Hollow Fiber Filtration Market Size, Share & Trends by Material (Polymer (PES, PVDF), Ceramic), Technique (Microfiltration, Ultrafiltration), Application (Harvest & Clarification, Concentration, Diafiltration), End User (Pharma, Biotech, CRO, CMO) & Region - Global Forecast to 2026

Hollow Fiber Filtration Market Size, Share & Trends

The size of global hollow fiber filtration market in terms of revenue was estimated to be worth $303 million in 2021 and is poised to reach $597 million by 2026, growing at a CAGR of 14.5% from 2021 to 2026. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

The growth of the global market is driven by factors such as the rising preference for continuous manufacturing, the increasing use of single-use technologies, and the rising biopharmaceutical industry. In addition, emerging economies and increased investment in cell-based research are expected to provide significant growth opportunities for players in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Hollow Fiber Filtration Market Dynamics

Driver: Growth in the biopharmaceutical industry

Many companies are investing heavily in the development of biologics and biosimilars. More than half of the drug candidates in the discovery stage are biologics, such as proteins, peptides, and monoclonal antibodies. Biologics are expected to contribute around half of the revenue generated by the top 100 pharmaceutical products in the coming years.

In 2019, the US FDA approved 48 new drugs and biologics. Growing investments by biopharmaceutical companies to develop biologics and biosimilars are further expected to increase the number of approved products worldwide and increase the manufacturing of biopharmaceutical drugs. Although small-molecule drugs dominate the global pharmaceutical market, the share of biologics, biosimilars, and large-molecule drugs is growing due to the launch of new biologics-based drugs and increased revenues from existing biologics. In the bioprocessing industry, filtration is an essential step as a standard unit operation or with other unit operations for separation, isolation, and purification of the biotherapeutics. It is also extremely important for recombinant proteins, vaccines, gene therapy, and cell therapy products. To cater to the rising demand for biopharmaceuticals, companies are focusing on implementing advanced bioprocessing systems throughout the process, including filtration systems such as perfusion systems that utilize hollow fiber filters. The demand for these systems is increasing among biopharmaceutical companies as these systems help decrease the costs associated with complicated steps, increase productivity, and help in adherence to GMP and FDA guidelines for filtration.

Thus, the growth in the biopharmaceutical industry is expected to boost the growth of the market.

Opportunity: Emerging economies

China, India, and Brazil are expected to offer major growth opportunities for the hollow fiber filtration market players. China is estimated to be a high-growth market for bioprocessing products due to the country's growing government support and private investments. Companies in China are increasingly making biologics-related investments and hiring a skilled workforce for their operations. Also, R&D investments in markets such as India and Brazil have increased significantly over the last few years. Key players are establishing new facilities, R&D centers, and innovation centers in these emerging countries to capitalize on the available growth opportunities. For instance, in April 2021, Chime Biologics raised another USD 65 million to help build and kit out a second plant in Wuhan, China. The new plant will join Chime's first facility, built around a modular manufacturing system from Cytiva Life Sciences. Similarly, in January 2021, Lonza (Switzerland) opened its first manufacturing site for biologics in China. Lonza will combine Cytiva's KUBio modular facility and single-use equipment with supporting its Good Manufacturing Practice (GMP) manufacturing integrated with its platforms and expertise in development, including cell line construction and process development.

Despite the undermined global economy, the Indian pharmaceutical industry is experiencing unprecedented growth. The Indian government has laid out the Pharma Vision 2020 document for making India one of the leading destinations for drug discovery and innovation. The Indian biologics market is expected to reach USD 12 billion by 2025, at a CAGR of 22% from 2019 to 2025 (Source: IBEF). India has also become a leading destination for clinical trials, contract research, and manufacturing biologics and pharmaceutical drug products.

Thus, the growing biomanufacturing facility in these countries will provide lucrative growth opportunities for the market.

Challenge: Membrane fouling and fiber breakage

Irreversible fouling and fiber breakage are the main problems concerning hollow fiber filtration. Conductive membranes have the potential to mitigate fouling through the induction of Rayleigh-Bénard convection, gas evolution, electrochemical oxidation, or electrostatic repulsion of foulants. These membranes are usually prepared with conductive polymers and particles or a blend of conductive particles and a conventional polymer. The fouling can be assumed to be due to internal fouling by protein and/or external fouling by a residual.

Due to the flexibility of the fibers, these filters are more likely to break when under high strain compared to other filtration methods such as tubular or spiral-wound elements. Hollow fiber membranes tend to have moderate capital costs, but high operating costs compared to other configurations. High price and membrane fouling issues challenge the greater adoption of hollow fiber filters in biopharmaceutical filtration processes.

By material segment, the polymeric segment accounted for the largest share of the hollow fiber filtration industry in 2020.

Based on material, the hollow fiber filtration market is segmented into polymeric and ceramic filters. The polymeric segment is further sub segmented into polysulfide/polyethersulfone (PS/PES), polyvinylidene fluoride (PVDF), and other polymeric materials (cellulose & cellulose acetate, mixed cellulose ester, and polypropylene). In 2020, the polymeric segment accounted for the largest market share of the market. The large share of this segment is primarily attributed to the hydrophilic nature of PES/PS, low protein-binding properties, and its wide range of applications.

By application, the continuous cell perfusion segment accounted for the largest share of the hollow fiber filtration industry in 2020.

Based on application type, the hollow fiber filtration market is segmented into continuous cell perfusion, harvest and clarification, and concentration and diafiltration. In 2020, continuous cell perfusion accounted for the largest market share due to the advantages of hollow fibers in continuous cell perfusion, such as enabling efficient cell separation (with low shear) and allowing robust large-scale manufacturing.

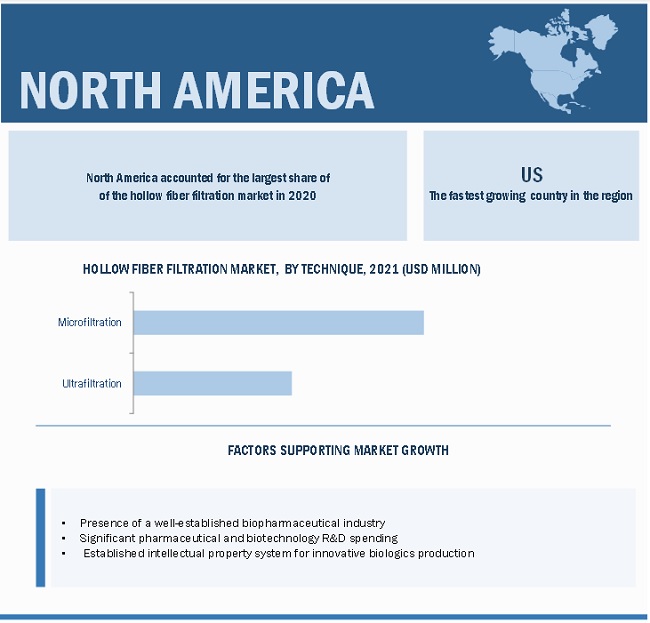

By technique, the microfiltration segment accounted for the largest market share of the hollow fiber filtration industry in 2020.

Based on technique, the hollow fiber filtration market is segmented into microfiltration and ultrafiltration. In 2020, the microfiltration segment accounted for the largest share of the global market due to the availability of a wide range of pore sizes which have vast applications such as separation of a virus, bacteria, aerosols, and innumerable macromolecules from fluids, without the requirement of autoclaving a procedure.

By end users, the pharmaceutical and biotechnology manufacturers accounted for the largest market share of the hollow fiber filtration industry in 2020.

Based on end users, the hollow fiber filtration market is segmented into pharmaceutical and biotechnology manufacturers, contract research organizations (CROs) & contract manufacturing organizations (CMOs), and other end users. In 2020, the pharmaceutical and biotechnology manufacturers segment accounted for the largest share of the market. The large share of this segment is attributed to the increasing demand for hollow fiber filters in ultrafiltration, diafiltration, and microfiltration processes in biopharmaceutical manufacturing and the growing adoption of continuous manufacturing processes (due to advantages such as improved manufacturing process efficiency and flexibility).

North America accounted for the largest share of the hollow fiber filtration industry in 2020.

North America accounted for the largest share of the hollow fiber filtration market in 2020. This region's large share can be attributed to North American companies focusing primarily on new products such as perfusion systems, the convenience and cost-efficiency of hollow fibre filters, and the rising demand for filtration systems for the biopharmaceuticals industry.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in the hollow fiber filtration market are Repligen Corporation (US), Danaher (US), Asahi Kasei Corporation (Japan), Parker-Hannifin Corp (US), Sartorius Stedim Biotech S.A (France), TOYOBO CO., LTD (Japan), and Cantel Medical (US). The key players in this market are focusing on strategic expansions, and acquisition to expand their presence in the market.

Scope of the Hollow Fiber Filtration Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$303 million |

|

Projected Revenue Size by 2026 |

$597 million |

|

Industry Growth Rate |

Poised to grow at a CAGR of 14.5% |

|

Market Driver |

Growth in the biopharmaceutical industry |

|

Market Opportunity |

Emerging economies |

The study categorizes the hollow fiber filtration market to forecast revenue and analyze trends in each of the following submarkets:

By Material

- Polymeric

- PS/PES

- Polyvinylidene fluoride (PVDF)

- Other polymeric materials

- Ceramic

By Application

- Continuous Cell Perfusion

- Harvest and Clarification

- Concentration and Diafiltration

By Technique

-

Microfiltration

- <0.2 Micron Meter

- >0.2 Micron Meter and <0.7 Micron Meter

-

Ultrafiltration

- >50,000 kDa

- >10,000 kDa and <50,000 kDa

- <10,000 kDa

By End User

- Pharmaceutical and Biotechnology Manufacturers

- Contract Research Organization and Contract Manufacturing Organization (CROs & CMOs)

- Other end users

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- The Middle East and Africa

Recent Developments of Hollow Fiber Filtration Industry:

- In 2020, Sartorius Stedim Biotech (France) acquired WaterSep BioSeparations to expand its product offerings in the market.

- In 2020, Repligen Corporation (US) acquired ARTeSYN Biosolutions. This acquisition helped expand the company’s offerings in the market.

- In 2020, Repligen Corporation (US) acquired Engineered Molding Technology. This acquisition expanded Repligen’s line of single-use filtration products and gave the company more flexibility to scale and expand its single-use systems portfolio in the market.

- In 2020 Danaher (US) acquired the Biopharma business from GE Company’s Life Sciences division. This business is known as Cytiva and acts as a standalone operating company within Danaher’s Life Sciences segment. This acquisition strengthened Danaher’s position in the market.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global hollow fiber filtration market?

The global hollow fiber filtration market boasts a total revenue value of $597 million by 2026.

What is the estimated growth rate (CAGR) of the global hollow fiber filtration market?

The global hollow fiber filtration market has an estimated compound annual growth rate (CAGR) of 14.5% and a revenue size in the region of $303 million in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 MARKET, BY MATERIAL: INCLUSIONS & EXCLUSIONS

TABLE 2 MARKET, BY TECHNIQUE: INCLUSIONS & EXCLUSIONS

TABLE 3 MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

TABLE 4 MARKET, BY END USERS: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

FIGURE 3 MARKET: BREAKDOWN OF PRIMARIES

2.1.2.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS, 2020

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL HOLLOW FIBER FILTRATION PRODUCTS

FIGURE 6 MARKET: CAGR PROJECTIONS, 2021–2026

FIGURE 7 MARKET: GROWTH ANALYSIS OF DRIVERS, OPPORTUNITIES, AND CHALLENGES

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH LIMITATION

2.5 RESEARCH ASSUMPTIONS

2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 9 MARKET, BY MATERIAL, 2021 VS. 2026 (USD MILLION)

FIGURE 10 MARKET SHARE, BY APPLICATION, 2020

FIGURE 11 MARKET, BY END USER, 2021−2026

FIGURE 12 GEOGRAPHICAL SNAPSHOT OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 HOLLOW FIBER FILTRATION OVERVIEW

FIGURE 13 GROWTH IN THE BIOPHARMACEUTICAL INDUSTRY IS A KEY FACTOR EXPECTED TO DRIVE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 ASIA PACIFIC: HOLLOW FIBER FILTRATION, BY APPLICATION & COUNTRY (2020)

FIGURE 14 CONTINUOUS CELL PERFUSION ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2020

4.3 HOLLOW FIBER FILTRATION MATERIAL FOR POLYMER MATERIAL, BY TYPE

FIGURE 15 THE POLYSULFONE /POLYETHERSULFONE SEGMENT IS PROJECTED TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

5.2.1 MARKET DRIVERS

5.2.1.1 Growth in the biopharmaceutical industry

TABLE 5 INDICATIVE LIST OF BIOLOGICAL LICENSE APPLICATION APPROVALS, 2020 AND 2021

5.2.1.2 Increasing preference for continuous manufacturing

5.2.1.3 Increasing usage of single-use technologies

5.2.2 MARKET OPPORTUNITIES

5.2.2.1 Emerging economies

5.2.2.2 Increasing investments in cell-based research

5.2.3 MARKET CHALLENGES

5.2.3.1 Membrane fouling and fiber breakage

5.3 RANGES/ SCENARIOS

FIGURE 17 DEPENDING ON HOW THE UNCERTAINTIES UNFOLD, WE SEE A SPECTRUM OF SCENARIOS FOR THE MARKET - 2020

5.4 IMPACT OF COVID-19 ON THE MARKET

5.5 TECHNOLOGY ANALYSIS

5.6 ECOSYSTEM ANALYSIS OF MARKET

FIGURE 18 ECOSYSTEM ANALYSIS OF THE MARKET

TABLE 6 MARKET: ECOSYSTEM

5.7 PATENT ANALYSIS

5.7.1 LIST OF MAJOR PATENTS

FIGURE 19 NUMBER OF PATENTS GRANTED IN THE LAST 20 YEARS

TABLE 7 TOP 10 GRANTED PATENT OWNERS (US) IN THE LAST 20 YEARS

FIGURE 20 TOP 10 PLAYERS WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

5.8 YC, YCC SHIFT

FIGURE 21 YC-YCC SHIFT FOR THE MARKET

5.9 REGULATORY ANALYSIS

5.9.1 UNITED STATES PHARMACOPOEIA (USP) CLASS VI

5.9.2 CURRENT GOOD MANUFACTURING PRACTICE

5.10 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN ANALYSIS OF THE MARKET

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

6 MARKET, BY MATERIAL (Page No. - 62)

6.1 INTRODUCTION

TABLE 9 MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

6.2 POLYMERIC

TABLE 10 POLYMERIC MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 11 NORTH AMERICA: POLYMERIC MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 12 EUROPE: POLYMERIC MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 13 ASIA PACIFIC: POLYMERIC MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 14 POLYMERIC MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.2.1 PS/PES

6.2.1.1 High reliability and wide applications of PS/PES for biological & pharmaceutical solutions

TABLE 15 MARKET FOR PS/PES, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 NORTH AMERICA: MARKET FOR PS/PES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 17 EUROPE: MARKET FOR PS/PES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 18 ASIA PACIFIC: MARKET FOR PS/PES, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.2 POLYVINYLIDENE FLUORIDE (PVDF)

6.2.2.1 Usage in protein purification and cell separation has ensured a steady demand for PVDF material membranes

TABLE 19 MARKET FOR PVDF, BY REGION, 2019–2026 (USD MILLION)

TABLE 20 NORTH AMERICA: MARKET FOR PVDF, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 21 EUROPE: MARKET FOR PVDF, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 22 ASIA PACIFIC: MARKET FOR PVDF, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.3 OTHER POLYMERIC MATERIALS

TABLE 23 MARKET FOR OTHER POLYMERIC MATERIALS, BY REGION, 2019–2026 (USD MILLION)

TABLE 24 NORTH AMERICA: MARKET FOR OTHER POLYMERIC MATERIALS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 25 EUROPE: MARKET FOR OTHER POLYMERIC MATERIALS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 26 ASIA PACIFIC: MARKET FOR OTHER POLYMERIC MATERIALS, BY COUNTRY, 2019–2026 (USD MILLION)

6.3 CERAMIC

6.3.1 THE BIO-INERT NATURE OF CERAMICS MAKES THEM IDEAL FOR PROTEIN FILTRATION

TABLE 27 CERAMIC MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 NORTH AMERICA: CERAMIC MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 29 EUROPE: CERAMIC MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 30 ASIA PACIFIC: CERAMIC MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7 MARKET, BY APPLICATION (Page No. - 72)

7.1 INTRODUCTION

TABLE 31 MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 CONTINUOUS CELL PERFUSION

7.2.1 INCREASING ADOPTION OF HOLLOW FIBER CARTRIDGES IN CONTINUOUS PERFUSION CULTURE TO DRIVE THE MARKET GROWTH

TABLE 32 MARKET FOR CONTINUOUS CELL PERFUSION, BY REGION, 2019–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET FOR CONTINUOUS CELL PERFUSION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 34 EUROPE: MARKET FOR CONTINUOUS CELL PERFUSION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 35 ASIA PACIFIC: MARKET FOR CONTINUOUS CELL PERFUSION, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 HARVEST AND CLARIFICATION

7.3.1 THE INCREASING ADOPTION OF HOLLOW FIBER FILTRATION FOR VACCINE DEVELOPMENT DRIVES THE GROWTH OF THIS SEGMENT

TABLE 36 MARKET FOR HARVEST AND CLARIFICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET FOR HARVEST AND CLARIFICATION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 38 EUROPE: MARKET FOR HARVEST AND CLARIFICATION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 39 ASIA PACIFIC: MARKET FOR HARVEST AND CLARIFICATION, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 CONCENTRATION AND DIAFILTRATION

7.4.1 HOLLOW FIBER DIAFILTRATION DEVICES CAN BE DIRECTLY SCALED UP FROM R&D VOLUMES TO PRODUCTION EFFICIENTLY

TABLE 40 MARKET FOR CONCENTRATION AND DIAFILTRATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET FOR CONCENTRATION AND DIAFILTRATION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 42 EUROPE: MARKET FOR CONCENTRATION AND DIAFILTRATION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 43 ASIA PACIFIC: MARKET FOR CONCENTRATION AND DIAFILTRATION, BY COUNTRY, 2019–2026 (USD MILLION)

8 MARKET, BY TECHNIQUE (Page No. - 79)

8.1 INTRODUCTION

TABLE 44 MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

8.2 MICROFILTRATION

8.2.1 INCREASING ADOPTION OF MICROFILTRATION TECHNIQUES IN THE CLARIFICATION AND SEPARATION OF CELL DEBRIS TO DRIVE THE MARKET GROWTH

TABLE 45 MARKET FOR MICROFILTRATION, BY PORE SIZE, 2019–2026 (USD MILLION)

TABLE 46 MARKET FOR MICROFILTRATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET FOR MICROFILTRATION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 48 EUROPE: MARKET FOR MICROFILTRATION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 49 ASIA PACIFIC: MARKET FOR MICROFILTRATION, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 ULTRAFILTRATION

8.3.1 ULTRAFILTRATION HAS WIDE APPLICATIONS IN DOWNSTREAM PROCESSING

TABLE 50 MARKET FOR ULTRAFILTRATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 51 MARKET FOR ULTRAFILTRATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET FOR ULTRAFILTRATION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 53 EUROPE: MARKET FOR MICROFILTRATION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET FOR ULTRAFILTRATION, BY COUNTRY, 2019–2026 (USD MILLION)

9 MARKET, BY END USER (Page No. - 85)

9.1 INTRODUCTION

TABLE 55 MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2 PHARMACEUTICAL AND BIOTECHNOLOGY MANUFACTURERS

9.2.1 INCREASING ADOPTION OF CONTINUOUS MANUFACTURING TO DRIVE THE DEMAND FOR HOLLOW FIBER FILTERS BY PHARMACEUTICAL & BIOTECHNOLOGY MANUFACTURERS

TABLE 56 MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY MANUFACTURERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY MANUFACTURERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 58 EUROPE: MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY MANUFACTURERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY MANUFACTURERS, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 CONTRACT RESEARCH ORGANIZATIONS & CONTRACT MANUFACTURING ORGANIZATIONS (CROS & CMOS)

9.3.1 GROWING OUTSOURCING OF R&D AND MANUFACTURING OF BIOPHARMACEUTICALS TO CROS AND CMOS TO SUPPORT MARKET GROWTH

TABLE 60 MARKET FOR CROS & CMOS, BY REGION, 2019–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET FOR CROS & CMOS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 62 EUROPE: MARKET FOR CROS & CMOS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET FOR CROS & CMOS, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 OTHER END USERS

TABLE 64 MARKET FOR OTHER END USERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 66 EUROPE: MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

10 MARKET, BY REGION (Page No. - 92)

10.1 INTRODUCTION

TABLE 68 MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 23 NORTH AMERICA: MARKET SNAPSHOT

TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 The US is expected to dominate the North American MARKET during the forecast period

TABLE 75 US: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 76 US: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 77 US: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 78 US: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 79 US: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Availability of funding by the government will support market growth in Canada

TABLE 80 CANADA: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 81 CANADA: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 CANADA: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 83 CANADA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 84 CANADA: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 85 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 87 EUROPE: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Increasing investments in biologics to drive the market growth for hollow fiber filters in Germany

TABLE 91 GERMANY: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 92 GERMANY: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 GERMANY: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 94 GERMANY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 95 GERMANY: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 The presence of leading research institutes and benefits granted by the government to drive the market growth in the UK

TABLE 96 UK: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 97 UK: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 UK: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 99 UK: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 100 UK: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Increasing public research funding by the government to boost the growth of the biopharmaceutical industry in France

TABLE 101 FRANCE: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 102 FRANCE: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 FRANCE: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 104 FRANCE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 105 FRANCE: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Increasing pharmaceutical production to drive the market growth for hollow fiber filtration in Italy

TABLE 106 ITALY: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 107 ITALY: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 ITALY: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 109 ITALY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 110 ITALY: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Expansion of biopharmaceutical manufacturing facilities in Spain to support the market growth of hollow fiber filtration

TABLE 111 SPAIN: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 112 SPAIN: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 SPAIN: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 114 SPAIN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 115 SPAIN: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE (ROE)

TABLE 116 ROE: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 117 ROE: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 ROE: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 119 ROE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 120 ROE: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 24 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 121 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Rising government support for drug development to support the market growth in China

TABLE 127 CHINA: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 128 CHINA: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 CHINA: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 130 CHINA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 131 CHINA: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Investments by market players for research and development to drive the market growth for hollow fiber filters in Japan

TABLE 132 JAPAN: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 133 JAPAN: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 JAPAN: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 135 JAPAN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 136 JAPAN: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Increasing growth of the pharmaceutical industry in India to support the market growth

TABLE 137 INDIA: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 138 INDIA: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 139 INDIA: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 140 INDIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 141 INDIA: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 142 ROAPAC: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 143 ROAPAC: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 ROAPAC: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 145 ROAPAC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 146 ROAPAC: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 INVESTMENTS FOR THE GROWING BIOPHARMACEUTICAL INDUSTRY IN THE REGION TO BOOST MARKET GROWTH

TABLE 147 LATAM: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 148 LATAM: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 149 LATAM: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 150 LATAM: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 151 LATAM: MARKET, BY END USERS, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA (MEA)

10.6.1 FOCUS ON BIOLOGICS DEVELOPMENT TO SUPPORT MARKET GROWTH IN THIS REGION

TABLE 152 MEA: MARKET, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 153 MEA: MARKET FOR POLYMERIC MATERIAL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 MEA: MARKET, BY TECHNIQUE, 2019–2026 (USD MILLION)

TABLE 155 MEA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 156 MEA: MARKET, BY END USERS, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 132)

11.1 RIGHT-TO-WIN APPROACH ADOPTED BY KEY MARKET PLAYERS

FIGURE 25 OVERVIEW OF STRATEGIES ADOPTED BY KEY HOLLOW FIBER FILTRATION PLAYERS

11.2 MARKET SHARE ANALYSIS

FIGURE 26 MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS, 2020

TABLE 157 MARKET: DEGREE OF COMPETITION

11.3 COMPETITIVE LEADERSHIP MAPPING

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE PLAYERS

11.3.4 PARTICIPANTS

FIGURE 27 MARKET: COMPANY EVALUATION MATRIX (2020)

11.4 COMPETITIVE BENCHMARKING

11.4.1 COMPANY PRODUCT FOOTPRINT (18 COMPANIES)

TABLE 158 COMPANY INDUSTRY FOOTPRINT (18 COMPANIES)

TABLE 159 COMPANY REGION FOOTPRINT (18 COMPANIES)

11.5 GROWTH STRATEGIES ADOPTED BY MAJOR AND EMERGING PLAYERS

TABLE 160 MARKET: KEY DEALS (JANUARY 2018 TO JUNE 2021)

TABLE 161 MARKET: OTHER DEVELOPMENTS (JANUARY 2018 TO JUNE 2021)

12 COMPANY PROFILES (Page No. - 141)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 REPLIGEN CORPORATION

TABLE 162 REPLIGEN CORPORATION: BUSINESS OVERVIEW

FIGURE 28 REPLIGEN CORPORATION: COMPANY SNAPSHOT (2020)

TABLE 163 REPLIGEN CORPORATION: PRODUCT OFFERINGS

12.2 DANAHER

TABLE 164 DANAHER: BUSINESS OVERVIEW

FIGURE 29 DANAHER: COMPANY SNAPSHOT (2020)

TABLE 165 DANAHER: PRODUCT OFFERINGS

12.3 ASAHI KASEI CORPORATION

TABLE 166 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

FIGURE 30 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT (2020)

TABLE 167 ASAHI KASEI CORPORATION: PRODUCT OFFERINGS

12.4 PARKER HANNIFIN CORP

TABLE 168 PARKER HANNIFIN CORP: BUSINESS OVERVIEW

FIGURE 31 PARKER HANNIFIN CORP: COMPANY SNAPSHOT (2020)

TABLE 169 PARKER HANNIFIN CORP: PRODUCT OFFERINGS

12.5 SARTORIUS STEDIM BIOTECH S.A.

TABLE 170 SARTORIUS STEDIM BIOTECH: BUSINESS OVERVIEW

FIGURE 32 SARTORIUS STEDIM BIOTECH: COMPANY SNAPSHOT (2020)

12.6 TOYOBO CO., LTD.

TABLE 172 TOYOBO CO. LTD.: BUSINESS OVERVIEW

FIGURE 33 TOYOBO CO. LTD.: COMPANY SNAPSHOT (2020)

TABLE 173 TOYOBO CO. LTD.: PRODUCT OFFERINGS

12.7 CANTEL MEDICAL

TABLE 174 CANTEL MEDICAL: BUSINESS OVERVIEW

FIGURE 34 CANTEL MEDICAL: COMPANY SNAPSHOT (2020)

TABLE 175 CANTEL MEDICAL: PRODUCT OFFERINGS

12.8 KURARAY CO. LTD.

TABLE 176 KURARAY CO. LTD.: BUSINESS OVERVIEW

FIGURE 35 KURARAY CO. LTD.: COMPANY SNAPSHOT (2020)

TABLE 177 KURARAY CO. LTD.: PRODUCT OFFERINGS

12.9 KOCH INDUSTRIES, INC.

TABLE 178 KOCH INDUSTRIES, INC.: BUSINESS OVERVIEW

TABLE 179 KOCH INDUSTRIES: PRODUCT OFFERINGS

12.10 MANN+HUMMEL HOLDING GMBH

TABLE 180 MANN+HUMMEL: BUSINESS OVERVIEW

TABLE 181 MANN+HUMMEL HOLDING GMBH: PRODUCT OFFERINGS

12.11 COORSTEK INC.

TABLE 182 COORSTEK INC.: BUSINESS OVERVIEW

TABLE 183 COORSTEK INC.: PRODUCT OFFERINGS

12.12 ALPHA PLAN GMBH.

TABLE 184 ALPHA PLAN GMBH: BUSINESS OVERVIEW

TABLE 185 ALPHA PLAN GMBH: PRODUCT OFFERINGS

12.13 ANTYLIA SCIENTIFIC

TABLE 186 ANTYLIA SCIENTIFIC: BUSINESS OVERVIEW

TABLE 187 ANTYLIA SCIENTIFIC: PRODUCT OFFERINGS

12.14 MEISSNER FILTRATION PRODUCTS, INC

TABLE 188 MEISSNER FILTRATION PRODUCTS, INC: BUSINESS OVERVIEW

TABLE 189 MEISSNER FILTRATION PRODUCT, INC: PRODUCT OFFERINGS

12.15 MMS MEMBRANE SYSTEMS

TABLE 190 MMS MEMBRANE SYSTEMS: BUSINESS OVERVIEW

TABLE 191 MMS MEMBRANE SYSTEMS: PRODUCT OFFERINGS

12.16 BIOZEEN PVT. LTD.

TABLE 192 BIOZEEN: COMPANY OVERVIEW

12.17 BIOTREE

TABLE 193 BIOTREE: COMPANY OVERVIEW

12.18 APAH TECHNOLOGIES

TABLE 194 APAH TECHNOLOGIES: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 178)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

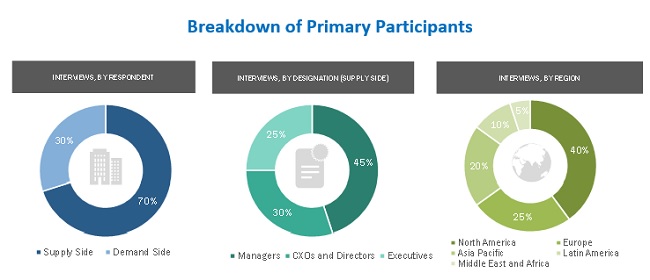

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the global hollow fiber filtration market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study included publications from government sources such as the World Health Organization (WHO), American Filtration and Separations Society (AFS), American Membrane Technology Associations (AMTA), European Membrane Society (EMS), National Institutes of Health (NIH), National Institute for Bioprocessing Research and Training (NIBRT), Bio-Process Systems Alliance (BPSA), National Center for Biotechnology Information (NCBI), US Food and Drug Administration (US FDA), Factiva, BioProcess International Magazine, BioPharm International, BioPlan Associates, ScienceDirect.

Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall size of the global market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (such as personnel from research centers, government and academic institutes, and pharmaceutical & biopharmaceutical companies) and supply sides (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners) across five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Approximately 80% and 20% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall size of the hollow fiber filtration market through the methodology mentioned above, this market was split into several segments and subsegments. Market breakdown procedures were employed, wherever applicable, to arrive at the exact market value for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand and supply-side participants.

Report Objectives

- To define, describe, and forecast the hollow fiber filtration market on the basis of material, application, technique, end user, and region

- To provide detailed information regarding the factors influencing the market growth (such as drivers, opportunities, restraints, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile the key players in the global market and comprehensively analyze their core competencies2 and market rankings

- To forecast the size of the market segments in North America, Europe, the Asia Pacific (APAC), Latin America, and the Middle East and Africa

- To track and analyze competitive developments such as product launches, product approvals, expansions, acquisitions, partnerships, collaborations, and agreements in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Geographical Analysis

- Further breakdown of the European hollow fiber filtration market into RoE countries

- Further breakdown of the Asia Pacific hollow fiber filtration market into RoAPAC countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hollow Fiber Filtration Market