Membrane Filtration Market by Application (Dairy Products, Drinks & Concentrates, Wine & Beer), Module Design (Spiral Wound, Tubular Systems, Plate & Frame and Hollow Fiber), Membrane Material, Type and Region - Global Forecast to 2028

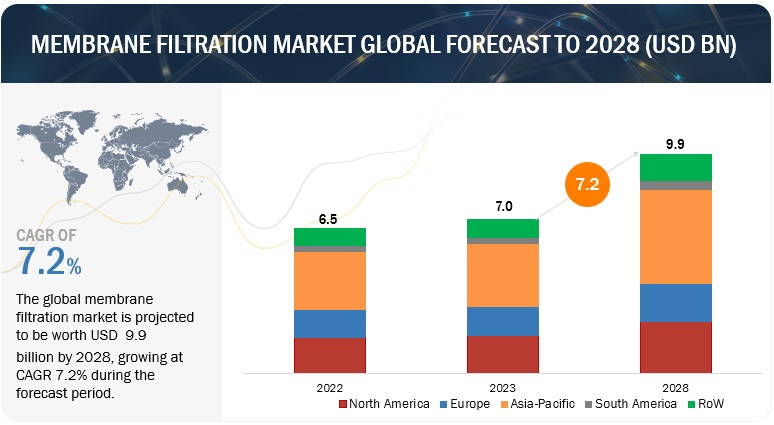

[424 Pages Report] The membrane filtration market is estimated to be valued at USD 7.0 billion in 2023 and is projected to reach USD 9.9 billion by 2028, at a CAGR of 7.2% from 2023 to 2028.

The membrane filtering industry is seeing tremendous growth, notably in the dairy, food and beverage, and wine and beer industries. This increased interest can be due to a variety of things. Membrane filtration is increasingly being used in the dairy industry to improve the quality and shelf life of dairy products such as milk, cheese, and yogurt while also removing contaminants and germs. Similarly, in the food and beverage industry, membrane filtration is critical for maintaining the freshness and flavor of items such as juices, sauces, and soups by separating solids and pollutants.

This technique is being adopted in the wine and beer industries to produce more clarity, uniformity, and quality in the finished goods, enhancing both flavor and aesthetic appeal. As customer demand for high-quality, safe, and minimally processed food and drinks rises, membrane filtration is positioned to remain a critical solution, propelling continued growth in these industries.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Rising demand for premium products

The demand for membrane filtration technologies in food & beverage applications has grown significantly in recent years, owing to its major function of removing harmful microorganisms. Currently, food & beverage manufacturers are increasingly adopting proactive food safety technologies due to the continuous rise in the demand for high-quality, safe, and value-added food products across the world. Membrane technologies are widely used in the food industry because they combine the functions of separation, concentration, purification, and refining as well as the characteristics of high efficiency, energy savings, and environmental protection. Dairy products, soy products, fruit and vegetable juices, the brewing and sugar industries, purification and concentration of enzyme preparations, the concentration of egg whites, and the separation and concentration of food additives such as natural colors and spices are only a few of the major applications.

The food & beverage industry has its own set of trends, processes, and technologies. According to an article published in Filtration+Separation, the growing trend of organic farming and food production has raised issues about food safety; artificial sweeteners continue to pose a threat to the sugar industry and increased awareness of sustainability has also had an impact on the food & beverage industry as more consumers try to minimize their carbon footprints by selecting foods with low "food miles." Food production is also impacted by the disposal of food waste and surplus product packaging intended to keep products fresh. If the appropriate technologies are used, filtration technologies can filter, separate, concentrate, and clarify liquid solutions in addition to complying with regulations.

Wine and beer both go through the processes of clarification and fine filtration. Cold stabilization and sterile membrane filtration are two sterilization techniques used in beer production. Filtration is used in the production of soda to control microorganisms, clarify ingredients and the finished product, and filter and dechlorinate water. Compared to the traditional methods of producing food and beverages, filtration has several benefits. Cold stabilization in the manufacturing of beer is an affordable and effective substitute for flash pasteurization. By utilizing filtration technologies, wine producers can optimize the wine production process and produce high-quality wines in less time.

Filtration technologies used in wine production include:

Clarifying or trap filtration: Removes dirt and other foreign objects from wine while also "polishing" it.

Fine filtration: Removes yeast and is frequently used as a pre-sterilization step.

Filtration using sterile membranes: Removes spoilage organisms.

Standardization of milk by UF technology regulates the protein content without the need for adding milk powders, casein, and whey protein concentrates. This improves the appearance and viscosity of milk. This technique is also used in improving the quality of ice cream, yogurt, and cottage cheese. Milk protein concentrates (MPC), with 50–58% protein, are processed through UF and MF, which are used as food additives. Value-added protein ingredients can be achieved by fractionating milk proteins using membrane technology. MF membranes in beer clarification aid in beer yields by separating yeast and microorganisms efficiently without modifying the taste. Applying RO removes 50% of the water from fruit juices before evaporation to produce fruit juice concentrates. This aids in the better retention of sugars, acids, and volatile flavors compared to traditional methods. The production of other functional ingredients such as concentrated whole eggs, chicken blood plasma, and the extraction of vegetable oils also drives the market for membrane filtration in the food industry.

Restraints: High setup costs

Membrane filtration is very effective in terms of purification and reducing the overall operation cost. However, the setup cost for membrane filtration equipment is substantially high, which is expected to be a major challenge during the review period.

Additionally, a process known as fouling affects practically all membrane filtration systems. One of the most common issues that membrane filtration end users deal with is membrane fouling. Fouling can decrease production levels, increase energy consumption, and damage equipment in membrane filtration systems, particularly in microfiltration (MF), ultrafiltration (UF), reverse osmosis (RO), and nanofiltration (NF). All these factors can result in unnecessary expenses for the business. The corrective actions required to maintain the functionality of membranes can be altered even slightly by changes in operating procedures, stream composition, pH, and temperature, among other factors. This makes treating and identifying problems very challenging.

Membrane fouling happens when impurities are left on a filtration membrane's surface, obstructing the flow of liquids through the membrane's pores. Fouling can be caused by several things, including excess metals, biological, colloidal, and/or organic particles in the source water; an incorrect choice of membrane material; unsuitable flow rate, temperature, and pressure; and/or one or more other factors.

In developing countries where membrane filtration technology does not have full penetration yet, the high cost of membrane filtration technology acts as a prominent restraint.

Opportunities: Rising demand for extended shelf life

The rising need for longer shelf life represents a substantial and expanding potential for the membrane filtration industry, notably in the dairy, food and beverage, wine, and beer industries. Consumers' demand for fresher, safer, and longer-lasting products has driven businesses to pursue better preservation technologies, with membrane filtration serving as a crucial enabler.

Perishable dairy products such as milk, yogurt, and cheese are subject to spoiling due to microbial growth and enzymatic activity. Membrane filtration provides a solution by eliminating spoiling microbes, enzymes, and particles, prolonging the shelf life of these items without the need for significant heat treatment or chemical preservatives. This not only improves food safety but also protects nutritional content and quality, which aligns with customers' health-conscious decisions.

Membrane filtration's fine filtering capabilities enable the removal of pollutants that lead to spoiling, such as bacteria and yeast, in the food and beverage sector, where freshness is at a premium. This means longer shelf life without sacrificing taste or nutritional value. Furthermore, in the wine and beer sectors, membrane filtration assists in product stabilization by eliminating undesirable particles, resulting in increased clarity and stability, both of which are critical for sustaining product integrity over time.

The use of membrane filtration not only meets customer desires for longer shelf life, but it also fits with industry goals to decrease food waste. Membrane filtering aids waste reduction at both the consumer and production levels by prolonging the period items stay viable and safe for consumption.

As the emphasis on sustainability grows, the potential for membrane filtration to provide prolonged shelf life becomes increasingly apparent. Manufacturers may make products that fulfill consumer expectations for both quality and environmental responsibility by using fewer artificial preservatives and additives. This intersection of consumer tastes and industry sustainability goals places membrane filtration as a critical technology in satisfying the increased demand for products with prolonged shelf life across all industries.

Challenges: Lack of awareness about the advantages of membrane filtration

Most of the processed water, food, and beverage manufacturers utilize conventional purification and filtration methods such as biological or chemical treatment. Membrane filtration provides high efficiency and requires less preparation in food, beverage, or water processing. Desalination, fractionation, standardization, concentration, and clarifying or separation are some of the main functions of membrane technologies in the food industry. The emulsified oils in foods and beverages are also separated using membrane filtration systems. Membrane filtration has fewer processing stages, allowing for greater levels of purity as well as higher total yields. The technology is employed in numerous industrial large-scale applications, making it possible for industries to run cleaner, more cost-effective, and legal operations free of contaminants and harmful particles. Additionally, it consumes less energy than traditional methods and reduces the total production cost. These are some key advantages that make this technology a vital investment. Yet, due to the lack of awareness regarding the above-mentioned advantages, most food, beverage, and processed water manufacturers still utilize conventional filtration technologies and methods.

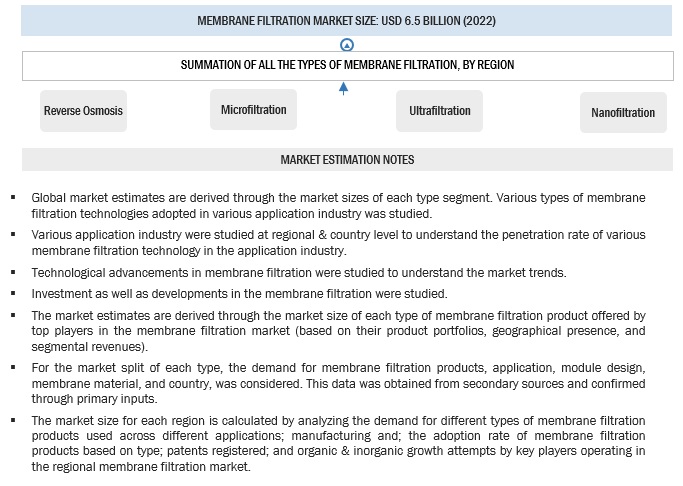

Based on type, the reverse osmosis segment is estimated to account for the largest market share of the membrane filtration market.

Reverse osmosis is a highly efficient method for purifying water, capable of removing nearly 99% of most mineral contaminants. In the food and beverage industry, reverse osmosis is a commonly employed water filtration technique that employs pressure to drive water through a semi-permeable membrane, effectively eliminating most impurities, including particles, flavors, colors, and odors. Traditional reverse osmosis systems are designed with multiple stages, each of which filters half of the wastewater generated by the previous stage.

Reverse osmosis has also gained popularity within the beverage industry. Since water is a critical ingredient in beverages, ensuring water quality and sterility is of paramount importance to producers. Typically, water in the beverage industry is sourced from municipal supplies, which may contain hardness or heavy metal deposits, often originating from transportation pipes. These elements in the water can impact the taste of both the water and the beverages produced with it. To mitigate this, reverse osmosis is widely used in beverage manufacturing plants.

Moreover, reverse osmosis finds extensive application in the food sector. It is employed in the concentration process of substances like egg whites, gelatin, and fruit juices. Additionally, it is utilized for the removal of bacteria and brine from meat, as well as the extraction of alcohol from spirits. The dairy, starch, and sugar industries also rely on reverse osmosis for various purposes.

Based on Module design, the spiral wound sub segment of the membrane filtration market is anticipated to dominate the market.

Spiral wound modules play a crucial role in membrane filtration systems used in diverse industries such as water treatment, dairy, food, and beverage production, and more. These modules are essential for effectively separating particles, impurities, and contaminants from liquids, making them an integral part of modern filtration processes.

The structure of spiral wound modules includes a permeate collection tube, a feed spacer, and multiple layers of flat hollow fiber membranes wound together in a spiral arrangement. This design optimizes the available surface area while minimizing the physical footprint, resulting in highly efficient filtration capabilities for various processes.

Spiral wound modules are commonly employed to remove dissolved solids from solutions, especially in nanofiltration and reverse osmosis applications. They are available in various configurations, featuring different types of spacers, membrane materials, lengths, and diameters, which enhances their versatility for multiple filtration tasks. These modules find wide-ranging applications in the processing of bottled water, dairy products, and the beverage industry.

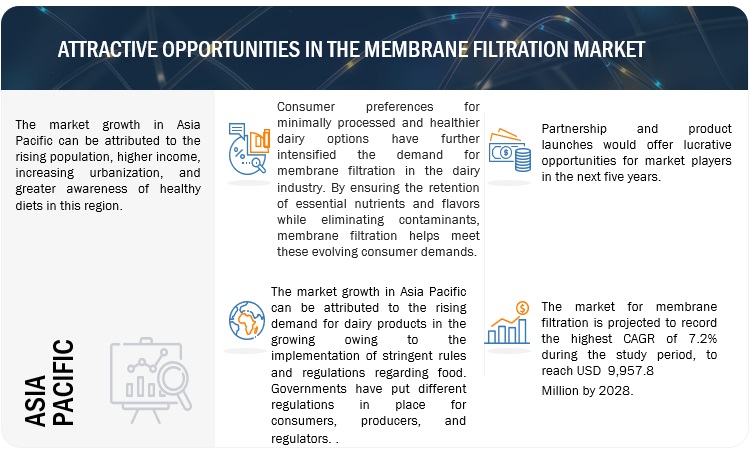

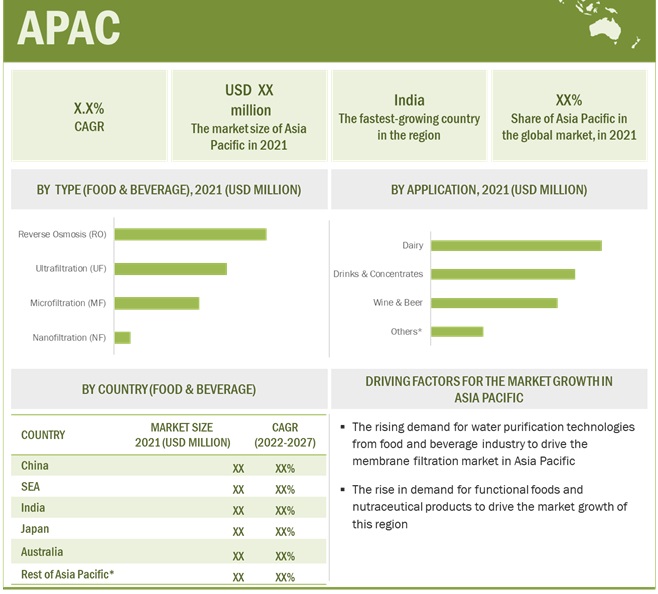

The Asia Pacific market is projected to dominate the membrane filtration market.

The Asia Pacific region is currently experiencing a significant increase in demand for membrane filtration technology, particularly within the dairy, food and beverage, and wine and beer industries. This surge in demand can be attributed to a combination of factors, including a growing population, urbanization, heightened consumer awareness of food safety, and an escalating preference for high-quality products. Within the dairy sector, membrane filtration processes such as ultrafiltration and microfiltration are being employed to enhance product quality, extend shelf life, standardize compositions, and reduce waste. In the food and beverage industry, membrane filtration plays a pivotal role in clarifying liquids, concentrating flavors and nutrients, maintaining product quality, and ensuring safety and compliance with rigorous standards. Additionally, in the emerging wine and beer market of the region, membrane filtration is crucial for achieving clarity, stability, flavor preservation, quality control, and production efficiency. As these industries continue to expand and evolve, membrane filtration technology is poised to play an increasingly essential role in meeting the growing demands of consumers and regulatory requirements.

Key Market Players

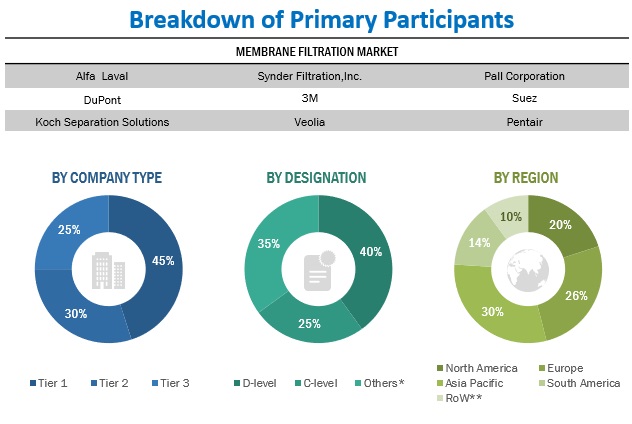

Alfa Laval (Sweden), GEA Group Aktiengesellschaft (Germany), DuPont (US), Pall Corporation (US), 3M (US) and TORAY INDUSTRIES, INC.(Japan) are among the key players in the global membrane filtration market. To increase their company's revenues and market shares, companies are focusing on launching new services, developing partnerships, and expanding their laboratory facilities. The key strategies used by companies in the food pathogen testing market include geographical expansion to tap the potential of emerging economies, strategic acquisitions to gain a foothold over the extensive supply chain, and new service launches because of extensive research and development (R&D) initiatives.

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Type, By Membrane Material, By Application, By Module Design, and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

|

Membrane Filtration Market:

By Type

- Reverse Osmosis

- Microfiltration

- Ultrafiltration

- Nanofiltration

By Module Design

- Spiral Wound

- Tubular Systems

- Plate & Frame and Hollow fiber

By Membrane Material

- Ceramic

- Polymeric

By Application

- Dairy Products

- Liquid Milk

- Milk Protein Fractionation

- Milk Pre-Concentration

- Milk Concentration

- Water Recovery

- Other Dairy Products

- Milk

- Milk and whey-based ingredients

- Cheese

- Drinks & Concentrates

- Wine & Beer

- Other Food & Beverage Applications

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Other food & beverage applications include sugar, fish, and poultry products .

RoW includes the Middle East & Africa.

Recent Developments

- In February 2021, TORAY INDUSTRIES, INC. (Japan) launched the PVDF UF membrane. This product launched a Polyvinylidene fluoride (PVDF) ultrafiltration (UF) membrane with virus removal capabilities and high water permeability. This innovation targets safe and economical water supplies treated with minimal energy for various applications, from food and beverages to wastewater reuse.

- In April 2022, SPX Flow (US) acquired Lone Star (US). An affiliate of Lone Star Funds has successfully acquired SPX Flow, a leading provider of process solutions for the nutrition, health, and industrial markets (“Lone Star”). This transaction is the best strategy and achieves the company’s desire to maximize value for SPX FLOW shareholders.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the membrane filtration market?

The Asia Pacific region accounted for the largest share, in terms of value, of USD 2.6 billion, of the global membrane filtration market in 2022 and is expected to grow at a CAGR of 8.4%. The growing consumer base and rising demand for processed and functional foods are expected to drive the growth of the membrane filtration market in emerging countries such as China, India, and Thailand, to name a few.

What is the current size of the global membrane filtration market?

The membrane filtration market is estimated at USD 7.0 billion in 2023 and is projected to reach USD 9.9 billion by 2028, at a CAGR of 7.2% from 2023 to 2028.

Which are the key players in the market?

The key players in this market include Alfa Laval (Sweden), GEA Group Aktiengesellschaft (Germany), DuPont (US), Pall Corporation (US), 3M (US) and TORAY INDUSTRIES, INC.(Japan), Koch Separation Solutions (US), Veolia (France), ProMinent (Germany).

What are the factors driving the membrane filtration market?

Consumers' inclination toward high-quality products.

Which segment by type accounted for the largest membrane filtration market share?

The reverse osmosis segment dominated the market for membrane filtration market and was valued at USD 2.65 billion in 2022. The quality of water used in food and beverage production can have a significant impact on the taste and flavor of the final products. RO-treated water is known for its neutral taste and lack of unwanted odors or flavors, making it ideal for preserving the natural taste of ingredients and beverages. This drives the demand for reverse osmosis in the membrane filtration market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSGROWTH IN INDUSTRIAL AND URBAN INFRASTRUCTUREHEALTH & ENVIRONMENTAL AWARENESS

-

5.3 MARKET DYNAMICSDRIVERS- Rapid growth of dairy industry- Rise in demand for premium food and beverage products- Consumers’ inclination toward high-quality products- Emerging technologies in membrane filtration field- Optimization of product efficiency in food processing due to innovations in ceramic membranes- Efficiencies offered by membrane filtration technologiesRESTRAINTS- High setup cost- Maintenance and cleaning involved in membrane filtrationOPPORTUNITIES- Growth of markets for plant-based and dairy alternatives- Rise in demand for extended shelf lifeCHALLENGES- Lack of awareness about advantages of membrane filtration- Membrane integrity and lifespan

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTSOURCINGMANUFACTURINGMEMBRANE MODULE ASSEMBLYDISTRIBUTION AND MARKETINGEND USERSAFTER-SALES SERVICE

-

6.3 TRADE ANALYSISAMINO-RESINS, PHENOLIC RESINS, AND POLYURETHANES IN PRIMARY FORMS

- 6.4 SUPPLY CHAIN ANALYSIS

-

6.5 TECHNOLOGY ANALYSISGRAPHENEBIOMIMETICMILK FRACTIONATION

-

6.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGIONINDICATIVE PRICING ANALYSIS, BY MEMBRANE MATERIAL

-

6.7 PATENT ANALYSIS

-

6.8 ECOSYSTEM ANALYSIS

- 6.9 KEY CONFERENCES & EVENTS

-

6.10 REGULATORY LANDSCAPEINTRODUCTION- US- IndiaREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

6.13 CASE STUDY ANALYSISSNYDER’S NFS MEMBRANES USED FOR WHEY CONCENTRATION & DE-ASHINGLAGUNITAS BREWING COMPANY’S HIGH-STRENGTH BREWERY WASTEWATER TREATED TO HIGH MBR AND RO STANDARDS FOR REUSE

-

6.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 DAIRY PRODUCTSLIQUID MILK- Growing consumer interest in broad spectrum of liquid milk offerings to fuel market expansion- Milk protein fractionation- Milk concentration- Milk pre-concentration- Water recoveryOTHER DAIRY PRODUCTS- Whey- Milk and whey-based ingredients- Cheese

-

7.3 DRINKS & CONCENTRATESRISING DEMAND FOR CONVENIENCE FOOD ITEMS, DRINKS, AND JUICES TO DRIVE USE OF MEMBRANE FILTRATION

-

7.4 WINE & BEERCHANGING LIFESTYLES AND INCREASED CONSUMPTION OF BEVERAGES TO DRIVE MARKET

- 7.5 OTHER FOOD & BEVERAGE APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 POLYMERICINCREASING UTILIZATION OF POLYSULFONE MEMBRANES IN FOOD & BEVERAGE SECTOR TO FUEL MARKET GROWTH

-

8.3 CERAMICDEMAND FOR MEMBRANES WITH DURABILITY, EXCEPTIONAL TEMPERATURE RESISTANCE, AND EASE OF MAINTENANCE TO DRIVE POPULARITY OF CERAMIC MEMBRANES

- 9.1 INTRODUCTION

-

9.2 SPIRAL WOUNDEXTENSIVE UTILIZATION OF SPIRAL WOUND MEMBRANES IN FOOD & BEVERAGE INDUSTRY TO DRIVE MARKET

-

9.3 TUBULAR SYSTEMSGROWING IMPORTANCE OF TUBULAR SYSTEMS IN DAIRY AND WINE INDUSTRIES TO ENCOURAGE MARKET GROWTH

-

9.4 PLATE & FRAME AND HOLLOW FIBEREXTENSIVE USE OF HOLLOW FIBERS FOR ULTRAFILTRATION AND MICROFILTRATION OF MEMBRANE SYSTEMS IN BEVERAGE INDUSTRY TO BOOST GROWTH

- 10.1 INTRODUCTION

-

10.2 REVERSE OSMOSIS (RO)GROWING POPULARITY OF PROCESSED FOOD PRODUCTS TO DRIVE USE OF RO TECHNOLOGY FOR WATER FILTRATION

-

10.3 ULTRAFILTRATION (UF)GROWING USE OF ULTRAFILTRATION IN TREATING DAIRY PRODUCTS TO DRIVE MARKET

-

10.4 MICROFILTRATION (MF)RISING ADOPTION OF MICROFILTRATION IN TREATING BEVERAGES TO PROPEL GROWTH

-

10.5 NANOFILTRATION (NF)ABILITY OF NANOFILTRATION TECHNOLOGY TO REMOVE LOW-MOLECULAR COMPONENTS FROM LIQUID TO DRIVE ITS USE

- 11.1 INTRODUCTION

- 11.2 RECESSION INDICATORS

-

11.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Growing popularity of dairy products to propel demand for membrane filtration solutionsCANADA- Growing demand for functional food products and wine to drive marketMEXICO- Rapid growth in dairy industry to drive growth

-

11.4 EUROPEEUROPE: RECESSION IMPACT ANALYSISSPAIN- Growing wine industry to drive membrane filtration marketITALY- Stringent food safety regulations to encourage use of membrane filtration technologiesGERMANY- Growing consumption of food products and beverages to drive growthUK- Rising consumption of drinks and concentrates to boost demand for membrane filtration technologiesFRANCE- Rising demand to adopt membrane filtration technologies in cheese industryNETHERLANDS- Extensive use of membrane filtration by dairy, beverage, and functional food manufacturers to drive marketDENMARK- Increased consumption of cheese to propel marketREST OF EUROPE

-

11.5 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Rising demand for milk products in high-end restaurants to drive growthSOUTHEAST ASIA- Growing demand for functional foods and nutraceutical products to encourage market expansionINDIA- Growing use of UF and MF technologies in dairy industry to drive marketJAPAN- Increasing need for membrane filtration in functional food industry to boost growthAUSTRALIA- Rising health concerns and demand for nutritious food products to drive growthNEW ZEALANDREST OF ASIA PACIFIC

-

11.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Focus of manufacturers on adding value to products and ensuring sustainable production processes to propel growthCHILE- Rising income of people and inclination to healthy living to drive marketARGENTINA- Increased demand for drinks and concentrates to drive adoption of membrane filtration technologyREST OF SOUTH AMERICA

-

11.7 REST OF THE WORLD (ROW)ROW: RECESSION IMPACT ANALYSISMIDDLE EAST- Rising demand for functional food products and beverages to boost marketAFRICA- Increasing water scarcity and environmental concerns to drive popularity of membrane filtration technologies

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS

- 12.3 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- 12.4 ANNUAL REVENUE VS. REVENUE GROWTH FOR KEY PLAYERS

- 12.5 EBITDA OF KEY PLAYERS, 2022 (USD BILLION)

- 12.6 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.7 GLOBAL SNAPSHOT OF KEY PARTICIPANTS

-

12.8 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.9 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING

-

12.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSALFA LAVAL- Business overview- Products offered- Recent developments- MnM viewGEA GROUP AKTIENGESELLSCHAFT- Business overview- Products offered- Recent developments- MnM viewDUPONT- Business overview- Products offered- MnM viewPALL CORPORATION- Business overview- Products offered- Recent developments- MnM viewVEOLIA- Business overview- Products offered- MnM view3M- Business overview- Products offered- MnM viewPENTAIR- Business overview- Products offered- Recent developments- MnM viewDONALDSON COMPANY, INC.- Business overview- Products offered- MnM viewPORVAIR FILTRATION GROUP- Business overview- Products offered- Recent developments- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewHYDRANAUTICS - A NITTO GROUP COMPANY- Business overview- Products offered- MnM viewSPXFLOW- Business overview- Products offered- Recent developments- MnM viewMMS MEMBRANE SYSTEMS- Business overview- Products offered- Recent developments- MnM viewKOCH SEPARATION SOLUTIONS- Business overview- Products offered- Recent developments- MnM viewSYNDER FILTRATION, INC.- Business overview- Products offered- Recent developments- MnM viewPROMINENT- Business overview- Products offered- Recent developments- MnM view

-

13.2 STARTUPS/SMESMANN+HUMMEL- Business overview- Products offered- Recent developments- MnM viewGRAVER TECHNOLOGIES- Business overview- Products offered- MnM viewCRITICAL PROCESS FILTRATION, INC.- Business overview- Products offered- MnM viewNOVASEP- Business overview- Products offered- MnM viewNILSAN NISHOTECH SYSTEMS PVT. LTD.- Business overview- Products offered- MnM viewAPPLIED MEMBRANES, INC.ZWITTERCOMEMBRANE SOLUTIONS (NANTONG)MEMBRANE SYSTEM SPECIALISTS, INC.IMEMFLO

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 MICROFILTRATION MEMBRANE MARKETMARKET DEFINITIONMARKET OVERVIEWMICROFILTRATION MEMBRANE MARKET, BY TYPEMICROFILTRATION MEMBRANE MARKET, BY REGION

-

14.4 MEMBRANE SEPARATION TECHNOLOGY MARKETMARKET DEFINITIONMARKET OVERVIEWMEMBRANE SEPARATION TECHNOLOGY MARKET, BY TECHNOLOGYMEMBRANE SEPARATION TECHNOLOGY MARKET, BY REGION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2021

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 MEMBRANE FILTRATION MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 4 TOP 10 IMPORTERS AND EXPORTERS OF ALMONDS, 2022 (USD THOUSANDS)

- TABLE 5 TOP 10 IMPORTERS AND EXPORTERS OF AMINO-RESINS, PHENOLIC RESINS, AND POLYURETHANES IN PRIMARY FORMS, 2022 (USD THOUSANDS)

- TABLE 6 INDICATIVE PRICING ANALYSIS, BY MEMBRANE MATERIAL (USD/SQUARE METER)

- TABLE 7 KEY PATENTS PERTAINING TO MEMBRANE FILTRATION MARKET, 2013–2022

- TABLE 8 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 9 MEMBRANE FILTRATION MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MEMBRANE FILTRATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MEMBRANE FILTRATION, BY TYPE

- TABLE 15 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR, BY TYPE

- TABLE 16 MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 17 MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 18 DAIRY PRODUCTS: MEMBRANE FILTRATION MARKET, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 19 DAIRY PRODUCTS: MEMBRANE FILTRATION MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 20 DAIRY PRODUCTS: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 DAIRY PRODUCTS: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 DAIRY PRODUCTS: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 23 DAIRY PRODUCTS: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 24 LIQUID MILK: MEMBRANE FILTRATION MARKET, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 25 LIQUID MILK: MEMBRANE FILTRATION MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 26 LIQUID MILK: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 LIQUID MILK: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 MILK PROTEIN FRACTIONATION: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 MILK PROTEIN FRACTIONATION: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 MILK CONCENTRATION: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 MILK CONCENTRATION: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 MILK PRE-CONCENTRATION: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 MILK PRE-CONCENTRATION: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 WATER RECOVERY: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 WATER RECOVERY: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 OTHER DAIRY PRODUCTS: MEMBRANE FILTRATION MARKET, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 37 OTHER DAIRY PRODUCTS: MEMBRANE FILTRATION MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 OTHER DAIRY PRODUCTS: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 OTHER DAIRY PRODUCTS: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 WHEY: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 WHEY: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 MILK AND WHEY-BASED INGREDIENTS: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 MILK AND WHEY-BASED INGREDIENTS: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 CHEESE: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 CHEESE: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 DRINKS & CONCENTRATES: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 DRINKS & CONCENTRATES: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 DRINKS & CONCENTRATES: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 49 DRINKS & CONCENTRATES: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 50 WINE & BEER: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 WINE & BEER: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 WINE & BEER: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 53 WINE & BEER: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 54 OTHER FOOD & BEVERAGE APPLICATIONS: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 OTHER FOOD & BEVERAGE APPLICATIONS: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 OTHER FOOD & BEVERAGE APPLICATIONS: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 57 OTHER FOOD & BEVERAGE APPLICATIONS: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 58 MEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL, 2018–2022 (USD MILLION)

- TABLE 59 MEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL, 2023–2028 (USD MILLION)

- TABLE 60 POLYMERIC: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 POLYMERIC: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 CERAMIC: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 CERAMIC: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 MEMBRANE FILTRATION MARKET, BY MODULE DESIGN, 2018–2022 (USD MILLION)

- TABLE 65 MEMBRANE FILTRATION MARKET, BY MODULE DESIGN, 2023–2028 (USD MILLION)

- TABLE 66 SPIRAL WOUND: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 SPIRAL WOUND: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 TUBULAR SYSTEMS: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 TUBULAR SYSTEMS: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 PLATE & FRAME AND HOLLOW FIBER: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 71 PLATE & FRAME AND HOLLOW FIBER: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 73 MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 74 REVERSE OSMOSIS: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 75 REVERSE OSMOSIS: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 ULTRAFILTRATION: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 77 ULTRAFILTRATION: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 MICROFILTRATION: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 79 MICROFILTRATION: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 NANOFILTRATION: MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 81 NANOFILTRATION: MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 MEMBRANE FILTRATION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 83 MEMBRANE FILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: MEMBRANE FILTRATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: MEMBRANE FILTRATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: MEMBRANE FILTRATION MARKET, BY MODULE DESIGN, 2018–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: MEMBRANE FILTRATION MARKET, BY MODULE DESIGN, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: MEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL, 2018–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: MEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL, 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR LIQUID MILK, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR LIQUID MILK, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR OTHER DAIRY PRODUCTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR OTHER DAIRY PRODUCTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 US: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 107 US: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 US: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 109 US: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 110 US: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 111 US: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 112 US: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 113 US: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 114 US: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 115 US: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 116 US: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 117 US: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 118 CANADA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 119 CANADA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 CANADA: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 121 CANADA: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 122 CANADA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 123 CANADA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 124 CANADA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 125 CANADA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 126 CANADA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 127 CANADA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 128 CANADA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 129 CANADA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGES APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 130 MEXICO: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 131 MEXICO: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 MEXICO: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 133 MEXICO: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 134 MEXICO: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 135 MEXICO: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 136 MEXICO: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 137 MEXICO: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 138 MEXICO: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 139 MEXICO: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 140 MEXICO: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGES APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 141 MEXICO: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 142 EUROPE: MEMBRANE FILTRATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 143 EUROPE: MEMBRANE FILTRATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 144 EUROPE: MEMBRANE FILTRATION MARKET, BY MODULE DESIGN, 2018–2022 (USD MILLION)

- TABLE 145 EUROPE: MEMBRANE FILTRATION MARKET, BY MODULE DESIGN, 2023–2028 (USD MILLION)

- TABLE 146 EUROPE: MEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL, 2018–2022 (USD MILLION)

- TABLE 147 EUROPE: MEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL, 2023–2028 (USD MILLION)

- TABLE 148 EUROPE: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 149 EUROPE: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 150 EUROPE: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 151 EUROPE: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 152 EUROPE: MEMBRANE FILTRATION MARKET FOR LIQUID MILK, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 153 EUROPE: MEMBRANE FILTRATION MARKET FOR LIQUID MILK, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 154 EUROPE: MEMBRANE FILTRATION MARKET FOR OTHER DAIRY PRODUCTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 155 EUROPE: MEMBRANE FILTRATION MARKET FOR OTHER DAIRY PRODUCTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 156 EUROPE: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 157 EUROPE: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 158 EUROPE: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 159 EUROPE: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 160 EUROPE: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 161 EUROPE: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 162 EUROPE: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 163 EUROPE: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 164 EUROPE: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 165 EUROPE: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 166 SPAIN: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 167 SPAIN: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 168 SPAIN: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 169 SPAIN: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 170 SPAIN: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 171 SPAIN: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 172 SPAIN: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 173 SPAIN: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 174 SPAIN: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 175 SPAIN: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 176 SPAIN: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 177 SPAIN: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 178 ITALY: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 179 ITALY: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 180 ITALY: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 181 ITALY: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 182 ITALY: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 183 ITALY: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 184 ITALY: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 185 ITALY: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 186 ITALY: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 187 ITALY: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 188 ITALY: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 189 ITALY: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 190 GERMANY: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 191 GERMANY: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 192 GERMANY: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 193 GERMANY: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 194 GERMANY: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 195 GERMANY: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 196 GERMANY: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 197 GERMANY: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 198 GERMANY: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 199 GERMANY: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 200 GERMANY: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 201 GERMANY: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 202 UK: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 203 UK: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 204 UK: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 205 UK: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 206 UK: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 207 UK: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 208 UK: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 209 UK: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 210 UK: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 211 UK: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 212 UK: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 213 UK: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 214 FRANCE: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 215 FRANCE: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 216 FRANCE: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 217 FRANCE: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 218 FRANCE: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 219 FRANCE: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 220 FRANCE: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 221 FRANCE: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 222 FRANCE: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 223 FRANCE: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 224 FRANCE: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 225 FRANCE: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 226 NETHERLANDS: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 227 NETHERLANDS: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 228 NETHERLANDS: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 229 NETHERLANDS: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 230 NETHERLANDS: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 231 NETHERLANDS: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 232 NETHERLANDS: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 233 NETHERLANDS: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 234 NETHERLANDS: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 235 NETHERLANDS: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 236 NETHERLANDS: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 237 NETHERLANDS: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 238 DENMARK: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 239 DENMARK: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 240 DENMARK: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 241 DENMARK: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 242 DENMARK: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 243 DENMARK: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 244 DENMARK: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 245 DENMARK: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 246 DENMARK: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 247 DENMARK: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 248 DENMARK: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 249 DENMARK: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 250 REST OF EUROPE: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 251 REST OF EUROPE: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 252 REST OF EUROPE: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 253 REST OF EUROPE: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 254 REST OF EUROPE: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 255 REST OF EUROPE: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 256 REST OF EUROPE: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 257 REST OF EUROPE: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 258 REST OF EUROPE: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 259 REST OF EUROPE: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 260 REST OF EUROPE: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 261 REST OF EUROPE: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 262 ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 263 ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 264 ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY MODULE DESIGN, 2018–2022 (USD MILLION)

- TABLE 265 ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY MODULE DESIGN, 2023–2028 (USD MILLION)

- TABLE 266 ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL, 2018–2022 (USD MILLION)

- TABLE 267 ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL, 2023–2028 (USD MILLION)

- TABLE 268 ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 269 ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 270 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 271 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 272 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR LIQUID MILK, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 273 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR LIQUID MILK, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 274 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR OTHER DAIRY PRODUCTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 275 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR OTHER DAIRY PRODUCTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 276 ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 277 ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 278 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 279 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 280 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 281 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 282 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 283 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 284 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 285 ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 286 CHINA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 287 CHINA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 288 CHINA: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 289 CHINA: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 290 CHINA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 291 CHINA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 292 CHINA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 293 CHINA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 294 CHINA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 295 CHINA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 296 CHINA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 297 CHINA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 298 SOUTHEAST ASIA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 299 SOUTHEAST ASIA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 300 SOUTHEAST ASIA: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 301 SOUTHEAST ASIA: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 302 SOUTHEAST ASIA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 303 SOUTHEAST ASIA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 304 SOUTHEAST ASIA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 305 SOUTHEAST ASIA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 306 SOUTHEAST ASIA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 307 SOUTHEAST ASIA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 308 SOUTHEAST ASIA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 309 SOUTHEAST ASIA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 310 INDIA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 311 INDIA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 312 INDIA: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 313 INDIA: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 314 INDIA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 315 INDIA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 316 INDIA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 317 INDIA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 318 INDIA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 319 INDIA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 320 INDIA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 321 INDIA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 322 JAPAN: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 323 JAPAN: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 324 JAPAN: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 325 JAPAN: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 326 JAPAN: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 327 JAPAN: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 328 JAPAN: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 329 JAPAN: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 330 JAPAN: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 331 JAPAN: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 332 JAPAN: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 333 JAPAN: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 334 AUSTRALIA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 335 AUSTRALIA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 336 AUSTRALIA: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 337 AUSTRALIA: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 338 AUSTRALIA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 339 AUSTRALIA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 340 AUSTRALIA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 341 AUSTRALIA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 342 AUSTRALIA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 343 AUSTRALIA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 344 AUSTRALIA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 345 AUSTRALIA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 346 NEW ZEALAND: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 347 NEW ZEALAND: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 348 NEW ZEALAND: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 349 NEW ZEALAND: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 350 NEW ZEALAND: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 351 NEW ZEALAND: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 352 NEW ZEALAND: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 353 NEW ZEALAND: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 354 NEW ZEALAND: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 355 NEW ZEALAND: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 356 NEW ZEALAND: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 357 NEW ZEALAND: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 358 REST OF ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 359 REST OF ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 360 REST OF ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 361 REST OF ASIA PACIFIC: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 362 REST OF ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 363 REST OF ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 364 REST OF ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 365 REST OF ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 366 REST OF ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 367 REST OF ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 368 REST OF ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 369 REST OF ASIA PACIFIC: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 370 SOUTH AMERICA: MEMBRANE FILTRATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 371 SOUTH AMERICA: MEMBRANE FILTRATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 372 SOUTH AMERICA: MEMBRANE FILTRATION MARKET, BY MODULE DESIGN, 2018–2022 (USD MILLION)

- TABLE 373 SOUTH AMERICA: MEMBRANE FILTRATION MARKET, BY MODULE DESIGN, 2023–2028 (USD MILLION)

- TABLE 374 SOUTH AMERICA: MEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL, 2018–2022 (USD MILLION)

- TABLE 375 SOUTH AMERICA: MEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL, 2023–2028 (USD MILLION)

- TABLE 376 SOUTH AMERICA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 377 SOUTH AMERICA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 378 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 379 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 380 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR LIQUID MILK, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 381 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR LIQUID MILK, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 382 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR OTHER DAIRY PRODUCTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 383 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR OTHER DAIRY PRODUCTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 384 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 385 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 386 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 387 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 388 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 389 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 390 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 391 SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 392 BRAZIL: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 393 BRAZIL: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 394 BRAZIL: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 395 BRAZIL: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 396 BRAZIL: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 397 BRAZIL: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 398 BRAZIL: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 399 BRAZIL: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 400 BRAZIL: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 401 BRAZIL: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 402 BRAZIL: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 403 BRAZIL: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 404 CHILE: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 405 CHILE: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 406 CHILE: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 407 CHILE: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 408 CHILE: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 409 CHILE: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 410 CHILE: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 411 CHILE: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 412 CHILE: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 413 CHILE: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 414 CHILE: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 415 CHILE: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 416 ARGENTINA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 417 ARGENTINA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 418 ARGENTINA: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 419 ARGENTINA: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 420 ARGENTINA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 421 ARGENTINA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 422 ARGENTINA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 423 ARGENTINA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 424 ARGENTINA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 425 ARGENTINA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 426 ARGENTINA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 427 ARGENTINA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 428 REST OF SOUTH AMERICA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 429 REST OF SOUTH AMERICA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 430 REST OF SOUTH AMERICA: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 431 REST OF SOUTH AMERICA: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 432 REST OF SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 433 REST OF SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 434 REST OF SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 435 REST OF SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 436 REST OF SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 437 REST OF SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 438 REST OF SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 439 REST OF SOUTH AMERICA: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 440 ROW: MEMBRANE FILTRATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 441 ROW: MEMBRANE FILTRATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 442 ROW: MEMBRANE FILTRATION MARKET, BY MODULE DESIGN, 2018–2022 (USD MILLION)

- TABLE 443 ROW: MEMBRANE FILTRATION MARKET, BY MODULE DESIGN, 2023–2028 (USD MILLION)

- TABLE 444 ROW: MEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL, 2018–2022 (USD MILLION)

- TABLE 445 ROW: MEMBRANE FILTRATION MARKET, BY MEMBRANE MATERIAL, 2023–2028 (USD MILLION)

- TABLE 446 ROW: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 447 ROW: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 448 ROW: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 449 ROW: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 450 ROW: MEMBRANE FILTRATION MARKET FOR LIQUID MILK, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 451 ROW: MEMBRANE FILTRATION MARKET FOR LIQUID MILK, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 452 ROW: MEMBRANE FILTRATION MARKET FOR OTHER DAIRY PRODUCTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

- TABLE 453 ROW: MEMBRANE FILTRATION MARKET FOR OTHER DAIRY PRODUCTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 454 ROW: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 455 ROW: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 456 ROW: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 457 ROW: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 458 ROW: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 459 ROW: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 460 ROW: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 461 ROW: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 462 ROW: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 463 ROW: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 464 MIDDLE EAST: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 465 MIDDLE EAST: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 466 MIDDLE EAST: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 467 MIDDLE EAST: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 468 MIDDLE EAST: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 469 MIDDLE EAST: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 470 MIDDLE EAST: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 471 MIDDLE EAST: MEMBRANE FILTRATION MARKET FOR DRINKS & CONCENTRATES, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 472 MIDDLE EAST: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 473 MIDDLE EAST: MEMBRANE FILTRATION MARKET FOR WINE & BEER, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 474 MIDDLE EAST: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 475 MIDDLE EAST: MEMBRANE FILTRATION MARKET FOR OTHER FOOD & BEVERAGE APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 476 AFRICA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 477 AFRICA: MEMBRANE FILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 478 AFRICA: MEMBRANE FILTRATION MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 479 AFRICA: MEMBRANE FILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 480 AFRICA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 481 AFRICA: MEMBRANE FILTRATION MARKET FOR DAIRY PRODUCTS, BY TYPE, 2023–2028 (USD MILLION)