TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 IMMUNOASSAY MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED

1.4.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.6.1 IMPACT OF RECESSION: IMMUNOASSAY INDUSTRY

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

2.1.2.1 Primary sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

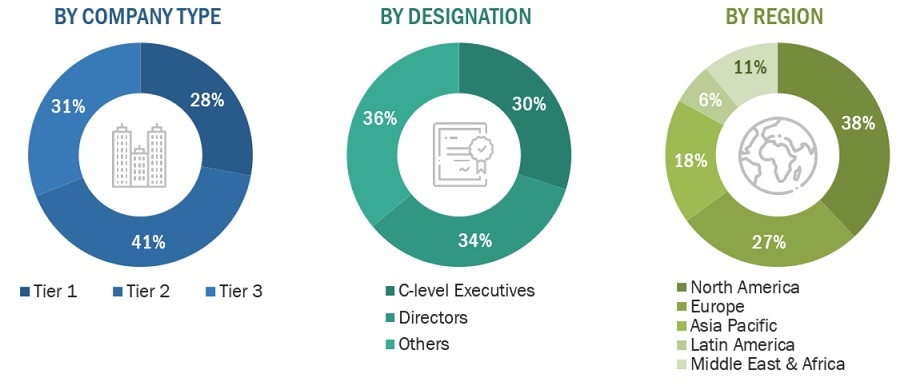

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

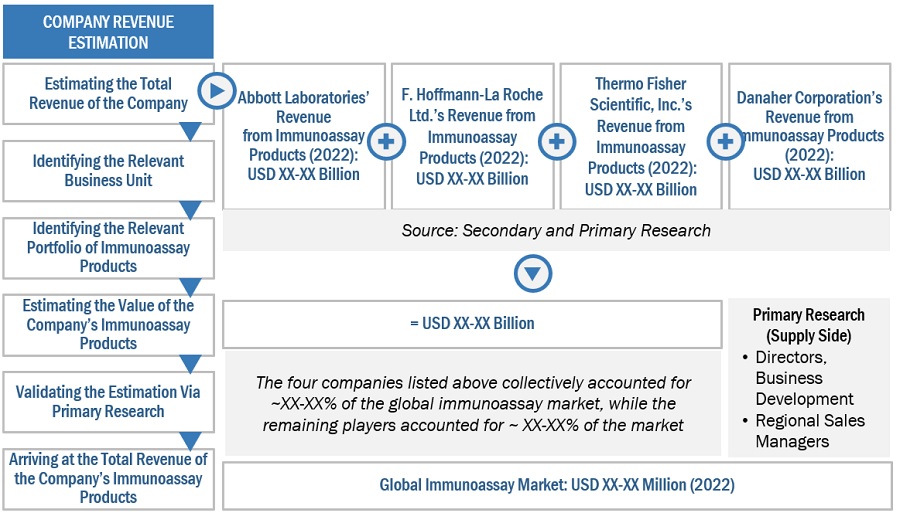

2.2 MARKET SIZE ESTIMATION

FIGURE 5 REVENUE SHARE ANALYSIS

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 STUDY ASSUMPTIONS

2.5.1 MARKET ASSUMPTIONS

2.5.2 GROWTH RATE ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

2.6.1 METHODOLOGY-RELATED LIMITATIONS

2.6.2 SCOPE-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: IMMUNOASSAY MARKET

2.8 IMPACT OF RECESSION ON IMMUNOASSAY INDUSTRY

3 EXECUTIVE SUMMARY (Page No. - 59)

FIGURE 9 IMMUNOASSAY MARKET SHARE, BY PRODUCT, 2023 VS. 2028 (USD BILLION)

FIGURE 10 IMMUNOASSAY INDUSTRY, BY TECHNOLOGY, 2023 VS. 2028 (USD BILLION)

FIGURE 11 IMMUNOASSAY ANALYZERS MARKET, BY SPECIMEN, 2023 VS. 2028 (USD BILLION)

FIGURE 12 MARKET, BY APPLICATION, 2023 VS. 2028 (USD BILLION)

FIGURE 13 AUTOMATED IMMUNOASSAY ANALYZERS MARKET, BY END USER, 2023 VS. 2028 (USD BILLION)

FIGURE 14 GEOGRAPHICAL SNAPSHOT: MARKET

4 PREMIUM INSIGHTS (Page No. - 65)

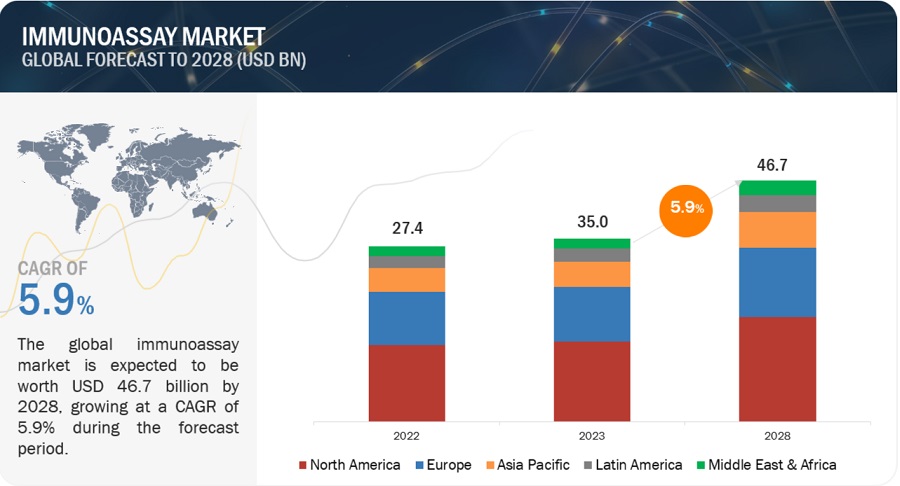

4.1 IMMUNOASSAY MARKET OVERVIEW

FIGURE 15 RISING INCIDENCE OF CHRONIC DISEASES AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

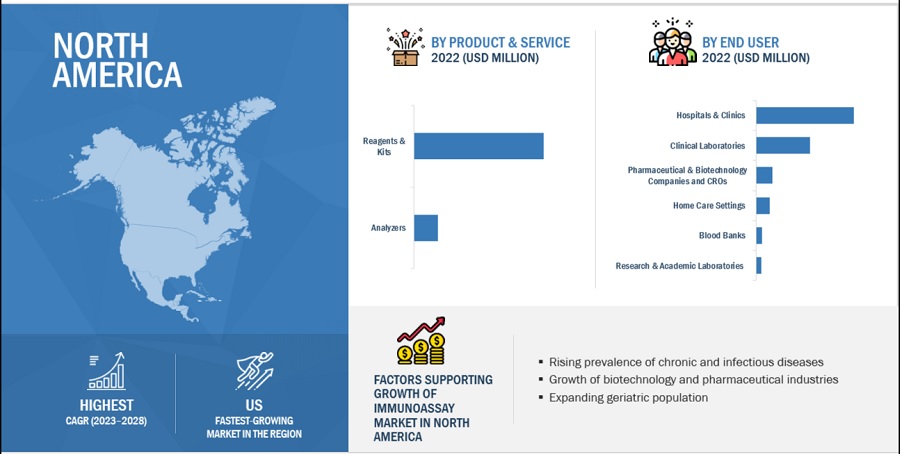

4.2 NORTH AMERICA: IMMUNOASSAY INDUSTRY, BY PRODUCT AND COUNTRY (2022)

FIGURE 16 REAGENTS & KITS AND US DOMINATED NORTH AMERICAN MARKET IN 2022

4.3 GEOGRAPHICAL SNAPSHOT: IMMUNOASSAY ANALYZERS MARKET, 2023–2028

FIGURE 17 CHINA TO WITNESS HIGHEST GROWTH RATES DURING FORECAST PERIOD

4.4 REGIONAL MIX: AUTOMATED IMMUNOASSAY ANALYZERS MARKET, 2021–2028

FIGURE 18 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING STUDY PERIOD

4.5 DEVELOPED VS. EMERGING ECONOMIES: MARKET, 2023–2028

FIGURE 19 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 70)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IMMUNOASSAY MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing incidence of chronic and infectious diseases

FIGURE 21 INCREASING INCIDENCES OF DIABETES (IN MILLION)

5.2.1.1.1 Growing use of immunoassays in oncology

TABLE 2 GLOBAL INCIDENCE OF MAJOR CANCERS IN MEN, 2020

TABLE 3 GLOBAL INCIDENCE OF MAJOR CANCERS IN WOMEN, 2020

5.2.1.1.2 Increasing use of immunoassays in diagnostic applications

TABLE 4 TIME REQUIRED FOR DRUG DETECTION BY URINE TESTING

5.2.1.1.3 Growing geriatric population

FIGURE 22 GLOBAL GERIATRIC POPULATION, BY REGION, 2019 VS. 2050 (IN MILLION)

5.2.1.2 Increasing need for blood donations

5.2.1.3 Growth in biotechnology & biopharmaceutical industries

5.2.1.4 Increasing adoption of immunoassay-based POC testing and rapid testing

5.2.1.5 Supportive government regulatory policies and initiatives

5.2.1.6 Increased drug abuse and use of cannabis

5.2.2 RESTRAINTS

5.2.2.1 Stringent approval criteria for immunoassay instruments and consumables

5.2.2.2 Technical problems in immunoassay kits

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing growth opportunities in emerging economies

5.2.3.2 Importance of companion diagnostics

TABLE 5 COMPANION DIAGNOSTIC ASSAYS APPROVED AND LAUNCHED, 2018–2022

5.2.3.3 Development of condition-specific biomarkers and tests

TABLE 6 NEW TESTS LAUNCHED BY KEY PLAYERS, 2019–2023

5.2.3.4 Integration of microfluidics in immunoassays

TABLE 7 LAB-ON-A-CHIP IMMUNOASSAY DEVICES/CHIPS/SYSTEMS OFFERED BY KEY PLAYERS

5.2.3.5 Improved immunoassay diagnostic technologies

5.2.4 CHALLENGES

5.2.4.1 Design challenges, complexities, and low quality of antibodies

5.2.4.2 Dearth of skilled professionals

5.2.4.3 Unfavorable reimbursement scenario

5.3 REGULATORY ANALYSIS

5.3.1 NORTH AMERICA

5.3.1.1 US

TABLE 8 US: CLASSIFICATION OF IMMUNOASSAY PRODUCTS

FIGURE 23 US: REGULATORY PROCESS FOR IVD DEVICES

5.3.1.2 Canada

FIGURE 24 CANADA: REGULATORY PROCESS FOR IVD DEVICES

5.3.2 EUROPE

TABLE 9 EUROPE: CLASSIFICATION OF IVD DEVICES

5.3.2.1 Russia

TABLE 10 RUSSIA: CLASSIFICATION OF IVD DEVICES

5.3.3 ASIA PACIFIC

5.3.3.1 Japan

FIGURE 25 JAPAN: REGULATORY PROCESS FOR IVD DEVICES

TABLE 11 JAPAN: CLASSIFICATION OF IVD REAGENTS

TABLE 12 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

5.3.3.2 China

TABLE 13 CHINA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

5.3.3.3 India

FIGURE 26 INDIA: REGULATORY PROCESS FOR IVD DEVICES

5.3.3.4 Indonesia

TABLE 14 INDONESIA: REGISTRATION PROCESS FOR IVD DEVICES

5.3.3.5 South Korea

TABLE 15 SOUTH KOREA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

5.3.4 LATIN AMERICA

5.3.4.1 Mexico

FIGURE 27 MEXICO: REGULATORY PROCESS FOR IVD DEVICES

TABLE 16 MEXICO: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

5.3.4.2 Brazil

FIGURE 28 BRAZIL: REGULATORY PROCESS FOR IVD DEVICES

5.3.5 MIDDLE EAST

5.3.5.1 Saudi Arabia

TABLE 17 SAUDI ARABIA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

5.3.6 AFRICA

5.4 TECHNOLOGY ANALYSIS

TABLE 18 CONVENTIONAL IMMUNOASSAY METHODS AND TECHNIQUES

TABLE 19 RECENT PRODUCT LAUNCHES WITH ADVANCED TECHNOLOGIES IN IMMUNOASSAY INDUSTRY

5.5 TRADE ANALYSIS

5.5.1 TRADE ANALYSIS FOR IMMUNOASSAY PRODUCTS

TABLE 20 IMPORT DATA FOR HS CODE 902780, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 21 EXPORT DATA FOR HS CODE 902780, BY COUNTRY, 2018–2022 (USD MILLION)

5.6 PATENT ANALYSIS

5.7 VALUE CHAIN ANALYSIS

FIGURE 29 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 30 SUPPLY CHAIN ANALYSIS: DIRECT DISTRIBUTION TO BE PREFERRED STRATEGY FOR PROMINENT COMPANIES

5.9 ECOSYSTEM/MARKET MAP

FIGURE 31 ECOSYSTEM/MARKET MAP: MARKET

5.9.1 ROLE IN ECOSYSTEM

5.9.2 KEY PLAYERS IN MARKET

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 22 PORTER’S FIVE FORCES

5.10.1 INTENSITY OF COMPETITIVE RIVALRY

5.10.2 BARGAINING POWER OF SUPPLIERS

5.10.3 BARGAINING POWER OF BUYERS

5.10.4 THREAT OF SUBSTITUTES

5.10.5 THREAT FROM NEW ENTRANTS

5.11 KEY CONFERENCES & EVENTS IN 2023–2024

TABLE 23 KEY CONFERENCES & EVENTS IN 2023–2024

5.12 PRICING ANALYSIS

TABLE 24 PRICE RANGE FOR IMMUNOASSAY PRODUCTS

5.13 KEY STAKEHOLDERS & BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

TABLE 25 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS

5.13.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR TOP END USERS

TABLE 26 KEY BUYING CRITERIA, BY TOP END USER

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6 IMMUNOASSAY MARKET TRENDS, BY PRODUCT (Page No. - 108)

6.1 INTRODUCTION

TABLE 27 IMMUNOASSAY INDUSTRY, BY PRODUCT, 2021–2028 (USD MILLION)

6.2 REAGENTS & KITS

TABLE 28 KEY REAGENTS & KITS AVAILABLE

TABLE 29 MARKET FOR REAGENTS & KITS, BY REGION, 2021–2028 (USD MILLION)

TABLE 30 MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

6.2.1 ELISA REAGENTS & KITS

6.2.1.1 Increased use of high-throughput screening in drug discovery programs to drive segment

TABLE 31 ELISA REAGENTS & KITS MARKET, BY REGION, 2021–2028 (USD MILLION)

6.2.2 RAPID TEST REAGENTS & KITS

6.2.2.1 High demand for rapid test reagents & kits in remote areas for preliminary screening tests to drive segment

TABLE 32 RAPID TEST REAGENTS & KITS MARKET, BY REGION, 2021–2028 (USD MILLION)

6.2.3 ELISPOT REAGENTS & KITS

6.2.3.1 High sensitivity, functionality, and adaptability of ELISpot technology to drive segment

TABLE 33 ELISPOT REAGENTS & KITS MARKET, BY REGION, 2021–2028 (USD MILLION)

6.2.4 CLIA REAGENTS & KITS

6.2.4.1 Better diagnosis and higher specificity to drive segment

TABLE 34 CLIA REAGENTS & KITS MARKET, BY REGION, 2021–2028 (USD MILLION)

6.2.5 IFA REAGENTS & KITS

6.2.5.1 Better adaptability in clinical diagnostics and medicine to drive segment

TABLE 35 IFA REAGENTS & KITS MARKET, BY REGION, 2021–2028 (USD MILLION)

6.2.6 WESTERN BLOT REAGENTS & KITS

6.2.6.1 Western blotting reagents & kits to be considered gold standard for COVID-19 test result validation

TABLE 36 WESTERN BLOT REAGENTS & KITS MARKET, BY REGION, 2021–2028 (USD MILLION)

6.2.7 OTHER REAGENTS & KITS

TABLE 37 OTHER REAGENTS & KITS MARKET, BY REGION, 2021–2028 (USD MILLION)

6.3 ANALYZERS

TABLE 38 KEY ANALYZERS AVAILABLE

TABLE 39 MARKET FOR ANALYZERS, BY REGION, 2021–2028 (USD MILLION)

6.3.1 MARKET FOR ANALYZERS, BY TYPE

TABLE 40 AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

6.3.1.1 Open-ended systems

6.3.1.1.1 Better flexibility and wider availability to drive segment

TABLE 41 OPEN-ENDED SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

6.3.1.2 Closed-ended systems

6.3.1.2.1 Higher precision and better automation to drive segment

TABLE 42 CLOSED-ENDED SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

6.3.2 MARKET FOR ANALYZERS, BY PURCHASE MODE

TABLE 43 MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

6.3.2.1 Rental purchase

6.3.2.1.1 Increased convenience and lack of liability to drive segment

TABLE 44 RENTAL PURCHASE MARKET, BY REGION, 2021–2028 (USD MILLION)

6.3.2.2 Outright purchase

6.3.2.2.1 Inflated cost of immunoassay testing technologies to limit market

TABLE 45 OUTRIGHT PURCHASE MARKET, BY REGION, 2021–2028 (USD MILLION)

7 IMMUNOASSAY MARKET TRENDS, BY TECHNOLOGY (Page No. - 126)

7.1 INTRODUCTION

TABLE 46 IMMUNOASSAY INDUSTRY, BY TECHNOLOGY, 2021–2028 (USD MILLION)

7.2 ELISA

7.2.1 BETTER SENSITIVITY AND QUICKER RESULTS TO DRIVE MARKET

TABLE 47 KEY ELISA TECHNOLOGIES AVAILABLE

TABLE 48 IMMUNOASSAY ANALYZERS MARKET FOR ELISA, BY REGION, 2021–2028 (USD MILLION)

7.3 CLIA

7.3.1 GOOD SPECIFICITY, WIDE LINEAR RANGE, AND HIGH SENSITIVITY TO DRIVE MARKET

TABLE 49 IMMUNOASSAY MARKET SHARE FOR CLIA, BY REGION, 2021–2028 (USD MILLION)

7.4 IFA

7.4.1 IFA TO DIAGNOSE ANTIBODIES AND ANALYZE SMALL BIOLOGICAL AND NON-BIOLOGICAL MOLECULES

TABLE 50 AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR IFA, BY REGION, 2021–2028 (USD MILLION)

7.5 RAPID TESTS

7.5.1 FASTER RESULTS AND EASE OF USE TO DRIVE MARKET

TABLE 51 KEY RAPID TESTS AVAILABLE

TABLE 52 MARKET FOR RAPID TESTS, BY REGION, 2021–2028 (USD MILLION)

7.6 WESTERN BLOTTING

7.6.1 ABILITY TO DETECT AND CONFIRM ANTIBODIES OF RETROVIRUSES TO DRIVE MARKET

TABLE 53 WESTERN BLOTTING SYSTEMS AVAILABLE

TABLE 54 IMMUNOASSAY ANALYZERS MARKET FOR WESTERN BLOTTING, BY REGION, 2021–2028 (USD MILLION)

7.7 ELISPOT

7.7.1 HIGH SENSITIVITY, SPECIFICITY, AND VERSATILITY TO DRIVE MARKET

TABLE 55 MARKET FOR ELISPOT, BY REGION, 2021–2028 (USD MILLION)

7.8 OTHER TECHNOLOGIES

TABLE 56 MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2021–2028 (USD MILLION)

8 IMMUNOASSAY MARKET TRENDS, BY SPECIMEN (Page No. - 136)

8.1 INTRODUCTION

TABLE 57 IMMUNOASSAY INDUSTRY, BY SPECIMEN, 2021–2028 (USD MILLION)

8.2 BLOOD

8.2.1 HIGH RELIABILITY AND ADVANCEMENTS IN HEALTHCARE SYSTEM TO DRIVE MARKET

TABLE 58 IMMUNOASSAY MARKET SHARE FOR BLOOD, BY REGION, 2021–2028 (USD MILLION)

8.3 SALIVA

8.3.1 DEVELOPMENTS IN IMMUNOASSAY-BASED SALIVA TESTS TO DRIVE MARKET

TABLE 59 AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR SALIVA, BY REGION, 2021–2028 (USD MILLION)

8.4 URINE

8.4.1 INCREASING USE BY LAW ENFORCEMENT AGENCIES AND RISING PREVALENCE OF KIDNEY DISEASES TO DRIVE MARKET

TABLE 60 MARKET FOR URINE, BY REGION, 2021–2028 (USD MILLION)

8.5 OTHER SPECIMENS

TABLE 61 MARKET FOR OTHER SPECIMENS, BY REGION, 2021–2028 (USD MILLION)

9 IMMUNOASSAY MARKET TRENDS, BY APPLICATION (Page No. - 142)

9.1 INTRODUCTION

TABLE 62 IMMUNOASSAY INDUSTRY, BY APPLICATION, 2021–2028 (USD MILLION)

9.2 INFECTIOUS DISEASES

9.2.1 RISING PREVALENCE OF CHRONIC INFECTIOUS DISEASES TO DRIVE MARKET

TABLE 63 MARKET FOR INFECTIOUS DISEASES, BY REGION, 2021–2028 (USD MILLION)

9.3 ENDOCRINOLOGY

9.3.1 RISING INCIDENCE OF DIABETES TO DRIVE MARKET

TABLE 64 IMMUNOASSAY MARKET SHARE FOR ENDOCRINOLOGY, BY REGION, 2021–2028 (USD MILLION)

9.4 CARDIOLOGY

9.4.1 HIGH BURDEN OF CARDIOVASCULAR DISEASES TO DRIVE MARKET

TABLE 65 KEY PRODUCTS FOR CARDIOLOGY APPLICATIONS

TABLE 66 MARKET FOR CARDIOLOGY, BY REGION, 2021–2028 (USD MILLION)

9.5 AUTOIMMUNE DISORDERS

9.5.1 HIGH INCIDENCE OF CHRONIC DISEASES AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

TABLE 67 MARKET FOR AUTOIMMUNE DISORDERS, BY REGION, 2021–2028 (USD MILLION)

9.6 ALLERGY DIAGNOSTICS

9.6.1 GROWING PREVALENCE OF ALLERGIES TO DRIVE MARKET

TABLE 68 MARKET FOR ALLERGY DIAGNOSTICS, BY REGION, 2021–2028 (USD MILLION)

9.7 ONCOLOGY

9.7.1 RISING BURDEN OF CANCER AND GROWING EMPHASIS ON EARLY DETECTION TO DRIVE MARKET

TABLE 69 INCREASING INCIDENCE OF CANCER, BY REGION, 2021 VS. 2030 VS. 2040 (MILLION)

TABLE 70 IMMUNOASSAY ANALYZERS MARKET FOR ONCOLOGY, BY REGION, 2021–2028 (USD MILLION)

9.8 BONE & MINERAL DISORDERS

9.8.1 INCREASING PREVALENCE OF BONE DISEASES TO DRIVE MARKET

TABLE 71 KEY PRODUCTS FOR BONE & MINERAL DISORDERS

TABLE 72 AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR BONE & MINERAL DISORDERS, BY REGION, 2021–2028 (USD MILLION)

9.9 DRUG MONITORING AND TESTING

9.9.1 RISING DRUG ABUSE AND INCREASING ILLICIT DRUG CONSUMPTION TO DRIVE MARKET

TABLE 73 KEY PRODUCTS FOR DRUG MONITORING

TABLE 74 KEY IMMUNOASSAY PRODUCTS FOR DRUG TESTING

TABLE 75 MARKET FOR DRUG MONITORING AND TESTING, BY REGION, 2021–2028 (USD MILLION)

9.10 BLOOD SCREENING

9.10.1 RISING NUMBER OF BLOOD DONATIONS TO DRIVE MARKET

TABLE 76 MARKET FOR BLOOD SCREENING, BY REGION, 2021–2028 (USD MILLION)

9.11 NEWBORN SCREENING

9.11.1 TECHNOLOGICAL ADVANCEMENTS AND INCREASED GOVERNMENT SUPPORT TO DRIVE MARKET

TABLE 77 KEY PRODUCTS FOR NEWBORN SCREENING

TABLE 78 MARKET FOR NEWBORN SCREENING, BY REGION, 2021–2028 (USD MILLION)

9.12 OTHER APPLICATIONS

TABLE 79 MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

10 IMMUNOASSAY MARKET TRENDS, BY END USER (Page No. - 158)

10.1 INTRODUCTION

TABLE 80 IMMUNOASSAY INDUSTRY, BY END USER, 2021–2028 (USD MILLION)

10.2 HOSPITALS & CLINICS

10.2.1 GROWING PATIENT POPULATION AND TESTING VOLUME TO DRIVE MARKET

TABLE 81 IMMUNOASSAY MARKET SHARE FOR HOSPITALS & CLINICS, BY REGION, 2021–2028 (USD MILLION)

10.3 CLINICAL LABORATORIES

10.3.1 INCREASING NUMBER OF ACCREDITED LABORATORIES TO DRIVE MARKET

TABLE 82 MARKET FOR CLINICAL LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

10.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CONTRACT RESEARCH ORGANIZATIONS

10.4.1 GROWING DRUG DISCOVERY AND INCREASING R&D INVESTMENTS TO DRIVE MARKET

TABLE 83 MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2021–2028 (USD MILLION)

10.5 HOME CARE SETTINGS

10.5.1 RISING UTILIZATION OF POC DIAGNOSTICS AND AT-HOME ANTIGEN DIAGNOSIS TO DRIVE MARKET

TABLE 84 IMMUNOASSAY ANALYZERS MARKET FOR HOME CARE SETTINGS, BY REGION, 2021–2028 (USD MILLION)

10.6 BLOOD BANKS

10.6.1 RISING DEMAND FOR BLOOD AND INCREASING NUMBER OF ACCIDENTS TO DRIVE MARKET

TABLE 85 AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR BLOOD BANKS, BY REGION, 2021–2028 (USD MILLION)

10.7 RESEARCH & ACADEMIC LABORATORIES

10.7.1 RISING NUMBER OF MEDICAL COLLEGES AND UNIVERSITIES TO DRIVE MARKET

TABLE 86 MARKET FOR RESEARCH & ACADEMIC LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

11 IMMUNOASSAY MARKET, BY REGION (Page No. - 167)

11.1 INTRODUCTION

TABLE 87 IMMUNOASSAY INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA: IMMUNOASSAY MARKET SNAPSHOT

TABLE 88 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 89 NORTH AMERICA: IMMUNOASSAY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 90 NORTH AMERICA: IMMUNOASSAY ASSAY MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 91 NORTH AMERICA: IMMUNOASSAY ASSAY MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 92 NORTH AMERICA: IMMUNOASSAY ASSAY MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 96 NORTH AMERICA: IMMUNOASSAY MARKET OVERVIEW, BY END USER, 2021–2028 (USD MILLION)

11.2.1 NORTH AMERICA: RECESSION IMPACT

11.2.2 US

11.2.2.1 High healthcare expenditure and growth in geriatric population to drive market

TABLE 97 US: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 98 US: IMMUNOASSAY ASSAY MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 99 US: IMMUNOASSAY ASSAY MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 100 US: IMMUNOASSAY ASSAY MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 101 US: AUTOMATED IMMUNOASSAY ANALYZERS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 102 US: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 103 US: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 104 US: IMMUNOASSAY MARKET OVERVIEW, BY END USER, 2021–2028 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Increasing government support and rising incidence of chronic diseases to drive market

TABLE 105 CANADA: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 106 CANADA: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 107 CANADA: IMMUNOASSAY ANALYZERS MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 108 CANADA: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 109 CANADA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 110 CANADA: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 111 CANADA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 112 CANADA: IMMUNOASSAY MARKET OVERVIEW, BY END USER, 2021–2028 (USD MILLION)

11.3 EUROPE

TABLE 113 EUROPE: IMMUNOASSAY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 114 EUROPE: AUTOMATED IMMUNOASSAY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 115 EUROPE: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 116 EUROPE: MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 117 EUROPE: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 121 EUROPE: IMMUNOASSAY MARKET OVERVIEW, BY END USER, 2021–2028 (USD MILLION)

11.3.1 EUROPE: RECESSION IMPACT

11.3.2 GERMANY

11.3.2.1 Germany to dominate European immunoassay market during forecast period

TABLE 122 GERMANY: IMMUNOASSAY MARKET PREDICTION, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 123 GERMANY: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 124 GERMANY: IMMUNOASSAY ANALYZERS MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 125 GERMANY: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 126 GERMANY: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 127 GERMANY: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 128 GERMANY: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 129 GERMANY: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.3.3 ITALY

11.3.3.1 Growing geriatric population and increasing support for research to drive market

TABLE 130 ITALY: IMMUNOASSAY MARKET PREDICTION, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 131 ITALY: AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 132 ITALY: MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 133 ITALY: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 134 ITALY: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 135 ITALY: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 136 ITALY: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 137 ITALY: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.3.4 FRANCE

11.3.4.1 Rising use of POC testing and favorable reimbursement policies to drive market

TABLE 138 FRANCE: IMMUNOASSAY MARKET PREDICTION, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 139 FRANCE: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 140 FRANCE: IMMUNOASSAY ANALYZERS MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 141 FRANCE: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 142 FRANCE: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 143 FRANCE: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 144 FRANCE: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 145 FRANCE: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Increasing adoption of technologically advanced immunoassay systems to drive market

TABLE 146 SPAIN: IMMUNOASSAY MARKET PREDICTION, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 147 SPAIN: AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 148 SPAIN: MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 149 SPAIN: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 150 SPAIN: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 151 SPAIN: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 152 SPAIN: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 153 SPAIN: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.3.6 UK

11.3.6.1 Government support for disease diagnostics and favorable investment scenario to drive market

TABLE 154 UK: IMMUNOASSAY MARKET PREDICTION, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 155 UK: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 156 UK: IMMUNOASSAY ANALYZERS MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 157 UK: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 158 UK: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 159 UK: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 160 UK: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 161 UK: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.3.7 RUSSIA

11.3.7.1 Lack of reimbursement and delays in approval to limit market

TABLE 162 RUSSIA: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 163 RUSSIA: AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 164 RUSSIA: MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 165 RUSSIA: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 166 RUSSIA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 167 RUSSIA: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 168 RUSSIA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 169 RUSSIA: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.3.8 REST OF EUROPE

TABLE 170 REST OF EUROPE: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 171 REST OF EUROPE: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 172 REST OF EUROPE: IMMUNOASSAY ANALYZERS MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 173 REST OF EUROPE: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 174 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 175 REST OF EUROPE: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 176 REST OF EUROPE: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 177 REST OF EUROPE: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: IMMUNOASSAY MARKET SNAPSHOT

TABLE 178 ASIA PACIFIC: AUTOMATED IMMUNOASSAY ANALYZERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 183 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 184 ASIA PACIFIC: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 185 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 186 ASIA PACIFIC: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.4.1 ASIA PACIFIC: RECESSION IMPACT

11.4.2 JAPAN

11.4.2.1 Increasing investments in healthcare technologies and research activities to drive market

TABLE 187 JAPAN: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 188 JAPAN: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 189 JAPAN: IMMUNOASSAY ANALYZERS MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 190 JAPAN: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 191 JAPAN: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 192 JAPAN: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 193 JAPAN: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 194 JAPAN: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.4.3 CHINA

11.4.3.1 Increasing government investment and rising geriatric population to drive market

TABLE 195 CHINA: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 196 CHINA: AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 197 CHINA: MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 198 CHINA: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 199 CHINA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 200 CHINA: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 201 CHINA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 202 CHINA: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.4.4 INDIA

11.4.4.1 Growing medical tourism and healthcare infrastructure to drive market

TABLE 203 INDIA: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 204 INDIA: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 205 INDIA: IMMUNOASSAY ANALYZERS MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 206 INDIA: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 207 INDIA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 208 INDIA: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 209 INDIA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 210 INDIA: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.4.5 AUSTRALIA

11.4.5.1 Increasing incidence of cancer and rising blood donations to drive market

TABLE 211 AUSTRALIA: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 212 AUSTRALIA: AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 213 AUSTRALIA: MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 214 AUSTRALIA: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 215 AUSTRALIA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 216 AUSTRALIA: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 217 AUSTRALIA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 218 AUSTRALIA: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.4.6 SOUTH KOREA

11.4.6.1 Rising healthcare spending and investments in research to drive market

TABLE 219 SOUTH KOREA: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 220 SOUTH KOREA: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 221 SOUTH KOREA: IMMUNOASSAY ANALYZERS MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 222 SOUTH KOREA: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 223 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 224 SOUTH KOREA: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 225 SOUTH KOREA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 226 SOUTH KOREA: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.4.7 INDONESIA

11.4.7.1 Increasing geriatric population and favorable government healthcare policies to drive market

TABLE 227 INDONESIA: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 228 INDONESIA: AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 229 INDONESIA: MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 230 INDONESIA: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 231 INDONESIA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 232 INDONESIA: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 233 INDONESIA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 234 INDONESIA: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.4.8 REST OF ASIA PACIFIC

TABLE 235 REST OF ASIA PACIFIC: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 236 REST OF ASIA PACIFIC: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 237 REST OF ASIA PACIFIC: IMMUNOASSAY ANALYZERS MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 238 REST OF ASIA PACIFIC: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 239 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 240 REST OF ASIA PACIFIC: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 241 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 242 REST OF ASIA PACIFIC: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.5 LATIN AMERICA

TABLE 243 LATIN AMERICA: IMMUNOASSAY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

TABLE 244 LATIN AMERICA: AUTOMATED IMMUNOASSAY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 245 LATIN AMERICA: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 246 LATIN AMERICA: MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 247 LATIN AMERICA: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 248 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 249 LATIN AMERICA: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 250 LATIN AMERICA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 251 LATIN AMERICA: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.5.1 LATIN AMERICA: RECESSION IMPACT

11.5.2 BRAZIL

11.5.2.1 Brazil commanded largest share in Latin American immunoassay market in 2022

TABLE 252 BRAZIL: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 253 BRAZIL: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 254 BRAZIL: IMMUNOASSAY ANALYZERS MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 255 BRAZIL: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 256 BRAZIL: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 257 BRAZIL: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 258 BRAZIL: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 259 BRAZIL: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.5.3 MEXICO

11.5.3.1 Increasing geriatric population and rising medical tourism to drive market

TABLE 260 MEXICO: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 261 MEXICO: AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 262 MEXICO: MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 263 MEXICO: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 264 MEXICO: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 265 MEXICO: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 266 MEXICO: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 267 MEXICO: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.5.4 REST OF LATIN AMERICA

TABLE 268 REST OF LATIN AMERICA: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 269 REST OF LATIN AMERICA: MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 270 REST OF LATIN AMERICA: IMMUNOASSAY ANALYZERS MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 271 REST OF LATIN AMERICA: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 272 REST OF LATIN AMERICA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 273 REST OF LATIN AMERICA: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 274 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 275 REST OF LATIN AMERICA: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

11.6.1 LACK OF SKILLED LAB PERSONNEL AND UNFAVORABLE REIMBURSEMENT POLICIES TO LIMIT GROWTH

11.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

TABLE 276 MIDDLE EAST & AFRICA: IMMUNOASSAY MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

TABLE 277 MIDDLE EAST & AFRICA: AUTOMATED IMMUNOASSAY ANALYZERS MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 278 MIDDLE EAST & AFRICA: MARKET FOR ANALYZERS, BY TYPE, 2021–2028 (USD MILLION)

TABLE 279 MIDDLE EAST & AFRICA: MARKET FOR ANALYZERS, BY PURCHASE MODE, 2021–2028 (USD MILLION)

TABLE 280 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

TABLE 281 MIDDLE EAST & AFRICA: MARKET, BY SPECIMEN, 2021–2028 (USD MILLION)

TABLE 282 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

TABLE 283 MIDDLE EAST & AFRICA: IMMUNOASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 291)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

12.2.1 OVERVIEW OF KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

TABLE 284 OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN IMMUNOASSAY MARKET

12.3 REVENUE ANALYSIS

FIGURE 36 REVENUE ANALYSIS OF KEY PLAYERS

12.4 MARKET SHARE ANALYSIS

TABLE 285 DEGREE OF COMPETITION IN IMMUNOASSAY INDUSTRY

FIGURE 37 IMMUNOASSAY INDUSTRY SHARE, BY KEY PLAYER (2022)

12.5 COMPANY EVALUATION MATRIX

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 38 COMPANY EVALUATION MATRIX, 2022

12.5.5 COMPANY FOOTPRINT

TABLE 286 OVERALL FOOTPRINT

TABLE 287 PRODUCT FOOTPRINT

TABLE 288 REGIONAL FOOTPRINT

12.6 START-UP/SME EVALUATION MATRIX

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 39 START-UP/SME EVALUATION MATRIX, 2022

12.6.5 COMPETITIVE BENCHMARKING

TABLE 289 KEY START-UPS/SMES IN IMMUNOASSAY MARKET

12.7 COMPETITIVE SCENARIOS AND TRENDS

12.7.1 KEY PRODUCT LAUNCHES AND APPROVALS

TABLE 290 KEY PRODUCT LAUNCHES AND APPROVALS, JANUARY 2020–SEPTEMBER 2023

12.7.2 KEY DEALS

TABLE 291 KEY DEALS, JANUARY 2020–SEPTEMBER 2023

12.7.3 OTHER KEY DEVELOPMENTS

TABLE 292 OTHER KEY DEVELOPMENTS, JANUARY 2022–SEPTEMBER 2023

13 COMPANY PROFILES (Page No. - 305)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1.1 ABBOTT LABORATORIES

TABLE 293 ABBOTT LABORATORIES: COMPANY OVERVIEW

FIGURE 40 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

13.1.2 F. HOFFMANN-LA ROCHE LTD.

TABLE 294 F. HOFFMANN-LA ROCHE LTD.: COMPANY OVERVIEW

FIGURE 41 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

13.1.3 SIEMENS HEALTHINEERS AG

TABLE 295 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

FIGURE 42 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2022)

13.1.4 DANAHER CORPORATION

TABLE 296 DANAHER CORPORATION: COMPANY OVERVIEW

FIGURE 43 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

13.1.5 THERMO FISHER SCIENTIFIC INC.

TABLE 297 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

FIGURE 44 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

13.1.6 REVVITY

TABLE 298 REVVITY: COMPANY OVERVIEW

FIGURE 45 REVVITY: COMPANY SNAPSHOT (2022)

13.1.7 BECTON, DICKINSON AND COMPANY

TABLE 299 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

FIGURE 46 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

13.1.8 DIASORIN S.P.A.

TABLE 300 DIASORIN S.P.A.: COMPANY OVERVIEW

FIGURE 47 DIASORIN S.P.A.: COMPANY SNAPSHOT (2022)

13.1.9 BIO-RAD LABORATORIES, INC.

TABLE 301 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

FIGURE 48 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

13.1.10 QUIDELORTHO CORPORATION

TABLE 302 QUIDELORTHO CORPORATION: COMPANY OVERVIEW

FIGURE 49 QUIDELORTHO CORPORATION: COMPANY SNAPSHOT (2022)

13.1.11 BIOMÉRIEUX

TABLE 303 BIOMÉRIEUX: COMPANY OVERVIEW

FIGURE 50 BIOMÉRIEUX: COMPANY SNAPSHOT (2022)

13.1.12 QIAGEN N.V.

TABLE 304 QIAGEN N.V.: COMPANY OVERVIEW

FIGURE 51 QIAGEN N.V.: COMPANY SNAPSHOT (2022)

13.1.13 SYSMEX CORPORATION

TABLE 305 SYSMEX CORPORATION: COMPANY OVERVIEW

FIGURE 52 SYSMEX CORPORATION: COMPANY SNAPSHOT (2022)

13.1.14 AGILENT TECHNOLOGIES, INC.

TABLE 306 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

FIGURE 53 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

13.1.15 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

TABLE 307 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: COMPANY OVERVIEW

FIGURE 54 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: COMPANY SNAPSHOT (2022)

13.2 OTHER PLAYERS

13.2.1 MERCK KGAA

13.2.2 MERIDIAN BIOSCIENCE

13.2.3 BIO-TECHNE

13.2.4 CELLABS

13.2.5 ABNOVA CORPORATION

13.2.6 J. MITRA & CO. PVT. LTD.

13.2.7 TOSOH CORPORATION (TOSOH BIOSCIENCE)

13.2.8 CELL SCIENCES

13.2.9 ENZO BIOCHEM

13.2.10 CREATIVE DIAGNOSTICS

13.2.11 BOSTER BIOLOGICAL TECHNOLOGY

13.2.12 ELABSCIENCE

13.2.13 WAK-CHEMIE MEDICAL

13.2.14 SERACARE LIFESCIENCES INC.

13.2.15 EPITOPE DIAGNOSTICS

13.2.16 KAMIYA BIOMEDICAL COMPANY

13.2.17 GYROS PROTEIN TECHNOLOGIES

13.2.18 TRIVITRON HEALTHCARE

13.2.19 INBIOS INTERNATIONAL, INC.

13.2.20 MACCURA BIOTECHNOLOGY CO., LTD.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 384)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Immunoassay Market

What are the major revenue pockets in Immunoassay Market?

What are the latest growth trends in immunoassay industry?

Which segment ot provide highest revenue expansion opportynity?