Function Generators Market by Type, Output Frequency (Up-to 50 MHz, 50-100 MHz, Above 100 MHz), End-User (Aerospace, Defense & Government Services, Automotive, Energy, Wireless Communication & Infrastructure), Region - Global Forecast to 2024

Function Generators Market

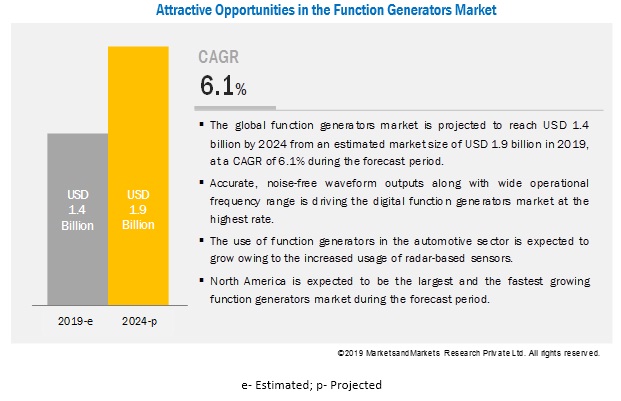

Global Function Generators Market is expected to grow at a CAGR of 6.1 %

Function Generators Market and Top Companies:

- National Instruments (US)

- Good Will Instruments (Taiwan)

- Keysight Technology (US)

- Kikusui Electronics (Japan)

- Teradyne (US)

- Tektronix (US)

- B&K Precision (US)

- Fluke Corporation (US)

- Teledyne Technologies (US)

- Rigol (China)

National Instruments (US): National Instruments supplies computer and electronic-based instrumentation hardware and software products for testing and calibration of electronic devices. All the products offered by National Instruments are majorly based on a common technology platform, namely, PCI extensions for Instruments (PXI) that helps to make the device compact.

Keysight Technologies (US): Keysight Technologies is an electronic measurement company offering electronic design and test solutions to communications, networking, and electronics industries. The company is mainly involved in the design, development, manufacture, installation, deployment, validation, optimization, and secure operation of electronics systems. It operates through four business segments, namely, communications solutions group, electronic industrial solutions, service solutions, and Ixia solutions group. The electronic industrial solutions group offers function generators.

Kikusui Electronics (Japan): Kikusui Electronics manufactures and markets electronic measuring instruments and power source equipment. The company provides products for business concepts, such as energy creation, energy storage, and energy saving. It provides function generators under test and measurement instruments, which also include equipment such as electrical safety testers, EMC testers, harmonics and flicker testers, fuel cell impedance meters, battery/capacitor testers, signal generators, and multimeters.

Teradyne (US): Teradyne is a major manufacturer of automation and electronic testing equipment used primarily in the semiconductor and electronics market. The company operates through four business segments, namely, semiconductor test, industrial automation, system test, and wireless test. It offers test solutions for industries such as production board tests, storage tests, and defense & aerospace.

Tektronix (US): Teradyne is a major manufacturer of automation and electronic testing equipment used primarily in the semiconductor and electronics market. The company operates through four business segments, namely, semiconductor test, industrial automation, system test, and wireless test. It offers test solutions for industries such as production board tests, storage tests, and defense & aerospace.

B&K Precision (US): B&K Precision designs and manufactures electronic test and measurement instruments. The company predominantly offers power supplies, DC electronic loads, oscilloscopes, signal generators, multimeters, component testers, data recorders, RF test instruments, device programmers, counters, electrical & battery testers, environmental testers, video & cable, and accessories. B&K Precision also offers supporting services such as calibration and repair services.

Fluke Corporation (US): Fluke Corporation designs and sells electronic test and measurement instruments and systems. The company’s product portfolio includes digital voltmeters, electronic counters, digital thermometers, data loggers, and PC-based data acquisition systems and software for the scientific, educational, government, and industrial markets. It offers products to various end-users such as the electronic industry, biomedical industry, process instruments, and networks.

Teledyne Technologies (US): Teledyne Technologies offers high-end technologies for the growth of industrial markets such as aerospace and defense, factory automation, monitoring of air and water quality, and many other types of research that require advanced technology. The company operates through four business segments, namely, instrumentation, digital imaging, aerospace and defense electronics, and engineered systems.

Rigol (China): Rigol Technologies designs and manufactures electronic equipment used for monitoring, testing, and calibration purposes. The company mainly offers products such as digital oscilloscopes, waveform generators, multimeters & data acquisition, DC power & loads, spectrum analyzers, and RF signal generators.

Function Generator Market by Type

Analog: An analog type of function generator has two main hardware components, namely, the power supply and a Printed Circuit Board (PCB) containing the function generator IC and the microcontroller. Analog function generators boast a relatively simpler construction than digital function generators owing to which they cost less when compared to the digital type of function generators. Also, analog function generators have a simpler operation due to which these types of function generators are preferred by end-users such as the education and research industry specifically for laboratory experiments.

Digital: A digital function generator is based on a digital platform for waveform generation. Direct Digital Synthesis (DDS) is the most versatile and most widely used technique for digital function generators. The key advantage of digital function generators is their ability to offer high levels of accuracy and stability when compared with analog function generators. However, the complexity in the construction, as well as the high cost, is a major disadvantage of digital function generators.

Function Generator Market by Output Frequency:

Up to 50MHz: The up to 50 MHz function generators are typically used in applications such as electronic testing, R&D, and education. In the automotive industry, the development of autonomous cars has increased the demand for sensors and radar-based systems, deployed for safe operation. These sensors and radars are majorly based on an ultrasonic frequency having a spectrum range of around 40 kHz.

50 to 100 MHz : The consumer electronics and associated products such as televisions, wireless mouse, and mobile phones depend on the wireless frequency ranging from 50 to 100 MHz. Function generators are used for testing and measurement purposes of finding the optimum operating scenario of electronics equipment. Rising need for testing and monitoring these equipment, increasing use of in-car entertainment in the automotive industry, and growing investments in R&D are likely to boost the deployment of 50–100 MHz operational frequency function generators.

Above 100 MHz : Major RF operations are done at typical frequencies greater than 100 MHz. These function generators are mainly used for end-use applications such as advanced research in the field of wireless communication devices, consumer electronics, laboratory electronic test and design, and testing and calibration of electronic equipment used by the aerospace and defense industry.

Function Generator Market by End-User:

Aerospace, defense & government services : It is one of the major end-users deploying test and measurement equipment such as function generators for testing and calibration purposes. The aerospace industry uses several electronic devices such as radio, satellite system components, amplifiers, and filters to establish a robust communication channel to ensure operational safety. Function generators play a crucial role in the testing and calibration of these communication devices and pilot-aiding mechanisms, like auto-pilot.

Automotive: Function generators are used to test in-car entertainment and driver assisting aids such as reverse parking sensors and remote keys. The demand for function generators in recent years has risen mainly due to testing requirements in the R&D of autonomous vehicle technologies and hybrid power-train systems. Global automakers are increasingly using function generators to ensure the quality, safety, and reliability of sensors and radars that are used in autonomous vehicle technologies. Function generators are also used to test the communication link between critical devices such as sensors and radars and the main computing unit.

Energy: Function generators are used in the energy sector for testing electronic components of various devices such as electronically assisted drilling or workover units, solar photovoltaic inverters, panels, and metering devices. Key technologies such as Artificial Intelligence (AI) and automation are gaining traction in energy sector operations. This has resulted in the implementation of electronic devices such as Programmable Logic Controllers (PLCs) and Motor Control Centers (MCCs) for safe and efficient operations. Function generators are used to ensure proper testing and working of these electronic components by simulating real-time operations at laboratory conditions.

Wireless Communication and Infrastructure: Globally, access to wireless communication has evolved with equipment such as satellite communication phones, mobile phones, and broadband and Internet facilities. These equipment have critical electronic components such as mic, band-pass filters, and network scanners for effective operations. Function generators are increasingly used to test the reliability and operational flexibility of these components. They are also used to test mobile device phenomena, such as electromagnetic radiation, to ensure that they remain under safe limits as prescribed by regulations.

Others: The others segment includes consumer electronics & appliances and medical equipment manufacturing. Consumer electronics & appliances include devices that are used on a day-to-day basis such as computers, laptops, smart televisions, portable mobile chargers, and home theater systems. Medical Equipment Manufacturing has witnessed one of the fastest evolutions in terms of electronic technology adoption in the past three decades. Medical equipment such as pacemakers, ventilators, and heart-rate monitoring devices are tested for their prescribed operation by means of function generators.

[161 Pages Report] The global function generators market size is projected to reach USD 1.9 billion by 2024 from an estimated market size of USD 1.4 billion in 2019, at a CAGR of 6.1% during the forecast period. The factors driving the market growth is the growing adoption of high-performance and power-efficient devices for aerospace, defense & government services along with investments in automotive (electric vehicles) sector due to the concern towards the hazardous environmental effect.

The aerospace, defense & government services segment is expected to be the largest market during the forecast period

The function generator market has been segmented, by end-user, into automotive, energy, wireless communication and infrastructure, aerospace and defense & government services, and others. The aerospace and defense & government services segment is expected to be the most significant function generators market, by end-user, during the forecast period.

This dominance can be attributed to a keen awareness towards developments across the world and rapid investments in the aerospace, defense & government services devices, which will increase the demand for corresponding services leading to an increase in the need for function generators.

The up-to 50 MHz segment is expected to be the largest and fastest-growing segment in the function generators market, by output frequency, during the forecast period

The function generators industry has been segmented, by output frequency, into up to 50 MHz, 50–100 MHz, and above 100 MHz. The up to 50 MHz segment is estimated to be the largest and fastest-growing during the forecast period.

Function generators with operational frequency ranging up-to 50 MHz are used typically in end-uses such as aerospace, defense & government services, automotive, energy, wireless communication & infrastructure, and other end-users. Increasing research and development in the medical as well as consumer electronics field along with advancements in the automotive in-car entertainment such as speakers, head units and more require function generators with output frequency up-to 50 MHz hence, increasing the demand for the same in the near future.

The analog segment is expected to hold the largest share of the function generators market during the forecast period

The market has been segmented, by type, into analog and digital. The analog segment is estimated to be the fastest-growing during the forecast period.

The analog segment accounted for the major share of the market in 2018. Analog function generators boast a relatively simpler construction than digital function generators owing to which they cost less when compared to the digital type. Also, due to their simpler operation, analog generators are preferred by end-users such as the education & research industry specifically for R&D and product development.

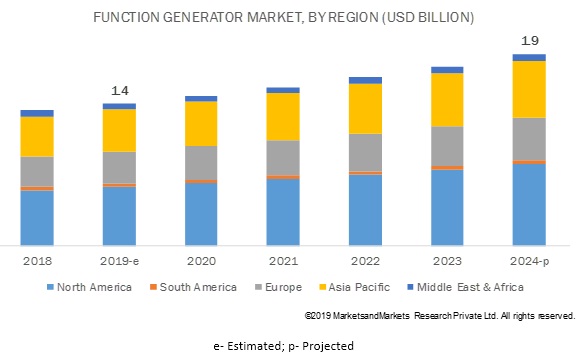

North America is expected to be the fastest-growing function generators market during the forecast period

In this report, the function generators industry has been analyzed with respect to five regions, namely, Asia Pacific, North America, Europe, South America, and the Middle East & Africa. North America is expected to dominate the global function generators market during the forecast period. The growth of this market can be attributed to the adoption of function generators for precise measurement of electrical components in the aerospace & defense and electronics manufacturing industries in North America, which in turn, have led to the growth of function generators industry in this region. Also, the growing number of 5G connections which would require wireless test equipment, test performance, and network management solutions such as function generators.

Key Market Players

The major players in the global function generators market include Keysight Technologies (US), National Instruments (US), Fortive (Fluke & Tektronix) (US), Teledyne (US), Good Will Instrument (Taiwan), and Teradyne (US).

Keysight Technologies (US) is a key player in the function generators market. The company’s recent new product launches, as part of its organic business strategy, is expected to increase its clientele base globally. Keysight Technologies launched a unique dynamic power device analyzer recently to strengthen and enhance its test and measurement product portfolio in the North American region. In May 2019, Keysight technologies launched a new dynamic power device analyzer with a double-pulse tester which is designed to be modular and test many devices having a different characterization of tests that are performed at a variety of power levels.

Yokogawa (Japan) was formerly known as Yokogawa Electric Works Ltd. and changed its name to Yokogawa Electric Corporation in 1986. It operates its business through three business segments, namely industrial automation and control business; test and measurement business; and aviation and other business. The company has a strong global presence with its critical operations in Algeria, US, Japan, Singapore, and the UK. The company has regional offices in countries such as Afghanistan, Algeria, Russia, Belgium and China.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, output frequency, end-user, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, and the Middle East & Africa |

|

Companies covered |

Keysight Technologies (US), National Instruments (US), Fortive (Fluke & Tektronix) (US), Teradyne (US), Good Will Instrument (Taiwan), Teradyne (US) |

This research report categorizes the function generators market by type, output frequency, end-user, and region.

By Type:

- Analog

- Digital

By Current:

- Up to 50 MHz

- 50–100 MHz

- Above 100 MHz

By End User:

- Automotive

- Energy

- Wireless Communication and Infrastructure

- Aerospace, Defense & Government Services

- Others

By Region:

- Asia Pacific

- North America

- Europe

- South America

- Middle East & Africa

Recent Developments

- In December 2019, National Instruments and Cadence Design Systems signed a partnership. The alliance is expected to help both the companies in improving the overall semiconductor development and testing of next-generation wireless, automotive, and mobile Integrated Circuits (ICs) and modules.

- In October 2019, Tektronix and Rapid Electronics partnered to provide the University of East Anglia (UEA) with 36 seated workstations across two laboratories for practical electronics experiments. The list of equipment included Tektronix AFG 1022, 25 MHz arbitrary function generators along with three other equipment.

- In October 2019, Tektronix launched a new software plugin for its AFG31000 arbitrary/function generators. The software reduces the amount of time required for testing when compared to alternative methods.

Key Questions Addressed by the Report

- Which revolutionary technology trends are expected over the next five years?

- Which elements of the function generators market are expected to lead by 2024?

- Which type of function generators is likely to get the maximum opportunity to grow during the forecast period?

- Which region is expected to lead with the highest market share by 2024?

- How are companies implementing organic and inorganic strategies to gain an increase in the share within the global function generators market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Definition

1.2.1 Function Generators Market, By Application: Inclusions & Exclusions

1.2.2 Function Generators Market, By Type: Inclusions & Exclusions

1.2.3 Function Generators Market, By Output Frequency: Inclusions & Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.1.1 Key Data From Primary Sources

2.1.1.2 Breakdown of Primaries

2.2 Scope

2.3 Market Size Estimation

2.3.1 Supply-Side Analysis

2.3.1.1 Assumptions

2.3.1.1.1 Key Primary Insights

2.3.1.2 Calculation

2.3.2 Demand Analysis

2.3.2.1 Key Parameters/Trends

2.3.3 Forecast

2.4 Market Breakdown and Data Triangulation

2.5 Some of the Insights of Industry Experts

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 38)

4.1 Attractive Opportunities in the Function Generators Market

4.2 Function Generators Market, By Region

4.3 North American Function Generators Market, By End-User & Country

4.4 Function Generators Market, By Type

4.5 Function Generators, By Output Frequency

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Investments in Research & Development (R&D) By End-Use Industries

5.2.1.2 Rising Dependence on Wireless Communication

5.2.2 Restraints

5.2.2.1 High Cost of Function Generators

5.2.2.2 Complex Operation

5.2.3 Opportunities

5.2.3.1 Growing Emphasis on Artificial Intelligence (AI) in Various Sectors

5.2.4 Challenges

5.2.4.1 Availability of Alternative Electronic Equipment

5.2.4.2 Rapidly Evolving Electronics Market

6 Function Generators Market, By Type (Page No. - 46)

6.1 Introduction

6.1.1 Analog

6.1.2 Low Cost and Simple Operation of Analog Function Generators are Expected to Drive Their Demand

6.2 Digital

6.2.1 Output Accuracy and Wide Frequency Output Range of Digital Function Generators are Expected to Propel the Market

7 Function Generators Market, By Output Frequency (Page No. - 51)

7.1 Introduction

7.2 Up to 50 Mhz

7.2.1 Increasing Need to Test Radar Equipment and Growing Scientific Research are Driving the Demand for Up to 50 Mhz Function Generators

7.3 50–100 Mhz

7.3.1 Increasing Emphasis on Enhancing Wireless Operations in Consumer Electronics is A Major Driver for Function Generators

7.4 Above 100 Mhz

7.4.1 Increasing Investments for Enhancing Communication Systems in the Aerospace & Defense Sector and Improving Radio Frequency (Rf) Operations are Expected to Drive the Function Generator Market

8 Function Generators Market, By End-User (Page No. - 57)

8.1 Introduction

8.2 Aerospace, Defense & Government Services

8.2.1 Rising Need for Testing the Wireless Communication Systems Used in the Aerospace Sector is Expected to Drive the Demand for Function Generators

8.3 Automotive

8.3.1 Increasing R&D in Sensor-Based Technologies for Autonomous Vehicles is Expected to Drive the Market for Function Generators

8.4 Energy

8.4.1 Need to Simulate Real-Time Operations is Expected to Drive the Demand for Function Generators

8.5 Wireless Communication and Infrastructure

8.5.1 Emphasis on Reliability and Flexibility of 5g Components is Driving the Demand for Function Generators

8.6 Others

8.6.1 Consumer Electronics & Appliances

8.6.2 Medical Equipment Manufacturing

9 Function Generators Market, By Region (Page No. - 64)

9.1 Introduction

9.2 North America

9.3 US

9.3.1 Demand for Testing Automotive and Aerospace Communication System Sensors is Driving the Market

9.4 Canada

9.4.1 Testing of High-Speed Wireless Services and Automotive Technologies is Expected to Drive the Demand for Function Generators

9.5 Mexico

9.5.1 Increasing Investment By Automotive Players in New Mobility Technology Testing is Expected to Drive the Market for Function Generators

9.6 South America

9.7 Brazil

9.7.1 Need for Product Development in Aerospace and Automotive Sectors is Driving the Demand for Function Generators

9.8 Argentina

9.8.1 Increasing Investment in Wireless Communication Testing is Expected to Drive the Market

9.9 Chile

9.9.1 Increasing Focus on R&D for the Aerospace Industry is Expected to Drive the Market

9.10 Europe

9.11 Germany

9.11.1 Growth in Autonomous Vehicles is Expected to Drive the Function Generators Market

9.12 UK

9.12.1 Rising Investments in the Aerospace Sector are Expected to Drive the Market

9.13 France

9.13.1 Need for Testing Equipment’s During the Stage of R&D is Expected to Drive the Market

9.14 Italy

9.14.1 Continued Research and Development in Driver-Assisting Technologies is Expected to Drive the Market

9.15 Spain

9.15.1 Increasing Focus on R&D Investment for the Support of Electric and Autonomous Vehicle is Expected to Drive the Market

9.16 Russia

9.16.1 Supportive Government Policies for Increasing Domestic Production of Aerospace and Automobiles are Driving the Russian Function Generator Market 89

9.17 Rest of Europe

9.18 Asia Pacific

9.19 China

9.19.1 Increasing Need to Test 5g Infrastructure Development and Automotive Powertrain and Infotainment Technologies is Driving the Market

9.2 Australia

9.20.1 Planned 5g Rollout and Need to Test New Mobility Concepts are Driving the Demand of Function Generators

9.21 Japan

9.21.1 Need to Test Sensors for Autonomous Vehicle Development and 5g Components is Driving the Market

9.22 India

9.22.1 R&D Initiatives in Aerospace Component Development and Automotive Technologies are Driving the Demand for Function Generators

9.23 South Korea

9.23.1 Development and Adoption of Driver Assisting Techniques and 5g Technology are Driving the Market

9.24 Rest of Asia Pacific

9.25 Middle East & Africa

9.26 Middle East

9.26.1 Growing Focus on the Aerospace Sector Manufacturing is Expected to Drive the Demand for Function Generators

9.27 Africa

9.27.1 Increasing Demand for Function Generators in Aerospace Testing is Driving the Market

10 Competitive Landscape (Page No. - 107)

10.1 Overview

10.2 Competitive Leadership Mapping (Overall Market)

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging Players

10.3 Market Share, 2018

10.4 Competitive Scenario

10.4.1 New Product Launches

10.4.2 Partnerships & Collaborations

11 Company Profile (Page No. - 112)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 National Instruments

11.2 Good Will Instrument

11.3 Keysight Technologies

11.4 Kikusui Electronics

11.5 Teradyne

11.6 Tektronix

11.7 B&K Precision

11.8 Fluke Corporation

11.9 Teledyne Technologies

11.10 Rigol Technologies

11.11 Promax Electronica

11.12 Tabor Electronics

11.13 AEMC Instruments

11.14 Scientech Technologies

11.15 Shijiazhuang Suin Instruments

11.16 Berkeley Nucleonics

11.17 Kuman

11.18 Sigma Instruments

11.19 Saelig

11.20 Maxim Integrated

11.21 National Test Equipment

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 54)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (104 Tables)

Table 1 Function Generators Market: Players/Companies Connected

Table 2 Function Generators Market Snapshot

Table 3 Global Market Size, By Type, 2017–2024 (USD Thousand)

Table 4 Analog: Function Generators Market Size, By Region, 2017–2024 (USD Thousand)

Table 5 Analog: Top Five Countries: Market Size, 2017–2024 (USD Thousand)

Table 6 Digital: Market Size, By Region, 2017–2024 (USD Thousand)

Table 7 Digital: Top Five Countries: Market Size, 2017–2024 (USD Thousand)

Table 8 Function Generators Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 9 Up to 50 Mhz: Market Size, By Region, 2017–2024 (USD Thousand)

Table 10 Up to 50 Mhz: Top Five Countries: Market Size, 2017–2024 (USD Thousand)

Table 11 50–100 Mhz: Market Size, By Region, 2017–2024 (USD Thousand)

Table 12 50– 100 Mhz: Top Five Countries: Market Size, 2017–2024 (USD Thousand)

Table 13 Above 100 Mhz: Market Size, By Region, 2017–2024 (USD Thousand)

Table 14 Above 100 Mhz: Top Five Countries: Market Size, 2017–2024 (USD Thousand)

Table 15 Function Generators Market Size, By End-User, 2017–2024 (USD Thousand)

Table 16 Aerospace, Defense & Government Services: Market Size, By Region, 2017–2024 (USD Thousand)

Table 17 Automotive: Market Size, By Region, 2017–2024 (USD Thousand)

Table 18 Energy: Market Size, By Region, 2017–2024 (USD Thousand)

Table 19 Wireless Communication and Infrastructure: Market Size, By Region, 2017–2024 (USD Thousand)

Table 20 Others: Market Size, By Region, 2017–2024 (USD Thousand)

Table 21 Global Market Size, By Region, 2017–2024 (USD Thousand)

Table 22 North America: Function Generators Market Size, By Type, 2017–2024 (USD Thousand)

Table 23 North America: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 24 North America: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 25 North America: Market Size, By Country, 2017–2024 (USD Thousand)

Table 26 US: Market Size, By Type, 2017–2024 (USD Thousand)

Table 27 US: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 28 US: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 29 Canada: Market Size, By Type, 2017–2024 (USD Thousand)

Table 30 Canada: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 31 Canada: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 32 Mexico: Market Size, By Type, 2017–2024 (USD Thousand)

Table 33 Mexico: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 34 Mexico: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 35 South America: Function Generators Market Size, By Type, 2017–2024 (USD Thousand)

Table 36 South America: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 37 South America: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 38 South America: Market Size, By Country, 2017–2024 (USD Thousand)

Table 39 Brazil: Market Size, By Type, 2017–2024 (USD Thousand)

Table 40 Brazil: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 41 Brazil: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 42 Argentina: Market Size, By Type, 2017–2024 (USD Thousand)

Table 43 Argentina: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 44 Argentina: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 45 Chile: Market Size, By Type, 2017–2024 (USD Thousand)

Table 46 Chile: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 47 Chile: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 48 Europe: Function Generators Market Size, By Type, 2017–2024 (USD Thousand)

Table 49 Europe: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 50 Europe: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 51 Europe: Market Size, By Country, 2017–2024 (USD Thousand)

Table 52 Germany: Market Size, By Type, 2017–2024 (USD Thousand)

Table 53 Germany: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 54 Germany: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 55 UK: Market Size, By Type, 2017–2024 (USD Thousand)

Table 56 UK: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 57 UK: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 58 France: Market Size, By Type, 2017–2024 (USD Thousand)

Table 59 France: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 60 France: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 61 Italy: Market Size, By Type, 2017–2024 (USD Thousand)

Table 62 Italy: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 63 Italy: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 64 Spain: Market Size, By Type, 2017–2024 (USD Thousand)

Table 65 Spain: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 66 Spain: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 67 Russia: Market Size, By Type, 2017–2024 (USD Thousand)

Table 68 Russia: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 69 Russia: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 70 Rest of Europe: Market Size, By Type, 2017–2024 (USD Thousand)

Table 71 Rest of Europe: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 72 Rest of Europe: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 73 Asia Pacific: Function Generators Market Size, By Type, 2017–2024 (USD Thousand)

Table 74 Asia Pacific: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 75 Asia Pacific: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 76 Asia Pacific: Market Size, By Country, 2017–2024 (USD Thousand)

Table 77 China: Market Size, By Type, 2017–2024 (USD Thousand)

Table 78 China: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 79 China: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 80 Australia: Market Size, By Type, 2017–2024 (USD Thousand)

Table 81 Australia: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 82 Australia: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 83 Japan: Market Size, By Type, 2017–2024 (USD Thousand)

Table 84 Japan: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 85 Japan: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 86 India: Market Size, By Type, 2017–2024 (USD Thousand)

Table 87 India: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 88 India: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 89 South Korea: Market Size, By Type, 2017–2024 (USD Thousand)

Table 90 South Korea: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 91 South Korea: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 92 Rest of Asia Pacific: Market Size, By Type, 2017–2024 (USD Thousand)

Table 93 Rest of Asia Pacific: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 94 Rest of Asia Pacific: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 95 Middle East & Africa: Function Generators Market Size, By Type, 2017–2024 (USD Thousand)

Table 96 Middle East & Africa: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 97 Middle East & Africa: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 98 Middle East & Africa: Market Size, By Region 2017–2024 (USD Thousand)

Table 99 Middle East: Market Size, By Type, 2017–2024 (USD Thousand)

Table 100 Middle East: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 101 Middle East: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 102 Africa: Market Size, By Type, 2017–2024 (USD Thousand)

Table 103 Africa: Market Size, By Output Frequency, 2017–2024 (USD Thousand)

Table 104 Africa: Market Size, By End-User, 2017–2024 (USD Thousand)

List of Figures (31 Figures)

Figure 1 Function Generators Market: Research Design

Figure 2 Research Methodology: Illustration of Function Generators Company Revenue Estimation (2018)

Figure 3 Ranking of Key Players & Industry Concentration, 2018

Figure 4 Function Generators Market: Industry/Country Analysis

Figure 5 Data Triangulation Methodology

Figure 6 North America Dominated the Market,By Region, in 2018

Figure 7 Analog Segment is Expected to Hold the Largest Share of the Function Generators Market, By Type, During the Forecast Period

Figure 8 Up to 50 Mhz Segment is Expected to Lead the Function Generator Market, By Output Frequency, During the Forecast Period

Figure 9 Aerospace, Defense & Government Services Segment is Expected to Lead the Function Generator Market, By End-User, During the Forecast Period 36

Figure 10 Technical Advancements in the Field of Aerospace, Defense & Government Services are Expected to Drive the Function Generator Market, 2019–2024

Figure 11 North American Function Generator Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Aerospace, Defense & Government Services and the US Dominated the Market in 2018

Figure 13 Analog Segment is Projected to Dominate the Function Generators Market Until 2024

Figure 14 Up to 50 Mhz Segment is Projected to Dominate the Function Generator Market Until 2024

Figure 15 Function Generators: Market Dynamics

Figure 16 Investment in the German Drone Industry, 2018

Figure 17 Revenue Generated From Wireless Service Providers in the Telecom Industry, US (2014–2018)

Figure 18 Analog Segment Holds the Largest Market for Function Generators During the Forecast Period

Figure 19 Up to 50 Mhz Segment is Projected to Be the Largest Market During the Forecast Period

Figure 20 Aerospace, Defense & Government Services Segment is Expected to Hold the Largest Market Share During the Forecast Period

Figure 21 Regional Snapshot: the Market in North America is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 North America Accounted for the Largest Market Share in 2018

Figure 23 North America: Function Generator Market Overview (2018)

Figure 24 Europe: Function Generator Market Overview (2018)

Figure 25 Key Developments in the Function Generator Market, 2016–2019

Figure 26 Competitive Leadership Mapping (Overall Market)

Figure 27 National Instruments Led the Function Generator Market in 2018

Figure 28 National Instruments: Company Snapshot

Figure 29 Keysight Technologies: Company Snapshot

Figure 30 Teradyne: Company Snapshot

Figure 31 Teledyne: Company Snapshot

This study involved four major activities in estimating the current size of the function generators market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as UNCTAD data, industry publications, several newspaper articles, Factiva, and journals to identify and collect information useful for a technical, market-oriented, and commercial study of the function generators market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The function generators market comprises several stakeholders such as technicians and repair personnel, companies in the consumer electronics industry, companies in the automotive electronics industry, wireless communication and infrastructure companies, government and research organizations, investment banks, third-party testing companies, medical equipment manufacturing companies, and state and national regulatory authorities.

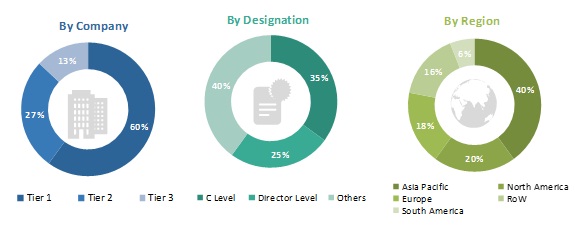

The supply side is characterized by the increasing adoption of new product launches, contracts & agreements, and mergers & acquisitions among leading players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global function generators market and its dependent submarkets. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and demand have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares split, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the function generators market.

Report Objectives

- To define, describe, and forecast the global market based on type, output frequency, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the function generators market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the function generator market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To benchmark players within the market using the proprietary Vendor DIVE framework, which analyzes the market players on various parameters within the broad categories of business and product strategies

- To track and analyze competitive developments such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Function Generators Market