Geocomposites Market by Product (Geotextile-Geonet, Geotextile-Geocore, Geotextile-Geogrid, Geotextile-Geomembrane), Function (Drainage, Containment), Application (Water Management, Road, Landfill, Soil Reinforcement), and Region - Global Forecast to 2023

[114 Pages Report] The geocomposites market was valued at USD 377.6 million in 2017 and is projected to reach USD 740.0 million by 2023, at a CAGR of 11.8% from 2018. In this study, 2017 has been considered as the base year, while the forecast period is from 2018 to 2023.

Market Dynamics

Drivers

- Growing infrastructure activities along with supportive government policies

- Environmental protection regulations

Opportunities

- Growing infrastructure in developing countries

Challenges

- Fluctuating raw material prices

Highway is the Largest Application Segment Of Geocomposites

Geocomposites are used for basic functions of roadways such as separation, drainage, filtration, and reinforcement. Geocomposites can be used to increase the strength and stability of underlying soil in a roadway. Geotextiles-geogrid geocomposites are the most preferred geosynthetics used in the road & highway application. Loaded vehicles on road track create cuts, rutting in roads, and water clogging in the cracks creates erosion and reduces the lifetime of roads. Geocomposites increase road life and cost-effectiveness for the road industry. The maintenance of rail track is very critical as the uneven track can cause accidents. Geocomposites are used under the railway tracks to provide stabilization and reinforcement. In addition, they are used as a filter separator between ballast and sub-grade, providing lateral drainage system.

Objectives of the Study:

- To analyze and forecast the size of the geocomposites market, in terms of value

- To provide detailed information regarding key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the geocomposite market

- To define, describe, and forecast the geocomposites market based on product type, function, and application

- To analyze and forecast the size of the geocomposite market in North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To strategically profile the key players operating in the geocomposite market and analyze their core competencies

- To analyze market opportunities and the competitive landscape for stakeholders and market leaders

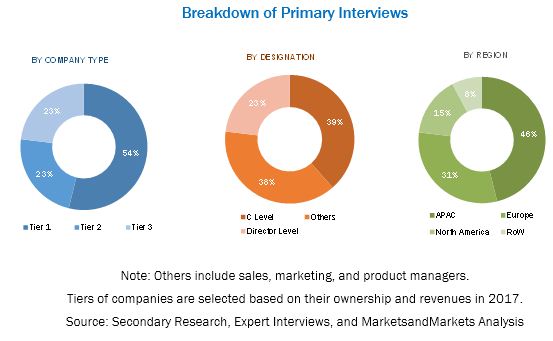

In this report, market sizes have been derived from various research methodologies. In the secondary research process, different sources have been referred to, to identify and collect information for this study on the geocomposites market. These secondary sources include annual reports, factiva, hoovers, press releases, investor presentations of companies and white papers, certified publications, and articles from recognized authors. In the primary research process, sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The bottom-up approach has been used to estimate the market size, in terms of value. The top-down approach has also been implemented to validate the market size, in terms of value. With the data triangulation procedure and validation of data through primaries, exact values of the sizes of the overall parent market and individual markets have been determined and confirmed in this study.

The figure below illustrates the breakdown of profiles of primary interview participants.

To know about the assumptions considered for the study, download the pdf brochure

The market for geocomposites has a diversified and established ecosystem comprising upstream players, such as raw material suppliers and downstream stakeholders, such as manufacturers, vendors, and end-users of geocomposites as well as various government organizations. Leading players operating in the geocomposites market include GSE Environmental (US), TenCate Geosynthetics (US), Maccaferri S.P.A. (Italy), SKAPS Industries (US), ABG Ltd. (UK), Hans Geo Components (US), Huesker Synthetics GmbH (Germany), and Thrace Group (Greece).

Please visit 360Quadrants to see the vendor listing of Top 20 Composites Companies, Worldwide 2023

Target Audience

- Manufacturers of geocomposites

- Suppliers of raw materials

- Distributors and suppliers of geocomposites

- End-use industries

- Industry associations

“This study answers several questions for stakeholders, primarily which market segments they need to focus upon during the next 2 to 5 years to prioritize their efforts and investments.”

Scope of the Report

This research report categorizes the geocomposites market based on product type, function, application, and region. It forecasts revenue growth and analyzes trends in each of these submarkets.

Geocomposites Market, By Product Type:

- Geotextile–geonet

- Geotextile-geocore

- Geotextile-geogrid

- Geotextile-geomembrane

- Others

Geocomposite Market, By Function:

- Drainage

- Containment

- Others

Geocomposites Market, By Application:

- Water & wastewater management

- Road & highway

- Landfill & mining

- Soil reinforcement for civil construction

- Others

Geocomposite Market, By Region

- Asia Pacific (APAC)

- North America

- Europe

- Middle East & Africa (MEA)

- Latin America

Each region has been further segmented into key countries in that region.

Critical questions which the report answers

- What are the upcoming trends for MCA in developing nations?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Asia Pacific geocomposites market

- Further breakdown of the North American geocomposite market

- Further breakdown of the European geocomposite market

- Further breakdown of the Latin America geocomposite market

- Further breakdown of the Middle East & Africa geocomposites market

Company Information

- Detailed analysis and profiles of additional market players

The geocomposites market is estimated at USD 423.7 million in 2018 and is projected to reach USD 740.0 million by 2023, at a CAGR of 11.8% between 2018 and 2023. The growth of the geocomposite market can be attributed to the growing construction & infrastructural projects, supportive government policies, and increasing environmental protection regulations.

The geocomposites market has been segmented on the basis of product type, function, application, and region. Based on function, the geocomposite market has been classified into drainage, containment, and others.

On the basis of product type, the geocomposites market can be segmented in to five products types, namely, geotextile–geonet, geotextile-geocore, geotextile-geogrid, geotextile-geomembrane, and others. The geotextile-geocore product type accounted for a major market share in 2017, due to its large-scale application in road & highway applications.

The geocomposite market is divided into three segments on the basis of its functions, namely, drainage, containment, and others. Drainage is the leading function of geocomposites used in civil & road construction, trench drains, pavement base course or edge drains, tunnel in railways and roads, rooftop, retaining walls and bridge abutments, and other applications.

In terms of applications, the geocomposites market is segmented into to five categories on the basis of applications, which include water & wastewater management, road & highway, landfills & mining, soil reinforcement, and others. The major application of geocomposites is in road & highway. Road & highway is expected to be the fastest-growing application of the geocomposite market. Geocomposites find wide applications due to its properties such as high tensile strength, durability, easy installation, and cost-effectiveness.

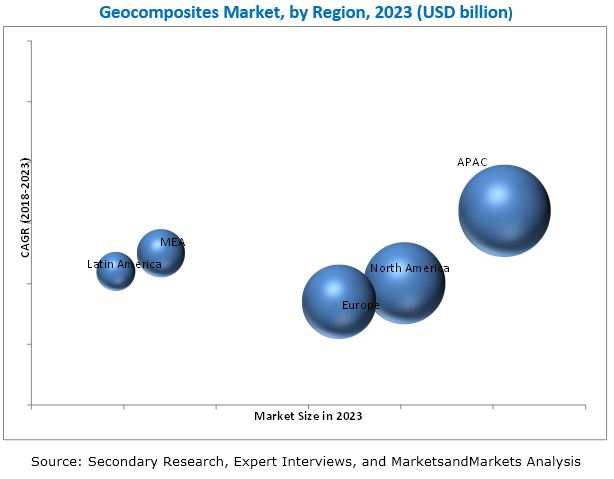

APAC was the fastest-growing geocomposites market, in terms of both value and volume. The rise in demand for geocomposites from the emerging economies and increase in government spending on infrastructural projects are the main factors contributing to the growth of the market in APAC.

Some of the drivers identified for the market growth of geocomposites are the growing construction & infrastructural projects and supportive government policies and increasing environmental protection regulations. The restraining factor identified is the absence of quality control in developing economies.

GSE Environmental (US), TenCate Geosynthetics (US), Maccaferri S.P.A. (Italy), ABG LTD (UK), and Thrace Group (Greece) are the key players operating in the geocomposite market. These key players offer a wide range of geocomposites to strengthen their competitive positions and cater to the growing demand for geocomposites from the road & highway, water & wastewater management, and landfill & mining applications.

GSE Environmental is among the major players in the geocomposite market. The company is focused on expanding its product portfolio and gaining a competitive edge over other players in the geocomposites market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Geocomposites Market

4.2 Geocomposite Market, By Application

4.3 Geocomposites Market, By Function and Region

4.4 Geocomposite Market, By Product Type

4.5 Geocomposites Market, By Country

5 Market Overview (Page No. - 31)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Growing Infrastructural Developement With Supportive Government Policies

5.1.1.2 Environmental Protection Regulations

5.1.1.3 Cost-Effective Solution

5.1.2 Restraints

5.1.2.1 Absence of Quality Control in the Developing Countries

5.1.3 Opportunities

5.1.3.1 Growing Infrastructural Developement in the Developing Countries

5.1.4 Challenges

5.1.4.1 Fluctuating Raw Material Prices

5.2 Porter’s Five Forces Analysis

5.2.1 Threat of New Entrants

5.2.2 Threat of Substitutes

5.2.3 Bargaining Power of Suppliers

5.2.4 Bargaining Power of Buyers

5.2.5 Intensity of Competitive Rivalry

6 Macroeconomic Overview and Key Trends (Page No. - 36)

6.1 Introduction

6.2 Trends and Forecast of GDP

6.3 Trends and Forecast of the Construction Industry

7 Geocomposites Market, By Product Type (Page No. - 39)

7.1 Introduction

7.1.1 Geotextile-Geonet Geocomposites

7.1.2 Geotextile–Geocore Geocomposites

7.1.3 Geotextile–Geogrid Geocomposites

7.1.4 Geotextile–Geomembrane Geocomposites

7.1.5 Others

8 Geocomposite Market, By Function (Page No. - 49)

8.1 Introduction

8.1.1 Drainage

8.1.2 Containment

8.1.3 Others

9 Geocomposites Market, By Application (Page No. - 56)

9.1 Introduction

9.1.1 Water & Wastewater Management

9.1.2 Road & Highway

9.1.3 Landfill & Mining

9.1.4 Soil Reinforcement for Civil Construction

9.1.5 Others

10 Geocomposites Market, By Region (Page No. - 66)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Italy

10.3.5 Russia

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 Australia

10.4.4 India

10.4.5 South Korea

10.5 Middle East and Africa (MEA)

10.5.1 UAE

10.5.2 Saudi Arabia

10.5.3 South Africa

10.6 Latin America

10.6.1 Brazil

10.6.2 Mexico

11 Company Profiles (Page No. - 86)

11.1 Thrace Group

11.2 GSE Environmental

11.3 Skaps Industries

11.4 ABG LTD

11.5 Hans Geo Components

11.6 Tencate Geosynthetics

11.7 Maccaferri S.P.A

11.8 Terrem Geosynthetics

11.9 Huesker Synthetics GmbH

11.10 Tenax Group

11.11 Other Key Players

11.11.1 Low & Bonar LPC

11.11.2 Contech Engineered Solutions Lic

11.11.3 Edifloor S.P.A.

11.11.4 American Wick Drain Corporation

11.11.5 Texinov

11.11.6 Climax Synthetics Pvt. Ltd.

11.11.7 Tema Corporation

11.11.8 Alyaf Industrial Co. Ltd

11.11.9 Feicheng Lianyi Engineering Plastics Co., Ltd.

11.11.10 Qingdao Haisan New Energy Co., Ltd.

12 Appendix (Page No. - 104)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (70 Tables)

Table 1 Trends and Forecast of GDP, 2018–2023 (USD Billion)

Table 2 Contribution of the Construction Industry in North America, USD Billion (2015–2022)

Table 3 Contribution of the Construction Industry in Europe, USD Billion (2015–2022)

Table 4 Contribution of the Construction Industry in APAC, USD Billion (2015–2022)

Table 5 Contribution of the Construction Industry in the Middle East, 2015–2022 (USD Billion)

Table 6 Contribution of the Construction Industry in Latin America - 2015–2022 (USD Billion)

Table 7 Geocomposites Market Size, By Product Type, 2016–2023 (Million Square Meter)

Table 8 Geocomposite Market Size, By Product Type, 2016–2023 (USD Million)

Table 9 Geotextile-Geonet Geocomposites Market Size, By Region, 2016–2023 (Million Square Meter)

Table 10 Geotextile-Geonet Geocomposite Market Size, By Region, 2016–2023 (USD Million)

Table 11 Geotextile-Geocore Market Size, By Region, 2016–2023 (Million Square Meter)

Table 12 Geotextile-Geocore Geocomposite Market Size, By Region, 2016–2023 (USD Million)

Table 13 Geotextile-Geogrid Geocomposites Market Size, By Region, 2016–2023 (Million Square Meter)

Table 14 Geotextile-Geogrid Geocomposite Market Size, By Region, 2016–2023 (USD Million)

Table 15 Geotextile-Geomembrane Market Size, By Region, 2016–2023 (Million Square Meter)

Table 16 Geotextile-Geomembrane Geocomposite Market Size, By Region, 2016–2023 (USD Million)

Table 17 Other Geocomposites Market Size, By Region, 2016–2023 (Million Square Meter)

Table 18 Other Geocomposite Market Size, By Region, 2016–2023 (USD Million)

Table 19 Geocomposites Market Size, By Function, 2016–2023 (Million Square Meter)

Table 20 Geocomposite Market Size, By Function, 2016–2023 (USD Million)

Table 21 Market Size in Drainage Function, By Region, 2016–2023 (Million Square Meter)

Table 22 Geocomposite Market Size in Drainage Function, By Region, 2016–2023 (USD Million)

Table 23 Geocomposites Market Size in Containment Function, By Region, 2016–2023 (Million Square Meter)

Table 24 Geocomposite Market Size in Containment Function, By Region, 2016–2023 (USD Million)

Table 25 Market Size in Other Functions, By Region, 2016–2023 (Million Square Meter)

Table 26 Geocomposite Market Size in Other Functions, By Region, 2016–2023 (USD Million)

Table 27 Geocomposites Market Size, By Application, 2016–2023 (Million Square Meter)

Table 28 Geocomposite Market Size, By Application, 2016–2023 (USD Million)

Table 29 Market Size in Water & Wastewater Management Application, By Region, 2016–2023 (Million Square Meter)

Table 30 Geocomposite Market Size in Water & Wastewater Management Application, By Region, 2016–2023 (USD Million)

Table 31 Geocomposites Market Size in Road & Highway Application, By Region, 2016–2023 (Million Square Meter)

Table 32 Geocomposite Market Size in Road & Highway Application, By Region, 2016–2023 (USD Million)

Table 33 Market Size in Landfill & Mining Application, By Region, 2016–2023 (Million Square Meter)

Table 34 Geocomposite Market Size in Landfill & Mining Application, By Region, 2016–2023 (USD Million)

Table 35 Geocomposites Market Size in Soil Reinforcement for Civil Construction Application, By Region, 2016–2023 (Million Square Meter)

Table 36 Geocomposite Market Size in Soil Reinforcement for Civil Construction Application, By Region, 2016–2023 (USD Million)

Table 37 Geocomposites Market Size in Other Applications, By Region, 2016–2023 (Million Square Meter)

Table 38 Geocomposite Market Size in Other Applications, By Region, 2016–2023 (USD Million)

Table 39 Geocomposites Market Size, By Region, 2016–2023 (Million Square Meter)

Table 40 Geocomposite Market Size, By Region, 2016–2023 (USD Million)

Table 41 North America: Market Size, By Country, 2016–2023 (Million Square Meter)

Table 42 North America: Market Size, By Country, 2016–2023 (USD Million)

Table 43 North America: Market Size, By Application, 2016–2023 (Million Square Meter)

Table 44 North America: Market Size, By Application, 2016–2023 (USD Million)

Table 45 North America: Market Size, By Function, 2016–2023 (Million Square Meter)

Table 46 North America: Market Size, By Function, 2016–2023 (USD Million)

Table 47 Europe: Market Size, By Country, 2016–2023 (Million Square Meter)

Table 48 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 49 Europe: Market Size, By Application, 2016–2023 (Million Square Meter)

Table 50 Europe: Market Size, By Application, 2016–2023 (USD Million)

Table 51 Europe: Market Size, By Function, 2016–2023 (Million Square Meter)

Table 52 Europe: Market Size, By Function, 2016–2023 (USD Million)

Table 53 APAC: Market Size, By Country, 2016–2023 (Million Square Meter)

Table 54 APAC: Market Size, By Country, 2016–2023 (USD Million)

Table 55 APAC: Market Size, By Application, 2016–2023 (Million Square Meter)

Table 56 APAC: Market Size, By Application, 2016–2023 (USD Million)

Table 57 APAC: Market Size, By Function, 2016–2023 (Million Square Meter)

Table 58 APAC: Market Size, By Function, 2016–2023 (USD Million)

Table 59 MEA: Market Size, By Country, 2016–2023 (Million Square Meter)

Table 60 MEA: Market Size, By Country, 2016–2023 (USD Million)

Table 61 MEA: Market Size, By Application, 2016–2023 (Million Square Meter)

Table 62 MEA: Market Size, By Application, 2016–2023 (USD Million)

Table 63 MEA: Market Size, By Function, 2016–2023 (Million Square Meter)

Table 64 MEA: Market Size, By Function, 2016–2023 (USD Million)

Table 65 Latin America: Geocomposites Market Size, By Country, 2016–2023 (Million Square Meter)

Table 66 Latin America: GeocompositesMarket Size, By Country, 2016–2023 (USD Million)

Table 67 Latin America: Market Size, By Application, 2016–2023 (Million Square Meter)

Table 68 Latin America: Market Size, By Application, 2016–2023 (USD Million)

Table 69 Latin America: Market Size, By Function, 2016–2023 (Million Square Meter)

Table 70 Latin America: Market Size, By Function, 2016–2023 (USD Million)

List of Figures (37 Figures)

Figure 1 Geocomposites Market Segmentation

Figure 2 Geocomposite Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Geocomposites Market: Data Triangulation

Figure 6 Geotextile-Geocore Geocomposites to Lead the Market

Figure 7 Road & Highway Application to Dominate the Market

Figure 8 Drainage to Be the Largest Funciton of Geocomposites

Figure 9 APAC to Be the Fastest-Growing Geocomposite Market Between 2018 and 2023

Figure 10 Increased Demand for Geocomposites From the Construction & Infrastructure Industry to Drive the Market

Figure 11 Road & Highway to Be the Largest Application of Geocomposites

Figure 12 Drainage Was the Largest Segment of the Geocomposite Market

Figure 13 Geotextile-Geocore to Be the Largest Segment of the Geocomposites Market

Figure 14 India to Be the Fastest-Growing Geocomposite Market

Figure 15 Overview of Factors Governing the Geocomposites Market

Figure 16 Geocomposites Market: Porter’s Five Forces Analysis

Figure 17 Geotextile-Geocore Segment to Lead the Geocomposite Market

Figure 18 APAC to Be the Largest Market for Geotextile-Geonet Geocomposites

Figure 19 North America to Be the Second-Largest Geotextile-Geocore Geocomposites Market

Figure 20 North America to Be the Second-Largest Geotextile-Geogrid Geocomposite Market

Figure 21 APAC to Be the Fastest-Growing Geotextile-Geomembrane Geocomposite Market

Figure 22 APAC to Be the Fastest-Growing Geocomposites Market in the Others Segment

Figure 23 Drainage to Be the Dominating Segment of the Geocomposites Market

Figure 24 APAC to Be the Largest Geocomposite Market for Drainage Function

Figure 25 North America to Be the Largest Geocomposite Market in the Containment Segment

Figure 26 APAC to Be the Fastest-Growing Geocomposites Market in the Others Segment

Figure 27 Road & Highway to Be the Dominating Application of Geocomposites

Figure 28 North America to Be the Largest Geocomposites Market in Water & Wastewater Management Application

Figure 29 APAC to Be the Largest Geocomposite Market in the Road & Highway Application

Figure 30 North America to Be the Largest Geocomposite Market in the Landfill & Mining Application

Figure 31 APAC to Be the Fastest-Growing Geocomposite Market in Soil Reinforcement for the Civil Construction Application

Figure 32 APAC to Be the Fastest-Growing Geocomposites Market in Other Applications

Figure 33 India to Be the Fastest-Growing Geocomposite Market

Figure 34 North America: Geocomposites Market Snapshot

Figure 35 Europe: Geocomposite Market Snapshot

Figure 36 APAC: Geocomposites Market Snapshot

Figure 37 Thrace Group: Company Snapshot

Growth opportunities and latent adjacency in Geocomposites Market