Specialty Chemicals Market by Type (Plasticizers, Water-Based, Coagulants and Flocculants, Scale Inhibitors), Application (Paper and Packaging, Automotive, Consumer Goods, Construction), and Region - Global Forecast to 2028

Updated on : November 11, 2025

Specialty Chemicals Market

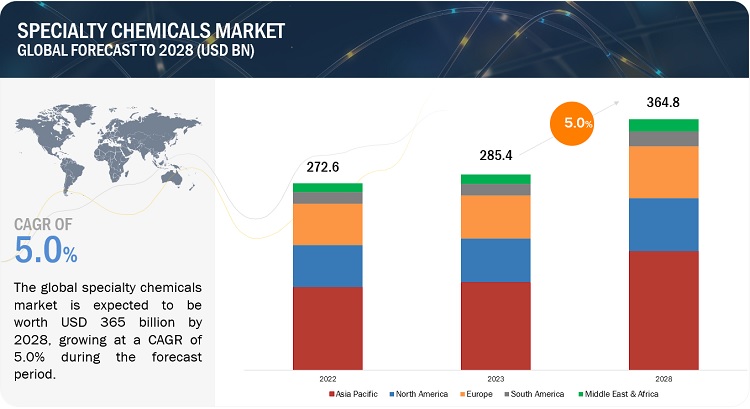

The global specialty chemicals market was valued at USD 285.4 billion in 2023 and is projected to reach USD 364.8 billion by 2028, growing at 5.0% cagr from 2023 to 2028. Specialty chemicals is a whole ecosystem consisting of multiple chemicals within the category. In this report we have considered different specialty chemicals such as plastic additives, rubber additives, adhesives, cosmetic ingredients, lubricating oil additives, specialty oilfield chemicals, water treatment chemicals, electronic chemicals, textile chemicals, and advanced ceramic chemicals. Packaging industry is one of the major consumer of specialty chemicals, especially for food and cosmetic packaging application. This growth is driven by the emergence of e-commerce platforms.

Specialty Chemicals Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Specialty Chemicals Market

Specialty Chemicals Market Dynamics

Driver: Increasing demand from end-use industries

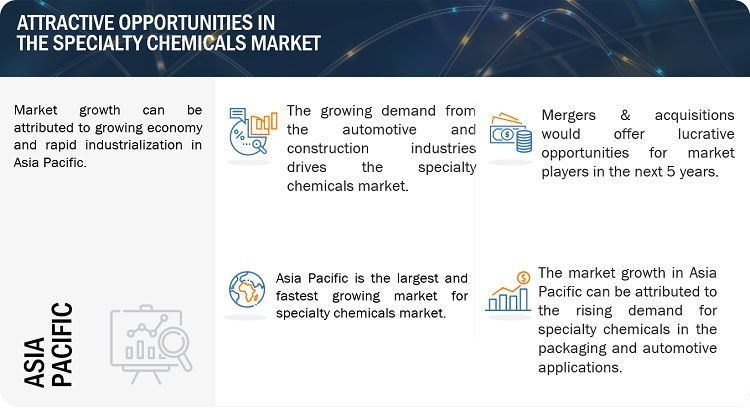

Due to the expansion of different end-use industries, including automotive, electronics, construction, medical, and packaging, the demand for specialty chemicals has been rising recently. One of the biggest consumers of specialty chemicals is the automotive industry. Specialty chemicals are used in the manufacturing of a few automobile parts, including tires, coatings, and adhesives inorder to enhance their performance and durability. The demand for specialty chemicals is expected to grow further as these sectors develop and innovate, presenting potential for producers in the specialty chemicals market.

Restraints: Government and environmental regulations

The regulatory framework in which the specialty chemicals industry operates frequently puts strict rules on the companies. To protect workers, customers, and the environment, these rules are implemented by government organizations and environmental authorities. Although these laws are essential for safeguarding the public's health and reducing their negative effects on the environment, they can be difficult for the companies to comply with. To satisfy the required standards, they must spend a lot of money on testing, research and development, and documentation.

Opportunities: Green & sustainable specialty chemicals

Specialty chemicals that provide eco-friendly and sustainable solutions now have a lot of opportunities because of rising environmental concerns and standards around sustainability. The need for specialty chemicals that support these initiatives is rising as the companies work to minimize their environmental impact and implement more eco-friendly practices. These specialty chemicals are essential for lowering emissions, increasing energy effectiveness, and promoting sustainability in a variety of industries, including consumer goods, construction, and the automobile industry.

Challenges: Volatility in raw material prices

The specialty chemicals manufacturing process includes the use of various raw materials. Specialty chemicals often depend on specific raw materials, and any changes in their prices can have a major impact on manufacturing costs and profit margins. The cost of producing specialty chemicals can be directly impacted by changes in the price of these raw ingredients. If the prices of key raw materials increase significantly, it can result in higher production costs for plastic additive, rubber additives, adhesives and other specialty chemicals manufacturer. When the cost of raw materials used in specialty chemicals rises, manufacturers may face challenges in maintaining competitive pricing. Specialty chemicals may be more expensive and less appealing to consumers if they are unable to bear the extra costs.

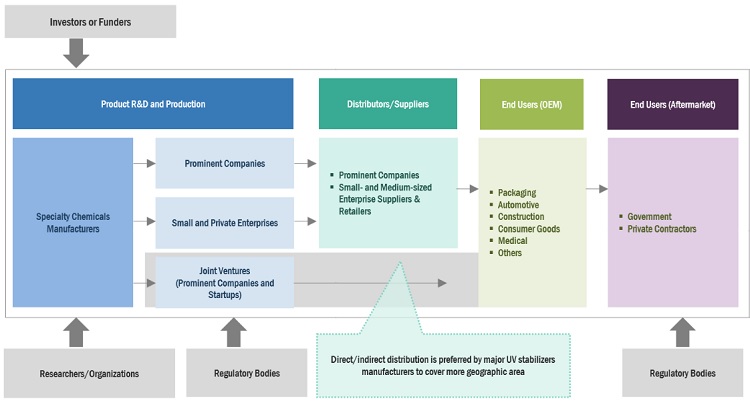

Specialty Chemicals Market Ecosystem

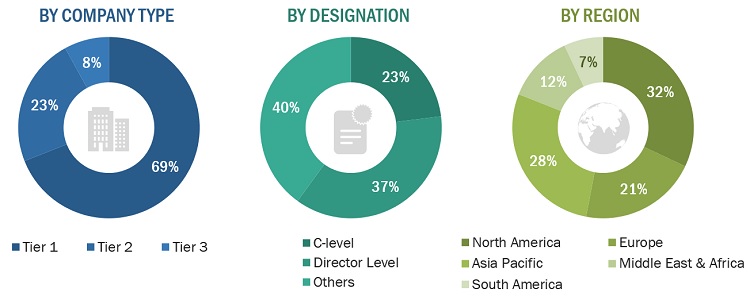

Prominent companies in this market include well-established, financially stable manufacturers of specialty chemicals. These companies have been in business for a while and have a broad range of products, cutting-edge technologies, and robust international sales and marketing networks. Prominent companies in this market include BASF SE (Germany), DOW Inc. (US), Nouryon (The Netherlands), LANXESS AG (Germany), Evonik Industries AG (Germany), Huntsman Corporation (US), Covestro AG (Germany), Clariant AG (Switzerland), Solvay S.A. (Belgium), and Arkema (France).

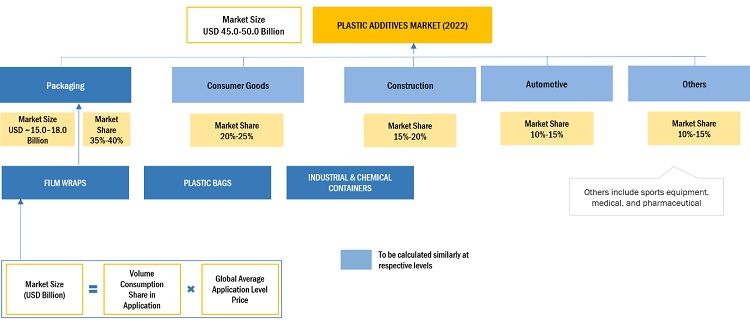

Based on type, plasticizers was the largest segment for plastic additives market, in terms of value, in 2022.

The development of new plasticizer formulations and manufacturing processes has expanded the range of applications for plasticizers. This includes the development of bio-based and non-phthalate plasticizers, which have gained popularity because of their safe and non-toxic attributes. Also the growing construction industries fuels the demand for plasticizers as they are used in the manufacturing of PVC-based pipes, cables, and other construction materials.

Based on application, consumer goods was the second-largest segment for plastic additives market, in terms of value, in 2022.

The consumer goods segment accounted for the second-largest market share in the plastic additives market in terms of value, in 2022. There is a significant demand for plastic additives in the consumer goods application to protect goods from the damaging by UV rays while being stored and transported, improve durability, and enhance performance . Overall, the need for product protection, consumer expectations, regulatory requirements, and technological developments in plastic additives formulations are all projected to drive up demand for plastic additives in consumer goods application.

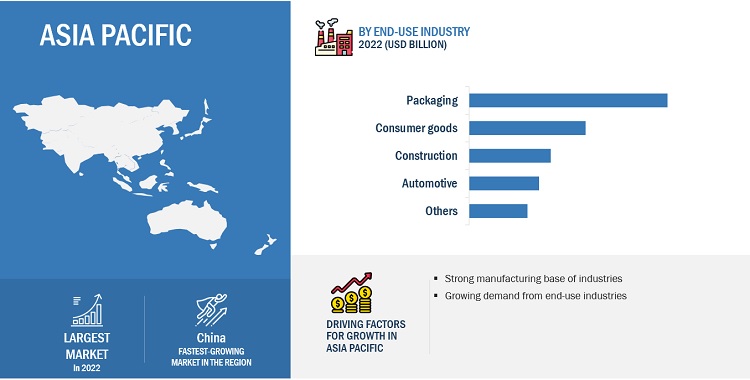

“Asia Pacific accounted for the largest market share for plastic additives market, in terms of value, in 2022”

Asia Pacific is home to some of the fastest-growing economies, such as China, India, and Southeast Asian countries. The economic growth in these countries leads to the growth of construction activities, infrastructure development, and urbanization, which drives the demand for specialty chemicals. Specialty chemicals are used in finished products as ingerdients to enhance their performance, durability, and protect from damaging. Also the rising disposable income in this region contributes to an increased infrastructure and construction activities. Asia Pacific countries such as India and China have low cost labor which attract major automotive manufacturers to set up their operational plant in these countries. All these factors are driving the market for specialty chemicals in Asia Pacific region majorly in automotive, construction, medical, packaging, and consumer goods applications.

Note: For illustration, largest type, application, region is provided for plastic additives similar information is provided for all the ten chemicals in the report.

To know about the assumptions considered for the study, download the pdf brochure

Specialty Chemicals Market Players

The players profiled in the report include BASF SE (Germany), Evonik Industries AG (Germany), Clariant AG (Switzerland), Solvay S.A. (Belgium), DOW Inc. (US), Nouryon (The Netherlands), LANXESS AG (Germany), Huntsman Corporation (US), Covestro AG (Germany), and Arkema (France). Unitechem Group (China), and Everlight Chemical Industrial Corporation (Taiwan) among others, these are the key manufacturers that secured major market share in the last few years.

Read More: Specialty Chemicals Companies

Specialty Chemicals Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 285.4 billion |

|

Revenue Forecast in 2028 |

USD 364.8 billion |

|

CAGR |

5.0% |

|

Years considered for the study |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Kiloton) and Value (USD Million/Billion) |

|

Segments covered |

Type, Application, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

The key players profiled in the report include BASF SE (Germany), DOW Inc. (US), Nouryon (The Netherlands), LANXESS AG (Germany), Evonik Industries AG (Germany), Huntsman Corporation (US), Covestro AG (Germany), Clariant AG (Switzerland), Solvay S.A. (Belgium), Arkema (France) among others. |

This report categorizes the global specialty chemicals market based on type, application, and region.

On the basis of type, the specialty chemicals market has been segmented as follows:

-

Adhesives

- Water-based

- Solvent-based

- Hot-Melt

- Reactive & Others

-

Water Treatment Chemical

- Coagulants & Flocculants

- Scale Inhibitors

- Corrosion Inhibitors

- Biocides & Disinfectants

- Chelating Agents

- Others

-

Electronic Chemicals

- Silicon Wafers

- PCB Laminates

- Specialty Gases

- Conductive Polymers

- Photoresist & Photoresist Ancillaries

- Others

-

Rubber Additives

- Antidegradants

- Accelerators

- Others

-

Lubricating Oil Additives

- Viscosity Index Improvers

- Dispersants

- Detergents

- Antioxidants

- Extreme Pressure Additives

- Others

-

Cosmetic Ingredients

- Emollients

- Surfactants

- Conditioning Polymers

- Rheology Modifiers

- Emulsifiers

- Others

-

Advanced Ceramic Materials

- Alumina Ceramics

- Silicon Carbide Ceramics

- Titanate Ceramics

- Zirconia Ceramics

- Others

-

Plastic Additives

- Plasticizers

- Flame Retardants

- Stabilizers

- Impact Modifiers

- Nucleating Agent

- Others

-

Specialty Oilfield Chemicals

- Demulsifers

- Inhibitors & Scavengers

- Rheology Modifiers

- Friction Modifiers

- Specialty Biocides

- Others

-

Textile Chemicals

- Coating & Sizing Agents

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Desizing Agents

- Others

On the basis of application, the specialty chemicals market has been segmented as follows:

-

Adhesives

- Paper & Packaging

- Building & Construction

- Medical

- Automotive & Transportation

- Electronic

- Others

-

Water Treatment Chemical

- Residential

- Commercial

- Industrial

-

Electronic Chemicals

- Semiconductor

- Others

-

Rubber Additives

- Tire

- Non-Tire

-

Lubricating Oil Additives

- Automotive

- Industrial

-

Cosmetic Ingredients

- Skin Care

- Hair Care

- Oral Care

- Make-Up

- Others

-

Advanced Ceramic Materials

- Electronics & Electricals

- Transportation

- Medical

- Environmental

- Chemical

- Others

-

Plastic Additives

- Packaging

- Consumer Goods

- Construction

- Automotive

- Others

-

Specialty Oilfield Chemicals

- Production

- Well Stimulation

- Drilling Fluids

- Enhanced Oil Recovery

- Cementing

- Others

-

Textile Chemicals

- Apparel

- Home Textile

- Technical Textile

- Others

On the basis of region, the specialty chemicals market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In June 2021, BASF SE introduced VALERAS to its plastic additives’ portfolio with high sustainability value. This new product portfolio allows its customers gain access to a range of innovative solutions that empower them to effectively pursue their sustainability objectives..

- In December 2022, Dow has introduced the SILASTIC SA 994X Liquid Silicone Rubber (LSR) series, demonstrating the company's ongoing commitment to developing intelligent, secure, and environmentally friendly technologies for the mobility and transportation sector. The SILASTIC SA 994X LSR series comprises a collection of primerless, self-adhesive, general-purpose, and self-lubricating LSRs with a one-to-one mix ratio.

- In February 2021, Dow introduced DOWSIL IE-8749, a new generation durable water repellent finish for fabrics based on the silicone chemistry. Studies conducted on a variety of textiles substrates based on DOWSIL IE-8749 Emulsion treatment demonstrated improved fabric retention in comparison to standard silicone finishes..

- In June 2022, Nouryon launched Expancel HP92 microspheres, revolutionizing the use of thermoplastic microsphere fillers in high-pressure manufacturing applications for the automotive industry. With the growing emphasis on lightweight materials to comply with stringent emission standards and meet consumer demands for fuel-efficient vehicles without compromising performance or passenger comfort, the introduction of Expancel HP92 microspheres marks a significant advancement.

- In August 2022, Nouryon entered into an exclusive partnership with Brenntag Specialties, appointing them as the sole distributor of Nouryon's innovative LumaTreat® tagged polymers in the United States and Canada. This agreement covers a diverse range of Nouryon's specialty polymers and aims to provide professionals in the water treatment industry with enhanced availability of essential ingredients for industrial and commercial cooling and heating systems.

Frequently Asked Questions (FAQ):

Which are the major players in specialty chemicals market?

The key players profiled in the report include BASF SE (Germany), DOW Inc. (US), Nouryon (The Netherlands), LANXESS AG (Germany), Evonik Industries AG (Germany), Huntsman Corporation (US), Covestro AG (Germany), Clariant AG (Switzerland), Solvay S.A. (Belgium), and Arkema (France).

What are the drivers for the specialty chemicals market?

The increasing demand from end-use industries are the major drives for specialty chemicals market. Also, advancement in technology and innovation is expected to create new opportunities for the market.

What are the various strategies key players are focusing within specialty chemicals market?

New product launches, expansion and partnership are some of the strategies atoped by key players to expand their global presence.

What are the opportunities for specialty chemicals market during the forecast period?

Green & sustainable specialty chemicals and growing influence of specialty chemicals in personal care and cosmetic industries is expected to create new opportunities during the forecast period.

What are the major factors restraining specialty chemicals market growth during the forecast period?

Government & environmental regulations is expected to restrict the market demand. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand from end-use industries- Innovation and technological advancements- Expanding global markets and emerging economiesRESTRAINTS- Government and environmental regulationsOPPORTUNITIES- Green & sustainable specialty chemicals- Growing demand for specialty chemicals in personal care and cosmetics industryCHALLENGES- Volatile raw material prices and supply chain risks

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIALSMANUFACTURING OF SPECIALTY CHEMICALSDISTRIBUTION NETWORKSEND-USE INDUSTRIES

-

6.2 KEY STAKEHOLDERSKEY STAKEHOLDERS IN BUYING PROCESS FOR PLASTIC ADDITIVESKEY STAKEHOLDERS IN BUYING PROCESS OF WATER TREATMENT CHEMICALSKEY STAKEHOLDERS IN BUYING PROCESS OF LUBRICATING OIL ADDITIVES

- 6.3 BUYING CRITERIA

-

6.4 PRICING ANALYSISAVERAGE SELLING PRICE OF PLASTIC ADDITIVES FOR TOP 3 APPLICATIONS, BY KEY PLAYER- Plastic additives- Water treatment chemicals- Lubricating oil additivesAVERAGE SELLING PRICE, BY REGION- Plastic additives- Water treatment chemicals- Lubricating oil additives

-

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS IN SPECIALTY CHEMICALS MARKET

-

6.6 ECOSYSTEM ANALYSIS

-

6.7 TECHNOLOGY ANALYSISADVANCED MATERIALS AND NANOTECHNOLOGY

-

6.8 CASE STUDY ANALYSISCASE STUDY ON LANXESS AG

-

6.9 TRADE DATA STATISTICSIMPORT SCENARIO OF SPECIALTY CHEMICALSEXPORT SCENARIO OF SPECIALTY CHEMICALS

-

6.10 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS FOR SPECIALTY CHEMICALS, BY COUNTRY/REGION

- 6.11 KEY CONFERENCES AND EVENTS IN 2023–2024

-

6.12 PATENT ANALYSISAPPROACHDOCUMENT TYPEJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

- 7.2 ADHESIVES

- 7.3 WATER TREATMENT CHEMICALS

- 7.4 ELECTRONIC CHEMICALS

- 7.5 RUBBER ADDITIVES

- 7.6 LUBRICATING OIL ADDITIVES

- 7.7 COSMETIC INGREDIENTS

- 7.8 ADVANCED CERAMIC MATERIALS

- 7.9 PLASTIC ADDITIVES

- 7.10 SPECIALTY OILFIELD CHEMICALS

- 7.11 TEXTILE CHEMICALS

- 8.1 INTRODUCTION

- 8.2 ADHESIVES

- 8.3 WATER TREATMENT CHEMICALS

- 8.4 ELECTRONIC CHEMICALS

- 8.5 RUBBER ADDITIVES

- 8.6 LUBRICATING OIL ADDITIVES

- 8.7 COSMETIC INGREDIENTS

- 8.8 ADVANCED CERAMIC MATERIALS

- 8.9 PLASTIC ADDITIVES

- 8.10 SPECIALTY OILFIELD CHEMICALS

- 8.11 TEXTILE CHEMICALS

- 9.1 INTRODUCTION

-

9.2 SPECIALTY CHEMICALS MARKET, BY REGIONADHESIVESWATER TREATMENT CHEMICALSELECTRONIC CHEMICALSRUBBER ADDITIVESLUBRICATING OIL ADDITIVESCOSMETIC INGREDIENTSADVANCED CERAMIC MATERIALSPLASTIC ADDITIVESSPECIALTY OILFIELD CHEMICALSTEXTILE CHEMICALS

-

9.3 ASIA PACIFICIMPACT OF RECESSIONASIA PACIFIC SPECIALTY CHEMICALS MARKET, BY TYPE- Adhesives- Electronic chemicals- Rubber additives- Lubricating oil additives- Cosmetic ingredients- Plastic additives- Specialty oilfield chemicalsASIA PACIFIC SPECIALTY CHEMICALS MARKET, BY APPLICATION- Adhesives- Water treatment chemicals- Electronic chemicals- Rubber additives- Lubricating oil additives- Cosmetic ingredients- Advanced ceramic materials- Plastic additives- Specialty oilfield chemicals- Textile chemicalsASIA PACIFIC SPECIALTY CHEMICALS MARKET, BY COUNTRY- Water treatment chemicals- Electronic chemicals- Rubber additives- Lubricating oil additives- Cosmetic ingredients- Advanced ceramic materials- Plastic additives- Specialty oilfield chemicals- Textile chemicalsASIA PACIFIC SPECIALTY CHEMICALS: COUNTRY-WISE MARKET- China- India- Japan

-

9.4 EUROPEIMPACT OF RECESSIONEUROPEAN SPECIALTY CHEMICALS MARKET, BY TYPE- Adhesives- Electronic chemicals- Rubber additives- Lubricating oil additives- Cosmetic ingredients- Plastic additives- Specialty oilfield chemicalsEUROPEAN SPECIALTY CHEMICALS MARKET, BY APPLICATION- Adhesives- Water treatment chemicals- Electronic chemicals- Rubber additives- Lubricating oil additives- Cosmetic ingredients- Advanced ceramic materials- Plastic additives- Specialty oilfield chemicals- Textile chemicalsEUROPEAN SPECIALTY CHEMICALS MARKET, BY COUNTRY- Water treatment chemicals- Electronic chemicals- Rubber additives- Lubricating oil additives- Cosmetic ingredients- Advanced ceramic materials- Plastic additives- Specialty oilfield chemicals- Textile chemicalsEUROPEAN SPECIALTY CHEMICALS: COUNTRY-WISE MARKET- Germany- France- UK- Italy- Spain

-

9.5 NORTH AMERICAIMPACT OF RECESSIONNORTH AMERICAN SPECIALTY CHEMICALS MARKET, BY TYPE- Adhesives- Electronic chemicals- Rubber additives- Lubricating oil additives- Cosmetic ingredients- Plastic additives- Specialty oilfield chemicalsNORTH AMERICAN SPECIALTY CHEMICALS MARKET, BY APPLICATION- Water treatment chemicals- Electronic chemicals- Rubber additives- Lubricating oil additives- Cosmetic ingredients- Advanced ceramic materials- Plastic additives- Specialty oilfield chemicals- Textile chemicalsNORTH AMERICAN SPECIALTY CHEMICALS MARKET, BY COUNTRY- Water treatment chemicals- Electronic chemicals- Rubber additives- Lubricating oil additives- Cosmetic ingredients- Advanced ceramic materials- Plastic additives- Specialty oilfield chemicals- Textile chemicalsNORTH AMERICAN SPECIALTY CHEMICALS: COUNTRY-WISE MARKET- US- Mexico- Canada

-

9.6 MIDDLE EAST & AFRICAIMPACT OF RECESSIONMIDDLE EAST & AFRICAN SPECIALTY CHEMICALS MARKET, BY TYPE- Adhesives- Rubber additives- Lubricating oil additives- Cosmetic ingredients- Plastic additives- Specialty oilfield chemicalsMIDDLE EAST & AFRICAN SPECIALTY CHEMICALS MARKET, BY APPLICATION- Adhesives- Water treatment chemicals- Rubber additives- Lubricating oil additives- Cosmetic ingredients- Advanced ceramic materials- Plastic additives- Specialty oilfield chemicals- Textile chemicals

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

10.3 MARKET SHARE ANALYSISPLASTIC ADDITIVES- Ranking of key market players, 2022- Market share of key playersWATER TREATMENT CHEMICALS- Ranking of key market players, 2022- Market share of key playersLUBRICATING OIL ADDITIVES- Ranking of key market players, 2022- Market share of key players

- 10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

10.5 COMPANY EVALUATION MATRIX (TIER 1)PLASTIC ADDITIVES- Stars- Emerging leaders- Participants- Pervasive playersWATER TREATMENT CHEMICALS- Stars- Emerging leaders- Participants- Pervasive playersLUBRICATING OIL ADDITIVES- Stars- Emerging leaders- Participants- Pervasive players

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 STARTUP/SME EVALUATION MATRIXPLASTIC ADDITIVES- Progressive companies- Responsive companies- Starting blocks- Dynamic companiesWATER TREATMENT CHEMICALS- Progressive companies- Responsive companies- Starting blocks- Dynamic companiesLUBRICATING OIL ADDITIVES- Progressive companies- Responsive companies- Starting blocks- Dynamic companies

-

10.8 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 MAJOR PLAYERSBASF SE- Business overview- Products offered- Recent developments- MnM viewDOW INC.- Business overview- Products offered- Recent developments- MnM viewNOURYON- Business overview- Products offered- Recent developments- MnM viewLANXESS AG- Business overview- Products offered- Recent developments- MnM viewEVONIK INDUSTRIES AG- Business overview- Products offered- Recent developments- MnM viewHUNTSMAN CORPORATION- Business overview- Products offered- Recent developments- MnM viewCOVESTRO AG- Business overview- Products offered- Recent developments- MnM viewCLARIANT AG- Business overview- Products offered- Recent developments- MnM viewSOLVAY SA- Business overview- Products offered- Recent developments- MnM viewARKEMA- Business overview- Products offered- Recent developments- MnM view

-

11.2 OTHER KEY PLAYERSALBEMARLE CORPORATIONASHLAND INC.KEMIRA OYJWACKER CHEMIE AGECOLAB INCLINDE PLCSONGWON INDUSTRIAL CO. LTD.HENKEL AG & CO. KGAA3M COMPANYTHE LUBRIZOL CORPORATIONCRODA INTERNATIONAL PLCLONZAH.B. FULLERBAKER HUGHESADEKA CORPORATION

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 UV STABILIZERS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

12.4 UV STABILIZERS MARKET BY REGIONASIA PACIFIC- Asia Pacific UV stabilizers market, by countryNORTH AMERICA- North American UV stabilizers market, by countryEUROPE- European UV stabilizers market, by countrySOUTH AMERICA- South American UV stabilizers market, by countryMIDDLE EAST & AFRICA- Middle East & African UV stabilizers market, by country

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 SPECIALTY CHEMICALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 GDP TRENDS AND FORECAST, BY MAJOR ECONOMY, 2021–2028 (USD BILLION)

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS OF PLASTIC ADDITIVES (%)

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS OF WATER TREATMENT CHEMICALS (%)

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS OF LUBRICATING OIL ADDITIVES (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS OF PLASTIC ADDITIVES

- TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS OF WATER TREATMENT CHEMICALS

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS OF LUBRICATING OIL ADDITIVES

- TABLE 9 AVERAGE SELLING PRICE OF PLASTIC ADDITIVES FOR TOP 3 APPLICATIONS, BY KEY PLAYERS (USD/KG)

- TABLE 10 AVERAGE SELLING PRICE OF WATER TREATMENT CHEMICALS FOR TOP 3 APPLICATIONS, BY KEY PLAYER (USD/KG)

- TABLE 11 AVERAGE SELLING PRICE OF LUBRICATING OIL ADDITIVES FOR TOP 3 APPLICATIONS, BY KEY PLAYER (USD/KG)

- TABLE 12 AVERAGE SELLING PRICE OF PLASTIC ADDITIVES, BY REGION (USD/KG)

- TABLE 13 AVERAGE SELLING PRICE OF WATER TREATMENT CHEMICALS, BY REGION (USD/KG)

- TABLE 14 AVERAGE SELLING PRICE OF LUBRICATING OIL ADDITIVES, BY REGION (USD/KG)

- TABLE 15 SPECIALTY CHEMICALS MARKET: ROLE IN ECOSYSTEM

- TABLE 16 IMPORT OF SPECIALTY CHEMICALS, BY REGION, 2017–2022 (USD MILLION)

- TABLE 17 EXPORT OF SPECIALTY CHEMICALS, BY REGION, 2017–2022 (USD MILLION)

- TABLE 18 SPECIALTY CHEMICALS MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 19 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS

- TABLE 20 PATENTS BY 3M INNOVATIVE PROPERTIES COMPANY

- TABLE 21 PATENTS BY NITTO DENKO CORPORATION

- TABLE 22 PATENTS BY LG CHEMICAL LTD.

- TABLE 23 TOP 10 PATENT OWNERS IN US, 2012–2022

- TABLE 24 SPECIALTY CHEMICALS: ADHESIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 25 SPECIALTY CHEMICALS: ADHESIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 26 SPECIALTY CHEMICALS: ADHESIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 27 SPECIALTY CHEMICALS: ADHESIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 28 SPECIALTY CHEMICALS: WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 29 SPECIALTY CHEMICALS: WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 30 SPECIALTY CHEMICALS: WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 31 SPECIALTY CHEMICALS: WATER TREATMENT CHEMICALS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 32 SPECIALTY CHEMICALS: ELECTRONIC CHEMICALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 33 SPECIALTY CHEMICALS: ELECTRONIC CHEMICALS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 34 SPECIALTY CHEMICALS: RUBBER ADDITIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 35 SPECIALTY CHEMICALS: RUBBER ADDITIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 36 SPECIALTY CHEMICALS: RUBBER ADDITIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 37 SPECIALTY CHEMICALS: RUBBER ADDITIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 38 SPECIALTY CHEMICALS: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 39 SPECIALTY CHEMICALS: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 40 SPECIALTY CHEMICALS: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 41 SPECIALTY CHEMICALS: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 42 SPECIALTY CHEMICALS: COSMETIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 43 SPECIALTY CHEMICALS: COSMETIC INGREDIENTS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 44 SPECIALTY CHEMICALS: COSMETIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 45 SPECIALTY CHEMICALS: COSMETIC INGREDIENTS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 46 SPECIALTY CHEMICALS: ADVANCED CERAMIC MATERIALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 47 SPECIALTY CHEMICALS: ADVANCED CERAMIC MATERIALS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 48 SPECIALTY CHEMICALS: ADVANCED CERAMIC MATERIALS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 49 SPECIALTY CHEMICALS: ADVANCED CERAMIC MATERIALS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 50 SPECIALTY CHEMICALS: PLASTIC ADDITIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 51 SPECIALTY CHEMICALS: PLASTIC ADDITIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 52 SPECIALTY CHEMICALS: PLASTIC ADDITIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 53 SPECIALTY CHEMICALS: PLASTIC ADDITIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 54 SPECIALTY CHEMICALS: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 55 SPECIALTY CHEMICALS: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 56 SPECIALTY CHEMICALS: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 57 SPECIALTY CHEMICALS: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 58 SPECIALTY CHEMICALS: TEXTILE CHEMICALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 59 SPECIALTY CHEMICALS: TEXTILE CHEMICALS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 60 SPECIALTY CHEMICALS: ADHESIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 61 SPECIALTY CHEMICALS: ADHESIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 62 SPECIALTY CHEMICALS: ADHESIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 63 SPECIALTY CHEMICALS: ADHESIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 64 SPECIALTY CHEMICALS: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 65 SPECIALTY CHEMICALS: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 66 SPECIALTY CHEMICALS: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 67 SPECIALTY CHEMICALS: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 68 SPECIALTY CHEMICALS: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 69 SPECIALTY CHEMICALS: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 70 SPECIALTY CHEMICALS: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 71 SPECIALTY CHEMICALS: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 72 SPECIALTY CHEMICALS: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 73 SPECIALTY CHEMICALS: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 74 SPECIALTY CHEMICALS: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 75 SPECIALTY CHEMICALS: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 76 SPECIALTY CHEMICALS: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 77 SPECIALTY CHEMICALS: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 78 SPECIALTY CHEMICALS: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 79 SPECIALTY CHEMICALS: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 80 SPECIALTY CHEMICALS: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 81 SPECIALTY CHEMICALS: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 82 SPECIALTY CHEMICALS: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 83 SPECIALTY CHEMICALS: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 84 SPECIALTY CHEMICALS: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 85 SPECIALTY CHEMICALS: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 86 SPECIALTY CHEMICALS: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 87 SPECIALTY CHEMICALS: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 88 SPECIALTY CHEMICALS: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 89 SPECIALTY CHEMICALS: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 90 SPECIALTY CHEMICALS: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 91 SPECIALTY CHEMICALS: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 92 SPECIALTY CHEMICALS: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 93 SPECIALTY CHEMICALS: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 94 ADHESIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 95 ADHESIVES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 96 ADHESIVES MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 97 ADHESIVES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 98 WATER TREATMENT CHEMICALS, BY REGION, 2017–2021 (USD MILLION)

- TABLE 99 WATER TREATMENT CHEMICALS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 100 WATER TREATMENT CHEMICALS, BY REGION, 2017–2021 (KILOTON)

- TABLE 101 WATER TREATMENT CHEMICALS, BY REGION, 2022–2028 (KILOTON)

- TABLE 102 ELECTRONIC CHEMICALS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 103 ELECTRONIC CHEMICALS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 104 RUBBER ADDITIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 105 RUBBER ADDITIVES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 106 RUBBER ADDITIVES MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 107 RUBBER ADDITIVES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 108 LUBRICATING OIL ADDITIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 109 LUBRICATING OIL ADDITIVES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 110 LUBRICATING OIL ADDITIVES MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 111 LUBRICATING OIL ADDITIVES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 112 COSMETIC INGREDIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 113 COSMETIC INGREDIENTS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 114 COSMETIC INGREDIENTS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 115 COSMETIC INGREDIENTS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 116 ADVANCED CERAMIC MATERIALS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 117 ADVANCED CERAMIC MATERIALS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 118 ADVANCED CERAMIC MATERIALS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 119 ADVANCED CERAMIC MATERIALS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 120 PLASTIC ADDITIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 121 PLASTIC ADDITIVES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 122 PLASTIC ADDITIVES MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 123 PLASTIC ADDITIVES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 124 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 125 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 126 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 127 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 128 TEXTILE CHEMICALS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 129 TEXTILE CHEMICALS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: ADHESIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 131 ASIA PACIFIC: ADHESIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: ADHESIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 133 ASIA PACIFIC: ADHESIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 134 ASIA PACIFIC: ELECTRONIC CHEMICALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 135 ASIA PACIFIC: ELECTRONIC CHEMICALS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 137 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 139 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 140 ASIA PACIFIC: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 141 ASIA PACIFIC: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 143 ASIA PACIFIC: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 144 ASIA PACIFIC: COSMETIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 145 ASIA PACIFIC: COSMETIC INGREDIENTS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: COSMETIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 147 ASIA PACIFIC: COSMETIC INGREDIENTS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 148 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 149 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 151 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 152 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 153 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 155 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 156 ASIA PACIFIC: ADHESIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 157 ASIA PACIFIC: ADHESIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: ADHESIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 159 ASIA PACIFIC: ADHESIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 160 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 161 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 163 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 164 ASIA PACIFIC: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 165 ASIA PACIFIC: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 167 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 169 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 170 ASIA PACIFIC: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 171 ASIA PACIFIC: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 173 ASIA PACIFIC: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 174 ASIA PACIFIC: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 175 ASIA PACIFIC: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 177 ASIA PACIFIC: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 179 ASIA PACIFIC: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 180 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 181 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 183 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 184 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 185 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 187 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 188 ASIA PACIFIC: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 189 ASIA PACIFIC: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 191 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 192 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 193 ASIA PACIFIC: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 194 ASIA PACIFIC: ELECTRONIC CHEMICALS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 195 ASIA PACIFIC: ELECTRONIC CHEMICALS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 196 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 197 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 198 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 199 ASIA PACIFIC: RUBBER ADDITIVES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 200 ASIA PACIFIC: LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 201 ASIA PACIFIC: LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 202 ASIA PACIFIC: LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 203 ASIA PACIFIC: LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 204 ASIA PACIFIC: COSMETIC INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 205 ASIA PACIFIC: COSMETIC INGREDIENTS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 206 ASIA PACIFIC: COSMETIC INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 207 ASIA PACIFIC: COSMETIC INGREDIENTS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 208 ASIA PACIFIC: ADVANCED CERAMIC MATERIALS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 209 ASIA PACIFIC: ADVANCED CERAMIC MATERIALS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 210 ASIA PACIFIC: ADVANCED CERAMIC MATERIALS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 211 ASIA PACIFIC: ADVANCED CERAMIC MATERIALS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 212 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 213 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 215 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 216 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 217 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 218 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 219 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 220 ASIA PACIFIC: TEXTILE CHEMICALS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 221 ASIA PACIFIC: TEXTILE CHEMICAL MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 222 CHINA: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 223 CHINA: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 224 CHINA: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 225 CHINA: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 226 CHINA: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 227 CHINA: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 228 CHINA: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 229 CHINA: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 230 CHINA: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 231 CHINA: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 232 CHINA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 233 CHINA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 234 CHINA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 235 CHINA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 236 CHINA: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 237 CHINA: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 238 CHINA: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 239 CHINA: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 240 CHINA: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 241 CHINA: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 242 CHINA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 243 CHINA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 244 CHINA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 245 CHINA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 246 CHINA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 247 CHINA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 248 CHINA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 249 CHINA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 250 CHINA: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 251 CHINA: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 252 INDIA: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 253 INDIA: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 254 INDIA: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 255 INDIA: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 256 INDIA: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 257 INDIA: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 258 INDIA: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 259 INDIA: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 260 INDIA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 261 INDIA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 262 INDIA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 263 INDIA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 264 INDIA: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 265 INDIA: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 266 INDIA: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 267 INDIA: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 268 INDIA: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 269 INDIA: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 270 INDIA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 271 INDIA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 272 INDIA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 273 INDIA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 274 INDIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 275 INDIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 276 INDIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 277 INDIA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 278 INDIA: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 279 INDIA: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 280 JAPAN: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 281 JAPAN: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 282 JAPAN: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 283 JAPAN: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 284 JAPAN: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 285 JAPAN: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 286 JAPAN: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 287 JAPAN: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 288 JAPAN: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 289 JAPAN: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 290 JAPAN: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 291 JAPAN: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 292 JAPAN: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 293 JAPAN: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 294 JAPAN: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 295 JAPAN: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 296 JAPAN: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 297 JAPAN: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 298 JAPAN: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 299 JAPAN: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 300 JAPAN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 301 JAPAN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 302 JAPAN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 303 JAPAN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 304 EUROPE: ADHESIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 305 EUROPE: ADHESIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 306 EUROPE: ADHESIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 307 EUROPE: ADHESIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 308 EUROPE: ELECTRONIC CHEMICALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 309 EUROPE: ELECTRONIC CHEMICALS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 310 EUROPE: RUBBER ADDITIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 311 EUROPE: RUBBER ADDITIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 312 EUROPE: RUBBER ADDITIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 313 EUROPE: RUBBER ADDITIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 314 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 315 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 316 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 317 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 318 EUROPE: COSMETIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 319 EUROPE: COSMETIC INGREDIENTS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 320 EUROPE: COSMETIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 321 EUROPE: COSMETIC INGREDIENTS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 322 EUROPE: PLASTIC ADDITIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 323 EUROPE: PLASTIC ADDITIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 324 EUROPE: PLASTIC ADDITIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 325 EUROPE: PLASTIC ADDITIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 326 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 327 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 328 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 329 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 330 EUROPE: ADHESIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 331 EUROPE: ADHESIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 332 EUROPE: ADHESIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 333 EUROPE: ADHESIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 334 EUROPE: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 335 EUROPE: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 336 EUROPE: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 337 EUROPE: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 338 EUROPE: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 339 EUROPE: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 340 EUROPE: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 341 EUROPE: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 342 EUROPE: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 343 EUROPE: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 344 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 345 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 346 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 347 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 348 EUROPE: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 349 EUROPE: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 350 EUROPE: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 351 EUROPE: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 352 EUROPE: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 353 EUROPE: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 354 EUROPE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 355 EUROPE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 356 EUROPE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 357 EUROPE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 358 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 359 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 360 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 361 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 362 EUROPE: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 363 EUROPE: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 364 EUROPE: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 365 EUROPE: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 366 EUROPE: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 367 EUROPE: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 368 EUROPE: ELECTRONIC CHEMICALS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 369 EUROPE: ELECTRONIC CHEMICALS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 370 EUROPE: RUBBER ADDITIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 371 EUROPE: RUBBER ADDITIVES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 372 EUROPE: RUBBER ADDITIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 373 EUROPE: RUBBER ADDITIVES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 374 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 375 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 376 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 377 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 378 EUROPE: COSMETIC INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 379 EUROPE: COSMETIC INGREDIENTS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 380 EUROPE: COSMETIC INGREDIENTS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 381 EUROPE: COSMETIC INGREDIENTS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 382 EUROPE: ADVANCED CERAMIC MATERIALS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 383 EUROPE: ADVANCED CERAMIC MATERIALS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 384 EUROPE: ADVANCED CERAMIC MATERIALS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 385 EUROPE: ADVANCED CERAMIC MATERIALS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 386 EUROPE: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 387 EUROPE: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 388 EUROPE: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 389 EUROPE: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 390 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 391 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 392 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 393 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 394 EUROPE: TEXTILE CHEMICALS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 395 EUROPE: TEXTILE CHEMICALS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 396 GERMANY: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 397 GERMANY: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 398 GERMANY: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 399 GERMANY: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 400 GERMANY: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 401 GERMANY: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 402 GERMANY: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 403 GERMANY: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 404 GERMANY: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 405 GERMANY: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 406 GERMANY: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 407 GERMANY: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 408 GERMANY: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 409 GERMANY: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 410 GERMANY: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 411 GERMANY: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 412 GERMANY: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 413 GERMANY: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 414 GERMANY: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 415 GERMANY: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 416 GERMANY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 417 GERMANY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 418 GERMANY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 419 GERMANY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 420 GERMANY: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 421 GERMANY: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 422 FRANCE: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 423 FRANCE: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 424 FRANCE: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 425 FRANCE: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 426 FRANCE: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 427 FRANCE: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 428 FRANCE: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 429 FRANCE: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 430 FRANCE: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 431 FRANCE: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 432 FRANCE: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 433 FRANCE: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 434 FRANCE: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 435 FRANCE: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 436 FRANCE: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 437 FRANCE: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 438 FRANCE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 439 FRANCE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 440 FRANCE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 441 FRANCE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 442 FRANCE: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 443 FRANCE: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 444 UK: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 445 UK: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 446 UK: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 447 UK: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 448 UK: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 449 UK: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 450 UK: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 451 UK: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 452 UK: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 453 UK: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 454 UK: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 455 UK: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 456 UK: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 457 UK: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 458 UK: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 459 UK: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 460 UK: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 461 UK: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 462 UK: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 463 UK: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 464 UK: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 465 UK: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 466 UK: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 467 UK: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 468 UK: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 469 UK: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 470 UK: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 471 UK: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 472 UK: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 473 UK: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 474 ITALY: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 475 ITALY: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 476 ITALY: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 477 ITALY: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 478 ITALY: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 479 ITALY: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 480 ITALY: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 481 ITALY: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 482 ITALY: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 483 ITALY: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 484 ITALY: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 485 ITALY: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 486 ITALY: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 487 ITALY: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 488 ITALY: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 489 ITALY: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 490 ITALY: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 491 ITALY: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 492 ITALY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 493 ITALY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 494 ITALY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 495 ITALY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 496 ITALY: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 497 ITALY: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 498 SPAIN: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 499 SPAIN: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 500 SPAIN: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 501 SPAIN: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 502 SPAIN: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 503 SPAIN: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 504 SPAIN: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 505 SPAIN: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 506 SPAIN: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 507 SPAIN: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 508 SPAIN: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 509 SPAIN: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 510 SPAIN: ADVANCED CERAMIC MATERIALS MARKET, BY END-USE INDUSTRY, 2017–2021 (KILOTON)

- TABLE 511 SPAIN: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 512 SPAIN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 513 SPAIN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 514 SPAIN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 515 SPAIN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 516 SPAIN: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 517 SPAIN: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 518 NORTH AMERICA: ADHESIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 519 NORTH AMERICA: ADHESIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 520 NORTH AMERICA: ADHESIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 521 NORTH AMERICA: ADHESIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 522 NORTH AMERICA: ELECTRONIC CHEMICALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 523 NORTH AMERICA: ELECTRONIC CHEMICALS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 524 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 525 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 526 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 527 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 528 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 529 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 530 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 531 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 532 NORTH AMERICA: COSMETIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 533 NORTH AMERICA: COSMETIC INGREDIENTS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 534 NORTH AMERICA: COSMETIC INGREDIENTS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 535 NORTH AMERICA: COSMETIC INGREDIENTS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 536 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 537 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 538 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 539 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 540 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 541 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 542 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 543 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 544 NORTH AMERICA: ADHESIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 545 NORTH AMERICA: ADHESIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 546 NORTH AMERICA: ADHESIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 547 NORTH AMERICA: ADHESIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 548 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 549 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 550 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 551 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 552 NORTH AMERICA: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 553 NORTH AMERICA: ELECTRONIC CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 554 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 555 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 556 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 557 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 558 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 559 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 560 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 561 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 562 NORTH AMERICA: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 563 NORTH AMERICA: COSMETIC INGREDIENTS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 564 NORTH AMERICA: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 565 NORTH AMERICA: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 566 NORTH AMERICA: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 567 NORTH AMERICA: ADVANCED CERAMIC MATERIALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 568 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 569 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 570 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 571 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 572 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 573 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 574 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 575 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 576 NORTH AMERICA: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 577 NORTH AMERICA: TEXTILE CHEMICALS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 578 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 579 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 580 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 581 NORTH AMERICA: WATER TREATMENT CHEMICALS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 582 NORTH AMERICA: ELECTRONIC CHEMICALS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 583 NORTH AMERICA: ELECTRONIC CHEMICALS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 584 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 585 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 586 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 587 NORTH AMERICA: RUBBER ADDITIVES MARKET, BY COUNTRY, 2022–2028 (KILOTON)