Gas Mixtures Market by Mixture Type (O2, N2, Co2, AR, H2, and Specialty Gas), by End-Use Industry (Chemical, Medical & Healthcare, Food & Beverage, Electronics), by Storage & Distribution Mode (Tonnage, Merchant Liquid), & Region - Global Forecast to 2020

[207 Pages Report] The gas mixtures market size is estimated to grow from USD 28.20 Billion in 2015 to USD 36.76 Billion by 2020, at a CAGR of 5.44%. The gas mixtures market is growing rapidly in accordance with the growth in the industrial gas market globally. The use of gas mixtures such as oxygen mixtures, hydrogen mixtures, and carbon dioxide mixtures are used in the metal manufacturing & fabrication industry in order to enhance the arc characteristics or facilitate metal transfer in gas metal arc welding. This application is projected to foster the demand for gas mixtures during the forecast period. The report aims at estimating the market size and future growth potential of the gas mixtures market across different segments such as mixtures, end-use industry, manufacturing process, distribution mode, and region. The base year considered for the study is 2014 and the market size is projected from 2015 to 2020. Factors such as growing industrialization and burgeoning energy markets and medical sector are expected to be the major drivers of the gas mixtures market in the next five years.

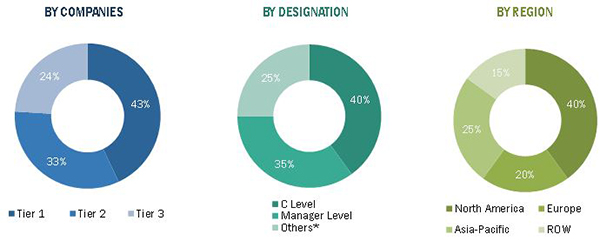

The research methodology used to estimate and forecast the gas mixtures market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global gas mixtures market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments, which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of profiles of primary is depicted in the below figure:

The gas mixtures ecosystem comprises gas mixtures companies such as Linde Ag (Germany), Praxair Inc., (U.S.) Air Liquide S.A. (France), Airgas Inc. (U.S.), Taiyo Nippon Sanso Corporation (Japan), Air Products and Chemicals Inc. (U.S.), Iwatani Corporation (Japan), Welsco Inc. (U.S.), and Advanced Specialty Gases (U.S.).

Target audience

- OEM companies

- Electronic equipment manufacturers

- Metal manufacturers and fabricators

- Medical equipment manufacturers

- Consulting firms

Scope of the Report

The research report segments the gas mixtures market to following submarkets:

By mixture:

- Oxygen mixtures

- Nitrogen mixtures

- Carbon dioxide mixtures

- Argon mixtures

- Hydrogen mixtures

- Specialty gas mixtures

- Other mixtures (rare gas mixtures)

By end-use industry:

- Metal manufacturing & fabrication

- Chemicals

- Medical & healthcare

- Electronics

- Food & beverage

- Others (glass, energy, and oil & gas)

By storage, distribution, and transportation:

- Cylinder & packaged distribution

- Merchant liquid distribution

- Tonnage distribution

By manufacturing process:

- Air separation technology

- Hydrogen production technology

- Others (pressure swing adsorption)

By region:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America gas mixtures market

- Further breakdown of the Europe gas mixtures market

- Further breakdown of the APAC gas mixtures market

- Further breakdown of the RoW gas mixtures market

Company Information

- Detailed analysis and profiling of additional market players

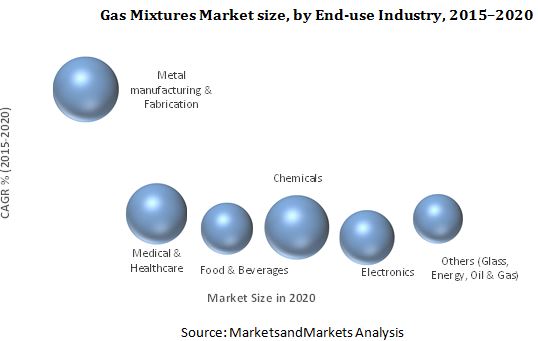

MarketsandMarkets projects that the gas mixtures market size is to grow from USD 28.20 Billion in 2015 to USD 36.76 Billion by 2020, at an estimated CAGR of 5.44%. The increasing income and spending capacity of people in developing economies, increasing demand in various applications such as metal fabrication, electronics, medical & healthcare, automotive, and lighting is the major factor driving the growth of the gas mixtures industry. Additionally, with rapid urbanization, growth in infrastructural activities, and increasing industrialization and medical sector across the globe, there is a rapidly increasing need for gas mixtures. Gas mixtures are a wide and diverse group of products developed for application in specific end-use industries. Gas mixtures are used in electronics, fabrication of specialty alloys, lasers, metals, and other industrial applications. Metal manufacturing & fabrication is projected to have the largest market share and dominate the gas mixtures market from 2015 to 2020, as various applications of metal manufacturing industries use gas mixtures. Chemicals and medical & healthcare sectors are to play a key role in changing the gas mixtures landscape and grow at a high rate during the forecast period.

Oxygen mixtures are projected to form the fastest-growing mixtures in the gas mixtures market as it is used in many end-use industries such as metal manufacturing & fabrication, chemicals, pharmaceuticals, and medical & health care. The merchant liquid distribution mode is projected to account for the largest market share in the gas mixtures market. Verticals such as tonnage distribution and cylinder & packaged distribution will be key growing distribution modes during the forecast period.

North America is projected to have the largest market share and dominate the gas mixtures market from 2015 to 2020. Asia-Pacific offers potential growth opportunities, as developing countries such as China and India are projected to be emerging markets, making the Asia-Pacific region the fastest-growing market for gas mixtures. The growth of the gas mixtures market in this region is propelled by factors such as the growth of the metal manufacturing & fabrication industry, rise in demand for electronic products from the growing population, and economic development.

However, due to high cost of gas processing and intricate manufacturing processes, the organizations are exposed to potential risks and are restraining the growth of the gas mixtures market. The major vendors in the gas mixtures market include Praxair Inc. (U.S.), Air Liquide S.A. (France), The Linde Group (Germany), Messer Group GmbH (Germany), Airgas Inc. (U.S.), Taiyo Nippon Sanso Corporation (Japan), Air Products and Chemicals Inc. (U.S.), Advanced Specialty Gases Inc. (U.S.), and Iwatani Corporation (Japan). These players adopted various strategies such as new product developments, mergers & acquisitions, partnerships, joint ventures, and business expansion to cater to the needs of the gas mixtures market.

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered for the Gas Mixtures Market

1.4 Currency Considered for the Gas Mixtures Market

1.5 Unit Considered for the Gas Mixtures Market

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.3 Rising Population

2.2.4 Increasing Income and Spending Capacity

2.2.5 Supply-Side Analysis

2.2.6 Industry Regulations

2.2.7 Fluctuations in Fuel Prices

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Market Share Estimation

2.6 Research Assumptions and Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 32)

3.1 Metal Manufacturing & Fabrication Segment is Projected to Account for the Largest Share By 2020

3.2 North America is Projected to Dominate the Global Gas Mixtures Market By 2020

3.3 China is Projected to Have the Highest CAGR From 2015 to 2020

4 Premium Insights (Page No. - 37)

4.1 Attractive Market Opportunities in the Gas Mixtures

4.2 Gas Mixtures Market in the Asia-Pacific Region

4.3 China is Projected to Have the Highest CAGR Between 2015 and 2020

4.4 North America Occupied the Largest Market Share Among All Regions in 2014

4.5 Emerging Markets Are Projected to Grow at A Higher Rate Than Developed Markets From 2015 to 2020

4.6 Gas Mixtures Market Life Cycle Analysis, By Region

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Evolution

5.3 Gas Mixtures Market Segmentation

5.3.1 By Type

5.3.2 By End-Use Industry

5.3.3 By Manufacturing Process

5.3.4 By Distribution Mode

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increased Demand for Electronics Products

5.4.1.2 Growing Healthcare Sector Demand

5.4.1.3 Growing Energy Industry

5.4.1.4 Growing Beverage Industry

5.4.2 Restraints

5.4.2.1 Structural and Regulatory Restrictions

5.4.3 Opportunities

5.4.3.1 High Demand in Chemical Industry

5.4.4 Challenges

5.4.4.1 Intricate Manufacturing Process

6 Industry Trends (Page No. - 51)

6.1 Introduction

6.2 Value Chain

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threats of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Gas Mixtures Market, By Type (Page No. - 56)

7.1 Introduction

7.2 Oxygen Mixtures

7.3 Nitrogen Mixtures

7.4 Carbon Dioxide Mixtures

7.5 Argon Mixtures

7.6 Hydrogen Mixtures

7.7 Specialty Gas Mixtures

7.8 Other Mixtures

8 Gas Mixtures Market, By End-Use Industry (Page No. - 67)

8.1 Introduction

8.2 Metal Manufacturing & Fabrication

8.3 Food & Beverage

8.4 Healthcare

8.5 Chemicals

8.6 Electronics

8.7 Others

9 Gas Mixtures Market, By Storage, Distribution & Transportation (Page No. - 71)

9.1 Introduction

9.2 Cylinders & Packaged Gas

9.3 Merchant Liquid/Bulk

9.4 Tonnage

10 Gas Mixtures Market, By Manufacturing Process (Page No. - 76)

10.1 Introduction

10.2 Air Separation Technologies

10.2.1 Cryogenic Air Separation

10.2.2 Non Cryogenic Air Separation

10.3 Hydrogen Production Technologies

10.3.1 Steam Reforming

10.3.2 Partial Oxidation

10.3.3 Plasma Reforming

10.4 Others

10.4.1 Pressure Swing Adsorption

11 Gas Mixtures Market, By Region (Page No. - 81)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Asia-Pacific

11.3.1 China

11.3.2 India

11.3.3 Japan

11.3.4 Rest of Asia-Pacific

11.4 Europe

11.4.1 Belgium

11.4.2 Germany

11.4.3 France

11.4.4 Rest of Europe

11.5 RoW

11.5.1 Brazil

11.5.2 South Africa

11.5.3 Argentina

11.5.4 Other RoW Countries

12 Competitive Landscape (Page No. - 168)

12.1 Overview

12.2 Development Analysis

12.3 Competitive Situations & Trends

12.4 Key Growth Strategies, 20112015

12.4.1 Expansions

12.4.2 Mergers & Acquisitions

12.4.3 Joint Ventures, Agreements & Contracts, 2011-2015

12.4.4 New Product Launches

13 Company Profiles (Page No. - 175)

13.1 Introduction

13.2 The Linde Group

13.3 Praxair Inc.

13.4 Air Liquide S.A.

13.5 Air Products and Chemicals, Inc.

13.6 Airgas Inc.

13.7 Advanced Specialty Gases Inc.

13.8 Messer Group

13.9 Welsco, Inc.

13.10 Taiyo Nippon Sanso Corporation

13.11 Iwatani Corporation

14 Appendix (Page No. - 201)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (197 Tables)

Table 1 Assumptions Made for This Study

Table 2 Limitations Made for This Study

Table 3 Gas Mixtures Market Snapshot

Table 4 Mixture Type & Description

Table 5 End-Use Industry & Description

Table 6 Manufacturing Process & Description

Table 7 Distribution Mode & Description

Table 8 The Standard By Compressed Gas Association

Table 9 Gas Mixtures Market Size, By Mixture, 20132020 (USD Million)

Table 10 Gas Mixtures Market Size, By Mixture, 20132020 (MMT)

Table 11 Oxygen Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 12 Oxygen Mixtures Market Size, By End-Use Industry, 20132020 (MMT)

Table 13 Nitrogen Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 14 Nitrogen Mixtures Market Size, By End-Use Industry, 20132020 (MMT)

Table 15 Carbon Dioxide Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 16 Carbon Dioxide Mixtures Market Size, By End-Use Industry,20132020 (MMT)

Table 17 Argon Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 18 Argon Mixtures Market Size, By End-Use Industry, 20132020 (MMT)

Table 19 Hydrogen Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 20 Hydrogen Mixtures Market Size, By End-Use Industry, 20132020 (MMT)

Table 21 Specialty Gas Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 22 Specialty Gas Mixtures Market Size, By End-Use Industry,20132020 (MMT)

Table 23 Other Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 24 Other Mixtures Market Size, By End-Use Industry, 20132020 (MMT)

Table 25 Gas Mixtures Market Size, By End-Use Industry, 20132020 (USD Million)

Table 26 Gas Mixtures Market Size, By End-Use Industry, 20132020 (Mt)

Table 27 Regulations on Transportation and Storage of Gas Cylinders

Table 28 Gas Mixtures Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 29 Gas Mixtures Market Size, By Storage, Distribution & Transportation, 20132020 (Mt)

Table 30 Gas Mixtures Market Size, By Manufacturing Process,20132020 (USD Million)

Table 31 Gas Mixtures Market Size, By Manufacturing Process, 20132020 (Mt)

Table 32 Gas Mixtures Market Size, By Region, 20132020 (USD Million)

Table 33 Gas Mixtures Market Size, By Region, 20132020 (MMT)

Table 34 North America: Gas Mixtures Market Size, By Country,20132020 (USD Million)

Table 35 North America: Gas Mixtures Market Size, By Country, 20132020 (MMT)

Table 36 North America: Gas Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 37 North America: Gas Mixtures Market Size, By End-Use Industry,20132020 (MMT)

Table 38 North America: Gas Mixtures Market Size, By Storage, Distribution& Transportation, 20132020 (USD Million)

Table 39 North America: Gas Mixtures Market Size, By Storage, Distribution& Transportation, 20132020 (MMT)

Table 40 North America: Gas Mixtures Market Size, By Type,20132020 (USD Million)

Table 41 North America: Gas Mixtures Market Size, By Type, 20132020 (MMT)

Table 42 North America: Gas Mixtures Market Size, By Manufacturing Process, 20132020 (USD Million)

Table 43 North America: Gas Mixtures Market Size, By Manufacturing Process, 20132020 (MMT)

Table 44 U.S.: Gas Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 45 U.S.: Market Size, By End-Use Industry, 20132020 (MMT)

Table 46 U.S.: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 47 U.S.: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 48 U.S.: Market Size, By Type, 20132020 (USD Million)

Table 49 U.S.: Market Size, By Type, 20132020 (MMT)

Table 50 U.S.: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 51 U.S.: Market Size, By Manufacturing Process,20132020 (MMT)

Table 52 Canada: Gas Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 53 Canada: Market Size, By End-Use Industry,20132020 (MMT)

Table 54 Canada: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 55 Canada: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 56 Canada: Market Size, By Type, 20132020 (USD Million)

Table 57 Canada: Market Size, By Type, 20132020 (MMT)

Table 58 Canada: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 59 Canada: Market Size, By Manufacturing Process,20132020 (MMT)

Table 60 Mexico: Gas Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 61 Mexico: Market Size, By End-Use Industry,20132020 (MMT)

Table 62 Mexico: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 63 Mexico: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 64 Mexico: Market Size, By Type, 20132020 (USD Million)

Table 65 Mexico: Market Size, By Type, 20132020 (MMT)

Table 66 Mexico: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 67 Mexico: Market Size, By Manufacturing Process,20132020 (MMT)

Table 68 Asia-Pacific: Gas Mixtures Market Size, By Country,20132020 (USD Million)

Table 69 Asia-Pacific: Market Size, By Country, 20132020 (MMT)

Table 70 Asia-Pacific: Market Size, By End-Use Industry,20132020 (USD Million)

Table 71 Asia-Pacific: Market Size, By End-Use Industry,20132020 (MMT)

Table 72 Asia-Pacific: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 73 Asia-Pacific: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 74 Asia-Pacific: Market Size, By Type, 20132020 (USD Million)

Table 75 Asia-Pacific: Market Size, By Type, 20132020 (MMT)

Table 76 Asia-Pacific: Market Size, By Manufacturing Process, 20132020 (USD Million)

Table 77 Asia-Pacific: Market Size, By Manufacturing Process, 20132020 (MMT)

Table 78 China: Gas Mixtures Market Size, By Type, 20132020 (USD Million)

Table 79 China: Market Size, By Type, 20132020 (MMT)

Table 80 China: Market Size, By Storage, Distribution& Transportation, 20132020 (USD Million)

Table 81 China: Market Size, By Storage, Distribution& Transportation, 20132020 (MMT)

Table 82 China: Market Size, By End-Use Industry,20132020 (USD Million)

Table 83 China: Market Size, By End-Use Industry, 20132020 (MMT)

Table 84 China: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 85 China: Market Size, By Manufacturing Process,20132020 (MMT)

Table 86 India: Gas Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 87 India: Market Size, By End-Use Industry, 20132020 (MMT)

Table 88 India: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 89 India: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 90 India: Market Size, By Type, 20132020 (USD Million)

Table 91 India: Market Size, By Type, 20132020 (MMT)

Table 92 India: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 93 India: Market Size, By Manufacturing Process,20132020 (MMT)

Table 94 Japan: Gas Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 95 Japan: Market Size, By End-Use Industry, 20132020 (MMT)

Table 96 Japan: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 97 Japan: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 98 Japan: Market Size, By Type, 20132020 (USD Million)

Table 99 Japan: Market Size, By Type, 20132020 (MMT)

Table 100 Japan: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 101 Japan: Market Size, By Manufacturing Process,20132020 (MMT)

Table 102 Rest of Asia-Pacific: Gas Mixtures Market Size, By End-Use Industry, 20132020 (USD Million)

Table 103 Rest of Asia-Pacific: Market Size, By End-Use Industry, 20132020 (MMT)

Table 104 Rest of Asia-Pacific: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 105 Rest of Asia-Pacific: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 106 Rest of Asia-Pacific: Market Size, By Type,20132020 (USD Million)

Table 107 Rest of Asia-Pacific: Market Size, By Type, 20132020 (MMT)

Table 108 Rest of Asia-Pacific: Market Size, By Manufacturing Process, 20132020 (USD Million)

Table 109 Rest of Asia-Pacific: Market Size, By Manufacturing Process, 20132020 (MMT)

Table 110 Europe: Gas Mixtures Market Size, By Country, 20132020 (USD Million)

Table 111 Europe: Market Size, By Country, 20132020 (MMT)

Table 112 Europe: Market Size, By End-Use Industry,20132020 (USD Million)

Table 113 Europe: Market Size, By End-Use Industry,20132020 (MMT)

Table 114 Europe: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 115 Europe: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 116 Europe: Market Size, By Type, 20132020 (USD Million)

Table 117 Europe: Market Size, By Type, 20132020 (MMT)

Table 118 Europe: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 119 Europe: Market Size, By Manufacturing Process,20132020 (MMT)

Table 120 Belgium: Gas Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 121 Belgium: Market Size, By End-Use Industry,20132020 (MMT)

Table 122 Belgium: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 123 Belgium: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 124 Belgium: Market Size, By Type, 20132020 (USD Million)

Table 125 Belgium: Market Size, By Type, 20132020 (MMT)

Table 126 Belgium: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 127 Belgium: Market Size, By Manufacturing Process,20132020 (MMT)

Table 128 Germany: Gas Mixtures Market Size, By End-Use Industry,20132020 (USD Million)

Table 129 Germany: Market Size, By End-Use Industry,20132020 (MMT)

Table 130 Germany: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 131 Germany: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 132 Germany: Market Size, By Type, 20132020 (USD Million)

Table 133 Germany: Market Size, By Type, 20132020 (MMT)

Table 134 Germany: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 135 Germany: Market Size, By Manufacturing Process,20132020 (MMT)

Table 136 France: Gas Mixtures Market Size, End-Use Industry,20132020 (USD Million)

Table 137 France: Market Size, End-Use Industry, 20132020 (MMT)

Table 138 France: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 139 France: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 140 France: Market Size, By Type, 20132020 (USD Million)

Table 141 France: Market Size, By Type, 20132020 (MMT)

Table 142 France: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 143 France: Market Size, By Manufacturing Process,20132020 (MMT)

Table 144 Rest of Europe: Gas Mixtures Market Size, End-Use Industry,20132020 (USD Million)

Table 145 Rest of Europe: Market Size, End-Use Industry,20132020 (MMT)

Table 146 Rest of Europe: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 147 Rest of Europe: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 148 Rest of Europe: Market Size, By Type,20132020 (USD Million)

Table 149 Rest of Europe: Market Size, By Type, 20132020 (MMT)

Table 150 Rest of Europe: Market Size, By Manufacturing Process, 20132020 (USD Million)

Table 151 Rest of Europe: Market Size, By Manufacturing Process, 20132020 (MMT)

Table 152 RoW: Gas Mixtures Market Size, By Country, 20132020 (USD Million)

Table 153 RoW: Market Size, By Country, 20132020 (MMT )

Table 154 RoW: Market Size, End-Use Industry,20132020 (USD Million)

Table 155 RoW: Market Size, End-Use Industry, 20132020 (MMT)

Table 156 RoW: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 157 RoW: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 158 RoW: Market Size, By Mixtures, 20132020 (USD Million)

Table 159 RoW: Market Size, By Type, 20132020 (MMT)

Table 160 RoW: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 161 RoW: Market Size, By Manufacturing Process,20132020 (MMT)

Table 162 Brazil: Gas Mixtures Market Size, End-Use Industry,20132020 (USD Million)

Table 163 Brazil: Market Size, End-Use Industry, 20132020 (MMT)

Table 164 Brazil: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 165 Brazil: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 166 Brazil: Market Size, By Type, 20132020 (USD Million)

Table 167 Brazil: Market Size, By Type, 20132020 (MMT)

Table 168 Brazil: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 169 Brazil: Market Size, By Manufacturing Process,20132020 (MMT)

Table 170 South Africa: Gas Mixtures Market Size, End-Use Industry,20132020 (USD Million)

Table 171 South Africa: Market Size, End-Use Industry,20132020 (MMT)

Table 172 South Africa: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 173 South Africa: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 174 South Africa: Market Size, By Type,20132020 (USD Million)

Table 175 South Africa: Market Size, By Type, 20132020 (MMT)

Table 176 South Africa: Market Size, By Manufacturing Process, 20132020 (USD Million)

Table 177 South Africa: Market Size, By Manufacturing Process, 20132020 (MMT)

Table 178 Argentina: Gas Mixtures Market Size, End-Use Industry,20132020 (USD Million)

Table 179 Argentina: Market Size, End-Use Industry,20132020 (MMT)

Table 180 Argentina: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 181 Argentina: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 182 Argentina: Market Size, By Type, 20132020 (USD Million)

Table 183 Argentina: Market Size, By Type, 20132020 (MMT)

Table 184 Argentina: Market Size, By Manufacturing Process,20132020 (USD Million)

Table 185 Argentina: Market Size, By Manufacturing Process,20132020 (MMT)

Table 186 Other RoW Countries: Gas Mixtures Market Size, End-Use Industry, 20132020 (USD Million)

Table 187 Other RoW Countries: Market Size, End-Use Industry, 20132020 (MMT)

Table 188 Other RoW Countries: Market Size, By Storage, Distribution & Transportation, 20132020 (USD Million)

Table 189 Other RoW Countries: Market Size, By Storage, Distribution & Transportation, 20132020 (MMT)

Table 190 Other RoW Countries: Market Size, By Type,20132020 (USD Million)

Table 191 Other RoW Countries: Market Size, By Type,20132020 (MMT)

Table 192 Other RoW Countries: Market Size, By Manufacturing Process, 20132020 (USD Million)

Table 193 Other RoW Countries: Market Size, By Manufacturing Process, 20132020 (MMT)

Table 194 Expansions, 20112015

Table 195 Mergers & Acquisitions, 20112015

Table 196 Agreements, Partnerships, Contracts & Joint Ventures, 2011-2015

Table 197 New Product Launches, 20112015

List of Figures (58 Figures)

Figure 1 Gas Mixtures Market: Research Design

Figure 2 Population Growth Has Increased Considerably in the Last Three Decades

Figure 3 Increase in Total Expenditure of Middle Class Families

Figure 4 Crude Oil Spot Prices, 2004-2014

Figure 5 Natural Gas Prices, 2004-2014

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation Methodology

Figure 9 Gas Mixtures Market Size, By End-Use Industry,2015 vs. 2020 (USD Million)

Figure 10 Gas Mixtures Market Size, By Region, 2015 vs. 2020 (USD Million)

Figure 11 China is Projected to Be the Fastest-Growing Market for Gas Mixtures From 2015 to 2020

Figure 12 Hydrogen Mixture Segment is Projected to Be the Leader in the Market Till 2020

Figure 13 Leading Market Players Adopted Expansions & Investments as Key Strategy From 2011 to 2015

Figure 14 Emerging Economies Offer Attractive Opportunities in this Market

Figure 15 Metal Manufacturing & Fabrication End-Use Industries Captured the Largest Share in the Emerging Asia-Pacific Market in 2014

Figure 16 China Projected to Be the Fastest-Growing Country Market for Gas Mixtures, 2015-2020

Figure 17 Gas Mixtures Market in Asia-Pacific to Grow Fastest Among All Regions in 2014

Figure 18 Emerging Markets to Grow Faster Than Developed Markets, 2015-2020

Figure 19 Gas Mixtures Market in Asia-Pacific Region is Experiencing High Growth During the Forecast Period

Figure 20 Evolution of Gas Mixtures Market

Figure 21 Gas Mixtures Market Segmentation

Figure 22 Market Dynamics

Figure 23 Silicon Wafer Industry Trends

Figure 24 Flat Panel Display Market Forecast

Figure 25 Global Health Care Market, 2014-2050

Figure 26 Global Health Care Sector Outlook for 2009 to 2013

Figure 27 Global Energy Demand

Figure 28 Chemical Market, CAGR (2013-2020)

Figure 29 Gas Mixtures Value Chain

Figure 30 Porters Five Forces Analysis

Figure 31 Hydrogen Mixtures Segment is Projected to Dominate the Gas Mixtures Market

Figure 32 Metal Manufacturing & Fabrication Dominated in this Market in 2014

Figure 33 Merchant Liquid Segment Dominated in this Market in 2014

Figure 34 Air Separation Technology Process is Projected to Dominate in this Market

Figure 35 Geographical Snapshot: Gas Mixtures Market Growth Rate, CAGR (2015-2020)

Figure 36 U.S., China & India Are Expected to Grow at High CAGRs By 2020

Figure 37 North America: Market Snapshot

Figure 38 Asia-Pacific: Market Snapshot

Figure 39 Europe: Market Snapshot

Figure 40 RoW: Market Snapshot

Figure 41 Companies Adopted Expansions as Their Key Growth Strategy Over the During Year 2011 to 2015

Figure 42 Gas Mixtures Market Developments, By Key Player, 2014

Figure 43 Expansions Fueled Growth of the Gas Mixtures Market

Figure 44 Key Growth Strategies, 2011-2015

Figure 45 Geographic Revenue Mix of Top 5 Players

Figure 46 The Linde Group: Company Snapshot

Figure 47 SWOT Analysis: the Linde Group

Figure 48 Praxair Inc.: Company Snapshot

Figure 49 SWOT Analysis: Praxair Inc.

Figure 50 Air Liquide S.A.: Company Snapshot

Figure 51 Air Liquide S.A.: SWOT Analysis

Figure 52 Air Products and Chemicals, Inc.: Company Snapshot

Figure 53 Air Products and Chemicals, Inc.: SWOT Analysis

Figure 54 Airgas Inc.: Company Snapshot

Figure 55 SWOT Analysis: Airgas Inc.

Figure 56 Messer Group: Company Snapshot

Figure 57 Taiyo Nippon Sanso Corporation: Company Snapshot

Figure 58 Iwatani Corporation: Company Snapshot

Growth opportunities and latent adjacency in Gas Mixtures Market