Future of Hydrogen Market by Upstream (Generation (SMR, POX, Coal Gasification, Electrolysis) Source (Gray, Blue, Green), Storage (Tanks ), Midstream (Conversion, Transportation, H2 Pipelines, Distribution/Refueling Station) Downstream (Industrial & Chemicals, Mobility) - Global Forecast to 2030, 2040 and 2050

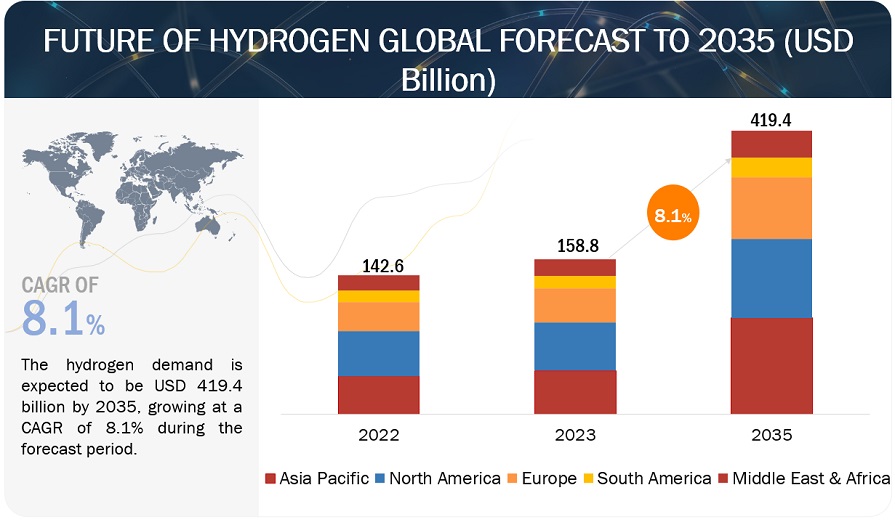

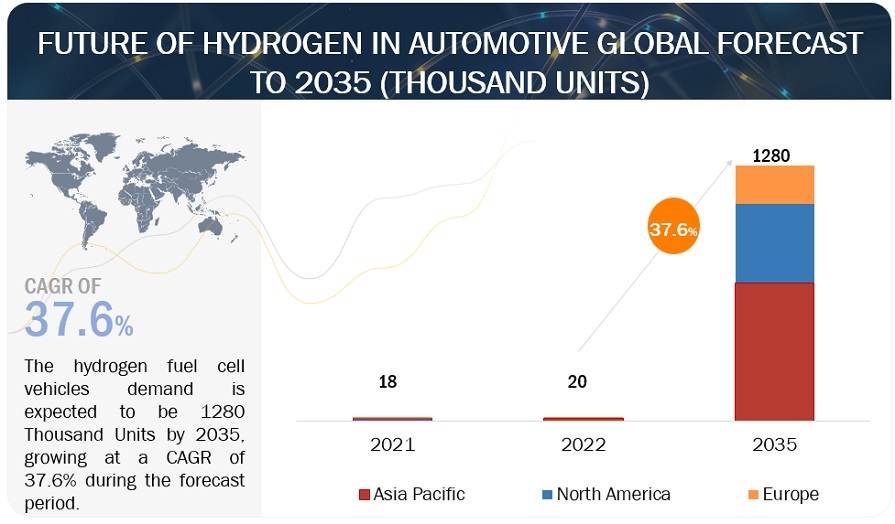

The outlook for future of hydrogen explores in depth the upstream, midstream and downstream segments involved in the hydrogen economy. The need for hydrogen generation and storage in the upstream is thoroughly assessed in the Future of Hydrogen study, which then moves on to analyze the demand for hydrogen conversion, transportation, and distribution in the midstream. In addition, the study explores the market for hydrogen fuel cell vehicles, evaluates changes in the automotive industry, and examines significant innovations made by Tier Is and OEMs. With a compound annual growth rate (CAGR) of 8.1%, the demand for hydrogen generation globally is expected to increase from USD 158.8 billion in 2023 to USD 419.4 billion in 2035. The global hydrogen fuel cell vehicle demand is projected to grow from 20 thousand units in 2022 to 1,280 thousand units by 2035, at a CAGR of 37.6%.

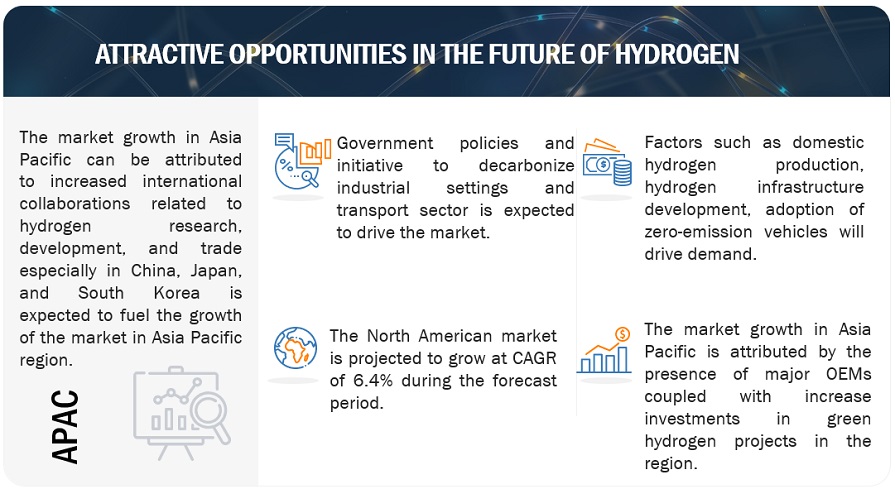

The upstream, midstream, and downstream sectors are seeing a surge in demand for hydrogen due to the global transition toward a more renewable and sustainable energy mix. Renowned for its adaptability as a fuel and storage material, hydrogen is essential to the seamless integration of renewable energy sources like solar and wind power into the energy system. Prominent original equipment manufacturers (OEMs) contributing significantly to the upstream segment are thyssenkrupp Nucera, Siemens Energy, Nel ASA, and ITM Power PLC. These OEMs are currently producing large-scale electrolyzers for industrial hydrogen generation. The focus also includes methods for storing hydrogen, such as pipelines, salt caverns, and high-pressure tanks. Esteemed OEMs such as Linde plc, Air Liquide, and Praxair are involved in both the production and installation of storage tanks designed for a range of hydrogen applications. Countries throughout the Middle East have devised ambitious plans to establish a significant presence in the emerging green hydrogen economy news. Saudi Arabia, Oman, Kuwait, Bahrain, UAE, Qatar are positioning themselves as clean hydrogen hubs for exports especially to major markets such as Europe and Asia. According to the International Energy Agency, Oman is set to become one of the leading exporter of hydrogen in the Middle East by 2030. Saudi Arabian Oil Co., ADNOC, NEOM Green Hydrogen Company are few of the companies focussing extensively on clean hydrogen projects in the middle east.

Trends that were changing the transportation, conversion, and distribution landscape of hydrogen were found in the midstream sector. A significant uptick in interest was observed in Power-to-X technologies, which use hydrogen as a feedstock to produce chemicals, synthetic fuels, and other products with added value. Moreover, initiatives to improve the seamless and widespread distribution of hydrogen were being made to extend the infrastructure of hydrogen pipelines.

The chemical industry is one of the most critical sector where hydrogen is used as a key input material in the production of numerous chemicals. The chemical industry has been striving to develop innovative solutions to enable the shift toward a sustainable and circular economy. However, it is facing a massive challenge to attain the net-zero targets. In fact, in the European Union, the chemical industry has targeted to reduce their carbon footprint by 50% by 2030 and 95% by 2050. These targets of net zero could only be achieved through energy efficiency, bio-based or renewable feedstock, and closing material loops, stressing the need for solutions such as carbon capture and green energy.

Ammonia is produced from hydrogen and nitrogen. It is infact, the second most widely produced chemical by volume, with a global market of over 192 MT in 2023. Ammonia is primarily (85%) used in fertilizer manufacturing. Increase in food demand across the globe is set to increase the demand for fertilizers. Furthermore, the emerging perspective use of ammonia as an energy source is expected to result in ammonia demand to cross 245 MT by 2035, of which about 1/3rd could be manufactured using low carbon hydrogen. Traditional hydrogen production accounted for 90% of the carbon footprint of ammonia manufacturing, which can be reduced by using green hydrogen.

Methanol, on the other hand, is a resourceful molecule used in the synthesis of heavy alcohols, acids, and other complex chemicals. The synthesis of chemicals accounts for about 60% of the global methanol demand. It can function as a stand-alone energy source or be converted to other chemicals that could be blended with gasoline. Fuel sources account for 30% of the global methanol demand. Methanol is conventionally manufactured through the transformation of fossil gas or coal into synthetic gas (a mixture of hydrogen and carbon monoxide), and then into methanol. The demand for methanol is projected to reach 210 MT by 2035, of which 30% could be produced from low carbon hydrogen.

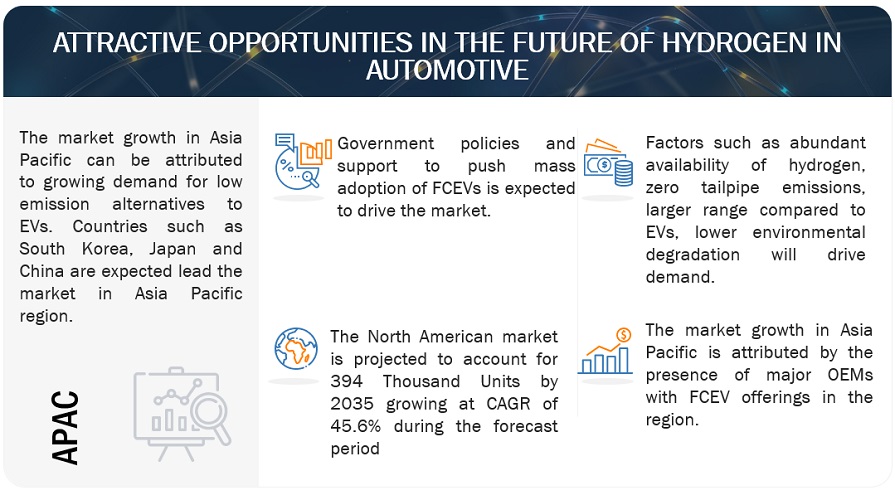

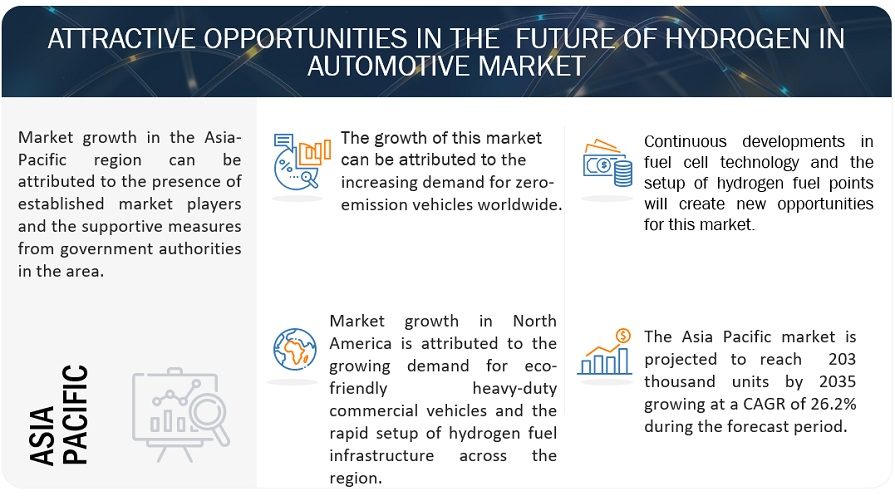

New opportunities for hydrogen-fueled vehicles will arise as the downstream landscape unfolds due to factors like rising demand for low-emission commuting and government subsidies and tax breaks for zero-emission vehicles, abundant fuel availability, ease of refueling and lower environmental degradation will create new opportunities for hydrogen fuelled vehicles. They are expected to be an alternative for EVs in the coming years. Leading OEMs have already started providing/developing hydrogen powered vehicles such as FCEVs, H2-ICEVs and FCHEVs across different vehicle categories. OEMs such as Hyundai, Toyota and Riversimple have also started developing new business models around hydrogen fuelled vehicles. Riversimple, for instance has its own pay per mile business model, where cars are not sold to users, but leased out. Similarly, Toyota provides direct sales, as well as innovative business models such as subscription based services as well as fuel card plans. Further, Hyundai has also developed on direct sales and fleet based business models. Such developments are expected to drive the demand for hydrogen market in the coming decade.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Lower emissions

Heavy manufacturing and long-distance transportation are two sectors battling with direct electrification. In these industries, hydrogen and hydrogen-derived fuels are low-emission solutions that are crucial for lowering carbon emissions. As of 2021, these fuels will only make up around 1% of the world's total energy usage. When compared to other fossil fuels, hydrogen is an especially clean fuel for transportation since it emits fewer greenhouse gases. The generation of hydrogen has increased as a result of more stringent environmental laws and engine manufacturer requirements. For example, China is anticipated to enact emission rules equal to Euro V standards by 2018, while India intends to establish Bharat Stage VI regulations by 2020. The demand for cleaner fuels is expected to increase significantly in the future due to a 10% growth in automotive sales in the Asia Pacific region, the development of premium quality cars, and a rise in consumer fuel spending patterns.

The use of hydrogen fuel presents a significant reduction in emissions compared to Diesel or Gasoline fuelled ICE vehicles. Hydrogen combustion in fuel cells primarily produces water vapor, minimizing carbon dioxide emissions. In contrast, traditional ICE vehicles emit substantial amounts of CO2 during the combustion of fossil fuels. Additionally, hydrogen combustion generates negligible carbon monoxide and virtually eliminates NOX emissions, pollutants commonly associated with internal combustion engines. This cleaner combustion profile positions hydrogen fuel as a promising alternative for mitigating environmental impact and addressing climate change concerns.

Restraint: Highly Flammable

Safety emerges as a prominent consideration for hydrogen storage vehicles in case of collisions and accidents. According to the Department of Energy (US), various tests, including the hydrogen tank drop test, tank leak test, and garage leak simulations, can be conducted to ensure the safe production and storage of hydrogen.

Hydrogen is highly flammable. It has a wide flammability range and low ignition energy requirements, making it more susceptible to ignition compared to conventional fuels. This heightened flammability necessitates stringent safety measures in the design and handling of hydrogen fuel systems in vehicles. Safety concerns surrounding hydrogen combustion can hinder consumer acceptance and erode trust in the technology. This flammability factor not only influences consumer perception but also invites increased regulatory scrutiny, potentially resulting in stricter safety standards. To counter these challenges, industry players must invest in advanced safety technologies, conduct public awareness campaigns to educate consumers, collaborate with stakeholders to shape industry standards, and consider diversifying hydrogen applications beyond the automotive sector.

Opportunity: Lower environmental degradation

The H2Mobility initiative in Germany is fostering the uptake of fuel cell vehicles through the establishment of fueling stations, thereby creating opportunities for the integration of hydrogen storage tanks. Furthermore, Europe's HyFIVE project is dedicated to expanding the network of hydrogen fuel cell infrastructure, with plans for station development across Italy, the UK, Austria, and Denmark. Additionally, prominent automotive manufacturers like Honda, Toyota, and Nissan from Japan are collaborating with gas companies to establish a 100-station hydrogen highway in Japan. In India, Indian Oil, the leading hydrogen producer, is committed to establishing a robust hydrogen distribution network and has allocated USD 40 million towards a demonstration project for hydrogen fuel cell vehicles.

In the pursuit of sustainable transportation, hydrogen fuelled vehicles present a compelling advantage over electric vehicles in mitigating environmental degradation during development. Unlike EVs, which rely on resource-intensive processes such as lithium mining for batteries, hydrogen FCVs donot require large batteries, significantly reducing the ecological impact of production. Additionally, FCVs bypass the need for rare earth elements, minimizing habitat disruption associated with their extraction. As the market navigates through the evolving landscape of sustainable transportation, the environmental edge of hydrogen fuelled vehicles in will become pivotal alternative to electric vehicles.

Challenge: Poor hydrogen Infrastructure and energy loss across hydrogen value chain

All the way through the hydrogen generation value chain, energy is continuously lost. The production stage of electrolysis wastes about 30% of the energy needed, and the conversion into other forms wastes an additional 10–25%. More energy is required for the delivery of green hydrogen for usage in automobiles or energy pipelines. Further energy loss occurs when hydrogen is used in fuel cells.

One major barrier preventing the mass use of hydrogen-powered cars is the limited supply of hydrogen filling stations, which reduces consumer demand. As of 2022, there were only around 91 H2 refueling stations in the US, most of which were in California. Similarly, in Europe, only Germany and France had 105 and 44 hydrogen refueling stations, while rest countries had less than 20 hydrogen refueling stations. In Asia Pacific, China, Japan and South Korea had 138, 165 and 149 hydrogen refueling stations with support from OEMs and government. The sparse refueling infrastructure limits the convenience and accessibility of hydrogen refueling, discouraging potential buyers and fostering consumer reluctance due to concerns about range anxiety and the inconvenience of finding a nearby station. This is one of the major reasons, for hydrogen fuelled vehicles having a limited demand around the world in the current scenerio. Further, in the commercial sector, the dearth of refueling options disrupts the integration of hydrogen FCVs into fleets, impeding the transition to cleaner transportation solutions. This can be seen from the low presence of H2 powered commercial vehicles in most countries outside China.

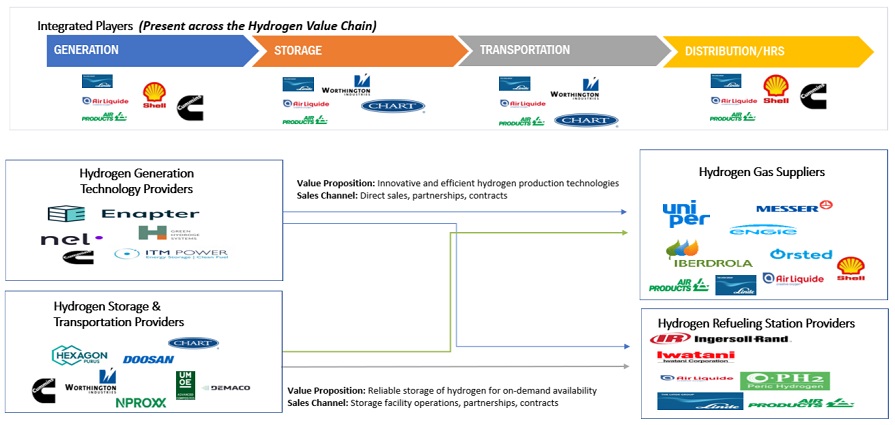

Market Ecosystem

The electrolysis & physical storage segment to be the fastest growing during the forecast period

There are five primary techniques for producing hydrogen: electrolysis, partial oxidation, steam methane reforming, auto thermal reforming and coal gasification. Future of hydrogen study is anticipated to witness a faster growth rate in the electrolysis segment. Technologies for producing hydrogen are evolving as a result of ongoing research and development, becoming more efficient and economical. For instance, improvements in electrolysis are bringing down the cost of creating green hydrogen, which is driving the expansion of electrolysis technologies. Global CO2 emissions were projected to reach above 50 gigatons in 2022. By switching to green hydrogen, it is possible to cut overall emissions from current uses in the chemical and industrial markets by 2% (1 GT). There are two categories for hydrogen storage technologies: material-based and physical storage. The section on physical storage systems can be divided into two main types: compressed gas storage and liquefied hydrogen storage. The process of compressed hydrogen storage involves compressing hydrogen gas to extremely high pressures and then storing it in metal or composite containers with great strength. During the projected period, physical hydrogen storage is expected to rise due in part to the growing use of compressed hydrogen storage, especially in industrial settings and automobiles that run on hydrogen fuel cells.

“Compression to be the largest segment based on hydrogen conversion during forecast period”

Normally, hydrogen is generated under relatively low pressures, typically around 20 to 30 bar, and requires compression before transportation. Presently, the primary methods for compressing gaseous hydrogen involve either positive displacement compressors or centrifugal compressors. Hydrogen is commonly conveyed over extensive distances from production facilities to end users through pipelines or as compressed gas stored in trailers or containers. Compression plays a crucial role in readying hydrogen for transit, ensuring effective and safe conveyance. The compression process allows for high-density storage of hydrogen, enabling greater storage capacity within a given container. This feature is especially vital for applications where spatial limitations are a concern.

The passenger car segment to be the largest segment during the forecast period

The passenger car segment accounts for the largest market share of the hydrogen fuel cell vehicles. Some leading passenger car FCEV models available in the market include Toyota Mirai, Honda Clarity, Mercedes-Benz GLC FCEV, Nissan X-Trail FCEV, and Riversimple RASA. Other OEMs are also planning to launch new hydrogen fuelled models in the coming years, realizing the significant potential. For instance, BMW has announced plans to introduce the fuel-cell technology developed with Toyota in the BMW X5, X6 and X7 models by 2025. Further, Hyundai also announced plans to launch its new generation of NEXO FCEV in 2024. Similarly, Honda has also announced plans to launch its upcoming CR-V FCEV in 2024. Kia also plans to launch its Carnival FCEV in 2026.

The Heavy duty commercial vehicle segment to be the fastest growing segment during the forecast period

Feasiblity of H2 propulsion in commercial vehicles is much higher than in passenger cars for the short term. This is especially prominent in Heavy Duty Commercial Vehicle use cases. Leading Bus and Truck Manufacturers have been working on H2 powered Buses and Trucks since past few years. Currently, leading OEMs such as Toyota, Hyundai, New Flyer, Polaris, Daimler, among others have launched or showcased prototypes for Class 8 H2 Trucks and H2 Transit Buses. Unlike in Passenger cars, where TCO of EVs is still much lower than that of H2 vehicles, in Heavy Duty Commercial Vehicles, TCO is much closer and is expected to be bridged by end of this decade. This is expected to lead to a rapid increase in H2 based heavy commercial vehicle demand in coming years. Leading countries such as US, Germany and China have also stepped up the set up H2 infrastructure since 2024 for commercial vehicle use cases. For instance, since March 2024, US states outside California started setup of portable H2 refueling stations for intracty transit of H2 fueled buses and trucks. Similarly, Massive setup of H2 refueling stations is ongoing in China for its growing number of H2 buses and Trucks.

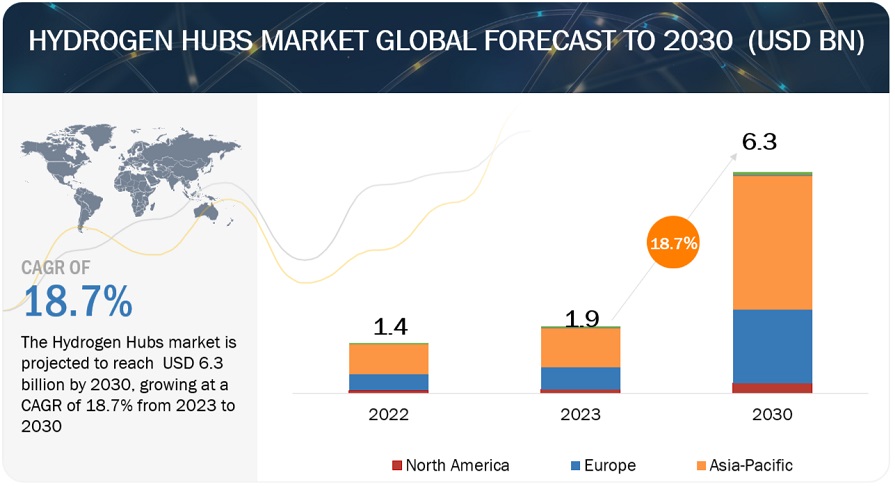

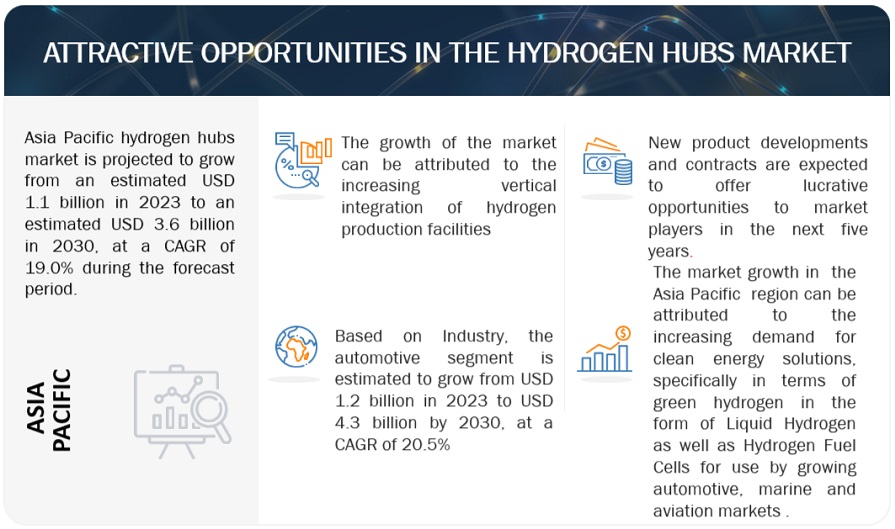

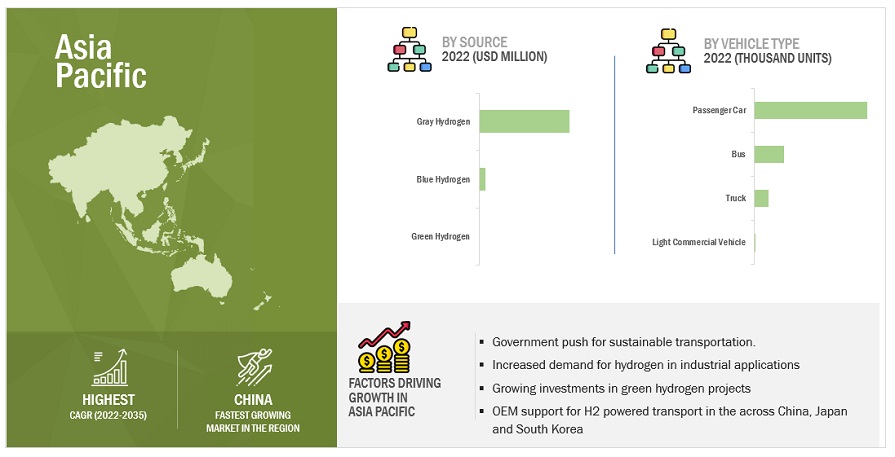

Asia Pacific to be the prominent market for hydrogen during the forecast period.

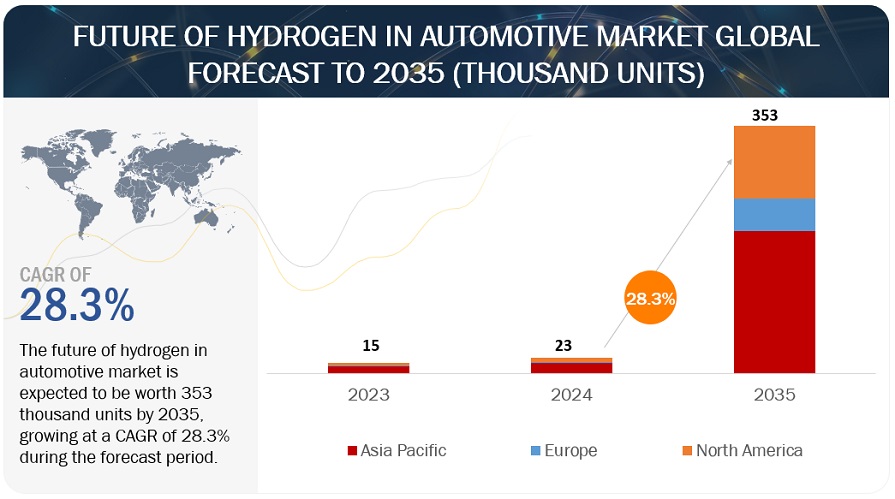

Asia Pacific has been leading the market with growing demand for hydrogen fuelled vehicles. Countries such as China, India, South Korea, Japan, and Australia are leading the demand for hydrogen in the region. China is now focusing on supplying hydrogen for zero-emission vehicles in ten global cities. However, the country may eventually participate in international hydrogen trading. China is currently the largest market for Hydrogen Trucks and Buses around the world, while South Korea and Japan are amongst the largest passenger car FCEV markets. In 2022, more than 10,000 fuel cell passenger cars sold in South Korea, making it the country with largest FCEV sales. It held around 60% of market share in Asia Pacific, and more than 45% of global market share. China on the other hand, had around 4,400 FCEVs sold, most of which were trucks and buses. Simialrly, Japan also sold 1,040 FCEVs, majority of them being passenger cars. Regulations for hydrogen refueling station across countries in the Asia Pacific region, are expected to increase demand for hydrogen fuelled vehicles in the region. India, for instance, plans to produce 5 Million tons of green hydrogen per annum by 2030; with H2 to be the main alternative for electric transport. Similarly, China announced plans for over 50,000 H2 fuel-cell vehicles sold by 2025 and planned multifold increase in green hydrogen production. Japan announced plans to set up 320 H2 refueling stations by 2025 and have 800,000 FCEVs on road by 2030. Similarly, South Korea announced plans for 6.2 Mn FCEVs and 1,200 H2 refueling stations by 2040. Further, Australia has established trade ties with other Asian nations and is currently the leading LNG exporter in the region. The nation possesses a plentiful supply of coal and renewable resources that may be converted into low-carbon hydrogen to fulfill the increasing demand from Korea and Japan. Australia is actively developing a national hydrogen strategy, with an emphasis in the near future on exports rather than local consumption.

Key Market Players

Established firms such as Linde plc (Ireland), Air Products and Chemicals, Inc. (US), Air Liquide (France), Chevron Corporation (US), Saudi Arabian Oil Co. (Saudi Arabia), and Uniper SE (Germany) dominate the hydrogen upstream and midstream space. While, the hydrogen fuel cell vehicles space is dominated by established players such as Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), Honda Motors (Japan), BMW Group (Germany), Stellantis (Netherlands) among others. These companies develop new technologies in the hydrogen fuelled vehicles domain. They have invested in R&D for related technologies and offer best-in-class products to their customers.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2021–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Value (USD million/billion) |

|

Segments Covered |

Upstream (Generation (SMR, POX, ATR, Coal Gasification, Electrolysis) Source (Gray, Blue, Green), Storage) Midstream (Conversion, Transportation, Distribution/Hydrogen Refueling Station (Onsite, Offsite), Downstream (Platform, Propulsion), and Region |

|

Geographies covered |

Asia Pacific, Europe, North America. South America, and Middle East & Africa |

|

Companies Covered |

Linde plc (Ireland), Air products and Chemicals, Inc. (US), Air Liquide (France), Chevron Corporation (US), Saudi Arabian Oil Co., (Saudi Arabia), Uniper SE (Germany), Worthington Industries (US), ITM Power plc (UK), Enapter S.r.l. (Italy), INOX India Limited (India), Cryolor (France), Pragma Industries (France), BNH Gas Tanks (India), Hexagon Purus (Norway), NPROXX (Netherlands), Oxygen Service Company, Inc. (OSC) (US), BayoTech (US), Luxfer Gas Cylinders (UK), Chart Industries (US), Quantum Fuel Systems LLC (US), AMS Composite Cylinders (UK), Weldship Corporation (US), Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), Honda Motors (Japan), BMW Group (Germany), and Stellantis (Netherlands), Airbus Group (Netherlands), Kongsberg Gruppen Asa (Norway) |

This research report categorizes the future of hydrogen based on upstream, midstream, downstream and Region.

Based on Upstream:

-

Generation

- Steam Methane Reforming

- Partial Oxidation

- Auto Thermal Reforming (ATR)

- Coal Gasification

- Electrolysis

-

Source

- Gray Hydrogen

- Blue Hydrogen

- Green Hydrogen

-

Storage

-

Physical Storage

- Gaseous Hydrogen Storage in Pressure Tanks

- Storage of Liquid Hydrogen

-

Material-based

- Metal Hydrides

- Chemical Hydrides

-

Physical Storage

Based on Midstream:

-

Conversion

- Compression

- Liquefaction

-

Hydrogen Transportation:

- Pipeline Transportation

- Liquid Tankers

- Tube Trailers for Gaseous Hydrogen

-

Distribution/Hydrogen Refueling Station:

- On-site hydrogen refueling station

- Off-site hydrogen refueling station

Based on Downstream:

-

Platform

-

Automotive

- Passenger Car

- Light Commercial Vehicle

- Bus

- Truck

-

Aerospace & Defense

- Aviation

- Marine

- Unmanned

- Space

- Defense

-

Hydrogen Hubs

- Airport

- Marine Port

- Military Hub

-

Automotive

-

Propulsion Type

- FCEV

- FCHEV

- H2-ICEV

Based on the region:

-

Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

-

Europe

- Germany

- UK

- France

- Russia

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

South America

- Brazil

- Argentina

- Rest of South America

-

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

Recent Developments

- In February 2024, Hyzon Motors partnered with New Way to develop Fuel Cell Refuse Trucks

- In January 2024, Honda and GM announced commercialization of their FCEV drivetrains

- In November 2023, Spark EV and AVL partnered to develop FCEV optimization technology to increase FCEV efficiency

- In October 2023, Hyundai and IVECO showcased the E-WAY H2 Hydrogen FCEB

- In June 2023, Air Liquide partnered with TotalEnergies to form an equally owned joint venture to build a network of hydrogen stations aimed at heavy-duty vehicles along major European highways.

- In May 2023, PACCAR and Toyota expanded their FCEV collaboration for Kenworth T680 and Peterbilt 579 Hydrogen Trucks, which will begin deliveries from 2024.

- In April 2023, Linde plc entered into a long-term agreement with Evonik to provide green hydrogen.

- In March 2023, Toyota partnered with Haima Automotive to develop Fuel Cell Vans and Cars.

- In 2023, Airbus teams up with HyPort to advance green hydrogen availability at airports.

- In 2023, Hamburg Airport joins international “Hydrogen Hub at Airport” network.

- In 2021, Full-scale hydrogen-based propulsion system for ferries, tested by HySeas-III

Frequently Asked Questions (FAQ):

What is the current size of the hydrogen generation market by value?

The current size of the hydrogen generation market is estimated at USD 158.8 billion in 2023.

Who are the winners in the future of hydrogen study?

Linde plc (Ireland), Air Products and Chemicals, Inc. (US), Air Liquide (France), Chevron Corporation (US), Saudi Arabian Oil Co. (Saudi Arabia), Uniper SE (Germany), and others are leading the way in the future of hydrogen study.

Which region will have the fastest-growing demand for hydrogen?

Due to plans for expanding the number of H2 refueling stations outside of France and Germany, as well as government programs that encourage environmental sustainability, Europe is expected to have the fastest-growing hydrogen market.

What are the new market trends impacting the future of hydrogen?

Hydrogen policies are being implemented by governments across the globe, with financing and legislation supporting infrastructure development, demand, and research.

What are different countries covered in Asia Pacific region in overall hydrogen value chain?

The countries covered in report for hydrogen market are China, Japan, India, South Korea, Australia.

What is the current size of the hydrogen fuel cell vehicles by volume?

The current size of the hydrogen market for automotive is estimated at 15 thousand units in 2023.

Who are the winners in the future of hydrogen in automotive?

The future of hydrogen in automotive is led by Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), Honda Motors (Japan) among others.

Which region will have the fastest-growing hydrogen fuel cell vehicles?

Europe will be the fastest-growing hydrogen market for automotive due to the increasing awareness of environmental sustainability, and supportive government initiatives as well as plans for increasing setup of H2 refueling stations outside France and Germany.

What are the new market trends impacting the future of hydrogen in automotive?

OEM plans for diversification in low emission propulsion types, development of new generation of fuel cell systems for advanced FCEV propulsion, market consolidation with forward and backward integration will be some trends impacting the market in the future.

What are different countries covered in Asia Pacific region for hydrogen fuel cell vehicles?

The countries covered in report for hydrogen market for automotive are China, Japan, India, South Korea. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

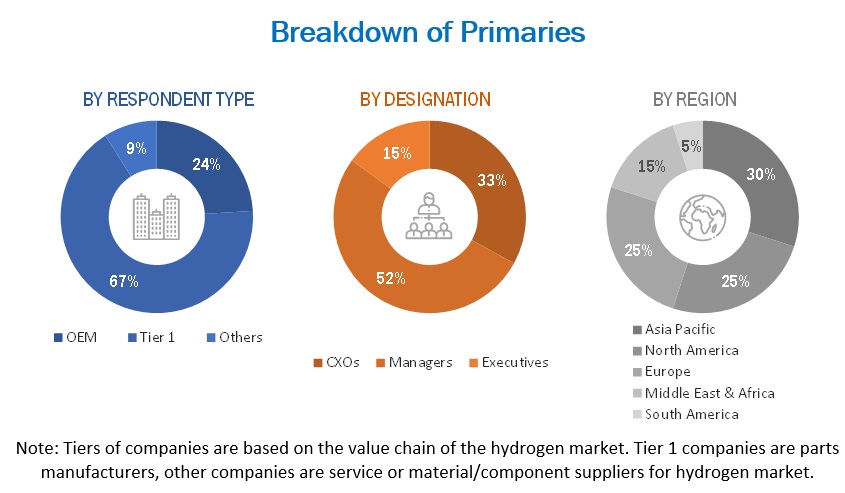

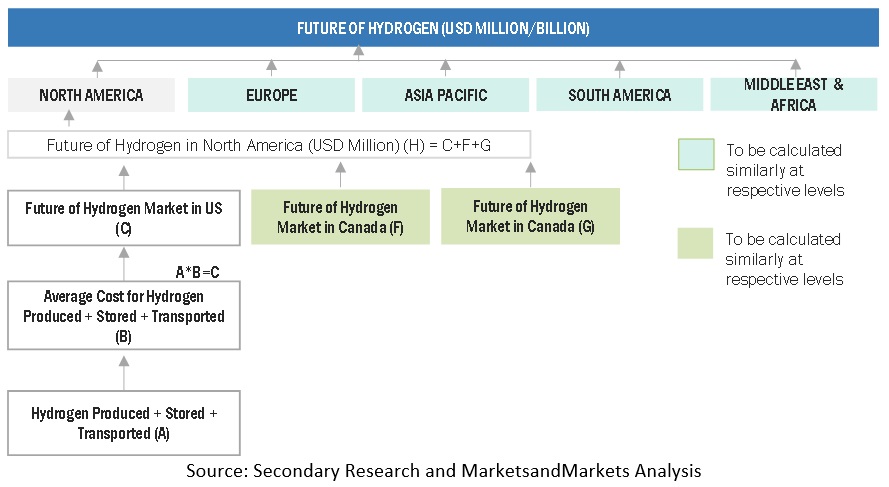

The study involved four major activities in estimating the market size of the ‘Future of Hydrogen’ study. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; whitepapers, certified publications; articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources. Secondary research has been used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across five regions, namely, Asia Pacific, Europe, North America, South America, and Middle East & Africa. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total market size. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Future of Hydrogen: Bottom-Up Approach for Global Hydrogen Market Size

Future of Hydrogen: Bottom-Up Approach for Global Hydrogen Fuel Cell Vehicles Market Size

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Hydrogen, the lightest and most abundant element in the universe, boasts exceptional energy-carrying capabilities. It can be generated in significant quantities and catered to large-scale industries for diverse operations. Produced as both a primary and by-product from various primary energy sources such as wind, solar, coal, natural gas, and nuclear energy, hydrogen is supplied in bulk for numerous value-added uses and chemical applications. This versatile element fuels various applications, including fuel cells and combined heat and power technologies, delivering power efficiently across different sectors.

The hydrogen market encompasses hydrogen generation, storage, and transportation. The hydrogen generation sector comprises revenue generated by companies producing hydrogen for applications such as chemical & refinery, energy, and mobility. Within the hydrogen storage market, both physical-form and material-based storage methods contribute to the overall revenue. Hydrogen transportation involves generating revenue from transporting hydrogen over both long and short distances.

The chemical industry is one of the most critical sector where hydrogen is used as a key input material in the production of numerous chemicals. The chemical industry has been striving to develop innovative solutions to enable the shift toward a sustainable and circular economy. However, it is facing a massive challenge to attain the net-zero targets. In fact, in the European Union, the chemical industry has targeted to reduce their carbon footprint by 50% by 2030 and 95% by 2050. These targets of net zero could only be achieved through energy efficiency, bio-based or renewable feedstock, and closing material loops, stressing the need for solutions such as carbon capture and green energy.

Future of Hydrogen in Automotive includes key trends, insights on ecosystem and market size for automobiles that run on hydrogen fuel cells, and are considered as low emission vehicles. According to Alternative Fuel Data Center (AFDC), fuel cells produce electricity and heat by electrochemically reacting hydrogen fuel with oxygen. Stringent emission regulations have led to the increased use of fuel cells in the automotive and transportation industry.

A fuel cell electric vehicle (FCEV) is a type of electric vehicle that uses a fuel cell. A fuel cell can also be used in combination with a battery or supercapacitor to power the onboard electric motor. In an FCEV, hydrogen is pumped into the car and then fed to the fuel cell stack. The fuel-cell stack is the center where hydrogen is electrochemically converted into electricity with no combustion and zero emissions. Fuel cells in vehicles generate electricity to power the motor. As long as hydrogen is available, the fuel cell will continue to produce electricity. Most fuel-cell vehicles are classified as zero-emission vehicles that emit only water and heat

List of Key Stakeholders

- Manufacturers of fuel cell electric vehicles (FCEVs)

- Government organizations

- Owners of hydrogen charging stations

- Developers and operators of hydrogen fuel pumps

- Manufacturers and suppliers of hydrogen generation equipment

- Developers of hydrogen generation infrastructure

- Institutional investors

- Merchant hydrogen producers

- Methanol producers

- Ammonia producers

- Refinery operators

- Research institutes

- Fuel Cell and Hydrogen Energy Association (FCHEA)

- Hydrogen Gas Suppliers

- Hydrogen Station Service Providers

- United States Council for Automotive Research LLC (USCAR)

- Alternative Fuels Data Center (AFDC)

- Automobile OEMs

- Automotive Fuel Cell Raw Material Suppliers

- Automotive Fuel Cell Suppliers

- California Fuel Cell Partnership (CAFCP)

- Aircraft Manufacturers

- Ship Manufacturers & System Integrators

- Space Stations

- Semiconductor Manufactuers

- Cement Manufacturers

- Steel Manufacturers

- Chemical Manufacturers

- Ammonia Manufacturers

Report Objectives

- To define, describe, segment, and forecast the hydrogen market size, by upstream and midstream, in terms of value and volume.

- To define, describe, and forecast the size of the hydrogen fuel cell vehicles in terms of volume (thousand units).

- To define, describe, and forecast the size of the hydrogen fuel cell vehicles based on propulsion type (FCEV, FCHEV, H2-ICEV)

- To segment and forecast the market size by vehicle type (Passenger Car, Light Commercial Vehicle, Bus, Truck)

- To segment and forecast the market size by hydrogen production & storage, source, hydrogen conversion, hydrogen transportation, and hydrogen refueling station.

- To segment and forecast the market size, by region (Asia Pacific, Europe, North America, South America, and Middle East & Africa)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the future of hydrogen

- To understand the dynamics of competitors in market, and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio strength and business strategies

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze the opportunities offered by various segments of the market to its stakeholders

- To analyze and forecast the trends and orientation for the hydrogen market in the global industry

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

- Future of Hydrogen, By Source, at the country level (For countries covered in the report)

- Future of Hydrogen in Automotive, By vehicle type, at the country level (For countries covered in the report)

- Future of Hydrogen in Automotive, By Component, at the regional level

- Future of Hydrogen in Aerospace & Defense, By Platform, at the regional level

- Profiling of Additional Market Players (Up to 5)

Growth opportunities and latent adjacency in Future of Hydrogen Market