Fruit and Vegetable Seeds Market by Family Type (Solanaceae, Cucurbit, Root & Bulb, Brassica, Leafy, and Other Families), Form (Inorganic and Organic), Trait (Conventional and Genetically Modified), Crop Type, and Region - Global Forecast to 2025

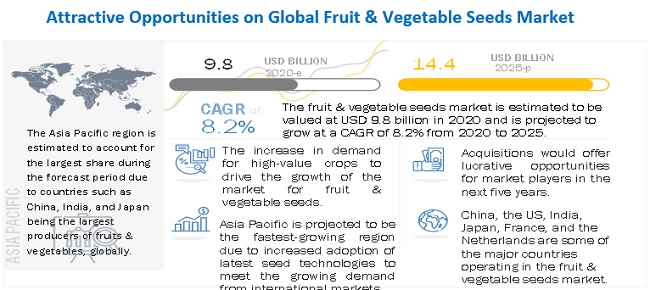

The global fruit and vegetable seeds market is anticipated to be worth $9.8 billion in 2020 and $14.4 billion by 2025, with an 8.2% CAGR from 2020 to 2025.

The global market is a thriving industry that encompasses the production, distribution, and sale of seeds used for growing various types of fruit and vegetable crops. These seeds play a crucial role in producing fresh and nutritious food, and their demand has been increasing in recent years due to the growing focus on healthy eating and sustainable agriculture. Factors driving the growth of the market include increasing population, urbanization, and greater consumer awareness about the health benefits of consuming fresh fruits and vegetables. In addition, advancements in seed technology and research have led to the development of new and improved seed varieties, which is also expected to drive growth in the market. In conclusion, the fruit and vegetable seeds market is set for robust growth in the coming years, driven by increasing consumer demand for fresh and healthy produce and advances in seed technology.

To know about the assumptions considered for the study, Request for Free Sample Report

Fruit and Vegetable Seeds Market Dynamics:

With the changes in the consumption patterns of consumers toward a healthy and nutritious diet, the demand for fresh fruits and vegetables has been growing. This has led to an increase in the land area being brought under cultivation of fruits and vegetables. The growing adoption of organic food & beverages is also pushing a large number of farmers to adopt organic farming techniques, due to which the market for organic seeds has been growing. The high demand for large quantities of fresh fruits and vegetables from across the globe has led to the increased need for higher yield, as a consequence of which, there has been an increase in R&D investment toward the development of genetically-modified seeds.

Driver: Increase in seed replacement ratio

Seeds act as the foundation for the progress of the food chain and play a significant role in the sustainability of the agri-food system. Farmers across the globe have been gradually shifting from traditional farming methods to gain higher yield and profit from the restricted resource availability, commercial seeds being one of the major trends in the industry. According to a report published by Syngenta, one of the leading players in the commercial seeds industry, the global seeds market has grown almost by 90% since 2000.

The seed replacement rate is defined as the percentage of new seeds procured for production to the total number of seeds used. As mentioned, traditionally, the focus was on production through farm-saved seeds only. However, as the benefits and value enhancement potential of seeds procured from specialized channels became increasingly clear, the resultant rise in the demand for seeds through such channels presents a huge opportunity.

Restraint: High R & D expenses for quality vegetable seed development leads to high seed price

The seed industry is one of the most R&D intensive industries. The R&D spends varies between companies depending on the company’s strategy and choice of techniques. This is in stark contrast with the crop protection industry, where a majority of the leading companies have a similar percentage of the sale on R&D. Due to erratic climatic conditions and high demand for food from end consumers, the adoption of genetically-modified seeds is higher among farmers. The cost of developing GM seeds is higher, thereby pushing up the price of the seed. Certain companies have a pioneering position in the development of GM seeds with specific traits (insect resistance and herbicide tolerance), due to which they are in a better position to charge a premium for their products (seeds). Hybrid seeds and organic seeds of different varieties of vegetables and fruits such as tomatoes, apples, grapes, and melons also cost higher than the average price of seed due to which farmers could make use of existing seeds from the previous harvest cycle to reduce the overall expenditure on seeds. This could have a negative impact on the growth of the market for fruit & vegetable seeds.

Opportunity: Increase in land under organic agriculture and the subsequent rise in demand for organic seeds

According to a report published by FiBL in 2017 on organic agriculture worldwide, there was an increase in organic farmland, the number of organic producers, and sales of organic products. Globally, approximately 1.4% of the total agricultural land is under organic cultivation. Some of the major crops cultivated under organic agriculture include cereals, oilseeds, dry pulses, and vegetables. Some of the fruit & vegetable crops gaining popularity in organic farming include grapes, sub-tropical and tropical fruits. Of the various regions which have adopted organic farming, Oceania is the largest, followed by Europe and Latin America. Some of the major countries that strongly propose and have large areas under organic farming include Argentina, Australia, China, and Spain, among others. These countries also witness strong demand for organic food & beverages, which further drives the growth for organic seeds and other crops.

Challenges: Presence of illegal seed practices in developing economies

According to the International Seed Federation (ISF), there has been an increase in illegal seed practices, including counterfeit seeds, fake seeds, fraudulent labeling, infringement of intellectual property, and regulatory offenses. Over the years, there has been an increase in the number of incidents reported the counterfeit of labels and bags of seeds being sold in developing nations. The phenomenon is largely driven by the fact that low-income farmers are not in a position to purchase seeds in large quantities. This paves the way for the sellers to breakdown the bags, repack them in smaller volumes and sell them in loose form. This creates an opportunity for adulteration. For instance, in Uganda, the illegal seeds industry deceives farmers by selling them seeds that promise high yields but fail to germinate. The fear of counterfeit among small-scale farmers makes the commercial seeds a seemingly unviable option.

The tomato segment of the fruit & vegetable seeds market is projected to have the highest CAGR during the forecast period, by type

There are 7,500 varieties of tomatoes, including beefsteak, plum tomatoes, pear tomatoes, cherry tomatoes, and grape tomatoes. Tomatoes require cross-pollination for growth. China, India, the U.S., Turkey, Egypt, Iran, Italy, and Uzbekistan are among the largest producers of tomatoes. Israel exports more than USD 2 billion worth of produce tomatoes are its fourth-largest commodity and is among the world’s top developers of better-looking, better-tasting, disease-resistant and more nutritious varieties. These factors are driving the growth of the market for tomato seeds during the forecast period.

The market for the Solanaceae segment is projected to account for the largest share during the forecast period

The Solanaceae family includes potatoes, eggplant, tomato, capsicum, and chili. According to the FAO, tomatoes and potatoes account for the largest produced vegetables across the globe. Countries such as China, India, and South Korea are among the major producers of potatoes

The family of Solanaceae has approximately 75 genera and 2,000 species of herbs, shrubs, and small trees. Solanaceae can be produced by both seed and stem cutting. The cutting method is used to produce shrub-like plants. Tomato, botanically a fruit, is a perennial plant grown in the tropical climatic conditions. Tomatoes are prone to developing fungi, which could hamper the growth of the plant. The application of fungicide seed protectant and rotation of crops could help reduce the impact of these diseases on tomatoes.

New species of pests and diseases are now impacting the production of these products, which are staple crops across the globe. For instance, the Colorado potato beetle threatened the production of tomatoes and eggplants. The adoption of integrated pest management such as farm hygiene practices, biological controls, and selection of appropriate quantities of chemicals could help in coping with pest infestation

Fruit & vegetable seeds market by form, inorganic seeds drive the fruit & vegetable market during the forecast period

Inorganic seeds need fertilizers to promote growth, insecticides to reduce pests and diseases, and chemical herbicides to manage weeds that affect growth. These seeds are grown mostly in conventional farms and are easily available. Consumers buy inorganic seeds as they are cheaper than organic seeds. The quality standards of inorganic foods are also slightly lower than those of organic foods, and they are sold with normal quality approval labels.

The conventional segment of the fruit and vegetable seeds market is projected to account for the largest share

By trait, the conventional segment accounted for the largest share in 2019. The fruit & vegetable seeds market, on the basis of trait, has been segmented into conventional and genetically modified. Conventional seeds account for a larger market size owing to the lower prevalence of genetically modified seeds in vegetables. According to International Service for the Acquisition of Agri-Biotech Applications (ISAAA), the approved list of GM fruit & vegetable seeds includes beans, eggplant, melons, potatoes, and tomatoes. Experts state that extensive research trials are being conducted for GM varieties of vegetable seeds; however, the adoption rate is not significant. The number of vegetables and fruits approved for GM is also significantly lower than cereals & grains and oilseeds & pulses, which have a higher prevalence of GM seeds. The benefits of adoption of GM seeds are becoming popular among the farmers, due to which the market for it is projected to grow at a higher rate during the forecast period.

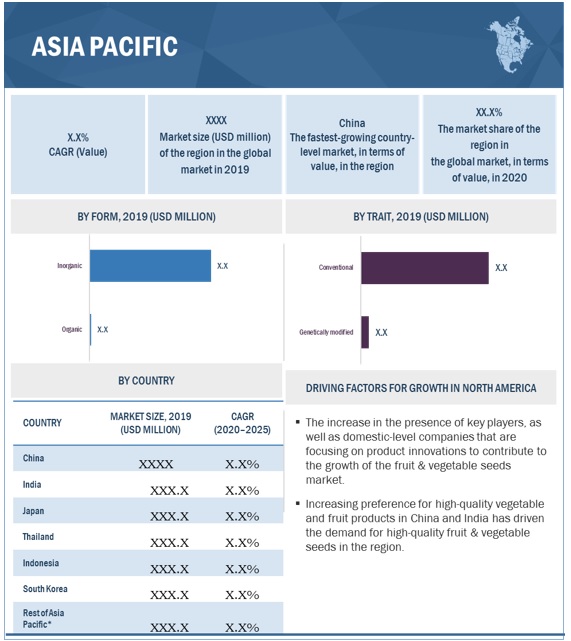

Asia Pacific is the fastest-growing market during the forecast period in the global fruit & vegetable seeds market

Asia Pacific is projected to account for the largest market size during the forecast period, owing to large-scale production of major vegetables such as tomatoes, potatoes, eggplants, and melons in countries such as China, India, South Korea, and Japan, among others. These countries serve as major exporters of fruits & vegetables to North America and the European Union. The region is also a host to some of the major seed producing companies such as UPL Corporation (Advanta Seeds) (India), Takii Seeds (Japan), and Sakata Seeds (Japan). These factors aid in driving the growth of the market during the forecast period

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key market players in the fruit & vegetable seeds market include BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), KWS SAAT SE (Germany), Corteva Agriscience (US), Sakata Seed Corporation (Japan), Groupe Limagrain (France), Takii & Co Ltd (Japan), UPL (Advanta Seeds) (India), DLF (Denmark), Mahyo (India), Longping Hitech (China), Enza Zaden (Netherlands), FMC Corporation (US), Vikima Seeds (Denmark), East-West Seeds (Thailand), RIJK ZWAAN ZAADTEELT EN ZAADHANDELBY (Netherlands), Stark Ayres (South Africa), Bejo Zaden BV (Netherlands), Tokita Sementi (Japan), Vina Seeds (Vietnam), Bioseed (India), Technisem (France), Simlaw Seeds (Kenya), and Mahinra Agri Business ( India)

Fruit & Vegetable Seeds Market Report Scope (Revenue, USD Billion, 2020- 2025)

|

Report Metric |

Details |

|

Market valuation in 2020 |

USD 9.8 billion |

|

Revenue prediction in 2025 |

USD 14.4 billion |

|

Progress rate |

CAGR of 8.2% from 2020-2025 |

|

Historical data |

2018-2025 |

|

Base year for estimation |

2019 |

|

Forecast period |

2020-2025 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report coverage |

Revenue forecast, company ranking, driving factors, competitive landscape, and analysis |

|

Segments covered |

Family Type, Form, Trait, Crop Type |

|

Regional scope |

Europe, North America, South America, Asia Pacific |

|

Leading organizations outlined |

BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), KWS SAAT SE (Germany), Corteva Agriscience (US), Sakata Seed Corporation (Japan), Groupe Limagrain (France), Takii & Co Ltd (Japan), UPL (Advanta Seeds) (India), DLF (Denmark), Mahyo (India), Longping Hitech (China), Enza Zaden (Netherlands), FMC Corporation (US), Vikima Seeds (Denmark), East-West Seeds (Thailand) |

|

Driving factors |

|

This research report categorizes the Fruit & Vegetable Seeds market based on type, family type, trait, form, and region.

|

Aspect |

Details |

|

By Type |

|

|

By Form |

|

|

By Trait |

|

|

By Family Type |

|

|

By Region |

|

Recent Developments

- In March 2020, BASF SE signed an agreement with Graines Voltz (France), a leading vegetable seeds distributor, to sell its HILD Samen business, a part of the vegetable seeds business of BASF’s Agricultural Solutions division. The agreement would help the company to strengthen its presence in Europe by making strong foothold through distribution of vegetable seeds.

- In May 2019 BASF SE collaborated with Rothamsted Research (UK), an agricultural research center, on sustainable agriculture, where the two would be utilizing their combined expertise to jointly address agricultural challenges.

- In February 2020, Bayer AG and Meiogenix (France), a biotech company focused on next-generation breeding technologies, announced a collaboration to advance agricultural research & development by accelerating the development of Meiogenix’s proprietary technologies related to plant breeding and genome editing applications.

Frequently Asked Questions (FAQ):

How do fruit and vegetable seeds help in increasing crop yields?

Fruit and vegetable seeds help in increasing crop yields by providing high-quality genetic material, which leads to improved plant growth, increased fruit or vegetable size, and higher resistance to pests and diseases.

What is the future outlook for the fruit and vegetable seeds market?

The future outlook for the fruit and vegetable seeds market is positive, with a growing demand for fresh and healthy food, advances in seed technology, and a focus on sustainable agriculture. The market is expected to grow at a steady pace over the next few years.

Who are some of the major exporters of vegetable seeds across the globe?

Countries such as China, the US, Netherlands, and France are among the major exporters of vegetable seeds across the globe.

Which countries dominate the fruit & vegetable seeds market in terms of value?

The fruit & vegetable seeds market is dominated by China, the US, France, Netherlands, India, and Japan are among the major countries occupying a significant share during the forecast period.

What are some of the potential opportunities in the fruit & vegetable seeds market?

Increase in the adoption of hydrid seed technology and the changing consumer tastes & preferences towards a quality diet could serve as potential opportunities in the fruit & vegetable seeds market.

Which region is projected to emerge as a global leader by 2025?

Asia Pacific region is projected to emerge as a global leader by 2025 owing to the region being a host to various seed companies and the high adoption rate for seed technologies in countries such as China, India, and Japan.

What are the driving factors in the market ?

Increase in the seed replacement ratio is one of the key factors driving the growth of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.1.1 MARKET INTELLIGENCE

1.1.2 COMPETITIVE INTELLIGENCE

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 FRUIT & VEGETABLE SEEDS MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2015–2019

1.6 STAKEHOLDERS

1.7 INCLUSIONS & EXCLUSIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN: FRUIT & VEGETABLE SEEDS MARKET

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 7 GLOBAL FRUIT & VEGETABLE SEEDS MARKET, 2018–2025 (USD MILLION)

FIGURE 8 TOMATO SEEDS TO THE LARGEST MARKET DUE TO GROWING ACREAGE DEDICATED TO ITS BREEDING AND HIGH DEMAND IN INTERNATIONAL MARKETS

FIGURE 9 SOLANACEAE ACCOUNTED FOR THE LARGEST SHARE DUE TO HIGH DEMAND FOR TOMATOES AND POTATOES GLOBALLY

FIGURE 10 CONVENTIONAL SEEDS TO ACCOUNT FOR THE LARGER SHARE IN 2020

FIGURE 11 INORGANIC FORM OF SEEDS TO HOLD THE LARGER SHARE DURING THE FORECAST PERIOD DUE TO HIGH ADOPTION OF CROP PROTECTION CHEMICALS IN CONVENTIONAL FARMING

FIGURE 12 FRUIT & VEGETABLE SEEDS MARKET SNAPSHOT: ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE, 2019 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 OPPORTUNITIES IN THE FRUIT & VEGETABLE SEEDS MARKET

FIGURE 13 INCREASE IN DEMAND FOR HIGH-VALUE CROPS TO DRIVE THE MARKET GROWTH FOR FRUIT & VEGETABLE SEEDS

4.2 FRUIT & VEGETABLE SEEDS MARKET, BY CROP TYPE

FIGURE 14 TOMATO HELD THE LARGEST SHARE IN THE FRUIT & VEGETABLE SEEDS MARKET IN 2019

4.3 ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET, BY KEY FAMILY TYPE & COUNTRY

FIGURE 15 ASIA PACIFIC: CHINA IS ONE OF THE LARGEST MARKETS FOR FRUIT & VEGETABLE SEEDS

4.4 FRUIT & VEGETABLE SEEDS MARKET, BY FORM & REGION

FIGURE 16 INORGANIC FORM ACCOUNTED FOR THE LARGER SHARE IN THE MARKET IN 2019 DUE TO HIGHER PREVALENCE OF CONVENTIONAL FARMING TECHNIQUES

4.5 FRUIT & VEGETABLE SEEDS MARKET, MAJOR REGIONAL SUBMARKETS

FIGURE 17 CHINA ACCOUNTED FOR THE LARGEST SHARE IN THE FRUIT & VEGETABLE SEEDS MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASE IN USAGE OF CROP PROTECTION CHEMICALS

FIGURE 18 TOTAL NUMBER OF ACTIVE INGREDIENTS AVAILABLE AT A GLOBAL LEVEL (1950–2010)

5.2.2 INCREASE IN THE USE OF COMMERCIAL SEEDS

FIGURE 19 COMMERCIAL SEEDS MARKET SIZE, 2013–2018 (USD MILLION)

5.3 MARKET DYNAMICS

FIGURE 20 GROWING DEMAND FOR FRUITS & VEGETABLES ACROSS THE GLOBE TO DRIVE THE MARKET

5.3.1 DRIVERS

5.3.1.1 Rise in demand for fruits & vegetables across the globe

FIGURE 21 INCREASE IN HARVESTED AREA FOR FRUITS & VEGETABLES, 2015–2019 (MILLION HA)

5.3.1.2 Increase in seed replacement ratio

5.3.2 RESTRAINTS

5.3.2.1 High R&D expenses on quality vegetable seed development lead to high seed price

FIGURE 22 MAJOR SEED MANUFACTURERS’ R&D EXPENDITURE, 2018 (USD MILLION)

5.3.3 OPPORTUNITIES

5.3.3.1 Increase in land under organic agriculture and the subsequent rise in demand for organic seeds

FIGURE 23 ORGANIC AGRICULTURE MARKET SHARE, BY REGION, 2017

FIGURE 24 TOP TEN COUNTRIES WITH AREA UNDER ORGANIC FARMING, 2017 (MILLION HA)

5.3.3.2 Growth in adoption of hybrid seed technology for vegetables

5.3.4 CHALLENGES

5.3.4.1 Presence of illegal seed practices in developing economies

5.3.4.2 Lack of availability and access to high-quality seeds

5.4 VALUE CHAIN

FIGURE 25 VALUE CHAIN

5.5 TRADE ANALYSIS

FIGURE 26 EXPORT OF VEGETABLE SEEDS, 2015–2018 (USD MILLION)

5.6 PATENT ANALYSIS

FIGURE 27 NUMBER OF PATENTS APPROVED FOR FRUIT & VEGETABLE SEEDS IN THE MARKET, 2015–2020

FIGURE 28 REGIONAL ANALYSIS OF PATENTS APPROVED IN THE SEEDS MARKET, 2015–2020

TABLE 2 LIST OF KEY PATENTS FOR SEEDS, 2017–2020

5.7 REGULATORY FRAMEWORK

5.7.1 NORTH AMERICA

5.7.1.1 US

5.7.1.2 Canada

5.7.2 EUROPEAN UNION

5.7.3 ASIA PACIFIC

5.7.3.1 India

5.7.3.2 China

5.7.3.3 Bangladesh

5.7.3.4 Thailand

5.7.4 BRAZIL

5.7.5 SOUTH AFRICA

5.8 TECHNOLOGY ANALYSIS

5.9 MARKET ECOSYSTEM

5.9.1 UPSTREAM

5.9.1.1 Major fruit & vegetable seed provider

5.9.1.2 Raw material providers

5.9.2 DOWNSTREAM

5.9.2.1 Regulatory bodies & certification providers

5.10 YC–YCC SHIFTS IN THE FRUIT & VEGETABLE SEEDS MARKET

FIGURE 29 DEMAND FOR HIGH-QUALITY FRUIT & VEGETABLE SEEDS FOR IMPROVING FOOD QUALITY IS THE NEW HOT BET IN THE MARKET

5.11 COVID-19 IMPACT ON THE FRUIT & VEGETABLE SEEDS MARKET

5.12 CASE STUDY ANALYSIS

5.12.1 HIGH-PERFORMANCE DEMAND BY INDUSTRY PLAYERS TO ENSURE BETTER QUALITY OF SEEDS

5.12.1.1 Problem statement

5.12.1.2 Solution offered

5.12.1.3 Outcome

5.12.2 KWS SAAT SE STARTED INCREASING PRODUCTION FACILITIES FOR ITS CUSTOMERS

5.12.2.1 Problem statement

5.12.2.2 Solution offered

5.12.2.3 Outcome

5.12.3 NEW VARIETY OF SEED DEMAND BY INDUSTRY PLAYERS TO ENSURE LONG PRODUCTION CYCLES OF SEEDS

5.12.3.1 Problem statement

5.12.3.2 Solution offered

5.12.3.3 Outcome

5.13 PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 THREAT OF SUBSTITUTES

5.13.3 BARGAINING POWER OF SUPPLIERS

5.13.4 BARGAINING POWER OF BUYERS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

6 FRUIT & VEGETABLE SEEDS MARKET, BY CROP TYPE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 30 TOMATO SEGMENT TO DOMINATE THE FRUIT & VEGETABLE SEEDS MARKET DURING THE FORECAST PERIOD

TABLE 3 FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 4 FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

6.2 POST-COVID-19 IMPACT ON FRUIT & VEGETABLE SEEDS, BY TYPE

6.2.1 OPTIMISTIC SCENARIO

TABLE 5 COVID-19 IMPACT ON THE FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION) (OPTIMISTIC SCENARIO)

6.2.2 REALISTIC SCENARIO

TABLE 6 COVID-19 IMPACT ON THE FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TYPE, 2020–2021 (USD MILLION) (REALISTIC SCENARIO)

6.2.3 PESSIMISTIC SCENARIO

TABLE 7 COVID-19 IMPACT ON THE FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TYPE, 2020–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

6.3 TOMATO

6.3.1 TOMATOES ARE THE MOST WIDELY PRODUCED VEGETABLE IN THE WORLD

TABLE 8 TOMATO SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 9 TOMATO SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.4 PEPPER

6.4.1 CONSUMER PREFERENCE FOR SPICY FOODS IS LEADING TO GROWING DEMAND FOR PEPPER, THEREBY DRIVING THE MARKET FOR ITS SEEDS

TABLE 10 PEPPER SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 PEPPER SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.5 ONION

6.5.1 COUNTRIES SUCH AS CHINA AND INDIA DRIVE THE DEMAND FOR ONION SEEDS IN THE WORLD

TABLE 12 ONION SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 ONION SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.6 CUCUMBER

6.6.1 THE INCREASE IN CONSUMPTION OF SALAD-BASED DIETS HAS BEEN DRIVING THE DEMAND FOR CUCUMBER

TABLE 14 CUCUMBER SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 CUCUMBER SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.7 LETTUCE

6.7.1 LETTUCE IS GAINING DEMAND IN GREENHOUSE CULTIVATION DUE TO GROWING FEAR OF POLLUTING AND LIMITED LAND AREA

TABLE 16 LETTUCE SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 LETTUCE SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.8 MELON

6.8.1 MELON ARE A RICH SOURCE OF VITAMINS

TABLE 18 MELON SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 MELON SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.9 CARROT

6.9.1 RICH IN CAROTENOIDS, CARROTS ARE GOOD SOURCES OF ANTIOXIDANTS

FIGURE 31 GLOBAL CARROT PRODUCTION SHARE, BY REGION, 2018

TABLE 20 CARROT SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 CARROT SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.10 OTHER CROP TYPES

6.10.1 THE GROWING HOUSEHOLD DEMAND FOR FRESH VEGETABLES IS DRIVING THE MARKET

TABLE 22 OTHER CROP SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 OTHER CROP SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7 FRUIT & VEGETABLE SEED MARKET, BY FAMILY TYPE (Page No. - 90)

7.1 INTRODUCTION

FIGURE 32 SOLANACEAE SEGMENT TO DOMINATE THE FRUIT & VEGETABLE SEED DURING THE FORECAST PERIOD

TABLE 24 FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FAMILY TYPE, 2016–2019 (USD MILLION)

TABLE 25 FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FAMILY TYPE, 2020–2025 (USD MILLION)

7.2 BRASSICA

7.2.1 REDUCED FEED COST MAKES BRASSICAS AN ECONOMICAL OPTION FOR FEED MANUFACTURERS

TABLE 26 BRASSICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 BRASSICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.3 CUCURBIT

7.3.1 SEEDLESS HYBRID VARIANTS OF CUCUMBER TO BE USED FOR POLYHOUSE CULTIVATION IN ASIAN COUNTRIES

TABLE 28 CUCURBIT: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 CUCURBIT: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.4 LEAFY

7.4.1 INTRODUCTION OF SMART TECHNOLOGIES HAS ALLOWED FOR THE IMPROVEMENT IN THE YIELD OF LEAFY VEGETABLES

TABLE 30 LEAFY VEGETABLES: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 LEAFY VEGETABLES: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.5 ROOT & BULB

7.5.1 WITH A GREATER EMPHASIS ON HEALTHY SNACKING HABITS, CARROTS ARE BECOMING POPULAR IN SALADS

TABLE 32 ROOT & BULB: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 ROOT & BULB: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.6 SOLANACEAE

7.6.1 SOLANACEAE INGREDIENTS HAVE BEEN GAINING IMPORTANCE IN THE PROCESSED FOOD INDUSTRY FOR THEIR NUTRITIONAL PROPERTIES

TABLE 34 SOLANACEAE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 SOLANACEAE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.7 OTHER FAMILIES

7.7.1 THE GROWING HOUSEHOLD DEMAND FOR FRESH VEGETABLES IS DRIVING THE MARKET

TABLE 36 OTHER FAMILIES: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 OTHER FAMILIES: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8 FRUIT & VEGETABLE SEEDS MARKET, BY TRAIT (Page No. - 100)

8.1 INTRODUCTION

FIGURE 33 CONVENTIONAL FRUIT & VEGETABLE SEEDS TO DOMINATE DURING THE FORECAST PERIOD

TABLE 38 FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TRAIT, 2016–2019 (USD MILLION)

TABLE 39 FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TRAIT, 2020–2025 (USD MILLION)

8.2 GENETICALLY MODIFIED

8.2.1 GENETICALLY MODIFIED SEEDS BEING USED TO COMBAT VITAMIN DEFICIENCIES IN CONSUMERS

TABLE 40 GENETICALLY MODIFIED: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 GENETICALLY MODIFIED: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.3 CONVENTIONAL

8.3.1 COMPANIES ARE FOCUSING THEIR R&D ON INTRODUCING COST-SAVING HYBRID SEEDS

TABLE 42 ENVIRONMENTAL IMPACT OF CONVENTIONAL SOYBEAN

TABLE 43 CONVENTIONAL: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 CONVENTIONAL: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9 FRUIT & VEGETABLE SEEDS MARKET, BY FORM (Page No. - 107)

9.1 INTRODUCTION

FIGURE 34 INORGANIC SEGMENT TO DOMINATE THE FRUIT & VEGETABLE SEEDS DURING THE FORECAST PERIOD

TABLE 45 FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 46 FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

9.2 COVID-19 IMPACT ON FRUIT & VEGETABLE SEEDS MARKET, BY FORM

9.2.1 OPTIMISTIC SCENARIO

TABLE 47 COVID-19 IMPACT ON THE FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

9.2.2 REALISTIC SCENARIO

TABLE 48 COVID-19 IMPACT ON THE FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

9.2.3 PESSIMISTIC SCENARIO

TABLE 49 COVID-19 IMPACT ON THE FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2018–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

9.3 ORGANIC

9.3.1 RISE IN TREND TOWARD ORGANIC PRODUCTS IS FUELING GROWTH OF THE ORGANIC MARKET IN DEVELOPING COUNTRIES

TABLE 50 ORGANIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 ORGANIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.4 INORGANIC

9.4.1 DUE TO LOW-QUALITY APPROVAL LABELS, INORGANIC SEEDS ARE CHEAPLY AVAILABLE THAN ORGANIC SEEDS

TABLE 52 INORGANIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 53 INORGANIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10 FRUIT & VEGETABLE SEEDS MARKET, BY REGION (Page No. - 113)

10.1 INTRODUCTION

FIGURE 35 INDIA IS PROJECTED TO WITNESS HIGH GROWTH RATE IN THE FRUIT & VEGETABLE SEEDS MARKET BETWEEN 2020 AND 2025

TABLE 54 FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.2 COVID-19 IMPACT ON FRUIT & VEGETABLE SEEDS MARKET, BY REGION

10.2.1 OPTIMISTIC SCENARIO

TABLE 56 COVID-19 IMPACT ON THE FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

10.2.2 REALISTIC SCENARIO

TABLE 57 COVID-19 IMPACT ON THE FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

10.2.3 PESSIMISTIC SCENARIO

TABLE 58 COVID-19 IMPACT ON THE FRUIT & VEGETABLE SEEDS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

10.3 NORTH AMERICA

FIGURE 36 NORTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SNAPSHOT

TABLE 59 NORTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 60 NORTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: ORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 62 NORTH AMERICA: ORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY,2020–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: INORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 64 NORTH AMERICA: INORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY,2020–2025 (USD MILLION)

TABLE 65 NORTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 66 NORTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 67 NORTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FAMILY TYPE, 2016–2019 (USD MILLION)

TABLE 68 NORTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FAMILY TYPE, 2020–2025 (USD MILLION)

TABLE 69 NORTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TRAIT, 2016–2019 (USD MILLION)

TABLE 70 NORTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TRAIT, 2020–2025 (USD MILLION)

TABLE 71 NORTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 72 NORTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.3.1 US

10.3.1.1 Significant presence of major seed companies in the US

TABLE 73 US: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 74 US: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 75 US: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016- 2019 (USD MILLION)

TABLE 76 US: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Adoption of cutting-edge technologies in plant breeding in the Canadian market

TABLE 77 CANADA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 78 CANADA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 79 CANADA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016- 2019 (USD MILLION)

TABLE 80 CANADA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 Rise in demand for healthy and nutritious food in Mexico

TABLE 81 MEXICO: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 82 MEXICO: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 83 MEXICO: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016- 2019 (USD MILLION)

TABLE 84 MEXICO: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.4 EUROPE

TABLE 85 EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 86 EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 87 EUROPE: ORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 88 EUROPE: ORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 89 EUROPE: INORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 90 EUROPE: INORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 91 EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 92 EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 93 EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FAMILY TYPE, 2016–2019 (USD MILLION)

TABLE 94 EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FAMILY TYPE, 2020–2025 (USD MILLION)

TABLE 95 EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TRAIT, 2016–2019 (USD MILLION)

TABLE 96 EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TRAIT, 2020–2025 (USD MILLION)

TABLE 97 EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 98 EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.4.1 SPAIN

10.4.1.1 Development of high-quality value seeds in Spain has resulted in added benefits in maintaining the health of the seeds

TABLE 99 SPAIN: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 100 SPAIN: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 101 SPAIN: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 102 SPAIN: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.4.2 GERMANY

10.4.2.1 Germany is one of the principal exporters of high-quality fruits & vegetables

TABLE 103 GERMANY: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 104 GERMANY: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 105 GERMANY: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 106 GERMANY: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.4.3 FRANCE

10.4.3.1 Rise in adoption of organic farming due to growing demand for bio-based products in France

TABLE 107 FRANCE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 108 FRANCE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 109 FRANCE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 110 FRANCE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.4.4 ITALY

10.4.4.1 Rise in production of major vegetables in Italy

TABLE 111 ITALY: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 112 ITALY: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 113 ITALY: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 114 ITALY: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.4.5 UK

10.4.5.1 Increasing number of high-quality seed producers drives the market for fruit & vegetable seeds in the UK

TABLE 115 UK: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 116 UK: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 117 UK: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 118 UK: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.4.6 NETHERLANDS

10.4.6.1 The Netherlands is largely focusing on the production of vegetable seeds

TABLE 119 NETHERLANDS: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 120 NETHERLANDS: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 121 NETHERLANDS: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 122 NETHERLANDS: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.4.7 DENMARK

10.4.7.1 Denmark is largely focusing on the production of high-quality vegetable seeds

TABLE 123 DENMARK: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 124 DENMARK: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 125 DENMARK: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 126 DENMARK: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.4.8 REST OF EUROPE

10.4.8.1 Rise in the expansion of seed-producing companies in this region

TABLE 127 REST OF EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 128 REST OF EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 129 REST OF EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 130 REST OF EUROPE: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.5 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SNAPSHOT

TABLE 131 ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 132 ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 133 ASIA PACIFIC: ORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 134 ASIA PACIFIC: ORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 135 ASIA PACIFIC: INORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 136 ASIA PACIFIC: INORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 137 ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 138 ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 139 ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FAMILY TYPE, 2016–2019 (USD MILLION)

TABLE 140 ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FAMILY TYPE, 2020–2025 (USD MILLION)

TABLE 141 ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TRAIT, 2016–2019 (USD MILLION)

TABLE 142 ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TRAIT, 2020–2025 (USD MILLION)

TABLE 143 ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 144 ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.5.1 CHINA

10.5.1.1 Increase in demand for high-quality vegetables in China

TABLE 145 CHINA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 146 CHINA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 147 CHINA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 148 CHINA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.5.2 INDIA

10.5.2.1 Rise in demand for Indian vegetable seeds in other international markets

TABLE 149 INDIA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 150 INDIA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 151 INDIA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 152 INDIA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.5.3 JAPAN

10.5.3.1 Japan is focusing on the adoption of inorganic strategies for the development of high-quality fruit & vegetable seeds

FIGURE 38 JAPAN: SEED EXPORTS, 2017

TABLE 153 JAPAN: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 154 JAPAN: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 155 JAPAN: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 156 JAPAN: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.5.4 THAILAND

10.5.4.1 Strong export market for Solanaceae crops in Thailand

TABLE 157 THAILAND: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 158 THAILAND: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 159 THAILAND: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 160 THAILAND: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.5.5 INDONESIA

10.5.5.1 Rise in awareness of health and nutritional benefits of fruits & vegetables

TABLE 161 INDONESIA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 162 INDONESIA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 163 INDONESIA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 164 INDONESIA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.5.6 SOUTH KOREA

10.5.6.1 Increase in government initiatives fuels the growth of developing high varieties of fruit & vegetable seeds in the country

TABLE 165 SOUTH KOREA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 166 SOUTH KOREA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 167 SOUTH KOREA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 168 SOUTH KOREA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.5.7 REST OF ASIA PACIFIC

10.5.7.1 Increase in technological developments in seed production in Rest of Asia Pacific

TABLE 169 REST OF ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 170 REST OF ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 171 REST OF ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.6 SOUTH AMERICA

TABLE 173 SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 174 SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 175 SOUTH AMERICA: ORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 176 SOUTH AMERICA: ORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY,2020–2025 (USD MILLION)

TABLE 177 SOUTH AMERICA: INORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 178 SOUTH AMERICA: INORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY,2020–2025 (USD MILLION)

TABLE 179 SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 180 SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 181 SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FAMILY TYPE, 2016–2019 (USD MILLION)

TABLE 182 SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FAMILY TYPE, 2020–2025 (USD MILLION)

TABLE 183 SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TRAIT, 2016–2019 (USD MILLION)

TABLE 184 SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TRAIT, 2020–2025 (USD MILLION)

TABLE 185 SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 186 SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 High demand for vegetable seeds among consumers

TABLE 187 BRAZIL: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 188 BRAZIL: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 189 BRAZIL: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 190 BRAZIL: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.6.2 ARGENTINA

10.6.2.1 Argentinian companies are promoting the adoption of genetically modified crops

TABLE 191 ARGENTINA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 192 ARGENTINA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 193 ARGENTINA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 194 ARGENTINA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.6.3 REST OF SOUTH AMERICA

10.6.3.1 High Demand for Vegetable Seeds from the European Region

TABLE 195 REST OF SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 196 REST OF SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE,2020–2025 (USD MILLION)

TABLE 197 REST OF SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 198 REST OF SOUTH AMERICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.7 REST OF THE WORLD (ROW)

TABLE 199 ROW: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 200 ROW: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 201 ROW: ORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 202 ROW: ORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 203 ROW: INORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 204 ROW: INORGANIC FRUIT & VEGETABLE SEEDS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 205 ROW: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 206 ROW: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 207 ROW: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FAMILY TYPE, 2016–2019 (USD MILLION)

TABLE 208 ROW: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FAMILY TYPE, 2020–2025 (USD MILLION)

TABLE 209 ROW: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TRAIT, 2016–2019 (USD MILLION)

TABLE 210 ROW: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY TRAIT, 2020–2025 (USD MILLION)

TABLE 211 ROW: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 212 ROW: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.7.1 MIDDLE EAST

10.7.1.1 High demand for fruit & vegetable seeds in the food and feed industry

TABLE 213 MIDDLE EAST: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 214 MIDDLE EAST: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 215 MIDDLE EAST: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 216 MIDDLE EAST: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

10.7.2 AFRICA

10.7.2.1 South African regulations to support the growth of the fruit & vegetable seeds market in the region

TABLE 217 AFRICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2016–2019 (USD MILLION)

TABLE 218 AFRICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY CROP TYPE, 2020–2025 (USD MILLION)

TABLE 219 AFRICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2016–2019 (USD MILLION)

TABLE 220 AFRICA: FRUIT & VEGETABLE SEEDS MARKET SIZE, BY FORM, 2020–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 198)

11.1 OVERVIEW

11.2 RANKINGS OF KEY PLAYERS

FIGURE 39 CARGILL DOMINATED THE FRUIT & VEGETABLE SEEDS MARKET IN 2019

11.3 MARKET SHARE ANALYSIS

11.4 REVENUE ANALYSIS

11.5 COMPANY EVALUATION QUADRANT- DEFINITIONS AND METHODOLOGY

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 40 FRUIT & VEGETABLE SEEDS MARKET COMPANY EVALUATION QUADRANT, 2019

11.6 COMPANY EVALUATION QUADRANT- SME/START-UPS

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 41 FRUIT & VEGETABLE SEEDS MARKET COMPANY EVALUATION QUADRANT (START-UPS/SMES), 2019

11.6.5 COMPETITIVE SCENARIO AND TRENDS

11.6.5.1 NEW PRODUCT LAUNCHES

TABLE 221 NEW PRODUCT LAUNCHES, 2018–2020

11.6.6 EXPANSIONS

TABLE 222 EXPANSIONS, 2018–2020

11.6.7 ACQUISITIONS

TABLE 223 ACQUISITIONS, 2018–2020

11.6.8 PARTNERSHIPS, AGREEMENTS, COLLABORATIONS, AND JOINT VENTURES

TABLE 224 PARTNERSHIPS, AGREEMENTS, COLLABORATIONS, AND JOINT VENTURES, 2018–2020

12 COMPANY PROFILES (Page No. - 210)

12.1 OVERVIEW

(Business overview, Products offered, Recent Developments, SWOT analysis, Right to Win)*

12.2 KEY PLAYERS

12.2.1 BASF SE

FIGURE 42 BASF SE: COMPANY SNAPSHOT

FIGURE 43 BASF SE: SWOT ANALYSIS

12.2.2 BAYER AG

FIGURE 44 BAYER AG: COMPANY SNAPSHOT

FIGURE 45 BAYER AG: SWOT ANALYSIS

12.2.3 SYNGENTA GROUP

FIGURE 46 SYNGENTA GROUP: COMPANY SNAPSHOT

FIGURE 47 SYNGENTA AG: COMPANY SNAPSHOT

12.2.4 KWS SAAT SE

FIGURE 48 KWS SAAT SE: COMPANY SNAPSHOT

FIGURE 49 KWS SAAT SE: COMPANY SNAPSHOT

12.2.5 CORTEVA AGRISCIENCE

FIGURE 50 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

FIGURE 51 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

12.2.6 SAKATA SEED CORPORATION

FIGURE 52 SAKATA SEED CORPORATION: COMPANY SNAPSHOT

FIGURE 53 SAKATA SEED CORPORATION: COMPANY SNAPSHOT

12.2.7 GROUPE LIMAGRAIN

FIGURE 54 GROUPE LIMAGRAIN: COMPANY SNAPSHOT

FIGURE 55 GROUPE LIMAGRAIN: COMPANY SNAPSHOT

12.2.8 TAKII & CO, LTD

12.2.9 UPL (ADVANTA SEEDS)

FIGURE 56 ADVANTA SEEDS: COMPANY SNAPSHOT

12.2.10 DLF

FIGURE 57 DLF: COMPANY SNAPSHOT

12.3 OTHER PLAYERS

12.3.1 MAHYCO

12.3.2 LONGPING HIGH-TECH

12.3.3 ENZA ZADEN

12.3.4 FMC CORPORATION

FIGURE 58 FMC CORPORATION: COMPANY SNAPSHOT

12.3.5 VIKIMA SEEDS A/S

12.3.6 EAST-WEST SEED

12.3.7 RIJK ZWAAN ZAADTEELT EN ZAADHANDEL B.V.

12.3.8 STARKE AYRES

12.3.9 BEJO ZADEN B.V.

12.3.10 TOKITA SEMENTI

12.3.11 VINASEED

12.3.12 BIOSEED

12.3.13 TECHNISEM

12.3.14 SIMLAW SEEDS

12.3.15 MAHINDRA AGRI BUSINESS

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, Right to Win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 264)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

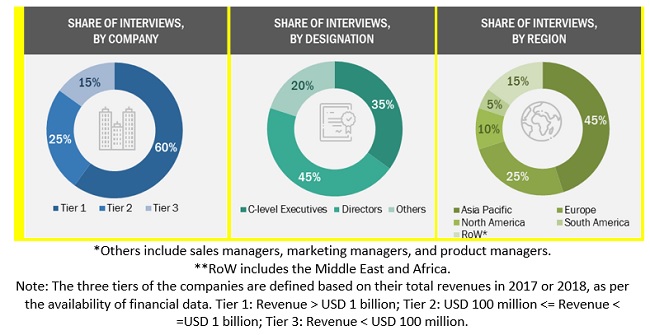

This research study involved the extensive use of secondary sources, directories, and databases, such as Bloomberg Businessweek and Factiva, to identify and collect information useful for a technical, market-oriented, and commercial study of the fruit & vegetable seeds market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), and C-level executives of key players and industry consultants—to obtain and verify critical qualitative and quantitative information, as well as to assess prospects. The following figure depicts the market research methodology applied in drafting this report on the fruit & vegetable seeds market.

Secondary Research

The secondary sources referred to, for this research study, include government sources and international organizations, such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), Agricultural and Processed Food Products Export Development Authority (APEDA), International Seed Federation (ISF), International Service for the Acquisition of Agri-biotech Applications (ISAAA), Euroseeds, and American Seed Trade Association (ASTA) among others. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. Secondary research was primarily used to obtain key information about the industry’s value chain—the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, and geographical markets, according to the industry trends from the market-oriented perspectives.

Primary Research

Extensive primary research was conducted after acquiring information about the fruit & vegetable seeds market scenario through secondary research. The interviews were conducted with market experts from the demand-side (farmers, commercial research institutions, government research institutions) and supply-side (manufacturers of seeds, distributors and suppliers of seeds) across countries in the studied regions. This primary data was collected through questionnaires, e-mails, and telephonic interviews.

Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of food antioxidant producers and end-use industries.

The primary sources from the supply side included executives from research institutions involved in R&D to introduce technology, key opinion leaders, distributors, and fruit & vegetable seeds product manufacturers.

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

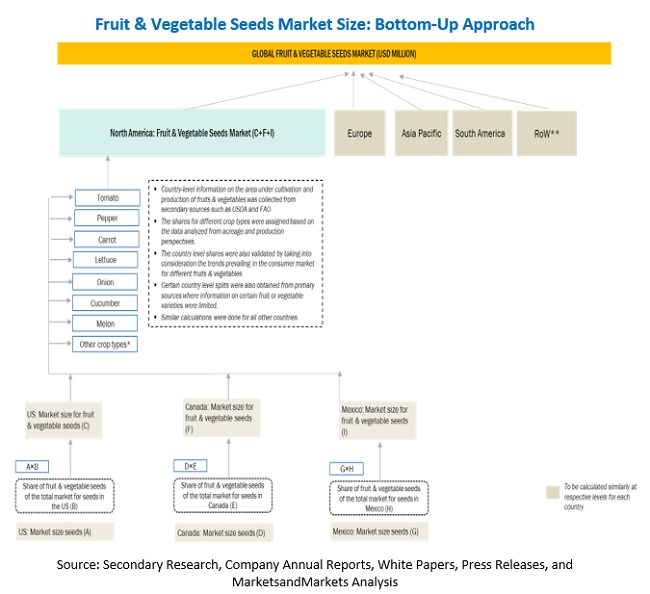

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the fruit & vegetable seeds market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size include the following:

- Key players were identified through extensive secondary research.

- The industry’s value chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources and extensive product mapping.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- Data from the parent market—seeds—has also been taken into consideration to arrive at the estimated market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and estimate the size of the fruit & vegetable seeds market with respect to its type, family type, trait, form, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments, such as new product launches, acquisitions, , expansions, partnerships, joint ventures, collaborations, and product approvals, in the fruit & vegetable seeds market

The Rise of Sustainable Agriculture: Exploring the Organic Fruit and Vegetable Seeds Market

The organic fruit and vegetable seeds market is a growing industry that caters to consumers who are interested in purchasing seeds that are certified organic and free from synthetic chemicals. This market includes a wide range of products, including seeds for fruits, vegetables, herbs, and flowers that are grown without the use of pesticides, fertilizers, or genetically modified organisms (GMOs). The demand for organic fruit and vegetable seeds has been increasing in recent years as consumers become more aware of the benefits of organic farming and the impact of synthetic chemicals on the environment and human health. Additionally, the rise in popularity of home gardening and the desire for fresh, locally grown produce has contributed to the growth of the organic seed market.

Organic fruit and vegetable seeds can be purchased from a variety of sources, including specialty seed companies, online retailers, and local garden centers. In addition to the seeds themselves, many companies also offer information and resources for growing organic produce, such as planting guides and tips for natural pest control.

The global organic fruit and vegetable seeds market is projected to continue to grow in the coming years, driven by increasing consumer demand for organic and sustainable food options. Additionally, technological advancements in seed breeding and genetics are expected to further expand the variety and availability of organic seed options.

The fruit seeds market and the fruit and vegetable seeds market are related but distinct industries that can impact each other in a number of ways.

The fruit seeds market involves the production and sale of seeds specifically for growing fruit-bearing plants, such as apple, pear, and citrus trees. These seeds are often purchased by commercial growers and nurseries who specialize in fruit production.

On the other hand, the fruit and vegetable seeds market encompasses a wider range of seeds for both fruits and vegetables, including tomatoes, peppers, berries, and melons. These seeds are used by both home gardeners and commercial growers.

While the two markets have some overlap, their impact on each other may be limited. However, some factors that can impact both markets include:

Climate and Weather Conditions: Changes in climate and weather patterns can affect both the fruit and vegetable seeds market and the fruit seeds market. For example, drought or extreme temperatures can impact the viability of seeds, as well as the growth and yield of fruit crops.

Consumer Demand: Trends in consumer demand for specific fruits and vegetables can impact the demand for seeds in both markets. For example, a surge in popularity of blueberries can increase the demand for both blueberry seeds and blueberry plant seeds.

Technological Advancements: Advances in seed breeding and genetics can impact both markets by expanding the range of available varieties, improving crop yield, and enhancing disease and pest resistance.

Overall, while the fruit and vegetable seeds market and the fruit seeds market are distinct, they are both part of the larger seed industry and can be influenced by similar factors.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

Geographic Analysis

- Further breakdown of the fruit & vegetable seeds market in Rest of Europe which includes countries such as Poland, Portugal, Sweden, Russia, Switzerland, Ukraine, and Turkey

- Further breakdown of the fruits & vegetable seeds market in Rest of Asia Pacific, which includes countries such as Malaysia, Myanmar, Singapore, Vietnam, and the Philippines

- Further breakdown of the fruit & vegetable seeds market in Rest of South America, which includes Peru, Chile, and Venezuela

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fruit and Vegetable Seeds Market