Software Defined Radio Market by Type (General Purpose Radio, Joint Tactical Radio System, Cognitive/Intelligent Radio, Terrestrial Trunked Radio), Application, Component, Platform, Frequency, and Region – Global Forecast to 2027

Update: 11/08/2024

A Software Defined Radio (SDR) is a type of radio communication system where traditional hardware components, such as filters, amplifiers, and modulators, are instead implemented through software on a computer or embedded system. This flexibility allows SDRs to support a wide range of frequencies, protocols, and functionalities, making them adaptable to changing requirements or standards simply by updating the software. SDRs are widely used in military and defense applications, emergency response systems, cellular communications, and research due to their ability to handle complex signal processing tasks. They enable multi-band, multi-standard communication, making them valuable for secure, reliable, and versatile communication in dynamic environments.

Software Defined Radio Market Size & Growth

The Global Software Defined Radio Market Size was valued at USD 10.0 Billion in 2022 and is estimated to reach USD 12.5 Billion by 2027, growing at a CAGR of 4.6% during the forecast period.

The rapidly evolving dynamics of the Software Defined Radio Industry are attributed to the changing geo-political situations in economies across North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa. The increasing defense spending on tactical communications in these regions also influences the demand for software defined radios. These radios have undergone enormous technological advancements since their invention. Several industry players focus on improving their product portfolios as per customer requirements. One of these customer requirements includes the transition of radio communication devices from analog to digital. The growing demand for digitalized products owing to their multiple advantages over analog products will also contribute to the software defined radio market growth.

Software Defined Radio Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Software Defined Radio Market Trends

Driver: Constant development of next-generation software defined radios

The requirement for communications systems for several types of missions being carried out by defense forces, space agencies, and government authorities has been changing rapidly over the years. The software defined radios (SDRs) developed a decade earlier have come to be mostly inadequate to support the diverse nature of operations in the current communication systems. The earlier radios were heavy and massive (in weight and size) and, hence, do not meet the mobility-related requirements of troops stationed in adverse and difficult terrains. These mobility-related requirements, as well as the implementation of communication concepts, have contributed to the demand for lighter and more agile SDR systems.

Industry players are focusing on designing and developing new and improved SDRs to replace conventional communication systems across the globe. Government officials are involved in supporting such developments with the help of new projects. For instance, the US Defense Advanced Research Projects Agency (DARPA) made an announcement (HR001120S0027) for new project initiation on Wideband Adaptive RF Protection (WARP). This will support industry players in developing wideband SDRs that are highly usable in spectrum-congested environments. In March 2022, L3Harris Technologies, Inc. (US) was awarded a contract by the UK’s Ministry of Defence to provide its handheld, multichannel Falcon IV AN/PRC-163 software defined radios (SDRs). The aim of this procurement is to improve interoperability between US and NATO allies during coalition operations. Such contracts will enable companies to improve products, further increasing the SDR demand.

The demand for next-generation software defined radio equipment is increasing as older equipment requires a high amenity for its transportation, which further limits the equipment’s flexibility in terms of deployment. The bandwidth within which the older SDR equipment operates is unable to adequately meet the demand for modern network-enabled applications. Furthermore, older equipment is also more vulnerable to network interferences and sophisticated electronic attacks. These factors have led to increased spending by governments toward procuring advanced communication equipment that offers high durability, flexibility, and ease of setting up in a harsh and demanding environment. The rising focus of SDR industry players towards technological progression will contribute to the market’s growth.

Restraint: Security concerns associated with new SDR installations

The chances of a security breach are high when installing or loading new software in an SDR unit through an over-the-air update. There is a high possibility of unauthorized and potentially malicious software getting installed on the specified platform. The process is similar to the installation of software on laptops or personal computers, where the prevention of any malicious functions is required.

Concerns related to unlicensed codes restrict the market’s growth owing to the potential for compromising the security of the users’ assets along with threats to the communication capability of the devices. Such security concerns will create a barrier in the sales growth of communication systems, including software defined radios. Thus, security concerns act as a key restraining factor for the software defined radio market’s growth.

Opportunity: Innovations in new cognitive radio technology

Cognitive radios are likely to witness an increased demand in the coming decade. Cognitive radios can autonomously exploit locally unused spectrum to provide new paths to spectrum access in order to be able to roam across borders. They also comply with local regulations and cooperate with several local service providers (networks), enabling connectivity at the lowest cost. They provide context-aware services for the user and improved spectrum utilization through dynamic spectrum access.

Cognitive radios require platforms with fast and dynamic reconfiguration abilities to continuously gain the advantage of spectrum opportunities. For cognitive radio systems, additions to the Software Communications Architecture (SCA), including middleware that supports adaptation, will be beneficial. Such middleware will improve radio operations and standardize solutions for cognitive and adaptive systems. SCA is expected to remain the dominating architecture in the military sector, where waveform application reuse and portability are major priorities, especially through cooperative programs. Moreover, a substantial portion of the SDR product’s designs for the civilian commercial sector, where hardware cost is considered one of the major factors, is likely to utilize dedicated and lightweight architectures. Thus, the derived technologies of SDR, such as cognitive radio, will showcase new opportunities for the market.

Challenge: Upgrading communication standards

The presence of multiple standards in the communication spectrum with networks including 2G, 3G, and 4G LTE for mobile connections poses a challenge to the SDR market’s growth. This is because numerous standards stimulate the complexity within the communication network, further requiring considerable hardware upgrades or installations. Moreover, considering the handheld devices, multiple upgrades in standards pose a resistance to the SDR devices due to the integration of new hardware resulting in increased weight and size. Thus, SDRs should be capable of supporting several communication standards.

Software Defined Radio Market Segments

Based on Component, the hardware segment registered largest share in 2022

Based on component, the software-defined radio (SDR) market has been segmented into hardware and software. The hardware segment is further subdivided into general purpose processors, digital signal processors, integrated circuits, amplifiers, antennas, converters, and others. The need for secure communication, secure networking, and anti-jamming communication in the military has contributed to the growth of the SDR market. SDR finds a number of distinct applications in various sectors, such as military, public safety, and telecommunications. Radio applications like Radar (Radio Detection and Ranging), Bluetooth, and GPS (Global Positioning System) can be implemented with SDR technology. SDR is an advanced technology that helps accelerate the expansion of multi-service, multi-featured, multi-band, and radio systems.

Based on Type, cognitive/intelligent radio is anticipated to grow at the highest CAGR during 2022-2027

Based on type, the software-defined radio (SDR) market has been segmented into joint tactical radio system (JTRS), general purpose radio, terrestrial trunked radio (TETRA), and cognitive/intelligent radio. This software-defined radio is used for commercial and defense applications.

Among all type joint tactical radio system (JTRS) registered large share in the base year. The traditional radio systems had inadequate bandwidth to meet new communications challenges. The solution for such interoperability issues was an advanced radio along with a new wideband network waveform that provides network connectivity across the battlespace.

On other side cognitive radio is anticipated to grow at the highest compound annual growth rate during 2022-2027. Cognitive radio refers to a type of radio in which the systems are aware of their internal state, established policies, and location. The radio system with such intelligence can make decisions on its radio operating parameters by comparing predefined objectives. It utilizes SDR, adaptive radio, and other related technologies to automatically adjust its behavior or operations to achieve desired objectives.

Software Defined Radio Market Regions

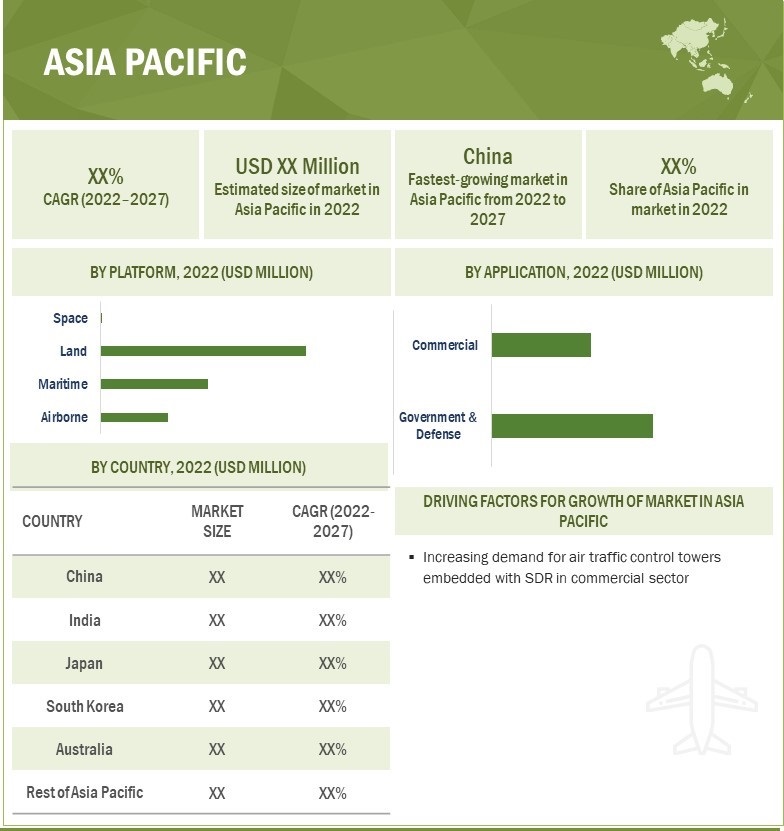

The Asia Pacific region is projected to Grow at highest CAGR during the forecast period

Asia Pacific is anticipated to witness the highest compound annual growth rate during 2022-2027. For the market analysis, Asia Pacific includes China, India, Japan, South Korea, Australia, and the Rest of Asia Pacific. These countries are strengthening their combat systems by investing in tactical radio systems to counter threats arising from regional conflicts.

Market players in this region are setting up new manufacturing facilities to increase their production capacities and launch new products. For instance, in October 2021, Rafael Advanced Defense Systems Ltd. (Israel) introduced BNET NANO, its newest member of the BENT SDR family. BNET NANO is based on Rafael’s game-changing Multi-Channel Reception (MCR) technology; BNET cognitively manages scarce spectrum resources, providing force merge with minimal planning and spectrum usage. The radio works in GPS-denied areas, and it has support for ‘flat’ networks with hundreds of members.

The South China Sea disputes, North Korea’s increased nuclear arsenal, border conflicts between India and Pakistan, and Afghan unrests are some of the key issues that have led to increased government & defense expenditures in the Asia Pacific region. Prime concerns for this region include border disputes between countries and increasing terrorism. Thus, countries in this region are upgrading their surveillance and resource allocation capabilities by upgrading their software-defined radio networks. Asia Pacific will experience a high adoption rate of the 5G network, along with a large-scale installation of new telecommunication infrastructure to support the high-speed network. Increasing demand for air traffic control towers embedded with software-defined radios in the commercial sector will also drive the growth of the software-defined radio market in the Asia Pacific region.

Software Defined Radio Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Software Defined Radio Companies: Top Key Market Players

The Software Defined Radio Companies is dominated by globally established players such as:

- L3Harris Technologies, Inc. (US)

- Raytheon Technologies Corporation (US)

- Northrop Grumman Corporation (US)

- General Dynamics Corporation (US)

- Thales Group (France)

These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to further expand their presence in the software defined radio market.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 10.0 Billion in 2022 |

|

Projected Market Size |

USD 12.5 Billion by 2027 |

|

Growth Rate |

4.6% |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By platform, By application, By component, By type, By frequency, and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East, Latin America, and Africa |

|

Companies covered |

L3Harris Technologies, Inc. (US), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), General Dynamics Corporation (US), and Thales Group (France) |

|

Companies covered (SDR start-ups and Software Defined Radio ecosystem) |

NXP Semiconductors N.V. (Netherland), Pentek Inc. (US), Rafael Advanced Defense Systems Ltd. (Israel), Bharat Electronics Limited (BEL) (India), Rolta India Limited (Rolta) (India) |

Software Defined Radio Market Highlights

This research report categorizes the software defined radio market based on platform, application, component, type, frequency, and region

|

Aspect |

Details |

|

By Platform |

|

|

By Application |

|

|

By Component |

|

|

By Type |

|

|

By Frequency |

|

|

By Region |

|

Recent Developments

- In April 2022, FlexRadio introduced its newly developed FLEX-6400M software defined radio transceiver with an integrated display for the amateur radio market. FlexRadio’s industry-leading SmartSDR software offers compatibility across the entire FLEX-6000 Signature Series family to deliver continuous leveraged software enhancement.

- In March 2022, Rohde & Schwarz introduced its new satellite receiver, R&SMSR4, which can be used for multipurpose SDR applications in satellite communications and monitoring. The new receiver has four tunable channels and receives signals in the L-band between 500 MHz and 3 GHz with on-board recording capability.

- In October 2021, Elbit Systems Ltd. introduced its upgraded E-LynX family of SDR. The new SDR has multi-channel and full-duplex capabilities.

- In August 2021, General Dynamics Corporation introduced its newly developed Badger SDR at the Navy League’s Sea-Air-Space Symposium in National Harbor, Maryland (US). Badger SDR is a dual-channel SDR that offers Multiple Independent Levels of Security (MILS) for ship-to-ship and ship-to-shore voice and data communications.

Frequently Asked Questions (FAQ):

What is the current size of the software defined radio market?

The software defined radio market is projected to grow from USD 10.0 Billion in 2022 to USD 12.5 Billion by 2027, at a CAGR of 4.6% from 2022 to 2027.

Who are the winners in the software defined radio market?

L3Harris Technologies, Inc. (US), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), General Dynamics Corporation (US), and Thales Group (France).

What are some of the technological advancements in the market?

Several technological advancements in the markets are software defined radio access network (SDRAN), near-field radio frequency identification (RFID), software defined doppler radar, and near field communication (NFC).

WebSDR is an advanced software defined radio receiver that is connected to the internet over a specified network. The device allows multiple users to link simultaneously and connect to different channels as per the user's requirements. This ability of WebSDR gains an advantage over the conventional receivers that are linked over the internet across the globe.

What are the factors driving the growth of the market?

Constant development of next-generation software defined radios, increasing demand from telecommunications industry, rising procurement of modern military tactical communication systems are some factors that supporting the market growth.

What region holds the largest share of the market in 2021?

North America registered the largest share of 37.32% in global software defined radio market in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 SOFTWARE-DEFINED RADIO MARKET: INCLUSIONS & EXCLUSIONS

1.4 CURRENCY

1.5 USD EXCHANGE RATE

1.6 MARKET SCOPE

1.6.1 MARKETS COVERED

FIGURE 1 SOFTWARE-DEFINED RADIO MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED

1.6.3 REGIONAL SCOPE

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

FIGURE 2 SOFTWARE-DEFINED RADIO MARKET TO GROW AT LOWER RATE COMPARED TO PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.2.2 Key data from primary sources

2.1.2.3 Breakdown of primaries

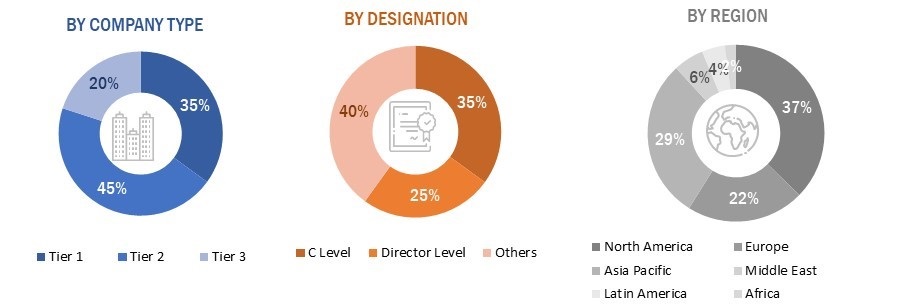

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.3 MARKET SIZE ESTIMATION

2.4 RESEARCH APPROACH & METHODOLOGY

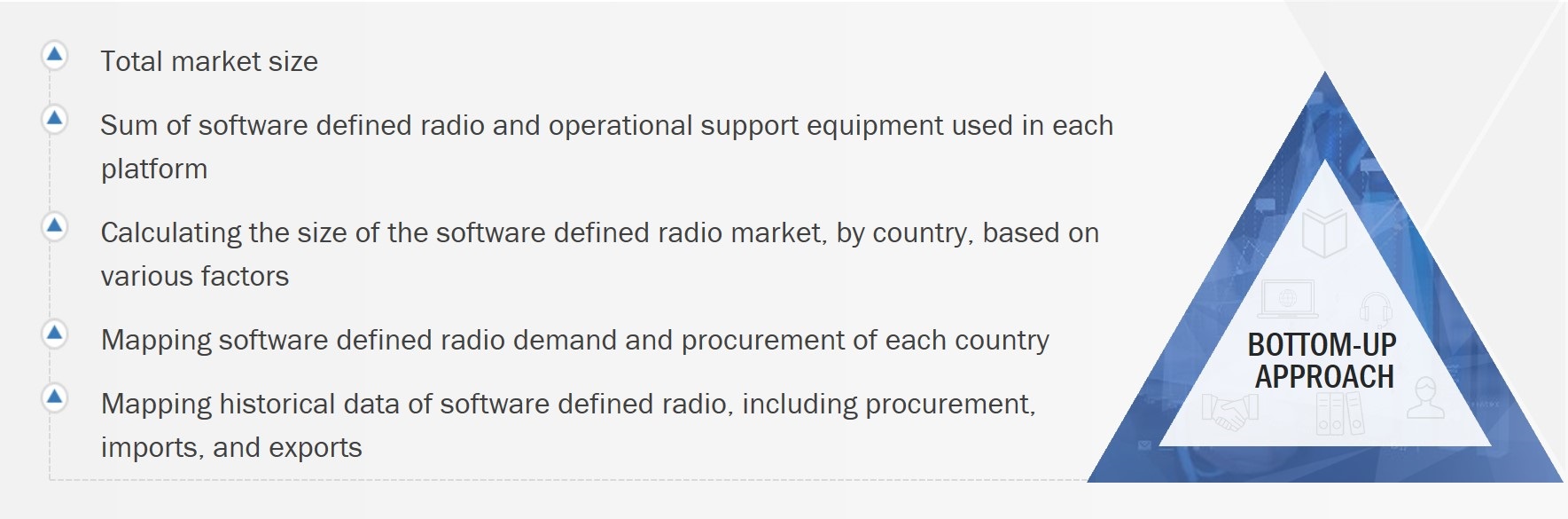

2.4.1 BOTTOM-UP APPROACH

2.4.1.1 Software-defined radio market for airborne

2.4.1.2 Software-defined radio market for maritime

2.4.1.3 Software-defined radio market for land

2.4.1.4 Software-defined radio market for space

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.6 GROWTH RATE ASSUMPTIONS

2.7 RESEARCH ASSUMPTIONS

FIGURE 9 ASSUMPTIONS FOR RESEARCH STUDY

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 10 LAND PLATFORM SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

FIGURE 11 GOVERNMENT & DEFENSE APPLICATIONS TO HOLD LARGER MARKET SHARE IN 2022

FIGURE 12 HARDWARE COMPONENTS TO DOMINATE MARKET IN 2022

FIGURE 13 JOINT TACTICAL RADIO SYSTEM (JTRS) SEGMENT ESTIMATED TO LEAD MARKET IN 2022

FIGURE 14 MULTIBAND FREQUENCY SEGMENT PROJECTED TO REGISTER HIGHER CAGR FROM 2022 TO 2027

FIGURE 15 NORTH AMERICA PROJECTED TO COMMAND MAJOR SHARE FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN SOFTWARE-DEFINED RADIO MARKET

FIGURE 16 INCREASING ADOPTION OF SOFTWARE-DEFINED RADIO IN DEFENSE SECTOR TO BOOST MARKET DURING FORECAST PERIOD

4.2 SOFTWARE-DEFINED RADIO MARKET, BY AIRBORNE PLATFORM

FIGURE 17 COMMERCIAL AIRCRAFT SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.3 SOFTWARE-DEFINED RADIO MARKET, BY COMMERCIAL AIRCRAFT

FIGURE 18 NBA SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 SOFTWARE-DEFINED RADIO MARKET, BY MARITIME PLATFORM

FIGURE 19 UNMANNED MARITIME VEHICLES TO GROW FASTEST DURING FORECAST PERIOD

4.5 SOFTWARE-DEFINED RADIO MARKET, BY LAND PLATFORM

FIGURE 20 MOBILE SEGMENT PROJECTED TO HAVE HIGHER CAGR DURING FORECAST PERIOD

4.6 SOFTWARE-DEFINED RADIO MARKET, BY MOBILE PLATFORM

FIGURE 21 HANDHELD SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.7 SOFTWARE-DEFINED RADIO MARKET, BY FIXED PLATFORM

FIGURE 22 OTHERS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.8 SOFTWARE-DEFINED RADIO MARKET, BY SPACE PLATFORM

FIGURE 23 LEO SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.9 SOFTWARE-DEFINED RADIO MARKET, BY GOVERNMENT & DEFENSE APPLICATION

FIGURE 24 MILITARY COMMUNICATIONS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.10 SOFTWARE-DEFINED RADIO MARKET, BY COMMERCIAL APPLICATION

FIGURE 25 TELECOMMUNICATION SEGMENT PROJECTED TO COMMAND MARKET DURING FORECAST PERIOD

4.11 SOFTWARE-DEFINED RADIO MARKET, BY HARDWARE TYPE

FIGURE 26 CONVERTERS SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.12 SOFTWARE-DEFINED RADIO MARKET, BY SINGLE BAND FREQUENCY

FIGURE 27 VHF SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 68)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 SOFTWARE-DEFINED RADIO MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Constant development of next-generation software-defined radios

5.2.1.2 Increasing demand from telecommunications industry

5.2.1.3 Rising procurement of modern military tactical communication systems

FIGURE 29 MILITARY EXPENDITURE OF MAJOR COUNTRIES, 2019–2021 (USD MILLION)

5.2.1.4 Growing demand for mission-critical communications

5.2.2 RESTRAINTS

5.2.2.1 Security concerns associated with new SDR installations

5.2.3 OPPORTUNITIES

5.2.3.1 Increased focus on development of next-generation IP radio systems

5.2.3.2 Rising usage of SDR in commercial, industrial, and homeland security applications

5.2.3.3 Innovations in new cognitive radio technology

5.2.3.4 Implementation of TETRA Enhanced Data Service (TEDS)

5.2.4 CHALLENGES

5.2.4.1 Interoperability between disparate communication technologies

5.2.4.2 Development of SDR with low power consumption

5.2.4.3 Maintaining partnerships between vendors and operators

5.2.4.4 Upgrading communication standards

5.3 RANGES AND SCENARIOS

FIGURE 30 IMPACT OF COVID-19 ON SOFTWARE-DEFINED RADIO MARKET: THREE GLOBAL SCENARIOS

5.4 TRENDS/BUSINESS IMPACTING CUSTOMER BUSINESS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SOFTWARE-DEFINED RADIO MANUFACTURERS

FIGURE 31 REVENUE SHIFT IN SOFTWARE-DEFINED RADIO MARKET

5.5 SOFTWARE-DEFINED RADIO MARKET ECOSYSTEM

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

FIGURE 32 MARKET ECOSYSTEM MAP: SOFTWARE-DEFINED RADIO

5.6 VALUE CHAIN ANALYSIS

FIGURE 33 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING OEM AND SYSTEM INTEGRATION PHASES

5.7 TRADE ANALYSIS

TABLE 2 COUNTRY-WISE EXPORTS, 2020 & 2021 (USD THOUSAND)

TABLE 3 COUNTRY-WISE IMPORTS, 2020 & 2021 (USD THOUSAND)

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 SOFTWARE-DEFINED RADIO MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 SOFTWARE-DEFINED RADIO MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 TARIFF AND REGULATORY LANDSCAPE

5.10 AVERAGE SELLING PRICE ANALYSIS

TABLE 5 AVERAGE SELLING PRICE: SOFTWARE-DEFINED RADIOS

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP TWO APPLICATIONS

TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP TWO APPLICATIONS (%)

5.11.2 BUYING CRITERIA

FIGURE 36 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

TABLE 7 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

5.12 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 8 SOFTWARE-DEFINED RADIO MARKET: CONFERENCES & EVENTS (2022–2023)

6 INDUSTRY TRENDS (Page No. - 88)

6.1 INTRODUCTION

6.1.1 EVOLUTION: SOFTWARE-DEFINED RADIO

6.2 BUSINESS MODELS FOR SOFTWARE-DEFINED RADIO PROGRAMS

6.2.1 INVESTMENT MODELS

6.2.1.1 Government funding

6.2.1.2 Military off-the-shelf (MOTS) solutions

6.2.1.3 Government-industry convergence: Government off-the-shelf (GOTS) solutions

6.3 TECHNOLOGY TRENDS

FIGURE 37 TECHNOLOGICAL ADVANCEMENT – A GROWING TREND IN SOFTWARE-DEFINED RADIO MARKET

6.3.1 SOFTWARE-DEFINED RADIO ACCESS NETWORK (SDRAN)

6.3.2 NEAR-FIELD RADIO FREQUENCY IDENTIFICATION (RFID)

6.3.3 SOFTWARE-DEFINED DOPPLER RADAR

6.3.4 NEAR FIELD COMMUNICATION

6.3.5 MULTIBAND TACTICAL COMMUNICATION AMPLIFIERS

6.3.6 NEXT-GENERATION IP

6.3.7 WEBSDR

6.3.8 HIGH-PERFORMANCE SOFTWARE-DEFINED RADIO (HPSDR)

6.3.9 GNU RADIO

6.4 USE CASE ANALYSIS: SOFTWARE-DEFINED RADIO MARKET

6.4.1 RF AND MICROWAVE COMPONENTS TO ENABLE SDR TO OPERATE IN CONTESTED ENVIRONMENTS

6.4.2 DARPA BLACKJACK EXPERIMENTS WITH SDR TO LINK LEO AND TACTICAL RADIOS

6.4.3 SCISRS PROGRAM SEEKS TO DEVELOP SMART RADIO TECHNIQUES TO DETECT SUSPICIOUS SIGNALS AND OTHER RF ANOMALIES

6.5 TECHNOLOGY ANALYSIS

6.5.1 COGNITIVE RADIO: A MERGER OF ARTIFICIAL INTELLIGENCE AND SOFTWARE-DEFINED RADIO

6.5.1.1 Cognitive radio

6.5.1.2 Adaptive radio

6.5.1.3 Intelligent radio

6.5.2 USE OF SOFTWARE-DEFINED RADIO AND COGNITIVE RADIO (CR) IN 5G TECHNOLOGY

6.5.3 MOBILE USER OBJECTIVE SYSTEM (MUOS): CELLPHONE-LIKE CAPABILITY IN SOFTWARE-DEFINED RADIO

6.6 IMPACT OF MEGATRENDS

6.6.1 DISRUPTIVE TECHNOLOGIES IN SUPPLY CHAIN MANAGEMENT

6.6.2 SHIFTING GLOBAL ECONOMIC POWERS

6.6.3 SDR ADVANCEMENTS THROUGH NEW TECHNOLOGY ADOPTION

6.7 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 9 SOFTWARE-DEFINED RADIO MARKET: KEY PATENTS (2019–2022)

7 SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM (Page No. - 100)

7.1 INTRODUCTION

FIGURE 38 LAND SEGMENT TO LEAD SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

TABLE 10 SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 11 SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

7.2 AIRBORNE

FIGURE 39 COMMERCIAL AIRCRAFT SEGMENT TO DOMINATE SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

TABLE 12 SOFTWARE-DEFINED RADIO MARKET, BY AIRBORNE PLATFORM, 2018–2021 (USD MILLION)

TABLE 13 SOFTWARE-DEFINED RADIO MARKET, BY AIRBORNE PLATFORM, 2022–2027 (USD MILLION)

7.2.1 COMMERCIAL AIRCRAFT

7.2.1.1 Increase in air passenger traffic to boost demand for commercial aircraft

FIGURE 40 COMMERCIAL NBA AIRCRAFT TO BE LARGEST SEGMENT IN SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

TABLE 14 SOFTWARE-DEFINED RADIO MARKET, BY COMMERCIAL AIRCRAFT, 2018–2021 (USD MILLION)

TABLE 15 SOFTWARE-DEFINED RADIO MARKET, BY COMMERCIAL AIRCRAFT, 2022–2027 (USD MILLION)

7.2.1.2 Wide-body aircraft

7.2.1.3 Narrow-body aircraft

7.2.1.4 Regional transport aircraft

7.2.2 MILITARY AIRCRAFT

7.2.2.1 Long-term procurement and maintenance contracts for fixed-wing military aircraft to fuel market growth

7.2.3 UNMANNED AERIAL VEHICLES

7.2.3.1 Increasing demand for UAVs by defense forces and advancements in communication technologies to assist market growth

7.3 MARITIME

FIGURE 41 COMMERCIAL SHIPS TO BE MAJOR MARITIME SOFTWARE-DEFINED RADIO SEGMENT FROM 2022 TO 2027

TABLE 16 SOFTWARE-DEFINED RADIO MARKET, BY MARITIME PLATFORM, 2018–2021 (USD MILLION)

TABLE 17 SOFTWARE-DEFINED RADIO MARKET, BY MARITIME PLATFORM, 2022–2027 (USD MILLION)

7.3.1 COMMERCIAL SHIPS

7.3.1.1 Increase in number of cargo ships to accommodate rise in marine trade to drive market

7.3.2 MILITARY SHIPS

7.3.2.1 Improved communication and navigation capacity of navy ships with new SDR technology to boost market

7.3.3 SUBMARINES

7.3.3.1 Market driven by increased procurement of submarines by defense forces in North America and Asia Pacific

7.3.4 UNMANNED MARITIME VEHICLES

7.3.4.1 Growing demand for maritime autonomous search missions and border security to aid market growth

7.4 LAND

FIGURE 42 MOBILE LAND PLATFORMS TO BE DOMINANT IN SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

TABLE 18 SOFTWARE-DEFINED RADIO MARKET, BY LAND PLATFORM, 2018–2021 (USD MILLION)

TABLE 19 SOFTWARE-DEFINED RADIO MARKET, BY LAND PLATFORM, 2022–2027 (USD MILLION)

7.4.1 MOBILE

7.4.1.1 Increased procurement of modern handheld radios for armed forces in North America and Asia Pacific to drive market

FIGURE 43 HANDHELD SEGMENT TO LEAD LAND-BASED SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

TABLE 20 LAND: SOFTWARE-DEFINED RADIO MARKET, BY MOBILE PLATFORM, 2018–2021 (USD MILLION)

TABLE 21 LAND: SOFTWARE-DEFINED RADIO MARKET, BY MOBILE PLATFORM, 2022–2027 (USD MILLION)

7.4.1.2 Handheld

7.4.1.3 Manpack

7.4.1.4 Vehicle-mounted

7.4.2 FIXED

7.4.2.1 Rising demand in traffic control stations to boost market growth

FIGURE 44 FIXED AIR TRAFFIC CONTROL STATIONS TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

TABLE 22 LAND: SOFTWARE-DEFINED RADIO MARKET, BY FIXED PLATFORM, 2018–2021 (USD MILLION)

TABLE 23 LAND: SOFTWARE-DEFINED RADIO MARKET, BY FIXED PLATFORM, 2022–2027 (USD MILLION)

7.4.2.2 Command stations

7.4.2.3 Air traffic control stations

7.4.2.4 Maritime traffic control stations

7.4.2.5 Others

7.5 SPACE

FIGURE 45 LEO SEGMENT TO LEAD SPACE SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

TABLE 24 SOFTWARE-DEFINED RADIO MARKET, BY SPACE PLATFORM, 2018–2021 (USD MILLION)

TABLE 25 SOFTWARE-DEFINED RADIO MARKET, BY SPACE PLATFORM, 2022–2027 (USD MILLION)

7.5.1 LEO

7.5.2 GEO

7.5.3 MEO

8 SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION (Page No. - 115)

8.1 INTRODUCTION

FIGURE 46 GOVERNMENT & DEFENSE APPLICATIONS TO LEAD SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

TABLE 26 SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 27 SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 GOVERNMENT & DEFENSE

FIGURE 47 MILITARY COMMUNICATIONS SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

TABLE 28 GOVERNMENT & DEFENSE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 29 GOVERNMENT & DEFENSE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.1 MILITARY COMMUNICATION

8.2.1.1 Increased demand for secure communications for military ISR operations

8.2.2 HOMELAND SECURITY & EMERGENCY RESPONSE

8.2.2.1 Rising demand for software-defined radio by law enforcement agencies

8.3 COMMERCIAL

FIGURE 48 TELECOMMUNICATION SEGMENT TO WITNESS FASTEST GROWTH DURING 2022– 2027

TABLE 30 COMMERCIAL: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 31 COMMERCIAL: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.1 AVIATION COMMUNICATION

8.3.1.1 Increased use of advanced communication systems for improved air traffic flow management

8.3.2 MARINE COMMUNICATION

8.3.2.1 Use of SDR for commercial vessel traffic monitoring and communications

8.3.3 TELECOMMUNICATION

8.3.3.1 Increasing adoption of SDR at cellular base stations

8.3.4 TRANSPORTATION

8.3.4.1 Use of software-defined radio in intelligent transportation systems for improved safety

8.3.5 SPACE COMMUNICATION

8.3.5.1 Increasing use of space communications for military operations

9 SOFTWARE-DEFINED RADIO MARKET, BY COMPONENT (Page No. - 122)

9.1 INTRODUCTION

FIGURE 49 HARDWARE SEGMENT TO LEAD SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

TABLE 32 SOFTWARE-DEFINED RADIO MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 33 SOFTWARE-DEFINED RADIO MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

9.2 HARDWARE

FIGURE 50 INTEGRATED CIRCUITS TO LEAD AMONG HARDWARE COMPONENTS FROM 2022 TO 2027

TABLE 34 SOFTWARE-DEFINED RADIO MARKET, BY HARDWARE COMPONENT, 2018–2021 (USD MILLION)

TABLE 35 SOFTWARE-DEFINED RADIO MARKET, BY HARDWARE COMPONENT, 2022–2027 (USD MILLION)

9.2.1 GENERAL PURPOSE PROCESSORS

9.2.2 DIGITAL SIGNAL PROCESSORS

9.2.3 INTEGRATED CIRCUITS

9.2.4 AMPLIFIERS

9.2.5 ANTENNAS

9.2.6 CONVERTORS

9.2.7 OTHERS

9.3 SOFTWARE

10 SOFTWARE-DEFINED RADIO MARKET, BY TYPE (Page No. - 128)

10.1 INTRODUCTION

FIGURE 51 COGNITIVE/INTELLIGENT RADIO SEGMENT ANTICIPATED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 36 SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 37 SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.2 GENERAL PURPOSE RADIO

10.2.1 TYPICALLY USED FOR SHORT-DISTANCE, TWO-WAY VOICE COMMUNICATION USING HANDHELD RADIOS

10.3 JOINT TACTICAL RADIO SYSTEM (JTRS)

10.3.1 ONGOING PROGRAMS FOR DEVELOPMENT OF ADVANCED SDR FOR DEFENSE FORCES

10.4 COGNITIVE/INTELLIGENT RADIO

10.4.1 TECHNOLOGICAL ADVANCEMENTS & INCREASING ADOPTION OF 5G

10.5 TERRESTRIAL TRUNKED RADIO (TETRA)

10.5.1 INCREASED USAGE IN EMERGENCY & TRANSPORT SERVICES, AND MILITARY SECTOR

11 SOFTWARE-DEFINED RADIO MARKET, BY FREQUENCY BAND (Page No. - 132)

11.1 INTRODUCTION

TABLE 38 DIFFERENT TYPES OF FREQUENCY BANDS

FIGURE 52 MULTIBAND SEGMENT LIKELY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 39 SOFTWARE-DEFINED RADIO MARKET, BY FREQUENCY BAND, 2018–2021 (USD MILLION)

TABLE 40 SOFTWARE-DEFINED RADIO MARKET, BY FREQUENCY BAND, 2022–2027 (USD MILLION)

11.2 SINGLE BAND

11.2.1 SINGLE BAND FREQUENCY WIDELY USED IN SECURE MILITARY COMMUNICATIONS

FIGURE 53 VERY HIGH FREQUENCY SEGMENT TO LEAD SOFTWARE-DEFINED RADIO MARKET FROM 2022 TO 2027

TABLE 41 SINGLE BAND: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 42 SINGLE BAND: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.2 LF

11.2.3 MF

11.2.4 HF

11.2.5 VHF

11.2.6 UHF

11.2.7 SHF

11.2.8 EHF

11.3 MULTIBAND

11.3.1 USED FOR COHERENT DETECTION AND TRACKING OF MOVING TARGET OBJECTS

12 REGIONAL ANALYSIS (Page No. - 138)

12.1 INTRODUCTION

FIGURE 54 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF SOFTWARE-DEFINED RADIO MARKET IN 2022

TABLE 43 SOFTWARE-DEFINED RADIO MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 SOFTWARE-DEFINED RADIO MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 INTRODUCTION

12.2.2 PESTLE ANALYSIS

FIGURE 55 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET SNAPSHOT

TABLE 45 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 46 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.3 US

12.2.3.1 Increasing focus on development of advanced SDR for government and commercial use

TABLE 53 US: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 54 US: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 55 US: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 56 US: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.2.4 CANADA

12.2.4.1 Promotion of various defense development programs by government

TABLE 57 CANADA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 58 CANADA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 59 CANADA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 60 CANADA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 INTRODUCTION

12.3.2 PESTLE ANALYSIS: EUROPE

FIGURE 56 EUROPE: SOFTWARE-DEFINED RADIO MARKET SNAPSHOT

TABLE 61 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 62 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 63 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 64 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 65 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 66 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 67 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 68 EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.3 UK

12.3.3.1 Supportive government initiatives for development of communication systems to increase SDR demand

TABLE 69 UK: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 70 UK: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 71 UK: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 72 UK: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.4 GERMANY

12.3.4.1 Continuous focus on upgrading battle management and communication systems

TABLE 73 GERMANY: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 74 GERMANY: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 75 GERMANY: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 76 GERMANY: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.5 FRANCE

12.3.5.1 Manufacturers focused on business expansion owing to rising demand

TABLE 77 FRANCE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 78 FRANCE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 79 FRANCE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 80 FRANCE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.6 ITALY

12.3.6.1 Increasing requirement for SDRs from Italian armed forces and law enforcement agencies

TABLE 81 ITALY: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 82 ITALY: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 83 ITALY: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 84 ITALY: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.7 SPAIN

12.3.7.1 Rising focus of Government of Spain on strengthening defense force capabilities

TABLE 85 SPAIN: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 86 SPAIN: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 87 SPAIN: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 88 SPAIN: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.8 RUSSIA

12.3.8.1 Rising frequency of cyber threats in Russia

TABLE 89 RUSSIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 90 RUSSIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 91 RUSSIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 92 RUSSIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.9 REST OF EUROPE

TABLE 93 REST OF EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 94 REST OF EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 95 REST OF EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 96 REST OF EUROPE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 INTRODUCTION

12.4.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 57 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET SNAPSHOT

TABLE 97 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 98 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 100 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 102 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 103 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 104 ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.3 CHINA

12.4.3.1 High investment in development and procurement of emerging defense technologies

TABLE 105 CHINA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 106 CHINA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 107 CHINA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 108 CHINA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.4 INDIA

12.4.4.1 Rising focus on procurement of government and defense equipment

TABLE 109 INDIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 110 INDIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 111 INDIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 112 INDIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.5 JAPAN

12.4.5.1 Increasing requirement from government and defense sectors

TABLE 113 JAPAN: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 114 JAPAN: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 115 JAPAN: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 116 JAPAN: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.6 SOUTH KOREA

12.4.6.1 Rising security concerns from neighboring countries

TABLE 117 SOUTH KOREA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 118 SOUTH KOREA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 119 SOUTH KOREA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 120 SOUTH KOREA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.7 AUSTRALIA

12.4.7.1 Rising incidences of violence resulting in upgrade of communication equipment

TABLE 121 AUSTRALIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 122 AUSTRALIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 123 AUSTRALIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 124 AUSTRALIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.8 REST OF ASIA PACIFIC

TABLE 125 REST OF ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 126 REST OF ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 127 REST OF ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 128 REST OF ASIA PACIFIC: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5 MIDDLE EAST

12.5.1 INTRODUCTION

12.5.2 PESTLE ANALYSIS

FIGURE 58 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET SNAPSHOT

TABLE 129 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 130 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 131 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 132 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 133 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 134 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 135 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 136 MIDDLE EAST: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.3 ISRAEL

12.5.3.1 Advanced technologies in communication systems and presence of major players

TABLE 137 ISRAEL: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 138 ISRAEL: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 139 ISRAEL: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 140 ISRAEL: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5.4 TURKEY

12.5.4.1 High focus on indigenous equipment manufacturing

TABLE 141 TURKEY: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 142 TURKEY: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 143 TURKEY: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 144 TURKEY: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5.5 SAUDI ARABIA

12.5.5.1 Increased focus on military equipment procurement, including communication systems

TABLE 145 SAUDI ARABIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 146 SAUDI ARABIA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 147 SAUDI ARABIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 148 SAUDI ARABIA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5.6 UAE

12.5.6.1 Increasing involvement in border safety and security to propel demand for SDR

TABLE 149 UAE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 150 UAE: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 151 UAE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 152 UAE: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 INTRODUCTION

12.6.2 PESTLE ANALYSIS

FIGURE 59 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET SNAPSHOT

TABLE 153 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 154 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 155 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 156 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 157 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 158 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 159 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 160 LATIN AMERICA: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.3 BRAZIL

12.6.3.1 High focus on increasing military and defense strength

TABLE 161 BRAZIL: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 162 BRAZIL: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 163 BRAZIL: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 164 BRAZIL: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.6.4 ARGENTINA

12.6.4.1 Rising SDR requirement for law enforcement personnel

TABLE 165 ARGENTINA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 166 ARGENTINA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 167 ARGENTINA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 168 ARGENTINA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.6.5 MEXICO

12.6.5.1 Increasing illegal activities result in SDR demand for use in critical communication

TABLE 169 MEXICO: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 170 MEXICO: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 171 MEXICO: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 172 MEXICO: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.7 AFRICA

12.7.1 INTRODUCTION

12.7.2 PESTLE ANALYSIS

FIGURE 60 AFRICA: SOFTWARE-DEFINED RADIO MARKET SNAPSHOT

TABLE 173 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 174 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 175 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 176 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 177 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 178 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 179 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 180 AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.7.3 SOUTH AFRICA

12.7.3.1 Increased government focus on defense sector

TABLE 181 SOUTH AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 182 SOUTH AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 183 SOUTH AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 184 SOUTH AFRICA: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.7.4 EGYPT

12.7.4.1 Contracts by defense forces for military aids to support SDR market growth

TABLE 185 EGYPT: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 186 EGYPT: SOFTWARE-DEFINED RADIO MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 187 EGYPT: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 188 EGYPT: SOFTWARE-DEFINED RADIO MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

This research study on the software defined radio (SDR) market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts as well as service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the software defined radio market as well as assess its growth prospects.

Secondary Research

The secondary sources referred for this research study on the software defined radio market included financial statements of companies offering SDR transceiver, SDR receiver, and SDR software, along with various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the software defined radio market, which was validated by primary respondents.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as chief X officers (CXOs), vice presidents (VPs), directors, regional managers, and business development and product development teams, distributors, and vendors.

Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, average selling price, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to platform, application, type, and regions. Stakeholders from the demand side include armed forces, telecommunication companies, space companies, and ship building companies who are willing to adopt software defined radio to enhance communication speed, quality, and security. These interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and software solutions, market breakdowns, market size estimations, market size forecasting, and data triangulation. These interviews also helped analyze the solution adoption by platform, application, component, type, frequency segments of the market for six key regions.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the software defined radio market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up approach

Market size estimation methodology: Top- Down approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation and market breakdown procedures explained below were implemented, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the software defined radio market based on platform, application, component, type, frequency, and region

- To forecast sizes of various segments of the software defined radio market with respect to 6 major regions, namely, North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa, along with major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the software defined radio market across the globe

- To identify industry trends, market trends, and technology trends that are currently prevailing in the software defined radio market

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, new product launches, new software launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the software defined radio market, along with a ranking analysis, market share analysis, and revenue analysis of key players

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Software Defined Radio Market

I am interested in knowing the market analysis of SDR as a product. We are into the development of the same and this report will help us out in aligning and positioning our product.