Health & Hygiene Packaging Market by Product Type (Films & Sheets, Laminates, Bags & Pouches, Bottles & Jars, Sachets, Labels, Tubes, Boxes & Carton), Form, Shipping Form, Structure, End-user Industry, and Region - Global Forecast to 2028

Updated on : June 27, 2024

Health & Hygiene Packaging Market

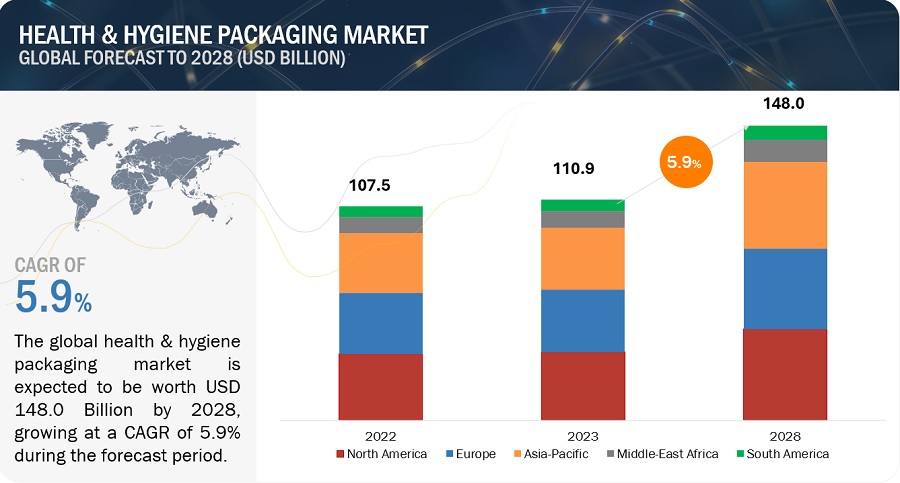

Health & hygiene packaging market was valued at USD 110.9 billion in 2023 and is projected to reach USD 148.0 billion by 2028, growing at 5.9% cagr from 2023 to 2028. The market growth is driven by increasing concerns about infectious diseases driving the demand for packaging that ensures product integrity and minimizes contamination risks. The growing preference for convenient, single-use packaging and the rise of e-commerce also play pivotal roles in propelling the health and hygiene packaging market.

Opportunities in the Health & Hygiene Packaging Market

To know about the assumptions considered for the study, Request for Free Sample Report

Recession impact

During a recession, the Health and hygiene packaging market may experience a range of impacts.

A recession profoundly affects the health and hygiene packaging market, encompassing personal care, home care, and OTC pharmaceuticals. As consumer spending tightens, demand for non-essential health and hygiene products may decline, impacting packaging markets. Companies may face challenges sustaining innovation and investing in sustainable packaging solutions, with potential shifts toward more cost-effective alternatives. While the essential nature of health and hygiene products offers some resilience, consumers might opt for budget-friendly options. The OTC pharmaceuticals market could experience altered purchasing patterns, impacting packaging dynamics.

Health & Hygiene Packaging Market Dynamics

Driver: The rising demand for flexible packaging in the personal care & home care sector drives the market.

The personal care and home care sectors are experiencing a surge in demand for flexible packaging. This growing preference is driven by several factors, including the convenience and versatility that flexible packaging offers. Flexible packaging adapts well to various product sizes and shapes, providing practical solutions for a range of personal care and home care items. Its lightweight nature and space efficiency contribute to reduced transportation costs and environmental impact. Additionally, the consumer-friendly features of easy resealing and dispensing enhance the overall user experience. As a result, the flexible packaging market continues to grow, meeting the evolving needs of the personal care and home care industries.

Restrain Recycling of Health and hygiene packaging.

The hygiene packaging market encounters significant restraints, notably driven by cost-related challenges. Escalating prices of raw materials like plastics and a limited supply of key components such as polypropylene impact manufacturing costs, thereby hampering market competitiveness. Moreover, the absence of a closed-loop recycling system for multi-layer high-barrier materials complicates recycling processes, contributing to environmental concerns. The intricacies involved in recycling flexible packaging, coupled with a lack of efficient infrastructure, make the process time-consuming and energy-intensive. Addressing these challenges is crucial for the hygiene packaging market to maintain sustainable growth in the face of economic and environmental constraints.

Opportunity: Growing demand for sustainable packaging

Brands are intensifying efforts to minimize their carbon footprint, responding to heightened environmental concerns. The 2015 Paris Agreement, aimed at restricting global warming to 2 degrees, spurred nations to commit to net-zero targets, aligning commercial goals with emissions reduction. Manufacturers are now prioritizing sustainable packaging solutions, optimizing materials to create smaller, lighter packaging, thus minimizing transportation needs. The surge in awareness about hygiene stands as a pivotal driver for the flexible packaging market. As consumers seek eco-friendly options, brands are increasingly adopting sustainable practices to align with environmental goals and meet evolving consumer expectations.

Challenge: Swift technological advancements in Health & Hygiene packaging

Flexible packaging continually evolves in formats, designs, and trends, spurred by technological advancements. Recognizing the demand for intelligent functionalities such as inventory management, sales tracking, and product monitoring, the packaging industry has embraced the concept of smart packaging, reducing reliance on manual labor. The swift pace of technological change renders existing flexible products obsolete. Furthermore, manufacturers are keen on captivating a broader consumer base by providing visually appealing packaging solutions that cater to the diverse preferences of consumers. This dual focus on smart features and aesthetic appeal reflects the dynamic nature of the flexible packaging landscape in response to evolving market demands and technological possibilities.

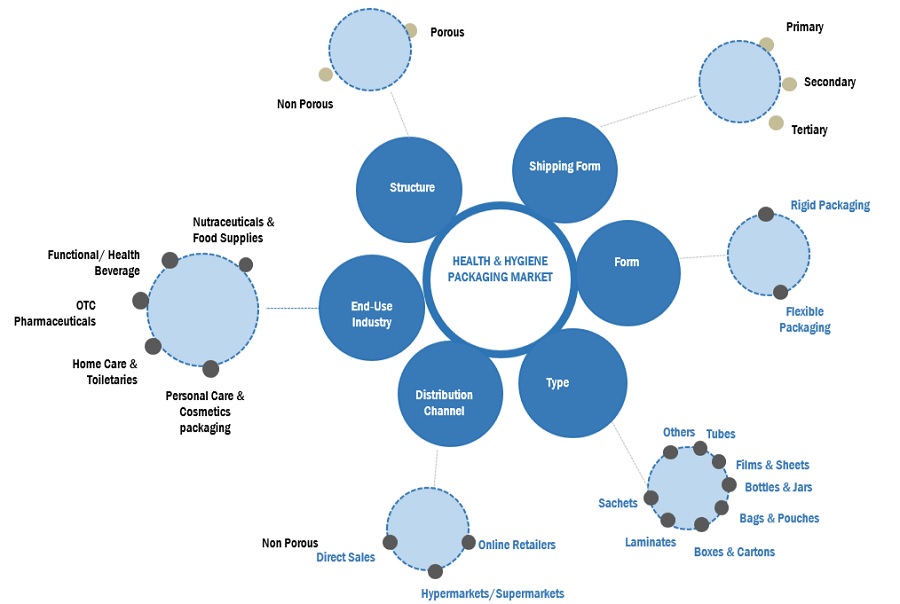

Health & Hygiene Packaging Market Ecosystem

The films and sheets segment is the fastest growing type in the Health and hygiene packaging market during the forecast period.

The films & sheets segment is the fastest growing in the Health and hygiene packaging market due to increasing consumer awareness regarding health and hygiene fuels the demand for protective and secure packaging solutions. Films & Sheets provide versatile options, ensuring lightweight and flexible packaging, thereby meeting evolving market needs. The rise of e-commerce activities amplifies the requirement for robust packaging, ensuring safe transportation of hygiene products. Innovative designs and materials enhance shelf appeal, influencing consumer choices.

Flexible Packaging is the fastest growing component in the Health & Hygiene packaging market during the forecast period.

The flexible packaging segment experiences the second fastest growth in the Health and hygiene packaging market due to their pivotal role in various end use, especially in personal care & home care packaging market. The flexible packaging market is witnessing heightened growth due to various contributing factors. Rapid changes in consumer lifestyles and preferences drive the demand for packaging solutions that offer convenience and versatility. Manufacturers are innovating with materials and designs to cater to evolving market needs. E-commerce expansion further accelerates the demand for flexible packaging, ensuring secure transportation and delivery of products.

The tertiary segment is the fastest growing form in the Health & Hygiene packaging market during the forecast period.

With an increasing focus on supply chain efficiency, there is a rising demand for robust and sustainable tertiary packaging solutions. Tertiary packaging, including pallets, containers, and bulk packaging, plays a crucial role in ensuring safe and efficient transportation of goods. The growth of e-commerce and globalization further amplifies the need for effective tertiary packaging to protect products during transit.

Direct Sales is the fastest growing end-use industry in the Health and hygiene packaging market during the forecast period.

The direct sales distribution channel in personal care packaging is witnessing increased growth owing to changing consumer preferences and market dynamics. Brands are leveraging direct sales models to establish a closer connection with consumers, offering personalized shopping experiences and exclusive product access. The rise of e-commerce platforms facilitates direct-to-consumer sales, eliminating intermediaries and streamlining distribution.

Home care & toiletries are the fastest-growing end-use industry in the Health and hygiene packaging market during the forecast period.

Increased awareness of hygiene and cleanliness amplifies the demand for home care products, fostering a parallel surge in packaging requirements. Manufacturers are responding with innovative and sustainable packaging solutions to meet the growing market demands. The rise of e-commerce and convenient packaging formats further fuels the expansion of the home care packaging market.

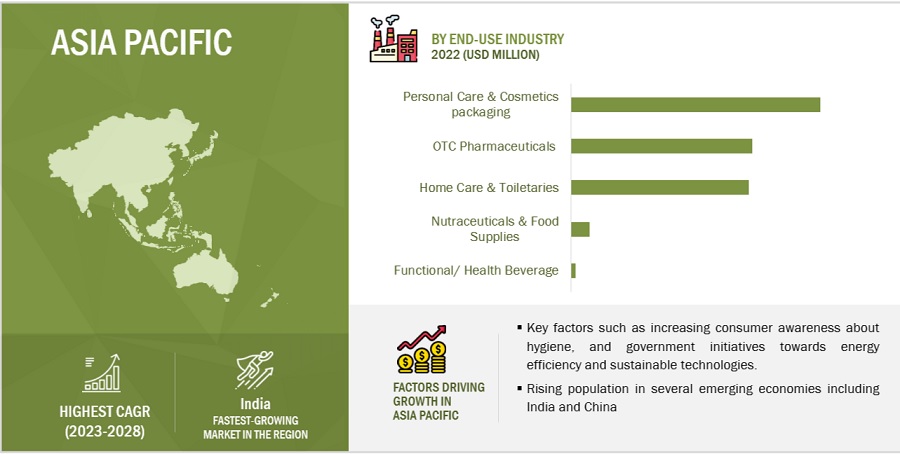

Asia Pacific is the fastest growing in the Health & Hygiene packaging market, in terms of value.

Asia Pacific stands as the fastest-growing region in the Health and hygiene packaging market due to rising population and increasing adoption of advanced technologies. The health & hygiene packaging market has experienced rapid growth in the Asia Pacific region, with countries like India, China, Japan, Australia, South Korea, and the Rest of Asia Pacific leading the way. Notably, India, China, and Japan are anticipated to exhibit substantial growth in flexible packaging due to ongoing developmental activities and swift economic expansion. This growth is driven by the increasing demand for packaging solutions that cater to the diverse needs of these dynamic and populous markets.

To know about the assumptions considered for the study, download the pdf brochure

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

Health & Hygiene Packaging Market Players

Berry Global (US), Amcor Plc (Switzerland), WestRock (US) and Kimberly Clark (US) are some of the established players in the health & hygiene packaging market. These players have established a strong foothold in the market by adopting strategies, such expansions, joint ventures, and mergers & acquisitions.

Health & Hygiene Packaging Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 107.5 Billion |

|

Revenue Forecast in 2028 |

USD 148.0 Billion |

|

CAGR |

5.9% |

|

Years considered for the study |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Million meters) and Value (USD) |

|

Segments |

Product Type, Shipping form, form, distribution channel, End-use Industry, and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies |

Berry Global (US), Amcor Plc (Europe), Mondi Group (US), WestRock (US) and Kimberly Clark (US) |

The study categorizes the Health and hygiene packaging market based on material, implementation, end-use industry, and region.

Health & Hygiene Packaging Market by Product Type:

- Films and sheets

- Bags & Pouches

- laminates

- labels

- Jars & Bottles

- Sachets

- boxes and cartons

- others

Health & Hygiene Packaging Market by Form:

-

Rigid Packaging

- Molding

- Extrusion

- Others

-

Flexible Packaging

- Single Layer

- Multi-Layer

Health & Hygiene Packaging Market by Structure:

- Porous

- Non-porous

Health & Hygiene Packaging Market by Shipping Form:

- Primary

- Secondary

- Tertiary

Health & Hygiene Packaging Market by Distribution Channel:

- Hypermarkets/Supermarkets

- Online Retailers

- Direct Sales

- Others

Health & Hygiene Packaging Market by End-use Industry:

- Nutraceuticals And Food Supplements

- Personal Care & Cosmetics

- Functional/Health Beverage

- Pharmaceutical And Otc Formulations

- Home Care & Toiletries

- Others

Health & Hygiene Packaging Market by Region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- In February 2023, Berry Global launched child resistant PET bottles for pharmaceutical syrups and liquid medicines. This involves seven sets of 28mm neck PET bottles, available in sizes ranging from 20ml to 1,000ml and offered in various designs. These bottles are complemented by eight closures designed to include tamper-evident and child-resistant features. This has strengthened company PET bottles portfolio.

- In October 2022, Berry Global and PYLOTE announced partnership for a new ophthalmic dropper, offering a unique multidose ophthalmic dropper combining high barrier with unique antimicrobial protection properties.

- In September 2022, Amcor developed the Dairy Seal line of packaging that features ClearCor, an advanced polyethylene terephthalate (PET) barrier. This introduction will help nutritional, dairy alternatives, and ready-to-drink (RTD) market.

- In April 2022, Mondi and Thimonnier introduced a new recyclable mono-material berlingot sachet for liquid soap refills. Compared to rigid plastic bottles, the novel new packaging reduces plastic usage by more than 75%.

Frequently Asked Questions (FAQ):

What is the current size of the global Health and hygiene packaging market?

Global Health and hygiene packaging market size is estimated to reach USD 148.0 billion by 2028 from USD 110.9 billion in 2023, at a CAGR of 5.9% during the forecast period.

Who are the winners in the global Health and hygiene packaging market?

Berry Global (US), Amcor Plc (Switzerland), WestRock (US) and Kimberly Clark (US) fall under the winner's category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use expansions, joint ventures, and mergers & acquisitions as important growth tactics.

What is the recession on Health and hygiene packaging manufacturers?

Companies may focus more on cost-cutting measures and short-term survival strategies rather than long-term investments. Recessions might bring about shifts in consumer preferences and market demands.

What are some of the drivers in the market?

Energy efficient regulations and stringent emission standards .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing consumer awareness and health consciousness- Rising demand for adult incontinence product packaging- Innovation in sustainable packaging solutions- Surge in e-commerce and changing consumer patterns- Tamper resistance and product integrityRESTRAINTS- Increasing raw material prices- Limited recycling infrastructure and environmental concernsOPPORTUNITIES- Advanced printing technologies for featured branding- Anti-counterfeiting technologies for product security- Advanced barrier systems for extended product shelf life- Nanotechnology for improved packaging performanceCHALLENGES- Integration costs and adoption of new technologies- Regulatory compliance and standardization

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND USERS

-

5.5 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPESINSIGHTSTOP APPLICANTS

-

5.6 ECOSYSTEM MAPPING

-

5.7 TECHNOLOGY ANALYSISPRINTING METHODS FOR PRODUCT PACKAGING- Rotogravure- Lithography- Flexography- Digital printingFORM FILL SEAL MACHINE FOR FLEXIBLE PACKAGINGSTRETCHABLE PAPER FOR NOVEL APPLICATIONSNEW PET PREFORM MOLDING SOLUTIONNEW TECHNOLOGY TO HELP RECYCLE SMALL PLASTIC BOTTLES

-

5.8 TARIFF & REGULATORY LANDSCAPECONTAINER COMPLIANCE OPTIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.9 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.10 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS

-

5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.13 CASE STUDY ANALYSISSIMULIA-AMCOR CASEPAPERPAK CASE STUDY FOR KATHMANDU

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSQUALITYSERVICE

-

5.15 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGIONAVERAGE SELLING PRICE TREND, BY END-USE INDUSTRYAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

- 6.1 INTRODUCTION

-

6.2 FILMS & SHEETSANTIMICROBIAL AND TAMPER-EVIDENT COATINGS TO DRIVE MARKET

-

6.3 BAGS & POUCHESDEMAND FOR COMPACT AND ECO-FRIENDLY PACKAGING IN PERSONAL CARE PRODUCTS TO BOOST MARKET

-

6.4 LAMINATESINCREASING DEMAND FOR AESTHETIC AND PROTECTIVE PACKAGING SOLUTIONS TO DRIVE MARKET

-

6.5 LABELSSURGE IN DEMAND FOR OTC PHARMACEUTICAL PRODUCTS TO BOOST MARKET

-

6.6 BOTTLES & JARSWIDE DEPLOYMENT IN PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

-

6.7 SACHETSCOMPACTNESS AND SUSTAINABILITY TO FUEL DEMAND IN HEALTHCARE SECTOR

-

6.8 BOXES & CARTONSVISUAL APPEAL AND STURDINESS TO SURGE DEMAND IN HEALTH & HYGIENE INDUSTRY

-

6.9 TUBESEFFICIENT PACKAGING SOLUTIONS TO SPUR MARKET GROWTH

- 6.10 OTHER TYPES

- 7.1 INTRODUCTION

-

7.2 RIGID PACKAGINGMOLDING- Increasing demand for bottles & jars to drive marketEXTRUSION- Rising need for tubes in OTC pharmaceuticals & personal care to boost marketOTHER RIGID FORMS

-

7.3 FLEXIBLE PACKAGINGSINGLE LAYER- Effective and sustainable solutions in health & hygiene packaging to drive marketMULTI LAYER- Growing demand for diapers to boost market

- 8.1 INTRODUCTION

-

8.2 PRIMARY PACKAGINGWIDE USE OF TUBES AND POUCHES TO DRIVE MARKET

-

8.3 SECONDARY PACKAGINGHIGH DEMAND FOR LABELS AND LAMINATES TO FUEL MARKET

-

8.4 TERTIARY PACKAGINGSECURE AND ORGANIZED PACKAGING SOLUTIONS TO DRIVE GROWTH

- 9.1 INTRODUCTION

-

9.2 NONPOROUSEXTENSIVE USE IN LIQUID PACKAGING TO DRIVE MARKET

-

9.3 POROUSBIODEGRADABILITY AND MICROBIAL RESISTANCE TO FUEL DEMAND

- 10.1 INTRODUCTION

-

10.2 HYPERMARKETS & SUPERMARKETSGROWING DEMAND FOR SECURE AND HYGIENIC PACKAGING TO DRIVE MARKET

-

10.3 ONLINE RETAILERSINCREASING CONSUMER PREFERENCE FOR CONVENIENT PACKAGING SOLUTIONS TO DRIVE GROWTH

-

10.4 DIRECT SALESRISING DEMAND FOR SECURE AND TRANSPARENT SALES IN PHARMACEUTICAL INDUSTRY TO BOOST MARKET

- 11.1 INTRODUCTION

-

11.2 NUTRACEUTICAL & FOOD SUPPLIESGROWING CONSUMER AWARENESS TOWARD NUTRITIONAL AND WELLNESS PRODUCTS TO DRIVE MARKET

-

11.3 PERSONAL CARE & COSMETICS PACKAGINGTECHNOLOGICAL ADVANCEMENTS AND GROWTH OF E-COMMERCE SECTOR TO FUEL MARKET

-

11.4 FUNCTIONAL & HEALTH BEVERAGESINNOVATIVE AND CONVENIENT PACKAGING SOLUTIONS TO DRIVE MARKET

-

11.5 PHARMACEUTICALS & OTC FORMULATIONSINCREASING GLOBAL CONSUMPTION OF PHARMACEUTICAL AND OTC FORMULATIONS TO DRIVE MARKET

-

11.6 HOME CARE & TOILETRIESRISING FOCUS ON HEALTH & HYGIENE TO PROPEL MARKET

- 11.7 OTHER END-USE INDUSTRIES

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICARECESSION IMPACTUS- Surge in industrial demand for packaging products to boost marketCANADA- Highly diversified and developed economy to drive marketMEXICO- Cost-effective and efficient manufacturing and packaging solutions to drive growth

-

12.3 ASIA PACIFICRECESSION IMPACTCHINA- Open economy and established manufacturing base to drive marketJAPAN- Increasing disposable income to drive marketINDIA- High demand from e-commerce sector to boost marketSOUTH KOREA- Rising need for functional health and nutraceutical items to drive marketAUSTRALIA- Growth of industrial sector to boost marketREST OF ASIA PACIFIC

-

12.4 EUROPERECESSION IMPACTGERMANY- Growth of packaging industry to drive marketFRANCE- Technological advancements in pharmaceutical industry to boost marketUK- Increasing demand for functional foods to fuel marketITALY- High nutraceutical import by government to boost marketREST OF EUROPE

-

12.5 MIDDLE EAST & AFRICARECESSION IMPACTGCC COUNTRIES- Saudi Arabia- UAE- Other GCC CountriesSOUTH AFRICA- High birth rate to fuel demand for hygiene productsREST OF THE MIDDLE EAST & AFRICA

-

12.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Rising health consciousness and rapid urbanization to drive marketARGENTINA- Strong focus on economic development to drive demandREST OF SOUTH AMERICA

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

-

13.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

13.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 13.7 COMPETITIVE SCENARIO AND TRENDS

-

14.1 KEY PLAYERSBERRY GLOBAL INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMCOR PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWESTROCK COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGLENROY, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMONDI GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSONOCO PRODUCTS COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOMAR PACKAGING SOLUTIONS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMERPLAST LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKIMBERLY-CLARK PROFESSIONAL- Business overview- Products/Solutions/Services offered- MnM viewESSITY- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

14.2 OTHER PLAYERSNAPCO NATIONALSLIGAN HOLDINGS INC.ALPLA GROUPMOD-PACAMGRAPH PACKAGING, INC.KRIS FLEXIPACKS PVT. LTD.GEORGIA-PACIFICJOHNSBYRNE COMPANYS.B. PACKAGINGSPOLYFILM GROUPDORAN & WARD PACKAGINGNOVUS HOLDINGSKLOCKNER PENTAPLASTPLASTIPACK HOLDINGS INC.SONIC PACKAGING INDUSTRIES INC.

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 RELATED REPORTS

- 15.4 AUTHOR DETAILS

- TABLE 1 SHARE OF ELDERLY POPULATION, BY COUNTRY

- TABLE 2 HEALTH & HYGIENE PACKAGING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- TABLE 4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2018–2025

- TABLE 6 HEALTH & HYGIENE PACKAGING MARKET: KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 9 HEALTH & HYGIENE PACKAGING MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 10 HEALTH & HYGIENE PACKAGING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 11 HEALTH & HYGIENE PACKAGING MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 12 HEALTH & HYGIENE PACKAGING MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 13 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (USD MILLION)

- TABLE 14 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 15 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (KILOTON)

- TABLE 16 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 17 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2020–2022 (USD MILLION)

- TABLE 18 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2023–2028 (USD MILLION)

- TABLE 19 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2020–2022 (KILOTON)

- TABLE 20 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2023–2028 (KILOTON)

- TABLE 21 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2020–2022 (USD MILLION)

- TABLE 22 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2023–2028 (USD MILLION)

- TABLE 23 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2020–2022 (KILOTON)

- TABLE 24 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2023–2028 (KILOTON)

- TABLE 25 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020–2022 (USD MILLION)

- TABLE 26 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 27 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020–2022 (KILOTON)

- TABLE 28 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (KILOTON)

- TABLE 29 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 30 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 31 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 32 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 33 HEALTH & HYGIENE PACKAGING MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 34 HEALTH & HYGIENE PACKAGING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 HEALTH & HYGIENE PACKAGING MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 36 HEALTH & HYGIENE PACKAGING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 37 HEALTH & HYGIENE PACKAGING MARKET, BY PRODUCT TYPE, 2020–2022 (USD MILLION)

- TABLE 38 HEALTH & HYGIENE PACKAGING MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 39 HEALTH & HYGIENE PACKAGING MARKET, BY PRODUCT TYPE, 2020–2022 (KILOTON)

- TABLE 40 HEALTH & HYGIENE PACKAGING MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTON)

- TABLE 41 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2020–2022 (USD MILLION)

- TABLE 42 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2023–2028 (USD MILLION)

- TABLE 43 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2020–2022 (KILOTON)

- TABLE 44 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2023–2028 (KILOTON)

- TABLE 45 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2020–2022 (USD MILLION)

- TABLE 46 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2023–2028 (USD MILLION)

- TABLE 47 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2020–2022 (KILOTON)

- TABLE 48 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2023–2028 (KILOTON)

- TABLE 49 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020–2022 (USD MILLION)

- TABLE 50 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 51 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020–2022 (KILOTON)

- TABLE 52 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (KILOTON)

- TABLE 53 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (USD MILLION)

- TABLE 54 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 55 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (KILOTON)

- TABLE 56 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 57 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 58 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 59 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 60 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 61 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 64 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 65 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (KILOTON)

- TABLE 68 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 69 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 72 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 73 US: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 74 US: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 75 US: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 76 US: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 77 CANADA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 78 CANADA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 79 CANADA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 80 CANADA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 81 MEXICO: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 82 MEXICO: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 83 MEXICO: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 84 MEXICO: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 85 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 88 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 89 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (KILOTON)

- TABLE 92 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 93 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 96 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 97 CHINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 98 CHINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 99 CHINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 100 CHINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 101 JAPAN: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 102 JAPAN: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 103 JAPAN: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 104 JAPAN: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 105 INDIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 106 INDIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 107 INDIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 108 INDIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 109 SOUTH KOREA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 110 SOUTH KOREA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 111 SOUTH KOREA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 112 SOUTH KOREA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 113 AUSTRALIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 114 AUSTRALIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 115 AUSTRALIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 116 AUSTRALIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 117 REST OF ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 120 REST OF ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 121 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 122 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 123 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 124 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (USD MILLION)

- TABLE 125 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (KILOTON)

- TABLE 127 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 128 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 129 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 130 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 131 EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 132 GERMANY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 133 GERMANY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 134 GERMANY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 135 GERMANY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 136 FRANCE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 137 FRANCE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 138 FRANCE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 139 FRANCE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 140 UK: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 141 UK: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 142 UK: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 143 UK: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 144 ITALY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 145 ITALY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 146 ITALY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 147 ITALY: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 148 REST OF EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 149 REST OF EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 150 REST OF EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 151 REST OF EUROPE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 152 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 155 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 156 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 163 MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 164 SAUDI ARABIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 165 SAUDI ARABIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 166 SAUDI ARABIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 167 SAUDI ARABIA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 168 UAE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 169 UAE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 170 UAE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 171 UAE: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 172 REST OF GCC COUNTRIES: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 173 REST OF GCC COUNTRIES: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 174 REST OF GCC COUNTRIES: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 175 REST OF GCC COUNTRIES: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 176 SOUTH AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 177 SOUTH AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 178 SOUTH AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 179 SOUTH AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 184 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 185 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 186 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 187 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 188 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (USD MILLION)

- TABLE 189 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 190 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020–2022 (KILOTON)

- TABLE 191 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 192 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 193 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 194 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 195 SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 196 BRAZIL: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 197 BRAZIL: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 198 BRAZIL: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 199 BRAZIL: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 200 ARGENTINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 201 ARGENTINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 202 ARGENTINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 203 ARGENTINA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 204 REST OF SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 205 REST OF SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 206 REST OF SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 207 REST OF SOUTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 208 HEALTH & HYGIENE PACKAGING MARKET: DEGREE OF COMPETITION

- TABLE 209 COMPANY END-USE INDUSTRY FOOTPRINT (25 COMPANIES)

- TABLE 210 COMPANY REGION FOOTPRINT (25 COMPANIES)

- TABLE 211 COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 212 HEALTH & HYGIENE PACKAGING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (15 COMPANIES)

- TABLE 213 DETAILED LIST OF COMPANIES

- TABLE 214 PRODUCT LAUNCHES, 2018—2023

- TABLE 215 DEALS, 2018—2023

- TABLE 216 OTHERS, 2018–2023

- TABLE 217 BERRY GLOBAL INC.: COMPANY OVERVIEW

- TABLE 218 BERRY GLOBAL INC.: PRODUCT OFFERINGS

- TABLE 219 BERRY GLOBAL INC.: PRODUCT LAUNCHES

- TABLE 220 BERRY GLOBAL: DEALS

- TABLE 221 BERRY GLOBAL: OTHERS

- TABLE 222 AMCOR PLC: COMPANY OVERVIEW

- TABLE 223 AMCOR PLC: PRODUCT OFFERINGS

- TABLE 224 AMCOR PLC: PRODUCT LAUNCHES

- TABLE 225 AMCOR PLC: DEALS

- TABLE 226 AMCOR PLC: OTHERS

- TABLE 227 WESTROCK COMPANY: COMPANY OVERVIEW

- TABLE 228 WESTROCK COMPANY: PRODUCT OFFERINGS

- TABLE 229 WESTROCK COMPANY: DEALS

- TABLE 230 WESTROCK COMPANY: OTHERS

- TABLE 231 GELENROY, INC.: COMPANY OVERVIEW

- TABLE 232 GLENROY, INC.: PRODUCT OFFERINGS

- TABLE 233 GLENROY, INC.: PRODUCT LAUNCHES

- TABLE 234 GLENROY INC.: OTHERS

- TABLE 235 MONDI GROUP: COMPANY OVERVIEW

- TABLE 236 MONDI GROUP: PRODUCT OFFERINGS

- TABLE 237 MONDI GROUP: PRODUCT LAUNCHES

- TABLE 238 MONDI GROUP: DEALS

- TABLE 239 MONDI GROUP: OTHERS

- TABLE 240 SONOCO PRODUCTS COMPANY: COMPANY OVERVIEW

- TABLE 241 SONOCO PRODUCTS COMPANY: PRODUCT OFFERINGS

- TABLE 242 SONOCO PRODUCTS COMPANY: PRODUCT LAUNCHES

- TABLE 243 SONOCO PRODUCTS COMPANY: DEALS

- TABLE 244 COMAR PACKAGING SOLUTION: COMPANY OVERVIEW

- TABLE 245 COMAR PACKAGING SOLUTION: PRODUCT OFFERINGS

- TABLE 246 COMAR PACKAGING SOLUTION: DEALS

- TABLE 247 COMAR PACKAGING SOLUTION: OTHERS

- TABLE 248 AMERPLAST LTD.: COMPANY OVERVIEW

- TABLE 249 AMERPLAST LTD.: PRODUCT OFFERINGS

- TABLE 250 AMERPLAST LTD.: DEALS

- TABLE 251 AMERPLAST LTD.: OTHERS

- TABLE 252 KIMBERLY-CLARK PROFESSIONAL: COMPANY OVERVIEW

- TABLE 253 KIMBERLY-CLARK PROFESSIONAL: PRODUCT OFFERINGS

- TABLE 254 ESSITY: COMPANY OVERVIEW

- TABLE 255 ESSITY: PRODUCT OFFERINGS

- TABLE 256 ESSITY: DEALS

- TABLE 257 NAPCO NATIONAL: COMPANY OVERVIEW

- TABLE 258 SLIGAN HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 259 ALPLA GROUP: COMPANY OVERVIEW

- TABLE 260 MOD-PAC: COMPANY OVERVIEW

- TABLE 261 AMGRAPH PACKAGING, INC.: COMPANY OVERVIEW

- TABLE 262 KRIS FLEXIPACKS PVT. LTD.: COMPANY OVERVIEW

- TABLE 263 GEORGIA-PACIFIC: COMPANY OVERVIEW

- TABLE 264 JOHNSBRYNE COMPANY: COMPANY OVERVIEW

- TABLE 265 S.B. PACKAGINGS: COMPANY OVERVIEW

- TABLE 266 POLYFILM GROUP: COMPANY OVERVIEW

- TABLE 267 DORAN & WARD PACKAGING: COMPANY OVERVIEW

- TABLE 268 NOVUS HOLDINGS: COMPANY OVERVIEW

- TABLE 269 KLOCKNER PENTAPLAST: COMPANY OVERVIEW

- TABLE 270 PLASTICPACK HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 271 SONIC PACKAGING INDUSTRIES INC.: COMPANY OVERVIEW

- FIGURE 1 HEALTH & HYGIENE PACKAGING: RESEARCH DESIGN

- FIGURE 2 HEALTH & HYGIENE PACKAGING MARKET: TOP-DOWN APPROACH

- FIGURE 3 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 4 HEALTH & HYGIENE PACKAGING MARKET: DATA TRIANGULATION

- FIGURE 5 BOTTLES & JARS TO BE LARGEST PRODUCT TYPE DURING FORECAST PERIOD

- FIGURE 6 RIGID PACKAGING FORM TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 7 PRIMARY PACKAGING SHIPPING FORM TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 8 NONPOROUS PACKAGING TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 HYPERMARKETS DISTRIBUTION CHANNEL TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 10 PERSONAL CARE & COSMETICS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO LEAD HEALTH & HYGIENE PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 13 FILMS & SHEETS TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 RIGID PACKAGING TO BE LARGEST GROWING FORM BY 2028

- FIGURE 15 TERTIARY PACKAGING TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 NONPOROUS TO BE FASTEST-GROWING MARKET BY 2028

- FIGURE 17 HYPERMARKETS/SUPERMARKETS TO BE LARGEST DISTRIBUTION CHANNEL BY 2028

- FIGURE 18 PERSONAL CARE & COSMETICS TO BE LARGEST END-USE INDUSTRY BY 2028

- FIGURE 19 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HEALTH & HYGIENE PACKAGING MARKET

- FIGURE 21 HEALTH & HYGIENE PACKAGING MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 22 HEALTH & HYGIENE PACKAGING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 GRANTED PATENTS

- FIGURE 24 PUBLICATION TRENDS IN LAST 10 YEARS

- FIGURE 25 JURISDICTION ANALYSIS

- FIGURE 26 HEALTH & HYGIENE PACKAGING MARKET ECOSYSTEM

- FIGURE 27 IMPORT OF CHEMICALLY PURE FRUCTOSE IN SOLID FORM, BY KEY COUNTRY, 2018–2022

- FIGURE 28 EXPORT OF ARTICLES FOR CONVEYANCE OR PACKAGING OF GOODS, BY KEY COUNTRY, 2018–2022

- FIGURE 29 REVENUE SHIFT FOR HEALTH & HYGIENE PACKAGING MANUFACTURERS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- FIGURE 31 SUPPLIER SELECTION CRITERION

- FIGURE 32 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- FIGURE 33 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY (USD/KG)

- FIGURE 34 AVERAGE SELLING PRICE, BY KEY MARKET PLAYERS (USD/KG)

- FIGURE 35 FILMS & SHEETS SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 36 FLEXIBLE PACKAGING TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 37 TERTIARY PACKAGING TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 38 NONPOROUS SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 39 HYPERMARKETS & SUPERMARKETS TO BE LARGEST DISTRIBUTION CHANNEL DURING FORECAST PERIOD

- FIGURE 40 PERSONAL CARE & COSMETICS PACKAGING TO DRIVE MARKET BETWEEN 2023 AND 2028

- FIGURE 41 INDIA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: HEALTH & HYGIENE PACKAGING MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: HEALTH & HYGIENE PACKAGING MARKET SNAPSHOT

- FIGURE 44 COMPANIES ADOPTED PARTNERSHIP AND EXPANSION AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2023

- FIGURE 45 REVENUE ANALYSIS OF KEY COMPANIES (2020–2022)

- FIGURE 46 SHARE OF TOP COMPANIES IN HEALTH & HYGIENE PACKAGING MARKET

- FIGURE 47 HEALTH & HYGIENE PACKAGING MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 48 COMPANY PRODUCT FOOTPRINT (25 COMPANIES)

- FIGURE 49 HEALTH & HYGIENE PACKAGING MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 50 BERRY GLOBAL INC.: COMPANY SNAPSHOT

- FIGURE 51 AMCOR PLC: COMPANY SNAPSHOT

- FIGURE 52 WESTROCK COMPANY: COMPANY SNAPSHOT

- FIGURE 53 MONDI GROUP: COMPANY SNAPSHOT

- FIGURE 54 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

- FIGURE 55 ESSITY: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size for health & hygiene packaging. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

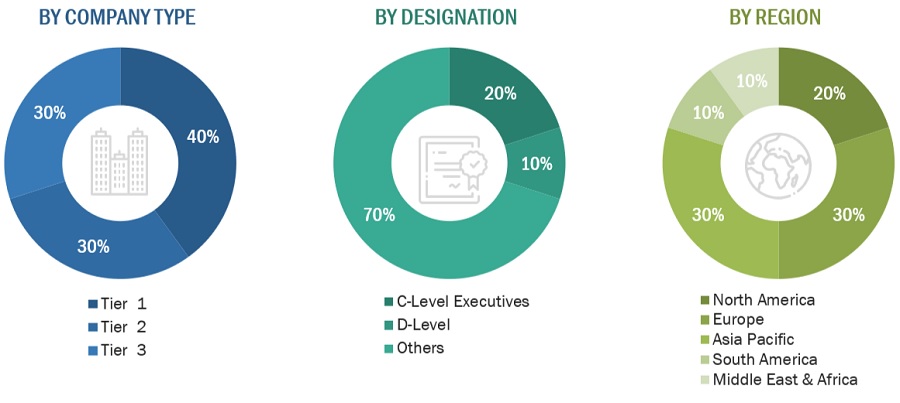

The Health and hygiene packaging market involves a variety of stakeholders across the value chain, including raw material suppliers, manufacturers, and end-users. For this study, both the supply and demand sides of the market were interviewed to gather qualitative and quantitative information. Key opinion leaders from various end-use sectors were interviewed from the demand side, while manufacturers and associations were interviewed from the supply side.

Primary interviews helped to gather insights on market statistics, revenue data, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped to identify trends related to grade, application, end-use industries, and region. C-level executives from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand their perspective on suppliers, products, and component providers, which will affect the overall market.

Breakdown of primary interviews

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Berry Global |

Sales Manager |

|

Amerplast |

Sales Manager |

|

Kimberly Clark |

Technical Sales Manager |

|

Mondi Group |

Marketing Manager |

|

Essity AB |

R&D Manager |

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for Health and hygiene packaging for each region. The research methodology used to estimate the market size included the following steps:

The key players in the industry have been identified through extensive secondary research.

The supply chain of the industry has been determined through primary and secondary research.

The global market was then segmented into five major regions and validated by industry experts.

All percentage shares, splits, and breakdowns based on product type, form, shipping form, distribution channel, structure and end-use industry, and country were determined using secondary sources and verified through primary sources.

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

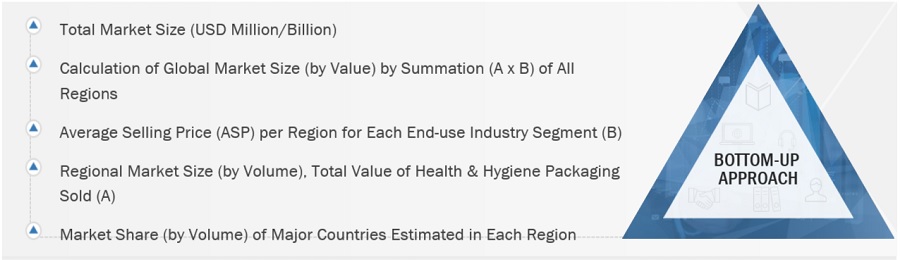

Health & Hygiene Packaging Market: Bottum-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Health & Hygiene Packaging Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of Health and hygiene packaging and their applications.

Market Definition

Common components within the hygiene packaging market include films, sheets, bottles, jars, boxes, tubes, and laminates. Packaging solutions that offer a high level of protection and security, meeting the rigorous hygiene standards essential for products in sectors such as healthcare, pharmaceuticals, and personal care. The escalating demand for personal care and home care, coupled with the robust growth of the over-the-counter (OTC) pharmaceuticals market, is driven by heightened health consciousness and evolving consumer lifestyles.

Key Stakeholders

- Manufacturers of Health & Hygiene packaging

- Raw Material Suppliers

- Manufacturers In End-use Industries

- Traders, Distributors, and Suppliers

- Regional Manufacturers’ Associations

- Government and regional Agencies and Research Organizations

Objectives of the Study:

- To analyze and forecast the size of the Health & Hygiene packaging market in terms of value and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market

- To analyze and forecast the market by product type, form, shipping form, distribution channel, end-use industry, and region.

- To forecast the size of the market with respect to five regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders.

- To analyze competitive developments in the market, such as investment & expansion, joint venture, partnership, and merger & acquisition

- To strategically profile key players and comprehensively analyze their market shares and core competencies2.

Notes: Micromarkets1 are the sub-segments of the Health and hygiene packaging market included in the report.

Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report.

- Additional country-level analysis of the Health and hygiene packaging market

- Profiling of additional market players (up to 3)

Growth opportunities and latent adjacency in Health & Hygiene Packaging Market