Hemato Oncology Testing Market by Product & Services (Services, Assay Kits), Cancer (Leukemia (Acute Myeloid, Acute Lymphocytic), Lymphoma (Non-Hodgkin, Hodgkin), Technology (PCR, NGS), End User & Region - Global Forecast to 2027

Market Growth Outlook Summary

The global hemato oncology testing market growth forecasted to transform from $2.9 billion in 2022 to $5.6 billion by 2027, driven by a CAGR of 14.2%. The growth in this market is attributed to the increasing number of the hematologic cancer patients as these patient require the regular monitoring and the diagnostic testing during the treatment. The clinical trials on hematologic cancers have increased in the last few years and the companies are requiring the hemato oncology testing product to preform the diagnostic assays which have certainly increased the collaboration between the companies, the increasing number of the diagnostic centers which provide diagnostic assay and services will drive the growth of the market.

Growth Opportunities Hemato Oncology Testing Market

Hemato Oncology Testing Market Growth Dynamics

Driver: Growing incidence of hematologic cancer

Over the years, the incidence of hematologic cancer has increased significantly. According to the Leukemia & Lymphoma Society, an estimated 1,519,907 people in the US are either living with, or are in remission from, leukemia, lymphoma, or myeloma. These patients require continuous monitoring during treatment. Also, monitoring of minimal residual disease (MRD) has become a routine clinical practice for acute lymphoblastic leukemia. Due to this, physicians prefer drugs combined with companion diagnostics to prevent adverse drug reactions in cancer patients and to reduce mortality rates. This is expected to fuel the demand for hemato-oncology testing products in the market.

The rising geriatric population across the globe is also a key factor supporting the increasing incidence of hematologic cancer, as this population segment is more prone to various chronic diseases. The rising geriatric population and the subsequent increase in the prevalence of hematologic cancers is expected to drive the growth of the hemato-oncology testing market.

Restraint: Unfavorable reimbursement scenario

The hemato-oncology testing market is currently witnessing rapid growth; however, reimbursement challenges in different regions could limit the market growth to a certain extent. Reimbursements for hemato-oncology testing vary widely across regions and countries. Currently, in most countries, regulatory procedures are not well-adapted to the hemato-oncology testing market. The current regulatory systems in these countries were developed for simple diagnostic tests and are not well-suited for novel biomarker-based diagnostics. Obtaining reimbursement is one of the major obstacles to the commercial adoption of hemato-oncology testing. The US government or private agencies do not cover analyte-specific reagents used to identify and quantify markers. As a result, diagnostic companies operating in these markets experience difficulties in seeking reimbursements for tests. The reimbursement levels for diagnostics set by the centers for Medicare and Medicaid Services (CMS) do not adequately reflect their actual cost or clinical value. Thus, the complex and highly diverse reimbursement scenario affects the efficient introduction of precision medicine based on targeted therapies. This often leads to uncertain reimbursement scenarios, consequently restricting the adoption of these tests.

Opportunity: Emerging markets

Emerging markets such as India, China, and Brazil offer significant growth opportunities for players operating in the hemato-oncology testing market owing to the rising geriatric population, growing incidence of hematologic cancers, rising health expenditure per capita, and improving healthcare infrastructure.

Challenge: Intellectual property rights protection issues

Several market players are facing challenges related to the intellectual property rights of their innovative diagnostic tests. Although drugs can be protected by patents, the patenting of biomarkers is still debatable in many countries (biomarker detection is fundamental in companion diagnostics). In cases where an intellectual property has been developed through collaboration between a drug developer and diagnostic developer, the drug developer is interested in controlling the ownership or exclusive licensing of any intellectual property related to the drug product; whereas, the diagnostic developer is interested in controlling the intellectual property related to the diagnostic and the general platform technology. Currently, there are no intellectual property laws related to products developed through such collaborations. In the case of co-ownership of the new product between these entities, issues may arise while licensing the product to third parties. For example, if the drug developer wants to license the diagnostic product to a competitor diagnostic company, the revenues of the diagnostic developer involved in the co-ownership will be affected. In order to avoid such complications, an exclusivity agreement can be signed, although this can also create other obstacles. For instance, after the co-development of a product by the drug developer and diagnostic developer, the diagnostic developer may fail to fulfill the market demand for the product. In such cases, the drug developer will be compelled to find another partner, which will not be allowed by the exclusivity agreement.

In 2021, services segment accounted for the largest share of the hemato oncology testing industry, by product

By products & services type, the global hemato oncology testing market is broadly segmented into services and assay kits. The services segment dominate the global hemato oncology testing market in 2021. The factor supporting the growth of the segment is the increase in the global burden of the disease diagnosis, advancement in diagnostic techniques and procedures and quality and affordability of the diagnostic testing.

In 2021, lymphoma dominated hemato oncology testing market

By cancer type, the hemato oncology testing market is divided into leukemia, lymphoma, and other cancers market. In 2021, the lymphoma segment dominated the global market. Factor such as lower immunity, immune system deficiency, autoimmune diseases and family history and age can cause lymphoma.

In 2021, PCR dominated hemato oncology testing market

By technology, the global hemato oncology testing market is segmented into PCR, IHC, NGS, cytogenetics, and other technologies. In 2021, the PCR segment accounted for the largest share in the hemato oncology testing market. PCR is the most widely used technology in the diagnostic market which the easy use application, cost effective in nature, easy access to the kits and reagents.

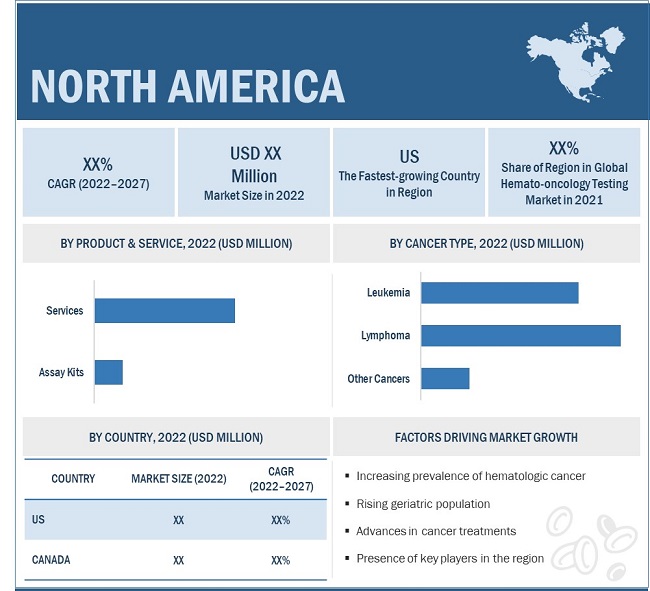

In 2021, North America accounted for the largest share of the hemato oncology testing market

The global hemato oncology testing market is segmented into North America, Europe, Asia Pacific, and ROW. North America dominated hemato oncology testing market. The largest share can be attributed to the increasing number of the leukemia and lymphoma patients, growing awareness of the personalized medicine, increasing number of the owl age population and increasing collaboration for developing new assays kits.

The Hemato oncology testing market is dominated by players such as Abbott Laboratories (US), F. Hoffmann-La Roche (Switzerland), QIAGEN (Germany), Thermo Fisher Scientific (US), and Illumina (US).

Scope of the Hemato Oncology Testing Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$2.9 billion |

|

Projected Revenue Size by 2027 |

$5.6 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 14.2% |

|

Market Driver |

Growing incidence of hematologic cancer |

|

Market Opportunity |

Emerging markets |

This research report categorizes the hemato oncology testing market to forecast revenue and analyze trends in each of the following submarkets

By Product & Service

- Services

- Assay Kits

By Cancer Type

- Introduction

-

Leukemia

- Acute myeloid leukemia

- Acute lymphocytic leukemia

- Other leukemia

-

lymphoma

- Non-Hodgkin Lymphoma

- Hodgkin Lymphoma

- Other cancers

By Technology

- Introduction

- PCR

- IHC

- NGS

- Cytogenetics

- Others Technologies

by End User

- Introduction

- Clinical laboratories

- Hospitals

- Academic & Research Institutes

- Other End Users

By Region

- Introduction

-

North America

- US

- Canada

- Europe

- Asia Pacific

- Rest of the World

Recent Developments of Hemato Oncology Testing Industry:

- In 2022, F. Hoffmann-La Roche Ltd. (Switzerland) received FDA approval for the cobras EZH2 mutation test as a companion diagnostic for patients with follicular lymphoma

- In 2020, F. Hoffmann-La Roche Ltd. (Switzerland) and Illumina Inc. (US) entered into a 15-year non-exclusive partnership with Illumina to broaden the adoption of NGS-based testing in oncology.

- In 2021, QIAGEN N.V. (Germany) and Denovo Biopharma LLC (US) collaborated to develop a blood-based companion diagnostic (CDx) test for treatment of diffuse large B-cell lymphoma (DLBCL), one of the most common lymphoid cancers.

- Illumina, Inc. (US) acquired GRAIL (US) QIAGEN collaborated with DeNovo to develop a blood-based companion diagnostic (CDx) test for treatment of diffuse large B-cell lymphoma (DLBCL), one of the most common lymphoid cancers.

- In 2020, Thermo Fisher Scientific Inc. (US) and First Genetics JCS (Russia) came into a strategic partnership with First Genetics to focus on commercializing NGS-based diagnostics in Russia.

Frequently Asked Questions (FAQs):

What is the size of Hemato Oncology Testing Market?

The global hemato oncology testing market size is projected to reach USD 5.6 billion by 2027, growing at a CAGR of 14.2%.

What are the major growth factors of Hemato Oncology Testing Market?

The growth in this market is attributed to the increasing number of the hematologic cancer patients as these patient require the regular monitoring and the diagnostic testing during the treatment. The clinical trials on hematologic cancers have increased in the last few years and the companies are requiring the hemato oncology testing product to preform the diagnostic assays which have certainly increased the collaboration between the companies, the increasing number of the diagnostic centers which provide diagnostic assay and services will drive the growth of the market.

Who all are the prominent players of Hemato Oncology Testing Market?

The Hemato oncology testing market is dominated by players such as Abbott Laboratories (US), F. Hoffmann-La Roche (Switzerland), QIAGEN (Germany), Thermo Fisher Scientific (US), and Illumina (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the hemato oncology testing market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

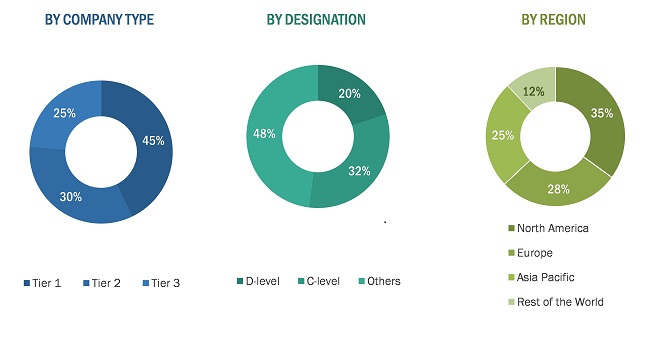

Extensive primary research was conducted after acquiring knowledge about the hemato oncology testing market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such clinical laboratories, hospitals, and academic & research institutes) and supply-side (such as product manufacturers, wholesalers, channel partners, and distributors). Approximately 42% of the primary interviews were conducted with stakeholders from the demand side while those from the supply side accounted for the remaining 58%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

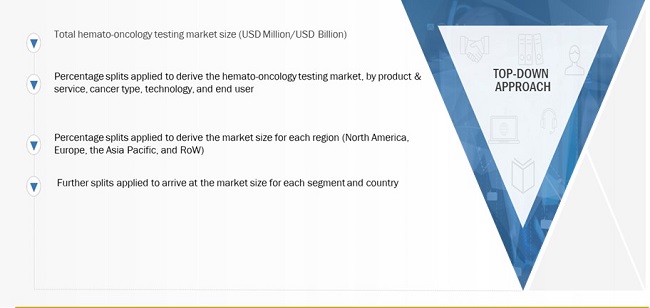

Market Size Estimation

All major product manufacturers offering various hemato oncology testing were identified at the global/regional level. Revenue mapping was done for the major players (who contribute at least 35-40% of the overall market share at the global level) and was extrapolated to arrive at the global market value of each type segment. The market value of hemato oncology testing market was also split into various segments and subsegments at the region and country-level based on:

- Product and services mapping of various manufacturers for each type of hemato oncology testing market at the regional and country-level

- Relative adoption pattern of each hemato oncology testing market among key cancer type segments at the regional and/or country-level

- Relative adoption pattern of each hemato oncology testing market among key technology segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country-level

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the hemato oncology industry.

Report Objectives

- To define, describe, and forecast the hemato oncology testing market based on the product, type, cancer type application, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micro markets with respect to their growth trends, prospects, and contributions to the total market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the revenue of market segments with respect to five regions, namely, North America (US and Canada), Europe, Asia Pacific and ROW.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as collaborations, partnerships, acquisitions, expansions, and product launches in the hemato oncology testing market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global Hemato Oncology Testing Market report:

- Company Information: Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hemato Oncology Testing Market