Game-based Learning Market Size, Share, Growth, Latest Trends

Game-based Learning Market by Offering (Gamified Learning, Microlearning, Simulation Learning, LMS, Adaptive Learning, Authoring Tools), Application (K-12, Higher Education, Corporate Training, STEM, Cognitive Development) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

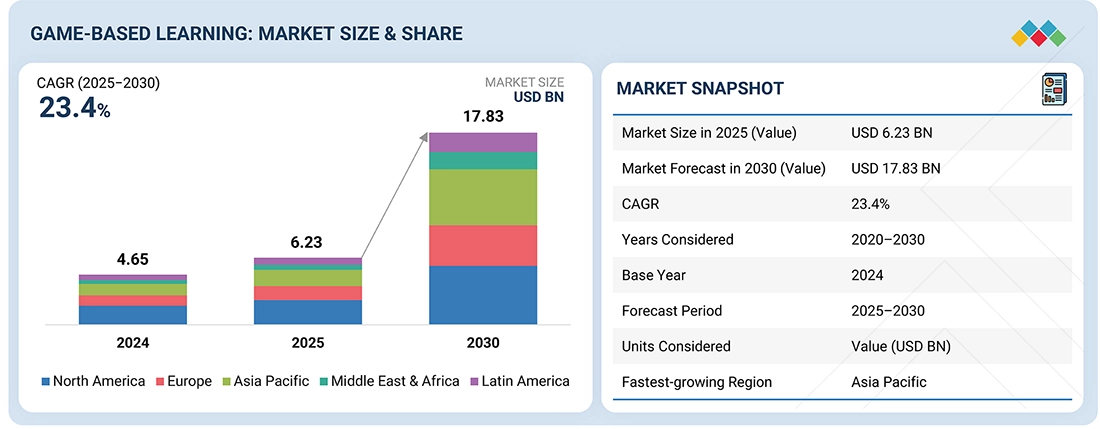

The global game-based learning (GBL) market is projected to grow from USD 6.23 billion in 2025 to USD 17.82 billion by 2030, registering a CAGR of 23.4%. This growth is driven by rising demand for engaging, measurable, and personalized learning experiences across education and enterprise sectors. Key adoption drivers include - AI, AR, and VR integration is enhancing immersive learning environments, Mobile-first access and expanding internet penetration are enabling scalable, remote delivery, Strong uptake of LMS, assessment tools, and skill-based applications is fueling platform growth.

KEY TAKEAWAYS

- By Region, North America accounted for largest market share of 36.8% in 2025.

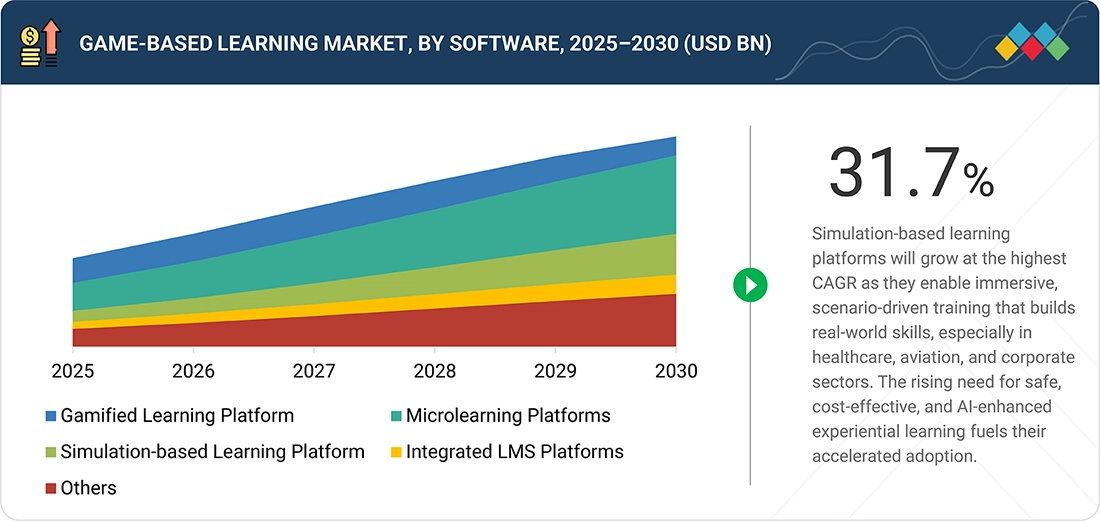

- By Software, the Simulation-based Learning Platforms segment is expected to grow at the highest CAGR of 25.6% during the forcast period.

- By Game Type, Skill-based, Assessment & Evaluation Games segment is projected to hold largest market share during the forecast period

- By Integration Type, Web-based Deployment segment accounted for largest market share 2025.

- The medical & healthcare training application segment is expected to grow at the highest CAGR of 26.2% during the forecast period.

- Leading market players like Duolingo, Kahoot!, and Stride Inc are pursuing strategic partnerships, mergers, and acquisitions to expand their product portfolios and strengthen global presence. The competitive landscape is shaped by innovation in AI-powered gamification, immersive VR/AR learning, and analytics-driven engagement models.

- Companies like Tenneo, Game Strategies, and Axonify among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Game-based learning is accelerating globally, driven by immersive technologies, cloud-enabled platforms, and data-driven engagement. Educators, enterprises, and learners are seeking Higher engagement and retention, Flexible remote and hybrid learning models, Skill-based training in leadership, compliance, and soft skills. Adaptive content delivery tailored to individual progress. Vendors are responding with AI-powered platforms for scalable personalization, AR/VR-enabled simulations for experiential learning, Learning-as-a-Service (LaaS) models for flexible deployment, Performance-based gamification to align learning with measurable outcomes. They are also addressing challenges around Data privacy and compliance, Curriculum alignment and interoperability, Teacher enablement and onboarding support.

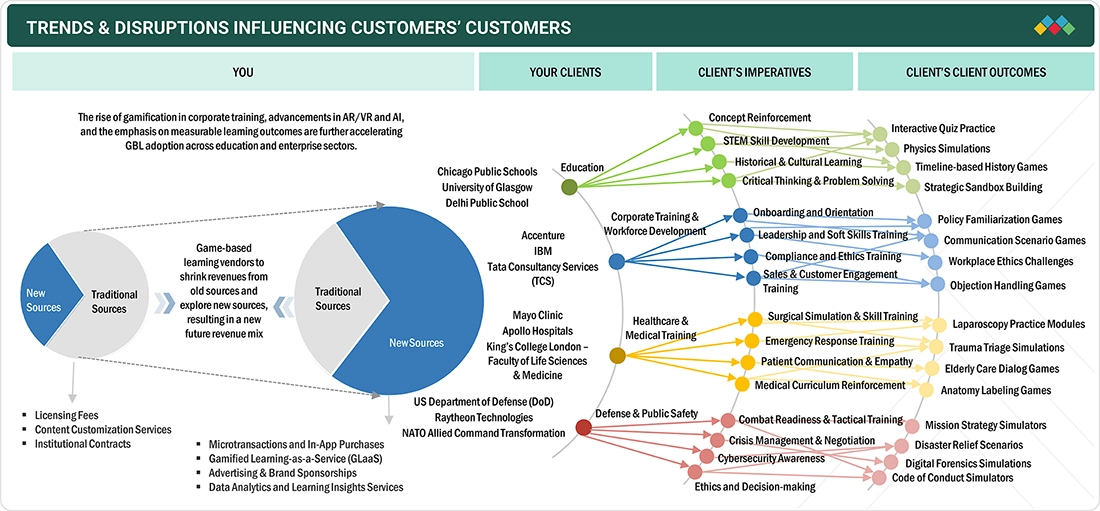

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Game-based Learning market is experiencing accelerated growth, driven by the demand for engaging, interactive, and measurable learning experiences across education, corporate, healthcare, and defense sectors. As institutions and enterprises strive to improve learner outcomes, skill development, and knowledge retention, GBL platforms are gaining significant traction. This evolving landscape is shaped by the integration of immersive technologies such as AR/VR, AI, and gamification engines, along with real-time analytics, adaptive learning systems, and AI-driven feedback mechanisms. Use cases now span from curriculum reinforcement and leadership training to surgical simulation and crisis response drills. Organizations are adopting game-based tools not only to improve engagement but also to build critical thinking, empathy, and soft skills in learners. The shift toward data-driven personalization, microlearning, and simulation-based environments is redefining how training is delivered across age groups and sectors. Furthermore, as Generative AI enables content scalability and scenario branching, new business models like Learning-as-a-Service and performance-based gamification are emerging. These advances are accompanied by challenges around learner data privacy, outcome validation, and platform interoperability, prompting vendors to build secure, scalable, and compliant solutions. In this dynamic environment, GBL providers must continuously innovate to meet the evolving needs of learners and stakeholders, while shaping the future of education and training in a digitally immersive, outcome-focused world.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Cognitive and psychological benefits of gamification increase its acceptance in learning environments.

-

Rising mobile technology penetration is expanding game-based learning accessibility.

Level

-

Resistance from traditional educators and institutions slows down implementation

-

Concerns about excessive screen time and digital overexposure

Level

-

Integration of AI and analytics into GBL platforms offers personalization at scale

-

Game-based learning is expanding into areas like language learning and STEM subjects

Level

-

Balancing educational content with engaging gameplay while maintaining curriculum alignment standards

-

Teacher training and digital competency gaps hinder effective GBL integration

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cognitive and psychological benefits of gamification increase its acceptance in learning environments.

Growing awareness of the cognitive and psychological benefits of gamification is driving its integration across learning environments. Game-based learning (GBL) enhances memory retention, motivation, and problem-solving by engaging both emotional and intellectual faculties. Vendors are positioning gamified tools as solutions that build learner confidence, sustain attention, and improve conceptual understanding, making learning more measurable, enjoyable, and outcome-driven.

Resistance from traditional educators and institutions slows down implementation

Despite rising interest, traditional educators and institutions remain cautious about adopting GBL. Concerns around curriculum alignment, assessment integrity, and implementation complexity slow integration into conventional models. Vendors are addressing this through educator enablement, policy-aligned frameworks, and low-friction onboarding, helping institutions transition from passive to interactive learning ecosystems.

Integration of AI and analytics into GBL platforms offers personalization at scale

The integration of AI and analytics into GBL platforms is enabling personalized learning at scale. Adaptive algorithms dynamically adjust content based on learner progress, offering tailored challenges that match individual pace and proficiency. Vendors are leveraging real-time dashboards to provide educators and enterprises with visibility into engagement, performance, and learning outcomes, supporting data-driven decision-making and curriculum optimization.

Balancing educational content with engaging gameplay while maintaining curriculum alignment standards

Balancing engaging gameplay with pedagogical rigor remains a core challenge. Developers must ensure that entertainment elements support—not distract from—learning goals. Vendors are investing in instructional design, curriculum mapping, and educator co-creation models to maintain academic credibility, measurable outcomes, and intuitive user experiences, ensuring long-term adoption and impact.

Game-based Learning Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Hyundai Spain implemented Gamelearn's multilingual game-based learning platform to enhance employee development. The cloud-based solution eliminated time constraints and physical classroom requirements, offering games in English, Spanish, French, and German. | Hyundai improved employee professional development and productivity through game-based learning. The approach enabled measurement of training effectiveness throughout the process. The multilingual platform provided flexibility and broad accessibility for global operations. |

|

Clifton Public Schools implemented Prodigy Math Game for 10,700 diverse students. The adaptable platform allowed students to participate at their own pace, providing real-time data and detailed progress reports for teachers. | Students showed increased engagement and improved math performance, especially lower-performing learners. Students mastered nearly double the math skills per month compared to the previous year. Prodigy's reporting enhanced communication and fostered data-driven instruction. |

|

Professor Toni Marie integrated Kahoot! into nutrition education for 1,200 students. She utilized AI features including PDF-to-kahoot generator and question generator to streamline teaching and create varied, dynamic question formats. | Kahoot! with AI increased student engagement and improved lecture content retention. AI features provided considerable time savings in lesson preparation while offering fresh perspectives and creative touches, enhancing the overall learning experience. |

|

Maruti Suzuki partnered with Tenneo (formerly G-Cube) for digital learning transformation. The solution included online courses with videos, animations, and interactive games, as well as providing reports and skill gap analyses across departments. | Digital training aligned with learners' specific needs and improved skill development. Interactive content like mini-games boosted engagement. The modern LMS drastically reduced infrastructure costs while enhancing learning efficiency and optimizing operational expenditure. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The game-based learning market ecosystem, comprises of software types (gamified learning platforms, microlearning platforms, simulation-based learning platforms, integrated LMS platforms, adaptive learning systems, and AI authoring tools & development platforms). This segmented ecosystem works collaboratively to drive the transition toward more efficient workflows and output generation, leveraging technology and data to achieve goals.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Game-Based Learning Market, By Offering

Simulation-based learning platforms are revolutionizing experiential education by replicating real-world scenarios for hands-on practice, collaboration, and skill development. These platforms allow learners to apply theoretical knowledge in safe, interactive, and controlled digital environments, enhancing knowledge retention, decision-making, and performance across academic and professional domains. The integration of AI-driven simulations and immersive content is further strengthening personalized training experiences.

Game-Based Learning Market, By Game Type

AI-powered educational games are reshaping personalized learning by combining adaptive algorithms, gamification mechanics, and real-time analytics. These games dynamically adjust difficulty levels and learning content to match individual learner behavior and progress. This approach ensures continuous engagement, deeper conceptual understanding, and improved mastery over time. The growing use of strategy-based, role-playing, and problem-solving games is further driving demand across both K–12 and corporate sectors.

Game-Based Learning, By Integration Type

Immersive technologies, including Virtual Reality (VR) and Augmented Reality (AR), are expanding the frontiers of interactive education. These integrations create realistic, spatial learning environments that bridge the gap between theory and practice. Learners benefit from enhanced experiential recall, situational awareness, and hands-on application of concepts. As institutions and enterprises adopt mixed-reality learning ecosystems, the demand for scalable, device-compatible platforms continues to grow.

Game-Based Learning, By Application

The medical and healthcare sectors are rapidly adopting game-based learning to enhance clinical decision-making, procedural skills, and patient care outcomes. Through interactive simulations, case-based scenarios, and VR-based training modules, healthcare professionals can safely practice high-stakes situations and develop critical thinking abilities. This approach not only boosts readiness and confidence but also supports ongoing professional development and competency-based learning outcomes.

REGION

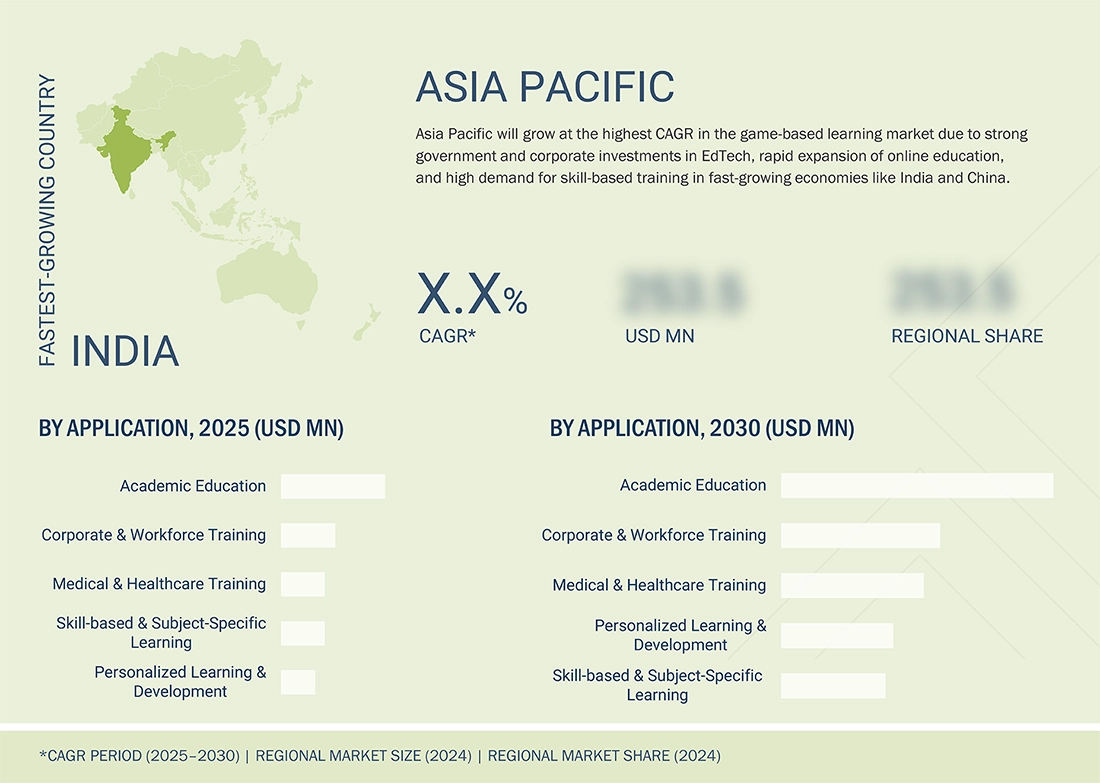

Asia Pacific to be fastest-growing region in global Game-Based Learning Market during forecast period

Asia Pacific is projected to grow at the highest CAGR in the game-based learning market owing to rapid digitalization in the education sector and the strong push from governments to integrate technology into classrooms. The region’s vast student population, coupled with a rising emphasis on skill-based and experiential learning, is driving significant adoption of simulation and game-based platforms. Expanding internet and smartphone penetration, along with increasing affordability of digital tools, further supports this growth. Moreover, local EdTech startups and global players are investing heavily in culturally relevant, gamified content and AI-driven learning experiences, making the region a key innovation hub for the game-based learning industry.

Game-based Learning Market: COMPANY EVALUATION MATRIX

In the Game-Based Learning market matrix, Duolingo (Star) leads with its engaging, gamified approach to language learning that combines bite-sized lessons, adaptive challenges, and AI-driven personalization to enhance learner motivation and retention. Its global reach, continuous innovation, and strong community ecosystem reinforce its position as the top player transforming digital education through play-based engagement. Age of Learning (Emerging Leader) is gaining momentum with its comprehensive, curriculum-aligned educational games that promote foundational skills across subjects through immersive, interactive experiences. Its focus on learning outcomes and scalable digital platforms positions it as a fast-growing contender in the game-based learning landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 6.23 BN |

| Market Forecast in 2030 (value) | USD 17.83 BN |

| Growth Rate | 23.40% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Units Considered | USD Million |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

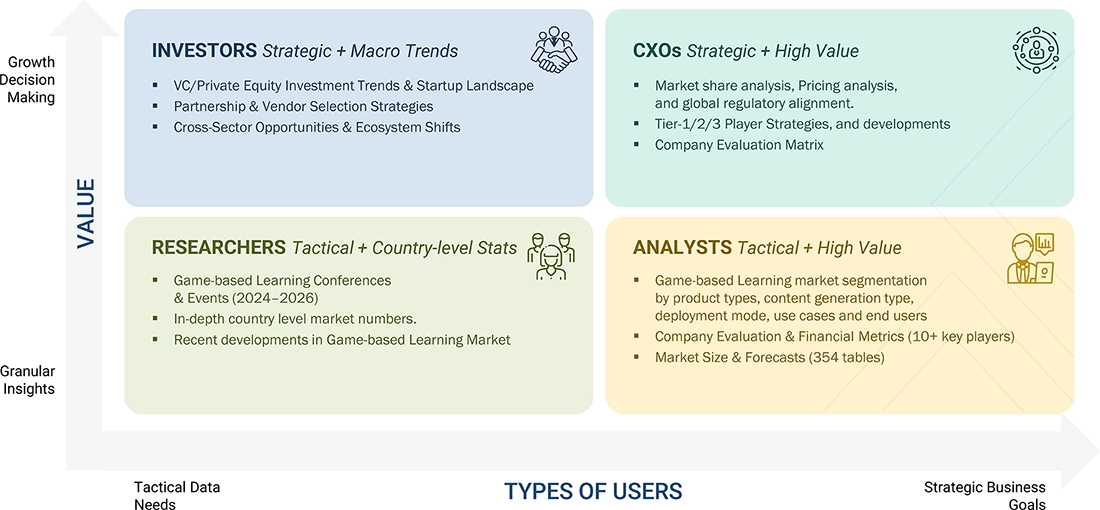

WHAT IS IN IT FOR YOU: Game-based Learning Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading GBL Vendor |

|

|

| Leading GBL Vendor |

|

|

RECENT DEVELOPMENTS

- April 2025 : Duolingo launched its largest content expansion ever with 148 new language courses, more than doubling its current offering. The expansion makes their seven most popular non-English languages - Spanish, French, German, Italian, Japanese, Korean, and Mandarin - available across all 28 supported user interface languages.

- March 2025 : K12 Tutoring, a personalized, online tutoring service of Stride, Inc., partnered with Lake Forest School District in Delaware to ensure students continue receiving high-impact tutoring following the sudden closure of their former tutoring provider. This collaboration reflects K12 Tutoring’s commitment to delivering innovative, tailored educational solutions that empower students to reach their full potential.

- February 2025 : Kahoot! announced an exciting new collaboration with the globally loved Sanrio characters, including Hello Kitty, My Melody, Kerokerokeroppi, Mr. Men Little Miss, and many more. This collaboration introduces a collection of educational learning games designed for children and families.

- January 2025 : Microsoft Corp. and Pearson announced a strategic partnership to help address one of the top challenges facing organizations globally: skilling for the era of AI. The partnership will focus on providing employers, workers, and learners with new AI-powered products and services to help prepare the current and future workforce across industries for the era of work in an AI-driven economy.

- December 2024 : Duolingo announced a new partnership with Netflix’s Squid Game to promote Korean language learning through an immersive, one-of-a-kind campaign, including an update to its Korean course. Titled “Learn Korean or Else,” the campaign combines Duolingo’s humorous approach to promoting learning with the high-stakes energy of Netflix’s Squid Game to motivate fans to do their Korean lessons.

Table of Contents

Methodology

This research study on the game-based learning market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Game-Based Learning (IJGBL), British Journal of Educational Technology (BJET), International Journal of Serious Games, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred game-based learning providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the game-based learning spending of various countries was extracted from the respective sources.

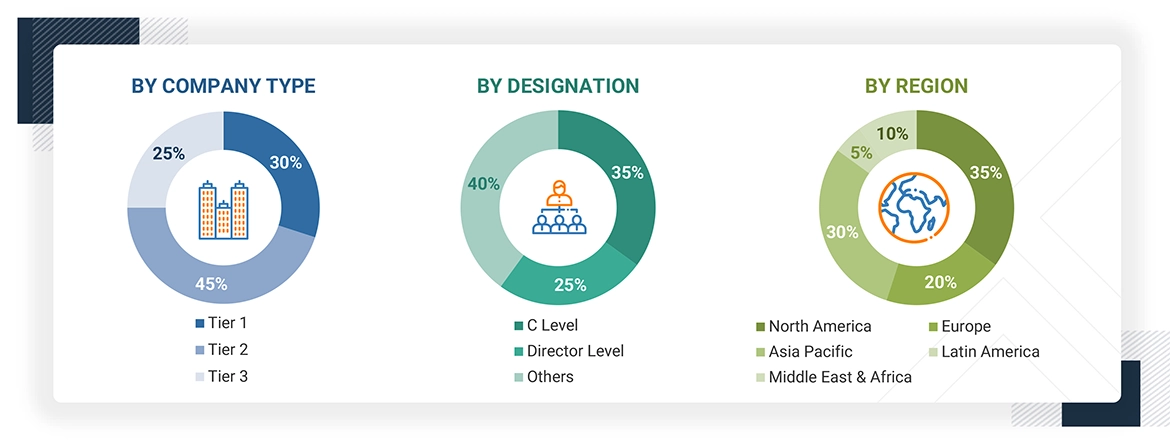

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and game-based learning providers. They also included key executives from game-based learning solution vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

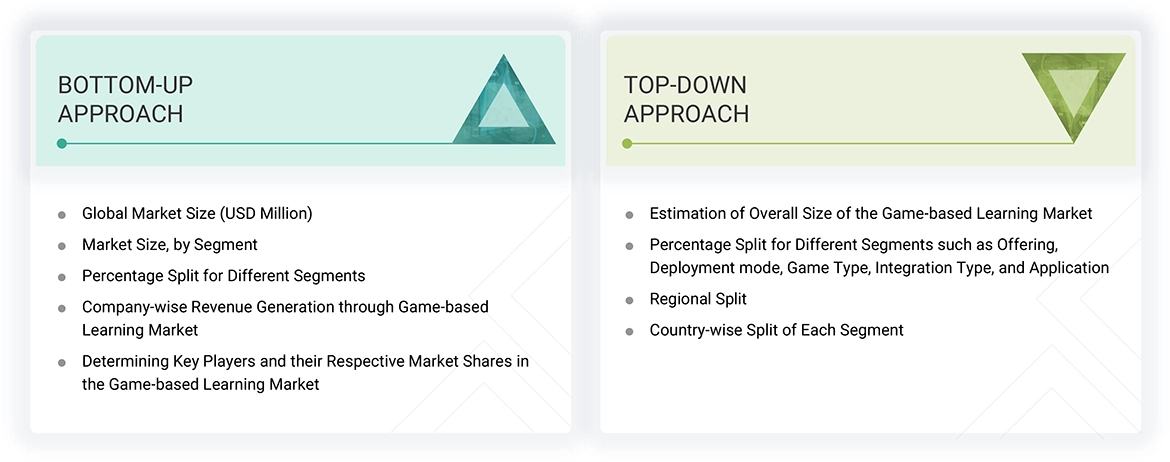

Multiple approaches were adopted to estimate and forecast the game-based learning market. The first approach involved estimating the market size by companies’ revenue generated by selling game-based learning products.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering products in the game-based learning market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on software, services, deployment mode, game type, integration type, application, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of game-based learning products among various verticals in key countries relative to the regions that contribute most to market share was identified. For cross-validation, the adoption of game-based learning products among enterprises, along with different use cases concerning their regions, was identified and extrapolated. Use cases identified in different regions were given weightage for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the game-based learning market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major game-based learning providers, and organic and inorganic business development activities of regional and global players were estimated.

Game-based Learning Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Game-based learning is an instructional approach that incorporates game elements and mechanics to enhance learning outcomes. It involves using digital or physical games to teach concepts, promote engagement, and reinforce knowledge across various domains, such as education, corporate training, and healthcare.

Stakeholders

- Game-based learning solution providers

- Game-based learning content developers

- Learning management system (LMS) providers

- Educational institutions

- Corporate training departments

- Independent software vendors (ISVs)

- Government education departments

- E-learning platform providers

- Instructional designers and gamification experts

- EdTech investors and venture capitalists

Report Objectives

- To define, describe, and predict the game-based learning market by offering, deployment mode, game type, integration type, application, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, mergers, and acquisitions, in the game-based learning market

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American Game-based Learning Market

- Further breakup of the European Market

- Further breakup of the Asia Pacific Market

- Further breakup of the Middle East & Africa Market

- Further breakup of the Latin American Market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is game-based learning (GBL)?

Game-based learning is an instructional approach that incorporates game elements and mechanics to enhance learning outcomes. It involves using digital or physical games to teach concepts, promote engagement, and reinforce knowledge across various domains, such as education, corporate training, and healthcare.

What are the major drivers of the game-based learning market?

Key drivers include the rising demand for interactive and immersive learning experiences, increasing adoption of digital technologies in education and training, the effectiveness of GBL in improving learner retention and motivation, and the integration of AI, AR/VR, and analytics in educational content.

How is AI impacting the game-based learning market?

AI enhances game-based learning through personalized learning paths, real-time feedback, adaptive difficulty levels, and performance analytics. AI-driven games can assess learner behavior and dynamically adjust content to maximize learning efficiency and engagement.

How do game-based learning platforms differ from traditional e-learning systems?

Unlike traditional e-learning, which is often passive and text-heavy, GBL platforms offer interactive, story-driven, and challenge-based environments that actively engage learners and foster critical thinking, collaboration, and long-term knowledge retention.

What challenges are limiting the widespread adoption of game-based learning?

Challenges include high development costs, a lack of awareness or resistance to change among educators and trainers, limited access to advanced technology in underdeveloped regions, and difficulties in measuring learning outcomes quantitatively.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Game-based Learning Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Game-based Learning Market

Max

May, 2022

what are the market stats from 2022 to 2028?.

wob

Jul, 2022

Interested in understanding how the game-based learning market is expanding for education, consumers, and commercial customers in the coming years, as well as how companies are growing in this period. Along with this, what are present trends in the market? Which features seem to be driving adoption, retention/renewal of products, frequency of in-app content updates (how often do companies release new content within their apps), solo vs. multiplayer, and subjects covered within the app? Would like to know the revenue for game-based learning in 2024 - either globally or just in the United States. .