Fluid Transfer System Market

Fluid Transfer System Market by Propulsion & Component (Petrol/Gasoline, Diesel, CNG, Battery Electric, Plug-In Hybrid Electric), System Type, Vehicle Type (Passenger Cars, LCVs, Trucks, and Buses), and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The fluid transfer system market is projected to reach USD 6.77 billion by 2032 from USD 2.70 billion in 2025, growing at a CAGR of 14.0%. Meanwhile, the global fluid transfer system market is projected to reach USD 29.95 billion by 2032, at a CAGR of 3.3%. The high market growth is driven by rising demand for SUVs and a higher adoption rate of hybrid and electric vehicles. Electrification is creating newer application areas for battery, motor, and DC-DC converter cooling systems. At the same time, hybrid vehicles require both traditional ICE-specific cooling lines and EV-specific coolant hoses, increasing fluid transfer component utilization.

KEY TAKEAWAYS

-

BY VEHICLE TYPEPassenger cars are estimated to account for the largest market share, supported by rising demand for personal mobility and advanced vehicle designs. Growth is further driven by increasing adoption of turbocharged and hybrid powertrains, higher average fluid transfer system content per vehicle, and expanding electrification across passenger car models.

-

BY SYSTEM TYPEBrake and clutch systems are expected to see the largest growth, driven by safety requirements and advanced control systems. Body and exterior systems are growing the fastest as lightweight and compact fluid transfer solutions are increasingly adopted.

-

BY PROPULSION & COMPONENTDiesel propulsion is estimated to account for the largest share, due to its established presence in commercial vehicles. Battery electric propulsion is set to grow the fastest, supported by increasing adoption of EVs and demand for thermal management components like cooling hoses and lines.

-

BY REGIONAsia Pacific is estimated to be the largest market, supported by the rapid expansion of EVs and HVs, with higher utilization of fluid transfer components in HVs due to dual propulsion. Europe is anticipated to witness the fastest growth, driven by stringent emission norms and rising demand for premium cars, leading to increased need for high-performance fluid transfer components.

-

COMPETITIVE LANDSCAPECooper Standard leads the global fluid transfer system market, followed by TI Fluid Systems. Key players, including Cooper Standard, TI Fluid Systems, Sumitomo Riko, Parker Hannifin, and Gates Corporation, are expanding their product portfolios, enhancing durability and leak-resistant designs, and collaborating with OEMs to address evolving propulsion systems and thermal management needs. These companies are also investing in lightweight materials and compact packaging solutions to meet next-generation vehicle requirements.

Apart from newer application areas in EVs and HVs, other segments are also showing a steady rise in demand for fluid transfer system components. Brake and clutch systems are steadily growing with applications across ICE and EV platforms, while HVAC fluid components such as vacuum booster hoses, A/C hoses, and thermal lines are seeing increased utilization as more advanced vehicle architectures are introduced. To address these diverse requirements, Tier 1 suppliers are redefining sourcing strategies, acting as system integrators to offer comprehensive, bundled solutions that streamline fluid management for OEMs.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The fluid transfer system market’s revenue mix is evolving, moving from traditional rubber and metal-based components for ICE systems to new growth areas. EV adoption and lightweighting are driving demand for battery and power electronics cooling lines, multi-layer plastic tubing, and recyclable or bio-based materials.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in demand for SUVs and premium passenger cars

-

Expansion of vehicle manufacturing and innovations in fluid transfer systems

Level

-

Electrification of passenger cars in select countries

Level

-

Rapid adoption of PHEVs

-

Sustained demand in trucks due to slower rate of electrification

Level

-

Shift toward electric buses and municipal EV fleets

-

Tariff-driven procurement volatility and system-level disruptions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise in demand for SUVs and premium passenger cars

Rising demand for SUVs and premium cars is increasing the requirement for fluid transfer components globally. Passenger car production in key markets like China, the US, and Europe is shifting toward larger and higher-spec models, driving the need for cooling, brake, and transmission lines, which raises average fluid transfer components. Suppliers like Hutchinson and Kongsberg are expanding high-capacity, modular systems.

Restraint: Electrification of passenger cars in select countries

Electrification is reducing the demand for traditional fluid transfer system products like fuel lines, turbo oil lines, and engine hoses. BEVs now account for more than 50% of new sales in China, Norway, and Sweden. OEMs are reducing ICE production, challenging suppliers like TI Fluid Systems to offset lost demand with EV thermal lines.

Opportunity: Rapid adoption of PHEVs

PHEV growth is boosting fluid transfer component demand due to dual ICE and electric architecture. Conventional and EV-specific lines for battery and power electronics increase content per vehicle. Suppliers like Denso, Continental, and Cooper Standard benefit, while TI Fluid Systems and Sanoh expand modular, lightweight offerings.

Challenge: Shift toward electric buses and municipal EV fleets

Electric bus and municipal EV growth in Asia, Europe, and North America is reducing diesel fluid line demand. China added 85,000 electric buses in 2024, driven by subsidies and targets. EVs need simpler coolant lines for batteries and inverters. Suppliers must adapt R&D and manufacturing to evolving OEM architectures.

Fluid Transfer System Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

High-pressure fuel injection lines, throttle valve cables, and fuel rail systems for passenger cars and commercial vehicles | Improved fuel atomization, better combustion efficiency, lower emissions, enhanced engine performance |

|

Radiator hoses, battery coolant hoses, and DC-DC converter cooling hoses for electric buses and trucks | Efficient thermal management, reduced overheating risk, longer battery life, optimized cooling system performance |

|

Brake and clutch hose assemblies, vacuum booster hoses, and EVAP lines in electric and hybrid commercial vehicles | Enhanced braking response, improved safety, minimized vapor leaks, and reliable hydraulic operation under extreme conditions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis highlights various players across the fluid transfer system market, which is primarily represented by raw material suppliers, tier 1, tier 2, and OEMs. Some of the tier 1 fluid transfer system companies include Cooper Standard, Continental AG, and Faurecia. Top tier 2 manufacturers include Nichirin, Kongsberg Automotive, and Sumitomo Riko.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fluid Transfer System Market, By Vehicle Type

Passenger cars lead the fluid transfer system market due to high production and demand for efficient, high-performance powertrains. Growth is driven by TGDi engines boosting demand for turbo oil and coolant lines, and stricter norms like Euro 6 and BS6 increasing EGR and SCR line requirements in LCVs and trucks. The rise of electric buses with air suspension systems is further expanding demand for air suspension lines.

Fluid Transfer System Market, By Propulsion & Component

Brake and clutch systems account for the largest market share, critical for safety and performance across all vehicles. Growth is supported by strict safety regulations, rising vehicle production, and demand for reliable braking under varied conditions. Advances in brake fluids, hydraulic clutch components, and aftermarket needs further sustain this segment.

Fluid Transfer System Market, By System Type

Diesel propulsion dominates the fluid transfer system market due to its prevalence in commercial vehicles and trucks. SCR and DPF technologies increase demand for specialized fluid lines, while diesel engines’ durability requires robust fuel, oil, and coolant hoses. Despite electrification, diesel remains key, supporting steady demand and innovation in fluid transfer components.

REGION

Asia Pacific to be the largest region in global fluid transfer system market during forecast period

Asia Pacific is set to be the largest fluid transfer system market during the forecast period, driven by high vehicle production, rising SUV and premium car demand, and rapid EV adoption. China, India, and Japan are expanding passenger and commercial vehicle volumes, increasing fluid transfer components per vehicle. Strong OEM presence and supplier networks support advanced, modular systems, while policies promoting electrification and emission cuts boost demand for EV-ready solutions.

Fluid Transfer System Market: COMPANY EVALUATION MATRIX

In the fluid transfer system market matrix, Cooper Standard (Star) leads with a strong market presence and diverse product lineup, driving large-scale adoption in passenger cars and commercial vehicles. Sanoh Industrial Co., Ltd. (Emerging Leader) is gaining momentum with new EV-ready fluid transfer system offerings and tier 1.5 strategy. While Cooper Standard dominates with scale and infrastructure, Sanoh Industrial shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2025 (Value) | 2.70 billion in 2025 |

| Market Forecast, 2032 (Value) | 6.77 billion by 2032 |

| Growth Rate | CAGR of 14.0% from 2025 to 2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Volume (Thousand Units), Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Southeast Asia, Europe, North America, and Rest of the World |

WHAT IS IN IT FOR YOU: Fluid Transfer System Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Tier 1 auto component provider planning for EV shift | Fluid transfer system market analysis across 2- and 3-wheelers, passenger cars, commercial vehicles, and off-highway vehicles | Identified opportunities in ICE, hybrid, and EV thermal lines, enabling targeted product development and portfolio optimization |

| Tier 2 auto component manufacturer looking for new market capture strategies | Market sizing, segmentation, and competitor benchmarking | Highlighted high-potential regions, vehicle segments, and fluid transfer system components to prioritize, supporting go-to-market planning |

| Tier 1 auto component provider assessing European demand | Country-wise fluid transfer system demand forecast for passenger cars and commercial vehicles | Provided regulatory, EV adoption, and OEM trend insights to guide production planning and supply alignment |

| Tier 1 component manufacturer looking to enter Latin American market | Market entry assessment, country-specific fluid transfer system adoption, and infrastructure mapping | Identified underserved markets, local supplier landscape, and potential partnerships to accelerate market penetration |

RECENT DEVELOPMENTS

- 01-Jun-25 : Parker Hannifin Corp (US) announced the acquisition of Curtis Instruments, Inc. (US) to strengthen its position in electric and hybrid vehicle systems.

- 01-Apr-25 : Continental AG (Germany) announced the development of a new production line for hydrogen hoses at its Korbach facility.

- 01-Apr-25 : Nichirin (Japan) acquired ATCO Products (US). With this acquisition, Nichirin expands into North American heavy-duty vehicles market.

- 01-Feb-25 : Sumitomo Riko Company Limited (Japan) showcased its Hydrogen Hose for FCEV at the H2 & FC EXPO 2025 (Hydrogen and Fuel Cell Expo) along with other products such as a carbon separator for fuel cells. The hydrogen hose is used to supply hydrogen from the hydrogen tank to the fuel cell stack.

- 01-Nov-24 : Parker Hannifin Corp (US) announced the divestiture of its North America Composites and Fuel Containment (CFC) division to private investment firm SK Capital Partners.

Table of Contents

Methodology

The research study involves extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the fluid transfer system market. Primary sources, such as experts from related industries, automobile OEMs, and suppliers, have been interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study include corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers and automotive fluid and flow transfer-related journals; certified publications; articles by recognized authors; directories; and databases. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

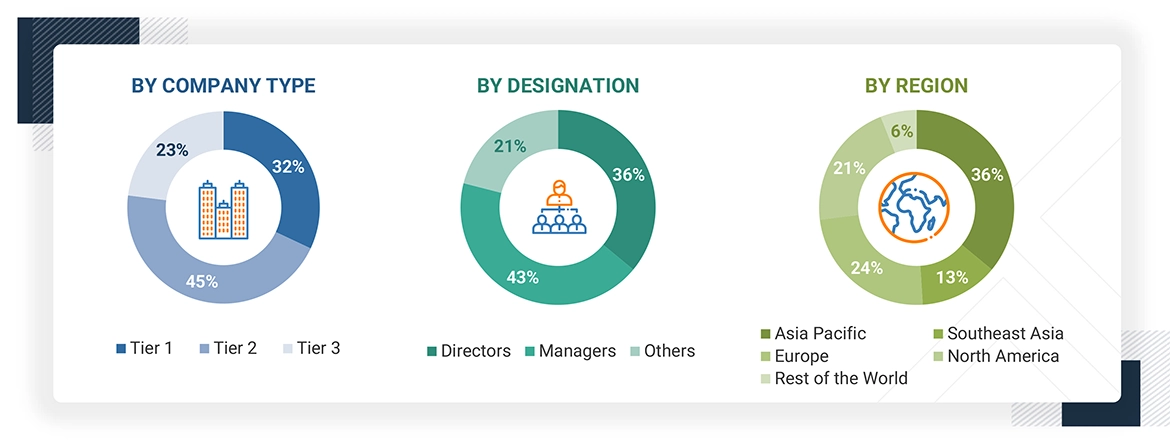

Extensive primary research has been conducted after understanding the fluid transfer system market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand side (vehicle manufacturers, country-level government associations, and trade associations) and the supply side (fluid transfer system providers and integrators). The regions considered for the research include Asia Pacific, Southeast Asia, Europe, North America, and the Rest of the World. Approximately 32% and 68% of primary interviews have been conducted from the demand and supply sides. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, have been covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions have been conducted with highly experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings described in this report.

Note: Tiers are based on the value chain; the company’s revenue is not considered. Others include sales and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the total size of the fluid transfer system market. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Fluid Transfer System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size through the methodology above, the fluid transfer system market has been split into several segments and subsegments. Where applicable, the data triangulation procedure has been employed to complete the overall market engineering process and arrive at the exact market value for key segments and subsegments. The extrapolated market data has been triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

The fluid transfer system market in the automotive sector includes hoses, pipes, tubes, and fluid transfer lines designed to transport fluids such as fuel, oil, coolant, brake fluid, and air across vehicle subsystems. These components are critical for thermal management, powertrain, brake, and transmission across passenger and commercial vehicles.

Stakeholders

- Authorized Service Centers and Independent Aftermarket Service Providers

- Automobile Organizations/Associations and Government Bodies

- Automobile OEMs

- Automotive Component Manufacturers

- Automotive Raw Material Suppliers

- Automotive Research Organizations

- EV and EV Component Manufacturers

- Fluid Transfer System Integrators

- Fluid Transfer System Manufacturers

- Tooling and Machinery Suppliers

- Vehicle Safety and Emission Regulatory Bodies

Report Objectives

- To analyze and forecast the size of the fluid transfer system market in terms of volume (thousand units) and value (USD million) from 2025 to 2032

-

To segment the market by propulsion & component, vehicle type, system type, and region

- To segment and forecast the market size by propulsion & component [petrol/gasoline (air intake hose, vacuum hose, fuel feed line, feed return line, fuel leak-off assembly, turbocharger oil feed line, turbocharger oil drain line, turbocharger coolant line, turbocharger coolant return line, positive crankcase ventilation (PVC) hose, vacuum modulator hose, dipstick tube, fluid return hose, pressure control solenoid hose, transmission oil cooler line, hydraulic power steering hose, fuel delivery line, fuel rail, direct fuel injection line, CNG tube, CNG hose, fuel vapor vent line, fuel injector line, fuel to tank filler line, fuel filler neck, thermal lines, expansion valve tube, A/C cabin climate control hose, radiator hose, reservoir overflow hose, bypass hose, DC-DC converter cooling hose, motor coolant hose, battery coolant hose, A/C drain line, hydraulic suspension line, air suspension line, shock absorber hose, anti roll bar, brake & clutch hose and line assembly, vacuum booster hose, brake bundle assembly, EGR tube & assembly, SCR tube & assembly, EVAP line, differential pressure hose, tail pipe, sunroof drain, windshield hose, power door lock hose, oil line), diesel, CNG, battery electric, and plug-in hybrid electric]

-

(*Note: A similar component-level breakdown is provided for other propulsion types.)

- To segment and forecast the market by vehicle type (passenger cars, light commercial vehicles, trucks, and buses)

- To segment and forecast the market by system type (engine, transmission, power steering, fuel delivery, thermal management, suspension, brake & clutch, exhaust, and body & exterior)

- To forecast the market by region (Asia Pacific, Southeast Asia, Europe, North America, and Rest of the World)

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing market growth

- To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Value Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Pricing Analysis

- Trends and Disruptions Impacting Customer Business

- Impact of AI/Gen AI

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- MnM Insights on Fluid Transfer Market Trends

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product launches/developments, and other activities undertaken by the industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

- Fluid transfer system market for two- & three-wheelers and off-highway vehicles at the regional level (those covered in the report)

- Fluid transfer system market by vehicle type for additional countries (those not covered in the report)

- Additional company profiles (up to five)

Key Questions Addressed by the Report

What is the current size of the fluid transfer system market?

The fluid transfer system market is estimated at USD 2.70 billion in 2025.

Who are the key players in the fluid transfer system market?

The fluid transfer system market is dominated by players such as Cooper Standard (US), TI Fluid Systems (UK), Sumitomo Riko Company Limited (Japan), Parker Hannifin Corp (US), and Gates Corporation (US).

Which region is projected to account for the largest share of the fluid transfer system market?

Asia Pacific is projected to hold the largest share of the fluid transfer system market, fueled by increased vehicle production, a robust industrial base, government support for the automotive and manufacturing sectors, and the localization of OEM supply chains.

Which country is projected to lead the fluid transfer system market in Asia Pacific during the forecast period?

China is projected to dominate the fluid transfer system market in Asia Pacific due to its large-scale automotive production capacity, strong EV manufacturing base, government support for cleaner mobility, and the presence of both global and domestic suppliers that cater to diverse fluid transfer needs.

What are the key market trends impacting the growth of the fluid transfer system market?

Key trends shaping the fluid transfer system market include the adoption of lightweight thermoplastics and composites, integration of sensor and smart fluid lines, expansion of thermal management solutions for EVs and hybrids, increased investment in modular and pre-assembled systems, and focus on sustainability through recyclable materials.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fluid Transfer System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Fluid Transfer System Market

Akshit

Jun, 2019

Being in lubricant line, its important to be abreast of emission regulations and impact which also has consequences on lubricant selection. .

Akshit

Jun, 2019

We want to know who the major suppliers and customers are for fluid management (coolant and oil) components such as coolant valves, regulators, reservoirs, etc..