Hyperspectral Imaging Systems Market Size, Share & Growth

Hyperspectral Imaging Systems Market By Product Type (Cameras, System Integrator), Technology (Pushbroom, Snapshot, Tunable Filter, Imaging FTIR, Whiskbroom) Wavelength (Visible & NIR, SWIR, MWIR, LWIR), Region - Global Forecast to 2030

OVERVIEW

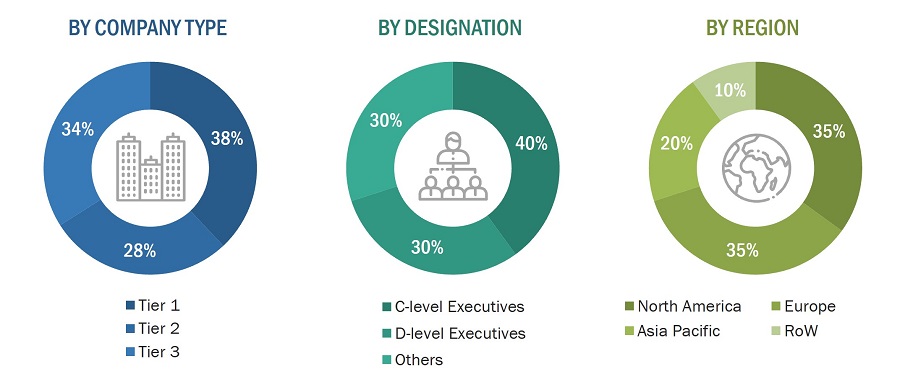

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

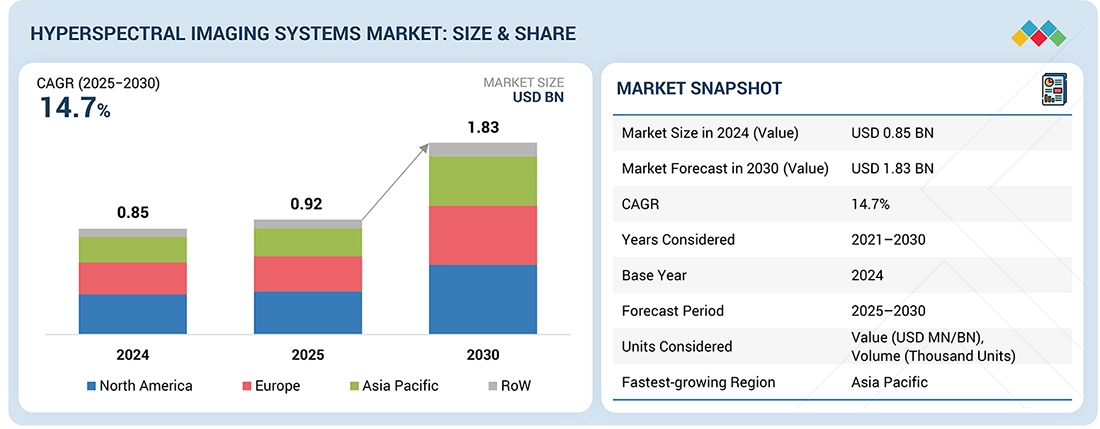

The hyperspectral imaging systems market is expected to be valued at USD 0.92 billion in 2025 and is projected to reach USD 1.83 billion by 2030, at a CAGR of 14.7% from 2025 to 2030. The market is growing due to new applications in various industries, driven by the superior spectral and spatial details provided by hyperspectral sensors, as well as the development of affordable, portable, and user-friendly hyperspectral imaging systems.

KEY TAKEAWAYS

-

BY REGIONNorth America is expected to dominate the hyperspectral imaging systems market with a share of ~35-37% in terms of value in 2025.

-

BY WAVELENGTHBy wavelength, the visible& NIR segment is expected to register the highest CAGR of ~9–13% during the forecast period.

-

BY TYPEBy type, the cameras segment is expected to register the highest CAGR of ~10–12% during the forecast period.

-

BY TECHNOLOGYBy technology, the pushbroom/ line scan segment is expected to dominate the market during the forecast period.

-

COMPETITIVE LANDSCAPE (KEY PLAYERS)HORIBA (Japan), Resonon Inc. (US), BaySpec, Inc. (US), and SPECIM, SPECTRAL IMAGING LTD. (Finland) were identified as star players in the hyperspectral imaging systems market due to their strong market share and extensive product footprint.

-

COMPETITIVE LANDSCAPE (STARTUPS/SMES)Brandywine Photonics, Pixxel, and Orbital Sidekick, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders in the hyperspectral imaging systems market.

The hyperspectral imaging systems industry is expected to expand as governments and enterprises increase their investments in advanced sensing and imaging technologies for defense, agriculture, environmental monitoring, and industrial inspection, which require detailed spectral analysis and high data accuracy. The growing adoption of precision agriculture, remote sensing, and quality control applications, along with the rising integration of hyperspectral cameras with AI and machine learning platforms, is strengthening demand. Continuous product innovations and strategic collaborations by players such as Headwall Photonics, Specim, and Resonon, including the launch of new sensors and partnerships with system integrators and research institutions, are further reinforcing sustained market growth.

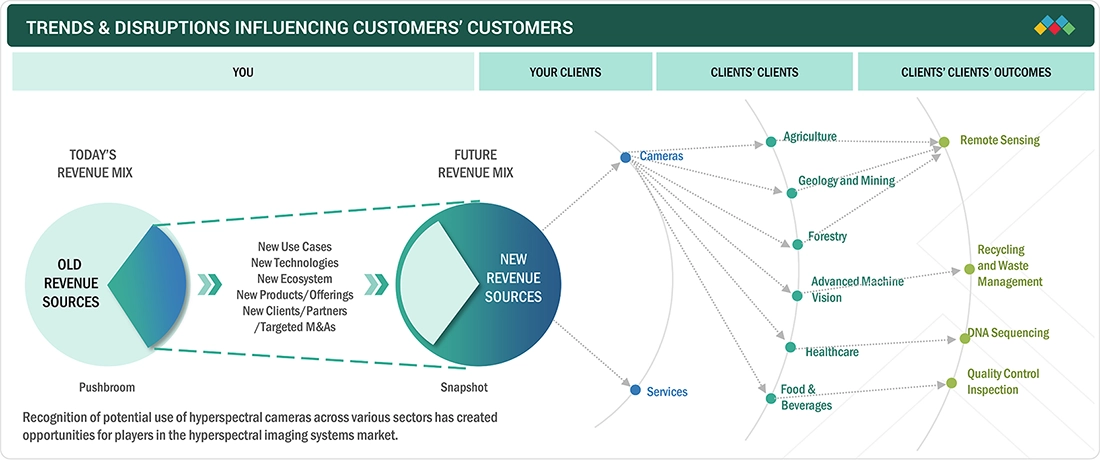

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customers in the hyperspectral imaging systems market are witnessing influential trends and disruptions that are shaping the industry. Advances in sensor technologies, marked by miniaturization and increased sensitivity, offer system manufacturers more capable and compact hyperspectral sensors to meet the requirements of various applications. The integration of artificial intelligence (AI) and machine learning (ML) algorithms into HSI data analysis enhances real-time decision-making and material identification. The rise of CubeSat hyperspectral imaging introduces cost-effective and frequent data access, particularly influencing precision agriculture and environmental monitoring. HSI is increasingly used in healthcare, with industry-specific collaborations and emphasis on portable, real-time solutions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Significant demand for hyperspectral imaging from diverse industries

-

Development of affordable, portable, and user-friendly hyperspectral imaging systems

Level

-

Need for specialized expertise to navigate complexities of hyperspectral imaging technology

-

Lack of standardized data formats and processing methods

Level

-

Ongoing miniaturization of sensors enabling deployment in handheld and airborne platforms

-

Collaborations among industry players

Level

-

Management and storage of large hyperspectral imagery datasets and high-resolution maps

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Significant demand for hyperspectral imaging from diverse industries

Emerging applications across various industries are benefiting from the superior spatial and spectral detail provided by hyperspectral sensors, which is driving growth in the hyperspectral imaging systems market. These sensors enable the precise identification and characterization of materials, leading to enhanced quality control, improved resource management, and more effective product development in sectors such as agriculture, mining, and pharmaceuticals. Businesses are eager to leverage this advanced technology to gain competitive advantages, enhance decision-making processes, and meet evolving regulatory requirements, thereby increasing the demand for hyperspectral imaging systems.

Restraint: Need for specialized expertise to navigate complexities of hyperspectral imaging technology

The interpretation and analyzing of hyperspectral data requires advanced knowledge in remote sensing, image processing, and spectral analysis, which may limit the pool of qualified professionals. Secondly, the complexity of hyperspectral imaging technology necessitates specialized training and skills, leading to higher operational costs for businesses. Additionally, the shortage of experts in this field can hinder the adoption of hyperspectral imaging systems across various industries, slowing down market growth.

Opportunity: Collaborations among industry players

Collaborations enable companies to pool resources, expertise, and technologies, leading to the development of more advanced and integrated solutions. This synergy enables the creation of tailored products that meet diverse market demands across various sectors, fostering innovation and increasing the adoption of hyperspectral imaging technology. Moreover, strategic partnerships facilitate market expansion, opening up new avenues for growth and establishing stronger footholds in emerging applications and geographic regions.

Challenge: Management and storage of large hyperspectral imagery datasets and high-resolution maps

The sheer volume of data generated by these hyperspectral imaging systems requires significant storage capacity and efficient data management solutions. Additionally, processing and analyzing such extensive datasets require advanced computational resources and expertise, which can be costly and time-consuming for businesses. Moreover, ensuring data integrity, security, and accessibility further compounds the challenge, necessitating the development of robust infrastructure and software solutions to address these complexities.

HYPERSPECTRAL IMAGING SYSTEMS MARKET SIZE, SHARE: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Google-backed space tech startup launching hyperspectral imaging satellites (Firefly constellation) to serve agriculture, mining, environmental monitoring, and defense applications from orbit. | Provides high-resolution spectral data for crop health, resource tracking, environmental analysis, and national security. |

|

Hyperspectral imaging systems deployed for precision agriculture, environmental monitoring, mining/ prospecting, industrial inspection, and defense applications using airborne, ground, and benchtop configurations. | Enables detection of crop stress and contaminants, non-destructive mineral mapping, environmental change tracking, and infrastructure inspection, improving operational insights and safety. |

|

Hyperspectral cameras deployed across agriculture, food processing, waste sorting, and research contexts, including universities using systems for mineral and food quality studies. | Provides detailed material identification and classification, enabling precise crop health analysis, contaminant detection, and academic research outcomes. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The hyperspectral imaging systems market ecosystem comprises software providers, hardware manufacturers, and end users, working together to deliver advanced spectral sensing solutions across scientific, industrial, and defense applications. Software providers focus on data processing, visualization, and analytics platforms that transform complex spectral data into actionable insights, while hardware providers supply hyperspectral cameras, sensors, and integrated systems for laboratory, airborne, and field deployments. End-users, such as space agencies, healthcare technology providers, and defense organizations, are driving adoption through large-scale programs and long-term procurement contracts. The ecosystem is further strengthened by ongoing product innovations, technology partnerships, and system integration agreements, such as collaborations between camera manufacturers and analytics software firms, as well as defense- and space-led deployments by organizations like NASA and Lockheed Martin, which support sustained market growth and the commercialization of hyperspectral imaging technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Hyperspectral Imaging Systems Market, by Wavelength

The growing focus on safety, security, and efficiency highlights the remarkable capabilities of LWIR cameras in detecting heat signatures and identifying potential hazards across various industries, including surveillance, defense, and automotive. Additionally, advancements in LWIR technology are reducing costs and improving performance, making these cameras more accessible and appealing to a wider range of businesses.

Hyperspectral Imaging Systems Market, by Type

Cameras offer precise spectral data, enabling enhanced detection and identification capabilities crucial for applications like agriculture, mineral exploration, and healthcare diagnostics. Moreover, advancements in technology have led to more compact and affordable hyperspectral cameras, making them accessible to a wider range of businesses and driving their adoption for diverse uses, thereby fueling market growth.

Hyperspectral Imaging Systems Market, by Technology

The pushbroom/line scan technology segment is expected to account for the largest market share in the hyperspectral imaging systems market during the forecast period. This rapid growth can be attributed to the technology's efficiency in capturing continuous spectral data along a linear path. Unlike other imaging technologies, pushbroom cameras can cover larger areas quickly while maintaining high resolution. This makes them particularly suitable for applications in agriculture, environmental monitoring, and infrastructure inspection. Additionally, their streamlined design and reduced complexity lead to lower costs and greater reliability, which further encourages adoption across various industries seeking advanced imaging solutions.

REGION

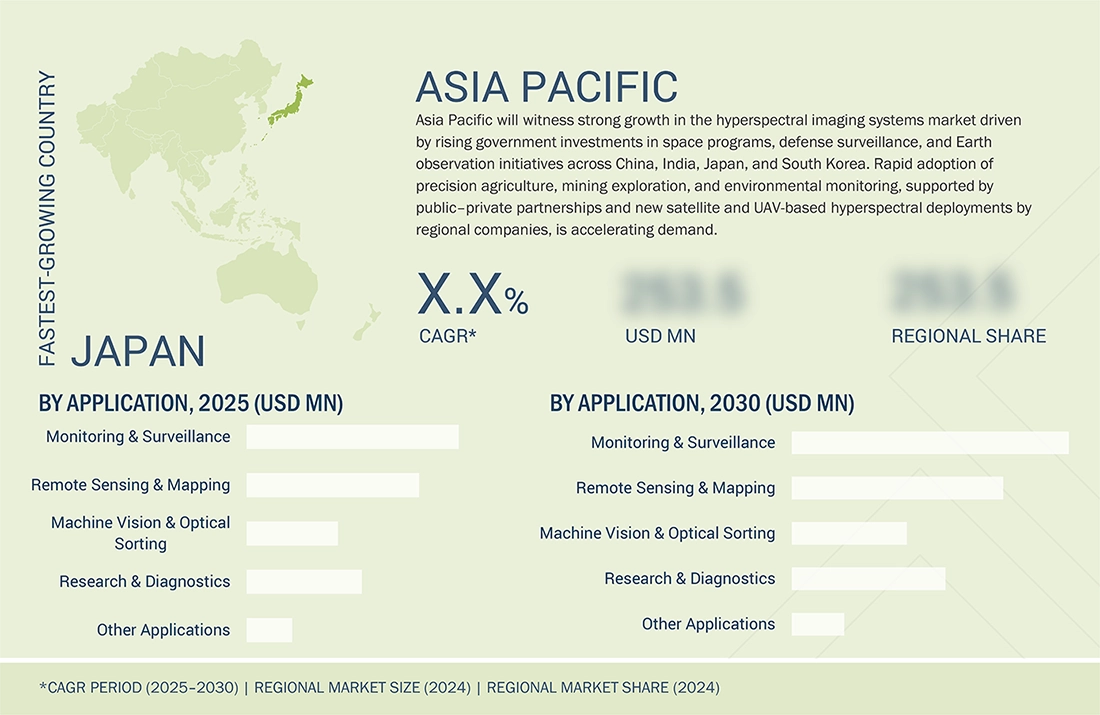

Asia Pacific to be fastest-growing region in hyperspectral imaging systems market during forecast period

The Asia Pacific region is anticipated to experience the fastest growth in the hyperspectral imaging systems market. This growth is driven by increasing government investments in space programs, defense surveillance, and precision agriculture in countries such as China, India, Japan, and South Korea. Additionally, the rapid expansion of smart farming, mining, and environmental monitoring initiatives is fueling the demand for advanced spectral imaging solutions. The region is also seeing a rise in collaborations among research institutes, system integrators, and technology providers. These partnerships, along with local product development and pilot deployments by companies, are supported by public-private agreements. Furthermore, the growth in manufacturing activity and the production of cost-effective systems is facilitating the quicker commercialization and adoption of hyperspectral imaging technologies across the Asia Pacific.

The North America hyperspectral imaging systems market is expected to be valued at USD 0.35 billion in 2025 and is projected to reach USD 0.66 billion by 2030; it is expected to grow at a CAGR of 13.9% from 2025 to 2030. The market is experiencing growth due to the emerging applications in industries. Hyperspectral sensors offer superior spectral and spatial details. The development of more affordable, portable, and user-friendly hyperspectral imaging systems further contribute to market growth.

The Asia Pacific hyperspectral imaging systems market is expected to be valued at USD 0.23 billion in 2025 and USD 0.48 billion by 2030, growing at a CAGR of 16.1% from 2025 to 2030. The regional market will grow due to rising investments in agriculture modernization, environmental monitoring, defense surveillance, and space programs across countries such as China, Japan, South Korea, and India. In parallel, increasing industrial automation and strong activity by regional players and research institutions through new product launches and government-backed sensing initiatives boost commercialization and adoption.

The Europe hyperspectral imaging systems market is expected to be valued at USD 0.28 billion in 2025 and USD 0.56 billion by 2030, growing at a CAGR of 15.0% from 2025 to 2030. The growth is due to the demand for high-resolution, multi-sector imaging in defense, medical diagnostics, agriculture and remote sensing is rising across Europe. This is supported by advances in AI-enabled sensors and miniaturization that expand use cases and lower barriers to adoption.

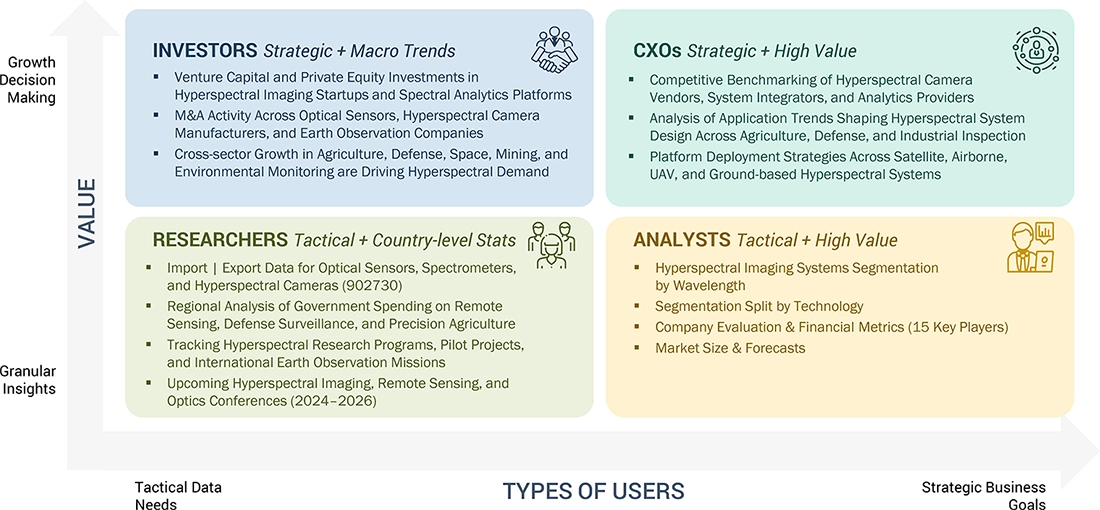

HYPERSPECTRAL IMAGING SYSTEMS MARKET SIZE, SHARE: COMPANY EVALUATION MATRIX

In the hyperspectral imaging systems market matrix, Specim (Star) holds a leading position with its strong market presence, broad hyperspectral camera portfolio, and deep expertise across industrial, agricultural, and research applications. The company’s advanced VNIR, SWIR, and MWIR solutions, along with continuous product innovation and collaborations with system integrators and research institutions, enable high adoption across food inspection, environmental monitoring, and industrial quality control. Gamaya (Emerging Leader) is gaining momentum with its drone-based hyperspectral imaging platforms, tailored for precision agriculture, which offer actionable crop intelligence through advanced analytics and AI-driven insights. While Specim continues to lead through scale, application diversity, and long-standing customer relationships, Gamaya’s focused solutions, partnerships with agribusinesses, and expanding deployment footprint highlight its potential to move closer to the leaders’ quadrant as demand for data-driven agriculture and remote sensing accelerates globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS - Hyperspectral Imaging Systems Companies

- Specim, Spectral Imaging Ltd.

- Corning Incorporated

- HORIBA

- Resonon

- Bayspec

- Imec

- Headwall Photonics

- Gamaya

- Diaspective Vision

- Photon etc

- ClydeHSI

- Norsk Electro Optikk

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.85 Billion |

| Market Forecast in 2030 (Value) | USD 1.83 Billion |

| Growth Rate | CAGR of 14.7% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: HYPERSPECTRAL IMAGING SYSTEMS MARKET SIZE, SHARE REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hyperspectral Imaging System Provider |

|

|

| Imaging Hardware Manufacturer |

|

|

| Software Analytics Provider |

|

|

| Defense/Space Organization |

|

|

RECENT DEVELOPMENTS

- November 2025 : Exosens introduced the Hyper-Cam Airborne Nano, a lightweight long-wave infrared hyperspectral camera designed for UAV and airborne missions for gas detection and environmental monitoring.

- October 2025 : Specim showcased its new high-resolution SWIR hyperspectral camera (SX25) and participated in WHISPERS 2025, spotlighting advanced imaging and signal processing capabilities for industrial and remote sensing applications.

- April 2022 : Hyperspectral satellite constellations such as Pixxel’s Firefly series continue deployment of hyperspectral sensors in space, enhancing Earth observation data for agriculture, mining, and environment.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the hyperspectral imaging systems market. Exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Sources |

Web Link |

|

Company Blogs |

What is hyperspectral Imaging?: A Comprehensive Guide - Specim Spectral Imaging |

|

Industry Journals |

|

|

Environmental Protection Agency |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the hyperspectral imaging systems market through secondary research. Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

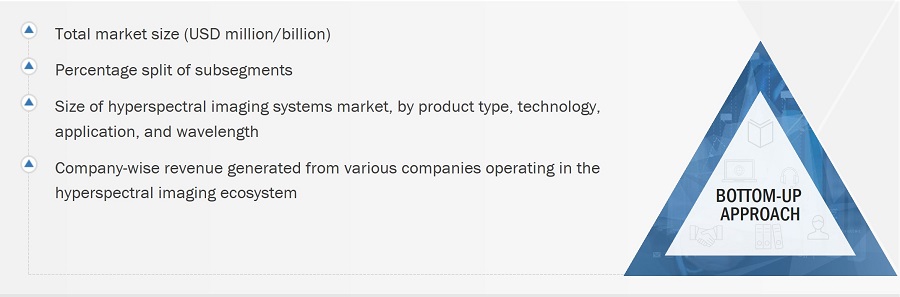

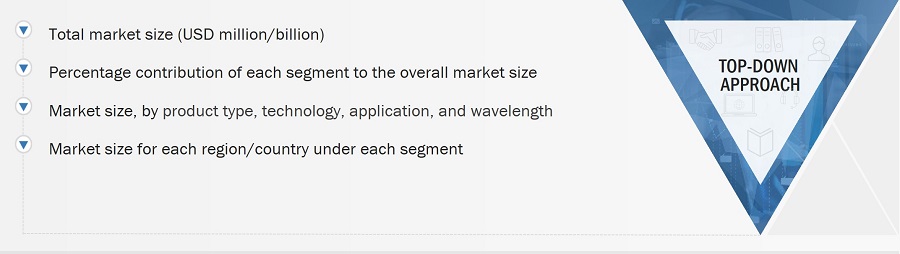

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods, to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

Bottom-Up Approach

- Identifying various wavelengths using hyperspectral imaging systems

- Analyzing the penetration of each type of wavelength through secondary and primary research

- Analyzing the penetration of hyperspectral imaging systems based on different applications and technologies through secondary and primary research

- Conducting multiple discussion sessions with key opinion leaders to understand the detailed working of hyperspectral imaging systems and their implementation in numerous applications; this helped analyze the break-up of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and finally with MarketsandMarkets domain experts

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of the hyperspectral imaging systems market; further, splitting the key market areas based on product type, technology, wavelength, application, and region, and listing the key developments.

- Identifying all leading players and applications in the hyperspectral imaging systems market based on region through secondary research and thoroughly verifying them through a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and critical applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with the industry experts to validate the information and identify critical growth pockets across all key segments

- Breaking down the total market based on verified splits and critical growth pockets across all segments

Data Triangulation

After arriving at the overall market size from the estimation process explained in the previous section, the total market was split into several segments and subsegments. Where applicable, the data triangulation procedure was employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides, and the market size was validated using top-down and bottom-up approaches.

Market Definition

Hyperspectral imaging systems are utilized to capture specific spectral bands across a continuous spectrum. Hyperspectral imaging systems are advanced imaging technologies that capture and process information across a wide range of the electromagnetic spectrum. Unlike traditional imaging systems, which typically capture images in three spectral bands (red, green, and blue), hyperspectral imaging systems collect spectral data across hundreds or thousands of narrow contiguous bands. These systems consist of hyperspectral cameras along with their accompanying systems. They are widely used in fields such as agriculture, environmental monitoring, mining etc.

Key Stakeholders

- Hyperspectral imaging systems providers

- Original equipment manufacturers (OEMs)

- Research organisations and consulting firms

- Technology standards organisationa

- Raw material suppliers

- Allaince and associations related to hyperspectral imaging technology

- Technology solution providers and design contractors

- Electronics and semiconductor companies

- Technology standards organizations, forums, alliances, and associations

- Analysts and strategic business planners

- Associations, organizations, and alliances related to hyperspectral imaging technology

- Universities and research organizations

- Government bodies

Report Objectives

- To describe and forecast the hyperspectral imaging systems market by offering, technology, wavelength, application, and region.

- To forecast the market size for various segments concerning four key regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges).

- To forecast the size of the hyperspectral cameras deployed in the hyperspectral imaging systems market.

- To provide a detailed overview of the value chain of hyperspectral imaging system ecosystems, along with the average selling price for hyperspectral cameras and other systems

- To strategically profile key players and comprehensively analyze their position in the hyperspectral imaging systems market regarding their ranking and core competencies and detail the competitive landscape for market leaders.

- To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios, tariff analysis, and case studies about the market under study.

- To analyze strategic developments, such as product launches, related developments, acquisitions, expansions, and agreements, in the market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of regions into respective countries

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hyperspectral Imaging Systems Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Hyperspectral Imaging Systems Market