Heat Exchanger Market by Type (Shell & Tube, Plate & Frame, Air Cooled), Material (Metal, Alloys, Brazing Clad Materials), End-Use Industry (Chemical, Energy, Hvacr, Food & Beverage, Power, Pulp & Paper), And Region - Global Forecast to 2029

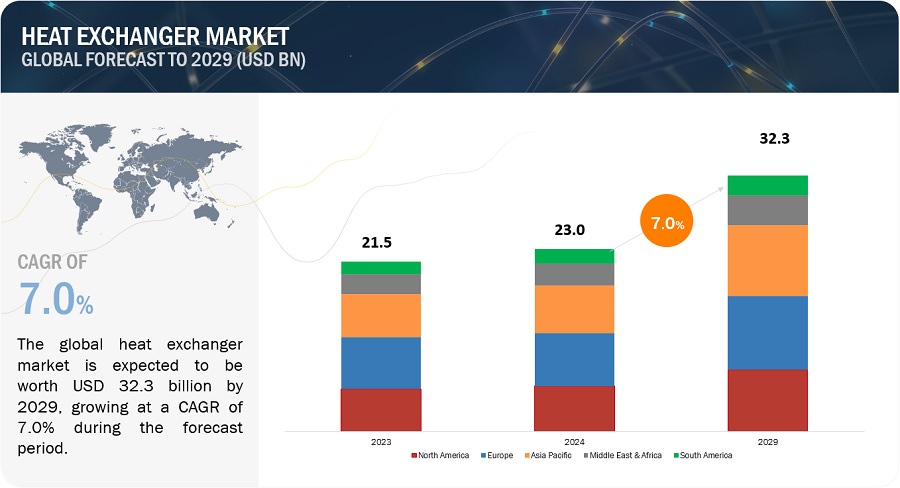

The global heat exchanger market size is projected to reach USD 32.3 billion by 2029 from USD 23.0 billion in 2024, at a CAGR of 7.0% during the forecast period. The heat exchanger market is projected to grow significantly in the coming years. Heat exchangers enable the efficient transfer of heat between fluids, facilitating the effective utilization of energy. Whether it's recovering waste heat from industrial operations or transferring heat between various fluid streams, heat exchangers play a crucial role in enhancing energy efficiency and minimizing energy consumption.

Global Heat Exchanger Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Heat exchangerMarket Dynamics

Driver: Growing demand for heat pumps in Europe

Heat pumps rely on heat exchangers as a vital element to transfer heat among various mediums, including air, water, or the ground. The increasing uptake of heat pumps in Europe results in a heightened need for heat exchangers to facilitate effective heat transfer within these systems. These pumps are commonly integrated into heating systems across residential, commercial, and industrial buildings to offer space heating, hot water, and cooling functionalities. Heat exchangers serve as indispensable components within heat pump setups, enabling the exchange of heat between the refrigerant and the surrounding environment. Additionally, the European Union's efforts to promote building renovation and enhance energy efficiency contribute to the rising adoption of heat pumps. As older buildings undergo retrofitting with heat pump systems to lower carbon emissions and energy usage, the demand for heat exchangers correspondingly increases.

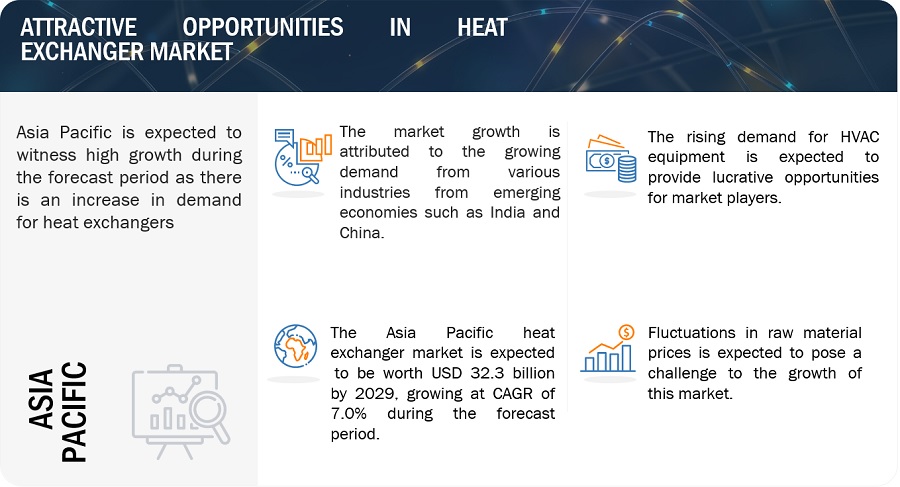

Restraint: Fluctuations in raw material prices

Heat exchanger manufacturers face risks associated with fluctuations in raw material prices, including copper, aluminum, steel, and other metals. These price fluctuations are influenced by various factors such as economic conditions, exchange rates, supply conditions, mining policies, and raw material processing. Volatility in metal prices can pose challenges for manufacturers, potentially impacting their profitability and operational efficiency. Unpredictable pricing trends may lead to increased costs for customers, potentially causing delays or cancellations of large capital projects. This, in turn, can affect manufacturers' profitability and financial stability. Conversely, oversupply in the market may compel manufacturers to reduce expenditure, impacting their competitiveness and market position. A decrease in demand can result in delays or cancellations of existing orders, leading to excess manufacturing capacity and unfavorable effects on fixed manufacturing costs. This situation may also influence average selling prices in the market.

Opportunity: Rising aftermarket

A heat exchanger holds a pivotal role in any process industry, with its performance and durability directly impacting both capital and operating expenses. Breakdowns and maintenance activities often incur significant costs. Therefore, regular maintenance of heat exchangers is paramount, with maintenance costs typically being lower compared to rotating equipment such as pumps, fans, and compressors. Ensuring the ongoing maintenance of heat exchangers is essential for uninterrupted operation, system uptime, and the prevention of sudden failures. Investing in preventive maintenance is usually more cost-effective than emergency repairs. Well-planned maintenance of heat exchangers enables companies to save energy and reduce operational costs by up to 30%. Maintenance activities help prevent pressure drops in the system, resulting in reduced loads on pumps and other components. This contributes to lower energy consumption, while simultaneously enhancing heat transfer rates and operational efficiency.

Challenges: Regulations concerning fluorinated gases

Regulations concerning fluorinated gases (F-gases) pose challenges for participants in the heat exchangers market, particularly in their use as evaporators and condensers. In 2015, the European Union (EU) proposed significant amendments to F-gas regulations aimed at controlling emissions of fluorinated greenhouse gases (F-gases), notably hydrofluorocarbons (HFCs). These amendments led to the adoption of two legislative acts by the EU: the MAC Directive, focusing on air conditioning systems in small motor vehicles, and the F-gas Regulation, covering various other key applications employing F-gases. While certain applications have banned the use of HFCs, allowances for HFC refrigerants are contingent upon meeting Eco-Design criteria. Similar regulatory discussions are underway in the US (SNAP - Significant New Alternative Policy) and China.

Market Ecosystem

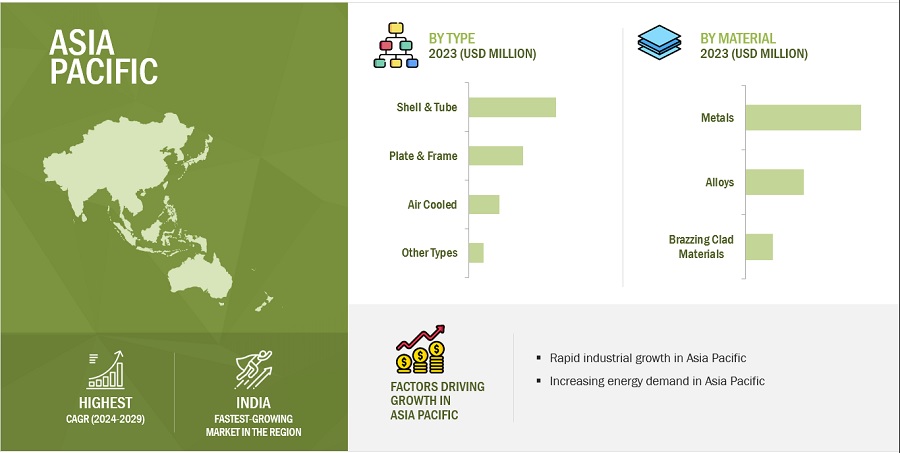

By material, metals is the second fastest growing in heat exchanger market, in 2023.

Metals, such as copper, aluminum, and stainless steel, possess excellent thermal conductivity properties, allowing them to efficiently transfer heat between fluids. This property makes metals highly suitable for heat exchanger applications where rapid heat transfer is essential. They offer superior mechanical strength and durability, enabling them to withstand high temperatures, pressures, and mechanical stresses encountered in heat exchanger operations. This durability ensures the reliability and longevity of heat exchanger systems. They offer a cost-effective solution for heat exchanger construction, particularly when compared to alternative materials such as ceramics or composites.

By type, shell & tube is the largest in heat exchanger market, in 2023.

Shell & tube heat exchangers are well-known for their effective heat transfer capabilities. Their design facilitates a generous surface area for heat exchange between the fluid flowing through the tubes and the fluid surrounding the tubes within the shell. This layout optimizes heat transfer efficiency, rendering shell & tube heat exchangers appropriate for a diverse array of applications. Constructed with sturdy materials like metals (e.g., stainless steel, carbon steel, copper alloys), shell and tube heat exchangers boast high mechanical strength and resistance to corrosion. This robust construction guarantees enduring reliability and performance, even when subjected to challenging operating conditions.

By end-use industry, energy segment is the second fastest growing end-use industry in the heat exchanger market, in 2023.

Heat exchangers are essential components in various energy end-use applications, including power generation, HVAC systems, district heating and cooling, and renewable energy systems such as solar thermal and geothermal. These applications require efficient heat transfer to control temperatures, generate electricity, provide heating and cooling, and facilitate energy conversion processes. They are essential components in renewable energy systems such as solar thermal collectors, geothermal heat pumps, and biomass boilers. These systems harness renewable energy sources to generate heat for space heating, hot water production, and industrial processes, with heat exchangers facilitating the transfer of thermal energy between the renewable energy source and the end-use application.

Asia Pacific accounted for the largest market share in the heat exchanger market, in terms of value.

The heat exchanger sector in the Asia-Pacific region is undergoing significant growth and development. This expansion is fueled by various factors, including the region's booming industrial domains, heightened emphasis on environmental sustainability, and increasing need for clean energy alternatives. Heat exchangers are crucial components in power plants, where they facilitate heat transfer processes in boilers, condensers, steam turbines, and cooling systems. Furthermore, governmental efforts targeting greenhouse gas reduction are driving the uptake of heat exchangers, positioning the Asia-Pacific market as a hub for the advancement and implementation of these innovative technologies.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Some of the key players operating in the heat exchanger market include ALFA LAVAL (Sweden), Kelvion Holding GmbH (Germany), Danfoss (Denmark), Exchanger Industries Limited (Canada), Mersen (France), API Heat Transfer (US), Boyd (US), H. Güntner (UK) Limited (Germany), Johnson Controls (Ireland), Xylem (US), Wabtec Corporation (US), SPX FLOW (US), LU-VE S.p.A. (Italy), Lennox International Inc. (US), and Modine Manufacturing Company (US) among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2020-2029 |

|

Base Year |

2023 |

|

Forecast period |

2024–2029 |

|

Units considered |

Units; Value (USD Million) |

|

Segments |

Material, Type, End-Use Industry, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

ALFA LAVAL (Sweden), Kelvion Holding GmbH (Germany), Danfoss (Denmark), Exchanger Industries Limited (Canada), Mersen (France), API Heat Transfer (US), Boyd (US), H. Güntner (UK) Limited (Germany), Johnson Controls (Ireland), Xylem (US), Wabtec Corporation (US), SPX FLOW (US), LU-VE S.p.A. (Italy), Lennox International Inc. (US), and Modine Manufacturing Company (US). |

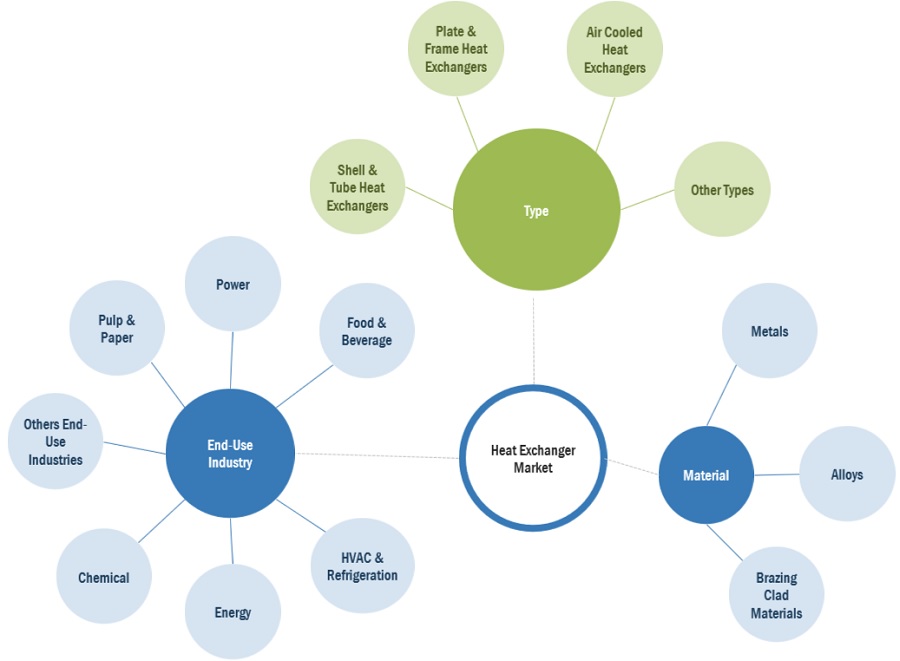

This report categorizes the global heat exchangers market based on material, type, end-use industry, and region.

Based on the material:

-

Metals

-

Steel

- Carbon Steel

- Stainless Steel

- Copper

- Aluminum

- Titanium

- Nickel

- Other Metals

-

Steel

-

Alloys

-

Nickel Alloys

- Hastelloy

- Inconel

- Monel

- Other Nickel Alloys

- Copper Alloys

- Titanium Alloys

- Other Alloys

-

Nickel Alloys

-

Brazing Clad Materials

- Copper Brazing

- Ni Clad Brazing

- Phosphor Copper Brazing

- Silver Brazing

- Other Brazing Clad Materials

Based on the type:

- Shell & Tube

- Plate & Frame

- Air Cooled

- Other Types

Based on the end-use industry:

- Chemical

- Energy

- HVACR

- Food & Beverage

- Power Generation

- Pulp & Paper

- Other End-Use Industries

Based on the region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

These companies have adopted various organic as well as inorganic growth strategies between 2019 and 2023 to strengthen their positions in the market. The new product launch is the key growth strategy adopted by these leading players to enhance regional presence and develop product portfolios to meet the growing demand for heat exchangerfrom emerging economies.

Recent Developments

- In December 2023, ALFA LAVAL partnered with Outokumpu, a global steel manufacturer, to reduce carbon emissions by utilizing Outokumpu's Circle Green stainless steel in the production of Alfa Laval's heat exchangers. This partnership targets a decrease in the carbon footprint associated with Alfa Laval's heat exchangers, which typically consist of up to 80 percent stainless steel, by transitioning from conventional stainless steel to a material with a significantly reduced carbon footprint, amounting to half of its original level.

- In November 2023, Danfoss Heat Exchangers signed an agreement with Danfoss Commercial Compressors to establish an in-house test capability for propane located in the ATEX-certified lab in Trevoux in France. The new propane test facility focuses on testing brazed plate heat exchangers ranging from 10 to 150kW capacity.

- In September 2023, Kelvion Holding GmbH has invested USD 4.3 million to expand its production capacities in Sarstedt to meet the increasing demand for its heat exchangers across diverse end-use sectors. This expansion enables the facility to manufacture an extra 150,000 heat exchangers annually, aligning with the company's strategic goal of expanding its presence in the U.S. market and establishing itself as the preferred partner in the Refrigeration and Data Center Industries.

Frequently Asked Questions (FAQ):

What is the current market size of the global heat exchanger market?

Global heat exchanger market size is estimated to reach USD 32.3 billion by 2029 from USD 23.0 billion in 2023, at a CAGR of 7.0% during the forecast period.

Who are the winners in the global heat exchanger market?

Companies such as include ALFA LAVAL (Sweden), Kelvion Holding GmbH (Germany), Danfoss (Denmark), Exchanger Industries Limited (Canada), Mersen (France), API Heat Transfer (US), Boyd (US), H. Güntner (UK) Limited (Germany), Johnson Controls (Ireland), Xylem (US), Wabtec Corporation (US), SPX FLOW (US), LU-VE S.p.A. (Italy), Lennox International Inc. (US), and Modine Manufacturing Company (US) among others. They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers in the market?

Growing demand for heat pumps in Europe, increasing industrialization in emerging economies, rising energy efficiency regulations and stringent emission standards, growing demand for HVACR equipment for commercial construction industry are some drivers of heat exchanger market.

What are the various material of heat exchanger?

Metals, alloys, and brazing clas materials are various materials of heta exchanger.

What are the end-use industries of heat exchanger?

Chemical, Energy, HVAC & Refrigeration, Food & beverage, Power generation, Pulp & paper are the main end-use industries of heat exchanger. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

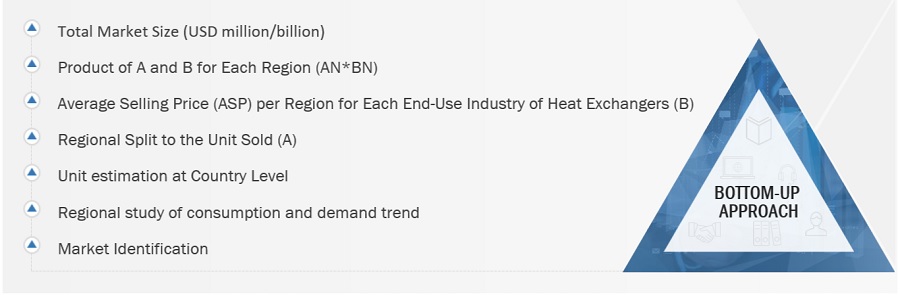

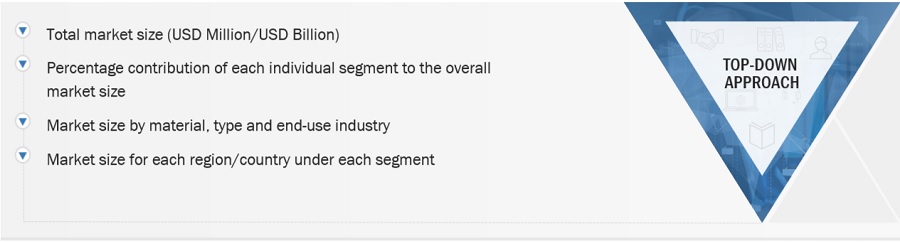

The study involved four major activities in estimating the market size of the heat exchangers market. Exhaustive secondary research was done to collect information on the market, the peer market, and the grandparent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The heat exchangers market comprises several stakeholders in the value chain, which include manufacturers, and end users. Various primary sources from the supply and demand sides of the heat exchangers market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in HVACR sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the heat exchangers industry. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to material, type, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of heat exchangers and outlook of their business, which will affect the overall market.

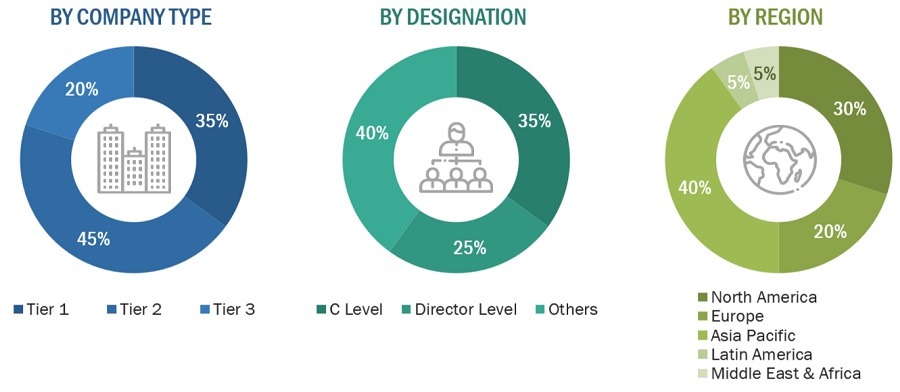

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the heat exchangerss market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Top - Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom - Up Approach-

Data Triangulation

After arriving at the total market size from the estimation process, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Heat exchangers are mechanical devices designed to transfer heat between two or more fluids or between a solid surface and a fluid, without the fluids mixing or coming into direct contact. They facilitate the efficient exchange of thermal energy from one fluid to another, typically to achieve heating, cooling, or temperature control in various industrial, commercial, and residential applications. Heat exchangers come in various types and configurations, including shell-and-tube heat exchangers, plate heat exchangers, finned-tube heat exchangers, spiral heat exchangers, and more. Each type has its own advantages and is chosen based on factors such as the fluid properties, temperature and pressure requirements, space limitations, and efficiency considerations.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Manufacturers

- Raw Material Suppliers

Report Objectives

- To define, describe, and forecast the size of the heat exchangers market, in terms of value and units.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on material, type, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and Impact on Heat exchangers Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Heat Exchanger Market