Military Electro-Optics/Infrared (EO/IR) Systems Market by Product Type (Handheld Systems, EO/IR Payloads), Platform, Component, Cooling Technology, Sensor Technology, Imaging Technology, Point of Sale, and Region - Global Forecast to 2028

Update: 11/22/2024

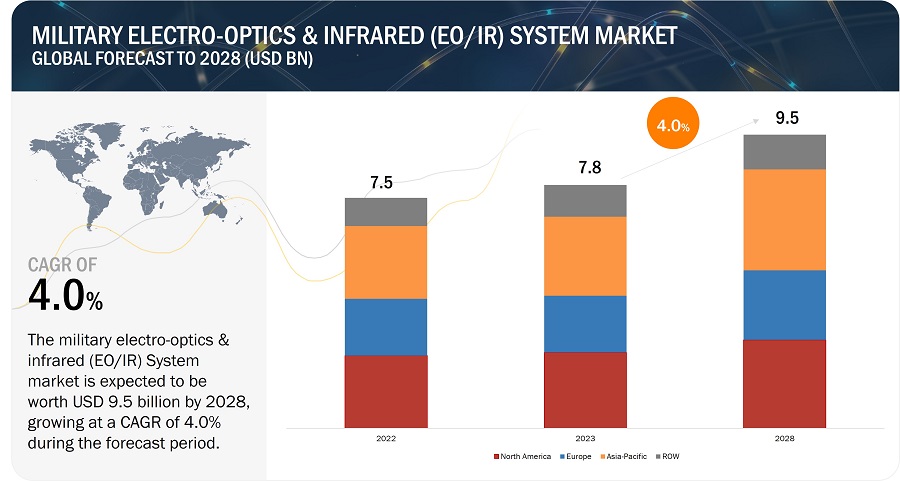

The Global Military Electro-Optics/Infrared (EO/IR) Systems Market Size was valued at USD 7.8 billion in 2023 and is estimated to reach USD 9.5 billion by 2028, growing at a CAGR of 4% during the forecast period. The market is driven by factors such as different value chain levels for vendors, increased use of military electro-optics & infrared (EO/IR) System in military operations among others.

Military Electro-Optics/Infrared (EO/IR) Systems Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Military electro-optics & infrared (EO/IR) System Market Dynamics:

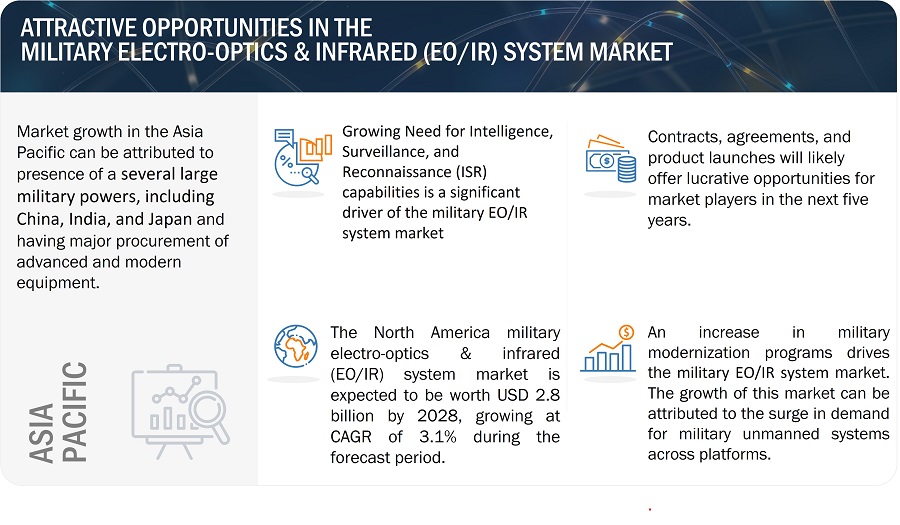

Drivers: Growing Need for Intelligence, Surveillance, and Reconnaissance (ISR)

The military requires reliable and accurate Intelligence, Surveillance, and Reconnaissance (ISR) capabilities to gather critical information about enemy forces, terrain, and other aspects of the battlefield. This information is crucial in determining the best course of action for military operations, as well as assessing the effectiveness of those operations. EO/IR sensors are a critical component of ISR capabilities, as they provide real-time situational awareness and surveillance capabilities. EO/IR sensors can detect, track, and identify potential threats in various lighting and weather conditions, providing critical information for military operations.

The growing need for ISR capabilities is driven by the changing nature of modern warfare. Militaries are increasingly facing asymmetrical threats, such as terrorism and insurgency, which require accurate and reliable intelligence to identify and neutralize potential threats. Furthermore, militaries are increasingly operating in urban environments, where traditional ISR methods may not be effective. In these environments, EO/IR sensors can provide valuable intelligence by detecting and tracking potential threats in real time. The demand for ISR capabilities is also driven by the need for increased efficiency in military operations. Accurate and reliable intelligence can help reduce the risks associated with military operations, as well as improve decision-making in critical situations.

Globally, the demand for robots is increasing as they are used for carrying out target acquisition and surveillance operations by defense forces of different countries. Companies like Northrup Grumman Corporation (US), L3Harris Technologies Inc. (US), IAI (Israel), and Elbit System (Israel), Raytheon Technologies Corporation (US), Thales Group (France), BAE System (UK) are developing military robots with intelligence, surveillance, reconnaissance (ISR), and target acquisition capabilities.

Overall, the growing need for ISR capabilities is a significant driver of the Military EOIR Market, as militaries continue to invest in advanced sensors that can provide real-time situational awareness and surveillance capabilities.

Restraints: Stagnant product life cycle

The life cycle for electro-optics/infrared systems varies from 10-15 years; these systems are upgraded post the mentioned time frame. Therefore, the market is prone to being stagnant in the technological front for a long time. The Military Electro optical and Infrared system market is also broadly dependent on the new line of aircraft and armored vehicles, as well as ships and submarines that are yet to be manufactured. In addition, the upgraded hardware or newly manufactured hardware might not be compatible with other parts of the EO/IR systems.

Opportunities: Integration of electro-optics/infrared systems with conventional military systems.

The military & defense community is currently facing the issue of obsolescence. The defense industry is a technology-driven industry; the need to upgrade systems in the defense industry is greater in comparison to other industries. Defense forces worldwide are required to support legacy systems, while constantly upgrading the existing systems with new technological capabilities. The best approach to preserve and extend the life of aging military systems is the addition of modern protocol devices. System manufacturers are currently focused on integrating electro-optics/infrared systems with traditional military systems. For instance, Wide Area Persistent Surveillance System (AWAPSS) manufactured by BAE Systems (UK) is integrated into an old in-service military aircraft for improved surveillance.

Challenges: Complexity involved in integration of EO/IR System with wide range of platforms.

Integrating a EO/IR system with standalone solutions to the desired level has always been a complex task. EO/IR system can be equipped with weapon gun systems, ISR system, CS4I System and their integration requires significant investments and power sources. The level of complexity increases with the decrease in the amount of space available on platforms. Thus, combat helicopters have the highest complications in integration, followed by armored vehicles and ships.

Military EO/IR systems must be integrated with other systems, including command and control systems, radar systems, and communications networks. This integration can be challenging and may require significant customization and testing to ensure compatibility and optimal performance.

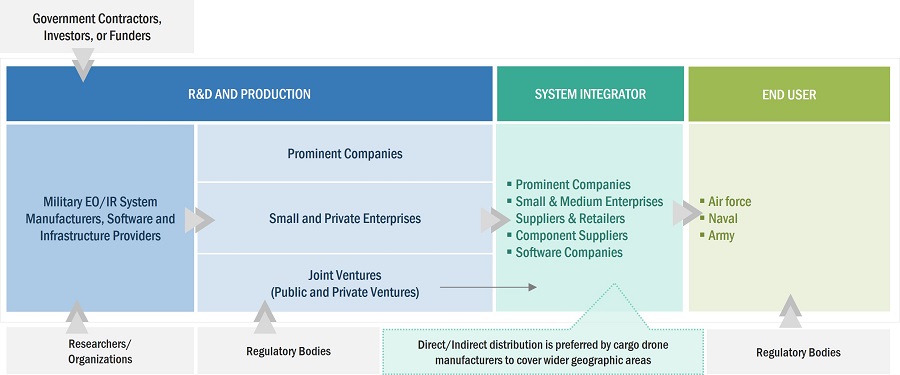

Military Electro-Optics & Infrared (Eo/Ir) System Market Ecosystem

Based on product type, the handheld system segment is projected to grow at the highest CAGR in the military electro-optics & infrared (EO/IR) System market during the forecast period

Based on product type, the Military Electro-Optics & Infrared (EO/IR) System Industry has been segmented into handheld system and EO/IR payload. Need to support to soldiers in battlefield and to remote places is driving the handheld system of military electro-optics & infrared (EO/IR) System market.

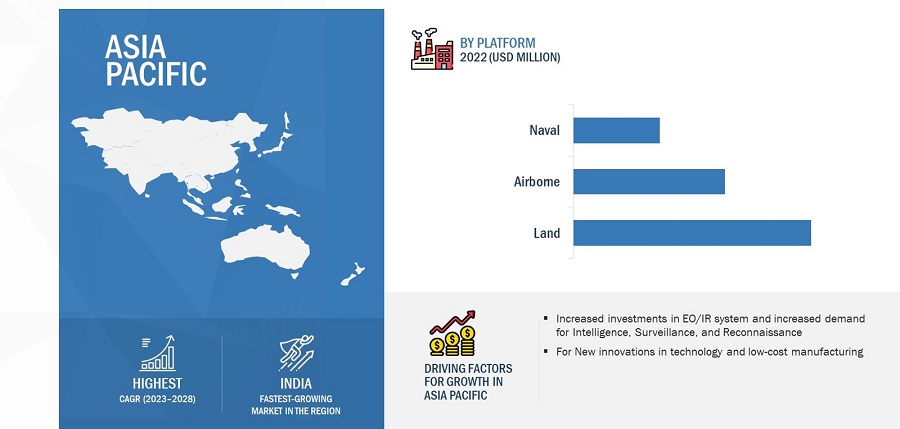

Based on platform, the land segment is projected to grow at the highest CAGR in the military electro-optics & infrared (EO/IR) System during the forecast period

Based on platform, the Military Electro optical and Infrared system market has been segmented into land, airborne, naval. The land segment is expected to grow at a higher CAGR during the forecast period. The increasing need to vehicle and soldier system in military application is driving this segment of the market.

Asia Pacific is expected to account for the highest CAGR in the forecasted period and largest share in 2022.

The Asia Pacific is estimated to account for the highest CAGR in forecasted period and largest share in 2022. The countries in Asia Pacific region offers significant opportunities for EO/IR system manufacturers as this region has been upgrading its soldier system and modernization military equipment by establishing new developments in the EO/IR system market. Increasing EO/IR system investments in countries such as India, China and Japan are driving the growth of this region.

Military Electro-Optics/Infrared (EO/IR) Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the Military Electro-Optics & Infrared (EO/IR) Companies include Northrop Grumman(US), Raytheon Technologies Corporation(US), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US) and Thales Group(France), Teledyne FLIR (US), Elbit System (Israel), BAE System (UK), Aselsan AS (Turkey).

Scope of the Report

This research report categorizes

|

Report Metric |

Details |

|

Growth Rate |

4.0% |

|

Estimated Market Size in 2023 |

USD 7.8 Billion |

|

Projected Market Size in 2028 |

USD 9.5 Billion |

|

Market Size Available for Years |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD billion) |

|

Segments Covered |

Cooling Technology, Imaging Technology, Sensor Technology, Product Type, Platform, Component, Point of Sale, Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies Covered |

Northrop Grumman Corporation(US), Raytheon Technologies Corporation(US), L3Harris Technologies Inc.(US), Lockheed Martin Corporation (US), Thales Group (France), Aselsan AS (Turkey), Teledyne FLIR (US), BAE System (UK), Elbit System (Israel), Rheinmetall AG (Germany), Alpha Design Technologies (India) |

Military Electro-Optics/Infrared (EO/IR) Systems Market Highlights

This research report categorizes the military EO/IR system market based on Cooling Technology, Imaging Technology, Sensor Technology, Product Type, Platform, Component, Point of Sale

|

Segment |

Subsegment |

|

By Cooling Technology: |

|

|

By Sensor Technology: |

|

|

By Component: |

|

|

By Imaging Technology: |

|

|

By Product Type: |

|

|

By Platform: |

|

|

By Point of Sale: |

|

|

By Region: |

|

Recent Developments

- In February 2023, The US Marine Corps awarded the initial production and operations contract for the Next Generation Handheld Targeting System (NGHTS). to Northrop Grumman Corporation. NGHTS is a portable targeting system that offers high-precision targeting and can function in locations without GPS.

- In July 2022, According to the terms of a USD 22.6 million contract, Combat aircraft specialists at Lockheed Martin Corporation will purchase 22 360-degree electro-optical sensor systems from Raytheon Technologies Corporation for the US F-35 joint strike fighter. Six infrared (IR) cameras are positioned around the aircraft, and the electro-optical DAS gathers real-time, high-resolution imagery from these cameras and delivers it to the pilot's helmet-mounted display, giving them a 360-degree spherical view of the surroundings.

- In October 2022, For the US Air Force Special Operations Command's AC-130J Ghostrider modernization program, L3Harris Technologies Inc. has provided an imaging system. L3Harris delivered its WESCAM MX-25D, the company's 6,000th such system, to act as the primary imaging asset for the heavy ground-attack aircraft. Electro-optical/infrared WESCAM MX-25D is a capability for intelligence, surveillance, and reconnaissance.

Frequently Asked Questions (FAQ):

What is the current size of the military electro-optics & infrared (EO/IR) System market?

The military electro-optics & infrared (EO/IR) System market is projected to grow from an estimated USD 7.8 billion in 2023 to USD 9.5 billion by 2028, at a CAGR of 4.0% from 2023 to 2028.

What are the key sustainability strategies adopted by leading players operating in the military EO/IR system market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the military EO/IR system market. Major players, including Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), Teledyne FLIR (US), Elbit System (Israel), and Rheinmetall AG (US), have adopted strategies, such as contracts and agreements, to expand their presence in the market further.

What new emerging technologies and use cases disrupt the military EO/IR system market?

Response: Some of the major emerging technologies and use cases disrupting the market include the development of land compact vehicles, unmanned systems across the platform, and others.

Who are the key players and innovators in the ecosystem of the military EO/IR system market?

Response: Key players include Lynred (France), Infiniti Electro Optics(Canada) Rafael Advanced Defense System Ltd. (Israel), Ascent Vision Technologies (Montana) Height Technologies (Netherlands), Mercury System (US).

Which region is expected to hold the highest market share in the remote weapon station market?

Response: Asia Pacific accounted for the largest share of 31.9% of the market in 2022, while Asia Pacific is expected to grow at the highest CAGR of 5.5% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

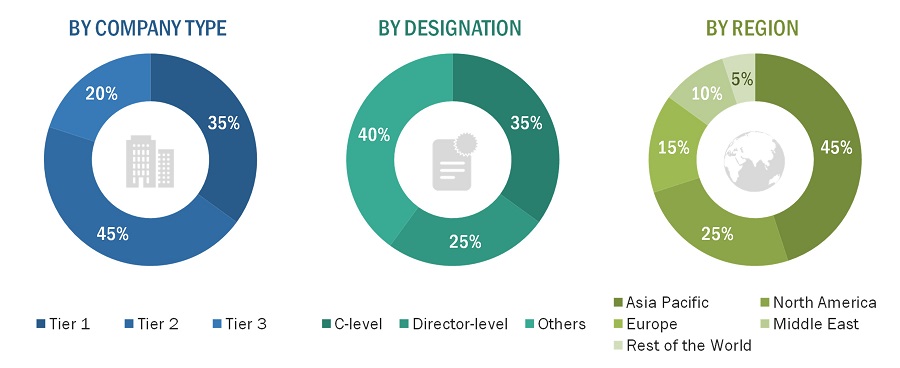

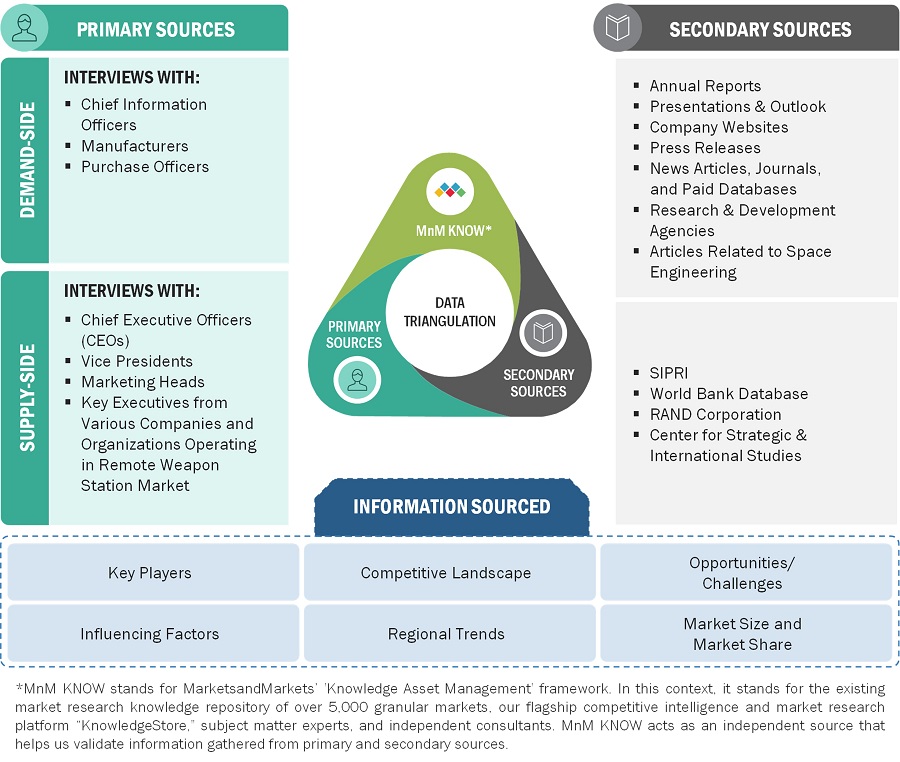

The research study conducted on the military electro-optics & infrared (EO/IR) system market involved extensive use of secondary sources, including directories, databases of articles, journals on military EO/IR system, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the military EO/IR system market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the military EO/IR system market.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the military electro-optics & infrared (EO/IR) system market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturer's associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the military electro-optics & infrared (EO/IR) system industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the military electro-optics & infrared (EO/IR) system market. Several primary interviews were conducted with the market experts from both demand- and supply-side across major regions, namely, North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa. Primary sources from the supply-side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the military electro-optics & infrared (EO/IR) system market.

To know about the assumptions considered for the study, download the pdf brochure

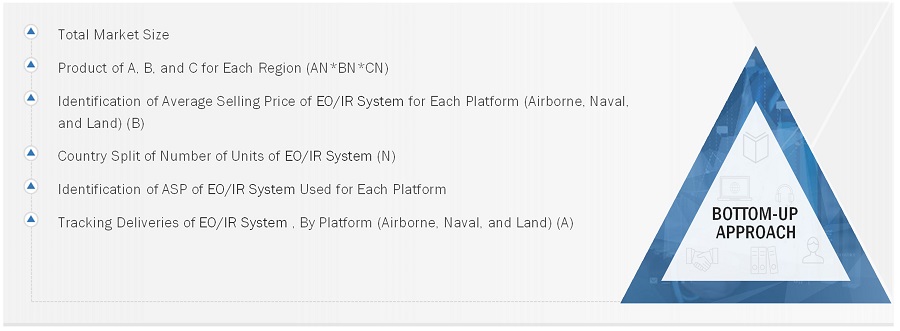

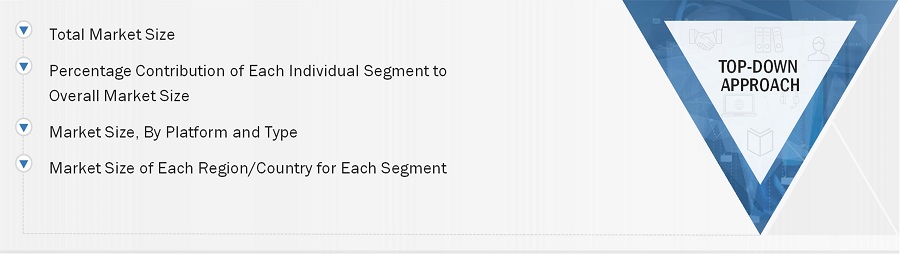

Market Size Estimation

The military electro-optics & infrared (EO/IR) system market is an emerging one due to the growing demand for intelligence, surveillance and Reconnaissance. Both top-down and bottom-up approaches were used to estimate and validate the size of the military electro-optics & infrared (EO/IR) system market. The research methodology used to estimate the market size also included the following details:

Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up approach

Market size estimation methodology: Top down approach

Data Triangulation

After arriving at the overall size of the military electro-optics & infrared (EO/IR) system market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated sizes of different market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches

Market Definition

EO/IR stands for Electro-Optical/Infrared, and it refers to technologies that use both visible light and infrared radiation to capture images and gather information about a scene or target. In the military context, EO/IR systems are often used for surveillance, reconnaissance, and targeting. Electro-optical systems use visible light to capture images, like a digital camera. These systems may include cameras, telescopes, and other optical devices. Infrared systems, on the other hand, capture images based on heat radiation, allowing them to detect objects even in low light or obscured conditions. Together, EO/IR systems can provide a comprehensive view of a scene, allowing military operators to gather information and make decisions about potential threats. They are often used in aircraft, drones, and ground-based systems for various military applications, including border security, force protection, and intelligence gathering.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the military electro-optics & infrared (EO/IR) system market based on platform, weapon type, component, application, mobility, technology, and region from 2023 to 2028.

- To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), which comprises the Middle East, Latin America & Africa

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the military electro-optics & infrared (EO/IR) system market across the globe.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the military electro-optics & infrared (EO/IR) system market

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions and expansions, agreements, joint ventures and partnerships, new product launches, and Research & Development (R&D) activities in the military electro-optics & infrared (EO/IR) system market

- To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players.

- To strategically profile key market players and comprehensively analyze their core competencies2.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Electro-Optics/Infrared (EO/IR) Systems Market

New investment in EO/IR sensing. What is the market size, trend, and opportunity for 2020-2025? OPIR, advanced/emerging threats, and similar government requirements.

Undergoing current analysis of electro-optical and infrared sensor assets for new UAV and UUV platforms which we are assessing and evaluating for potential FY 2020 implementation and deployment.