Foam Glass Market by Type (open cell and Closed Cell), Process (Physical and Chemical), Application (Building & Industrial Insulation and Chemical Processing Systems), End-Use Industry (Building & Construction and Industrial) - Global Forecast to 2024

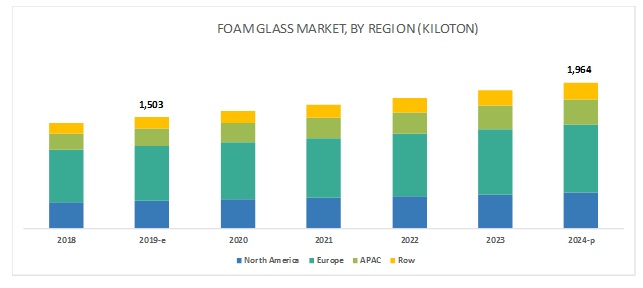

[90 Pages Report] The market size of foam glass is projected to grow from 1,503 kilotons in 2019 to 1,964 kilotons by 2024, at a CAGR of 5.5% during the forecast period. Foam glass is an inorganic, permissible material made from recycled glass by annealing used glass and adding foaming agents to molten form. It is used as an insulating material, and it offers excellent resistance against extreme temperatures, moisture, corrosion, and most chemicals. Among the insulating materials, foam glass has a higher resistance to fire than other insulating materials. Hence, these desirable properties make foam glass a suitable material for use in end-use industries such as industrial, building & construction, pharmaceutical, and packaging, among others.

The industrial segment is projected to be the fastest-growing end-use industry of foam glass during the forecast period.

In the industrial segment, foam glass is used as an insulating material for applications such as bases of cryogenic tanks, maintenance of integral temperature in chemical processing systems, piping insulation, and providing safety against fire. It is fire-proof, moisture-proof, and has excellent corrosion resistance.The market for foam glass in the industrial end-use is projected to grow at the fastest rate in the next five years.

Closed cell foam glass is projected to be the largest segment of the foam glass market during the forecast period.

Among the foam glass types, closed cell foam glass is projected to grow at the fastest rate during the forecast period. Closed cell foam glass exhibits properties such as high-temperature resistance, fire resistance, and high load bearing strength, moisture resistance, corrosion resistance, and pest resistance. Closed cell foam glass is used in applications such as insulating inner walls of residential and commercial buildings, sound-proofing meeting halls, floor insulation, roof insulation, walls and bases of tanks, insulating pipes, roadbeds, backfills, embankments, and runway arrestor systems.

Europe is projected to be the largest market during the forecast period.

Europe accounted for the largest share in the foam glass market, and this trend is expected to continue during the forecast period. In Europe, Germany, Norway, and Sweden are estimated to be the key players in the region. Growing demand for environment-friendly insulating materials in various end-use industries are driving the market in the region.

Key Players

The leading Foam glass manufacturers are Owens Corning (US), Zhejiang Dehe Insulation Technology Co., Ltd. (China), Zhejiang Zhenshen Insulation Technology Corp. (China), UUSIOAINES OY (Finland), Glapor (Germany), MISAPOR (Switzerland), Polydros S.A.(Spain), Refaglass (Czech Republic), Earthstone international (US), and Anhui Huichang New Material Co., Ltd. (China).These players adopted key growth strategies from 2014 to 2019, which helped them increase their capacities and cater to the widening customer base.

Owens Corning (US) is one of the leading players in the foam glass market. The company is involved in the manufacturing of foam glass and is also the largest manufacturer of the same. The company has wide geographical reach covering APAC, North America, the Middle East & Africa, and Europe.

UUSIOAINES OY was established in 1995. It is headquartered at Forssa, Finland. The company sells foam glass under the brand name, Foamit, which is made from 99% recycled glass. The Foam Glass Aggregates (FGA) is a lightweight aggregate used for construction projects. It has applications in retaining walls and backfills, service yard construction, road and street construction, and other such applications. It is offered in 5 different sizes. It is used in floor insulation and frost insulation of roads. It is also used to prevent groundwater pollution by insulating fields. The company generates 50.0% of its revenues through exports, with Finland, Scandinavian countries, and Western Europe as the key markets.

Zhejiang Zhenshen Insulation Technology Corp. Ltd. (China) was established in 1997 and is located at Jiaxing city Zhejiang Province. The company manufactures insulation solutions for the petrochemical industry, building decoration, chimney anti-corrosion, and ship insulation. The company is a leading producer of cellular glass. It serves three variations of cellular glass, namely, ZES500, Cellular Glass (High Performance), Cellular Glass (National Standard). These products have insulation applications. The company is one of the major exporters of cellular glass in China. It is registered in 32 countries across Europe, North America, APAC, and the Middle East.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Unit considered |

Volume (kiloton) |

|

Segments |

Type, Process, End-use Industry, Application, and Region |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies Profiled |

Owens Corning (US), Zhejiang Dehe Insulation Technology Co., Ltd. (China), Zhejiang Zhenshen Insulation Technology Corp. (China), UUSIOAINES OY (Finland), Glapor (Germany), MISAPOR (Switzerland), Polydros S.A.(Spain), Refaglass (Czech Republic), Earthstone international (US), and Anhui Huichang New Material Co., Ltd. (China) |

This research report categorizes the global foam glass market on the basis of type, process, end-use industry, application, and region.

On the basis of type:

- Open Cell Foam Glass

- Closed Cell Foam Glass

On the basis of process:

- Physical

- Chemical

On the basis of end-use industry:

- Building & Construction

- Industrial

- Others

On the basis of application

- Building & Industrial Insulation

- Chemical Processing Systems

- Consumer Abrasive

On the basis of region:

- North America

- Europe

- APAC

- RoW

The market is further analyzed for the key countries in each of these regions.

Recent Developments

- In June 2019, UUSIOAINES planned to acquire Hasopor AB, a Switzerland-based manufacturer of foam glass. The acquisition will make UUSIOAINES the leading foam glass manufacturer in Europe.

- In June 2017, Owens Corning acquired Pittsburg Corning, a manufacturer of foam glass. This helped Owens Corning to expand its portfolio of product offerings. Pittsburg Corning operates as a subsidiary of Owens Corning with a presence in 17 countries around the world and is a market leader for foam glass.

Key Questions Addressed by the Report

- What are the global demand trends for the foam glass market? Will the market witness an increase or decline in demand in the coming years?

- What is the estimated demand for foam glass? Which type is used the most in end-use industries and in which application?

- What were the revenue pockets for the foam glass market in 2018?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- Who are the major foam glass manufacturers, globally?

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of Foam Glass?

Foam glass is an excellent thermal insulator and is functional from temperature ranging from -200 degree Celsius up to 430 degree Celsius. This makes it suitable for Industrial applications. Foam glass is light weight and impervious to most environmental damage. Thusit has a longer lifespan. This has led to the growth of foam glass market.

Which are the major processes to manufacture Foam Glass?

Foam glass are made out of recycled or used glass. There are mainly two methods of processing the foam glass. The physical process and chemical process. Chemical process is the more dominant process among the two.

What are the major applications for foam glass?

There are four major applications areas for foam glass namely, building and industrial insulation, chemical processing system insulation, consumer abrasive systems and others.

What are the types of foam glass?

There are two types of foam glass - Open celled foam glass and closed cell foam glass. Closed cell foam glass has higher resistance towards heat flow and is the dominant type of insulation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Covered

1.3.2 Years Considered For The Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.1.3 Bottom-Up Approach

2.1.4 Top-Down Approach

2.2 Data Triangulation

2.3 Research Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in the Foam Glass Market

4.2 Foam Glass Market, By Type

4.3 Foam Glass Market, By Country

5 Market Overview (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Highest Form of Insulation for Industrial Purposes

5.2.1.2 Protection Against Fire and Longer Life

5.2.2 Restraints

5.2.2.1 Fragile and Susceptible to Vibration Induced Damage.

5.2.3 Opportunities

5.2.3.1 Environmental Regulations Driving the Growth of Foam Glass

5.2.3.2 New Application Areas Providing Growth Opportunities

5.2.4 Challenges

5.2.4.1 High Cost of Foam Glass

5.2.4.2 Lack of Awareness

5.3 Porters Five Forces

5.3.1 Threat of New Entrants(Moderate)

5.3.2 Threat of Substitute (High)

5.3.3 Bargaining Power of Supplier (Low)

5.3.4 Bargaining Power of Buyer (Moderate)

5.3.5 Competitive Rivalry (Moderate)

6 Foam Glass Market, By Type (Page No. - 33)

6.1 Introduction

6.2 Open Cell

6.2.1 Use of Foam Glass In Dynamic Insulation Applications Is Driving the Consumption of the Open Cell Type

6.3 Closed Cell

6.3.1 High R-Value of Closed Cell Foam Glass Makes It the Dominant Insulation Type

7 Foam Glass Market, By Process (Page No. - 36)

7.1 Introduction

7.2 Physical Process

7.2.1 Limited Availability of Crts Is Affecting The Growth of the Segment

7.3 By Chemical Process

7.3.1 Chemical Foaming is the Dominant Process

8 Foam Glass Market, By Application (Page No. - 39)

8.1 Introduction

8.2 Building and Industrial Insulation

8.2.1 Excellent Insulation Properties Make Foam Glass an Ideal Insulation Material in Building and Industrial Application

8.3 Chemical Processesing System

8.3.1 Good Chemical Resistance Makes Foam Glass A Preferred Insulation Material in the Segment

8.4 Consumer Abrasive

8.4.1 Non-Toxic Foam Glass Finds Use as Abrasives

8.5 Others

9 Foam Glass Market, By End-Use Industry (Page No. - 43)

9.1 Introduction

9.2 Building & Construction

9.2.1 Residential and Commercial Construction

9.2.1.1 Excellent Insulation Properties Make Foam Glass A Suitable Material for Residential and Commercial Construction

9.2.2 Civil Construction

9.2.2.1 Anti-Corrosion Properties of Foam Glass is Driving the Usage in Civil Construction

9.3 Industrial

9.3.1 Europe to Lead the Foam Glass Market in the Industrial Segment

9.4 Others

10 Foam Glass Market, By Region (Page No. - 47)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Newer Applications for Foam Glass Attracting New Entrants in the Foam Glass Market in the Us

10.2.2 Canada

10.2.2.1 Government Initiatives to Drive the Demand for Foam Glass in Canada

10.2.3 Mexico

10.2.3.1 Industrial Segment to Lead the Foam Glass Market in Mexico

10.3 APAC

10.3.1 China

10.3.1.1 Government Policy to Drive the Consumption of Foam Glass in China

10.3.2 Japan

10.3.2.1 Need for Energy Efficiency in Building and Industrial Application is Driving the Demand for Foam Glass in the Country

10.3.3 South Korea

10.3.3.1 Industrial End-Use Industry Segment to Lead the Foam Glass Market in South Korea

10.3.4 Rest of APAC

10.4 Europe

10.4.1 Germany

10.4.1.1 Renovation of Existing Buildings Will Drive the Market in Germany

10.4.2 Sweden

10.4.2.1 Growing Consumption of Natural Gas Will Drive the Foam Glass Market in Sweden

10.4.3 Italy

10.4.2.1 Growing Consumption of Natural Gas Will Drive the Foam Glass Market in Sweden

10.4.4 Norway

10.4.4.1 Government Policies Regarding Energy-Efficient Residential Buildings to Drive the Foam Glass Market During the Forecast Period

10.4.5 Rest of the Europe

10.5 Rest of World

10.5.1 Middle East & Africa

10.5.1.1 Increasing Awareness for Glass Recycling in the Region to Drive the Foam Glass Market During the Forecast Period

10.5.2 South America

10.5.2.1 Need For Energy-Efficient Acoustic Insulation Will Drive the Foam Glass Market in the Region

11 Company Profiles (Page No. - 70)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Owens Corning

11.2 Zhejiang Zhenshen Insulation Technology Corp. Ltd. (ZES)

11.3 UUSIOAINES OY/Ltd

11.4 Zhejiang DEHE Insulation Technology Co., Ltd. (DEHE)

11.5 Glapor

11.6 MISAPOR

11.7 Polydros

11.8 Earthstone International

11.9 Refaglass

11.10 Anhui Huichang New Material Co., Ltd.

11.11 Other Players

11.11.1 Liaver

11.11.2 Ningbo Yoyo Foam Glass Co., Ltd

11.11.3 Stikloporas

11.11.4 Aero Aggregates

11.11.5 Veriso Schaumglass

11.11.6 Anglitemp

11.11.7 Specialty Products & Insulation (SPI)

11.11.8 Pinosklo

11.11.9 Geocell

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 85)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Related Reports

12.4 Author Details

List of Tables (72 Tables)

Table 1 Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 2 Open Cell Foam Glass Market Size, By Region, 20172024 (Kiloton)

Table 3 Closed Cell Foam Glass Market Size, By Region, 20172024 (Kiloton)

Table 4 Foam Glass Market Size , By Process, 20172024 (Kiloton)

Table 5 Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 6 Foam Glass Market Size in Building and Industrial Insulation, By Region, 20172024 (Kiloton)

Table 7 Foam Glass Market Size in Chemical Processing Systems, By Region, 20172024 (Kiloton)

Table 8 Foam Glass Market Size in Consumer Abrasive, By Region, 20172024 (Kiloton)

Table 9 Foam Glass Market Size in Others, By Region, 20172024 (Kiloton)

Table 10 Foam Glass Market Size, By End Use, 20172024 (Kiloton)

Table 11 Foam Glass Market Size in Building and Construction, By Region, 20172024 (Kiloton)

Table 12 Foam Glass Market Size in Industrial End Use, By Region, 20172024 (Kiloton)

Table 13 Foam Glass Market Size in Building and Industrial Insulation, By Region, 20172024 (Kiloton)

Table 14 Foam Glass Market Size, By Region, 20172024 (Kiloton)

Table 15 North America: Foam Glass Market Size, 20172024 (Kiloton)

Table 16 North America : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 17 North America : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 18 North America : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 19 US : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 20 US : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 21 US : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 22 Canada : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 23 Canada : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 24 Canada : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 25 Mexico : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 26 Mexico : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 27 Mexico : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 28 APAC: Foam Glass Market Size, 20172024 (Kiloton)

Table 29 APAC : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 30 APAC : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 31 APAC : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 32 China : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 33 China : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 34 China : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 35 Japan : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 36 Japan : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 37 Japan : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 38 South Korea : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 39 South Korea : Foam Glass Market Size, By Application,20172024 (Kiloton)

Table 40 South Korea : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 41 Rest of APAC : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 42 Rest of APAC : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 43 Rest of APAC : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 44 Europe: Foam Glass Market Size, 20172024 (Kiloton)

Table 45 Europe : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 46 Europe : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 47 Europe : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 48 Germany : Foam Glass Market Size, By End Use Industry,20172024 (Kiloton)

Table 49 Germany : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 50 Germany : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 51 Sweden : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 52 Sweden : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 53 Sweden : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 54 Italy : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 55 Italy : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 56 Italy : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 57 Norway : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 58 Norway : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 59 Norway : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 60 Rest of Europe : Foam Glass Market Size, By End Use Industry, 20172024(Kiloton)

Table 61 Rest of Europe : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 62 Rest of Europe : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 63 Rest of World : Foam Glass Market Size, By Region, 20172024 (Kiloton)

Table 64 Rest of World : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 65 Rest of World : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 66 Rest of World : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 67 Middle East & Africa : Foam Glass Market Size, By End Use Industry, 20172024 (Kiloton)

Table 68 Middle East & Africa : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 69 Middle East & Africa : Foam Glass Market Size, By Type, 20172024 (Kiloton)

Table 70 South America : Foam Glass Market Size, By End-Use Industry, 20172024 (Kiloton)

Table 71 South America : Foam Glass Market Size, By Application, 20172024 (Kiloton)

Table 72 South America : Foam Glass Market Size, By Type, 20172024 (Kiloton)

List of Figures (24 Figures)

Figure 1 Foam Glass: Market Segmentation

Figure 2 Foam Glass Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Data Triangulation: Foam Glass

Figure 6 Building & Industrial Insulation Accounted for the Largest Share in the Foam Glass Market in 2018

Figure 7 Industrial Segment to Be the Fastest-Growing End-Use Industry of Foam Glass Between 2019 and 2024

Figure 8 APAC to Be the Fastest-Growing Market for Foam Glass

Figure 9 Increasing Demand From APAC to Drive the Glass Market

Figure 10 SSN By Type Segment and China Accounted for the Largest Share in the Foam Glass Market in APAC in 2018

Figure 11 China to Grow at the Highest Rate During the Forecast Period

Figure 12 Overview of Factors Governing the Foam Glass Market

Figure 13 Porters Five Forces: Foam Glass Market

Figure 14 Global Foam Glass Market, Share By Type in 2018

Figure 15 Global Foam Glass Market, Share By Application in 2018

Figure 16 Global Foam Glass Market, Share By End-Use Industry in 2018

Figure 17 Europe to Lead the Foam Glass Market

Figure 18 Snapshot: North America Foam Glass Market

Figure 19 Snapshot : Foam Glass Market in Europe

Figure 20 Owens Corning: Company Snapshot

Figure 21 Owens Corning: SWOT Analysis

Figure 22 ZES: SWOT Analysis

Figure 23 UUSIOAINES OY: SWOT Analysis

Figure 24 DEHE: SWOT Analysis

This study involves four major activities in estimating the current market size of foam glass market. Exhaustive secondary research was carried out to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; publications by recognized websites; and databases were referred to for identifying and collecting information. Secondary research was used to obtain key information about the supply chain of the industry, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Primary Research

The foam glass market comprises several stakeholders such as raw material suppliers, processors, fabricators, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the automotive, photovoltaic, aerospace, general industrial, medical, and other industries. The supply side is characterized by advancements in technology and diverse end-use industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global foam glass market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of volume, were determined through primary and secondary research.

- All percentage shares were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials such as directors and marketing executives.

Data Triangulation

After arriving at the total market size through the estimation process, the overall market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated by using the top-down and bottom-up approaches. Then, it was verified through primary interviews. Thus, for every data segment, there were three sources-top-down approach, bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Objectives of the Study

- To define, describe, and forecast the size of the foam glass market, in terms of volume

- To provide detailed information regarding the significant factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market size on the basis of type, process, application, and end-use industry

- To forecast the market size of different segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the world (RoW)

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze the competitive developments such as expansion, and acquisition

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Geographical Analysis:

- Country-level analysis of the global foam glass market

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Growth opportunities and latent adjacency in Foam Glass Market