FGD technology and was installed at the Vinh Tan 1 power plant, in the Binh Thuan province of Vietnam. Doosan Lentjes’ scope of work included engineering and delivery of key FGD equipment along with advisory services for erection and commissioning. This development establishes the company’s reputation as a specialist in the delivery of air quality control systems across the global utility, municipality, and industrial sectors.

Frequently Asked Questions (FAQ):

What is the estimated size of the FGD systems market in 2020?

The FGD systems market is projected to grow from USD 18,378 million in 2020 to USD 24.956 million by 2026, at a CAGR of 5.2% from 2021 to 2026

Which region to be the fastest-growing?

The APAC FGD systems market is projected to grow faster than EMEA and Americas.

Which end use industry to be fastest growing?

The power generation segment is expected to grow faster than other end use industries in the next five years

How can key players tap growth opportunities in FGD systems market?

Product development, merger and acquisitions are the major strategies the key players can use to tap market opportunities in the FGD systems market.

What will be the post-COVID-19 impact on the access control market?

All the key end-use industries are set to mark strong recovery by the end of 2021 due to the economic recovery. In 2021, the global energy demand is likely to grow by 4%, after a steep decline of 5% in 2020. This will drive good investment in FGD systems to contain the emission of harmful gases. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 SCOPE OF THE MARKET

1.3.1 MARKETS COVERED

FIGURE 1 FLUE GAS DESULFURIZATION (FGD)SYSTEMS MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED IN THE REPORT

1.4 CURRENCY

1.5 VOLUME

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

FIGURE 2 HISTORICAL GLOBAL FGD SYSTEMS MARKET: 2015–2022

FIGURE 3 CURRENT GLOBAL FGD SYSTEMS MARKET: 2018–2026

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 4 FGD SYSTEMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

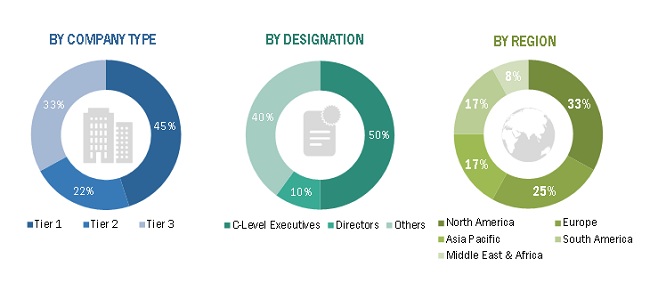

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 BASE NUMBER CALCULATION

2.3.1 SUPPLY-SIDE APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 9 POWER GENERATION EXPECTED TO HOLD LARGEST SHARE DURING THE FORECAST PERIOD (USD MILLION)

FIGURE 10 WET FGD SYSTEMS SEGMENT LED THE MARKET IN 2020

FIGURE 11 ASIA PACIFIC DOMINATED GLOBAL FGD SYSTEMS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN GLOBAL FGD SYSTEMS MARKET

FIGURE 12 GROWING DEMAND FROM POWER GENERATION INDUSTRY TO DRIVE FGD SYSTEMS MARKET

4.2 FGD SYSTEMS MARKET GROWTH, BY REGION

FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR FGD SYSTEMS BETWEEN 2021 AND 2026

4.3 FGD SYSTEMS MARKET SHARE, BY END-USE INDUSTRY

FIGURE 14 POWER GENERATION TO ACCOUNT FOR LARGEST SHARE OF FGD SYSTEMS MARKET IN ASIA PACIFIC

4.4 GLOBAL FGD SYSTEMS MARKET, MAJOR COUNTRIES

FIGURE 15 FGD SYSTEMS MARKET IN INDIA PROJECTED TO WITNESS HIGHEST CAGR (BY VALUE)

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE FGD SYSTEMS MARKET

5.1.1 DRIVERS

5.1.1.1 High dependence on coal-fired power plants

TABLE 1 TOP FIVE COUNTRY-WISE ANTHROPOGENIC SO2 EMISSIONS - 2018

5.1.1.2 Stringent standards for sulfur oxide emission

TABLE 2 MAJOR SECTORS CONTRIBUTING TO GLOBAL ANTHROPOGENIC SO2 EMISSIONS - 2018

TABLE 3 SO2 EMISSION STANDARDS FOR COAL-FIRED POWER PLANTS

5.1.1.3 Marketable by-products with a variety of applications

5.1.1.4 Focus on coal-fired power generation due to COVID-19 pandemic

5.1.2 RESTRAINTS

5.1.2.1 Emergence and adoption of clean energy sources

FIGURE 17 RENEWABLE CAPACITY GROWTH UNTIL 2024 – BY TECHNOLOGY

FIGURE 18 RENEWABLE CAPACITY GROWTH BY COUNTRY/REGION UNTIL 2024

5.1.2.2 FGD wastewater disposal and associated costs

5.1.3 OPPORTUNITIES

5.1.3.1 Increasing number of coal-fired power plants in China and India

5.1.3.2 Likely surge in power demand post COVID-19 pandemic

5.1.4 CHALLENGES

5.1.4.1 High energy consumption of FGD operations in power plants

5.1.4.2 Supply chain, trade, and economic disruptions due to COVID-19 pandemic

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 FGD SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.2.1 THREAT OF NEW ENTRANTS

5.2.2 THREAT OF SUBSTITUTES

5.2.3 BARGAINING POWER OF SUPPLIERS

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS OF FGD SYSTEMS

5.4 CASE STUDY ANALYSIS

5.4.1 POWER GENERATION

5.4.1.1 CEZ Group upgrades FGD system at Detmarovice coal-fired power plant

5.4.1.2 NTPC Ltd. to install FGD systems at two coal-fired power plants in India

5.4.1.3 Mitsui Engineering & Shipbuilding Co., Ltd. to install flue gas cleaning system at MES biomass power plant

5.4.2 CEMENT

5.4.2.1 Vietnam National Cement Corporation to implement flue gas cleaning systems for removal of sulfur oxide gases

5.4.2.2 NORCEM AS adopts seawater FGD system for Kjopsvik cement plant in Norway

5.4.3 WASTE INCINERATION

5.4.3.1 Kotkan Energia Oy installs FGD system at waste-to-energy power plant

5.5 FGD SYSTEMS MARKET, EMISSION CONTROL REGULATIONS

5.5.1 INTRODUCTION

5.5.2 SULFUR CONTROL REGULATIONS, BY REGION

5.5.2.1 Asia Pacific

5.5.2.1.1 China

TABLE 4 CHINA, EU, AND US COAL-FIRED POWER PLANT STANDARDS (MG/M3):

5.5.2.1.2 India

TABLE 5 REGULATIONS (2003–2017)

5.5.2.2 Europe

5.5.2.3 North America

5.5.2.3.1 US

FIGURE 21 US REGULATIONS FROM 2005-2015

5.5.3 CONCLUSION

6 COVID-19 IMPACT (Page No. - 61)

6.1 COVID-19 HEALTH ASSESSMENT

6.2 COVID-19 ECONOMIC ASSESSMENT

FIGURE 22 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

6.2.1 COVID-19 IMPACT ON THE ECONOMY—SCENARIO ASSESSMENT

TABLE 6 CRITERIA IMPACTING THE GLOBAL ECONOMY

6.3 COVID-19 IMPACT ON FLUE GAS DESULFURIZATION SYSTEMS MARKET

7 FGD SYSTEMS MARKET, BY TYPE (Page No. - 66)

7.1 INTRODUCTION

TABLE 7 FGD: AVAILABLE TECHNOLOGIES

TABLE 8 WET FGD SYSTEMS VS. DRY & SEMI-DRY FGD SYSTEMS

TABLE 9 FGD CLASSIFICATION AND CO-PRODUCTS BASED ON PROCESS

FIGURE 23 FGD SYSTEMS MARKET, BY TYPE, 2021 & 2026 (USD MILLION)

TABLE 10 FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

7.2 WET FGD SYSTEMS

TABLE 11 WET FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

7.2.1 WET FGD SYSTEMS, BY TYPE

FIGURE 24 WET FGD SYSTEMS MARKET, BY TYPE, 2021 & 2026 (USD MILLION)

7.2.1.1 Limestone

TABLE 12 LIMESTONE-BASED WET FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

7.2.1.2 Seawater

TABLE 13 SEAWATER-BASED WET FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

7.2.1.3 Others

TABLE 14 OTHER WET FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

7.3 DRY & SEMI-DRY FGD SYSTEMS

TABLE 15 DRY & SEMI-DRY FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

8 FGD SYSTEMS MARKET, BY INSTALLATION (Page No. - 74)

8.1 INTRODUCTION

FIGURE 25 FGD SYSTEMS MARKET, BY INSTALLATION, 2021 & 2026

TABLE 16 FGD SYSTEMS MARKET, BY INSTALLATION, 2018–2026 (USD MILLION)

8.2 GREENFIELD

TABLE 17 GREENFIELD FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

8.3 BROWNFIELD

TABLE 18 BROWNFIELD FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

9 FGD SYSTEMS MARKET, BY END-USE INDUSTRY (Page No. - 78)

9.1 INTRODUCTION

FIGURE 26 FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2021 & 2026 (USD MILLION)

TABLE 19 FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

9.2 POWER GENERATION

TABLE 20 POWER GENERATION: FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

9.3 CHEMICAL

TABLE 21 CHEMICAL: FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

9.4 IRON & STEEL

TABLE 22 IRON & STEEL: FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

9.5 CEMENT MANUFACTURING

TABLE 23 CEMENT MANUFACTURING: FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

9.6 OTHERS

TABLE 24 OTHER END-USE INDUSTRIES: FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

10 FGD SYSTEMS MARKET, BY REGION (Page No. - 84)

10.1 INTRODUCTION

FIGURE 27 GLOBAL GROWTH RATE SNAPSHOT, BY COUNTRY (2021-2026)

TABLE 25 FGD SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 26 FGD SYSTEMS MARKET, BY REGION, 2018–2026 (MW)

10.2 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC FGD SYSTEMS MARKET SNAPSHOT

TABLE 27 ASIA PACIFIC: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 28 ASIA PACIFIC: FGD SYSTEMS MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 29 ASIA PACIFIC: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.2.1 CHINA

10.2.1.1 China is the largest market for FGD systems, globally

TABLE 30 SO2 EMISSION STANDARDS FOR COAL-FIRED POWER PLANTS IN CHINA

10.2.1.2 COVID-19 impact in China

TABLE 31 CHINA: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 32 CHINA: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.2.2 JAPAN

10.2.2.1 Power generation industry to drive FGD systems market in Japan

10.2.2.2 COVID-19 impact in Japan

TABLE 33 JAPAN: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 34 JAPAN: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.2.3 INDIA

10.2.3.1 India expected to register fastest growth during the forecast period

TABLE 35 SO2 EMISSION STANDARDS FOR COAL-FIRED POWER PLANTS IN INDIA

TABLE 36 YEAR-WISE FGD PLAN IN INDIA

10.2.3.2 COVID-19 impact in India

TABLE 37 INDIA: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 38 INDIA: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.2.4 SOUTH KOREA

10.2.4.1 South Korea to account for third-largest share in Asia Pacific in 2020

10.2.4.2 COVID-19 impact in South Korea

TABLE 39 SOUTH KOREA: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 40 SOUTH KOREA: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.2.5 AUSTRALIA & NEW ZEALAND

10.2.5.1 Coal-fired power plants to spur demand for FGD systems in Australia & New Zealand

10.2.5.2 COVID-19 impact in Australia & New Zealand

TABLE 41 AUSTRALIA & NEW ZEALAND: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 42 AUSTRALIA & NEW ZEALAND: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.2.6 REST OF ASIA PACIFIC

10.2.6.1 COVID-19 impact in Rest of Asia Pacific

TABLE 43 REST OF ASIA PACIFIC: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 44 REST OF ASIA PACIFIC: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 29 NORTH AMERICA MARKET SNAPSHOT

TABLE 45 NORTH AMERICA: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: FGD SYSTEMS MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.3.1 US

10.3.1.1 US accounts for the largest share of the FGD systems market in North America

TABLE 48 SO2 EMISSION STANDARDS FOR COAL-FIRED POWER PLANTS IN US

10.3.1.2 COVID-19 impact in the US

TABLE 49 US: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 50 US: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Power generation and chemical industries to drive demand for FGD systems in Canada

10.3.2.2 COVID-19 impact in Canada

TABLE 51 CANADA: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 52 CANADA: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 Expansion of coal-based power generation to contribute to growth of FGD systems market in Mexico

TABLE 53 SO2 EMISSION STANDARDS FOR COAL-FIRED POWER PLANTS IN MEXICO

10.3.3.2 COVID-19 impact in Mexico

TABLE 54 MEXICO: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 55 MEXICO: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.4 EUROPE

FIGURE 30 EUROPE MARKET SNAPSHOT

TABLE 56 EUROPE: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 57 EUROPE: FGD SYSTEMS MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 58 EUROPE: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 Germany is largest and fastest-growing market for FGD systems in Europe

TABLE 59 SO2 EMISSION STANDARDS FOR COAL-FIRED POWER PLANTS IN GERMANY

10.4.1.2 COVID-19 impact in Germany

TABLE 60 GERMANY: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 61 GERMANY: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.4.2 UK

10.4.2.1 Chemical industry to spur demand for FGD systems in the UK

10.4.2.2 COVID-19 impact in the UK

TABLE 62 UK: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 63 UK: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.4.3 FRANCE

10.4.3.1 Chemical and iron & steel industries to drive demand for FGD systems in France

10.4.3.2 COVID-19 impact in France

TABLE 64 FRANCE: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 65 FRANCE: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.4.4 ITALY

10.4.4.1 Cement manufacturing is expected to increase demand for FGD systems in Italy

10.4.4.2 COVID-19 impact in Italy

TABLE 66 ITALY: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 67 ITALY: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.4.5 REST OF EUROPE

10.4.5.1 COVID-19 impact in Rest of Europe

TABLE 68 REST OF EUROPE: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 69 REST OF EUROPE: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.5 SOUTH AMERICA

TABLE 70 SOUTH AMERICA: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 71 SOUTH AMERICA: FGD SYSTEMS MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 72 SOUTH AMERICA: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Increased dependence on coal-fired power plants expected to boost FGD systems market in Brazil

10.5.1.2 COVID-19 impact in Brazil

TABLE 73 BRAZIL: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 74 BRAZIL: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 Argentina is second-largest market for FGD systems in South America

10.5.2.2 COVID-19 impact in Argentina

TABLE 75 ARGENTINA: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 76 ARGENTINA: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.5.3 CHILE

10.5.3.1 Chemical refining and smelting to drive FGD systems market in Chile

10.5.3.2 COVID-19 impact in Chile

TABLE 77 CHILE: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 78 CHILE: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.5.4 REST OF SOUTH AMERICA

10.5.4.1 COVID-19 impact in Rest of South America

TABLE 79 REST OF SOUTH AMERICA: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 80 REST OF SOUTH AMERICA: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

TABLE 81 MIDDLE EAST & AFRICA: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 82 MIDDLE EAST & AFRICA: FGD SYSTEMS MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 83 MIDDLE EAST & AFRICA: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.6.1 UAE

10.6.1.1 UAE is largest market for FGD systems in the Middle East

10.6.1.2 COVID-19 impact in the UAE

TABLE 84 UAE: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 85 UAE: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.6.2 SAUDI ARABIA

10.6.2.1 Saudi Arabia to register second-fastest growth of FGD systems market

10.6.2.2 COVID-19 impact in Saudi Arabia

TABLE 86 SAUDI ARABIA: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 87 SAUDI ARABIA: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.6.3 QATAR

10.6.3.1 Rising petrochemical industry to spur demand for FGD systems in Qatar

10.6.3.2 COVID-19 impact in Qatar

TABLE 88 QATAR: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 89 QATAR: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.6.4 KUWAIT

10.6.4.1 Iron & steel industry to increase demand for FGD systems in Kuwait

10.6.4.2 COVID-19 impact in Kuwait

TABLE 90 KUWAIT: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 91 KUWAIT: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.6.5 OMAN

10.6.5.1 Rise of coal-based power generation industry provides favorable prospects for FGD systems market in Oman

10.6.5.2 COVID-19 impact in Oman

TABLE 92 OMAN: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 93 OMAN: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.6.6 REST OF MIDDLE EAST & AFRICA

10.6.6.1 COVID-19 impact in Rest of Middle East & Africa

TABLE 94 REST OF MIDDLE EAST & AFRICA: FGD SYSTEMS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 95 REST OF MIDDLE EAST & AFRICA: FGD SYSTEMS MARKET, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

11 COMPETITIVE LANSCAPE (Page No. - 137)

11.1 OVERVIEW

FIGURE 31 COMPANIES PRIMARILY ADOPTED INORGANIC GROWTH STRATEGIES BETWEEN 2016 AND 2020

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 32 MARKET EVALUATION FRAMEWORK: 2017 AND 2018 SAW AGREEMENTS AND SUPPLY CONTRACTS LEADING THIS SPACE

11.3 MARKET RANKING ANALYSIS

11.3.1 MARKET RANKING ANALYSIS OF TOP PLAYERS IN THE FGD SYSTEMS MARKET

FIGURE 33 MARKET RANKING ANALYSIS

11.4 KEY MARKET DEVELOPMENTS

11.4.1 AGREEMENTS

TABLE 96 AGREEMENTS, 2016–2020

11.4.2 EXPANSIONS

TABLE 97 EXPANSIONS, 2016-2020

11.4.3 INNOVATIVE TECHNOLOGY

TABLE 98 INNOVATIVE TECHNOLOGY, 2016-2020

11.4.4 NEW PRODUCT DEVELOPMENT

TABLE 99 NEW PRODUCT DEVELOPMENT, 2016-2020

11.5 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

11.5.1 OVERVIEW

11.5.2 PRODUCT FOOTPRINT

FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE FGD SYSTEMS MARKET: 2020

11.5.3 STAR

11.5.4 EMERGING LEADERS

11.5.5 PERVASIVE

FIGURE 35 FGD SYSTEMS MARKET: COMPANY EVALUATION MATRIX, 2020

12 COMPANY PROFILES (Page No. - 154)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

12.1 KEY PLAYERS

12.1.1 MITSUBISHI HEAVY INDUSTRIES LTD.

TABLE 100 MITSUBISHI HEAVY INDUSTRIES LTD.: BUSINESS OVERVIEW

FIGURE 36 MITSUBISHI HEAVY INDUSTRIES LTD.: COMPANY SNAPSHOT

TABLE 101 MITSUBISHI HEAVY INDUSTRIES: DEALS

TABLE 102 MITSUBISHI HEAVY INDUSTRIES LTD.: NEW PRODUCT LAUNCH

12.1.2 GENERAL ELECTRIC COMPANY

TABLE 103 GENERAL ELECTRIC COMPANY: BUSINESS OVERVIEW

FIGURE 37 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

TABLE 104 GENERAL ELECTRIC COMPANY: DEALS

TABLE 105 GENERAL ELECTRIC COMPANY: NEW PRODUCT LAUNCH

12.1.3 DOOSAN LENTJES GMBH

TABLE 106 DOOSAN LENTJES GMBH: BUSINESS OVERVIEW

TABLE 107 DOOSAN LENTJES GMBH: DEALS

12.1.4 BABCOCK & WILCOX ENTERPRISES INC.

TABLE 108 BABCOOK & WILCOX ENTERPRISES: BUSINESS OVERVIEW

FIGURE 38 BABCOCK & WILCOX ENTERPRISES: COMPANY SNAPSHOT

TABLE 109 BABCOCK & WILCOX: DEALS

12.1.5 RAFAKO S.A.

TABLE 110 RAFAKO SA.: BUSINESS OVERVIEW

FIGURE 39 RAFAKO S.A.: COMPANY SNAPSHOT

TABLE 111 RAFAKO S.A.: DEALS

12.1.6 ANDRITZ AG

TABLE 112 ANDRITZ AG: BUSINESS OVERVIEW

FIGURE 40 ANDRITZ AG: COMPANY SNAPSHOT

TABLE 113 ANDRITZ AG: DEALS

12.1.7 FLSMIDTH & CO.

TABLE 114 FLSMIDTH & CO.: BUSINESS OVERVIEW

FIGURE 41 FLSMIDTH & CO.: COMPANY SNAPSHOT

TABLE 115 FLSMIDTH & CO.: DEALS

12.1.8 VALMET CORPORATION

TABLE 116 VALMET CORPORATION: BUSINESS OVERVIEW

FIGURE 42 VALMET CORPORATION.: COMPANY SNAPSHOT

TABLE 117 VALMET CORPORATION: DEALS

12.1.9 KAWASAKI HEAVY INDUSTRIES LTD.

TABLE 118 KAWASAKI HEAVY INDUSTRIES LTD.: BUSINESS OVERVIEW

FIGURE 43 KAWASAKI HEAVY INDUSTRIES LTD.: COMPANY SNAPSHOT

TABLE 119 KAWASAKI HEAVY INDUSTRIES LTD.: DEALS

12.1.10 HAMON GROUP

TABLE 120 HAMON GROUP: BUSINESS OVERVIEW

FIGURE 44 HAMON GROUP: COMPANY SNAPSHOT

TABLE 121 HAMON GROUP: DEALS

12.2 SME PROFILES

12.2.1 THERMAX LTD.

TABLE 122 THERMAX LTD.: BUSINESS OVERVIEW

FIGURE 45 THERMAX LTD.: COMPANY SNAPSHOT

TABLE 123 THERMAX LTD.: DEALS

12.2.2 MARSULEX ENVIRONMENTAL TECHNOLOGIES

TABLE 124 MARSULEX ENVIRONMENTAL: BUSINESS OVERVIEW

TABLE 125 MARSULEX ENVIRONMENTAL: DEALS

12.2.3 DUCON TECHNOLOGIES INC.

TABLE 126 DUCON TECHNOLOGIES INC.: BUSINESS OVERVIEW

12.2.4 CHIYODA CORPORATION

TABLE 127 CHIYODA CORPORATION: BUSINESS OVERVIEW

FIGURE 46 CHIYODA CORPORATION: COMPANY SNAPSHOT

TABLE 128 CHIYODA CORPORATION: DEALS

12.2.5 LAB SA.

TABLE 129 LAB SA.: BUSINESS OVERVIEW

12.2.6 MACROTEK INC.

TABLE 130 MACROTEK INC.: BUSINESS OVERVIEW

12.2.7 CHINA EVERBRIGHT INTERNATIONAL LTD.

TABLE 131 CHINA EVERBRIGHT INTERNATIONAL LTD.: BUSINESS OVERVIEW

FIGURE 47 CHINA EVERBRIGHT INTERNATIONAL LTD.: COMPANY SNAPSHOT

12.2.8 AECOM

TABLE 132 AECOM: BUSINESS OVERVIEW

FIGURE 48 AECOM: COMPANY SNAPSHOT

12.2.9 BURNS & MCDONNELL

TABLE 133 BURNS & MCDONNELL: BUSINESS OVERVIEW

12.2.10 RUDIS TRBOVLJE

TABLE 134 RUDIS TRBOVLJE: BUSINESS OVERVIEW

12.2.11 STEINMULLER ENGINEERING GMBH

TABLE 135 STEINMULLER ENGINEERING GMBH: BUSINESS OVERVIEW

12.2.12 SHANDONG BAOLAN ENVIRONMENTAL PROTECTION ENGINEERING CO. LTD

TABLE 136 SHANDONG BAOLAN ENVIRONMENTAL PROTECTION ENGINEERING CO. LTD.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 212)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved four major activities to estimate the current size of the FGD systems market. Exhaustive secondary research was undertaken to collect information on the FGD systems market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the FGD systems value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the overall size of the market. Thereafter, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the FGD systems market.

Secondary Research

As a part of the secondary research process, sources such as Hoovers, Bloomberg, BusinessWeek, Reuters, and Factiva were referred to for identifying and collecting information for this study on the FGD systems market. Other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification & segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology-oriented perspectives.

Primary Research

As a part of the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the FGD systems market. Primary sources from the supply side included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the FGD systems market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the FGD systems market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both, the demand and supply sides. In addition to this, the market size was validated using both, the top-down and bottom-up approaches.

Objectives of the Report

- To define, describe, and forecast the size of the FGD systems market based on type, end-use industry, installation, and region

- To forecast the size of the market and its segments with respect to four main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their respective key countries

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze competitive developments such as agreements, expansions, and new product developments in the FGD systems market

The following customization options are available for the report:

- Further breakdown of the Asia Pacific and Europe FGD systems markets

- Product matrix, which provides a detailed comparison of the product portfolio of each company

- Detailed analysis and profiles of additional market players (up to 3)

- Further breakdown of the type and end-use industry segments into various subsegments

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Flue Gas Desulfurization System Market

Want to produce gypsum in his plant (Synthetic Gypsum Market)

Gas Analyzers Market in APAC

Detailed information on Flue Gas Desulfurization Market

Interested in patent analysis of the FGD technology in India

General information on global and European market of pigments by application area

FGD Market in Middle East region.

General information required on Flue-gas desulfurization system used in power generation and steel plants

Interest in Air Pollution Control systems

Market data on calcium carbonate and lime and global coal fired power plants information

Looking for more information on FDG (Fludeoxyglucose)