Generative Design in Built Environment Market - Global Forecast to 2030

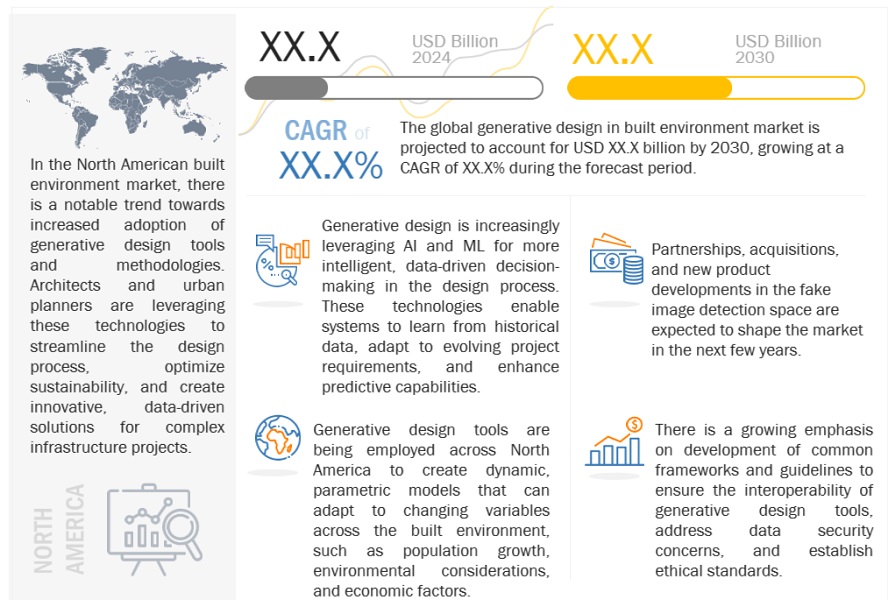

The generative design in the built environment market is poised for remarkable growth, forecasted to surge from USD XX.X billion in 2024 to a substantial USD XX.X billion by 2030, reflecting a robust CAGR of XX.X% between 2024–2030. This trend underscores the increasing recognition and adoption of generative design methodologies in architecture, urban planning, and construction. Fueled by advancements in artificial intelligence, parametric modeling, and sustainability imperatives, the market is witnessing a transformative shift towards innovative, data-driven solutions. As architects and urban planners seek more efficient, sustainable, and aesthetically pleasing designs, the generative design sector is becoming a pivotal force in shaping the future of the built environment.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increasing demand for sustainable and energy-efficient designs

One significant driver for the global generative design in the built environment market is the increasing demand for sustainable and energy-efficient designs. With a growing emphasis on environmental consciousness, architects and urban planners are turning to generative design to optimize structures for energy efficiency, material use, and overall environmental impact. Generative design tools enable the exploration of innovative solutions that can meet stringent sustainability standards, aligning with global efforts to reduce carbon footprints and promote green building practices.

Restraint: Associated initial costs and the need for specialized expertise

A notable restraint for the adoption of generative design in the built environment is the initial cost and investment required for implementing these advanced technologies. While generative design offers long-term benefits, including efficiency gains and sustainable outcomes, the upfront costs associated with software licenses, training, and hardware infrastructure can be a barrier for smaller firms or projects with limited budgets. Overcoming this restraint requires a strategic approach in highlighting the long-term return on investment and emphasizing the potential for cost savings through optimized designs and reduced resource consumption.

Opportunity: integration of artificial intelligence (AI) and machine learning (ML) technologies

An emerging opportunity in the global generative design market for the built environment lies in integrating artificial intelligence (AI) and machine learning (ML) technologies. The ability of generative design systems to learn and adapt from historical data and project outcomes opens up possibilities for more intelligent, data-driven decision-making in the design process. This can lead to enhanced predictive capabilities, improved performance analyses, and more accurate estimations of project outcomes, providing a competitive edge for firms embracing these advanced technologies.

Challenge: Need for standardized industry practices and regulations

A key challenge facing the widespread adoption of generative design in the built environment is the need for standardized industry practices and regulations. As these technologies become more prevalent, it is necessary to establish common frameworks, guidelines, and standards to ensure interoperability, data security, and ethical use of generative design tools. Overcoming this challenge requires collaboration among industry stakeholders, policymakers, and technology providers to establish a cohesive regulatory environment that fosters innovation while addressing concerns related to data privacy, intellectual property, and ethical considerations in design processes.

Generative Design in the Built Environment Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By project type, the infrastructure projects segment will account for a significant market size during the forecast period.

The growth of the infrastructure projects segment is propelled by the increasing recognition of its generative design solutions to revolutionize the planning and execution of complex infrastructure endeavors. As infrastructure projects become more intricate, generative design provides a transformative approach by utilizing algorithms and parametric modeling to optimize structural configurations, improve resource efficiency, and enhance overall project performance. This trend is particularly evident in segments such as transportation, utilities, and energy infrastructure, where generative design facilitates the exploration of innovative solutions, streamlines decision-making processes, and contributes to creating more resilient and sustainable infrastructure systems. The demand for advanced and efficient designs, coupled with the potential for substantial time and cost savings, positions generative design as a valuable tool in shaping the future of infrastructure development.

By end-user, the architectural firms segment is slated to witness an impressive growth rate during the forecast period.

Architectural firms increasingly leverage generative design tools to enhance creativity, optimize building performance, and efficiently navigate complex design challenges. This technology enables architects to explore various design possibilities, considering sustainability, energy efficiency, and aesthetic appeal parameters. The trend reflects a shift towards more data-driven and innovative design processes, allowing architects to streamline workflows, iterate designs rapidly, and deliver innovative solutions that align with evolving client demands and industry standards. As generative design demonstrates its potential in fostering design innovation, architecture firms are poised to integrate these tools further into their practices, influencing a dynamic and progressive evolution in the field.

The Asia Pacific region is set to experience market expansion over the forecast period.

The growth of generative design in the built environment market across the Asia-Pacific has been marked by increasing urbanization, rapid economic development, and a growing emphasis on sustainable and innovative design solutions. Countries within APAC, such as China, Japan, Singapore, and India, are experiencing a surge in construction activities, creating a demand for advanced technologies to optimize the design and development processes. Generative design, with its ability to iteratively explore and optimize architectural and engineering solutions, aligns well with the complex challenges posed by the dynamic urban landscapes in the region. Urban planning authorities and regional architectural firms are increasingly turning to generative design tools to address issues such as efficient land use, infrastructure development, and environmental sustainability, fostering a trend of technological adoption in the built environment sector.

The region's governments recognize the potential of generative design in fostering smart cities and sustainable development, leading to increased investment in research, development, and technology infrastructure. As the awareness of generative design benefits, such as optimized resource utilization, energy efficiency, and cost-effectiveness, continues to rise, the regional market is poised for substantial growth in the coming years.

Key Market Players

The generative design in built environment solutions and service providers have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships, agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. Some major players in the generative design in built environment market include Altair Engineering (US), Autodesk (US), Bentley Systems (US), PTC (US), and Dassault Systèmes (France), along with SMEs and startups such as Graphisoft (Hungary), MakeT.AI (US), NodeBox (Belgium), PreOptima (US), and SrinSoft (India).

Recent Developments:

- In November 2023, Autodesk introduced ‘Autodesk AI’, an AI-powered module within the Fusion 360 platform. The module offers a swift means of generating and evaluating multiple design options for linking two or more surfaces in built environment projects. This tool is specifically geared towards enhancing creativity and efficiency in the initial stages of the design process. Additionally, there have been significant enhancements in the ‘Configurations’ feature, allowing users to reuse parametric logic to create diverse design variations.

- In July 2023, Singapore, a city-state known for its advanced urban solutions, incorporated generative design in its urban planning endeavors. Utilizing generative design tools combined with AI, Singapore's urban planners simulated diverse urban scenarios to forecast the consequences of various planning strategies.

- In May 2023, PTC unveiled Creo+, a software-as-a-service (SaaS) CAD solution, during the Liveworx conference in Boston. This launch aligned with the introduction of Creo CAD's tenth version and integrated Creo 10 with innovative cloud-based tools, aiming to improve design collaboration and streamline CAD administration.

Frequently Asked Questions (FAQ):

What is generative design in built environment?

Generative design in the built environment refers to applying computational algorithms and AI in the architectural and construction fields to automatically generate and optimize design solutions for buildings, infrastructure, and urban spaces. The process explores several design alternatives by defining constraints, objectives, and parameters, considering structural integrity, energy efficiency, and aesthetic appeal. This approach enables architects and urban planners to explore a vast design space efficiently, fostering innovation and facilitating the creation of sustainable, efficient, and aesthetically pleasing built environments.

What is the total CAGR expected to be recorded for the generative design in built environment market from 2023 to 2028?

The generative design in built environment market is expected to record a CAGR of 20.8% from 2023-2028.

Which are the major growth enablers catalyzing the generative design in built environment market?

The generative design in built environment market is driven by increasing demand for sustainable and energy-efficient designs, advancements in artificial intelligence and parametric modeling, emphasis on innovative, data-driven solutions in architecture and urban planning, growing awareness and adoption of green building practices, and the need for optimizing resource utilization and reducing environmental impact.

Which key software types prevail in the generative design in built environment market?

Architectural design software, construction simulation software, building information modeling (BIM) software, urban planning and design software, and parametric design software are among the key software in terms of adoption in the generative design in built environment market.

Who are the key vendors in generative design in built environment market?

Some major players in the generative design in built environment market include Altair Engineering (US), Autodesk (US), Bentley Systems (US), Caracol (US), Dassault Systèmes (France), Desktop Metal (US), Diabatix (Belgium), ESI Group (France), Hexagon (Sweden), nTopology (US), Paramatters (US), ArchiSoft (Hungary), Arup Group (UK), ClearEdge3D (US), Evolve Lab (US), Graphisoft (Hungary), MakeT.AI (US), NodeBox (Belgium), PreOptima (US), Rhino (US), Soliquid (US), SrinSoft (India), and Vectorworks (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Generative Design in Built Environment Market