Edtech and Smart Classrooms Market

Edtech and Smart Classrooms Market by Solution (Projection & Display Systems, Adaptive & Personalized Learning, Assessment & Grading Tools, AR & VR & Simulations), End User (K-12, Higher Education, Vocational Training Centers) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The edtech and smart classrooms market is estimated to be USD 197.3 billion in 2025 and is projected to reach USD 353.1 billion by 2030, registering a CAGR of 12.3% during 2025–2030. The widespread availability of smartphones, tablets, and affordable internet connectivity is significantly boosting EdTech adoption. In emerging economies, where access to traditional education infrastructure may be limited, mobile-first learning models have become the primary medium of education.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 15.4%, driven by the region's high digital adoption and mobile-first consumer base. The growing adoption of immersive technologies, such as AR and VR, is reshaping Asia Pacific’s learning ecosystem.

-

BY SOLUTIONBy solution the adaptive & personalized learning segment is expected to register the highest CAGR of 17.8%. The rise of AI-powered tools is driving personalized and adaptive learning experiences, offering customized content and real-time feedback to improve student outcomes

-

BY END USERAmong the differentend users of edtech and smart classrooms, K-12 is expected to have the largest market size in 2025. K-12 institutions are rapidly integrating smart classroom tools such as interactive whiteboards, digital content libraries, gamified learning platforms, and AI-powered adaptive learning systems to enhance engagement and improve learning outcomes.

-

BY DEPLOYMENT TYPEThe continuous growth of the cloud deployment segment is driven by the increasing demand for personalized learning experiences, as cloud-based platforms can leverage data analytics and AI to deliver customized content and provide real-time feedback.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships, collaborations, and investments. For instance, in March 2025, Pearson launched a new AI-powered tool called the Smart Lesson Generator, designed to help English language teachers create curriculum-aligned lesson plans in seconds. The tool aimed to reduce the administrative burden on educators, who spend several hours a week on lesson preparation.

The shift from passive learning to active engagement is driving the edtech and smart classrooms market. Modern classrooms are increasingly integrating AR/VR, gamification, and multimedia-based teaching tools to foster collaboration and critical thinking. Interactive platforms encourage peer-to-peer discussions, group projects, and immersive experiences that replicate real-world scenarios, making learning more engaging and effective. Such solutions not only appeal to digital-native students but also align with evolving educational practices focused on experiential learning. By boosting attention spans and knowledge retention, collaborative tools are reshaping classrooms into dynamic ecosystems. Their rising popularity across schools, universities, and training institutes is fueling market demand worldwide.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends and disruptions such as AI-driven personalization, immersive learning technologies, and connected classroom ecosystems. The hot bets are the clients of EdTech and Smart Classroom solution providers, including educational institutions and platform developers, who are rapidly adopting digital learning tools, IoT-enabled devices, and data analytics to enhance engagement, improve learning outcomes, and drive operational efficiency across the education value chain.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Mobile Learning & AI-based Personalization

-

Increasing Adoption of LMS & Cloud-based Education Platforms

Level

-

High capital expenditure for integrated smart classroom hardware

-

Limited infrastructure and bandwidth in rural and underserved areas

Level

-

Rising demand for AR/VR-enabled immersive learning solutions

-

Demand for interoperable, analytics-enabled platforms

Level

-

Integration with legacy systems and cross-platform compatibility

-

Cybersecurity risks and regulatory compliance

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Mobile Learning & AI-based Personalization

Increasing mobile learning and AI-based personalization adoption is expected to drive the edtech and smart classroom market. Personalized learning has become a critical differentiator for edtech providers as institutions seek to improve learner outcomes, engagement, and retention. AI-based personalization enables real-time content adaptation and outcome-aligned instruction catering to individual learner needs, enhancing teaching effectiveness and student progression. In June 2025, D2L launched multiple AI-powered enhancements to its Lumi platform within Brightspace, including Lumi Outcomes and Study Support, which automate outcome alignment and deliver targeted content recommendations, streamlining course delivery and advancing personalized learning at scale. In parallel, mobile learning platforms continue to reshape access and flexibility in education by allowing students to learn anywhere and anytime. In February 2024, Instructure introduced offline access for its Canvas Student app, enabling learners to download assignments and materials on mobile devices and maintain continuity in low-connectivity environments. Vendors integrating mobile-first strategies with robust AI personalization features are well-positioned to capitalize on the evolving needs of educational institutions worldwide, offering scalable solutions that support equitable access, tailored instruction, and continuous learner engagement across geographies and modalities.

Restraint: High capital expenditure for integrated smart classroom hardware

High capital expenditure associated with integrated smart classroom hardware substantially restrains the growth of the edtech and smart classroom market. While demand is increasing for advanced solutions such as interactive whiteboards, AR/VR modules, sensor-enabled attendance systems, and multi-device integration, the initial investment required for full-scale deployment remains prohibitively high for many institutions, particularly in public and low-income private sectors. According to a March 2024 UNESCO-led global teacher survey, over 52% of educators in developing countries reported that their institutions lack access to interactive whiteboards or smart panels, citing budget limitations as the primary barrier. This excludes recurring costs for maintenance, upgrades, and technical training. These high costs are particularly challenging for educational institutions in developing economies and rural districts, where budget allocations for digital transformation remain limited. As a result, many schools opt for partial deployments or delay adoption altogether, restricting the market’s overall scale. Vendors must respond by offering modular, scalable hardware bundles, leasing-based procurement models, and device-agnostic platforms that reduce upfront expenditures. Strategic partnerships with government bodies, local system integrators, and financing providers can also help broaden adoption and reduce the financial burden for educational institutions seeking innovative classroom modernization

Opportunity: Rising demand for AR/VR-enabled immersive learning solutions

The growing demand for AR/VR-enabled immersive learning solutions creates significant opportunities in the edtech and smart classroom market. As educational institutions seek to enhance engagement, retention, and conceptual clarity, immersive technologies are gaining traction across K–12, higher education, and vocational training segments. AR/VR tools allow learners to interact with 3D models, simulate real-world environments, and access experiential content that transcends traditional instruction methods. In May 2024, Lenovo introduced its ThinkReality VRX headset tailored for education, enabling institutions to deploy virtual science labs, language immersion modules, and career simulations through a centralized platform. The product reduces the dependency on physical infrastructure while expanding learning accessibility across geographies. Vendors should respond by offering curriculum-aligned AR/VR content, educator training programs, and device management solutions that streamline classroom integration. Similarly, in March 2025, Discovery Education partnered with immersive content developers to integrate AR-based STEM modules into its platform, targeting increased student interaction and measurable learning outcomes. Such collaborations highlight the potential for vendors to differentiate through specialized content offerings and partnerships with content creators. To capture this opportunity, providers must ensure cross-platform compatibility, affordable deployment models, and compliance with institutional IT policies, positioning immersive learning as a core component of digitally transformed classrooms

Challenge:Integration with legacy systems and cross-platform compatibility

Integration with legacy systems and ensuring cross-platform compatibility continues to challenge the widespread adoption of innovative classroom technologies. Many educational institutions, particularly in public and underserved segments, still operate on outdated infrastructure and fragmented digital ecosystems that lack interoperability with modern learning tools. According to a 2024 survey by Clever involving over 1,500 K–12 teachers in US schools, 68% of respondents reported that their learning management systems (LMS) do not integrate well with one or more learning applications, resulting in limited student access, disrupted instructional flow, and increased administrative complexity. This disconnect restricts the effectiveness of digital initiatives and prevents educators from using real-time insights for personalized learning. As institutions implement multiple platforms for assessment, content delivery, and engagement, poor system compatibility further drives up IT overhead and training costs. Vendors must prioritize open architecture, standardized APIs, and compatibility with dominant operating systems and LMS platforms. Modular product design, built-in integration tools, and dedicated onboarding support can ease institutional transitions from legacy environments. For instance, Instructure, through its Canvas LMS, has responded effectively by offering robust integration capabilities with Google Workspace, Microsoft Teams, and third-party edtech tools, positioning itself as a vendor aligned with the interoperability needs of modern educational environments

Edtech and Smart Classrooms Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

You Employed, Inc. implemented Canvas LMS to transition in-person workforce training to a scalable online format across 17 countries, ensuring multilingual support and localized curriculum delivery. | Seamless transition to remote learning; improved localization and regional alignment; unified global curriculum; enhanced learner experience; strengthened platform adoption. |

|

Agora Cyber Charter School integrated Mystery Science with LMS tools to align the virtual science curriculum with Pennsylvania STEELS standards, encouraging interactive, inquiry-based learning from grades K–5. | Improved engagement and comprehension; shift to student-led learning; reduced instructional complexity; fostered collaboration and critical thinking; established a scalable science framework. |

|

Saanich School District deployed D2L Brightspace Core and Guardian modules to digitize student progress reporting, automate data uploads, and enhance real-time communication between parents and educators. | Secure digital reporting eliminating paper inefficiencies; increased parent engagement; improved visibility into academic performance; reduced administrative workload; supported sustainability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The EdTech and Smart Classrooms market ecosystem comprises content developers, hardware manufacturers, software platform providers, system integrators, and end-users such as schools, universities, and corporate training centers. It operates through seamless collaboration between technology enablers (AI, AR/VR, IoT) and educational institutions to deliver personalized, interactive, and data-driven learning experiences. This ecosystem enhances teaching efficiency and student engagement while driving digital transformation in education globally.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

EdTech and Smart Classrooms Market, By Solution

The projection and display systems solutions are expected to have the largest market share during the forecast period. it refers to hardware technologies like interactive projectors, smart boards, flat panels, and large displays that enable visual learning and real-time engagement in classrooms. These systems transform traditional teaching methods by providing dynamic content delivery, multimedia integration, and collaborative tools. A major trend driving adoption is the shift toward interactive flat panel displays (IFPDs), which are increasingly replacing conventional projectors due to higher resolution, touch-screen interactivity, and durability. Additionally, the rise of AR/VR-compatible displays is reshaping immersive learning experiences in subjects like science, geography, and history.

EdTech and Smart Classrooms Market, By End User

Unlike traditional academic institutions, vocational training centers emphasize hands-on, practical learning in areas such as healthcare, automotive, construction, hospitality, and information technology. The adoption of smart classroom technologies such as AR/VR simulations for real-world practice, AI-powered personalized learning platforms, and digital content libraries is transforming vocational education into a more immersive and effective experience. Governments and educational bodies across regions are increasing their investments in technical and vocational education and training (TVET) programs to bridge skill gaps, particularly in developing economies where employability is a critical concern. Moreover, the emphasis on lifelong learning and alternative education pathways is driving enrollment in vocational institutes.

EdTech and Smart Classrooms Market, By Deployment Type

Hybrid cloud segment solutions are projected to witness the fastest growth rate during the forecast period. The hybrid cloud segment combines the scalability of public cloud with the security of private infrastructure, making it an ideal choice for institutions balancing accessibility and compliance. This model allows sensitive data such as student records and examination systems to remain in private environments, while high-volume applications like video lectures, learning content, and collaboration tools are managed through public cloud platforms. The adoption of hybrid cloud is accelerating as regulatory frameworks such as GDPR in Europe and FERPA in the U.S. drive the need for data protection without compromising on flexibility. Vendors like IBM, Oracle, and Microsoft are actively offering hybrid solutions tailored for education, integrating AI-powered analytics, adaptive learning, and AR/VR applications.

REGION

North America is estimated to account for the largest market share during the forecast period

The North American edtech market is undergoing rapid transformation as universities and schools continue to embrace hybrid and blended learning models that became mainstream in the post-pandemic period. Major technology providers, including Google, Microsoft, and Instructure, are integrating AI-driven analytics into learning management systems, enabling institutions to monitor student performance with greater accuracy and improve learning outcomes. Collaboration between edtech companies and higher education institutions is also on the rise, with platforms such as Coursera for Campus and edX being embedded into traditional curricula to provide students with broader access to online courses and certifications. At the same time, startups catering to K–12 education, including Outschool and Nearpod, are scaling their digital content offerings. Their growth reflects a clear trend toward more flexible, engaging, and personalized classroom experiences that address the evolving needs of students and teachers alike.

Edtech and Smart Classrooms Market: COMPANY EVALUATION MATRIX

In the edtech & smart classrooms market matrix, Microsoft. (Star) lleads with a broad portfolio of digital classroom tools and scalable, cloud-based learning solutions, powering collaboration and accessibility at global scale. Instructure (Emerging Leader) excels through its Canvas LMS and expanding ecosystem, driving student engagement and educator support with seamless integration and interoperability. While Microsoft dominates with scale and ecosystem integration, Instructure shows strong growth potential to advance toward the leaders’ quadrant with its expanding enterprise security portfolio.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 173.5 Billion |

| Revenue Forecast in 2030 | USD 353.1 Billion |

| Growth Rate | CAGR of 12.3% from 2025-2030 |

| Actual data | 2020–2030 |

| Base year | 2024 |

| Forecast period | 2025–2030 |

| Units considered | Value (USD) Million/Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Solutions, End User, and Deployment Type |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Edtech and Smart Classrooms Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) | Regional Analysis: • Further breakdown of the North American edtech & smart classrooms market • Further breakdown of the European edtech & smart classrooms market • Further breakdown of the Asia Pacific edtech & smart classrooms market • Further breakdown of the Middle Eastern & African edtech & smart classrooms market • Further breakdown of the Latin American edtech & smart classrooms market | • Identifies high-growth regional opportunities, enabling tailored market entry strategies. • Optimizes resource allocation and investment based on region-specific demand and trends. |

| Company Information | Detailed analysis and profiling of additional market players (up to 5) | • Broadens competitive insights, helping clients make informed strategic and investment decisions. • Reveals market gaps and opportunities, supporting differentiation and targeted growth initiatives. |

RECENT DEVELOPMENTS

- June 2025 : Google Cloud and Pearson announced a strategic, multi-year partnership to leverage Google’s advanced AI models, including Gemini and LearnLM, to transform education. The collaboration will focus on developing AI-powered products that personalize learning for K-12 students and provide educators with valuable insights to improve educational outcomes.

- October 2024 : Anthology partnered with Obrizum to integrate the company's advanced AI and analytics into the Blackboard Learning Management System. This collaboration will deliver hyper-personalized and adaptive learning experiences to millions of users, empowering educators with unprecedented insights to improve teaching strategies and student engagement.

- July 2024 : McGraw Hill and Binary Logic formed a new partnership to enhance access to computing and ICT educational programs worldwide. Under the agreement, McGraw Hill will become the exclusive distributor of Binary Logic's K-12 and vocational curriculum, aiming to equip learners with essential digital skills for the future workforce.

- January 2024 : Class Technologies Inc. partnered with Microsoft to launch "Class for Microsoft Teams," a next-generation virtual classroom platform built on the Teams ecosystem. This new platform integrates seamlessly with Microsoft 365, adding unique features like interactive collaboration tools and advanced analytics to improve online learning engagement for students and instructors.

- September 2024 : PowerSchool, a global leader in K-12 edtech software, acquired Chennai-based ERP company Neverskip. This move was part of PowerSchool's India growth strategy, designed to create a unified technology platform that enhances school operations, student success, and family engagement.

Table of Contents

Methodology

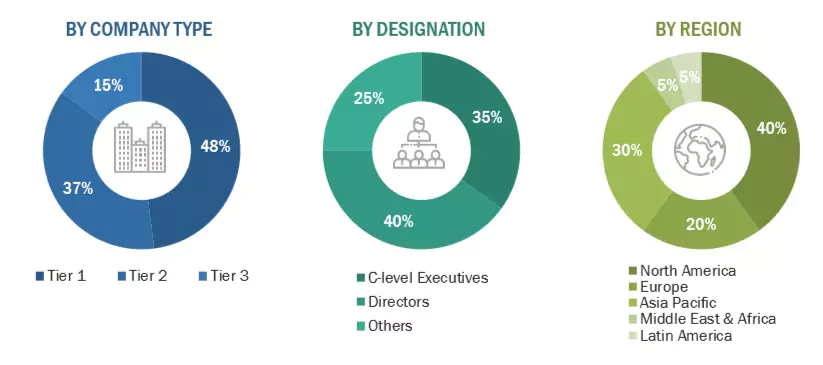

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the edtech and smart classrooms market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market size of companies offering edtech and smart classrooms worldwide was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolio of major companies and rating them based on their performance and quality. In the secondary research process, various secondary sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain and to identify key players through various solutions and services, market classification and segmentation according to offerings of major players, industry trends related to technologies, applications, and regions, and key developments from both market-oriented and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, related key executives from edtech and smart classrooms solution vendors, professional service providers, industry associations, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using edtech and smart classrooms solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of edtech and smart classrooms solutions, which would impact the overall edtech and smart classrooms market.

*Others include sales managers, marketing managers, and product managers.

Note: Tier 1 companies’ revenue is more than USD 1 billion; Tier 2 companies’ revenue ranges between USD 500 million and USD

1 billion; and Tier 3 companies’ revenue ranges between USD 100 million and USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

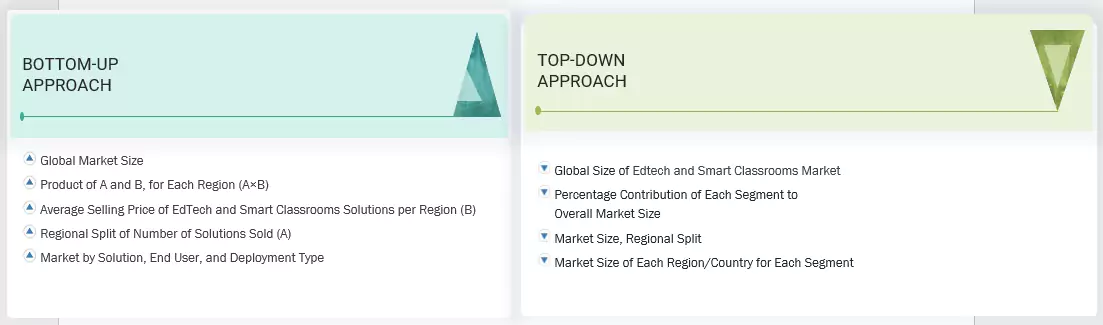

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the edtech and smart classrooms market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of edtech and smart classrooms solutions.

Top-down and bottom-up approaches were used to estimate and validate the total size of the edtech and smart classrooms market. These methods were also extensively used to estimate the size of various market segments. The research methodology used to evaluate the market size is listed below.

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Edtech and Smart Classrooms Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the edtech and smart classrooms market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Edtech, or educational technology, refers to the use of digital tools, software, and hardware to facilitate learning and improve educational outcomes. It encompasses a wide range of solutions, from simple learning apps and online course platforms to complex systems for institutional management and data analytics. A smart classroom is a specific implementation of edtech within a physical learning space. It is an environment where technology is integrated seamlessly to enhance teaching and collaboration. This typically includes the use of interactive whiteboards, high-speed internet, connected devices, and specialized software to create a more engaging, interactive, and efficient learning experience for both students and instructors.

Stakeholders

- System Integrators

- EdTech and Smart Classrooms Hardware and Solution Vendors

- Resellers and Distributors

- Universities and Schools

- Teachers/Professors

- School Board Members

- Research Organizations

- Enterprise Users

- Technology Providers

- Venture Capitalists, Private Equity Firms, and Startup Companies

Report Objectives

- To determine and forecast the global edtech and smart classrooms market by solution, end user, deployment type, and region

- To forecast the size of the market segments for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the edtech and smart classrooms market

- To analyze each submarket concerning individual growth trends, prospects, and contributions to the overall edtech and smart classrooms market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the edtech and smart classrooms market

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape

- Track and analyze the competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and research and development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the definition of the edtech and smart classrooms market?

Edtech and smart classrooms refer to the use of digital technologies, interactive tools, and connected learning environments to enhance teaching and learning. They enable personalized, engaging, and collaborative education across K-12, higher education, and vocational training centers.

What is the market size of the edtech and smart classrooms market?

The edtech and smart classrooms market is projected to grow from USD 197.3 billion in 2025 to USD 353.1 billion by 2030 at a CAGR of 12.3% from 2025 to 2030.

What are the major drivers of the edtech and smart classrooms market?

The major drivers of the edtech and smart classrooms market include the increasing adoption of LMS and cloud-based education platforms, mobile learning and AI-based personalization, government-funded digital learning initiatives, and rising demand for gamified interactive display deployments.

Who are the key players operating in the edtech and smart classrooms market?

The key players profiled in the edtech and smart classrooms market include Pearson (UK), Cisco (US), Anthology (US), IBM (US), McGraw-Hill Education (US), Google (US), Microsoft (US), Oracle (US), PowerSchool (US), Instructure (US), 2U (US), Ellucian (US), Turnitin (US), Kahoot (Norway), Smart Technologies (Canada), IXL Learning (US), D2L (Canada), Workday (US), Discovery Education (US), Promethean (US), Byju’s (India), Yuanfudao (China), VipKid (US), 17Zuoye (China), Seesaw (US), Nearpod (US), Age of Learning (US), and Brightbytes (US).

What are the key technological trends prevailing in the edtech and smart classrooms market?

Key technological trends in the edtech and smart classrooms market include the adoption of AI and ML for personalized learning, AR/VR for immersive education, and cloud-based platforms for scalability and accessibility. Additionally, the use of IoT-enabled smart devices and data analytics is enhancing real-time performance tracking and collaborative learning experiences.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Edtech and Smart Classrooms Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Edtech and Smart Classrooms Market

MnM Analyst

Feb, 2023

The following potential trends that could continue to influence the industry are based on recent and past developments in the EdTech and smart classroom market:

These are just a few possible trends that could influence the market for EdTech and smart classrooms in the upcoming years. However, it's crucial to remember that the industry is rapidly changing and that new trends and technologies may develop that we are unable to foresee at this time..

Anderson

Feb, 2023

What are the trends in EdTech and Smart Classroom Market in 2023?.