Hybrid Aircraft Market by Aircraft Type (Regional Transport Aircraft, Business Jets, Light Aircraft, UAVs, AAM), Power Source (Fuel Hybrid, Hydrogen Hybrid), Lift Technology, Mode of Operation, Range, System and Region - Global Forecast to 2030

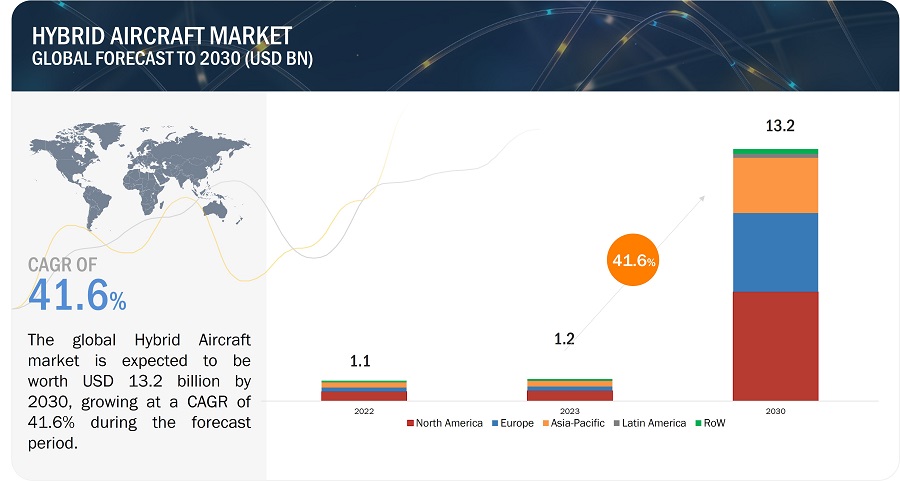

The Hybrid Aircraft Market size is estimated to grow from USD 1.2 billion in 2023 to USD 13.2 billion by 2030, at a CAGR of 41.6% from 2023 to 2030. The Hybrid Aircraft Industry is driven by factors such as increasing demand for short haul range connectivity, technological convergence and increasing demand for alternate modes of transportation.

Hybrid Aircraft Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Hybrid Aircraft Market Dynamics:

Driver: Increasing demand for Short-Haul range connectivity

Short-haul range connectivity refers to air travel over relatively short distances, typically between nearby cities or regions. These flights are usually within a few hundred to a few thousand kilometers, and they are commonly served by regional airlines or low-cost carriers. Short-haul flights are essential for connecting smaller cities, supporting regional economies, and providing convenient transportation options for travellers. Hybrid aircraft, especially those with electric propulsion systems as primary source, are well-suited for short-haul flights because they can operate with greater fuel efficiency compared to traditional aircraft. Electric propulsion systems have the potential to significantly reduce fuel consumption and operating costs, which is particularly attractive for airlines operating frequent short-haul flights. Short-haul flights, despite their relatively short distances, can collectively contribute to a substantial carbon footprint due to the high number of takeoffs and landings involved. Hybrid aircraft offer the advantage of reduced emissions and lower noise levels, making them more environmentally friendly. Short-haul flights often operate in and out of airports located in or near urban areas. Hybrid aircraft, particularly those with electric propulsion, produce less noise during takeoff and flight, making them more suitable for operating in noise-sensitive regions. This can lead to reduced community opposition and support for expanding regional flight operations.

Hybrid-electric aircraft can have faster charging times compared to traditional aircraft refueling processes, which can be advantageous for airlines running frequent short-haul flights. This reduces turnaround times at airports, enabling more efficient flight scheduling and improved utilization of aircraft. Short-haul flights serve regional markets, connecting smaller cities and remote locations that may not have the infrastructure to accommodate large airports. Hybrid aircraft can offer flexible and economically viable solutions for regional air travel, supporting regional connectivity and economic development. High chance of Governments and regulatory bodies prioritizing and supporting the development and adoption of hybrid aircraft for short-haul flights could be seen in upcoming years. They recognize the potential environmental and economic benefits of such hybrid-aircraft in reducing emissions, noise pollution, and enhancing regional connectivity. As hybrid aircraft technology continues to advance, their capabilities, reliability, and performance improve, making them increasingly viable for short-haul operations. Advancements in battery technology, electric motors, and power management systems contribute to the feasibility of electric and hybrid-electric aircraft for regional flights.

Restraint: Weight and Payload Management

The weight and payload management in the hybrid aircraft market refers to the restrains associated with managing the weight of hybrid aircraft and its impact on the payload capacity. Hybrid aircraft often incorporate additional components, such as fuel cells, combustion engines, batteries and electric motors, to enable electric propulsion, which can lead to increased weight compared to traditional aircraft. This increased weight can have several implications for the aircraft's overall performance and payload capacity. The weight of an aircraft directly affects its performance, including its takeoff distance, climb rate, cruise speed, and fuel efficiency. The additional weight from hybrid-electric components can result in increased fuel consumption and reduced overall efficiency, impacting the aircraft's range and endurance. One of the critical restrain of hybrid aircraft is achieving a sufficient range for different operational requirements. The weight of batteries, electric motors, and associated power systems can limit the energy available for flight, affecting the aircraft's range and making it more suitable for shorter flights, such as regional or short-haul operations. The increased weight of hybrid aircraft components can reduce the available payload capacity, i.e., the weight of passengers, cargo, and other items that the aircraft can carry. This restrains can affect the commercial viability of the aircraft, as operators need to strike a balance between payload capacity and range, considering the specific mission requirements. Hybrid aircraft design requires careful consideration of weight distribution to maintain stability and flight characteristics. The positioning of heavy components like batteries and electric motors must be carefully optimized to ensure proper balance and performance during different flight phases. The weight of hybrid-electric components can influence the overall design of the aircraft, including its airframe, wings, and landing gear. Structural considerations are critical to ensure the aircraft can handle the additional weight while maintaining safety and reliability. Aircraft manufacturers face trade-offs when selecting the appropriate technologies for hybrid aircraft. They must balance the benefits of electric propulsion, such as reduced emissions, with the weight penalties associated with batteries and power systems.

Opportunity: sustainable development

Sustainable development is an major opportunity for the hybrid aircraft market in which sustainable development refers to the alignment of hybrid aircraft with the principles of sustainability, which encompasses environmental, social, and economic considerations. Hybrid aircraft offer various features that support sustainable development goals, making them a promising solution for the aviation industry. Hybrid aircraft, particularly those incorporating electric propulsion, have the potential to significantly reduce carbon emissions and other pollutants compared to traditional fossil-fuel-powered aircraft. By using electric motors or alternative fuels, hybrid aircraft can contribute to mitigating climate change and improving air quality, aligning with global efforts to reduce the aviation industry's environmental impact. Hybrid aircraft can enhance energy efficiency by leveraging a combination of propulsion systems to optimize fuel consumption. Electric propulsion can be particularly efficient during certain phases of flight, such as takeoff and landing, reducing the overall energy consumption of the aircraft. Hybrid aircraft can improve social equity and accessibility by connecting underserved regions, remote communities, and island nations. They can enable faster and more efficient travel, supporting economic growth, trade, and tourism in these areas. Hybrid aircraft's versatility allows them to operate from traditional airports and small airfields alike, offering greater flexibility for point-to-point connectivity, especially in regions with limited aviation infrastructure. The development of hybrid aircraft technology creates opportunities for innovation and investment in related industries, such as electric propulsion, battery technology, lightweight materials, and power management systems. This innovation can drive progress not only in aviation but also in other sectors, promoting sustainable technologies. Airlines and companies that adopt hybrid aircraft can demonstrate their commitment to sustainability and environmental responsibility, enhancing their brand image and corporate social responsibility initiatives.

Challenges: Supply chain integration

Supply chain integration is a challenge for the hybrid aircraft market due to the complexity and uniqueness of hybrid aircraft components and technologies. Hybrid aircraft incorporate various advanced systems, such as electric propulsion, fuel cells, SAF, conventional engines, batteries, power management, and lightweight materials, which may come from different suppliers. Coordinating the sourcing, production, and integration of these components requires seamless collaboration among multiple stakeholders, and any disruptions in the supply chain can impact production schedules and overall program timelines. Hybrid aircraft require components from multiple suppliers, each specializing in different technologies. Coordinating with different suppliers to ensure timely delivery and quality control can be challenging, especially when some components are sourced globally. Hybrid aircraft involve the integration of various advanced technologies, each with specific requirements and compatibility considerations. Ensuring that these technologies work together seamlessly requires close collaboration among the suppliers and the aircraft manufacturer. Maintaining consistent quality across the supply chain is crucial to ensuring the safety and reliability of the final product. Stringent quality control measures must be in place to verify the performance and reliability of each component. Hybrid aircraft production involves managing inventories of various components. Striking the right balance between maintaining adequate stock levels and avoiding excess inventory can be a delicate task. Some hybrid aircraft components may still be in the development or testing phase when the aircraft production begins. Ensuring that all components are technologically ready and available on schedule is essential to avoid delays.

Disruptions in the supply chain, such as delays or quality issues with critical components, can pose significant risks to the hybrid aircraft program. Robust risk management strategies are essential to mitigate these potential challenges. Close collaboration and clear communication among all suppliers and partners are essential for successful supply chain integration. This includes ensuring that everyone is aligned with the program's goals, timelines, and quality standards. Efficient supply chain integration requires careful cost management. The prices of components and technologies, as well as transportation and logistics costs, must be taken into account to avoid cost overruns.

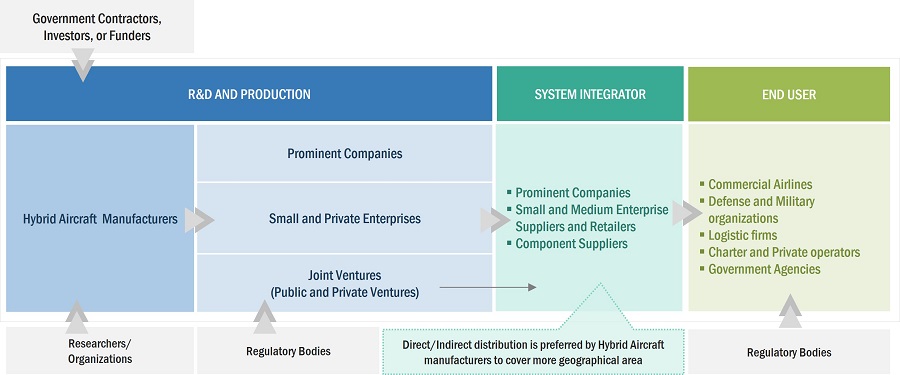

Hybrid-electric Aircraft Market Ecosystem:

Based on System, the electric motor’s segment is projected to have the second highest share in 2023

Based on system, the hybrid aircraft market has been segmented into Batteries & Fuel Cells, Electric Motors, Generators / Engines, Aerostructures, Avionics, Software and Others. Electric motors are used for propulsion, they weigh less than their piston-engine counterparts and in smaller aircraft they are used for shorter flights. These motors can improve the disparity between electric and gasoline energy densities. Electric motors are also used in flight control systems, environmental control systems, avionics systems, door actuation systems, landing and braking systems, and interior cabin systems. Replacing conventionally heavy hydraulic and pneumatic systems with electric motor run distribution systems allows aircraft to reduce their overall weight. Thus, the growth of electric motor segment is due to better power to weight ratio during the forecast period.

Based on lift technology, the STOL segment of the market is projected to grow at the second highest CAGR from 2023 to 2030.

Based on Lift Technology, hybrid-electric aircraft has been segmented into CTOL, STOL and VTOL. A short takeoff and landing (STOL) aircraft have short runway requirements for takeoff and landing. The requirement of a runway for STOL is nearly 1200m and there have been developments on aircraft that would require a runway as short as 600 m for taking off and landing. These aircraft could use vectored thrusts and hybrid wing type as a lift plus cruise for taking off and landing. Companies Like Plana (South Korea) and Electra aero (US) are developing aircraft that have STOL capabilities. The increasing requirement in shorter takeoff for hybrid aircraft will drive the STOL Segment during the forecast period.

Based on power source, the hydrogen hybrid segment of the market is projected to grow at the highest CAGR from 2023 to 2030.

Based on power source, the hybrid-electric aircraft market has been segmented into fuel hybrid and hydrogen hybrid. Hydrogen electric propulsion systems combine electric power with a hydrogen fuel cell to generate electricity, offering a clean and efficient power source. A hybrid aircraft with a hydrogen electric propulsion fuel cell is an electrochemical cell that converts the chemical energy of fuel like hydrogen and an oxidizing agent like oxygen into electricity through a pair of redox reactions. Hydrogen electric aircraft provide extended range capabilities similar to conventional aircraft, along with quick refueling times compared to battery charging. Hydrogen fuel cells produce electricity without emitting greenhouse gases, positioning electric hydrogen aircraft as a promising solution for sustainable air transportation. Hence the lower maintenance and vibration free capability of the hydrogen hybrid segment will boost the hydrogen hybrid segment by power source segment during the forecast period.

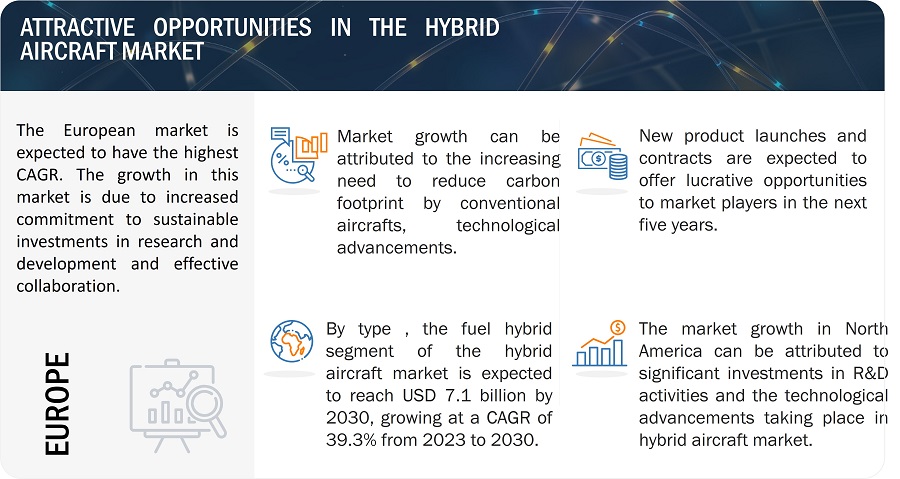

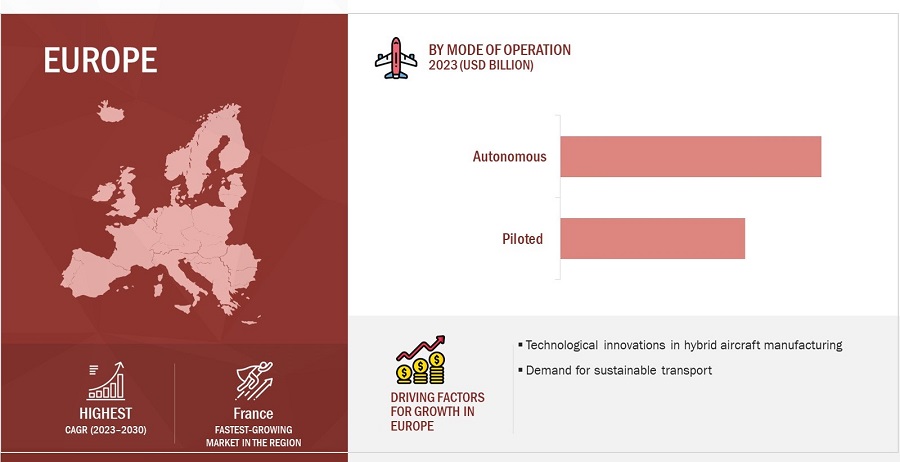

Europe is expected to account for the highest CAGR in the forecasted period.

Europe is estimated to account for the highest CAGR in the forecasted period. The market growth in this region is expected to be fuelled by an advancement in technology and investments in hybrid aircraft during the forecast period. The major countries considered under this region are the UK, France, Germany, Italy, Russia and Rest of Europe. The key factor responsible for Europe leading the hybrid aircraft market is the high demand for new modes of transportation in the region. The growing demand for hybrid aircraft for commercial applications and their increasing utility in the civil sector to carry out transport and logistics activities are additional factors influencing the growth of the Europe Hybrid Aircraft market.

Hybrid Aircraft Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Players such as Airbus (France), Embraer (Brazil), Zeroavia (US), Textron, Inc. (US), Ampaire Inc. (US), and Embraer (Brazil) among others covers various industry trends and new technological innovations in the hybrid aircraft companies for the period 2020-2030.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate

|

41.6% |

| Estimated Market Size in 2023 |

USD 1.2 Billion |

| Projected Market Size in 2030 |

USD 13.2 Billion |

|

Market size available for years |

2020-2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

By power source, by aircraft type, by lift technology, by range, by mode of operation, by system |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Rest of the World |

|

Companies covered |

Airbus SE (France), Embraer (Brazil), Textron Inc. (US), ZeroAvia (US) and Ampaire Inc. (US) are some of the major players of hybrid-electric aircraft market. (30 Companies) |

Hybrid Aircraft Market Highlights

This research report categorizes the hybrid aircraft market based on power source, aircraft type, lift technology, range, mode of operation, system, and region.

|

Segment |

Subsegment |

|

By Aircraft Type |

|

|

By Power Source |

|

|

By Mode of Operation |

|

|

By Range |

|

|

By Lift Technology |

|

|

By System |

|

|

By Region |

|

Recent Developments

- In June 2023, Airbus and STMicroelectronics a global semiconductor leader serving customers across the spectrum of electronics applications, have signed an agreement to cooperate on power electronics Research & Development to support more efficient and lighter power electronics, essential for future hybrid-powered aircraft and full-electric urban air vehicles.

- In June 2023, Embraer and GKN Aerospace announced a collaboration agreement on cutting-edge hydrogen technological development programs. The agreement aims to accelerate the implementation of hydrogen technologies in aviation, reducing emissions and paving the way for a more sustainable future. The collaboration will also explore the potential for a hydrogen flight demonstrator. The agreement is part of Embraer's commitment to the global efforts to collaborate with the Air Transport industry’s commitment to achieve net zero carbon by 2050.

- In June 2023, Air Cahana placed an order for 250 of ZeroAvia’s hydrogen-electric plane engines. The agreement represents a big step in the carrier’s goal of operating sustainable flights.

- In January 2023, Ampaire announced a contract to upgrade Conecta’s Grand Caravans to Ampaire Eco Caravans. Azul has ordered upgrade kits for its Caravan fleet because it sees the hybrid-electric solution as the fastest way to deploy sustainable technologies, benefiting passengers and the environment.

- In July 2023, Crane Aerospace & Electronics and Heart Aerospace have announced a collaboration to define the Electrical Power Distribution System on Heart’s ES-30 regional electric airplane.??

Frequently Asked Questions (FAQ):

What is the current size of the hybrid aircraft Market?

The global hybrid-electric aircraft market size is estimated to grow from USD 1.2 billion in 2023 to USD 13.2 billion by 2030, at a CAGR of 41.6% in the forecasted period.

Who are the winners in the hybrid aircraft market?

Airbus (France), Embraer (Brazil), Zeroavia (US), Textron, Inc. (US), Ampaire, Inc. (US), and Embraer (Brazil).

What are some of the opportunities of the hybrid aircraft market?

High demand for sustainable development and market expansion are a few opportunities for the hybrid-electric aircraft market.

What are some of the technological advancements in the market?

Automation, the Internet of Things, and advancement in battery technology, are some of the technological advancements in the hybrid-electric aircraft market.

What are the factors driving the growth of the market?

The increasing demand for alternate mode of transportation with rise in environmental concerns and technological convergence are few growth prospects of the hybrid aircraft market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for green and noise-free aircraft- Need for alternate mode of transportation- Increasing preference for short-haul connectivity- Rising fuel pricesRESTRAINTS- Implications of increased aircraft weight- Lack of robust infrastructureOPPORTUNITIES- Focus on sustainable development- Expansion of hybrid propulsion systemsCHALLENGES- Stringent regulatory processes- Challenges associated with supply chain integration

- 5.3 IMPACT OF RECESSION ON HYBRID AIRCRAFT MARKET

-

5.4 VALUE CHAIN ANALYSISRAW MATERIALSR&DCOMPONENT MANUFACTURINGOEMSEND USERS

-

5.5 ECOSYSTEM MAPPINGPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.9 VOLUME DATA

- 5.10 TRADE ANALYSIS

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 USE CASE ANALYSISURBAN AIR MOBILITYENVIRONMENTAL SUSTAINABILITYAIR CARGO AND LOGISTICS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSARTIFICIAL INTELLIGENCEAUTOMATIONIMPLEMENTATION OF HYBRID POWER SOURCES FOR URBAN AIR MOBILITYADVANCED MANUFACTURING TECHNIQUES AND MATERIALSADVANCEMENTS IN BATTERY TECHNOLOGY

-

6.3 IMPACT OF MEGATRENDSTECHNOLOGICAL ADVANCEMENTSINTERNET OF THINGSSUSTAINABLE AVIATION FUEL

-

6.4 INNOVATION AND PATENT ANALYSIS

- 6.5 ROADMAP TO HYBRID AIRCRAFT COMMERCIALIZATION

- 7.1 INTRODUCTION

-

7.2 REGIONAL TRANSPORT AIRCRAFTNEED FOR COST-EFFECTIVE SHORT-HAUL AIRLINERS TO DRIVE GROWTH

-

7.3 BUSINESS JETSLOW OPERATING COST OF HYBRID ENGINES TO DRIVE GROWTH

-

7.4 LIGHT AND ULTRALIGHT AIRCRAFTEXTENDED OPERATIONAL RANGE TO DRIVE GROWTH

-

7.5 UNMANNED AERIAL VEHICLESIMPROVED PAYLOAD CAPACITY TO DRIVE GROWTH

-

7.6 ADVANCED AIR MOBILITYFOCUS ON ECO-FRIENDLY TRANSPORTATION TO DRIVE GROWTH

- 8.1 INTRODUCTION

-

8.2 FUEL HYBRIDINCREASING FUEL PRICES TO DRIVE GROWTH

-

8.3 HYDROGEN HYBRIDLOW MAINTENANCE CAPABILITIES TO DRIVE GROWTH

- 9.1 INTRODUCTION

-

9.2 PILOTEDABILITY TO HANDLE COMPLEX SCENARIOS TO DRIVE GROWTH

-

9.3 AUTONOMOUSNEED FOR LIMITED HUMAN INTERVENTION TO DRIVE GROWTH

- 10.1 INTRODUCTION

-

10.2 CTOLRIGOROUS DEVELOPMENTS IN BUSINESS JETS TO DRIVE GROWTH

-

10.3 STOLWIDESPREAD USE IN URBAN TRANSPORTATION TO DRIVE GROWTH

-

10.4 VTOLFLEXIBLE TRANSPORTATION CAPABILITIES TO DRIVE GROWTH

- 11.1 INTRODUCTION

-

11.2 <100 KMABILITY TO FIT IN SMALL SPACES TO DRIVE GROWTH

-

11.3 101–500 KMRISE IN INTERCITY TRAVEL TO DRIVE GROWTH

-

11.4 >501 KMINCREASED PREFERENCE FOR LONG-HAUL FLIGHTS TO DRIVE GROWTH

- 12.1 INTRODUCTION

-

12.2 BATTERIES AND FUEL CELLSADVANCEMENTS IN BATTERY POWER DENSITY AND HYDROGEN FUEL CELLS TO DRIVE GROWTH

-

12.3 ELECTRIC MOTORSIMPROVED POWER-TO-WEIGHT RATIO TO DRIVE GROWTH

-

12.4 GENERATORS/ENGINESDEMAND FOR SUSTAINABLE AVIATION SOLUTIONS TO DRIVE GROWTH

-

12.5 AEROSTRUCTURESENHANCED PERFORMANCE AND SAFETY TO DRIVE GROWTH

-

12.6 AVIONICSABILITY TO MAINTAIN STABLE FLIGHT DYNAMICS TO DRIVE GROWTH

-

12.7 SOFTWARENEED FOR REAL-TIME FLEET HEALTH MONITORING TO DRIVE GROWTH

- 12.8 OTHERS

- 13.1 INTRODUCTION

- 13.2 REGIONAL RECESSION IMPACT ANALYSIS

-

13.3 NORTH AMERICARECESSION IMPACT ANALYSISPESTLE ANALYSISUS- Presence of domestic market leaders to drive growthCANADA- Availability of low-cost raw materials to drive growth

-

13.4 EUROPERECESSION IMPACT ANALYSISPESTLE ANALYSISUK- Technological advancements to drive growthFRANCE- Short-distance air travel to drive growthGERMANY- Increasing investments in R&D to drive growthITALY- High demand for hybrid aircraft from commercial end users to drive growthRUSSIA- Rising awareness toward environmental sustainability to drive growthREST OF EUROPE

-

13.5 ASIA PACIFICRECESSION IMPACT ANALYSISPESTLE ANALYSISCHINA- Strategic planning for hybrid aircraft development to drive growthINDIA- Dense population and urban congestion to drive growthJAPAN- Diversification of commercial operations to drive growthAUSTRALIA- Well-defined hybrid aircraft laws to drive growthSOUTH KOREA- Favorable government initiatives to drive growthREST OF ASIA PACIFIC

-

13.6 LATIN AMERICARECESSION IMPACT ANALYSISPESTLE ANALYSISBRAZIL- Intercity and intracity air taxi services by Airbus to drive growthMEXICO- Surge in VVIP travel to drive growthREST OF LATIN AMERICA

-

13.7 REST OF THE WORLDRECESSION IMPACT ANALYSISMIDDLE EAST- Domestic airport expansion to drive growthAFRICA- Widespread use of hybrid aircraft for emergency medical services to drive growth

- 14.1 INTRODUCTION

- 14.2 RANKING ANALYSIS, 2022

- 14.3 REVENUE ANALYSIS, 2022

- 14.4 MARKET SHARE ANALYSIS, 2022

-

14.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 14.6 COMPANY FOOTPRINT

-

14.7 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

14.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

15.1 KEY PLAYERSAIRBUS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTEXTRON INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEMBRAER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZEROAVIA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMPAIRE, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFARADAIR AEROSPACE- Business overview- Products/Solutions/Services offered- Recent developmentsHEART AEROSPACE- Business overview- Products/Solutions/Services offered- Recent developmentsHORIZON AIRCRAFT, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsBOMBARDIER, INC.- Business overview- Products/Solutions/Services offeredSAFRAN- Business overview- Products/Solutions/Services offered- Recent developmentsRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsHONEYWELL- Business overview- Products/Solutions/Services offered- Recent developmentsGENERAL ELECTRIC- Business overview- Products/Solutions/Services offered- Recent developmentsROLLS ROYCE- Business overview- Products/Solutions/Services offered- Recent developmentsGKN AEROSPACE- Business overview- Products/Solutions/Services offeredVOLTAERO- Business overview- Products/Solutions/Services offered- Recent developmentsELECTRIC AVIATION GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsPLANA- Business overview- Products/Solutions/Services offered- Recent developmentsASCENDANCE FLIGHT TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsXTI AIRCRAFT- Business overview- Products/Solutions/Services offered- Recent developments

-

15.2 OTHER PLAYERSELECTRA.AERO, INC.MANTA AIRCRAFTAMSL AERO PTY. LTD.TRANSCEND AIR CORPORATIONAVA PROPULSION, INC.SKYFLY TECHNOLOGIES LTD.H2FLYCOSTRUZIONI AERONAUTICHE TECNAM S.P.A.ELROY AIRAIRSPACE EXPERIENCE TECHNOLOGIES, INC.

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 4 PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 AVERAGE PRICE TREND OF HYBRID AIRCRAFT, BY AIRCRAFT TYPE

- TABLE 6 VOLUME DATA, BY AIRCRAFT TYPE (UNITS)

- TABLE 7 COUNTRY-WISE IMPORTS, 2020–2022 (USD THOUSAND)

- TABLE 8 COUNTRY-WISE EXPORTS, 2020–2022 (USD THOUSAND)

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 12 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING HYBRID AIRCRAFT, BY MODE OF OPERATION (%)

- TABLE 14 KEY BUYING CRITERIA FOR HYBRID AIRCRAFT, BY MODE OF OPERATION

- TABLE 15 INNOVATION AND PATENT ANALYSIS

- TABLE 16 HYBRID AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 17 HYBRID AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2023–2030 (USD MILLION)

- TABLE 18 HYBRID AIRCRAFT MARKET, BY POWER SOURCE, 2020–2022 (USD MILLION)

- TABLE 19 HYBRID AIRCRAFT MARKET, BY POWER SOURCE, 2023–2030 (USD MILLION)

- TABLE 20 HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 21 HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 22 HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 23 HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 24 HYBRID AIRCRAFT MARKET, BY RANGE, 2020–2022 (USD MILLION)

- TABLE 25 HYBRID AIRCRAFT MARKET, BY RANGE, 2023–2030 (USD MILLION)

- TABLE 26 HYBRID AIRCRAFT MARKET, BY SYSTEM, 2020–2022 (USD MILLION)

- TABLE 27 HYBRID AIRCRAFT MARKET, BY SYSTEM, 2023–2030 (USD MILLION)

- TABLE 28 HYBRID AIRCRAFT MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 29 HYBRID AIRCRAFT MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 30 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 31 NORTH AMERICA: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 33 NORTH AMERICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 36 NORTH AMERICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 37 US: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 38 US: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 39 US: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 40 US: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 41 CANADA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 42 CANADA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 43 CANADA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 44 CANADA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 45 EUROPE: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 46 EUROPE: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 47 EUROPE: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 48 EUROPE: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 49 EUROPE: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 50 EUROPE: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 51 UK: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 52 UK: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 53 UK: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 54 UK: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 55 FRANCE: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 56 FRANCE: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 57 FRANCE: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 58 FRANCE: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 59 GERMANY: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 60 GERMANY: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 61 GERMANY: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 62 GERMANY: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 63 ITALY: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 64 ITALY: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 65 ITALY: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 66 ITALY: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 67 RUSSIA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 68 RUSSIA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 69 RUSSIA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 70 RUSSIA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 71 REST OF EUROPE: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 72 REST OF EUROPE: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 73 REST OF EUROPE: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 74 REST OF EUROPE: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 75 ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 76 ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 81 CHINA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 82 CHINA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 83 CHINA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 84 CHINA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 85 INDIA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 86 INDIA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 87 INDIA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 88 INDIA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 89 JAPAN: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 90 JAPAN: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 91 JAPAN: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 92 JAPAN: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 93 AUSTRALIA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 94 AUSTRALIA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 95 AUSTRALIA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 96 AUSTRALIA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 97 SOUTH KOREA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 98 SOUTH KOREA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 99 SOUTH KOREA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 100 SOUTH KOREA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 101 REST OF ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 105 LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 106 LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 107 LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 108 LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 109 LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 110 LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 111 BRAZIL: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 112 BRAZIL: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 113 BRAZIL: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 114 BRAZIL: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 115 MEXICO: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 116 MEXICO: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 117 MEXICO: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 118 MEXICO: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 119 REST OF LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 120 REST OF LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 121 REST OF LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 122 REST OF LATIN AMERICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 123 REST OF THE WORLD: HYBRID AIRCRAFT MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 124 REST OF THE WORLD: HYBRID AIRCRAFT MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 125 REST OF THE WORLD: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 126 REST OF THE WORLD: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 127 REST OF THE WORLD: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 128 REST OF THE WORLD: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 129 MIDDLE EAST: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 130 MIDDLE EAST: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 131 MIDDLE EAST: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 132 MIDDLE EAST: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 133 AFRICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 134 AFRICA: HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030 (USD MILLION)

- TABLE 135 AFRICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 136 AFRICA: HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 137 STRATEGIES ADOPTED BY KEY PLAYERS IN HYBRID AIRCRAFT MARKET, 2022–2023

- TABLE 138 HYBRID AIRCRAFT MARKET: DEGREE OF COMPETITION

- TABLE 139 COMPANY FOOTPRINT

- TABLE 140 SEGMENT FOOTPRINT

- TABLE 141 HYBRID AIRCRAFT MARKET: KEY START-UPS/SMES

- TABLE 142 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 143 PRODUCT LAUNCHES, 2020–2023

- TABLE 144 DEALS, 2020–2023

- TABLE 145 AIRBUS: COMPANY OVERVIEW

- TABLE 146 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 147 AIRBUS: PRODUCT LAUNCHES

- TABLE 148 AIRBUS: DEALS

- TABLE 149 TEXTRON INC.: COMPANY OVERVIEW

- TABLE 150 TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 151 TEXTRON INC.: DEALS

- TABLE 152 EMBRAER: COMPANY OVERVIEW

- TABLE 153 EMBRAER: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 154 EMBRAER: DEALS

- TABLE 155 ZEROAVIA: COMPANY OVERVIEW

- TABLE 156 ZEROAVIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 157 ZEROAVIA: DEALS

- TABLE 158 AMPAIRE, INC.: COMPANY OVERVIEW

- TABLE 159 AMPAIRE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 160 AMPAIRE, INC.: DEALS

- TABLE 161 FARADAIR AEROSPACE: COMPANY OVERVIEW

- TABLE 162 FARADAIR AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 163 FARADAIR AEROSPACE: DEALS

- TABLE 164 HEART AEROSPACE: COMPANY OVERVIEW

- TABLE 165 HEART AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 166 HEART AEROSPACE: DEALS

- TABLE 167 HORIZON AIRCRAFT, INC.: COMPANY OVERVIEW

- TABLE 168 HORIZON AIRCRAFT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 169 HORIZON AIRCRAFT, INC.: DEALS

- TABLE 170 BOMBARDIER, INC.: COMPANY OVERVIEW

- TABLE 171 BOMBARDIER, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 172 SAFRAN: COMPANY OVERVIEW

- TABLE 173 SAFRAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 174 SAFRAN: DEALS

- TABLE 175 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 176 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED?

- TABLE 177 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 178 HONEYWELL: COMPANY OVERVIEW

- TABLE 179 HONEYWELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 180 HONEYWELL: PRODUCT LAUNCHES

- TABLE 181 HONEYWELL: DEALS

- TABLE 182 GENERAL ELECTRIC: COMPANY OVERVIEW

- TABLE 183 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 184 GENERAL ELECTRIC: PRODUCT LAUNCHES

- TABLE 185 GENERAL ELECTRIC: DEALS

- TABLE 186 ROLLS ROYCE: COMPANY OVERVIEW

- TABLE 187 ROLLS ROYCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 188 ROLLS ROYCE: PRODUCT LAUNCHES

- TABLE 189 GKN AEROSPACE: COMPANY OVERVIEW

- TABLE 190 GKN AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 191 VOLTAERO: COMPANY OVERVIEW

- TABLE 192 VOLTAERO: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 193 VOLTAERO: PRODUCT LAUNCHES

- TABLE 194 VOLTAERO: DEALS

- TABLE 195 ELECTRIC AVIATION GROUP: COMPANY OVERVIEW

- TABLE 196 ELECTRIC AVIATION GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 197 ELECTRIC AVIATION GROUP: DEALS

- TABLE 198 PLANA: COMPANY OVERVIEW

- TABLE 199 PLANA: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 200 PLANA: DEALS

- TABLE 201 ASCENDANCE FLIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 202 ASCENDANCE FLIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/ SERVICES OFFERED?

- TABLE 203 ASCENDANCE FLIGHT TECHNOLOGIES: DEALS

- TABLE 204 XTI AIRCRAFT: COMPANY OVERVIEW

- TABLE 205 XTI AIRCRAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 206 XTI AIRCRAFT: DEALS

- FIGURE 1 HYBRID AIRCRAFT MARKET SEGMENTATION

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 BOTTOM-UP APPROACH: MARKET SIZE CALCULATION

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 PILOTED SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 >501 KM TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 11 HYDROGEN HYBRID SEGMENT TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA TO BE LARGEST MARKET IN 2023

- FIGURE 13 INCREASE IN DEMAND FOR GREEN AVIATION SOLUTIONS

- FIGURE 14 BATTERIES AND FUEL CELLS TO HOLD MAXIMUM MARKET SHARE IN 2023

- FIGURE 15 CTOL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 CANADA TO BE FASTEST-GROWING COUNTRY BETWEEN 2023 AND 2030

- FIGURE 17 HYBRID AIRCRAFT MARKET DYNAMICS

- FIGURE 18 RISE IN GLOBAL POPULATION, 1950–2050

- FIGURE 19 VALUE CHAIN ANALYSIS

- FIGURE 20 ECOSYSTEM MAPPING

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING HYBRID AIRCRAFT, BY MODE OF OPERATION

- FIGURE 24 KEY BUYING CRITERIA FOR HYBRID AIRCRAFT, BY MODE OF OPERATION

- FIGURE 25 DEVELOPMENT POTENTIAL OF HYBRID AIRCRAFT MARKET, 2020–2035

- FIGURE 26 HYBRID AIRCRAFT MARKET, BY AIRCRAFT TYPE, 2023–2030

- FIGURE 27 HYBRID AIRCRAFT MARKET, BY POWER SOURCE, 2023–2030

- FIGURE 28 HYBRID AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2030

- FIGURE 29 HYBRID AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2023–2030

- FIGURE 30 HYBRID AIRCRAFT MARKET, BY RANGE, 2023–2030

- FIGURE 31 HYBRID AIRCRAFT MARKET, BY SYSTEM, 2023–2030

- FIGURE 32 HYBRID AIRCRAFT MARKET, BY REGION, 2023–2030

- FIGURE 33 NORTH AMERICA: HYBRID AIRCRAFT MARKET SNAPSHOT

- FIGURE 34 EUROPE: HYBRID AIRCRAFT MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: HYBRID AIRCRAFT MARKET SNAPSHOT

- FIGURE 36 LATIN AMERICA: HYBRID AIRCRAFT MARKET SNAPSHOT

- FIGURE 37 MARKET RANKING OF KEY PLAYERS, 2022

- FIGURE 38 REVENUE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 39 MARKET SHARE OF KEY PLAYERS, 2022

- FIGURE 40 COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 42 AIRBUS: COMPANY SNAPSHOT

- FIGURE 43 TEXTRON INC.: COMPANY SNAPSHOT

- FIGURE 44 EMBRAER: COMPANY SNAPSHOT

- FIGURE 45 BOMBARDIER, INC.: COMPANY SNAPSHOT

- FIGURE 46 SAFRAN: COMPANY SNAPSHOT

- FIGURE 47 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 HONEYWELL: COMPANY SNAPSHOT

- FIGURE 49 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 50 ROLLS ROYCE: COMPANY SNAPSHOT

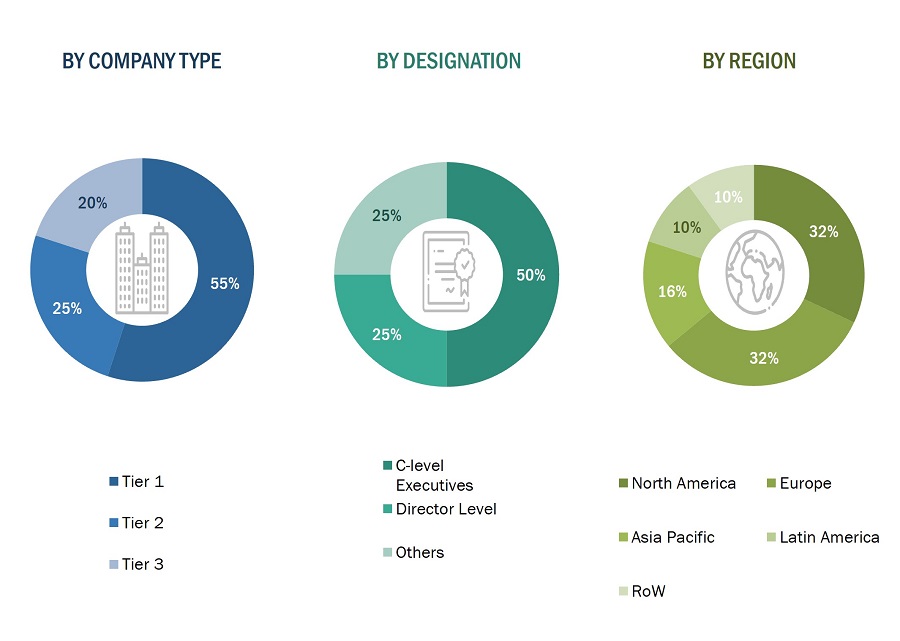

This research study used secondary sources, directories, and databases like D&B Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the hybrid-electric aircraft market. Primary sources included industry experts from the core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess prospects for the market's growth during the forecast period.

Secondary Research:

The share of companies in the hybrid aircraft market was determined using secondary data made available through paid and unpaid sources and by analyzing their product portfolios. The companies were rated based on the performance and quality of their products. These data points were further validated by primary sources. Secondary sources that were referred to for this research study on the hybrid aircraft market included financial statements of companies offering and developing hybrid aircraft products and solutions and information from various trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall size of the hybrid aircraft market, which was further validated by primary respondents.

Primary Research:

Extensive primary research was conducted after obtaining information about the current scenario of the hybrid aircraft market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, Latin America, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as vice presidents, directors, regional managers, technology providers, product development teams, distributors, and end users.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the trends related to aircraft type, lift technology, range, mode of operation, system, and region. Stakeholders from the demand side, such as CXOs, production managers, engineers, and installation teams of end users of hybrid-electric aircraft, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and future outlook of their business, which could affect the hybrid-electric aircraft market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

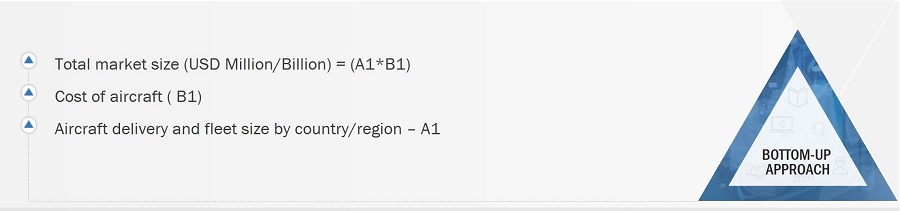

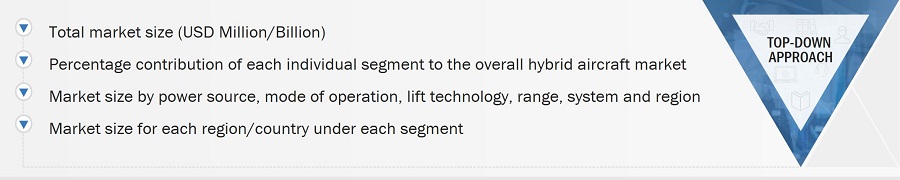

Top-down and bottom-up approaches were used to estimate and validate the size of the hybrid aircraft market. The research methodology used to estimate the size of the market includes the following details.

The key players in the hybrid-electric aircraft market were identified through secondary research, and their market shares were determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the hybrid aircraft market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the hybrid aircraft market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology:Top-Down Approach

Market Definition

A hybrid aircraft is an advanced aircraft platform that combines different propulsion systems, typically combining conventional internal combustion engines with electric motors or alternative power sources. This integration aims to capitalize on the strengths of both traditional and modern technologies, resulting in improved operational efficiency, ecological sustainability, and overall performance. By incorporating elements like batteries or fuel cells, hybrid aircraft can curtail fuel consumption, emissions, and noise, standing apart from aircraft that rely solely on fossil fuels. These aircraft frequently utilize electric power during phases requiring less thrust, like taxiing or cruising, optimizing fuel consumption and lessening their environmental footprint. The development of hybrid aircraft stems from the aviation sector's growing emphasis on environmental responsibility and reduced carbon emissions. The concept of hybridization spans a range of aircraft types, encompassing commercial airliners, regional planes, drones, and urban air mobility vehicles. This technology holds the potential to reshape the aviation landscape, offering a harmonious blend of established aviation practices and emerging clean energy innovations.

Key Stakeholders

- Raw Material suppliers

- Hybrid aircraft subsystem manufacturers

- Hybrid Aircraft manufacturers

- Technology support providers

- Logistics and transport solution providers

- System Integrators

- Government Agencies

- Investors and Financial Community Professionals

Objectives of the Study

- To define, describe, segment, and forecast the size of the hybrid aircraft market based on power source, aircraft type, range, mode of operation, lift technology, system, and region.

- To analyze the degree of competition in the market by mapping the recent developments, products, and services of key market players

- To understand the structure of the hybrid aircraft market by identifying its various segments and subsegments

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the market.

- To provide an overview of the tariff and regulatory landscape for the adoption of hybrid aircrafts across regions

- To forecast the size of market segments across North America, Europe, Asia Pacific, Latin America, and Rest of the World along with major countries in each region

- To identify transportation industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets with respect to individual technological trends and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies.

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers & acquisitions, partnerships, agreements, and product developments in the hybrid aircraft market

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the hybrid aircraft market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the hybrid-electric aircraft market.

Growth opportunities and latent adjacency in Hybrid Aircraft Market