Gas Separation Membrane Market

Gas Separation Membrane Market by Material Type (Polyimide & Polyaramide, Polysulfone, Cellulose Acetate), Module (Plate & Frame, Spiral Wound, Hollow Fiber), Application (Nitrogen Generation & Oxygen Enrichment, Hydrogen Recovery, Carbon Dioxide Removal, Vapor/Gas Separation, Vapor/Vapor Separation, Air Dehydration, H2S), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

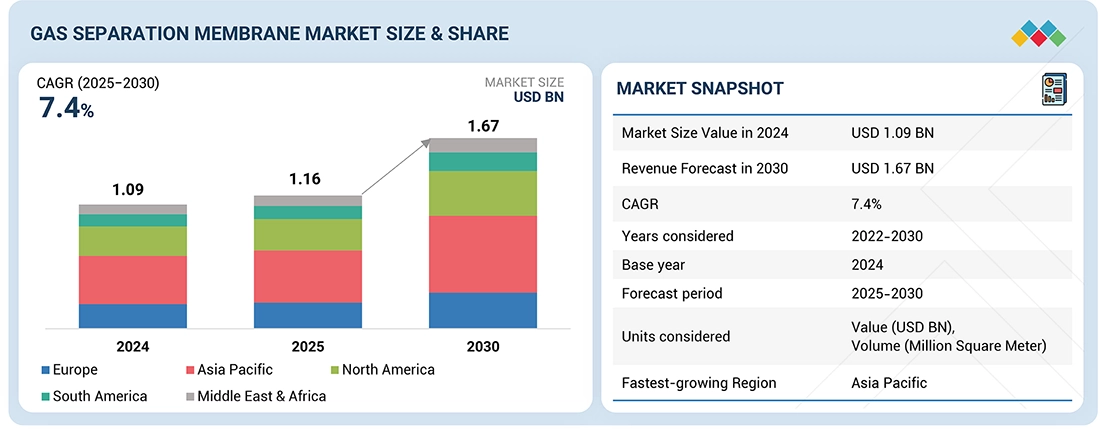

The gas separation membrane market is projected to reach USD 1.67 billion by 2030 from USD 1.16 billion in 2025, at a CAGR of 7.4% from 2025 to 2030. Gas separation membranes are expected to have considerable growth in the future as new technologies will provide regulatory compliance and industries are beginning to demand that separation technologies to be delivered in a cleaner manner and have less energy use.

KEY TAKEAWAYS

-

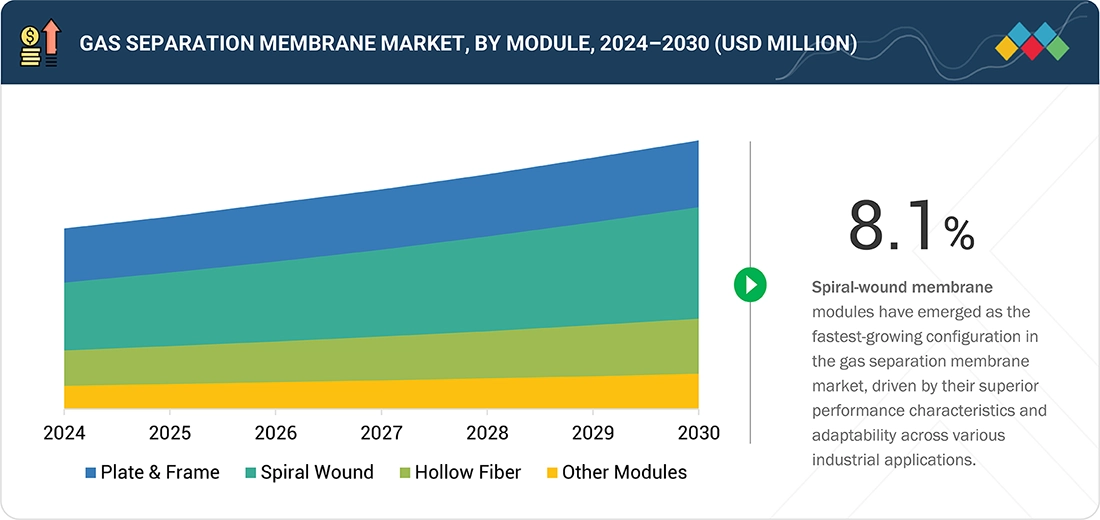

BY MODULEBy modules includes plate & frame, spiral wound, hollow fiber and other modules. Plate and frame modules have relatively simple stackable construction which allows for easy replacement & cleaning and are generally used in smaller scale or specialty applications. Spiral wound modules represent a compromise between high packing densities and cost, making them the most common modules used for industrial separations and large-scale natural gas separations. Hollow fiber modules contain thousands of small fibers bundled together providing extremely high surface area within a small volume, for a relatively high capacity in operational applications, such as hydrogen recovery, nitrogen generation, or biogas upgrading.

-

BY MATERIAL TYPEPolyimide & polyaramide, polysulfone, cellulose acetate and other types are include in by type. Gas separation membranes are made of various optimized polymers. Polyimide and polyaramide membranes are favored for thermally and chemically-advanced applications such as natural gas sweetening and hydrogen recovery. Polysulfone membranes provide superior mechanical stability and are typically employed as support membranes or for less aggressive separation conditions. Cellulose acetate membranes are less expensive, well understood in CO2/CH4 separation, and are also frequently used for natural gas processing where separation is performed in moderate conditions.

-

BY APPLICATIONGas separation membrane products are increasingly used in nitrogen generation & oxygen enrichment, hydrogen recovery, carbon dioxide removal, vapor/gas separation, vapor/vapor separation, air dehydration, H2S and other applications. Nitrogen generation and oxygen enrichment are expanding in food, healthcare, and wastewater treatment due to on-site generation and energy efficiency. Hydrogen recovery is rising in refineries and chemical plants for cost-effective purification of hydrogen from off-gases. Carbon dioxide removal is growing in natural gas processing and carbon capture under stricter emission regulations. Vapor/gas and vapor/vapor separation are increasingly used in chemical and pharmaceutical industries for solvent recovery and VOC control. Additionally, air dehydration and H2S removal membranes are gaining adoption in industrial gas streams and biogas treatment to meet quality and environmental standards.

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 8.1%, fueled by a combination of strong energy demand, industrial expansion, and sustainability-driven policy shifts. Strong government initiatives promoting clean energy, environmental regulations, and adoption of advanced membrane technologies further accelerate market expansion. Additionally, expanding petrochemical, power generation, and manufacturing sectors are driving steady demand for efficient and cost-effective gas separation solutions across the region.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as Air Liquide (France), Air Products and Chemicals, Inc. (US), Honeywell International Inc. (US), UBE Corporation (Japan), FUJIFILM RUS LLC (Japan). These companies are advancing gas separation membrane technologies and broadening end-use adoption, reflecting the growing demand for membranes in various applications

The gas separation membrane market is projected to reach USD 1.67 billion by 2030 from USD 1.16 billion in 2025, at a CAGR of 7.4% from 2025 to 2030. A gas separation membrane is a selective barrier that is thin in structure and intended to separate particular components of a gas mixture, based on differences in physical or chemical properties, for example, size, solubility, or diffusivity. Gas separation membranes allow for certain gases, such as carbon dioxide, hydrogen, or methane, to separate from gas mixtures more efficiently than others, allowing for more effective purification, enrichment, or removal steps.

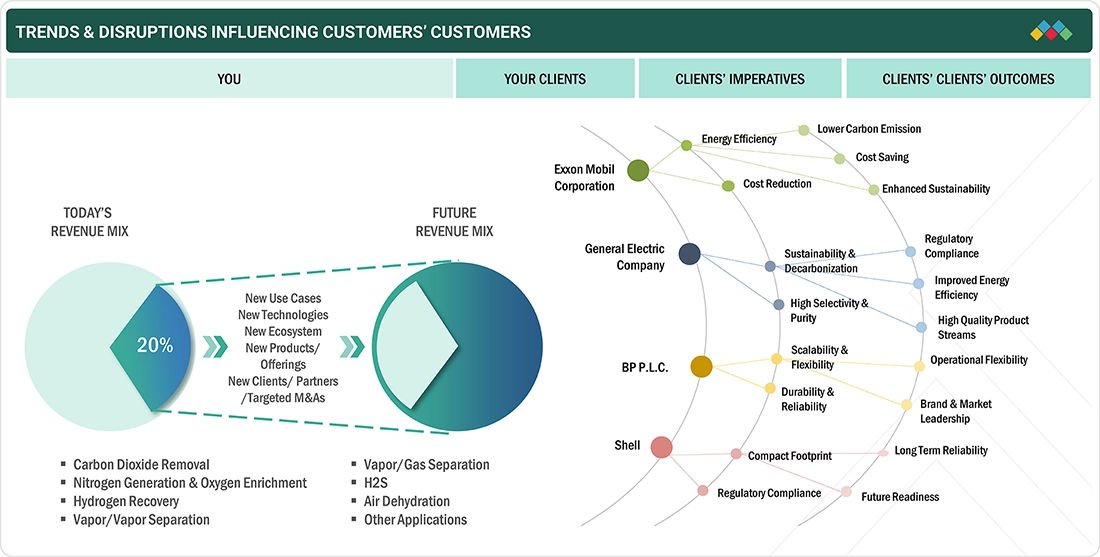

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Gas separation membranes are critical components across a wide range of applications, including nitrogen generation and oxygen enrichment, hydrogen recovery, carbon dioxide removal, vapor/gas separation, vapor/vapor separation, air dehydration, and other industrial gas purification processes. Customer demand for membranes is rising due to increasing adoption in oil & gas, chemicals and petrochemicals, biogas, hydrogen purification, and refining sectors. Key drivers include membranes’ high permeability, chemical and thermal stability, energy efficiency, and cost-effectiveness compared with traditional separation technologies. Disruptions impacting customer business include evolving environmental regulations, energy transition initiatives (such as the shift toward green hydrogen and CO2 capture projects), fluctuating raw material prices, and global trade policies affecting membrane supply chains.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing need for membranes in carbon dioxide separation processes

-

Rising demand for membranes in nitrogen generation and syngas cleaning

Level

-

Technical disadvantages compared to alternative gas separation technologies

-

Plasticization of polymeric membranes in high temperature applications

Level

-

Rising demand for clean energy

-

Development of mixed matrix membranes

Level

-

Upscaling and commercializing new membranes

-

Requirement for high initial investment for development and installation of polymeric membranes for separation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing need for membranes in carbon dioxide separation processes

Separating carbon dioxide from gas streams represents a critical application of gas separation membranes across diverse industries. This process finds utility in gas sweetening (purification of natural gas), enhanced oil recovery, and biogas purification. Carbon dioxide removal from natural gas is the largest application for gas separation membranes, followed by enhanced oil recovery. Carbon dioxide, classified as an acid gas, is often present in elevated concentrations within natural gas. When combined with water, it forms a highly corrosive substance, posing risks to pipeline and equipment integrity. Moreover, its presence diminishes the heating value of natural gas and reduces pipeline capacity. Carbon dioxide must be removed in liquefied natural gas (LNG) plants to prevent freezing in low-temperature chillers. Therefore, eliminating carbon dioxide is an essential separation process, optimizing natural gas transmission and processing.

Restraint: Technical disadvantages compared to alternative gas separation technologies

Gas separation membranes are primarily deployed for moderate-volume gas streams due to inherent limitations in flux and selectivity. In high-volume applications, such as natural gas sweetening or large-scale CO2 removal, amine absorption and cryogenic separation remain the preferred solutions because of their higher efficiency and scalability. For nitrogen generation and oxygen enrichment, pressure swing adsorption (PSA) technology maintains a clear advantage over membranes. PSA delivers higher purity levels (up to 99.9% compared to ~95% for membranes), greater reliability under variable feed conditions, and a longer operational lifespan. Cryogenic processes also dominate large-scale hydrogen and air separation due to superior throughput and purity. These comparative disadvantages, particularly in high-capacity and high-purity operations, continue to restrain the wider adoption of membrane technology in industrial gas separation markets

Opportunity: Rising demand for clean energy

The increasing global demand for clean energy sources is being driven by the urgent need to reduce greenhouse gas emissions, address climate change, and shift away from fossil fuels. Hydrogen is recognized as a clean and versatile energy carrier, particularly suitable for fuel cell technology. Gas separation membranes play a crucial role in extracting high-purity hydrogen from feedstocks such as natural gas or water. These membranes selectively allow hydrogen molecules to pass through while blocking impurities such as carbon dioxide and methane. As hydrogen gains momentum in sectors such as transportation and industrial processes, there is a growing demand for gas separation membranes in hydrogen production. Hydrogen is expected to play a vital role in decarbonizing sectors where alternative solutions are less advanced or economically challenging, such as heavy industry, long-distance transportation, and seasonal energy storage. In these applications, hydrogen has the potential to contribute significantly to emissions reduction efforts outlined in the IRENA 1.5°C Scenario and meet a substantial portion of the world's final energy demand, estimated at ~12%.

Challenge: Upscaling and commercializing new membranes

Many gas separation membranes developed by researchers are primarily tested in laboratory settings. However, scaling up new membrane technology is crucial to ensure reliability and durability, as well as to validate its performance under real operating conditions. Upscaling also involves stress analysis to guarantee the safe design and operation of the membrane in practical applications. Despite its importance, testing new membranes in pilot plants and analyzing their performance is a time-consuming process that is also associated with high installation costs. As a result, many membranes developed in recent years have yet to undergo testing under real-world conditions, leading to delays in their commercialization. The high costs and time requirements associated with upscaling and bringing new products to the market pose significant challenges for industry players.

Gas Separation Membrane Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Gas separation membranes can be applied in acid gas removal (CO2 and H2S), nitrogen rejection, and post-combustion CO2 capture from large refineries and petrochemical plants | Lower operating costs compared to cryogenic distillation and reduced carbon intensity of LNG and petrochemical value chains. |

|

Shell is investing heavily in blue and green hydrogen projects, as well as biogas plants in Europe. Gas separation membranes are vital for H2/CO2 separation in blue hydrogen and CO2/CH4 upgrading in RNG facilities. | Strengthens Shell’s hydrogen economy positioning by producing high-purity hydrogen and supports Shell’s net-zero ambitions with scalable CO2 separation for CCUS projects. |

|

BP operates numerous offshore platforms and is leading CCUS cluster projects in the UK (e.g., Net Zero Teesside). Membranes are well-suited for compact, space-limited offshore environments where traditional separation is too bulky. | Reduces offshore platform footprint and weight while increasing efficiency and enhances project economics of CCUS hubs by lowering CO2 separation costs. |

|

GE operates in gas turbines, power plants, and industrial systems. Membranes can be integrated into flue gas CO2 capture, oxygen enrichment for combustion, and hydrogen recovery from syngas. | Improves efficiency of gas-fired power plants through oxygen-enriched combustion and enables cost-effective CO2 capture retrofits for existing GE turbine customers. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The gas separation membrane ecosystem analysis involves identifying and analysing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, and end users. Suppliers of raw materials produce high-performance polymers like polyimides, polysulfones, cellulose acetates, and advanced fillers for mixed matrix membranes. Fabricators, such as Air Products and Chemicals Inc., Honeywell International Inc., Membrane Technology and Research, and others, design and fabricate membrane modules (hollow fiber, spiral wound, and plate & frame) for industrial process developers. Distributors and system integrators provide worldwide distribution of the membrane modules, as well as technical support and custom design across the entire system scale. End-use markets include natural gas processing, petrochemicals, hydrogen production, renewable natural gas upgrading, and carbon capture in large-scale power and heavy industries. All end-use sectors are leveraging membrane systems as a cost-effective, modular, and sustainable platform for gas separation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Gas Separation Membrane Market, By Module

Plate & frame modules make up the largest share of the module segment of the gas separation membrane market due to their simple design, ease of assembly, and flexibility in operation, which makes them highly attractive across diverse applications. Their flat-sheet configuration enables straightforward maintenance, cleaning, and replacement of membrane sheets, thereby reducing downtime and operating costs.

Gas Separation Membrane Market, By Material Type

Polyimide & polyaramide types represent the largest share of the global gas separation membrane market due to their superior selectivity, permeability, and durability in adverse operating conditions. They possess great thermal and chemical stability, making them reliable in challenging applications such as natural gas sweetening, hydrogen recovery, and the separation of CO2/CH4. They possess a stable molecular structure that resists plasticization and aging, resulting in longer lifespan and reduced replacement frequency compared to competitive materials.

Gas Separation Membrane Market, By Application

The carbon dioxide removal application dominates the gas separation membrane market segment because it caters to one of the most urgent and extensive industrial requirements—natural gas sweetening and emission control. High flow rates of natural gas have a high CO2 content that needs to be removed to satisfy pipeline conditions and enhance fuel quality. Therefore, membrane-based CO2/CH4 separation is very promising due to its reduced energy requirements and modularity compared to amine technologies. Moreover, the increasing focus on carbon capture, utilization, and storage (CCUS) for decarbonization in the power, cement, and steel sectors is also driving demand.

REGION

Asia Pacific to be fastest-growing region in global gas separation membrane market during forecast period

The gas separation membrane in Asia Pacific is expected to register the highest CAGR during the forecast period, due to its surging energy demand, rapid industrialization, and strong push for cleaner fuels across major economies like China, India, Japan, and South Korea. The region’s heavy reliance on natural gas and LNG imports has led to the widespread adoption of membranes for CO2 removal and nitrogen rejection in gas processing. At the same time, government-backed investments in hydrogen economy projects, renewable natural gas, and carbon capture are accelerating the deployment of membranes in energy transition pathways.

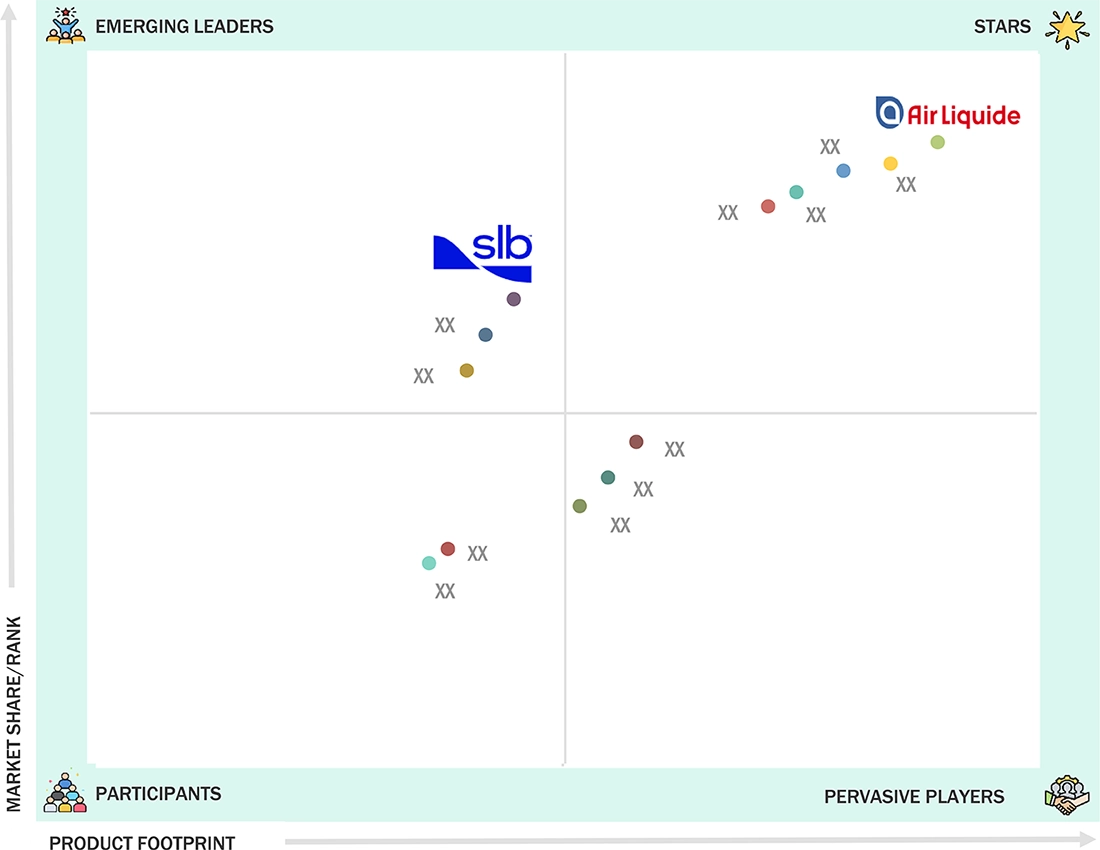

Gas Separation Membrane Market: COMPANY EVALUATION MATRIX

In the gas separation membrane market matrix, Air Liquide (Star), a French company, leads the market through its manufacturing and distribution of gas separation membranes. Its long-standing R&D investments have enabled the development of highly durable, high-performance membranes that meet the demands of applications in energy, chemicals, and environmental markets. Combined with its integrated gas supply business, large customer base, and worldwide distribution network, Air Liquide is positioned as the market leader in driving adoption of membrane-based gas separation technologies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.09 Billion |

| Market Forecast in 2030 (value) | USD 1.67 Billion |

| Growth Rate | CAGR of 7.4% from 2025–2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Square Meter) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

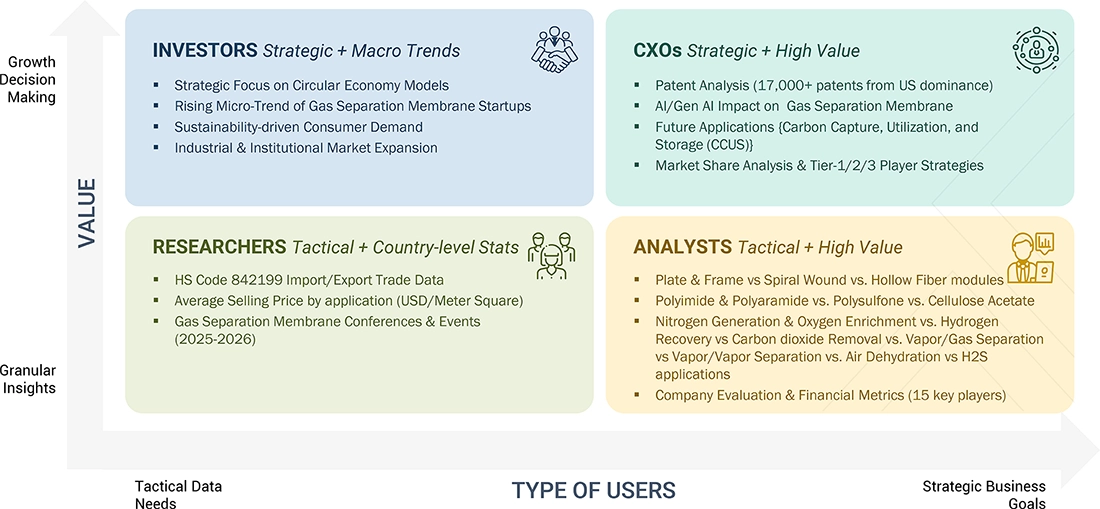

WHAT IS IN IT FOR YOU: Gas Separation Membrane Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Gas Separation Membrane Manufacturers |

|

|

| Benchmarking of gas separation membrane modules (Plate & frame vs Spinal wound vs Hollow fiber) |

|

|

| US Based gas separation membrane raw material supplier |

|

|

| Type based gas separation membrane products |

|

|

RECENT DEVELOPMENTS

- August 2025 : DIG Airgas operates an extensive portfolio of gas production facilities and pipeline networks in South Korea, serving high-growth industries such as semiconductors, clean energy, and bio-pharma — all sectors where gas separation membranes play a critical role in delivering high-purity gases (e.g., nitrogen, oxygen, and hydrogen). By integrating DIG’s operations, Air Liquide not only strengthens its footprint in one of the world’s most advanced manufacturing hubs but also enhances its ability to expand membrane-based separation solutions to meet the growing demand for efficiency, sustainability, and cost-effective gas supply.

- June 2025 : Air Liquide’s USD 200M investment in modernizing its Louisiana ASU and expanding pipeline infrastructure supports a long-term oxygen and nitrogen supply contract with Dow, enhancing delivery efficiency and reliability. This development strengthens Air Liquide’s foothold in the onsite gas separation membrane market by expanding its pipeline network and capacity to serve large industrial clients along the Gulf Coast.

- February 2025 : Air Products and Chemicals, Inc. expanded its operations in Cleveland, Ohio, with a new air separation facility and liquefier now onstream, supplying oxygen, nitrogen, and argon to onsite and regional customers. This investment not only strengthens its supply network but also complements advancements in gas separation technologies such as membranes

Table of Contents

Methodology

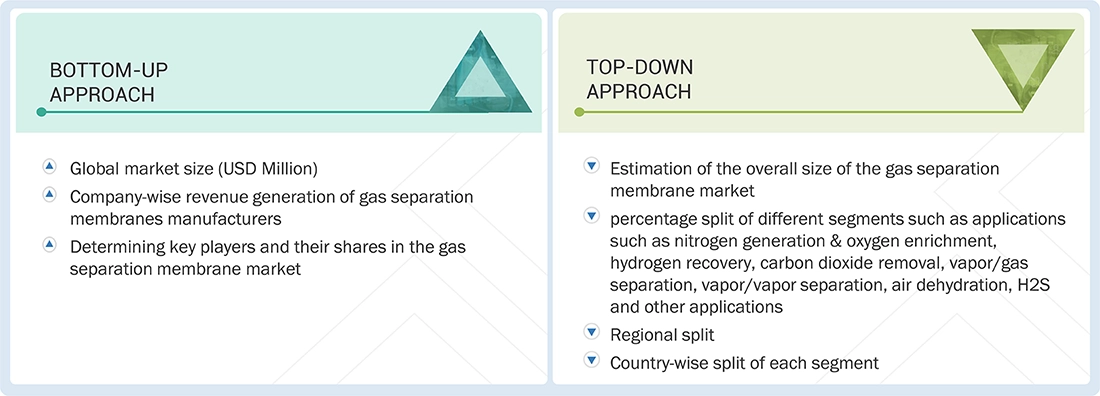

The study involves two major activities in estimating the current market size for the gas separation membrane market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Following this, market breakdown and data triangulation were employed to determine the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering gas separation membranes and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends, to the bottom-most level, and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the gas separation membrane market, which was validated by primary respondents.

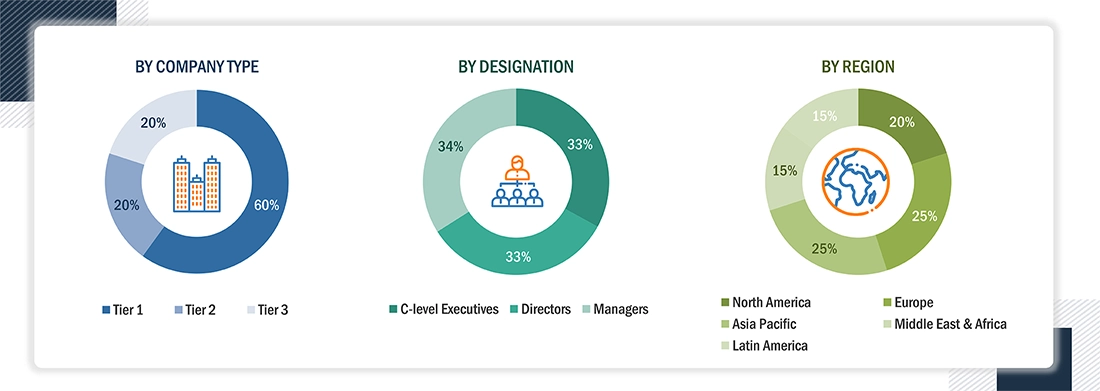

Primary Research

Extensive primary research was conducted after obtaining information regarding the gas separation membrane market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from gas separation membrane industry vendors, material providers, distributors, and key opinion leaders. Primary interviews were conducted to gather insights, including market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to modules, material types, applications, and regions. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking Gas separation membrane services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of gas separation membrane and future outlook of their business, which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the gas separation membrane market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on the demand for gas separation membranes in different applications at a regional level. Such procurements provide information on the demand aspects of the gas separation membrane industry for each application. For each application, all possible segments of the gas separation membrane market were integrated and mapped.

Gas Separation Membrane Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

A gas separation membrane is a selective barrier that allows certain gas molecules to pass through while restricting others, enabling the separation of specific components from a gas mixture based on differences in permeability or solubility. These membranes are typically made from polymers, ceramics, or metals and are engineered in various configurations such as hollow fiber, spiral-wound, and flat-sheet modules to optimize surface area, efficiency, and operational stability.

Stakeholders

- Gas Separation Membrane Manufacturers

- Gas Separation Membrane Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the gas separation membrane market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global gas separation membrane market, by module, by material type, by application, and by region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, partnerships & collaborations, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the gas separation membrane market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Gas Separation Membrane Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Gas Separation Membrane Market

Phuong

Dec, 2019

Research required on utilization of contaminated natural gas sources by using energy-consumed membrane technology.

Lebogang

Jul, 2018

Gas separation membranes for nitrogen generation of the London and oxygen and oxygen generation..