Thermal Systems Market by Application (Front & Rear A/C, Powertrain, Seat, Steering, Battery, Motor, Power Electronics, Waste Heat Recovery, Sensor), Technology, Components, Vehicle (ICE, Electric, Off-Vehicle & ATV) and Region - Global Forecast to 2027

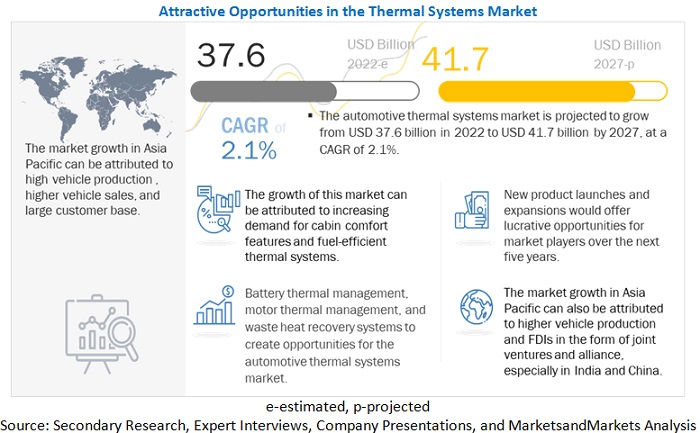

The global thermal systems market size was valued at USD 37.6 billion in 2022 and is projected to reach USD 41.7 billion by 2027, at a CAGR of 2.1%, during the forecast period. The growing stringency in emission regulations, rising demand of mid & full size SUV and luxury vehicle with enhanced cabin comfort will drive the market. Moreover, rising adoption of electric & hybrid vehicles and the advancements in semi-autonomous and autonomous vehicles would bring tremendous growth potential in the market

To know about the assumptions considered for the study, Request for Free Sample Report

Thermal Systems Market Dynamics

DRIVER: Strict vehicular emission norms and growing need of fuel efficient vehicles

With an increase in global vehicle production and sales, regional governments around the world have been focusing on controlling GHG emissions. For instance, European Union has already implemented Euro VI, and China implemented the China VI standard to encourage zero emissions. The rising stringency in emission norms has forced global automotive OEMs to focus on developing advanced engines and exhaust technologies for ICE vehicles. These new engine and exhaust technologies require advanced thermal systems which will reduce emissions and improve vehicle efficiency by reusing the waste heat for other functions. Premium vehicles are installed with various thermal system technologies such as engine thermal mass reduction, predictive powertrain control, integrated liquid-cooled exhaust/EGR, transmission rapid warm-up, dynamic engine thermal control, and Thermoelectric Capture and Generation (TEG).

Further, demand for cleaner emissions requires sophisticated exhaust systems with a good thermal management system. The exhaust thermal management can be active (catalytic heater, burner, and electric heater) or passive (low thermal mass catalyst substrates, double-walled pipes insulation, air dilution and after treatment technologies such as SCR and EGR). Following the emission mandates, the demand for these technologies is expected to grow for all vehicle types, mainly in European countries, China, and India

RESTRAINT: High cost of advanced thermal system technology

The implementation of stringent emission and fuel economy targets has prompted OEMs to adopt new technologies to achieve desired results. Also, increased demand for enhanced engine performance and in-vehicle comfort features has compelled manufacturers to focus on powertrain, drivetrain, and in-vehicle cabin comfort thermal systems. The performance of a thermal system can be assessed by estimating the cost incurred against the total amount of CO2 reduction achieved. Technologies with high ROI and CO2 reductions have already been accepted and introduced by OEMs in their premium models. Leading OEMs such as BMW, Fiat Chrysler, Ford, GM, Honda, Hyundai, JLR, Kia, Mercedes, and Nissan have deployed technologies such as predictive powertrain control, variable engine oil pump, integrated liquid-cooled exhaust/EGR, polymer material heat exchangers, active grille shutters, and multizone climate control system. Although there are several thermal system technologies, most of them are embedded in luxury vehicles and a few of them are used currently due to their cost-benefit ratio. Thus, due to the high cost of advanced thermal systems, their installation will be mostly limited to luxury vehicles only in the future as well

OPPORTUNITY: Rising demand for electric vehicles and advancement in mobility solutions

Electric vehicle has shown exponential acceptance rate in last 4-5 years across China, US, and European countries. OEMs are constantly working on developing efficient, affordable, long-range, battery-powered passenger vehicles. Thermal systems for battery, traction motors and power electronic modules along with auxiliary loads such as cabin heating and cooling and other electric components would becomes a critical factors which helps to improve performance, driving range and vehicle lifetime.

The automotive industry has experienced continuous progress in the field of semi-autonomous and fully autonomous vehicles The thermal systems for these vehicles not only regulate the internal heating and ventilation system but also aids in engine cooling and efficient functioning of the vehicle. With differential heating at start-up and TEG technologies, the vehicle start-stop mechanism can be centralized for optimum utilization of fuel with minimal wastage. Additionally, advanced technologies such as multizone climate control, autonomous collision avoidance system, infotainment system, head-up displays, heating and ventilated seating system, several sensors, and many other electronic components are installed, which require thermal protection for superior performance. Thus, growing developments in autonomous vehicles would subsequently require better thermal management to handle the heat of sensors and other components in these vehicles

CHALLENGE: Lack of Standardization

Local or regional manufacturers must follow the regulating body's emission regulations or norms. However, since emission restrictions vary by region, a lack of standardization might make it difficult to export various thermal-related systems such as catalytic converters, SCR, EGR etc. For instance, in Europe, emission reduction is required due to the stringent CO2 regulations, whereas in developing countries like South Africa, such a mandate does not exist. Thus, because of the absence of standardization, manufacturers are unable to source raw materials or inventory, thereby hampering export business. Low-volume production is used by manufacturers, resulting in high manufacturing costs. Engine technology must be upgraded to Euro III/IV/V and Tier 3/4, according to the European Commission and the US Environmental Protection Agency. As a result, the need for aftertreatment devices and enhanced thermal technologies that comply with upgraded technology has increased. Thus, lack of standardized technical norms and high cost of manufacturing can hinder the growth of the automotive thermal management market.

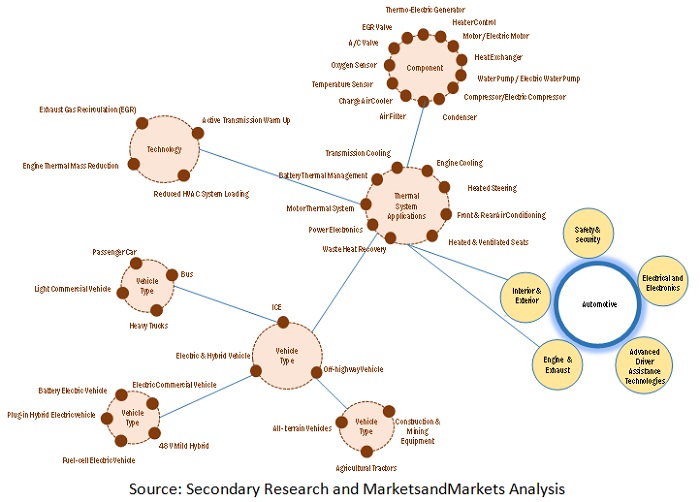

Thermal Systems Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Front Air conditioning is estimated to be the largest application segment during the forecast period

Front A/C market growth is mainly attributed to its standardization in all passenger cars and in most of the light commercial vehicles. Thus, demand of front A/C would grow in line to growing production of passenger & light commercial vehicles. Further, rising demand for high-end full-size SUVs, would boost demand of automatic climate control and rear air conditioning to provide sufficient cooling effect to third-row passengers. Increasing demand for luxury vehicles would drive the thermal market for multi-zone climte control system. At the same time, government mandates for cabin AC for commercial vehicles would drive front air conditioning market. For instance, European Commission mandated the use of cabin AC in all commercial trucks. Indian government mandated fitment of air conditioning in HCVs, though it is yet to be fully realized. Similar mandates are expected to come in commercial vehicles segment, which is expected to boost market share of front air conditioning system

The heat exchanger is projected to be the largest component segment for thermal systems

Engine and transmission cooling are one of major focus areas among global OEMs owing to stringent norms for harmful gases with increased demand of fuel efficient vehicles. Also, focus on reduction in energy consumption and growing automatic gearboxes in passenger car and LCV requires heat exchanger for transmission system. Further, air conditioning is responsible for major heat loss in vehicles, and rising adoption of automatic & multizone climate control in mid to top segment vehicle are set to drive heat exchangers for air conditioning systems. Additionally, increasing focus on heat recovery using thermos electric generator is estimated to offer growth potential to heat exchanger market for waste heat recovery technology.

Farm tractors lead the off-highway vehicle thermal systems market

Farm tractors hold the largest share on off-highway vehicle segment and Asia Pacific leads the share of the farm tractors thermal systems market. Likewise on-highway vehicles, emission regulations related to tractors are getting introduced in different parts of the world. In October 2020, Indian government implemented BS Term IV regulation application for diesel engine equipment, including agricultural tractors and construction equipment. Similarly, European Commission proposed emission standards for non-road mobile machinery (NRMM). These standards were adopted by the EU Parliament in 2016 and were rolled out in 2018 and all new off-highway engines entering the EU market were Stage V-certified on January 1, 2021. These stringent norms would fuel the demand of thermal system components such as radiators, charge air cooler, Hydraulic oil cooler and EGR systems.

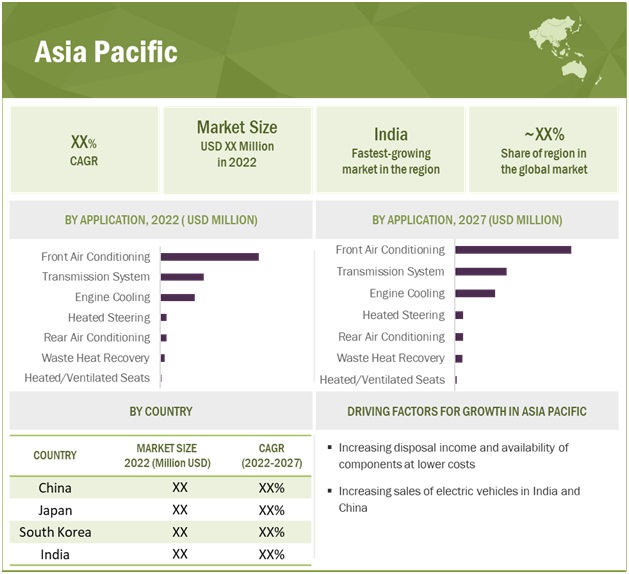

Asia Pacific is estimated to be the dominant regional market for thermal systems

The market growth in Asia Pacific countries such as China, Japan, and India can be attributed to the increasing demand for vehicle owing to changing consumer preferences, increasing per capita income of the middle-class population, and cost advantages to global OEMs. Due to the increased vehicle production and sales, China is estimated to be the largest market for thermal systems. As demand for passenger cars are growing, front A/C becomes standard in all of them. Additionally, increased demand for mid & full size SUVs, luxury cars and government push towards electric vehicles would propel requirement of thermal systems for engine & transmission, battery & electric motor along the superior cabin comfort technologies such as heated/ventilated seats and rear air conditioning in the region

Key Market Players

Denso Corporation (Japan), MAHLE GmbH (Germany), Hanon Systems (South Korea), Valeo SA (France), and BorgWarner Inc. (US). These companies adopted new product launches and expansion to gain traction in the thermal systems market

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Application (ICE), by Vehicle Type (ICE), by Technology (ICE), by Application (Electric and hybrid Vehicles), by Electric and Hybrid Vehicle Type, by Component (ICE), by component (Electric and hybrid vehicle), Off-highway by equipment type, ATV by Region and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, and RoW |

|

Companies covered |

Denso Corporation (Japan), MAHLE GmbH (Germany), Hanon Systems (South Korea), Valeo (France), and BorgWarner Inc. (US), Gentherm (US), Schaeffler AG (Germany), Johnson Electric Holding Ltd (Hong Kong), Dana Limited (US), Robert Bosch GmbH (Germany) |

Recent Developments

- In March 2022, MAHLE Aftermarket expanded its portfolio to include indirect air conditioning condensers that are becoming standard components in air conditioning systems of modern vehicles.

- In March 2022, Hanon Systems announced the opening of a new plant in Hubei, China, as part of the company's growing support for automakers in the electrified vehicle category. The new plant will manufacture HVAC modules for electrified vehicles

- In November 2021, MAHLE developed an innovative internal coating for fuel cell coolers that combine maximum operational safety with high cooling performance and enables long fuel cell service life

- In May 2021, Hanon Systems completed the acquisition of condenser business from Keihin Corporation for certain operations in Europe and North America.

- In March 2021, Hanon Systems began construction on its fifth plant in Korea. The facility will produce a range of solutions, including heat pump modules and coolant valve assemblies, to support electric vehicles for the Genesis brand and Ioniq 5 model of Hyundai.

- In February 2021, MAHLE reached an agreement with Keihin Corporation (now known as Hitachi Astemo, Ltd.) to acquire its thermal management business activities in Japan, Thailand, and the US.

- In February 2021. Schaeffler invested EUR 80 million in a new central laboratory complex in Herzogenaurach as part of the company's Roadmap 2025 strategy announced last year. The investment is aimed at securing the Schaeffler Group’s competitiveness and ability to realize future opportunities as well as strengthening the position of its Herzogenaurach campus as a center of technological excellence.

Frequently Asked Questions (FAQ):

What is the current size of the global thermal systems market?

The global thermal systems market is estimated to be USD 40.9 billion in 2021, with Asia Pacific dominating the market.

Which application type is currently leading the thermal systems market?

Front Air Conditioning segment is leading application type in the thermal systems market.

Many companies are operating in the thermal systems market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

Denso Corporation, MAHLE GmbH, Hanon Systems, Valeo, and BorgWarner Inc. These companies adopted new product launches and expansion strategies to gain traction in the thermal systems market.

How is the demand for thermal systems varies by region?

Asia Pacific is estimated to be the largest market for thermal systems. The Asia Pacific region has emerged as a hub for automotive production in recent years. Europe and North America are also expected to grow at a decent pace during the forecast period due to the increasing demand of luxury vehicles and comfort features in the region.

What are the drivers and opportunities for the thermal systems manufacturer?

Increasing stringency of emission regulations, increasing demand of luxury and comfort features, advancements in mobility solutions and increase in demand of electric vehicles. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 52)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 THERMAL SYSTEMS MARKET FOR AUTOMOTIVE: MARKET SEGMENTATION

1.3.2 MARKET, BY REGION

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 SUMMARY OF CHANGES

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 57)

2.1 RESEARCH DATA

FIGURE 2 THERMAL SYSTEMS MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES FOR VEHICLE PRODUCTION AND ELECTRIC VEHICLE SALES

2.2.2 KEY SECONDARY SOURCES FOR MARKET SIZING

2.2.3 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.4.1 BOTTOM-UP APPROACH

FIGURE 6 BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 7 TOP-DOWN APPROACH

2.4.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS & ASSOCIATED RISKS

2.7.1 RESEARCH ASSUMPTIONS

2.7.2 MARKET ASSUMPTIONS

TABLE 1 ASSUMPTIONS, ASSOCIATED RISKS, AND IMPACT

2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 72)

3.1 INTRODUCTION

3.2 REPORT SUMMARY

FIGURE 9 THERMAL SYSTEMS MARKET, BY APPLICATION (ICE), 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 75)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 10 STRINGENT EMISSION NORMS, GROWING PREMIUM VEHICLES, AND RISING DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET

4.2MARKET, BY REGION (ICE)

FIGURE 11 ASIA PACIFIC EXPECTED TO DOMINATE MARKET

4.3 MARKET, BY APPLICATION (ICE)

FIGURE 12 FRONT AIR CONDITIONING SEGMENT TO HOLD LARGEST MARKET

4.4 THERMAL SYSTEMS MARKET, BY TECHNOLOGY (ICE)

FIGURE 13 EGR LED THE TECHNOLOGY MARKET DURING FORECAST PERIOD

4.5 MARKET, BY COMPONENT (ICE)

FIGURE 14 HEAT EXCHANGER TO HOLD LARGEST SHARE OF COMPONENTS MARKET

4.6 MARKET, BY VEHICLE TYPE (ICE)

FIGURE 15 PASSENGER CAR SEGMENT PROJECTED TO HOLD LARGEST MARKET

4.7 ELECTRIC & HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY APPLICATION

FIGURE 16 WASTE HEAT RECOVERY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.8 MARKET, BY COMPONENT

FIGURE 17 HEAT EXCHANGER TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.9 MARKET, BY VEHICLE TYPE

FIGURE 18 BEV SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.10 OFF-HIGHWAY VEHICLE THERMAL SYSTEMS MARKET, BY EQUIPMENT

FIGURE 19 FARM TRACTOR TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.11 ALL-TERRAIN VEHICLE THERMAL SYSTEMS MARKET, BY REGION

FIGURE 20 NORTH AMERICA TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 81)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 THERMAL SYSTEMS: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Stringent emission regulations

5.2.1.2 Increasing demand for luxury vehicles and integration of advanced thermal management solutions

FIGURE 22 E & F SEGMENT VEHICLE PRODUCTION OF KEY PLAYERS, 2016–2021 (THOUSAND UNITS)

TABLE 2 ADVANCED THERMAL SYSTEM TECHNOLOGIES OFFERED BY KEY OEMS

5.2.2 RESTRAINTS

5.2.2.1 High cost

TABLE 3 ECONOMIC COMPARISON OF THERMAL SYSTEM TECHNOLOGIES: VALUE VS. COST OF CO2 REDUCTION

5.2.3 OPPORTUNITIES

5.2.3.1 Advancements in mobility solutions require innovative thermal products

5.2.3.2 Growing EV demand

FIGURE 23 ELECTRIC AND HYBRID PASSENGER VEHICLE SALES & FORECAST, 2018-2027 (‘000 UNITS)

5.2.4 CHALLENGES

5.2.4.1 Lack of standardization

5.2.4.2 Low adoption of advanced thermal systems in developing countries

TABLE 4 ADOPTION RATE OF THERMAL SYSTEMS IN PASSENGER CARS IN KEY COUNTRIES

5.3 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 24 TRENDS/DISRUPTIONS IMPACTING BUYERS

5.4 THERMAL SYSTEMS MARKET SCENARIO

FIGURE 25 MARKET SCENARIO, 2018–2027 (USD MILLION)

5.4.1 REALISTIC SCENARIO

TABLE 5 MARKET (REALISTIC SCENARIO), BY REGION, 2018–2027 (USD BILLION)

5.4.2 LOW-IMPACT SCENARIO

TABLE 6 MARKET (LOW-IMPACT SCENARIO), BY REGION, 2018–2027 (USD MILLION)

5.4.3 HIGH-IMPACT SCENARIO

TABLE 7 MARKET (HIGH-IMPACT SCENARIO), BY REGION, 2018–2027 (USD MILLION)

5.5 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF SUBSTITUTES

5.5.2 THREAT OF NEW ENTRANTS

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 BARGAINING POWER OF SUPPLIERS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 MARKET ECOSYSTEM

FIGURE 27 MARKET: ECOSYSTEM ANALYSIS

TABLE 9 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 28 SUPPLY CHAIN ANALYSIS: MARKET

5.8 NORTH AMERICA: KEY THERMAL SYSTEM SUPPLIERS

TABLE 10 NORTH AMERICA: KEY THERMAL SYSTEM SUPPLIERS

5.9 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR TOP 4 COMPONENTS

TABLE 11 KEY BUYING CRITERIA FOR TOP 4 COMPONENTS

5.10 PRICE ANALYSIS

5.10.1 PASSENGER CAR

TABLE 12 AVERAGE REGIONAL PRICE TREND: PASSENGER CAR THERMAL SYSTEM COMPONENTS (USD/UNIT), 2021

5.10.2 LIGHT COMMERCIAL VEHICLE

TABLE 13 AVERAGE REGIONAL PRICE TREND: LIGHT COMMERCIAL VEHICLE THERMAL SYSTEM COMPONENTS (USD/UNIT), 2021

5.10.3 TRUCK

TABLE 14 AVERAGE REGIONAL PRICE TREND: TRUCK THERMAL SYSTEM COMPONENTS (USD/UNIT), 2021

5.11 PATENT ANALYSIS

TABLE 15 APPLICATIONS AND PATENTS GRANTED, 2019–2021

5.12 CASE STUDY ANALYSIS

5.12.1 COOLING SYSTEM MAINTENANCE AND SERVICE CASE STUDY

5.12.2 OPTARE CASE STUDY

5.12.3 DENSO CORPORATION CASE STUDY

5.12.4 GENTHERM AND GM CASE STUDY

5.13 TRADE ANALYSIS

5.13.1 RADIATORS AND PARTS - IMPORT AND EXPORT DATA, BY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 16 RADIATORS AND PARTS IMPORT TRADE DATA, BY COUNTRY, 2017-2021

TABLE 17 RADIATORS AND PARTS EXPORT TRADE DATA, BY COUNTRY, 2017-2021

5.13.2 AIR CONDITIONING MACHINES USED IN VEHICLES FOR CABIN - IMPORT AND EXPORT DATA OF, BY COUNTRY, 2017-2021 (USD THOUSAND)

TABLE 18 VEHICLE AIR CONDITIONERS IMPORT TRADE DATA, BY COUNTRY, 2017-2021

TABLE 19 VEHICLE AIR CONDITIONERS EXPORT TRADE DATA, BY COUNTRY, 2017-2021

5.14 REGULATORY LANDSCAPE

TABLE 20 EMISSION NORM SPECIFICATIONS IN KEY COUNTRIES FOR PASSENGER CARS

5.14.1 EMISSION REGULATIONS

5.14.1.1 On-road vehicles

TABLE 21 EURO-5 VS. EURO-6 VEHICLE EMISSION STANDARDS ON NEW EUROPEAN DRIVING CYCLE

TABLE 22 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR PASSENGER CARS, 2016–2021

FIGURE 30 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR HEAVY-DUTY VEHICLES, 2014–2025

5.14.2 FUEL ECONOMY NORMS

5.14.2.1 US

TABLE 23 US: CAFE STANDARDS FOR EACH MODEL YEAR IN MILES PER GALLON, 2012–2025

5.14.2.2 Europe

5.14.2.3 China

5.14.2.4 India

5.15 REGULATORY BODIES/GOVERNMENT AGENCIES

TABLE 24 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 25 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 26 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.16 KEY CONFERENCES & EVENTS IN 2022–2023

5.16.1 MARKET: DETAILED LIST OF UPCOMING CONFERENCES & EVENTS

5.17 TECHNOLOGY ANALYSIS

5.17.1 THERMAL SYSTEMS TECHNOLOGY ANALYSIS

5.17.2 PASSENGER COMFORT TECHNOLOGY

5.17.3 INDIRECT CHARGE AIR COOLING

FIGURE 31 COOLANT CIRCUIT IN INDIRECT CHARGE AIR

5.17.4 LIQUID-COOLED CHARGE AIR COOLERS

6 THERMAL SYSTEMS MARKET, BY APPLICATION (ICE) (Page No. - 122)

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

6.1.2 ASSUMPTIONS

6.1.3 INDUSTRY INSIGHTS

FIGURE 32 MARKET, BY APPLICATION (ICE), 2022 VS. 2027 (USD MILLION)

TABLE 27 MARKET, BY APPLICATION (ICE), 2018–2021 (‘000 UNITS)

TABLE 28 MARKET, BY APPLICATION (ICE), 2022–2027 (‘000 UNITS)

TABLE 29 MARKET, BY APPLICATION (ICE), 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY APPLICATION (ICE), 2022–2027 (USD MILLION)

6.2 ENGINE COOLING

6.2.1 ENGINE DOWNSIZING AND DEMAND FOR LOW-EMISSION ENGINES TO DRIVE SEGMENT

TABLE 31 ENGINE COOLING: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 32 ENGINE COOLING: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 33 ENGINE COOLING: MARKET, BY REGION, 2018–2021 (MILLION USD)

TABLE 34 ENGINE COOLING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 FRONT AIR CONDITIONING

6.3.1 INCREASING DEMAND FOR COMFORT AND ADVANCEMENTS IN TECHNOLOGY TO DRIVE SEGMENT

TABLE 35 FRONT AIR CONDITIONING: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 36 FRONT AIR CONDITIONING: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 37 FRONT AIR CONDITIONING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 FRONT AIR CONDITIONING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 REAR AIR CONDITIONING

6.4.1 RISING DEMAND FOR FULL-SIZE SUVS TO DRIVE SEGMENT

TABLE 39 REAR AIR CONDITIONING: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 40 REAR AIR CONDITIONING: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 41 REAR AIR CONDITIONING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 REAR AIR CONDITIONING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 TRANSMISSION SYSTEM

6.5.1 GROWING DEMAND FOR AUTOMATIC TRANSMISSION IN DEVELOPING COUNTRIES TO DRIVE SEGMENT

TABLE 43 TRANSMISSION SYSTEM: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 44 TRANSMISSION SYSTEM: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 45 TRANSMISSION SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 TRANSMISSION SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.6 HEATED/ VENTILATED SEATS

6.6.1 INCREASING DEMAND FOR CABIN COMFORT TO DRIVE SEGMENT

TABLE 47 HEATED/ VENTILATED SEATS: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 48 HEATED VENTILATED SEATS: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 49 HEATED/ VENTILATED SEATS: THERMAL YSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 HEATED/ VENTILATED SEATS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.7 HEATED STEERING

6.7.1 DEMAND FOR COMFORT FEATURES IN COLD REGIONS TO DRIVE SEGMENT

TABLE 51 HEATED STEERING: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 52 HEATED STEERING: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 53 HEATED STEERING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 HEATED STEERING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.8 WASTE HEAT RECOVERY

6.8.1 EMISSION REGULATIONS AND INCREASING DEMAND FOR HYBRID VEHICLES TO DRIVE SEGMENT

TABLE 55 WASTE HEAT RECOVERY: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 56 WASTE HEAT RECOVERY: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 57 WASTE HEAT RECOVERY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 WASTE HEAT RECOVERY: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 THERMAL SYSTEMS MARKET, BY COMPONENT (ICE) (Page No. - 138)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

7.1.3 INDUSTRY INSIGHTS

FIGURE 33MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

TABLE 59 MARKET, BY COMPONENT, 2018–2021 (‘000 UNITS)

TABLE 60 MARKET, BY COMPONENT, 2022–2027 (‘000 UNITS)

TABLE 61 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 62 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.2 AIR FILTER

7.2.1 DEMAND FOR COMPLEX FLOW GUIDANCE DESIGNS TO DRIVE SEGMENT

TABLE 63 AIR FILTER: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 64 AIR FILTER: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 65 AIR FILTER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 AIR FILTER: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 CONDENSER

7.3.1 FOCUS ON REDUCING POWER CONSUMPTION AND INCREASING FUEL EFFICIENCY TO DRIVE SEGMENT

TABLE 67 CONDENSER: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 68 CONDENSER: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 69 CONDENSER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 CONDENSER: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 COMPRESSOR

7.4.1 GROWING TREND OF ADVANCED COMFORT AND CONVENIENCE FEATURES TO DRIVE SEGMENT

TABLE 71 COMPRESSOR: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 72 COMPRESSOR: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 73 COMPRESSOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 COMPRESSOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 WATER PUMP

7.5.1 DEMAND FOR INCREASING ENGINE EFFICIENCY TO DRIVE SEGMENT

TABLE 75 WATER PUMP: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 76 WATER PUMP: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 77 WATER PUMP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 WATER PUMP: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 MOTOR

7.6.1 BENEFITS LIKE BETTER EFFICIENCY AND PERFORMANCE TO DRIVE SEGMENT

TABLE 79 MOTOR: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 80 MOTOR: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 81 MOTOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 MOTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 HEAT EXCHANGER

7.7.1 INCREASING DEMAND FOR ELECTRIC AND HYBRID VEHICLES TO DRIVE SEGMENT

TABLE 83 HEAT EXCHANGER: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 84 HEAT EXCHANGER: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 85 HEAT EXCHANGER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 86 HEAT EXCHANGER: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.8 HEATER CONTROL

7.8.1 INCREASING DEMAND FOR LUXURY AND COMFORT TO DRIVE SEGMENT

TABLE 87 HEATER CONTROL: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 88 HEATER CONTROL: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 89 HEATER CONTROL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 HEATER CONTROL: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.9 THERMOELECTRIC GENERATOR

7.9.1 NEED FOR REDUCTION IN FUEL CONSUMPTION TO DRIVE SEGMENT

TABLE 91 THERMOELECTRIC GENERATOR: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 92 THERMOELECTRIC GENERATOR: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 93 THERMOELECTRIC GENERATOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 94 THERMOELECTRIC GENERATOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.1 EGR VALVE

7.10.1 STRINGENT FUEL CONSUMPTION AND EMISSION NORMS TO DRIVE SEGMENT

TABLE 95 EGR VALVE: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 96 EGR VALVE: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 97 EGR VALVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 98 EGR VALVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.11 A/C VALVE

7.11.1 DEMAND FOR EFFICIENT CABIN CLIMATE CONTROL TECHNOLOGIES TO DRIVE SEGMENT

TABLE 99 A/C VALVE: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 100 A/C VALVE: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 101 A/C VALVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 102 A/C VALVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.12 OXYGEN SENSOR

7.12.1 GROWING ENVIRONMENTAL AWARENESS TO DRIVE SEGMENT

TABLE 103 OXYGEN SENSOR: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 104 OXYGEN SENSOR: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 105 OXYGEN SENSOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 OXYGEN SENSOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.13 TEMPERATURE SENSOR

7.13.1 NEED FOR MEASURING HIGH TEMPERATURES TO DRIVE SEGMENT

TABLE 107 TEMPERATURE SENSOR: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 108 TEMPERATURE SENSOR: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 109 TEMPERATURE SENSOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 110 TEMPERATURE SENSOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.14 CHARGE AIR COOLER

7.14.1 NEED FOR HIGH-POWER ENGINE OUTPUT TO DRIVE SEGMENT

TABLE 111 CHARGE AIR COOLER: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 112 CHARGE AIR COOLER: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 113 CHARGE AIR COOLER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 114 CHARGE AIR COOLER: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 AUTOMOTIVE THERMAL SYSTEMS MARKET, BY TECHNOLOGY (ICE) (Page No. - 164)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 34 MARKET, BY TECHNOLOGY, 2022 VS. 2027 (‘000 UNITS)

TABLE 115 MARKET, BY TECHNOLOGY, 2018–2021 (‘000 UNITS)

TABLE 116 MARKET, BY TECHNOLOGY, 2022–2027 (‘000 UNITS)

8.2 ACTIVE TRANSMISSION WARM UP

8.2.1 FUEL ECONOMY AND FASTER TRANSMISSION TECHNOLOGY TO DRIVE SEGMENT

TABLE 117 ACTIVE TRANSMISSION WARM UP: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 118 ACTIVE TRANSMISSION WARM UP: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

8.3 EGR

8.3.1 INCREASED ADOPTION OF SCR SYSTEMS TO RESTRAIN SEGMENT

TABLE 119 EGR: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 120 EGR: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

8.4 ENGINE THERMAL MASS REDUCTION

8.4.1 DEMAND FOR FUEL-EFFICIENT VEHICLES TO DRIVE SEGMENT

TABLE 121 ENGINE THERMAL MASS REDUCTION: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 122 ENGINE THERMAL MASS REDUCTION: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

8.5 REDUCED HVAC SYSTEM LOADING

8.5.1 DEMAND FOR ENHANCED CABIN COMFORT TO DRIVE SEGMENT

TABLE 123 REDUCED HVAC SYSTEM LOADING: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 124 REDUCED HVAC SYSTEM LOADING: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

8.6 OTHER TECHNOLOGIES

TABLE 125 OTHER TECHNOLOGIES: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 126 OTHER TECHNOLOGIES: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

9 THERMAL SYSTEMS MARKET, BY VEHICLE TYPE (ICE) (Page No. - 173)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 35 MARKET, BY VEHICLE TYPE (ICE), 2022 VS. 2027 (USD MILLION)

TABLE 127 MARKET, BY VEHICLE TYPE (ICE), 2018–2021 (‘000 UNITS)

TABLE 128 MARKET, BY VEHICLE TYPE (ICE), 2022–2027 (‘000 UNITS)

TABLE 129 MARKET, BY VEHICLE TYPE (ICE), 2018–2021 (USD MILLION)

TABLE 130 MARKET, BY VEHICLE TYPE (ICE), 2022–2027 (USD MILLION)

9.2 PASSENGER CAR

9.2.1 NEED FOR FUEL EFFICIENCY TO DRIVE SEGMENT

TABLE 131 PASSENGER CAR: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 132 PASSENGER CAR: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 133 PASSENGER CAR: MARKET, 2018–2021 (USD MILLION)

TABLE 134 PASSENGER CAR: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 LIGHT COMMERCIAL VEHICLE (LCV)

9.3.1 HIGH DEMAND IN NORTH AMERICA TO DRIVE SEGMENT

TABLE 135 LIGHT COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 136 LIGHT COMMERCIAL VEHICLE:MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 137 LIGHT COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 138 LIGHT COMMERCIAL VEHICLE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 TRUCK

9.4.1 GROWTH OF LARGE-SCALE INDUSTRIES, LOGISTICS, AND CONSTRUCTION TO DRIVE SEGMENT

TABLE 139 TRUCK: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 140 TRUCK: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 141 TRUCK: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 142 TRUCK: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 BUS

9.5.1 HIGH DEPENDENCY ON PUBLIC TRANSPORT TO DRIVE SEGMENT

TABLE 143 BUS: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 144 BUS: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 145 BUS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 146 BUS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY APPLICATION (Page No. - 184)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

10.1.3 INDUSTRY INSIGHTS

FIGURE 36 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 147 MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 148 MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 149 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 150 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 BATTERY THERMAL MANAGEMENT

10.2.1 GOVERNMENT POLICIES FOR ELECTRIC VEHICLES TO DRIVE SEGMENT

TABLE 151 BATTERY THERMAL MANAGEMENT: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 152 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 153 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 154 BATTERY THERMAL MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 TRANSMISSION SYSTEM

10.3.1 INCREASED DEMAND FOR AUTOMATIC TRANSMISSION AND CVT TO DRIVE SEGMENT

TABLE 155 TRANSMISSION SYSTEM: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 156 TRANSMISSION SYSTEM: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 157 TRANSMISSION SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 158 TRANSMISSION SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 ENGINE COOLING

10.4.1 DEMAND FOR EFFICIENT ENGINES TO DRIVE SEGMENT

TABLE 159 ENGINE COOLING: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 160 ENGINE COOLING: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 161 ENGINE COOLING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 162 ENGINE COOLING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 FRONT AIR CONDITIONING

10.5.1 DEMAND FOR COMFORT AND CONVENIENCE TO DRIVE SEGMENT

TABLE 163 FRONT AIR CONDITIONING: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 164 FRONT AIR CONDITIONING: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 165 FRONT AIR CONDITIONING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 166 FRONT AIR CONDITIONING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 MOTOR THERMAL MANAGEMENT

10.6.1 DEMAND FOR ADVANCED ELECTRIC AND HYBRID POWERTRAINS TO DRIVE SEGMENT

TABLE 167 MOTOR TYPE USED IN DIFFERENT ELECTRIC VEHICLES

TABLE 168 MOTOR THERMAL MANAGEMENT: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 169 MOTOR THERMAL MANAGEMENT: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 170 MOTOR THERMAL MANAGEMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 171 MOTOR THERMAL MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 POWER ELECTRONICS

10.7.1 DEMAND FOR SMART EMISSION-FREE VEHICLES TO DRIVE SEGMENT

TABLE 172 POWER ELECTRONICS: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 173 POWER ELECTRONICS: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 174 POWER ELECTRONICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 175 POWER ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 REAR AIR CONDITIONING

10.8.1 INCREASED DEMAND FOR LUXURY AND MID-SEGMENT VEHICLES TO DRIVE SEGMENT

TABLE 176 REAR AIR CONDITIONING: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 177 REAR AIR CONDITIONING: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 178 REAR AIR CONDITIONING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 179 REAR AIR CONDITIONING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.9 HEATED/ VENTILATED SEATS

10.9.1 DEMAND FOR CABIN COMFORT FEATURES TO DRIVE SEGMENT

TABLE 180 HEATED/VENTILATED SEATS: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 181 HEATED/VENTILATED SEATS: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 182 HEATED/VENTILATED SEATS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 183 HEATED/VENTILATED SEATS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.10 HEATED STEERING

10.10.1 DEMAND FOR LUXURY VEHICLES TO DRIVE SEGMENT

TABLE 184 HEATED STEERING: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 185 HEATED STEERING: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 186 HEATED STEERING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 187 HEATED STEERING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.11 WASTE HEAT RECOVERY

10.11.1 ADVENT OF NEW TECHNOLOGIES TO DRIVE SEGMENT

TABLE 188 WASTE HEAT RECOVERY: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 189 WASTE HEAT RECOVERY: EMARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 190 WASTE HEAT RECOVERY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 191 WASTE HEAT RECOVERY: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY COMPONENT (Page No. - 205)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS

FIGURE 37 MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

TABLE 192 MARKET, BY COMPONENT, 2018–2021 (‘000 UNITS)

TABLE 193 MARKET, BY COMPONENT, 2022–2027 (‘000 UNITS)

TABLE 194 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 195 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.2 AIR FILTER

11.2.1 DEMAND FOR COMPLEX FLOW GUIDANCE DESIGNS TO DRIVE SEGMENT

TABLE 196 AIR FILTER: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 197 AIR FILTER: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 198 AIR FILTER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 199 AIR FILTER: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 CONDENSER

11.3.1 FOCUS ON REDUCING POWER CONSUMPTION AND INCREASING FUEL EFFICIENCY TO DRIVE SEGMENT

TABLE 200 CONDENSER: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 201 CONDENSER: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 202 CONDENSER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 203 CONDENSER: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 ELECTRIC COMPRESSOR

11.4.1 INCREASING ELECTRIC VEHICLE SALES AND TREND OF ADVANCED COMFORT AND CONVENIENCE FEATURES TO DRIVE SEGMENT

TABLE 204 ELECTRIC COMPRESSOR: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 205 ELECTRIC COMPRESSOR: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 206 ELECTRIC COMPRESSOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 207 ELECTRIC COMPRESSOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 ELECTRIC WATER PUMP

11.5.1 DEMAND FOR FUEL-EFFICIENT VEHICLES TO DRIVE SEGMENT

TABLE 208 ELECTRIC WATER PUMP: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 209 ELECTRIC WATER PUMP: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 210 ELECTRIC WATER PUMP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 211 ELECTRIC WATER PUMP: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 HEAT EXCHANGER

11.6.1 GROWING NEED FOR LONG RANGE AND FAST CHARGING TO DRIVE SEGMENT

TABLE 212 HEAT EXCHANGER: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 213 HEAT EXCHANGER: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 214 HEAT EXCHANGER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 215 HEAT EXCHANGER: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.7 HEATER CONTROL

11.7.1 INCREASING DEMAND FOR LUXURY AND COMFORT TO DRIVE SEGMENT

TABLE 216 HEATER CONTROL: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 217 HEATER CONTROL: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 218 HEATER CONTROL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 219 HEATER CONTROL: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.8 ELECTRIC MOTOR

11.8.1 BENEFITS LIKE LOW MAINTENANCE AND ZERO-EMISSION TO DRIVE SEGMENT

TABLE 220 ELECTRIC MOTOR: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 221 ELECTRIC MOTOR: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 222 ELECTRIC MOTOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 223 ELECTRIC MOTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.9 THERMOELECTRIC GENERATOR

11.9.1 NEED FOR REDUCTION IN FUEL CONSUMPTION TO DRIVE SEGMENT

TABLE 224 THERMOELECTRIC GENERATOR: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 225 THERMOELECTRIC GENERATOR: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 226 THERMOELECTRIC GENERATOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 227 THERMOELECTRIC GENERATOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEMS MARKET, BY VEHICLE TYPE (Page No. - 222)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

12.1.3 INDUSTRY INSIGHTS

FIGURE 38 MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 228 MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 229 MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 230 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 231 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2 BATTERY ELECTRIC VEHICLE (BEV)

12.2.1 GOVERNMENT SUBSIDIES AND INVESTMENTS IN CHARGING INFRASTRUCTURE TO DRIVE SEGMENT

TABLE 232 BEV: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 233 BEV: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 234 BEV: MARKET, 2018–2021 (USD MILLION)

TABLE 235 BEV: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

12.3.1 BENEFIT OF HIGHER RANGE TO DRIVE SEGMENT

TABLE 236 PHEV: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 237 PHEV: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 238 PHEV: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 239 PHEV: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

12.4.1 ADVANTAGE OF BETTER FUEL ECONOMY TO DRIVE SEGMENT

TABLE 240 FCEV: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 241 FCEV: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 242 FCEV: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 243 FCEV: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.5 48V MILD-HYBRID

12.5.1 EMISSION REGULATIONS TO DRIVE SEGMENT

TABLE 244 MILD-HYBRID (48V): MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 245 MILD-HYBRID (48V): MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 246 MILD-HYBRID (48V): MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 247 MILD-HYBRID (48V): MARKET, BY REGION, 2022–2027 (USD MILLION)

12.6 ELECTRIC COMMERCIAL VEHICLE

12.6.1 GOVERNMENT SUPPORT FOR ZERO-EMISSION TRANSPORTATION TO DRIVE SEGMENT

TABLE 248 ELECTRIC COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 249 ELECTRIC COMMERCIAL VEHICLE: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 250 ELECTRIC COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 251 ELECTRIC COMMERCIAL VEHICLE: MARKET, BY REGION, 2022–2027 (USD MILLION)

13 OFF-HIGHWAY THERMAL SYSTEMS MARKET, BY EQUIPMENT TYPE (Page No. - 234)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS

13.1.3 INDUSTRY INSIGHTS

FIGURE 39 OFF-HIGHWAY THERMAL SYSTEMS MARKET, BY EQUIPMENT TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 252 MARKET, BY EQUIPMENT TYPE, 2018–2021 (‘000 UNITS)

TABLE 253 MARKET, BY EQUIPMENT TYPE, 2022–2027 (‘000 UNITS)

TABLE 254 MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

TABLE 255 MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

13.2 CONSTRUCTION AND MINING EQUIPMENT

13.2.1 INCREASED CONSTRUCTION ACTIVITIES AND INDUSTRIAL DEVELOPMENT PROJECTS TO DRIVE SEGMENT

TABLE 256 CONSTRUCTION AND MINING EQUIPMENT THERMAL SYSTEMS MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 257 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 258 MARKET, 2018–2021 (USD MILLION)

TABLE 259 MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 FARM TRACTOR

13.3.1 ADOPTION OF MECHANIZED FARMING TO DRIVE SEGMENT

TABLE 260 FARM TRACTOR THERMAL SYSTEMS MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 261 MARKET, 2022–2027 (‘000 UNITS)

TABLE 262 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 263 MARKET, BY REGION, 2022–2027 (USD MILLION)

14 ALL-TERRAIN VEHICLE (ATV) THERMAL SYSTEMS MARKET, BY REGION (Page No. - 241)

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 ASSUMPTIONS

14.1.3 INDUSTRY INSIGHTS

FIGURE 40 ALL-TERRAIN VEHICLE THERMAL SYSTEMS MARKET, 2022 VS. 2027 (USD MILLION)

TABLE 264 MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 265 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 266 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 267 MARKET, BY REGION, 2022–2027 (USD MILLION)

14.2 ELECTRIC ATV

14.2.1 DEVELOPMENTS IN BATTERIES AND NEW ELECTRIC MODEL LAUNCHES TO DRIVE MARKET

14.3 GASOLINE ATV

14.3.1 HIGHER EFFICIENCY AND WIDE APPLICATION AREAS TO DRIVE SEGMENT

15 THERMAL SYSTEMS MARKET, BY REGION (Page No. - 246)

15.1 INTRODUCTION

15.1.1 RESEARCH METHODOLOGY

15.1.2 ASSUMPTIONS

15.1.3 INDUSTRY INSIGHTS

FIGURE 41 MARKET, 2022 VS. 2027 (USD MILLION)

TABLE 268 MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 269 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 270 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 271 MARKET, BY REGION, 2022–2027 (USD MILLION)

15.2 ASIA PACIFIC

FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 272 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 273 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 274 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 275 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

15.2.1 CHINA

15.2.1.1 High passenger vehicle demand to drive market

TABLE 276 CHINA: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 277 CHINA: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 278 CHINA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 279 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.2.2 INDIA

15.2.2.1 Growth in vehicle sales and demand for comfort features to drive market

TABLE 280 INDIA: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 281 INDIA: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 282 INDIA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 283 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.2.3 JAPAN

15.2.3.1 Advanced features in cabin comfort to drive market

TABLE 284 JAPAN: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 285 JAPAN: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 286 JAPAN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 287 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.2.4 SOUTH KOREA

15.2.4.1 Demand for luxury cars to drive market

TABLE 288 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 289 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 290 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 291 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.2.5 THAILAND

15.2.5.1 Growing demand for automotive components to drive market

TABLE 292 THAILAND: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 293 THAILAND: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 294 THAILAND: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 295 THAILAND: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.2.6 REST OF ASIA PACIFIC

TABLE 296 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 297 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 298 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 299 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.3 EUROPE

FIGURE 43 EUROPE: MARKET, 2022–2027 (USD MILLION)

TABLE 300 EUROPE: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 301 EUROPE: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 302 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 303 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

15.3.1 GERMANY

15.3.1.1 High demand for premium cars to drive market

TABLE 304 GERMANY: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 305 GERMANY: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 306 GERMANY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 307 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.3.2 FRANCE

15.3.2.1 Increasing demand for premium comfort features to drive market

TABLE 308 FRANCE: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 309 FRANCE: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 310 FRANCE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 311 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.3.3 UK

15.3.3.1 Strict emission norms to drive market

TABLE 312 UK: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 313 UK: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 314 UK: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 315 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.3.4 SPAIN

15.3.4.1 Increasing production of passenger cars to drive market

TABLE 316 SPAIN: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 317 SPAIN: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 318 SPAIN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 319 SPAIN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.3.5 ITALY

15.3.5.1 Presence of premium vehicle manufacturers to drive market

TABLE 320 ITALY: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 321 ITALY: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 322 ITALY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 323 ITALY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.3.6 RUSSIA

15.3.6.1 Increasing sales of passenger cars to drive market

TABLE 324 RUSSIA: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 325 RUSSIA: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 326 RUSSIA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 327 RUSSIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.3.7 REST OF EUROPE

TABLE 328 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 329 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 330 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 331 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.4 NORTH AMERICA

FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

TABLE 332 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 333 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 334 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 335 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

15.4.1 US

15.4.1.1 High demand for green vehicles to drive market

TABLE 336 US: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 337 US: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 338 US: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 339 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.4.2 CANADA

15.4.2.1 Government policies and regulatory standards to drive market

TABLE 340 CANADA: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 341 CANADA: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 342 CANADA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 343 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.4.3 MEXICO

15.4.3.1 Advanced thermal system solutions to drive market

TABLE 344 MEXICO: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 345 MEXICO: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 346 MEXICO: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 347 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.5 ROW

FIGURE 45 ROW: MARKET, 2021–2026 (USD MILLION)

TABLE 348 ROW: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 349 ROW: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 350 ROW: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 351 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

15.5.1 IRAN

15.5.1.1 Heavy investments in automotive sector to drive market

TABLE 352 IRAN: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 353 IRAN: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 354 IRAN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 355 IRAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.5.2 BRAZIL

15.5.2.1 Presence of major automotive companies to drive market

TABLE 356 BRAZIL: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 357 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 358 BRAZIL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 359 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.5.3 ARGENTINA

15.5.3.1 Production of commercial vehicles to drive market

TABLE 360 ARGENTINA: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 361 ARGENTINA: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 362 ARGENTINA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 363 ARGENTINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.5.4 OTHERS

TABLE 364 REST OF WORLD: MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 365 REST OF WORLD: MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 366 REST OF WORLD: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 367 REST OF WORLD: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

16 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 295)

16.1 ASIA PACIFIC WILL BE MAJOR MARKET FOR THERMAL SYSTEMS

16.2 ELECTRIC & HYBRID VEHICLE THERMAL SYSTEM APPLICATIONS CAN BE KEY FOCUS AREA FOR MANUFACTURERS

16.3 CONCLUSION

17 COMPETITIVE LANDSCAPE (Page No. - 297)

17.1 OVERVIEW

17.2 THERMAL SYSTEMS MARKET SHARE ANALYSIS, 2021

TABLE 368 MARKET SHARE ANALYSIS FORMARKET, 2021

FIGURE 46MARKET SHARE ANALYSIS, 2021

17.3 NORTH AMERICA MARKET RANKING ANALYSIS, (TOP PLAYERS) 2021

17.3.1 FRONT & REAR AIR CONDITIONING: NORTH AMERICA MARKET RANKING AND KEY PLAYERS

TABLE 369 FRONT & REAR AIR CONDITIONING: NORTH AMERICA MARKET RANKING AND KEY PLAYERS, 2021

17.3.2 ENGINE COOLING: NORTH AMERICA MARKET RANKING AND KEY PLAYERS

TABLE 370 ENGINE COOLING: NORTH AMERICA MARKET RANKING AND KEY PLAYERS, 2021

17.3.3 BATTERY COOLING: NORTH AMERICA MARKET RANKING AND KEY PLAYERS

TABLE 371 BATTERY COOLING: NORTH AMERICA MARKET RANKING AND KEY PLAYERS, 2021

17.3.4 EGR SYSTEM: NORTH AMERICA MARKET RANKING AND KEY PLAYERS

TABLE 372 EGR SYSTEM: NORTH AMERICA MARKET RANKING AND KEY PLAYERS, 2021

17.3.5 HEATED/VENTILATED SEATS: NORTH AMERICA MARKET RANKING

TABLE 373 HEATED/VENTILATED SEATS: NORTH AMERICA MARKET RANKING, 2021

17.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

17.5 COMPETITIVE EVALUATION QUADRANT – THERMAL SYSTEM MANUFACTURERS

17.5.1 TERMINOLOGY

17.5.2 STARS

17.5.3 EMERGING LEADERS

17.5.4 PERVASIVE COMPANIES

17.5.5 PARTICIPANTS

TABLE 374 THERMAL SYSTEMS MARKET: COMPANY PRODUCT FOOTPRINT, 2021

TABLE 375 MARKET: COMPANY APPLICATION FOOTPRINT, 2021

TABLE 376 MARKET: COMPANY REGION FOOTPRINT, 2021

FIGURE 47 THERMAL SYSTEM MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2021

17.6 COMPETITIVE EVALUATION QUADRANT: ELECTRIC AND HYBRID VEHICLE THERMAL SYSTEM MANUFACTURERS

17.6.1 STARS

17.6.2 EMERGING LEADERS

17.6.3 PERVASIVE COMPANIES

17.6.4 PARTICIPANTS

FIGURE 48 ELECTRIC VEHICLE THERMAL SYSTEM MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2021

17.7 COMPETITIVE SCENARIO

17.7.1 NEW PRODUCT LAUNCHES

TABLE 377 PRODUCT LAUNCHES, 2020- 2022

17.7.2 DEALS

TABLE 378 DEALS, 2020-2022

17.7.3 EXPANSIONS

TABLE 379 EXPANSIONS, 2020–2022

17.8 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2018–2022

TABLE 380 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSION AS KEY GROWTH STRATEGIES, 2018–2022

18 COMPANY PROFILES (Page No. - 317)

(Business overview, Products offered, Recent Developments, MNM view)*

18.1 THERMAL SYSTEMS MARKET – KEY PLAYERS

18.1.1 DENSO CORPORATION

TABLE 381 DENSO CORPORATION: BUSINESS OVERVIEW

FIGURE 49 DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 382 DENSO CORPORATION – PRODUCT LAUNCHES

TABLE 383 DENSO CORPORATION– DEALS

TABLE 384 DENSO CORPORATION: EXPANSIONS

18.1.2 MAHLE GMBH

TABLE 385 MAHLE GMBH: BUSINESS OVERVIEW

FIGURE 50 MAHLE GMBH: COMPANY SNAPSHOT

TABLE 386 MAHLE GMBH – PRODUCT LAUNCHES

TABLE 387 MAHLE GMBH: DEALS

TABLE 388 MAHLE GMBH: EXPANSIONS

18.1.3 VALEO SA

TABLE 389 VALEO SA: BUSINESS OVERVIEW

FIGURE 51 VALEO: COMPANY SNAPSHOT

18.1.4 HANON SYSTEMS

TABLE 390 HANON SYSTEMS: BUSINESS OVERVIEW

FIGURE 52 HANON SYSTEMS: COMPANY SNAPSHOT

TABLE 391 HANON SYSTEMS: DEALS

TABLE 392 HANNON SYSTEMS: EXPANSIONS

18.1.5 BORGWARNER INC.

TABLE 393 BORGWARNER INC.: BUSINESS OVERVIEW

FIGURE 53 BORGWARNER INC.: COMPANY SNAPSHOT

TABLE 394 BORGWARNER – PRODUCT LAUNCHES

TABLE 395 BORGWARNER INC.: DEALS

TABLE 396 BORGWARNER INC.: EXPANSIONS

18.1.6 GENTHERM INC.

TABLE 397 GENTHERM: BUSINESS OVERVIEW

FIGURE 54 GENTHERM: COMPANY SNAPSHOT

TABLE 398 GENTHERM – PRODUCT LAUNCHES

TABLE 399 GENTHERM: DEALS

18.1.7 SCHAEFFLER AG

TABLE 400 SCHAEFFLER AG: BUSINESS OVERVIEW

FIGURE 55 SCHAEFFLER AG: COMPANY SNAPSHOT

TABLE 401 SCHAEFFLER AG: PRODUCT LAUNCHES

TABLE 402 SCHAEFFLER AG: EXPANSIONS

18.1.8 JOHNSON ELECTRIC HOLDINGS LTD.

TABLE 403 JOHNSON ELECTRIC HOLDINGS: BUSINESS OVERVIEW

FIGURE 56 JOHNSON ELECTRIC HOLDINGS: COMPANY SNAPSHOT

TABLE 404 JOHNSON ELECTRIC HOLDINGS LTD.: PRODUCT LAUNCHES

18.1.9 DANA LIMITED

TABLE 405 DANA LIMITED: BUSINESS OVERVIEW

FIGURE 57 DANA LIMITED: COMPANY SNAPSHOT

TABLE 406 DANA LIMITED: PRODUCT LAUNCHES

TABLE 407 DANA LIMITED: DEALS

TABLE 408 DANA LTD.: EXPANSIONS

18.1.10 ROBERT BOSCH GMBH

TABLE 409 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 58 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 410 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

18.2 THERMAL SYSTEMS MARKET – ADDITIONAL PLAYERS

18.2.1 EBERSPÄCHER

TABLE 411 EBERSPÄCHER: COMPANY OVERVIEW

18.2.2 CONTINENTAL AG

TABLE 412 CONTINENTAL AG: COMPANY OVERVIEW

18.2.3 VOSS AUTOMOTIVE GMBH

TABLE 413 VOSS AUTOMOTIVE GMBH: COMPANY OVERVIEW

18.2.4 GRAYSON THERMAL SYSTEMS

TABLE 414 GRAYSON THERMAL SYSTEMS: COMPANY OVERVIEW

18.2.5 CAPTHERM SYSTEMS

TABLE 415 CAPTHERM SYSTEMS: COMPANY OVERVIEW

18.2.6 DUPONT

TABLE 416 DUPONT: COMPANY OVERVIEW

18.2.7 BEHR-HELLA THERMOCONTROL GMBH (BHTC)

TABLE 417 BEHR-HELLA THERMOCONTROL GMBH (BHTC): COMPANY OVERVIEW

18.2.8 BOYD CORPORATION

TABLE 418 BOYD CORPORATION: COMPANY OVERVIEW

18.2.9 SANDEN HOLDINGS CORPORATION

TABLE 419 SANDEN HOLDINGS CORPORATION: COMPANY OVERVIEW

18.2.10 SANHUA AUTOMOTIVE

TABLE 420 SANHUA AUTOMOTIVE: COMPANY OVERVIEW

18.2.11 SHANDONG HOUFENG GROUP

TABLE 421 SHANDONG HOUFENG GROUP: COMPANY OVERVIEW

18.3 THERMAL SYSTEMS MARKET – ADDITIONAL PLAYERS (NORTH AMERICA)

18.3.1 MAGNA INTERNATIONAL

TABLE 422 MAGNA INTERNATIONAL: COMPANY OVERVIEW

18.3.2 LEAR CORPORATION

TABLE 423 LEAR CORPORATION: COMPANY OVERVIEW

18.3.3 STANT CORPORATION

TABLE 424 STANT CORPORATION: COMPANY OVERVIEW

18.3.4 AIR INTERNATIONAL THERMAL SYSTEMS

TABLE 425 AIR INTERNATIONAL THERMAL SYSTEMS: COMPANY OVERVIEW

18.3.5 MICHIGAN AUTOMOTIVE COMPRESSOR, INC.

TABLE 426 MICHIGAN AUTOMOTIVE COMPRESSOR, INC: COMPANY OVERVIEW

18.3.6 MODINE MANUFACTURING COMPANY

TABLE 427 MODINE MANUFACTURING COMPANY: COMPANY OVERVIEW

18.3.7 WELLS VEHICLE ELECTRONICS

TABLE 428 WELLS VEHICLE ELECTRONICS: COMPANY OVERVIEW

18.3.8 T.RAD NORTH AMERICA, INC.

TABLE 429 T.RAD NORTH AMERICA, INC: COMPANY OVERVIEW

18.3.9 THERMAL SOLUTION MANUFACTURING, INC.

TABLE 430 THERMAL SOLUTIONS MANUFACTURING, INC: COMPANY OVERVIEW

18.3.10 AKG THERMAL SYSTEMS INC

TABLE 431 AKG THERMAL SYSTEMS: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

19 APPENDIX (Page No. - 392)

19.1 KEY INSIGHTS OF INDUSTRY EXPERTS

19.2 DISCUSSION GUIDE

19.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

19.4 AVAILABLE CUSTOMIZATIONS

19.4.1 ELECTRIC & HYBRID THERMAL SYSTEMS MARKET, BY APPLICATION COUNTRY-WISE DATA

19.4.1.1 Battery Thermal System

19.4.1.2 Transmission system

19.4.1.3 Engine Cooling

19.4.1.4 Front Air Conditioning

19.4.1.5 Motor Thermal System

19.4.1.6 Power Electronics

19.4.1.7 Rear Air Conditioning

19.4.1.8 Heated/Ventilated Seats

19.4.1.9 Heated Steering

19.4.1.10 Waste Heat Recovery

19.4.2 ELECTRIC & HYBRID THERMAL SYSTEMS MARKET, BY VEHICLE TYPE COUNTRY-WISE DATA

19.4.2.1 BEV

19.4.2.2 PHEV

19.4.2.3 FCEV

19.5 RELATED REPORTS

19.6 AUTHOR DETAILS

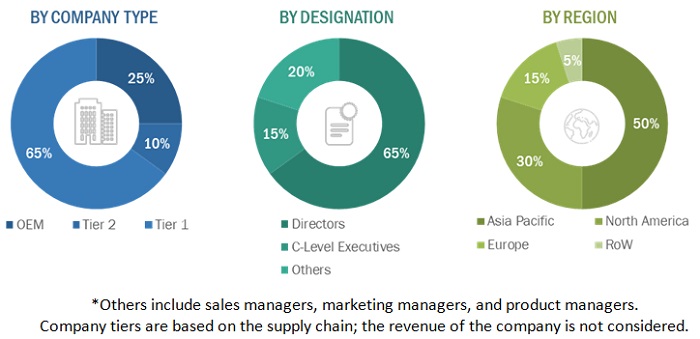

The study involves four main activities to estimate the current size of the thermal systems market. Exhaustive secondary research was done to collect information on the market, such as product type and application types. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Bottom-up and Top-down approach was employed to estimate the complete market size for different segments considered under this study. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to in this research study include international automotive thermal system organizations and published articles; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. The secondary data was collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive thermal system market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (thermal system integrators and component manufacturers) across major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 30% and 70% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and marketing, to provide a holistic viewpoint in our report.

After interacting with industry participants, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of the in-house subject-matter experts, led us to the findings as described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The size of the thermal systems market, in terms of volume, based on application is derived through bottom-up approach by estimating the country-level production (in units) of passenger cars, LCVs, trucks, and buses. The next step is to identify the various applications of thermal systems in different vehicle types. The country-level penetration of each thermal system application is derived for passenger cars, LCVs, trucks, and buses through secondary sources and is then validated through multiple primary interviews. At the country level, the penetration of each application is multiplied by the vehicle production numbers to estimate the volume of the thermal system market by application (ICE).

The average selling price of thermal systems used in various applications of a vehicle is identified at the country level. It is then multiplied with the volume of the country-level market by application to derive the country-level market in terms of value. The summation of country-level markets provides the regional-level market in terms of volume and value. Also, through this approach, the vehicle type market has been derived by the summation of the market by application in terms of value and volume at the regional level for each vehicle type. A similar approach has been used to estimate the electric & hybrid vehicle market by application and electric vehicle type.

Thermal Systems Market Size: Bottom-up Approach

Source: MarketsandMarkets Analysis

Report Objectives

-

To define, describe, and forecast the thermal systems market in terms of value (USD million) and volume (thousand units), based on the following segments:

- By Application (ICE) (engine cooling, front air conditioning, rear air conditioning, transmission system, heated/ventilated seats, heated steering, and waste heat recovery)

- By Vehicle Type (passenger car, LCV, truck, and bus)

- By Technology (ICE) (active transmission warmup, exhaust gas recirculation, engine thermal mass reduction, reduced HVAC system loading, and other technologies)

- By Component (ICE) (air filter, condenser, compressor, water pump, motor, heat exchanger, heater control unit, thermoelectric generator, EGR valve, A/C valve, oxygen sensor, temperature sensor, and charge air cooler)

- By Application (Electric & Hybrid Vehicle) (battery thermal system, transmission system, engine cooling, front air conditioning, motor thermal system, power electronics, rear air conditioning, heated/ventilated seats, heated steering, and waste heat recovery)

- By Electric & Hybrid Vehicle Type (PHEV, FCEV, 48V mild hybrid, and Electric Commercial vehicle)

- By Component (Electric and Hybrid Vehicle) (air filter, condenser, electric compressor, electric water pump, electric motor, heat exchanger, heater control unit, and thermoelectric generator)

- Off-highway Vehicle, By Equipment (Construction & Mining and Farm Tractor)

- All-Terrain Vehicle, By Region (Asia Pacific, Europe, North America, and RoW)

- By Region (Asia Pacific, Europe, North America, and RoW)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market ranking and market share of key players operating in the market

- To understand the dynamics of the market competitors and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio strength and business strategies

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry players in the thermal systems market.

- To conduct case study analysis, Porter’s five forces analysis, technology analysis, patent analysis, average premium analysis, and revenue analysis of top 5 players

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Electric & Hybrid Thermal System Market, By Application Country-Wise Data

- Battery Thermal System

- Transmission system

- Engine Cooling

- Front Air Conditioning

- Motor Thermal System

- Power Electronics

- Rear Air Conditioning

- Heated/Ventilated Seats

- Heated Steering

- Waste Heat Recovery

Note: Asia Pacific (China, India, Japan, and South Korea), NA (US & Canada), Europe (Germany, France, Norway, Spain, Sweden, UK)

Electric & Hybrid Thermal System Market, By Vehicle Type Country Wise Data

- BEV

- PHEV

- FCEV

Note: : Asia Pacific (China, India, Japan, and South Korea), NA (US & Canada), Europe (Germany, France, Norway, Spain, Sweden, UK)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermal Systems Market