Optical Imaging Market by Product (Cameras, Lenses), Technique (OCT, HIS, NIR, PAT), Therapeutic Area (Ophthalmology, Dermatology, Oncology), Application (Pathological, Intraoperative), End User (Hospital, Research Labs) & Region - Global Forecast to 2027

Market Growth Outlook Summary

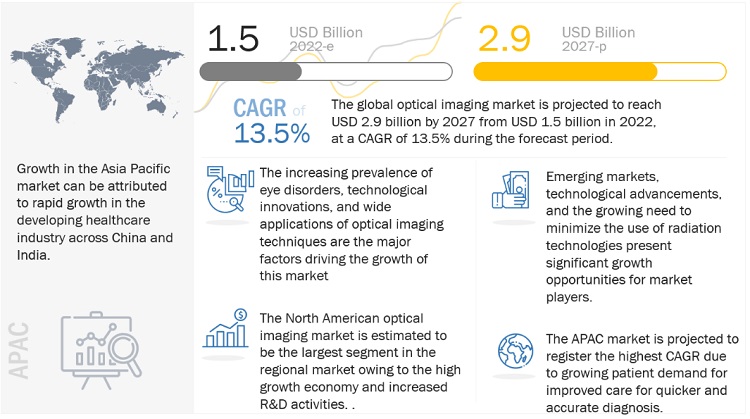

The global optical Imaging market, stood at US$1.5 billion in 2022 and is projected to advance at a resilient CAGR of 13.5% from 2023 to 2027, culminating in a forecasted valuation of US$2.9 billion by the end of the period. Precise differentiation between soft tissues and affected tissues, reduced patient exposure to eradicating radiations, increased prevalence of age related macular degeneration, increased GDP expenditure on healthcare among rapidly growing economies, increased need and adoption of non invasive tools for rapid scanning and identification of disorders coupled with increasing research to adopt these tools in the field of dentistry, gastroenterology, and gynecology are factors influencing the market growth and adoption of optical imaging systems. However, high costs of instruments, stringent regulatory approval procedures, a dearth of skilled operators, and insufficient reimbursements for optical imaging procedures are factors posing several challenges to the overall growth of the market during the forecast period.

Global Optical imaging Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Optical imaging Market Dynamics

DRIVERS: Increasing prevalence of eye disorders due to the rising geriatric population

The growing prevalence of eye disorders, owing to the rising global geriatric population, is one of the key factors driving the growth of the global market. The tear layer loses stability and degrades faster in the elderly, making them more prone to eye disorders. Therefore, the risk of getting severe eye disorders increases significantly with age, particularly after 60 years. Currently, the prevalence rate of glaucoma is four times higher in individuals aged 80 years and above as compared to those aged 40 years and above. Also, the prevalence rates of several other eye disorders, such as cataract, presbyopia, and age-related macular degeneration (AMD), is increasing across the globe. For instance, according to Prevent Blindness (US), 24.41 million people were suffering from cataracts in the US in 2010; this number is expected to increase to 50.0 million by 2050.

RESTRAINTS: Reimbursement challenges

The US is the largest market for optical imaging technologies. However, recent changes in reimbursement policies in the country are expected to affect the growth of this market. With the implementation of the Affordable Care Act (ACA), the size of the insured population in the US has increased. However, this has also resulted in insufficient reimbursements for newly insured patients. Moreover, medical reimbursements for various optical imaging technologies are decided based on their use for intended applications.

In July 2020, the Centers for Medicare, and Medicaid Services (CMS) implemented major changes in reimbursements for several vitreoretinal procedures. They implemented a 15% reimbursement cut for all cataract surgeries performed within the US. Thus, reimbursement changes pose a great barrier to the market growth.

OPPORTUNITIES: Emerging economies

Emerging countries such as India, China, Japan, and Brazil are expected to provide significant growth opportunities for players operating in the global market. These countries are some of the fastest-growing economies in the world. According to estimates from the World Economic Forum, 2020, these emerging economies contributed to around one-third of the global healthcare expenditure. The rise in geriatric population and diseases associated with it are also certain factors that create high growth opportunities for the market.

CHALLENGES: Sustainability of small and medium-sized players

Increasing market competitiveness is one of the major challenges in the optical imaging systems market, especially for small and mid-tier companies. Although the global market is dominated by few players such as PerkinElmer, Inc., Carl Zeiss Meditec AG, and Abbott Laboratories, new entrants and mid-tier firms continuously strive to garner a greater market share and market visibility. However, higher costs and longer time required for the development of optical imaging products pose a major barrier for such companies.

Optical Coherence Tomography segment accounted for the largest share in the optical imaging market by technique

The demand for better techniques and safer diagnostic procedures is rising as a result of changes in the medical technology sector. The demand for non-invasive diagnostic imaging modalities is driven by factors such as increasing elderly population, an increase in the prevalence of chronic diseases, and the need for safer diagnostic methods. This in turn fuels the market's expansion. OCT systems enables the visualisation of optically scattered, non transparent tissues, making it a useful tool for the diagnosis in various therapeutic areas.

Ophthalmology segment accounted for the largest share in the optical imaging market by therapeutic area

The market's overall growth for ophthalmology is likely to be driven by the growing number of ophthalmic procedures being performed every year across the globe. Nearly 3.7 million cataract procedures are performed in the US, 7 million in Europe and 20 million worldwide. With the increased awareness of optical instruments in the developing countries, the market provides great growth opportunity in these regions. Growing demand for low cost OCT systems is creating opportunities for the market to flourish in this region. This trend is expected to continue in the coming years and contribute to overall market growth. The increasing aging population, coupled with the rising prevalence of ophthalmic disorders, will play a vital role in the growth of the global market during the forecast period

Imaging systems segment accounted for the largest share in the optical imaging market by product

The imaging systems segment accounted for the largest share of the global market, by product in the forecast period. This segment's large share can be attributed to its wide application in ophthalmology, oncology, and other application. These systems are widely adopted as they provide real-time, 1D depth, 2D cross-sectional, and 3D volumetric images with micron-level resolution and imaging depths of up to a few millimeters with no hazardous radiation. Subsurface tissue details are hidden without OCT display in bright and sharp images, allowing for a better understanding of ocular pathology. In turn, this development helps surgeons overcome uncertainties during eye surgeries to achieve the best possible patient outcome.

Hospital segment accounted for the largest share in the optical imaging market by end user

Based on end user, the market, by end user is led by the hospital and clinics segment Hospitals and clinics majorly adopt optical imaging technologies for ophthalmological diagnostic imaging and cancer screening procedures. These technologies are also used in cardiology, neurology, and dermatology, but to a lesser extent. This market's growth is mainly driven by the increasing clinical applications of optical imaging techniques in various therapeutic areas and the growing demand for optical imaging products by clinicians across the globe.

Geographic Snapshot: Optical Imaging Market

To know about the assumptions considered for the study, download the pdf brochure

Key players in the optical imaging market include Carl Zeiss Meditec (Germany), Abbott (US), Topcon Corporation (Japan), Canon (Japan), PerkinElmer (US), Koninklijke Philips (Netherlands), Heidelberg Engineering (US), Leica Microsystems (Germany), Headwall Photonics (US), Visionix (US), Optical Imaging (Israel), Optos (Scotland), Wasatch Photonics (US), ArcScan (US), DermaLumics (Spain), Cylite (Australia), MOPTIM (Guangdong), Michelson Diagnostics (England), Thorlabs (US), Hamamatsu Photonics (Japan), iTheraMedical (Germany), Kibero (Germany), Seno Medical (US), Aspectus Imaging (Germany), and Agfa-Gevaert (Belgium).

Optical Imaging Market Report Scope

|

Report Metric |

Details |

|

Market Size available for years |

2020-2027 |

|

Base Year Considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast Unit |

Value(USD Billion) |

|

Segments covered |

Product, Application, Therapeutic Area, Techniques and End User |

The research report categorizes the optical imaging market into the following segments & sub-segments:

By Product

- Imaging Systems

- Camera

- Software

- Lenses

- Illuminating Systems

- Other

By Application

- Pathological Imaging

- Intraoperative Imaging

By End User

- Hospitals

- Research Laboratories

- Pharmaceutical and Biotechnology Companies

By Therapeutic Area

- Ophthalmology

- Oncology

- Cardiology

- Dermatology

- Neurology

- Others

By Technique

- Optical Coherence Tomography

- Near infrared Spectroscopy

- Hyperspectral Imaging

- Photoacoustic Tomography

By Region

-

North America North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- Rest of Latin America

- Middle East and Africa

Recent Developments of Optical Imaging Market

- In January 2023, Canon Medical Inc., partnered with ScImage. The strategic partnership between the two companies will directly broaden and advance Canon Medical Systems’ outreach in hemodynamics with the Fysicon QMAPP Hemo portfolio (Fysicon is a Canon Medical subsidiary). As a result, Canon Medical plans to increase its presence in the cardiac market, offering innovative solutions and unique business models tailored to each client’s specific needs.

- In August 2021, Topcon partnered with RetInSight to develop a seamless interface between RetInSight’s AI-assisted retinal biomarker applications and Topcon’s market-leading OCT devices and cloud-based data management solution, Harmony.

- In December 2020, Carl Zeiss acquired arivis to further strengthen its software competencies and market position in 3D image visualization, image processing, and analysis software for research microscopy.

Frequently Asked Questions (FAQ):

What is the expected market size for optical imaging technologies by 2027?

The global optical imaging technologies market is projected to grow from $1.5 billion in 2022 to $2.9 billion by 2027, at a compound annual growth rate (CAGR) of 13.5%, driven by the rising geriatric population, advancements in diagnostic imaging, and increased demand for non-invasive procedures.

What factors are driving the growth of the optical imaging market?

The growth of the optical imaging market is driven by the increasing prevalence of eye disorders, particularly due to the rising geriatric population, along with the expanding applications of optical imaging in drug discovery, preclinical research, and other healthcare applications.

What are the key challenges faced by the optical imaging market?

Key challenges in the optical imaging market include reimbursement issues, particularly in the U.S., where policy changes are affecting coverage for certain procedures, and the sustainability of small to mid-tier companies struggling with high product development costs.

Which optical imaging technology holds the largest market share?

Optical Coherence Tomography (OCT) holds the largest share in the optical imaging market, widely used for the non-invasive diagnosis of eye diseases, with increasing applications in other therapeutic areas such as oncology, cardiology, and dermatology.

Which therapeutic area is the largest contributor to the optical imaging market?

Ophthalmology is the largest contributor to the optical imaging market, with optical imaging technologies like OCT being extensively used for diagnosing and managing eye disorders such as glaucoma, cataract, and age-related macular degeneration (AMD).

What are the key opportunities in the optical imaging market?

Emerging economies such as India, China, and Brazil offer significant growth opportunities for the optical imaging market due to increasing healthcare expenditure, rising aging populations, and the growing prevalence of diseases requiring optical imaging diagnostics.

Which end-user segment dominates the optical imaging market?

Hospitals and clinics dominate the optical imaging market as they are the primary users of these technologies, especially for ophthalmological diagnostic imaging and cancer screening procedures.

How does the aging population impact the optical imaging market?

The aging population significantly impacts the optical imaging market, as the prevalence of age-related diseases like cataracts, glaucoma, and AMD increases, driving the demand for optical imaging technologies for early diagnosis and management.

What recent technological advancements are shaping the optical imaging market?

Recent technological advancements such as the development of advanced OCT systems, near-infrared spectroscopy, and hyperspectral imaging are enhancing the accuracy, speed, and depth of diagnostics, shaping the future of the optical imaging market.

Who are the leading players in the optical imaging market?

The leading players in the optical imaging market include Carl Zeiss Meditec, Abbott, Topcon Corporation, Canon, PerkinElmer, and Koninklijke Philips, among others, offering a wide range of innovative optical imaging products and solutions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing geriatric population and subsequent increase in prevalence of eye disorders- Technological innovations- Growing application areas of optical imaging techniques- Growing need to minimize use of radiation technologiesRESTRAINTS- Reimbursement challenges- Lack of skilled operatorsOPPORTUNITIES- Expansion and market penetration opportunities in emerging economies- Growing applications in pharmaceutical & biotechnology researchCHALLENGES- Sustainability of small and medium-sized players- High cost of optical imaging procedures and extensive data requirements

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- Japan- China- India

-

5.7 PATENT ANALYSIS

- 5.8 PRICING ANALYSIS

-

5.9 TRADE DATAUSCHINAUKINDIA

- 6.1 INTRODUCTION

-

6.2 IMAGING SYSTEMSOPTICAL IMAGING SYSTEMS- Growing need for high-resolution imaging in ophthalmology to drive market growthSPECTRAL IMAGING SYSTEMS- Growing need for advanced imaging techniques to promote growth

-

6.3 CAMERASBENEFITS SUCH AS BETTER SENSITIVITY AND HIGH-RESOLUTION IMAGING CAPABILITIES TO DRIVE DEMAND FOR CAMERAS

-

6.4 SOFTWAREGROWING DEMAND FOR ADVANCED AND OPTIMIZED OPTICAL IMAGING SOFTWARE TO SUPPORT GROWTH

-

6.5 LENSESTECHNOLOGICAL ADVANCEMENTS IN IMAGING TO BOOST DEMAND FOR LENSES

-

6.6 ILLUMINATION SYSTEMSGROWING DEMAND FOR NON-IONIZING AND RADIATION-FREE TECHNIQUES TO BOOST MARKET GROWTH

- 6.7 OTHER PRODUCTS

- 7.1 INTRODUCTION

-

7.2 OPTICAL COHERENCE TOMOGRAPHY (OCT)RISING INNOVATIONS IN OCT TO DRIVE MARKET GROWTH

-

7.3 NEAR-INFRARED SPECTROSCOPY (NIRS)INCREASING FUNDS BY GOVERNMENT ORGANIZATIONS AND UNIVERSITIES FOR R&D TO PROMOTE MARKET GROWTH

-

7.4 HYPERSPECTRAL IMAGING (HSI)GROWING INDUSTRIAL APPLICATIONS OF HYPERSPECTRAL IMAGING TO BOOST GROWTH

-

7.5 PHOTOACOUSTIC TOMOGRAPHY (PAT)RISING CANCER CASES AND BROAD APPLICATIONS IN RESEARCH AND CLINICAL CARE TO SUPPORT GROWTH

- 8.1 INTRODUCTION

-

8.2 PATHOLOGICAL IMAGINGLOW OPERATIONAL COSTS AND RELATIVE EASE OF USE TO DRIVE GROWTH

-

8.3 INTRA-OPERATIVE IMAGINGRISING LABOR COSTS AND INCREASING NEED FOR ACCURACY IN MEDICAL PROCESSES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 OPHTHALMOLOGYGROWING NUMBER OF OPHTHALMIC PROCEDURES TO PROPEL MARKET

-

9.3 ONCOLOGYGROWING PRECLINICAL DRUG DEVELOPMENT RESEARCH ON CANCER TO PROMOTE GROWTH

-

9.4 CARDIOLOGYADVANCED INNOVATIONS IN OCT TECHNIQUES FOR CARDIOLOGY APPLICATIONS TO BOOST MARKET

-

9.5 DERMATOLOGYGROWING INCIDENCE OF SKIN CANCER TO FUEL DEMAND FOR OPTICAL IMAGING

-

9.6 NEUROLOGYLOW COST AND GROWING UTILIZATION OF OPTICAL IMAGING TECHNIQUES TO PROMOTE GROWTH

- 9.7 OTHER THERAPEUTIC AREAS

- 10.1 INTRODUCTION

-

10.2 HOSPITALS & CLINICSINCREASING CLINICAL APPLICATIONS OF OPTICAL IMAGING TECHNIQUES IN HOSPITALS TO DRIVE MARKET

-

10.3 RESEARCH LABORATORIESAVAILABILITY OF RESEARCH FUNDING FROM PRIVATE AND GOVERNMENT ORGANIZATIONS TO PROMOTE GROWTH

-

10.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESGREATER UTILIZATION OF OPTICAL IMAGING TECHNIQUES IN DRUG DISCOVERY PROCESSES TO SUPPORT MARKET

- 11.1 INTRODUCTION

-

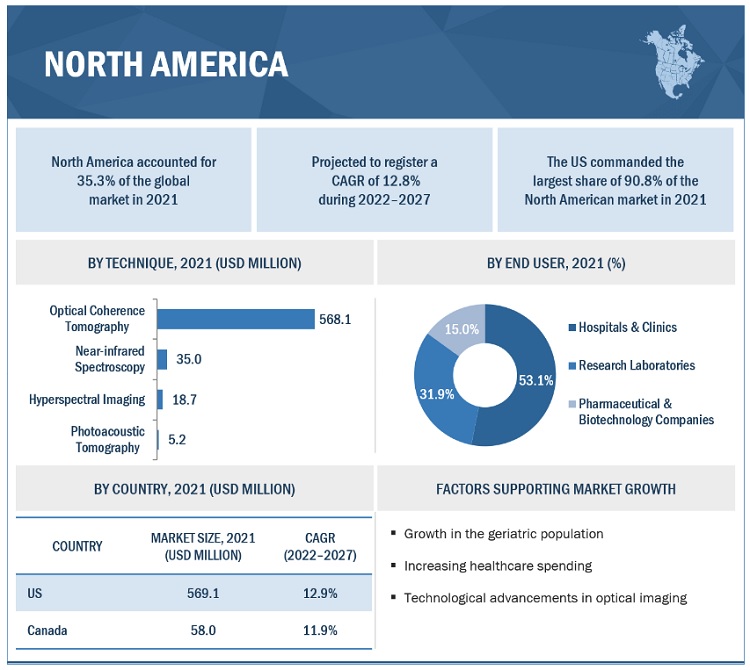

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Presence of several large hospitals & health systems to increase number of imaging & diagnostic procedures in countryCANADA- Availability of research funding to drive growth

-

11.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Robust healthcare spending to support market in GermanyFRANCE- Increasing healthcare expenditure and rising medical tourism in France to propel growthUK- Growing adoption of optical imaging techniques and in vivo research applications to drive growthITALY- Presence of major pharmaceutical & research institutes to drive marketSPAIN- Increasing development in biomedical sciences to drive growthREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTJAPAN- Established pharmaceutical & biotechnology research base to propel marketCHINA- Presence of large population base and favorable initiatives undertaken by authorities to aid growthINDIA- Rising adoption of advanced diagnostic imaging technologies by healthcare providers to boost marketAUSTRALIA- Growing awareness of healthcare services and rising healthcare expenditure to support marketSOUTH KOREA- Growing expenditure on improved healthcare services and rising geriatric population to propel growthREST OF ASIA PACIFIC

-

11.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTBRAZIL- Improved GDP expenditure on healthcareREST OF LATIN AMERICA

-

11.6 MIDDLE EAST & AFRICADEVELOPING HEALTHCARE INFRASTRUCTURE TO PROPEL MARKET GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT

- 12.1 INTRODUCTION

- 12.2 REVENUE SHARE ANALYSIS

- 12.3 MARKET SHARE ANALYSIS

-

12.4 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.5 START-UP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

12.6 COMPETITIVE BENCHMARKINGCOMPANY FOOTPRINT FOR KEY PLAYERSPRODUCT FOOTPRINTTECHNIQUE FOOTPRINTTHERAPEUTIC AREA FOOTPRINTREGIONAL FOOTPRINT

- 12.7 GEOGRAPHIC FOOTPRINT OF KEY PLAYERS

-

12.8 COMPETITIVE SITUATION AND TRENDSPRODUCT LAUNCHES & APPROVALSDEALSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSCARL ZEISS MEDITEC AG- Business overview- Products offered- Recent developments- MnM viewTOPCON CORPORATION- Business overview- Products offered- Recent developments- MnM viewCANON INC.- Business overview- Products offered- Recent developments- MnM viewABBOTT LABORATORIES INC.- Business overview- Products offered- Recent developments- MnM viewKONINKLIJKE PHILIPS N.V.- Business overview- Products offered- Recent developments- MnM viewPERKINELMER, INC.- Business overview- Products offeredLEICA MICROSYSTEMS (DANAHER CORPORATION)- Business overview- Products offered- Recent developmentsAGFA-GEVAERT N.V.- Business overview- Products offeredHAMAMATSU PHOTONICS K.K.- Business overview- Products offered- Recent developments

-

13.2 OTHER PLAYERSHEIDELBERG ENGINEERING, INC.- Business overview- Products offered- Recent developmentsHEADWALL PHOTONICS, INC.- Business overview- Products offered- Recent developmentsVISIONIX (FORMERLY LUNEAU TECHNOLOGY USA & OPTOVUE INC.)- Business overview- Products offered- Recent developmentsOPTICAL IMAGING LTD.- Business overview- Products offeredOPTOS- Business overview- Products offered- Recent developmentsWASATCH PHOTONICS- Business overview- Products offered- Recent developmentsARCSCAN INC.- Business overview- Products offeredDERMALUMICS- Business overview- Products offeredCYLITE PTY LTD.- Business overview- Products offeredMOPTIM- Business overview- Products offeredMICHELSON DIAGNOSTICS LTD.- Business overview- Products offeredTHORLABS- Business overview- Products offeredITHERAMEDICAL- Business overview- Products offered- Recent developmentsKIBERO- Business overview- Products offered- Recent developmentsSENO MEDICAL- Business overview- Products offered- Recent developmentsASPECTUS IMAGING- Business overview- Products offered- Recent developments

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 NUMBER OF GLAUCOMA PATIENTS, BY REGION AND TYPE, 2013 VS. 2020 VS. 2040 (MILLION)

- TABLE 2 KEY MARKET DRIVERS

- TABLE 3 KEY MARKET RESTRAINTS

- TABLE 4 GERIATRIC POPULATION TREND IN DEVELOPING REGIONS, 2020 AND 2060

- TABLE 5 KEY MARKET OPPORTUNITIES

- TABLE 6 KEY MARKET CHALLENGES

- TABLE 7 OPTICAL IMAGING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 STRINGENCY OF REGULATIONS FOR OPTICAL IMAGING PRODUCTS, BY REGION

- TABLE 9 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 10 CANADA: LEVEL OF RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 11 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 12 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 13 TOP SUPPLIERS AND BUYERS OF OPTICAL IMAGING SYSTEMS IN US, 2020

- TABLE 14 GLOBAL OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 15 IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 16 IMAGING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 17 KEY OPTICAL IMAGING SYSTEMS

- TABLE 18 OPTICAL IMAGING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 19 SPECTRAL IMAGING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 20 OPTICAL IMAGING CAMERAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 21 OPTICAL IMAGING SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 22 OPTICAL IMAGING LENSES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 23 OPTICAL IMAGING ILLUMINATION SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 24 OTHER OPTICAL IMAGING PRODUCTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 25 OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 26 OPTICAL COHERENCE TOMOGRAPHY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 27 NEAR-INFRARED SPECTROSCOPY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 28 HYPERSPECTRAL IMAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 29 PHOTOACOUSTIC TOMOGRAPHY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 30 OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 31 PATHOLOGICAL IMAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 32 INTRA-OPERATIVE IMAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 33 OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 34 OPTICAL IMAGING MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 35 OPTICAL IMAGING MARKET FOR ONCOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 36 OPTICAL IMAGING MARKET FOR CARDIOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 37 OPTICAL IMAGING MARKET FOR DERMATOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 38 OPTICAL IMAGING MARKET FOR NEUROLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 39 OPTICAL IMAGING MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 40 OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 41 OPTICAL IMAGING MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 42 OPTICAL IMAGING MARKET FOR RESEARCH LABORATORIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 43 OPTICAL IMAGING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 44 OPTICAL IMAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 45 NORTH AMERICA: OPTICAL IMAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 46 NORTH AMERICA: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 47 NORTH AMERICA: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 48 NORTH AMERICA: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 50 NORTH AMERICA: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 52 US: MACROECONOMIC INDICATORS

- TABLE 53 US: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 54 US: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 55 US: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 56 US: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 57 US: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 58 US: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 59 CANADA: MACROECONOMIC INDICATORS

- TABLE 60 CANADA: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 61 CANADA: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 62 CANADA: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 63 CANADA: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 64 CANADA: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 65 CANADA: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 66 EUROPE: OPTICAL IMAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 67 EUROPE: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 68 EUROPE: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 69 EUROPE: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 70 EUROPE: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 71 EUROPE: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 72 EUROPE: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 73 GERMANY: MACROECONOMIC INDICATORS

- TABLE 74 GERMANY: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 75 GERMANY: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 76 GERMANY: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 77 GERMANY: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 78 GERMANY: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 79 GERMANY: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 80 FRANCE: MACROECONOMIC INDICATORS

- TABLE 81 FRANCE: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 82 FRANCE: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 83 FRANCE: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 84 FRANCE: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 85 FRANCE: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 86 FRANCE: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 87 UK: MACROECONOMIC INDICATORS

- TABLE 88 UK: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 89 UK: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 90 UK: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 91 UK: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 92 UK: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 93 UK: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 94 ITALY: MACROECONOMIC INDICATORS

- TABLE 95 ITALY: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 96 ITALY: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 97 ITALY: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 98 ITALY: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 99 ITALY: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 100 ITALY: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 101 SPAIN: MACROECONOMIC INDICATORS

- TABLE 102 SPAIN: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 103 SPAIN: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 104 SPAIN: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 105 SPAIN: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 106 SPAIN: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 107 SPAIN: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 108 SHARE OF GERIATRIC POPULATION (AGED 65 YEARS AND ABOVE) IN ROE COUNTRIES

- TABLE 109 REST OF EUROPE: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 110 REST OF EUROPE: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 111 REST OF EUROPE: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 112 REST OF EUROPE: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 113 REST OF EUROPE: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 114 REST OF EUROPE: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 115 ASIA PACIFIC: OPTICAL IMAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 116 ASIA PACIFIC: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 117 ASIA PACIFIC: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 118 ASIA PACIFIC: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 119 ASIA PACIFIC: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 120 ASIA PACIFIC: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 121 ASIA PACIFIC: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 122 JAPAN: MACROECONOMIC INDICATORS

- TABLE 123 JAPAN: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 124 JAPAN: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 125 JAPAN: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 126 JAPAN: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 127 JAPAN: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 128 JAPAN: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 129 CHINA: MACROECONOMIC INDICATORS

- TABLE 130 CHINA: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 131 CHINA: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 132 CHINA: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 133 CHINA: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 134 CHINA: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 135 CHINA: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 136 INDIA: MACROECONOMIC INDICATORS

- TABLE 137 INDIA: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 138 INDIA: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 139 INDIA: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 140 INDIA: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 141 INDIA: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 142 INDIA: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 143 AUSTRALIA: MACROECONOMIC INDICATORS

- TABLE 144 AUSTRALIA: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 145 AUSTRALIA: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 146 AUSTRALIA: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 147 AUSTRALIA: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 148 AUSTRALIA: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 149 AUSTRALIA: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 150 SOUTH KOREA: MACROECONOMIC INDICATORS

- TABLE 151 SOUTH KOREA: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 152 SOUTH KOREA: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 153 SOUTH KOREA: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 154 SOUTH KOREA: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 155 OUTH KOREA: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 156 SOUTH KOREA: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 163 LATIN AMERICA: OPTICAL IMAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 164 LATIN AMERICA: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 165 LATIN AMERICA: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 166 LATIN AMERICA: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 167 LATIN AMERICA: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 168 LATIN AMERICA: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 169 LATIN AMERICA: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 170 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 171 BRAZIL: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 172 BRAZIL: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 173 BRAZIL: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 174 BRAZIL: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 175 BRAZIL: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 176 BRAZIL: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 177 REST OF LATIN AMERICA: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 178 REST OF LATIN AMERICA: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 179 REST OF LATIN AMERICA: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 180 REST OF LATIN AMERICA: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 181 REST OF LATIN AMERICA: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 182 REST OF LATIN AMERICA: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: OPTICAL IMAGING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: OPTICAL IMAGING MARKET, BY TECHNIQUE, 2020–2027 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2020–2027 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: OPTICAL IMAGING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: OPTICAL IMAGING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 189 OPTICAL IMAGING MARKET: PRODUCT LAUNCHES (JANUARY 2019 TO JANUARY 2023)

- TABLE 190 OPTICAL IMAGING MARKET: DEALS(JANUARY 2019 TO JANUARY 2023)

- TABLE 191 OPTICAL IMAGING MARKET: OTHER DEVELOPMENTS (JANUARY 2019 TO JANUARY 2023)

- TABLE 192 CARL ZEISS MEDITEC AG: BUSINESS OVERVIEW

- TABLE 193 TOPCON CORPORATION: BUSINESS OVERVIEW

- TABLE 194 CANON INC.: BUSINESS OVERVIEW

- TABLE 195 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- TABLE 196 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- TABLE 197 PERKINELMER, INC.: BUSINESS OVERVIEW

- TABLE 198 LEICA MICROSYSTEMS (DANAHER CORPORATION): BUSINESS OVERVIEW

- TABLE 199 AGFA-GEVAERT N.V.: BUSINESS OVERVIEW

- TABLE 200 HAMAMATSU PHOTONICS K.K.: BUSINESS OVERVIEW

- TABLE 201 HEIDELBERG ENGINEERING, INC.: BUSINESS OVERVIEW

- TABLE 202 HEADWALL PHOTONICS, INC.: BUSINESS OVERVIEW

- TABLE 203 VISIONIX: BUSINESS OVERVIEW

- TABLE 204 OPTICAL IMAGING LTD.: BUSINESS OVERVIEW

- TABLE 205 OPTOS: BUSINESS OVERVIEW

- TABLE 206 WASATCH PHOTONICS: BUSINESS OVERVIEW

- TABLE 207 ARCSCAN INC.: BUSINESS OVERVIEW

- TABLE 208 DERMALUMICS: BUSINESS OVERVIEW

- TABLE 209 CYLITE PTY LTD.: BUSINESS OVERVIEW

- TABLE 210 MOPTIM: BUSINESS OVERVIEW

- TABLE 211 MICHELSON DIAGNOSTICS LTD.: BUSINESS OVERVIEW

- TABLE 212 THORLABS: BUSINESS OVERVIEW

- TABLE 213 ITHERAMEDICAL: BUSINESS OVERVIEW

- TABLE 214 KIBERO: BUSINESS OVERVIEW

- TABLE 215 SENO MEDICAL: BUSINESS OVERVIEW

- TABLE 216 ASPECTUS IMAGING: BUSINESS OVERVIEW

- FIGURE 1 OPTICAL IMAGING MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION

- FIGURE 9 COUNTRY-LEVEL ANALYSIS OF OPTICAL IMAGING MARKET

- FIGURE 10 APPROACH 4: TOP-DOWN APPROACH

- FIGURE 11 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF OPTICAL IMAGING MARKET

- FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 13 MARKET DATA TRIANGULATION METHODOLOGY

- FIGURE 14 OPTICAL IMAGING MARKET, BY TECHNIQUE, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 OPTICAL IMAGING MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 OPTICAL IMAGING MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 17 OPTICAL IMAGING MARKET, BY THERAPEUTIC AREA, 2022 VS. 2027 (USD MILLION)

- FIGURE 18 OPTICAL IMAGING MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 19 GEOGRAPHICAL SNAPSHOT OF OPTICAL IMAGING MARKET

- FIGURE 20 INCREASING PREVALENCE OF EYE DISORDERS TO DRIVE GROWTH IN OPTICAL IMAGING MARKET

- FIGURE 21 PATHOLOGICAL IMAGING SYSTEMS DOMINATED MARKET IN 2021

- FIGURE 22 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 23 CHINA TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 24 OPTICAL IMAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 PERCENTAGE OF GERIATRIC POPULATION, BY REGION

- FIGURE 26 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 27 OPTICAL IMAGING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 OPTICAL IMAGING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 OPTICAL IMAGING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 30 NORTH AMERICA: OPTICAL IMAGING MARKET SNAPSHOT

- FIGURE 31 EUROPE: OPTICAL IMAGING MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: OPTICAL IMAGING MARKET SNAPSHOT

- FIGURE 33 KEY MARKET DEVELOPMENTS (JANUARY 2020 TO JANUARY 2023)

- FIGURE 34 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN OPTICAL IMAGING MARKET

- FIGURE 35 MARKET SHARE ANALYSIS OF KEY PLAYERS IN OPTICAL IMAGING MARKET, 2021

- FIGURE 36 OPTICAL IMAGING MARKET: GLOBAL COMPANY EVALUATION QUADRANT

- FIGURE 37 OPTICAL IMAGING MARKET: GLOBAL START-UP/SME MATRIX

- FIGURE 38 GEOGRAPHIC REVENUE MIX: KEY PLAYERS

- FIGURE 39 CARL ZEISS MEDITEC AG: COMPANY SNAPSHOT (2021)

- FIGURE 40 TOPCON CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 41 CANON INC.: COMPANY SNAPSHOT (2021)

- FIGURE 42 ABBOTT LABORATORIES INC.: COMPANY SNAPSHOT (2021)

- FIGURE 43 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2021)

- FIGURE 44 PERKINELMER, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 45 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 46 AGFA-GEVAERT N.V.: COMPANY SNAPSHOT (2021)

- FIGURE 47 HAMAMATSU PHOTONICS K.K.: COMPANY SNAPSHOT (2021)

This study involved four major approaches in estimating the current optical imaging market size. Extensive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the value market. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the optical imaging market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Some of the key secondary resources referred to in this study include:

- The United States Department of Health & Human Services (HHS)

- Center for Drug Evaluation and Research (CDER)

- Center for Disease Control and Prevention

- National Institute of Biomedical Imaging and Bioengineering (NIBIB)

- Center for Devices & Radiological Health

- World Health Organisation

- American Hospital Association

- U.S. Bureau of Labor Statistics

Primary Research

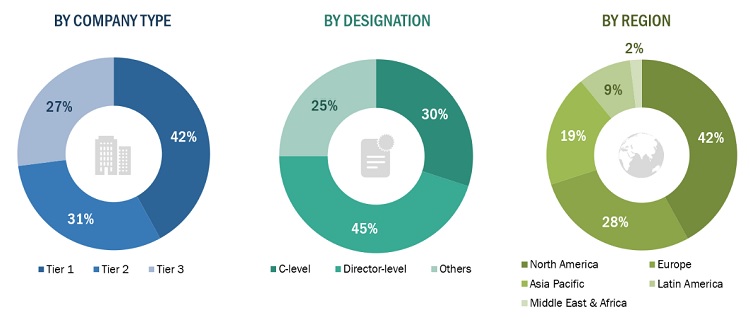

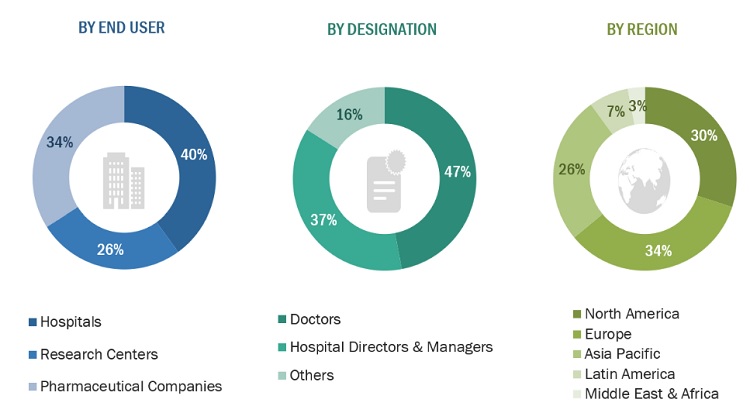

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include CEOs, consultants, subject-matter experts, directors, general managers, developers, and other key opinion leaders of the various companies that offer optical imaging products. Primary sources from the demand side include industry experts such as hospital directors, research professionals, pharmaceutical company research and development head, and other medical professionals.

Primary research was conducted to identify segmentation types; industry trends; technology trends; key players; and key market dynamics such as drivers, restraints, opportunities, challenges, and key player strategies.

Market Size Estimation

The total size of the optical imaging market was arrived at after data triangulation from four different approaches, as mentioned below.

Bottom-up Approach: Revenues of individual companies were gathered from public sources and databases. Shares of the medical device cleaning businesses of leading players were gathered from secondary sources to the extent available. In certain cases, the share of the business unit was ascertained after a detailed analysis of various parameters, including product portfolio, market positioning, selling price, and geographic reach and strength. Individual shares or revenue estimates were validated through expert interviews.

Country level Analysis: The size of the global market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of optical imaging products in the overall market was obtained from secondary data and validated by primary participants to arrive at the total market. Primary participants further validated the numbers.

Primary Interviews: As a part of the primary research process, individual respondent insights on the market size and growth were taken during the interview (regional and global, as applicable). All the responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall optical imaging market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

After complete market engineering with calculations for market statistics, market size estimations, market forecasting, market breakdown, and data triangulation, extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and further quantitative analysis was also done from all the numbers arrived at in the complete market engineering process to list key information throughout the report.

Breakdown of Primary Interviews (Supply Side): By End-User Type, Designation, and Region

* Others include sales managers, marketing managers, and product managers

Note: Tiers of companies are defined by their total revenues; as of 2020, Tier 1>= USD 500 million, Tier 2 = USD 200 million to USD 500 million, and Tier 3<= USD 200 million

To know about the assumptions considered for the study, download the pdf brochure

Breakdown of Primary Interviews (Demand Side): By End-User Type, Designation, and Region

Note: Other designation includes type-c executives of hospitals and clinics.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable.

Approach to derive the market size and estimate market growth

The market rankings for leading players were ascertained after a detailed assessment of their revenues from the optical imaging business using secondary data available through paid and unpaid sources. Owing to data limitations, in certain cases, the revenue share was arrived at after a detailed assessment of the product portfolios of major companies and their respective sales performance. At each point, this data was validated through primary interviews with industry experts.

Objectives of the Study

- To define, describe, and forecast the optical imaging market by product, application, end user, therapeutic area, techniques, and region.

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the global market with respect to five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market shares and core competencies in the global market

- To track and analyze competitive developments such as partnerships, agreements, acquisitions, product launches, and expansions in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific optical imaging market into Thailand, New Zealand, and other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Optical Imaging Market

Does this study covers detailed segment list of optical imaging market report ?

please share information on optical preclinical imaging market