Hydraulic Fracturing Market by Well Type (Horizontal Well, and Vertical Well), Technology (Plug and Perf, and Sliding Sleeve), Application (Shale gas, Tight Oil, and Tight gas) and Region - Global Trends and Forecast to 2028

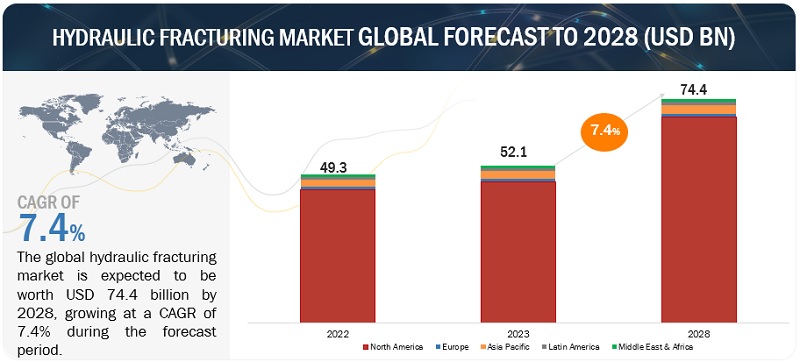

[256 Pages Report] The global hydraulic fracturing market is estimated to grow from USD 52.1 billion in 2023 to USD 74.4 billion by 2028; it is expected to record a CAGR of 7.4% during the forecast period. Recently regions have witnessed that crude oil prices are gaining momentum again. The upstream companies are optimistic about the long-term recovery of oil and natural gas, thereby leading to a surge in demand for hydraulic fracturing services.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Hydraulic Fracturing Market Dynamics

Driver: Growing demand for hydraulic fracturing technology with increasing requirement for energy

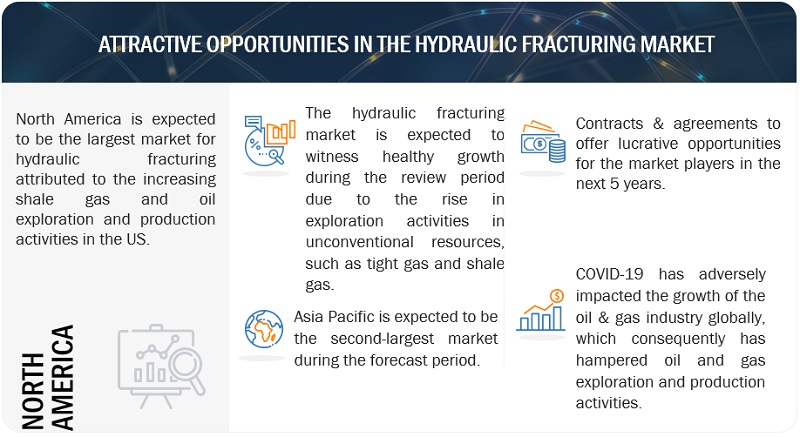

According to the IEA, global energy demand is set to increase by 5.4% in 2021, despite a decline of 4% in 2020 owing to the COVID-19 crisis. By 2026, global oil consumption is projected to reach 104.1 mb/d. This would represent an increase of 4.4 mb/d from the 2019 level. Oil demand in 2025 is expected to be 2.5 mb/d lower than 2020, according to a report by IEA. In addition, Asia Pacific is expected to be the largest consumer of oil and gas in the next decade. The region is witnessing a rapid increase in demand for oil and gas in recent years attributed to the growing population, increased per capita income, urbanization, and growth in the number of petrochemical refineries. The region, on average, accounted for about two-thirds of the global oil and gas demand between 2011 and 2019.

The increasing supply-demand gap for primary energy sources is one of the leading factors driving the growth of the hydraulic fracturing market, as the demand for oil and gas is constantly growing, and the production capacities of the related reserves are limited. Unconventional gas accounts for 44% of total natural gas production, out of which shale gas represents 28% of unconventional gas sources. While Eastern Europe, Eurasia (including Russia), and the Middle East are estimated to hold 61% of conventional gas, these regions account for only 16.6% of unconventional gas; all the other regions have a larger proportion of conventional gas as compared with unconventional gas. Due to this distribution, the development of unconventional gas reserves will create a shift in the global energy supply. As onshore and shallow water fields are depleting, oil companies are focusing on deepwater and unconventional reserves, where hydraulic fracturing is expected to be an ideal technique for exploration and production.

Restraint: Local ban and suspensions on hydraulic fracturing

Various landowners or residents belonging to shale-rich areas have expressed their opposition to extracting hydrocarbons using hydraulic fracturing, citing potential environmental impacts. As a result, the process has come under international scrutiny. A few countries, including France, which has significant shale reserves, have banned fracturing. Moreover, the government of California has initiated a regulatory action to end the issuance of new permits for hydraulic fracturing (fracking) by January 2024. Additionally, the California Air Resources Board (CARB) is aiming to phase out oil extraction across the state by 2045.

Hydraulic fracturing is primarily regulated by state oil and natural gas commissions and agencies. Some states have already adopted, and others are considering, new or stricter regulations pertaining to permitting, disclosure, or well construction for fracking comapnies operations. Certain states are even contemplating banning high-volume hydraulic fracturing altogether. Apart from state laws, local land-use restrictions can also restrict drilling or hydraulic fracturing activities. Municipalities may establish ordinances aiming to either prohibit fracking entirely or regulate the time, location, and method of these processes within their jurisdictions. In addition, the federal government can limit hydraulic fracturing activities on federal lands through permitting. In Australia, the Tasmanian government extended its moratorium on fracking from 2020 to 2025. In Western Australia, 98% of the land is protected from fracking due to strict regulations, including those that prohibit fracking within two kilometers of public drinking water sources, towns, and national parks. A few countries, such as Bulgaria and Germany, have extended moratoriums on fracking.

Opportunities: Capability of foams of providing waterless fracking

Foams, with their advantageous qualities like high viscosity and low liquid content, have extensive applications in various processes within the petroleum industry. They offer a viable alternative to traditional fracturing methods by consuming less water, thus addressing environmental concerns associated with fracturing operations. Fracturing constitutes a significant portion (about 89%) of the total water usage in well drilling, creating an opportunity for companies to integrate waterless fracking solutions into their offerings and gain a larger market share. Foams are prepared by dispersing a large internal volume (55–95%) through the liquid phase under a typical formation temperature of 90°F (32.2°C). The internal phase normally contains N2 or CO2 gases.

Challenges: Disruptions in hydraulic fracturing operations and demand shock

The propagation of the COVID-19 pandemic has slowed down the growth of various industries. The outbreak of the pandemic led to a significant reduction in oil and gas demand due to widespread global lockdowns. As of May 28, 2020, 212 countries were affected, resulting in decreased transportation and related activities. The International Energy Agency (IEA) reported that geopolitical events increased the supply of low-priced oil while demand declined due to the pandemic, causing oil prices to collapse in March 2020. These factors negatively impacted the demand for oil, natural gas, and hydraulic fracturing services and products, leading to price fluctuations in the oil market. The government's measures to contain the virus further affected the global oil and gas industry. As of December 31, 2019, West Texas Intermediate’s (WTI) oil price was USD 61.1, and by March 23, 2020, it was USD 23.4, a decline of more than 60.0%. As of April 2020, OPEC and other oil-producing countries had agreed to reduce oil production by 10 million bpd, which is about 23.0% of their production levels.

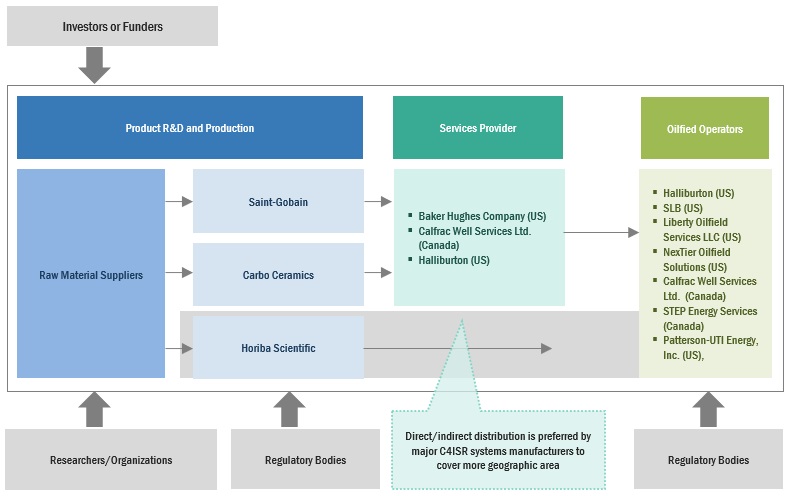

Hydraulic Fracturing Market Ecosystem

In this market, prominent companies stand out as well-established and financially stable providers of hydraulic fracturing products and services. With years of experience, these companies boast a diverse product portfolio, cutting-edge technologies, and robust global sales and marketing networks. Their proven track record in the industry positions them as reliable and trusted partners for customers seeking hydraulic fracturing solutions. These companies have demonstrated their ability to adapt to market dynamics and consistently deliver high-quality products and services, making them leaders in meeting the demands of the oil and gas sector. Prominent companies in this market include Halliburton (US), Schlumberger (US), Liberty Oilfield Services LLC (US), Baker Hughes (US), and NexTier Oilfield Solutions (US).

The sliding sleeve segment, by technology, is expected to be the second-largest market during the forecast period.

This report segments the hydraulic fracturing market report based on technology into different types: plug & perf and sliding sleeve. The sliding sleeve segment is expected to be the second-largest market during the forecast period. Sliding sleeve technology is a critical component in hydraulic fracturing operations. It allows operators to selectively open or close downhole ports in the wellbore, facilitating precise and controlled fracturing stages. This innovation enhances efficiency, reduces costs, and optimizes the overall effectiveness of hydraulic fracturing processes.

By application, tight oil is expected to be the second fastest growing during the forecast period.

This report segments the hydraulic fracturing market based on application into three segments: shale gas, tight oil, and tight gas. Hydraulic fracturing is the key technique for extracting tight oil, which can be further processed into gasoline, diesel, and jet fuels. The surge in tight oil production is driven by a combination of horizontal drilling and hydraulic fracturing. Technological advancements have significantly improved the profitability and economic feasibility of recovering tight oil from its resource base.

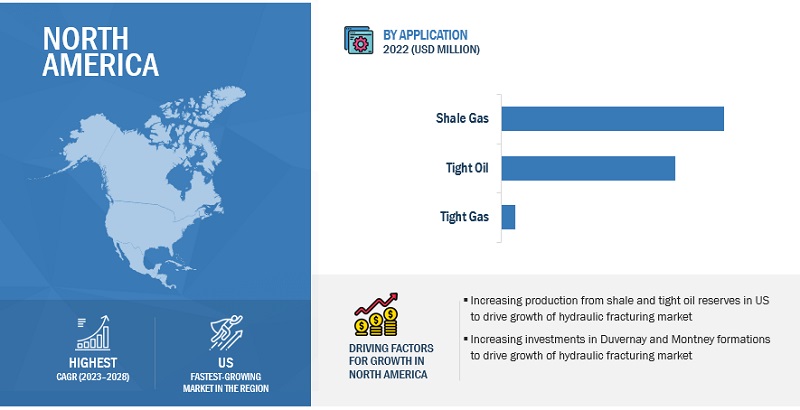

“North America: The largest in the hydraulic fracturing market.”

North America is expected to be the largest region in the hydraulic fracturing market between 2023–2028, followed by the Asia Pacific and Latin America. North America has been leading the hydraulic fracturing market. Unconventional gas production in North America is responsible for high growth in the sector, giving opportunities to oilfield companies for fracturing in this region. Growing environmental concerns have raised the importance of natural gas, which, in turn, has increased the demand for hydraulic fracturing. Hydraulic fracturing plays a vital role in increasing a well’s productivity.

Key Market Players

The hydraulic fracturing market is dominated by a few major players that have a wide regional presence. The major players in the market include Halliburton (US), Schlumberger (US), Liberty Oilfield Services LLC (US), Baker Hughes (US), and NexTier Oilfield Solutions (US). Between 2018 and 2023, Strategies such as contracts, agreements, acquisitions, and expansions are followed by these companies to capture a larger share of the hydraulic fracturing market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Hydraulic fracturing market by well type, Technology, Application, and Region. |

|

Geographies covered |

Asia Pacific, North America, Europe, Latin America, and Middle East & Africa. |

|

Companies covered |

Halliburton (US), Schlumberger (US), Liberty Oilfield Services LLC (US), Baker Hughes (US), NexTier Oilfield Solutions (US), Calfrac Well Services Ltd. (Canada), STEP Energy Services (Canada), Patterson-UTI Energy, Inc. (US), Trican (Canada), National Energy Services Reunited Corp. (US), Petro Welt Technologies AG (Austria), ProFrac Holding Corp. (US), Tacrom (Romania) TAM International, Inc. (US), GD Energy Products, LLC (US), Petro Welt Technologies AG (Austria), ProPetro Holding Corp. (US), TechnipFMC plc (UK), Weatherford (US), Nine Energy Service (US), and AFG Holdings, Inc (US). |

This research report categorizes the hydraulic fracturing market by design, industry, capacity, voltage, Application, and Region.

On the basis of by Well Type:

- Horizontal

- Vertical

On the basis of by Technology:

- Plug & Perf

- Sliding Sleeve

On the basis of by Application:

- Shale Gas

- Tight Oil

- Tight Gas

On the basis of Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Recent Developments

- In June 2023, NexTier Oilfield Solutions and Patterson-UTI Energy, Inc. announced that they have entered into a definitive merger agreement to combine in an all-stock merger of equals transaction. The combined company will be an industry-leading drilling and completions services provider with operations in the most active major U.S. basins.

- In January 2023, ProFrac Holding Corp. acquired REV Energy Holdings, LLC ("REV"), a privately owned pressure pumping service provider with operations in the Eagle Ford and Rockies. ProFrac paid $140 million for REV. The acquisition will expand ProFrac's presence in both South Texas and the Rockies.

- In January 2022, ProFrac acquired Producers Services Holdings LLC, an pressure pumping services company serving Appalachia and the Mid-Continent. ProFrac bought Producers for about $35 million in total transaction value, according to the terms of the arrangement.

- In December 2022, ProPetro Holding Corp. signed an agreement with a top independent Permian operator to use ProPetro's first electric-powered hydraulic fracturing fleet ("e-fleet"). ProPetro will provide committed services for three years following the delivery of the e-fleet under the terms of the agreement.

Frequently Asked Questions (FAQ):

What is the current size of the hydraulic fracturing market?

The current market size of the hydraulic fracturing market is USD 49.3 billion in 2022.

What are the major drivers for the hydraulic fracturing market?

Growing demand for hydraulic fracturing technology with increasing requirements for energy will be major drivers for the hydraulic fracturing market.

Which is the largest region during the forecasted period in the hydraulic fracturing market?

North America is expected to dominate the hydraulic fracturing market between 2023–2028, followed by Asia Pacific and Latin America.

Which is the largest segment, by technology, during the forecasted period in the hydraulic fracturing market?

The Plug & Perf segment is expected to be the largest market during the forecast period, owing to the growing need for reliable operations to increase the production capacity of wells.

Which is the fastest segment, by application, during the forecasted period in the hydraulic fracturing market?

Shale gas is expected to be the fastest market during the forecast period. The increasing demand for natural gas is attributed to driving the market of hydraulic fracturing for shale gas applications in the forecasted period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing shale exploration and production activities globally- Growing demand for hydraulic fracturing technology with increasing requirement for energyRESTRAINTS- High water usage and environmental concerns associated with hydraulic fracturing- Growing concerns regarding seismic activities due to hydraulic fracturing- Local ban and suspensions on hydraulic fracturingOPPORTUNITIES- Foams’ capability to facilitate waterless frackingCHALLENGES- Health and environmental impacts of fracking chemicals- Disruptions in hydraulic fracturing operations and demand shock

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS FOR PROVIDERS OF HYDRAULIC FRACTURING

-

5.4 SUPPLY CHAIN ANALYSISRAW MATERIAL SUPPLIERSSERVICE PROVIDERSOILFIELD OPERATORS

-

5.5 ECOSYSTEM MAPPING

-

5.6 PATENT ANALYSISLIST OF MAJOR PATENTS

-

5.7 TARIFFS AND REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSMARKET: REGULATORY FRAMEWORK

-

5.8 CASE STUDY ANALYSISOPTIMIZATION OF HYDRAULIC FRACTURING OF HIGH PRESSURE AND HIGH TEMPERATURE (HPHT) TIGHT FORMATIONS WITH MULTISTAGE COMPLETION SYSTEM

-

5.9 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

- 6.1 INTRODUCTION

-

6.2 SHALE GASINCREASING DEMAND FOR NATURAL GAS TO DRIVE SEGMENT

-

6.3 TIGHT OILINCREASING DEMAND FOR CRUDE OIL TO BOOST SEGMENTAL LANDSCAPE

-

6.4 TIGHT GASINCREASING INVESTMENTS IN DEVELOPMENT OF TIGHT GAS FIELDS TO DRIVE SEGMENT

- 7.1 INTRODUCTION

-

7.2 HORIZONTALSHALE DEVELOPMENTS TO BOOST GROWTH OF HORIZONTAL SEGMENT

-

7.3 VERTICALSTEADILY INCREASING INVESTMENTS IN UNCONVENTIONAL RESOURCES TO DRIVE SEGMENT

- 8.1 INTRODUCTION

-

8.2 PLUG & PERFEASE OF OPERATION AND ACCESSIBILITY TO BOOST DEMAND FOR PLUG & PERF TECHNOLOGY

-

8.3 SLIDING SLEEVEINCREASING INVESTMENTS IN DEVELOPMENT OF SLIDING SLEEVE TECHNOLOGY TO DRIVE MARKET GROWTH

- 9.1 INTRODUCTION

-

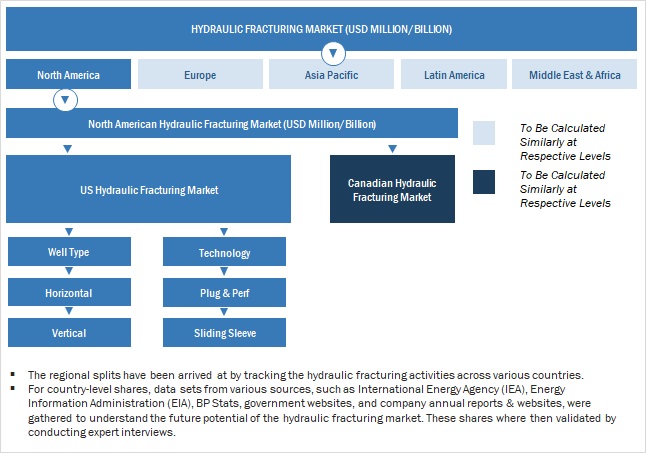

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTMACRO TRENDS- Shale gas reserves- Shale/Tight oil reserves- Crude oil productionBY APPLICATIONBY WELL TYPE- Well type, by countryBY TECHNOLOGY- Technology, by countryBY COUNTRY- US- Canada

-

9.3 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTMACRO TRENDS- Shale gas reserves- Shale/Tight oil reserves- Crude oil productionBY APPLICATIONBY WELL TYPE- Well type, by countryBY TECHNOLOGY- Technology, by countryBY COUNTRY- China- Australia- Rest of Asia Pacific

-

9.4 LATIN AMERICALATIN AMERICA: RECESSION IMPACTMACRO TRENDS- Shale gas reserves- Shale/Tight oil reserves- Crude oil productionBY APPLICATIONBY WELL TYPE- Well type, by countryBY TECHNOLOGY- Technology, by countryBY COUNTRY- Argentina- Mexico- Rest of Latin America

-

9.5 EUROPEEUROPE: RECESSION IMPACTMACRO TRENDS- Shale gas reserves- Shale/Tight oil reserves- Crude oil productionBY APPLICATIONBY WELL TYPE- Well type, by countryBY TECHNOLOGY- Technology, by countryBY COUNTRY- Russia- Rest of Europe

-

9.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTMACRO TRENDS- Shale gas reserves- Shale/Tight oil reserves- Crude oil productionBY APPLICATIONBY WELL TYPE- Well type, by countryBY TECHNOLOGY- Technology, by countryBY COUNTRY- Algeria- Jordan- Saudi Arabia- South Africa- Rest of Middle East & Africa

- 10.1 OVERVIEW

- 10.2 MARKET SHARE ANALYSIS, 2022

- 10.3 MARKET EVALUATION FRAMEWORK, 2019–2023

- 10.4 SEGMENTAL REVENUE ANALYSIS, 2017–2022

-

10.5 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

10.6 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.7 COMPANY FOOTPRINT

-

11.1 KEY COMPANIESHALLIBURTON- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLIBERTY OILFIELD SERVICES LLC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSLB- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNEXTIER OILFIELD SOLUTIONS- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBAKER HUGHES COMPANY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTRICAN- Business overview- Products/Services/Solutions offered- Recent developmentsSTEP ENERGY SERVICES- Business overview- Products/Services/Solutions offered- Recent developmentsWEATHERFORD- Business overview- Products/Services/Solutions offeredPROFRAC HOLDING CORP.- Business overview- Products/Services/Solutions offered- Recent developmentsCALFRAC WELL SERVICES LTD.- Business overview- Products/Services/Solutions offeredTECHNIPFMC PLC- Business overview- Products/Services/Solutions offeredPATTERSON-UTI ENERGY, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsPROPETRO HOLDING CORP.- Business overview- Products/Services/Solutions offered- Recent developmentsPETRO WELT TECHNOLOGIES AG- Business overview- Products/Services/Solutions offered- Recent developmentsNINE ENERGY SERVICE- Business overview- Products/Services/Solutions offered- Recent developments

-

11.2 OTHER PLAYERSNATIONAL ENERGY SERVICES REUNITED CORP.GD ENERGY PRODUCTS, LLCTAM INTERNATIONAL, INC.TACROMAFG HOLDINGS, INC.

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 MARKET SNAPSHOT

- TABLE 2 HYDRAULIC FRACTURING: POLICIES REGARDING SHALE OIL AND GAS PRODUCTION

- TABLE 3 COMPARISON OF VARIOUS FRACTURING FLUIDS

- TABLE 4 ROLE OF KEY COMPANIES IN HYDRAULIC FRACTURING ECOSYSTEM

- TABLE 5 HYDRAULIC FRACTURING: INNOVATIONS AND PATENT REGISTRATIONS, 2018–2023

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MARKET: REGULATIONS

- TABLE 12 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 13 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 14 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 15 SHALE GAS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 16 SHALE GAS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 TIGHT OIL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 18 TIGHT OIL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 TIGHT GAS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 20 TIGHT GAS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 22 MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 23 HORIZONTAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 HORIZONTAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 VERTICAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 VERTICAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 28 MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 29 PLUG & PERF: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 PLUG & PERF: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 SLIDING SLEEVE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 SLIDING SLEEVE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN NORTH AMERICA, BY COUNTRY (TCF)

- TABLE 36 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN NORTH AMERICA, BY COUNTRY (BILLION BBL)

- TABLE 37 CRUDE OIL PRODUCTION IN NORTH AMERICA, BY COUNTRY (THOUSAND BARRELS DAILY)

- TABLE 38 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: HORIZONTAL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 43 NORTH AMERICA: HORIZONTAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: VERTICAL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 45 NORTH AMERICA: VERTICAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 47 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: MARKET FOR PLUG & PERF, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 49 NORTH AMERICA: MARKET FOR PLUG & PERF, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: MARKET FOR SLIDING SLEEVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 51 NORTH AMERICA: MARKET FOR SLIDING SLEEVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 54 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN US (TCF)

- TABLE 55 SHALE/TIGHT OIL PROVEN RESERVES FROM SELECTED TIGHT PLAYS IN US, 2021 (MILLION BBL)

- TABLE 56 CRUDE OIL PRODUCTION IN US (THOUSAND BARRELS DAILY)

- TABLE 57 US: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 58 US: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 59 US: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 60 US: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 61 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN CANADA, BY COUNTRY (TCF)

- TABLE 62 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN CANADA (BILLION BBL)

- TABLE 63 CRUDE OIL PRODUCTION IN CANADA (THOUSAND BARRELS DAILY)

- TABLE 64 CANADA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 65 CANADA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 66 CANADA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 67 CANADA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 68 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN ASIA PACIFIC, BY COUNTRY (TCF)

- TABLE 69 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN ASIA PACIFIC, BY COUNTRY (BILLION BBL)

- TABLE 70 CRUDE OIL PRODUCTION IN ASIA PACIFIC, BY COUNTRY (THOUSAND BARRELS DAILY)

- TABLE 71 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 72 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: HORIZONTAL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 76 ASIA PACIFIC: HORIZONTAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: VERTICAL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: VERTICAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MARKET FOR PLUG & PERF, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MARKET FOR PLUG & PERF, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MARKET FOR SLIDING SLEEVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MARKET FOR SLIDING SLEEVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 87 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN CHINA (TCF)

- TABLE 88 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN CHINA (BILLION BBL)

- TABLE 89 CRUDE OIL PRODUCTION IN CHINA (THOUSAND BARRELS DAILY)

- TABLE 90 CHINA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 91 CHINA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 92 CHINA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 93 CHINA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 94 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN AUSTRALIA (TCF)

- TABLE 95 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN AUSTRALIA (BILLION BBL)

- TABLE 96 CRUDE OIL PRODUCTION IN AUSTRALIA (THOUSAND BARRELS DAILY)

- TABLE 97 AUSTRALIA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 98 AUSTRALIA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 99 AUSTRALIA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 100 AUSTRALIA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 101 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN INDIA (TCF)

- TABLE 102 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN TURKEY (TCF)

- TABLE 103 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN INDIA (BILLION BBL)

- TABLE 104 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN TURKEY (BILLION BBL)

- TABLE 105 CRUDE OIL PRODUCTION IN REST OF ASIA PACIFIC (THOUSAND BARRELS DAILY)

- TABLE 106 REST OF ASIA PACIFIC: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 110 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN LATIN AMERICA, BY COUNTRY (TCF)

- TABLE 111 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN LATIN AMERICA, BY COUNTRY (BILLION BBL)

- TABLE 112 CRUDE OIL PRODUCTION IN LATIN AMERICA, BY COUNTRY (THOUSAND BARRELS DAILY)

- TABLE 113 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 LATIN AMERICA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 116 LATIN AMERICA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 117 LATIN AMERICA: HORIZONTAL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 118 LATIN AMERICA: HORIZONTAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 119 LATIN AMERICA: VERTICAL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 120 LATIN AMERICA: VERTICAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 121 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 122 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 123 LATIN AMERICA: MARKET FOR PLUG & PERF, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 124 LATIN AMERICA: MARKET FOR PLUG & PERF, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 125 LATIN AMERICA: MARKET FOR SLIDING SLEEVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 126 LATIN AMERICA: MARKET FOR SLIDING SLEEVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 128 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 129 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN ARGENTINA (TCF)

- TABLE 130 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN ARGENTINA (BILLION BBL)

- TABLE 131 CRUDE OIL PRODUCTION IN ARGENTINA (THOUSAND BARRELS DAILY)

- TABLE 132 ARGENTINA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 133 ARGENTINA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 134 ARGENTINA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 135 ARGENTINA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 136 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN MEXICO (TCF)

- TABLE 137 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN MEXICO (BILLION BBL)

- TABLE 138 CRUDE OIL PRODUCTION IN MEXICO (THOUSAND BARRELS DAILY)

- TABLE 139 MEXICO: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 140 MEXICO: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 141 MEXICO: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 142 MEXICO: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 143 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN COLOMBIA (TCF)

- TABLE 144 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN CHILE (TCF)

- TABLE 145 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN COLOMBIA (BILLION BBL)

- TABLE 146 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN CHILE (BILLION BBL)

- TABLE 147 CRUDE OIL PRODUCTION IN REST OF LATIN AMERICA (THOUSAND BARRELS DAILY)

- TABLE 148 REST OF LATIN AMERICA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 149 REST OF LATIN AMERICA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 150 REST OF LATIN AMERICA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 151 REST OF LATIN AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 152 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN EUROPE, BY COUNTRY (TCF)

- TABLE 153 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN EUROPE, BY COUNTRY (BILLION BBL)

- TABLE 154 CRUDE OIL PRODUCTION IN EUROPE, BY COUNTRY (THOUSAND BARRELS DAILY)

- TABLE 155 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 156 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 EUROPE: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 158 EUROPE: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 159 EUROPE: HORIZONTAL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 160 EUROPE: HORIZONTAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 161 EUROPE: VERTICAL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 162 EUROPE: VERTICAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 163 EUROPE: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 164 EUROPE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 165 EUROPE: MARKET FOR PLUG & PERF, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 166 EUROPE: MARKET FOR PLUG & PERF, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 167 EUROPE: MARKET FOR SLIDING SLEEVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 168 EUROPE: MARKET FOR SLIDING SLEEVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 169 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 170 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 171 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN RUSSIA (TCF)

- TABLE 172 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN RUSSIA (BILLION BBL)

- TABLE 173 CRUDE OIL PRODUCTION IN RUSSIA (THOUSAND BARRELS DAILY)

- TABLE 174 RUSSIA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 175 RUSSIA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 176 RUSSIA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 177 RUSSIA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 178 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN POLAND (TCF)

- TABLE 179 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN UKRAINE (TCF)

- TABLE 180 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN ROMANIA (TCF)

- TABLE 181 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN SWEDEN (TCF)

- TABLE 182 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN UK (TCF)

- TABLE 183 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN POLAND (BILLION BBL)

- TABLE 184 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN UKRAINE (BILLION BBL)

- TABLE 185 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN ROMANIA (BILLION BBL)

- TABLE 186 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN UK (BILLION BBL)

- TABLE 187 CRUDE OIL PRODUCTION IN REST OF EUROPE (THOUSAND BARRELS DAILY)

- TABLE 188 REST OF EUROPE: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 189 REST OF EUROPE: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 190 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 191 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 192 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN MIDDLE EAST & AFRICA, BY COUNTRY (TCF)

- TABLE 193 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN MIDDLE EAST & AFRICA, BY COUNTRY (BILLION BBL)

- TABLE 194 CRUDE OIL PRODUCTION IN MIDDLE EAST & AFRICA, BY COUNTRY (THOUSAND BARRELS DAILY)

- TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: HORIZONTAL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: HORIZONTAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: VERTICAL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: VERTICAL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: MARKET FOR PLUG & PERF, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: MARKET FOR PLUG & PERF, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: MARKET FOR SLIDING SLEEVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: MARKET FOR SLIDING SLEEVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 211 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN ALGERIA (TCF)

- TABLE 212 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN ALGERIA (BILLION BBL)

- TABLE 213 CRUDE OIL PRODUCTION IN ALGERIA (THOUSAND BARRELS DAILY)

- TABLE 214 ALGERIA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 215 ALGERIA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 216 ALGERIA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 217 ALGERIA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 218 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN JORDAN (TCF)

- TABLE 219 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN JORDAN (BILLION BBL)

- TABLE 220 JORDAN: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 221 JORDAN: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 222 JORDAN: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 223 JORDAN: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 224 CRUDE OIL PRODUCTION IN SAUDI ARABIA (THOUSAND BARRELS DAILY)

- TABLE 225 SAUDI ARABIA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 226 SAUDI ARABIA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 227 SAUDI ARABIA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 228 SAUDI ARABIA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 229 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN SOUTH AFRICA (TCF)

- TABLE 230 SOUTH AFRICA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 231 SOUTH AFRICA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 232 SOUTH AFRICA: MARKET IN SOUTH AFRICA, 2019–2022 (USD MILLION)

- TABLE 233 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 234 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN LIBYA (TCF)

- TABLE 235 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN EGYPT (TCF)

- TABLE 236 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN OMAN (TCF)

- TABLE 237 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN UAE (TCF)

- TABLE 238 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN LIBYA (BILLION BBL)

- TABLE 239 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN EGYPT (BILLION BBL)

- TABLE 240 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN OMAN (BILLION BBL)

- TABLE 241 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN UAE (BILLION BBL)

- TABLE 242 CRUDE OIL PRODUCTION IN REST OF MIDDLE EAST & AFRICA (THOUSAND BARRELS DAILY)

- TABLE 243 REST OF MIDDLE EAST & AFRICA: MARKET, BY WELL TYPE, 2019–2022 (USD MILLION)

- TABLE 244 REST OF MIDDLE EAST & AFRICA: MARKET, BY WELL TYPE, 2023–2028 (USD MILLION)

- TABLE 245 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 247 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 248 MARKET: DEGREE OF COMPETITION

- TABLE 249 MARKET EVALUATION FRAMEWORK, 2019–2023

- TABLE 250 MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 251 MARKET: DEALS, 2018–2023

- TABLE 252 MARKET: OTHERS, 2019–2023

- TABLE 253 APPLICATION: COMPANY FOOTPRINT

- TABLE 254 TECHNOLOGY: COMPANY FOOTPRINT

- TABLE 255 WELL TYPE: COMPANY FOOTPRINT

- TABLE 256 REGION: COMPANY FOOTPRINT

- TABLE 257 HALLIBURTON: COMPANY OVERVIEW

- TABLE 258 HALLIBURTON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 259 HALLIBURTON: PRODUCT LAUNCHES

- TABLE 260 HALLIBURTON: DEALS

- TABLE 261 HALLIBURTON: OTHERS

- TABLE 262 LIBERTY OILFIELD SERVICES LLC: COMPANY OVERVIEW

- TABLE 263 LIBERTY OILFIELD SERVICES LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 264 LIBERTY OILFIELD SERVICES LLC: PRODUCT LAUNCHES

- TABLE 265 LIBERTY OILFIELD SERVICES LLC: DEALS

- TABLE 266 SLB: COMPANY OVERVIEW

- TABLE 267 SLB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 268 SLB: PRODUCT LAUNCHES

- TABLE 269 SLB: DEALS

- TABLE 270 SLB: OTHERS

- TABLE 271 NEXTIER OILFIELD SOLUTIONS: COMPANY OVERVIEW

- TABLE 272 NEXTIER OILFIELD SOLUTIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 273 NEXTIER OILFIELD SOLUTIONS: DEALS

- TABLE 274 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 275 BAKER HUGHES COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 276 BAKER HUGHES COMPANY: PRODUCT LAUNCHES

- TABLE 277 BAKER HUGHES COMPANY: DEALS

- TABLE 278 BAKER HUGHES COMPANY: OTHERS

- TABLE 279 TRICAN: COMPANY OVERVIEW

- TABLE 280 TRICAN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 281 TRICAN: PRODUCT LAUNCHES

- TABLE 282 TRICAN: DEALS

- TABLE 283 TRICAN: OTHERS

- TABLE 284 STEP ENERGY SERVICES: COMPANY OVERVIEW

- TABLE 285 STEP ENERGY SERVICES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 286 STEP ENERGY SERVICES: DEALS

- TABLE 287 WEATHERFORD: COMPANY OVERVIEW

- TABLE 288 WEATHERFORD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 289 PROFRAC HOLDING CORP.: COMPANY OVERVIEW

- TABLE 290 PROFRAC HOLDING CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 291 PROFRAC HOLDING CORP.: DEALS

- TABLE 292 CALFRAC WELL SERVICES LTD.: COMPANY OVERVIEW

- TABLE 293 CALFRAC WELL SERVICES LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 294 TECHNIPFMC PLC: COMPANY OVERVIEW

- TABLE 295 TECHNIPFMC PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 296 PATTERSON-UTI ENERGY, INC.: COMPANY OVERVIEW

- TABLE 297 PATTERSON-UTI ENERGY, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 298 PATTERSON-UTI ENERGY, INC.: DEALS

- TABLE 299 PROPETRO HOLDING CORP.: COMPANY OVERVIEW

- TABLE 300 PROPETRO HOLDING CORP.: PRODUCTS/SERVICES/SOLUTIONS

- TABLE 301 PROPETRO HOLDING CORP.: DEALS

- TABLE 302 PETRO WELT TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 303 PETRO WELT TECHNOLOGIES AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 304 PETRO WELT TECHNOLOGIES AG: DEALS

- TABLE 305 PETRO WELT TECHNOLOGIES AG: OTHERS

- TABLE 306 NINE ENERGY SERVICE: COMPANY OVERVIEW

- TABLE 307 NINE ENERGY SERVICE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 308 NINE ENERGY SERVICES: DEALS

- TABLE 309 NINE ENERGY SERVICES: OTHERS

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET: TOP-DOWN APPROACH

- FIGURE 6 METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR HYDRAULIC FRACTURING SYSTEMS

- FIGURE 7 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF HYDRAULIC FRACTURING

- FIGURE 8 MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 9 SHALE GAS SEGMENT TO CONTINUE TO HOLD LARGEST SIZE OF MARKET, BY APPLICATION, DURING FORECAST PERIOD

- FIGURE 10 HORIZONTAL SEGMENT TO DOMINATE MARKET, BY WELL TYPE, DURING FORECAST PERIOD

- FIGURE 11 PLUG & PERF SEGMENT TO HOLD LARGER SIZE OF MARKET, BY TECHNOLOGY, DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA DOMINATED MARKET IN 2022

- FIGURE 13 INCREASING SHALE EXPLORATION AND PRODUCTION ACTIVITIES TO DRIVE MARKET FROM 2023 TO 2028

- FIGURE 14 NORTH AMERICA TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 15 SHALE GAS SEGMENT DOMINATED MARKET IN 2022

- FIGURE 16 HORIZONTAL SEGMENT ACCOUNTED FOR LARGER SHARE OF MARKET IN 2022

- FIGURE 17 PLUG & PERF SEGMENT DOMINATED MARKET IN 2022

- FIGURE 18 HORIZONTAL & US DOMINATED MARKET IN NORTH AMERICA IN 2022

- FIGURE 19 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 DRY NATURAL GAS PRODUCTION IN US, BY TYPE, 2000–2050

- FIGURE 21 GLOBAL OIL DEMAND, 2019–2028

- FIGURE 22 GLOBAL NATURAL GAS DEMAND, BY REGION, 2010–2050

- FIGURE 23 WATER USAGE IN SHALE PLAYS ACROSS US

- FIGURE 24 HYDRAULIC FRACTURING WATER CYCLE AND ITS IMPACT ON WATER SUPPLIES

- FIGURE 25 FRACTURING FLUID COMPOSITION

- FIGURE 26 APPLICATIONS OF FOAM IN OIL & GAS INDUSTRY

- FIGURE 27 REVENUE SHIFTS FOR HYDRAULIC FRACTURING PROVIDERS

- FIGURE 28 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 MARKET MAP

- FIGURE 30 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 SHALE GAS SEGMENT HELD LARGEST SHARE OF MARKET IN 2022

- FIGURE 32 HORIZONTAL SEGMENT HELD LARGER SHARE OF MARKET IN 2022

- FIGURE 33 PLUG & PERF SEGMENT HELD LARGER SHARE OF MARKET IN 2022

- FIGURE 34 MARKET IN NORTH AMERICA TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 35 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2022

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 38 MARKET SHARE ANALYSIS, 2022

- FIGURE 39 SEGMENTAL REVENUE ANALYSIS, 2017–2022

- FIGURE 40 MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 HALLIBURTON: COMPANY SNAPSHOT, 2022

- FIGURE 42 LIBERTY OILFIELD SERVICES LLC: COMPANY SNAPSHOT, 2022

- FIGURE 43 SLB: COMPANY SNAPSHOT, 2022

- FIGURE 44 NEXTIER OILFIELD SOLUTIONS: COMPANY SNAPSHOT, 2022

- FIGURE 45 BAKER HUGHES COMPANY: COMPANY SNAPSHOT, 2022

- FIGURE 46 TRICAN: COMPANY SNAPSHOT, 2022

- FIGURE 47 STEP ENERGY SERVICES: COMPANY SNAPSHOT, 2022

- FIGURE 48 WEATHERFORD: COMPANY SNAPSHOT, 2022

- FIGURE 49 PROFRAC HOLDING CORP.: COMPANY SNAPSHOT, 2022

- FIGURE 50 CALFRAC WELL SERVICES LTD.: COMPANY SNAPSHOT, 2022

- FIGURE 51 TECHNIPFMC PLC: COMPANY SNAPSHOT, 2022

- FIGURE 52 PATTERSON-UTI ENERGY, INC.: COMPANY SNAPSHOT, 2022

- FIGURE 53 PROPETRO HOLDING CORP.: COMPANY SNAPSHOT, 2022

- FIGURE 54 PETRO WELT TECHNOLOGIES AG: COMPANY SNAPSHOT, 2022

- FIGURE 55 NINE ENERGY SERVICE: COMPANY SNAPSHOT, 2022

The study involved major activities in estimating the current size of the hydraulic fracturing market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the hydraulic fracturing market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, EIA, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the hydraulic fracturing market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The hydraulic fracturing market comprises several stakeholders, such as raw material suppliers, service providers, and oilfield operators in the supply chain. The demand side of this market is characterized by the rising demand for hydraulic fracturing for shale gas, tight oil, and tight gas. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

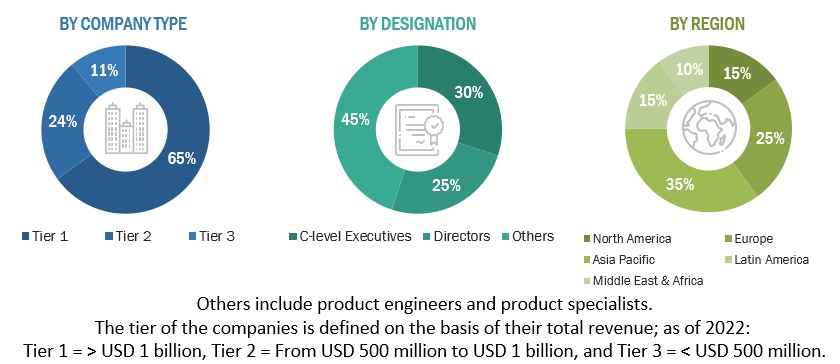

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the hydraulic fracturing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions has been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Hydraulic Fracturing Market Size: Tow-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

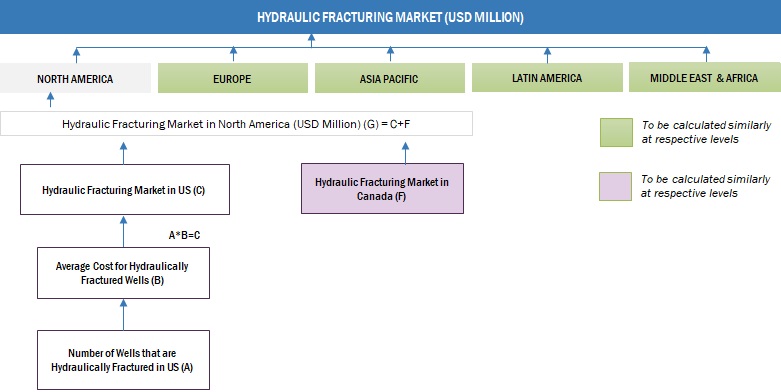

Hydraulic Fracturing Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Defenition

Hydraulic fracturing, or fracking, is a well-stimulation method used in the oil and gas industry to extract hydrocarbons from deep underground formations. It entails injecting a high-pressure fluid mixture into a wellbore, creating fractures in the rock, and enabling the flow of trapped oil or gas. The market driving forces for hydraulic fracturing encompass growing global energy demands, the exploration of unconventional resources like shale gas and tight oil, technological advancements, and economic advantages from enhanced domestic oil and gas production. These factors contribute to increased energy security and reduced reliance on imported resources.

The growth of the hydraulic fracturing market during the forecast period can be attributed to the increasing global energy demand, the exploration, and exploitation of unconventional resources, such as shale gas and tight oil, technological advancements, and economic benefits from increased domestic oil and gas production across major countries in North America, Latin America, Europe, Asia Pacific, and Middle East & Africa.

Key Stakeholders

- Consulting companies and associations in the hydraulic fracturing industry

- Environmental research institutes

- Government organizations

- Investors/shareholders

- Hydraulic fracturing equipment manufacturers

- Hydraulic fracturing service providers

- Organizations, forums, alliances, and associations

- Research and consulting companies in the oil & gas industry

- State and national regulatory authorities

Objectives of the Study

- To define, describe, segment, and forecast the hydraulic fracturing market on the basis of well type, Technology, Application, and Region, in terms of value.

- To describe and forecast the market for five key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa, along with their country-level market sizes, in terms of value.

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To provide the supply chain analysis, trends/disruptions impacting the customer’s business, market map, pricing analysis, and regulatory analysis of the market.

- To analyze opportunities for stakeholders in the market and draw a competitive landscape of the market.

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, Porter’s five forces, and case studies pertaining to the market under study.

- To benchmark market players using the company evaluation quadrant, which analyzes market players on broad categories of business and product strategies adopted by them.

- To compare key market players with respect to product specifications and applications.

- To strategically profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, new product launches, partnerships, joint ventures & collaborations, in the hydraulic fracturing market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydraulic Fracturing Market